Alarko SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alarko Bundle

Alarko's strengths lie in its diversified portfolio and strong brand recognition, but understanding its vulnerabilities and the competitive landscape is crucial for strategic advantage. Our comprehensive SWOT analysis dives deep into these areas, providing actionable insights for investors and business leaders.

Want to fully grasp Alarko's market position, potential threats, and untapped opportunities? Purchase our complete SWOT analysis for an in-depth, professionally written report that includes financial context and strategic takeaways, empowering your decision-making.

Strengths

Alarko Holding's strength lies in its remarkably diversified business portfolio, spanning construction, energy, manufacturing, tourism, and land development, with growing interests in agriculture and investment. This broad operational base acts as a significant buffer against sector-specific economic shocks, ensuring more consistent revenue generation.

For instance, in 2023, Alarko's energy segment contributed significantly to its overall performance, while its construction projects, both domestic and international, continued to generate substantial income. This multi-sector approach, as seen in its 2024 projections, allows the company to leverage opportunities across different economic cycles.

Alarko Holding boasts a strong financial position, evidenced by its equity growing to approximately 60 billion TL by the close of 2024. This robust financial health is further underscored by a consistently low debt ratio, indicating prudent financial management.

The company's adept cash management and financial discipline are key strengths, enabling Alarko to navigate economic uncertainties and maintain operational stability. This financial prudence also facilitates continued investment, even when credit markets tighten, providing a stable platform for ongoing development.

Alarko Holding is strategically directing its investments towards sectors poised for significant expansion and long-term viability, such as modern agriculture and energy distribution. The company has set an ambitious goal to achieve global leadership in greenhouse farming by 2028, signaling a strong commitment to innovation and market dominance in this area. This focused approach on high-growth, sustainable industries demonstrates Alarko's proactive strategy to align with evolving market needs and environmental consciousness, ensuring future competitiveness and profitability.

Established Market Presence and Brand Reputation

Alarko Holding boasts a formidable market presence, cultivated over 70 years of operation. This extensive history has allowed the company to develop and solidify leading brands within the Turkish economic landscape. Its strong brand equity, particularly evident in the tourism sector with the well-recognized Hillside brand, translates into significant customer trust and a distinct competitive edge across its diverse business segments.

This established reputation acts as a powerful magnet, attracting both customers and investors alike. The longevity and success of Alarko's brands underscore its deep understanding of market dynamics and consumer preferences. For instance, in 2023, Alarko Tourism Group reported a significant increase in occupancy rates, reflecting the enduring appeal of its established properties.

The company's established market presence provides a solid foundation for continued growth and resilience. This deep-rooted brand recognition and market penetration offer a distinct advantage when launching new products or services, as well as navigating competitive pressures.

Key aspects of Alarko's established market presence include:

- 70 Years of Operational Experience: A testament to sustained performance and market adaptation.

- Leading Brand Equity: Particularly strong in sectors like tourism with the 'Hillside' brand.

- Customer Trust: Built through consistent quality and long-term engagement.

- Competitive Advantage: Leveraged across its diverse portfolio of businesses.

Commitment to International Expansion

Alarko's commitment to international expansion is a significant strength, actively pursuing geographic diversification. This is clearly demonstrated by their ongoing greenhouse construction project in Kazakhstan, a key step in broadening their operational footprint beyond Turkey. This strategic move aims to reduce reliance on the domestic market, opening up new growth avenues and bolstering revenue streams.

This international push enhances Alarko's market reach and resilience. For instance, in 2023, Alarko Contracting Group secured new projects totaling $637 million, with a notable portion originating from international markets, underscoring the growing importance of their global endeavors in their overall financial performance.

- Geographic Diversification: Actively expanding operations beyond Turkey, exemplified by the Kazakhstan greenhouse project.

- Reduced Market Dependence: Lessening reliance on the domestic Turkish market for revenue generation.

- New Growth Avenues: Unlocking fresh opportunities for sales and profit through international ventures.

- Enhanced Resilience: Building a more robust business model less susceptible to single-market fluctuations.

