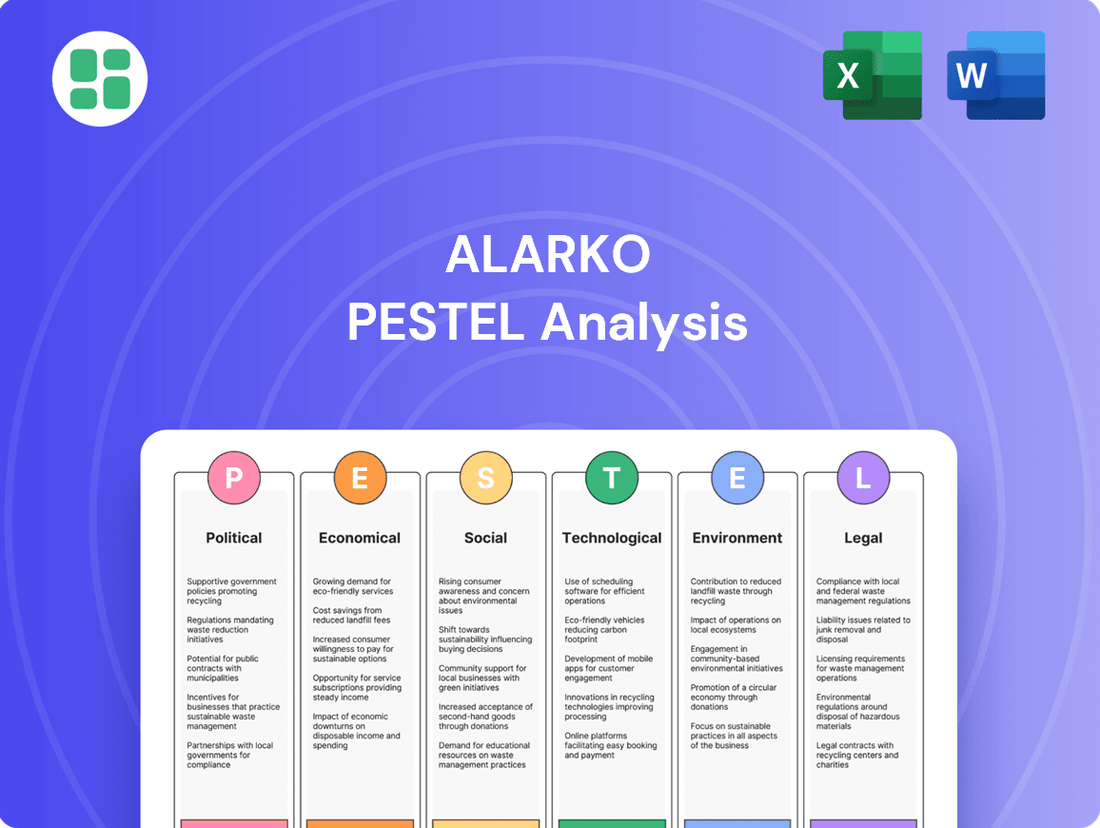

Alarko PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alarko Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Alarko's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version for actionable intelligence that will empower your decision-making.

Political factors

The Turkish government's commitment to infrastructure development presents a significant tailwind for Alarko Holding. In 2025 alone, a substantial $19 billion is earmarked for transport programs, with an overall $46.2 billion allocated to 3,783 public investment projects spanning multiple sectors.

This robust governmental spending, particularly in transportation, communications, and energy, directly translates into a stable and predictable stream of large-scale projects. These initiatives create fertile ground for Alarko's core construction and energy divisions, offering ample opportunities for growth and revenue generation.

Turkey's commitment to renewable energy is a significant political driver for Alarko. The government's 2035 Renewable Energy Road Map and the 2024-2028 Strategic Plan are actively pushing for increased green energy adoption.

These policies are backed by concrete actions, such as legislative reforms like the 'super permit,' which streamlines administrative processes for renewable energy projects. This initiative, along with new incentives, aims to create a more attractive investment climate for companies like Alarko in the renewable energy sector.

