Alarko Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alarko Bundle

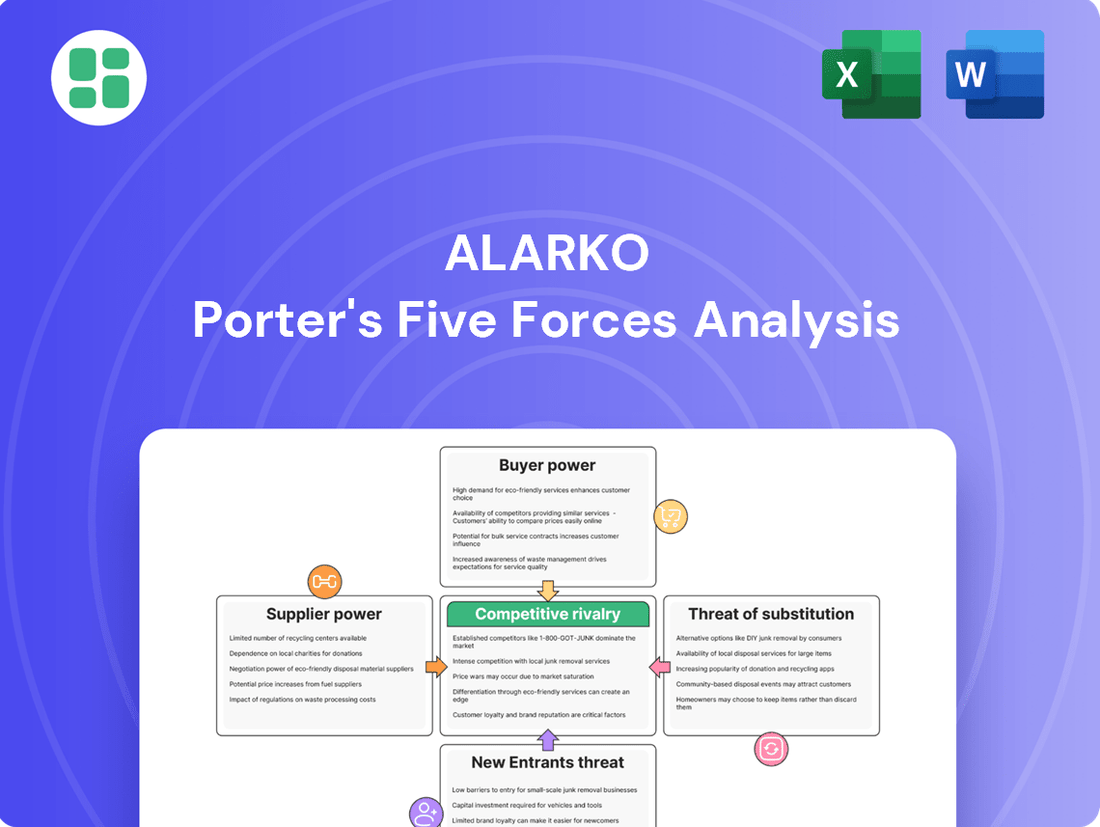

Alarko's competitive landscape is shaped by the interplay of five critical forces, impacting profitability and strategic positioning. Understanding the intensity of buyer power, supplier leverage, threat of new entrants, availability of substitutes, and the rivalry among existing competitors is crucial for navigating this market.

The complete report reveals the real forces shaping Alarko’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alarko Holding's diverse operations, spanning construction, energy, manufacturing, and agriculture, mean it sources a wide variety of raw materials and specialized equipment. The bargaining power of these suppliers hinges on how critical and readily available their offerings are. For instance, if Alarko requires highly specialized components for its energy projects, and few suppliers can provide them, those suppliers gain significant leverage.

In 2024, the global supply chain for critical minerals used in renewable energy, such as lithium and cobalt, saw price fluctuations driven by geopolitical factors and increased demand. This situation directly impacts Alarko's energy sector, potentially increasing input costs if these suppliers have limited competition and high switching costs for Alarko.

Global supply chain disruptions and inflationary pressures, which were particularly pronounced in 2024, have significantly amplified the bargaining power of suppliers across Alarko's diverse business segments. This means suppliers can dictate terms more readily, potentially leading to higher input costs for Alarko.