Alarko Holding's diversified business model is a core strength, insulating it from sector-specific downturns and ensuring more stable revenue. This breadth, encompassing construction, energy, and manufacturing, allows the company to capitalize on opportunities across different economic cycles, as evidenced by its consistent performance in 2023.

The company's robust financial health is a significant asset, with equity reaching approximately 60 billion TL by the end of 2024 and a consistently low debt ratio. This financial discipline, coupled with adept cash management, provides stability and enables continued investment even in challenging credit environments, supporting ongoing development.

Alarko's strategic focus on high-growth sectors like modern agriculture and energy distribution positions it well for the future. Their ambition to lead in greenhouse farming globally by 2028 highlights a commitment to innovation and sustainable growth, aligning with evolving market demands.

With 70 years of experience, Alarko possesses a formidable market presence and strong brand equity, particularly in tourism with its Hillside brand. This established reputation fosters customer trust and provides a competitive edge, as seen in the increased occupancy rates reported in 2023.

International expansion, exemplified by their greenhouse project in Kazakhstan, is a key strength, reducing reliance on the domestic market and opening new revenue streams. In 2023, Alarko Contracting Group secured $637 million in new projects, with international ventures playing an increasingly vital role.

| Strength Aspect | Description | Supporting Data (2023/2024) |

|---|---|---|

| Diversified Portfolio | Broad operational base across multiple sectors. | Consistent revenue generation across construction and energy segments in 2023. |

| Financial Strength | Strong equity and low debt ratio. | Equity approximately 60 billion TL by end of 2024; consistently low debt ratio. |

| Strategic Investments | Focus on high-growth, sustainable sectors. | Goal for global leadership in greenhouse farming by 2028. |

| Market Presence & Brand Equity | 70 years of experience and leading brands. | Strong brand recognition (e.g., Hillside); increased occupancy rates in tourism sector in 2023. |

| International Expansion | Geographic diversification and reduced market dependence. | Secured $637 million in projects in 2023, with growing international contribution. |