Turkey has ambitious goals for its energy mix, targeting a higher share of renewables in electricity production. Specifically, the country is focused on substantial additions to its solar and wind power capacity, presenting a clear growth opportunity for Alarko's energy generation business.

Recent amendments to zoning, construction supervision, urban transformation, and environmental regulations, enacted in late 2024 and taking effect in mid-2025, directly impact Alarko's construction operations. These changes aim to streamline processes and ensure compliance with updated standards, including new 'green cement' rules for government projects starting January 2025. Adapting to these evolving regulatory frameworks is crucial for maintaining project efficiency and compliance.

International Trade Relations

Alarko Holding's international trade activities mean it's directly influenced by Turkey's evolving trade relationships and broader global trade policies. For instance, the European Union remains a significant trading bloc for Turkey, with bilateral trade reaching approximately $170 billion in 2023, according to Turkish Ministry of Trade data. Any shifts in these agreements, such as changes in tariffs or quotas, could materially affect Alarko's export revenues and import costs.

Geopolitical risks and regional conflicts are also significant considerations. The ongoing conflicts in neighboring regions can disrupt supply chains, affecting the availability and cost of raw materials for Alarko's manufacturing segments. Furthermore, these instabilities can impact the attractiveness of export markets and create uncertainty for international investments and operations. For example, disruptions in the Eastern Mediterranean have previously affected energy exploration and related infrastructure projects.

The Turkish government's strategic focus on diversifying trade partners and securing energy supplies presents both opportunities and challenges for Alarko. Efforts to forge new trade agreements with countries in Asia and Africa could open up new markets for Alarko's products and services. Simultaneously, the drive for energy independence might lead to increased domestic investment in energy infrastructure, potentially benefiting Alarko's construction and energy divisions, but could also alter the competitive landscape for imported energy resources.

- Trade Agreements: Turkey's trade volume with the EU in 2023 was around $170 billion, highlighting the importance of EU-Turkey relations for Alarko.

- Supply Chain Vulnerability: Regional conflicts can lead to increased logistics costs and material shortages, impacting Alarko's production efficiency.

- Energy Security Focus: Government initiatives to diversify energy sources and partners could create new avenues for Alarko's involvement in energy infrastructure projects.

- Market Diversification: The push to expand trade with non-traditional partners offers potential for Alarko to tap into new customer bases and reduce reliance on established markets.

Political Stability and Investor Confidence

Political stability is a crucial element for investor confidence, and Turkey's landscape presents a mixed picture. While the government has aimed for economic stability, instances of political volatility and shifts in monetary policy have indeed affected how investors perceive the market. This uncertainty can directly impact foreign direct investment inflows and the cost of capital for companies like Alarko.

The Turkish Lira's performance is a tangible indicator of these concerns. For example, the Lira experienced significant depreciation throughout 2023 and into early 2024, impacting the purchasing power of foreign investment and increasing the cost of imported materials for businesses. This fluctuation creates a less predictable business environment, making long-term planning more challenging.

Alarko's strategic approach to financial management, characterized by strong financial discipline and a focus on prudent debt management, positions it to better navigate these political and economic uncertainties. By maintaining a healthy balance sheet and robust cash flow, the company can absorb some of the shocks stemming from external volatility.

- Turkish Lira Depreciation: The Lira saw a notable decline against the US Dollar in 2023, trading around 28-30 TRY/USD by year-end, impacting import costs and foreign investment valuations.

- Investor Confidence Metrics: Surveys of investor sentiment in emerging markets often highlight political risk as a key deterrent, influencing capital allocation decisions.

- Monetary Policy Shifts: The Central Bank of the Republic of Turkey adjusted its policy rates multiple times in 2023, reflecting attempts to manage inflation but also contributing to policy uncertainty.

The Turkish government's substantial infrastructure investment, with $46.2 billion allocated to 3,783 public projects in 2025, directly benefits Alarko's construction and energy sectors. Furthermore, the government's commitment to renewable energy, outlined in its 2035 Renewable Energy Road Map, coupled with legislative reforms like the 'super permit,' creates a favorable environment for Alarko's green energy initiatives.