For Alarko's large-scale construction and energy projects, these supply chain issues translate into tangible impacts. Delays in sourcing essential materials and escalating costs directly affect operational efficiency and can push back project completion dates, impacting revenue recognition and profitability.

In 2024, for instance, the global semiconductor shortage continued to affect various industries, including those supplying components for Alarko's energy infrastructure projects. Similarly, rising global commodity prices, such as steel and cement, directly increased Alarko's material sourcing costs.

Alarko's strategic response to this increased supplier power hinges on its ability to diversify its sourcing channels and cultivate robust, long-term relationships with key suppliers. This proactive approach is essential for mitigating risks and ensuring the continuity of its operations and project execution.

In industries like Alarko's construction and power generation, the availability of skilled labor and specialized engineers is a significant supplier consideration. A scarcity of such talent, or the presence of robust labor unions, can amplify the bargaining power of these suppliers, potentially driving up wage expenses and complicating hiring efforts.

Energy Sector Specific Suppliers

Alarko's energy generation and distribution operations are significantly influenced by its fuel suppliers, such as those providing coal for thermal power plants. The global price fluctuations of commodities like coal, which saw an average price of approximately $130 per ton in 2024 for thermal coal, directly impact Alarko's operational costs and profitability. This dependence grants considerable bargaining power to these essential suppliers.

Furthermore, technology providers play a crucial role, supplying vital equipment for power plant maintenance and the development of new energy storage solutions. The availability and cost of advanced energy technologies, particularly in the rapidly evolving energy storage market, can tip the scales of power in favor of these specialized vendors. For instance, the increasing demand for lithium-ion battery technology, a key component in energy storage, has seen prices stabilize but remain a significant investment for companies like Alarko.

- Fuel Price Volatility: The cost of coal, a primary fuel for Alarko's thermal plants, is subject to global market dynamics. In 2024, thermal coal prices demonstrated significant volatility, impacting Alarko's input costs.

- Technology Dependence: Alarko's reliance on specialized technology providers for maintenance and advanced solutions like energy storage grants these suppliers leverage.

- Strategic Partnerships: Alarko's joint venture with Gotion Group for energy storage aims to mitigate supplier power by securing access to critical technologies and potentially favorable terms.

- Market Concentration: The energy technology sector can be concentrated, with a limited number of providers for certain advanced solutions, further enhancing their bargaining position.

Agricultural and Industrial Raw Material Suppliers

Alarko's bargaining power with agricultural and industrial raw material suppliers is a key consideration. In its agricultural expansion, the company's need for specialized inputs like seeds, fertilizers, and greenhouse systems means suppliers of these items can wield significant influence over Alarko's operational costs. For instance, the global fertilizer market saw price volatility in early 2024, driven by supply chain disruptions and geopolitical factors, potentially impacting Alarko's agricultural segment.

Similarly, in its industrial product manufacturing, Alarko faces suppliers of metals, chemicals, and other essential materials. The availability and price of these commodities, which can fluctuate based on global demand and production levels, directly affect Alarko's cost of goods sold. For example, steel prices, a critical input for many industrial goods, experienced a notable surge in late 2023 and early 2024, presenting a challenge for manufacturers like Alarko.

Alarko's strategic move to invest in its own fertilizer production capacity is a direct response to mitigate this supplier dependency. By controlling a portion of its fertilizer supply chain, the company aims to reduce its exposure to external price fluctuations and gain more leverage in negotiations for any remaining external fertilizer needs. This vertical integration strategy is crucial for stabilizing costs in its agricultural operations.

- Agricultural Inputs: Alarko's reliance on specialized seeds, fertilizers, and greenhouse technology means suppliers in these niches can influence its cost structure.

- Industrial Raw Materials: The cost and availability of metals, chemicals, and other industrial inputs are subject to market fluctuations, affecting supplier power.

- Fertilizer Production: Alarko's investment in its own fertilizer production aims to reduce dependence on external suppliers for this critical agricultural input.

- Market Volatility: Global price shifts in commodities like steel and fertilizers in 2023-2024 highlight the potential bargaining power of suppliers in these sectors.