What is included in the product

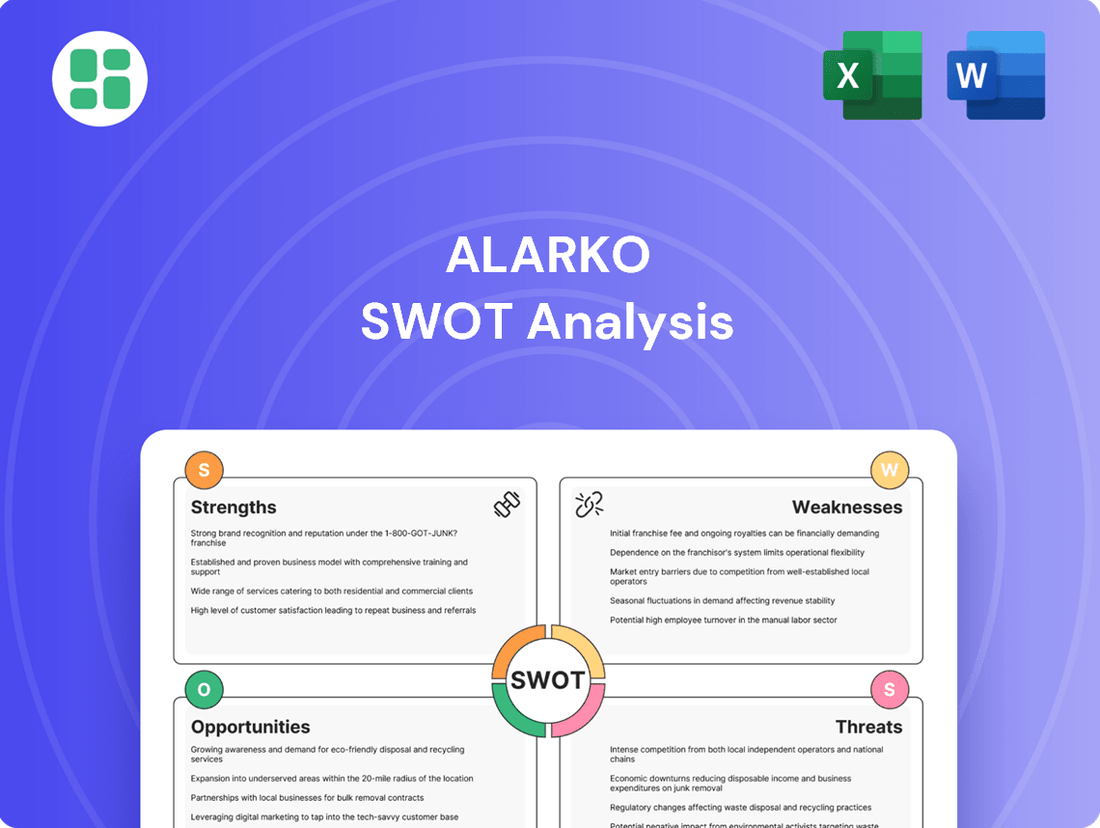

Analyzes Alarko’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing Alarko's core strategic challenges.

Weaknesses

Alarko Holding faced a significant downturn in its financial performance during the first quarter of 2025. Combined revenue saw a notable 19% drop when compared to the first quarter of 2024. This decline, coupled with a widening net loss, points to considerable pressures impacting the company's profitability and overall financial health.

The widening net loss suggests that expenses are outpacing revenue, a trend that requires careful scrutiny. This financial strain could be attributed to a variety of factors, including increased operational costs, reduced demand in key markets, or challenges within specific business segments.

A closer examination of each segment’s performance is crucial to understanding the root causes of this financial weakening. Identifying which areas are contributing most to the revenue decline and the increased net loss will be key to developing targeted strategies for improvement and recovery.

Alarko's significant reliance on its energy segment, its largest revenue driver, presents a notable weakness. This segment is particularly vulnerable to fluctuations in electricity prices, which can be quite volatile. For instance, in early 2024, global energy prices saw shifts influenced by geopolitical events, directly impacting the profitability of energy generation companies.

Furthermore, environmental factors pose a substantial risk. Lower water retention levels, a direct consequence of changing climate patterns and reduced rainfall, can significantly impair the performance of hydroelectric power generation, a key component of Alarko's energy portfolio. This sensitivity to both market price volatility and environmental conditions exposes the company to concentrated risks that could affect its overall financial health.

Turkey's persistent high inflation, estimated to remain elevated in 2024 and 2025, creates substantial monetary losses for Alarko Holding due to inflation accounting. This external economic pressure distorts reported net profits, making it challenging to discern the true operational performance of the company.

While some relief is expected as inflation potentially moderates, the ongoing volatility continues to complicate financial reporting and investor understanding of Alarko's underlying profitability. For instance, in the first quarter of 2024, Alarko reported a net profit of TRY 2.4 billion, but a significant portion of this was influenced by non-cash inflation adjustments, highlighting the masking effect of these economic conditions.

Underperformance in Specific Business Segments

Alarko's diverse operations show some vulnerability, with specific segments struggling to maintain momentum. For instance, the Industry and Trade division, along with the Tourism sector, experienced revenue drops and reported EBITDA or net losses during the fourth quarter of 2024 and the first quarter of 2025. This uneven performance across its various business lines suggests that not all of Alarko's diversified ventures are contributing positively to the group's overall financial health. Such underperformance in key areas could hinder aggregate profitability and necessitate focused strategic interventions to rectify the situation.

- Industry and Trade Segment: Faced revenue declines and potential EBITDA/net losses in Q4 2024 and Q1 2025.

- Tourism Segment: Also recorded revenue decreases and incurred EBITDA or net losses in the same periods.

- Diversified Operations: The mixed performance indicates that not all business units are operating at peak efficiency.

- Profitability Impact: Underperforming segments can negatively affect the overall profitability of the Alarko group.

Challenging Credit Access Environment

Alarko's operations are currently navigating a more restrictive credit environment, a factor highlighted in the Q1 2025 CEO's statement. This tightening access to external financing could potentially impede the company's ability to fund new investment and expansion projects, even with robust internal cash flow management.