Alarko's reliance on specialized suppliers, particularly for its energy and construction divisions, grants these entities considerable bargaining power. This is amplified when Alarko requires unique components or raw materials with limited alternative sources. For example, the global semiconductor shortage in 2024 directly impacted Alarko's energy infrastructure projects, increasing costs and potentially delaying timelines due to supplier leverage.

The bargaining power of fuel suppliers is a critical factor for Alarko's energy generation segment. In 2024, thermal coal prices, a key input for Alarko's thermal power plants, saw significant volatility, averaging around $130 per ton. This dependence empowers coal suppliers, allowing them to influence Alarko's operational expenses and profitability.

Alarko's strategic investments, such as its joint venture with Gotion Group for energy storage, aim to counter supplier power by securing access to critical technologies and potentially favorable terms, thereby mitigating the influence of concentrated technology providers.

Suppliers of agricultural inputs like fertilizers also hold significant sway. The global fertilizer market experienced price fluctuations in early 2024 due to supply chain disruptions. Alarko's investment in its own fertilizer production capacity is a direct measure to reduce this dependence and bolster its negotiating position.

| Supplier Type | Key Considerations for Alarko | 2024 Market Impact/Data | Alarko's Mitigation Strategy |

| Specialized Component Providers (Energy) | Limited availability, high switching costs | Semiconductor shortage impacting infrastructure projects | Diversifying sourcing, long-term relationships |

| Fuel Suppliers (Energy) | Dependence on global commodity prices | Thermal coal averaged ~$130/ton in 2024, with volatility | Exploring alternative energy sources, hedging |

| Agricultural Input Suppliers | Need for specialized seeds, fertilizers | Fertilizer prices volatile in early 2024 due to supply issues | Investing in own fertilizer production |

| Industrial Raw Material Suppliers | Price and availability of metals, chemicals | Steel prices surged in late 2023/early 2024 | Long-term contracts, exploring alternative materials |

What is included in the product

This analysis meticulously examines the five competitive forces impacting Alarko's industry, revealing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately, Alarko's strategic positioning.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Alarko's customer base is remarkably diverse, spanning government bodies and major corporations for its construction and energy infrastructure ventures. This broad reach across different sectors, from large-scale projects to individual consumers for electricity, tourism, and real estate, typically dilutes the bargaining power of any single customer group.

For instance, in the energy sector, while individual residential customers have limited power, large industrial consumers purchasing electricity might wield more influence due to the volume of their consumption. This segmentation means Alarko must tailor its strategies to manage varying levels of customer leverage across its different business units.

In regulated industries like electricity distribution, customer price sensitivity is often dampened by regulatory frameworks that dictate pricing, thereby limiting direct customer bargaining power. For instance, in 2024, energy price caps in many European countries aimed to protect consumers but also reduced the direct impact of customer demand on pricing flexibility for utility providers.

Conversely, in competitive sectors such as construction or industrial goods, customers possess a wider array of alternatives. This abundance of choice amplifies customer price sensitivity and, consequently, their bargaining power. In 2024, the construction sector, facing fluctuating material costs, saw buyers leveraging competitive bids to negotiate better terms, significantly impacting supplier margins.

The tourism industry, particularly in 2024, has been acutely sensitive to price increases. Rising operational costs and inflation led to higher travel prices, which directly impacted consumer demand, illustrating how elevated prices can diminish customer bargaining power by reducing their willingness to pay.

For services like electricity distribution, switching costs for customers are generally high due to the intricate infrastructure and regulatory frameworks involved. This complexity significantly limits a customer's ability to easily switch providers, thereby diminishing their bargaining power.

In the tourism sector, Alarko's Hillside brand showcases remarkable customer satisfaction, leading to high repeat guest rates. This strong brand loyalty acts as a buffer, effectively reducing the bargaining power customers might otherwise exert.

Large-Scale Project Clients

Clients for Alarko's large-scale construction and infrastructure projects, frequently government entities or significant developers, wield considerable bargaining power. This stems from the sheer volume and strategic nature of the contracts they award.

These major clients can negotiate for competitive pricing, demand advantageous contract terms, and insist on strict adherence to detailed project specifications. For instance, in 2024, major infrastructure tenders often saw multiple pre-qualified bidders, intensifying price competition.

- Significant Contract Value: Large projects represent a substantial portion of revenue, giving clients leverage.