The challenges in securing credit may act as a bottleneck for Alarko's growth trajectory. For instance, while the company reported a strong liquidity position, a significant portion of its Q1 2025 debt maturity profile might require refinancing, which could be more costly or difficult to arrange in the current market conditions. This could necessitate a more conservative approach to capital allocation.

- Limited external financing options could slow down strategic growth initiatives.

- Increased cost of borrowing may impact project profitability.

- Reliance on internal cash flow might constrain the scale of new investments.

Alarko's heavy dependence on its energy segment makes it susceptible to energy price volatility. For example, global energy price shifts in early 2024 directly impacted profitability for energy generators. Additionally, reduced rainfall due to climate change in 2024-2025 negatively affected hydroelectric power generation performance, a key part of Alarko's energy business.

Turkey's persistent high inflation, projected to remain elevated through 2025, creates accounting challenges. In Q1 2024, Alarko's reported TRY 2.4 billion net profit included significant non-cash inflation adjustments, obscuring true operational performance.

Several of Alarko's diversified segments, including Industry and Trade and Tourism, experienced revenue declines and reported losses in late 2024 and early 2025. This mixed performance across its portfolio indicates that not all business units are contributing positively, potentially hindering overall group profitability.

A more restrictive credit environment in 2025 could limit Alarko's ability to fund new investments and expansion projects. Refinancing existing debt may also become more costly or difficult, potentially necessitating a more conservative approach to capital allocation.

| Segment Performance (Q4 2024/Q1 2025) | Revenue Trend | Profitability |

| Energy | Vulnerable to price volatility | Impacted by climate factors (hydro) |

| Industry and Trade | Declined | Potential EBITDA/Net Loss |

| Tourism | Decreased | Incurred EBITDA/Net Loss |

Full Version Awaits

Alarko SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Alarko Holding is making significant strides in modern agriculture, evidenced by its substantial investments in greenhouse farming. These ventures in Turkey and Kazakhstan are strategically positioned to capitalize on the sector's considerable growth potential.

The company's ambition to rank among the top three global producers by 2028 underscores its commitment to this expansion. This goal is supported by the adoption of innovative farming techniques and a deliberate strategy to broaden its operational reach, which is expected to boost future revenue and EBITDA.

Alarko's tourism segment is poised for growth with the planned operationalization of new leisure investments, such as Bodrum Hillside, by the end of 2025. This expansion capitalizes on the established strength of the 'Hillside' brand, offering a significant opportunity to enhance rental income.

The group anticipates that these new ventures will bolster the tourism segment's contribution to its diversified revenue streams, reinforcing its position in the market. This strategic move is expected to yield positive financial results in the coming years.

The Turkish economy's ongoing efforts toward macroeconomic stabilization, including projected inflation easing and reduced inflation accounting losses in 2025, are expected to boost Alarko Holding's net profitability. This economic normalization could lead to higher real earnings for the company.

Increasing Demand for Renewable Energy Solutions

The global and national drive for sustainable energy presents a significant opportunity for Alarko Holding. With its established energy distribution network and existing energy assets, Alarko is well-positioned to capitalize on the increasing demand for renewable energy solutions.

This strategic alignment with environmental goals offers a pathway for stable, long-term growth. For instance, Turkey's renewable energy capacity reached approximately 35.6 GW by the end of 2023, with solar and wind power showing substantial increases. Alarko's continued investment in this sector, particularly in energy distribution and potentially in new generation projects, can leverage this expanding market.

- Expansion in Renewable Energy Projects: Alarko can further invest in and expand its portfolio of solar, wind, and other renewable energy generation facilities.

- Leveraging Energy Distribution Network: The company's existing infrastructure for energy distribution provides a ready-made channel to integrate and deliver renewable energy.

- Alignment with National Targets: Turkey aims to increase the share of renewables in its total energy consumption, creating a favorable regulatory environment for companies like Alarko.

- Stable Growth Trajectory: The predictable revenue streams from renewable energy projects and distribution services offer a stable growth outlook.

Agile Investment Strategy as a Portfolio Management Company

Alarko Holding's strategic shift towards becoming a dynamic portfolio management company enhances its ability to quickly identify and seize emerging investment prospects across diverse industries. This adaptability is crucial in today's rapidly evolving economic landscape, allowing for proactive adjustments to asset allocation strategies to maximize profitability.

This agile approach enables Alarko to swiftly rebalance its portfolio in response to market shifts, ensuring optimal performance. For instance, in 2024, the company's diversified holdings, which include energy, tourism, and construction, provided resilience against sector-specific downturns, demonstrating the benefits of a flexible investment strategy.

- Increased Responsiveness: Alarko can pivot its investments more rapidly to capitalize on new market trends or mitigate emerging risks.

- Diversification Benefits: By actively managing a broad portfolio, Alarko can spread risk and enhance overall returns through strategic sector allocation.

- Capitalizing on Emerging Sectors: The company's repositioning allows it to actively seek out and invest in high-growth sectors identified through ongoing market analysis.

Alarko's expansion into modern agriculture, particularly greenhouse farming in Turkey and Kazakhstan, presents a significant growth avenue, aiming for a top-three global producer position by 2028. The tourism segment is also set to benefit from new leisure investments like Bodrum Hillside, expected to enhance rental income and contribute to diversified revenue streams.

The company is well-positioned to capitalize on Turkey's increasing demand for renewable energy, with its existing distribution network and assets aligning with national sustainability goals. Turkey's renewable energy capacity reached approximately 35.6 GW by the end of 2023, highlighting the market's expansion potential.

Alarko's strategic shift to a dynamic portfolio management approach enhances its agility in seizing new investment opportunities across various industries, allowing for swift adjustments to asset allocation and risk mitigation. This flexibility was evident in 2024, where diversified holdings provided resilience against sector-specific downturns.

| Opportunity Area | Key Initiatives | Market Context/Data |

|---|---|---|

| Modern Agriculture | Greenhouse farming investments in Turkey & Kazakhstan | Target: Top 3 global producer by 2028 |

| Tourism | New leisure investments (e.g., Bodrum Hillside) | Expected operationalization by end of 2025; leverages 'Hillside' brand strength |

| Renewable Energy | Expansion of solar, wind, and distribution network | Turkey's renewable capacity ~35.6 GW (end 2023); aligns with national targets |

| Portfolio Management | Agile investment strategy across diverse sectors | Demonstrated resilience in 2024 through diversified holdings |

Threats

Persistent macroeconomic instability in Turkey remains a significant threat. Despite some stabilization efforts, the country has grappled with elevated inflation, which stood at 69.80% year-on-year in May 2024, and considerable currency volatility. This environment directly impacts Alarko Holding by increasing operational costs and diminishing consumer purchasing power across its diverse business segments, from tourism to construction.

Alarko Holding’s significant presence in international trade and tourism exposes it directly to geopolitical risks. For instance, ongoing conflicts or political instability in regions where Alarko operates or sources materials, such as the Eastern Mediterranean or parts of Africa, could severely disrupt its supply chains and project timelines. This exposure was highlighted in early 2024 with heightened tensions in the Middle East impacting shipping routes, a critical factor for Alarko's import/export activities.

Regional volatility can also deter international tourism, a key revenue driver for Alarko's hospitality segment. A perception of instability in Turkey or neighboring countries, even if not directly affecting Alarko's properties, can lead to a broad decline in visitor numbers. For example, a surge in regional conflicts in late 2023 saw a noticeable dip in inbound tourism figures for several Mediterranean destinations, a trend Alarko would likely experience.

Alarko Holding's diversified operations expose it to a broad spectrum of competitors, ranging from established domestic giants to agile international firms. This widespread competition intensifies pressure on pricing and market share across sectors like construction, tourism, and energy. For instance, the Turkish construction sector, a core area for Alarko, saw significant activity in 2024, with numerous local and global companies vying for major infrastructure projects, potentially impacting Alarko's project pipelines and profitability.