- Competitive Bidding Environment: The presence of numerous qualified contractors in tenders amplifies client negotiation strength.

- Stringent Specifications: Clients can dictate precise quality and performance standards, impacting Alarko's costs and flexibility.

Impact of Economic Conditions on Customer Demand

The economic climate in Turkey, marked by persistent inflation and tighter credit conditions, significantly impacts Alarko's customer base. This environment directly curtails consumer and business spending power, translating into lower demand across Alarko's key sectors, including energy and construction. For instance, the economic slowdown observed in late 2024 and early 2025 likely affected revenue streams in these segments.

These economic pressures can amplify the bargaining power of customers. As disposable incomes shrink and financing becomes more difficult to obtain, customers become more price-sensitive and scrutinize their purchases more closely. This heightened selectivity can force Alarko to offer more favorable terms or face reduced sales volumes.

- Inflationary pressures in Turkey reached an annual rate of 65.27% in May 2024, impacting consumer purchasing power.

- Access to credit has become more restricted, potentially limiting large capital expenditures for Alarko's B2B customers.

- Reduced consumer confidence, a common byproduct of economic instability, often leads to delayed or canceled discretionary spending.

Alarko's bargaining power of customers is influenced by sector-specific dynamics and the overall economic climate. While high switching costs in regulated energy markets and strong brand loyalty in tourism can limit customer leverage, competitive bidding in construction and price sensitivity in tourism can amplify it. The economic pressures in Turkey, including high inflation and restricted credit in 2024, further empower customers by reducing their spending ability and increasing their focus on price.

| Sector | Customer Type | Bargaining Power Factor | 2024 Data/Observation |

|---|---|---|---|

| Energy | Industrial Consumers | Volume of Consumption | Potential for negotiation on large electricity purchase agreements. |

| Construction | Major Developers/Government | Competitive Bidding Environment | Intensified price competition in infrastructure tenders. |

| Tourism | Individual Consumers | Price Sensitivity | Impact of rising operational costs on consumer demand. |

| Overall Economy (Turkey) | All Sectors | Reduced Spending Power | Annual inflation at 65.27% (May 2024) impacting purchasing ability. |

Preview Before You Purchase

Alarko Porter's Five Forces Analysis

This preview shows the exact, professionally written Alarko Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive understanding of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Alarko's industry. This detailed analysis is fully formatted and ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

Alarko Holding faces significant competitive rivalry across its key operational areas, which include construction, energy, and tourism. These sectors are characterized by a substantial number of well-established domestic and international companies, leading to a highly competitive landscape. For instance, in Turkey's construction sector, which is a major focus for Alarko, the market is populated by numerous large firms, many with decades of experience and extensive project portfolios.

The energy sector also presents robust competition, with both public and private entities vying for market share in generation, distribution, and trading. In 2023, Turkey's installed power generation capacity reached approximately 105,000 MW, with a diverse mix of energy sources, indicating a crowded market. This intense rivalry necessitates continuous innovation and efficiency improvements for Alarko to maintain its position.

Alarko's strategic diversification into these varied sectors, while exposing it to rivalry in each, also serves as a crucial risk mitigation strategy. By not being solely reliant on one industry, the company can potentially offset weaker performance in one area with stronger results in another, thereby smoothing out overall financial performance against the backdrop of intense competition.

The Turkish construction sector is fiercely competitive, featuring established giants such as Renaissance Construction and Limak Insaat. Alarko Contracting Group actively vies for significant residential, commercial, and infrastructure contracts, where price, execution proficiency, and established track records are key differentiators.

Despite anticipated market expansion, this intense rivalry remains a defining characteristic of the industry. For instance, in 2023, the total value of construction projects awarded in Turkey reached approximately $25 billion, underscoring the substantial stakes and the need for Alarko to maintain a competitive edge.

Alarko's competitive rivalry in the energy sector is significant, with both private and state-owned companies vying for market share in power generation and electricity distribution. For instance, in 2024, Turkey's total installed power generation capacity reached approximately 106,000 MW, with a substantial portion held by private sector players alongside state entities like the Turkish Electricity Generation Company (EÜAŞ).

The dynamic nature of electricity prices, influenced by global commodity markets and domestic demand, alongside evolving regulatory frameworks, constantly reshapes the competitive intensity. Alarko's proactive strategy, including substantial investments in renewable energy sources and advanced energy storage solutions, is designed to bolster its standing amidst these ongoing market shifts.

Tourism Industry Rivalry

The Turkish tourism industry is intensely competitive, featuring a broad array of domestic and international players vying for market share. Alarko's Hillside brand distinguishes itself by focusing on superior quality, exceptional service, and distinctive leisure experiences.

Despite these efforts, the sector grapples with escalating operational costs and robust global competition. This environment necessitates ongoing innovation and strategic adaptation to sustain market position and customer engagement.

- Intense Competition: The Turkish tourism market is crowded with numerous local and foreign companies.

- Differentiation Strategy: Alarko's Hillside brand competes by offering high-quality services and unique leisure concepts.

- Sector Challenges: Rising costs and global competitive pressures demand continuous innovation for market relevance.

- Market Dynamics: In 2023, Turkey welcomed approximately 56.7 million visitors, a significant increase from previous years, highlighting both the market's appeal and the intensity of competition to capture this demand.

New Business Ventures and Future Competition

Alarko's strategic diversification into modern agriculture, including greenhouses and fertilizer production, and its foray into aviation through cargo plane conversion, immediately exposes it to novel competitive arenas. These ventures, while promising for future growth, mean Alarko must contend with established businesses and potential new entrants. For instance, the global greenhouse market was valued at approximately USD 35.8 billion in 2023 and is projected to reach USD 53.4 billion by 2030, indicating a dynamic and competitive landscape.

Successfully navigating these new sectors will demand substantial capital investment and astute strategic planning to carve out market share. In the aviation sector, particularly cargo plane conversions, Alarko faces competition from specialized MRO (Maintenance, Repair, and Overhaul) providers and aircraft manufacturers themselves. The demand for freighter conversions saw a significant uptick in 2024, with orders for passenger-to-freighter (P2F) conversions increasing, driven by e-commerce growth.

- New Sectors, New Rivals: Alarko's expansion into modern agriculture and aviation introduces it to industries with existing, well-established players and the potential for new, agile competitors.

- Investment and Strategy are Key: Gaining traction in these new markets requires significant financial commitment and carefully crafted strategies to differentiate Alarko's offerings.

- Market Growth and Competition: The modern agriculture sector, valued at billions, and the burgeoning cargo plane conversion market both present opportunities alongside intense competitive pressures.

- Navigating Aviation Dynamics: In aviation, Alarko will compete with specialized conversion firms and original equipment manufacturers, necessitating a strong value proposition to secure its position.

Alarko's competitive rivalry is pronounced across its core sectors, with numerous established domestic and international players. In construction, for example, the market is dense with experienced firms, and in 2023, Turkey's construction project awards neared $25 billion, highlighting the intense competition for contracts. Similarly, the energy sector sees significant competition from both public and private entities, with Turkey's installed power capacity exceeding 106,000 MW in 2024, a testament to a crowded market.

Even in its newer ventures like modern agriculture and aviation, Alarko faces established businesses. The global greenhouse market, valued at approximately $35.8 billion in 2023, and the growing demand for cargo plane conversions in 2024 underscore that these new arenas are not without their own robust rivalries. Alarko's strategy involves differentiation through quality and innovation to navigate these competitive landscapes effectively.

| Sector | Key Competitors (Examples) | Market Size/Activity (Recent Data) | Competitive Intensity |

|---|---|---|---|

| Construction | Renaissance Construction, Limak Insaat | Turkey construction project awards: ~$25 billion (2023) | High |

| Energy | EÜAŞ, Private Power Producers | Turkey installed capacity: ~106,000 MW (2024) | High |

| Tourism | Numerous domestic & international operators | Turkey visitor arrivals: ~56.7 million (2023) | High |

| Modern Agriculture | Global Greenhouse Market | Global Greenhouse Market: ~$35.8 billion (2023) | Growing/Moderate to High |

| Aviation (Cargo Conversion) | Specialized MROs, Aircraft Manufacturers | Increased P2F conversion orders (2024) | Emerging/Moderate to High |

SSubstitutes Threaten

For Alarko's energy generation operations, a significant threat arises from alternative energy sources and distributed generation, particularly as the push for renewables intensifies. The growing trend of consumers and businesses installing rooftop solar panels or small-scale wind turbines directly impacts the demand for electricity supplied by traditional, centralized power plants.