Adverse Regulatory Changes and Policy Shifts

Alarko Holding operates in sectors susceptible to significant government oversight, making adverse regulatory changes a considerable threat. For instance, shifts in energy policies, such as changes to renewable energy incentives or fossil fuel regulations, could directly impact its energy generation and distribution segments. Similarly, evolving building codes, environmental standards, or urban planning regulations in the construction sector can increase project costs and timelines, affecting Alarko's development pipeline and profitability. The company’s reliance on public tenders and infrastructure projects also exposes it to potential policy shifts that could alter project funding or procurement processes.

The potential for increased compliance costs due to new or stricter regulations is a key concern. For example, if environmental regulations become more stringent in 2024 or 2025, Alarko might need to invest heavily in new technologies or upgrade existing facilities to meet these standards. This could divert capital from other growth initiatives and reduce overall margins. Furthermore, economic policy shifts, such as changes in interest rates, tax laws, or foreign exchange regulations, can impact Alarko’s borrowing costs, investment attractiveness, and the overall economic climate in which it operates.

Regulatory uncertainties can also dampen investment appeal, as investors may become hesitant to commit capital when the future regulatory landscape is unclear. This could affect Alarko’s ability to secure financing for new projects or expansions. For example, a sudden change in foreign investment laws could limit Alarko's access to international capital markets, a crucial source of funding for large-scale infrastructure and energy projects. The company must remain agile and prepared to adapt its strategies to navigate these evolving regulatory environments.

- Energy Sector Vulnerability: Changes in renewable energy support schemes or carbon pricing mechanisms could impact Alarko's energy portfolio.

- Construction Code Impact: Stricter building safety or environmental standards introduced in 2024-2025 could necessitate costly project redesigns.

- Economic Policy Sensitivity: Fluctuations in government spending on infrastructure projects, a key revenue driver for Alarko, are directly tied to economic policy.

- Compliance Cost Escalation: New regulations, such as those related to data privacy or labor standards, can lead to increased operational expenses.

Environmental Risks Affecting Core Operations

Climate-related challenges, particularly insufficient rainfall, directly impact hydroelectric power generation, a crucial component of Alarko's energy revenue. For instance, in 2024, below-average precipitation levels in key regions could lead to reduced output from Alarko's hydroelectric facilities, potentially impacting financial performance. While Alarko utilizes modern agricultural techniques, the broader effects of climate change, such as increased drought frequency, could still pose risks to agricultural yields and the availability of essential resources for their farming operations.

The company's reliance on natural resources makes it susceptible to environmental shifts. For example, a prolonged drought in 2025 could significantly affect the water levels in reservoirs powering their hydroelectric plants. This vulnerability extends to their agricultural segment, where unpredictable weather patterns can disrupt crop cycles and reduce overall output.

- Hydroelectric Power Generation: Reduced rainfall directly affects the operational capacity and revenue generated from Alarko's hydroelectric power plants.

- Agricultural Yields: Broader climate change impacts, like increased aridity, can negatively influence crop productivity and resource availability in their agricultural ventures.

- Operational Costs: Extreme weather events may necessitate increased investment in water management and climate adaptation strategies, thereby raising operational costs.

Persistent macroeconomic instability in Turkey, characterized by high inflation at 69.80% year-on-year in May 2024, poses a significant threat. This economic environment directly impacts Alarko Holding by increasing operational costs and reducing consumer purchasing power across its diverse business segments.

Geopolitical risks and regional volatility, evidenced by Middle Eastern tensions impacting shipping routes in early 2024, can disrupt supply chains and tourism revenue. Increased competition in core sectors like construction, with numerous local and global firms active in 2024, also intensifies pressure on pricing and market share.

Adverse regulatory changes and compliance cost escalation are key concerns, particularly regarding environmental standards or energy policies. For example, stricter environmental regulations introduced in 2024-2025 could necessitate costly project redesigns and increase operational expenses.

Climate-related challenges, such as insufficient rainfall impacting hydroelectric power generation in 2024, directly affect revenue. Broader climate impacts, like increased aridity, can negatively influence crop productivity and resource availability in their agricultural ventures.

SWOT Analysis Data Sources

This Alarko SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive market research data, and insights from reputable industry publications to ensure a thorough and accurate assessment.