This shift towards self-generation means less reliance on grid power, potentially eroding Alarko's market share. For instance, in 2023, Turkey saw a notable increase in installed solar capacity, with new additions contributing to a more decentralized energy mix, a trend expected to continue through 2024 and beyond.

Alarko's strategic investments in solar and hydroelectric power, coupled with a focus on energy storage solutions, represent a proactive measure to adapt to this evolving energy landscape. By diversifying its generation portfolio and embracing storage technologies, Alarko aims to mitigate the impact of these substitute energy sources and remain competitive.

The threat of substitutes in construction materials and methods is a significant consideration for companies like Alarko. Innovations such as modular construction, prefabrication, and advanced composite materials offer potential advantages in terms of cost reduction, accelerated project timelines, and improved sustainability. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow substantially, indicating a clear shift towards alternative building approaches.

These evolving methods can directly substitute traditional on-site construction techniques for specific project types, particularly those where speed and cost-efficiency are paramount. While Alarko's commitment to quality is a strong differentiator, the increasing adoption of these innovative substitutes means that clients may opt for solutions that bypass conventional construction processes altogether, thereby impacting demand for Alarko's traditional services.

The tourism sector is constantly challenged by substitutes, whether it’s a different country offering a better deal or an entirely different way to spend leisure time, including digital alternatives. For instance, as costs in Turkey have reportedly risen, attracting fewer visitors, tourists might opt for destinations with more appealing price points or unique offerings. This dynamic puts pressure on established players like Alarko to differentiate.

Alarko's strategy to combat these substitution threats centers on building a strong brand experience and fostering high guest loyalty, evidenced by its impressive repeat customer rates. By focusing on delivering exceptional value and memorable stays, Alarko aims to make its offerings more attractive than readily available alternatives, thereby mitigating the impact of substitutes on its market position.

In-house Capabilities and DIY Solutions

For certain industrial products or less complex construction services, major clients may choose to build their own internal capabilities or pursue do-it-yourself (DIY) approaches. This strategy directly diminishes their need for external suppliers such as Alarko. For example, a large manufacturing firm might invest in its own specialized assembly equipment rather than outsourcing that specific function.

While the scale of Alarko's major infrastructure projects makes complete in-house execution by clients highly improbable, this threat of substitutes becomes more relevant in market segments characterized by lower technical complexity. In these niches, the cost savings and control offered by DIY solutions can be a significant draw. For instance, a large property developer might handle minor landscaping or interior finishing work internally if the scope is manageable and their existing workforce can be utilized effectively.

- In-house capabilities can reduce reliance on external providers for specific industrial components or services.

- DIY solutions are more feasible for less complex tasks, potentially impacting service providers like Alarko in niche markets.

- The economic rationale for clients to develop in-house capabilities is often driven by cost savings and greater control over operations.

- While large-scale infrastructure projects remain a barrier to client self-sufficiency, smaller, less complex service segments are more vulnerable to this threat.

Evolution of Trade and Industrial Products

The threat of substitutes in international trade and industrial products is significant, driven by rapid technological advancements and evolving supply chain dynamics. For example, the development of advanced composites could challenge the market share of traditional steel or aluminum in various manufacturing sectors. In 2024, the global market for advanced materials was projected to reach over $150 billion, indicating a growing competitive landscape for established industrial products.

Shifts in global trade patterns also present a substitute threat. Countries adopting protectionist policies or developing domestic manufacturing capabilities can reduce reliance on imported industrial goods. This can lead to the emergence of new regional suppliers offering comparable products, potentially at lower costs. For instance, the increasing self-sufficiency in certain manufacturing sectors within emerging economies in 2024 has already begun to reshape global sourcing strategies.

Alarko's strategic diversification into new manufacturing and agricultural product lines serves as a crucial hedge against these substitution threats. By expanding its portfolio, the company can mitigate the impact of any single product line becoming obsolete or less competitive due to technological shifts or changing trade environments. This proactive approach enhances Alarko's resilience in a dynamic global market.

- Technological Obsolescence: New material sciences, like graphene or advanced polymers, can offer superior performance or cost advantages, directly substituting traditional industrial materials.

- Supply Chain Innovation: The rise of localized manufacturing hubs and 3D printing technologies can reduce the need for globally sourced, mass-produced industrial components.

- Emerging Market Competition: Increased domestic production capabilities in developing nations can create local substitutes for established industrial products, impacting international trade volumes.

- Alarko's Diversification Strategy: Expanding into sectors like renewable energy components or specialized agricultural machinery provides alternative revenue streams and reduces dependence on potentially threatened traditional product lines.

The threat of substitutes for Alarko's energy generation operations is primarily from renewable energy sources and distributed generation. As consumers and businesses increasingly adopt rooftop solar and small-scale wind, their reliance on grid power decreases, potentially impacting Alarko's market share.

In 2023, Turkey saw significant growth in installed solar capacity, a trend expected to continue through 2024, leading to a more decentralized energy mix. Alarko's investments in solar, hydro, and energy storage are strategic responses to this evolving landscape.

For construction, innovations like modular construction and advanced composites offer cost and time advantages, potentially substituting traditional methods. The global modular construction market was valued around $100 billion in 2023, highlighting this shift.

In tourism, substitute offerings include different destinations or alternative leisure activities, especially as cost perceptions change. Alarko counters this by focusing on brand experience and guest loyalty to retain customers.

For less complex industrial or construction services, clients might opt for in-house capabilities or DIY solutions, particularly if cost savings and control are prioritized. While large projects aren't susceptible, smaller segments face this threat.

Technological advancements and changing trade dynamics also pose substitution threats in industrial products, with new materials and localized manufacturing challenging established goods. Alarko's diversification into new product lines helps mitigate these risks.

| Sector | Substitute Threat | Impact on Alarko | Mitigation Strategy | 2023/2024 Data Point |

|---|---|---|---|---|

| Energy Generation | Renewables, Distributed Generation (e.g., rooftop solar) | Reduced demand for grid power, potential market share erosion | Investment in renewables, energy storage | Turkey's solar capacity growth in 2023 |

| Construction | Modular construction, advanced composites | Clients may bypass traditional methods for cost/speed | Focus on quality and brand differentiation | Global modular construction market ~$100 billion (2023) |

| Tourism | Alternative destinations, different leisure activities | Pressure to differentiate offerings | Enhance brand experience, foster guest loyalty | Visitor cost perceptions impacting destination choice |

| Industrial/Services | In-house capabilities, DIY solutions (for less complex tasks) | Reduced need for external suppliers in niche markets | Focus on specialized, large-scale projects | Large firms investing in specialized equipment |

| Industrial Products | New materials, localized manufacturing, 3D printing | Obsolescence of traditional products, new competition | Diversification into new product lines | Global advanced materials market projected >$150 billion (2024) |

Entrants Threaten

Many of Alarko's core operational areas, such as energy generation and major construction projects, demand immense upfront capital. For instance, developing a new power plant can easily run into hundreds of millions, if not billions, of dollars. This high financial threshold naturally deters many potential competitors from even attempting to enter these markets.

The sheer scale of investment needed for infrastructure development means that only well-capitalized entities can realistically consider competing. This creates a significant barrier, protecting Alarko and similar established firms from a flood of new, smaller players who lack the financial muscle to match their operational capacity and market presence.

Alarko's robust financial standing, evidenced by its consistent revenue streams and access to credit, directly underpins its ability to navigate these capital-intensive sectors. As of the first quarter of 2024, Alarko Holding reported a consolidated net profit of 1.2 billion TRY, demonstrating its financial strength and capacity to undertake large-scale projects, further solidifying its competitive advantage.

Sectors where Alarko operates, such as energy distribution and major infrastructure, are heavily regulated. New companies face significant challenges due to complex permitting processes and stringent licensing requirements. For instance, obtaining permits for a new power plant can take years and involve multiple government agencies, a process that demands substantial legal and administrative resources.

These extensive legal and bureaucratic processes are inherently costly and time-consuming, effectively acting as a substantial barrier to entry for potential new competitors. Alarko's decades of experience navigating these regulatory landscapes, dating back to its founding in 1968, give it a distinct advantage in understanding and managing these complexities, which new entrants would struggle to replicate quickly.

Alarko Holding enjoys significant cost advantages due to its economies of scale in sectors like power generation and large-scale construction. For instance, its substantial operational capacity in energy allows for lower per-unit production costs, a hurdle for newcomers.

New entrants would find it challenging to match these cost efficiencies without achieving comparable production volumes and operational experience. Alarko's extensive 70-year operational history translates into a deep understanding of its markets and processes, further solidifying its competitive position.

Established Brand Reputation and Customer Relationships

Alarko's established brand reputation and deep-rooted customer relationships present a significant barrier to new entrants. In 2024, for example, Alarko's construction segment continued to leverage its decades-long track record, securing major projects that rely on trust and proven performance. Similarly, its tourism arm, exemplified by properties like Hillside, benefits from loyal clientele who value consistent quality and experience.

Newcomers would need to invest heavily in marketing and potentially aggressive pricing to even begin chipping away at Alarko's customer base. Building comparable brand equity and fostering the same level of customer loyalty takes considerable time and resources, making direct competition challenging.

- Strong Brand Recognition: Alarko's name is synonymous with reliability in its core sectors.

- Loyal Customer Base: Long-term relationships, particularly in hospitality, translate to repeat business.

- High Customer Acquisition Costs: New entrants face substantial marketing and promotional expenses to attract customers.

- Trust Factor: Alarko's history of successful project delivery builds inherent trust that new firms must earn.

Diversification as a Barrier

Alarko's extensive diversification acts as a significant barrier to new entrants. By operating across diverse sectors like energy, construction, tourism, agriculture, manufacturing, and aviation, Alarko creates a formidable presence that a new competitor, likely focused on a single industry, would struggle to match.

This broad portfolio offers Alarko inherent stability and resilience. For instance, in 2023, Alarko Holding reported consolidated revenues of approximately 35.7 billion TRY, with its energy segment alone contributing significantly, showcasing the financial strength derived from its varied operations. This cross-segment synergy and financial robustness make it considerably more challenging for single-sector newcomers to compete effectively against Alarko's established, multi-faceted business model.

- Diversified Revenue Streams: Alarko's presence in multiple industries reduces reliance on any single market, offering a buffer against sector-specific downturns.

- Cross-Segment Synergies: Operations in different sectors can create cost efficiencies and market advantages through shared resources or complementary services.

- Economies of Scale: The sheer breadth of Alarko's operations allows for greater economies of scale in procurement, marketing, and administration.

- Brand Reputation and Financial Strength: A diversified portfolio often translates to a stronger overall brand and greater financial capacity, making it difficult for smaller, specialized entrants to gain traction.

The threat of new entrants for Alarko is generally low due to substantial capital requirements, particularly in energy and construction, where projects can cost hundreds of millions or billions. For example, developing a new power plant requires immense upfront investment, a barrier that deters many potential competitors. Alarko's strong financial position, with a consolidated net profit of 1.2 billion TRY in Q1 2024, further solidifies its ability to undertake these large-scale projects.

Additionally, stringent regulatory environments and complex licensing procedures in sectors like energy distribution create significant hurdles. Obtaining permits for new infrastructure can take years and involve substantial legal and administrative resources, a process Alarko, with its history since 1968, is well-equipped to manage. These factors combine to make it difficult for new players to challenge Alarko's established market presence.

Alarko's established brand reputation and loyal customer base, built over decades, also pose a considerable barrier. In 2024, its construction segment continued to secure projects based on its proven track record, while its tourism arm benefits from repeat clientele. Newcomers would need significant investment in marketing and potentially aggressive pricing to attract customers, a challenge given Alarko's deep-rooted customer relationships and trust factor.

The company's diversified operations across energy, construction, tourism, and more also present a formidable defense. In 2023, Alarko Holding reported consolidated revenues of approximately 35.7 billion TRY, showcasing the financial strength derived from its varied operations. This broad portfolio and the resulting economies of scale and cross-segment synergies make it challenging for single-sector newcomers to compete effectively.

Porter's Five Forces Analysis Data Sources

Our Alarko Porter's Five Forces analysis is built upon a robust foundation of data, including Alarko's annual reports, investor presentations, and public financial statements. We supplement this with industry-specific market research reports and data from reputable financial news outlets to capture a comprehensive view of the competitive landscape.