Political stability and policy consistency remain key considerations, as evidenced by the Turkish Lira's depreciation throughout 2023 and early 2024, which impacts import costs and foreign investment. Alarko's strong financial discipline helps mitigate these external volatilities.

Turkey's trade relations, particularly with the EU, which saw a bilateral trade volume of approximately $170 billion in 2023, are crucial for Alarko's international operations. Geopolitical risks in neighboring regions can disrupt supply chains and affect raw material costs, influencing Alarko's manufacturing segments.

| Political Factor | Impact on Alarko | Supporting Data/Context |

|---|---|---|

| Infrastructure Spending | Increased project opportunities for construction and energy divisions. | $46.2 billion allocated to 3,783 public projects in 2025. |

| Renewable Energy Policies | Growth potential in green energy generation. | 2035 Renewable Energy Road Map, 'super permit' reforms. |

| Currency Volatility | Increased import costs, potential impact on foreign investment. | Turkish Lira depreciated significantly in 2023-2024. |

| Trade Relations | Affects export revenues and import costs. | 2023 EU-Turkey trade volume: ~$170 billion. |

| Geopolitical Risks | Supply chain disruptions, increased raw material costs. | Regional conflicts can impact logistics and material availability. |

What is included in the product

The Alarko PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This analysis is designed to equip stakeholders with a clear understanding of the opportunities and threats shaping Alarko's operational landscape and strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Turkey's economic landscape in 2024 and 2025 is marked by elevated inflation, which, while projected to ease from over 40% in late 2024 to around 30% by year-end 2025, remains a significant concern.

This persistent inflationary pressure necessitates tight monetary policies, leading to high interest rates that directly impact borrowing costs and investment decisions for companies like Alarko Holding.

Alarko Holding's robust cash management strategies and unwavering financial discipline become even more critical in this environment to ensure continued access to credit and to effectively manage its financial obligations.

The Turkish Lira's persistent depreciation poses a significant challenge. Forecasts indicate a further 12-15% decline against the US Dollar in 2025, directly increasing costs for Alarko's imported raw materials in construction and manufacturing.

This devaluation also impacts Alarko's international trade profitability. Effectively managing foreign exchange exposure is therefore paramount to safeguarding the company's financial health and overall performance in the coming year.

Turkey's economy demonstrated robust GDP growth in the first quarter of 2024, with retail sales and industrial production serving as key drivers. This positive momentum is largely supported by government initiatives aimed at sustained economic expansion.

However, a critical aspect of rebalancing the economy and curbing inflation involves moderating the recent sharp slowdown in private consumption growth. This adjustment is essential for long-term economic stability.

Alarko's diverse business segments, spanning construction, energy, and various industrial sectors, are intrinsically linked to the strength of domestic demand and the overall health of the Turkish economy.

Tourism Sector Performance

The tourism sector is a significant driver for Turkey's economy, with 2024 witnessing record-breaking visitor arrivals, exceeding 60 million. Projections for 2025 indicate continued growth, potentially reaching 65 million tourists. This influx of international visitors is a crucial source of foreign currency, bolstering the Turkish Lira and alleviating pressure on the country's current account deficit.

Alarko's direct investments in tourism infrastructure, including hotels and resorts, are poised to capitalize on this upward trend. The company's facilities are expected to see increased occupancy rates and revenue generation, directly benefiting from the sector's strong performance.

- Record Visitor Numbers: Turkey welcomed over 60 million tourists in 2024.

- Projected Growth: Forecasts suggest 65 million visitors in 2025.

- Economic Impact: Tourism inflows strengthen the Turkish Lira and improve the current account.

- Alarko's Benefit: The company's tourism facilities are set to experience enhanced revenue and occupancy.

Investment Climate and Access to Finance

Despite a tighter credit market due to restrictive monetary policies, Alarko Holding has demonstrated resilience, continuing its operations effectively. The company has ambitious investment plans for 2025, with a substantial TL20 billion earmarked for key sectors like agriculture, real estate, and energy distribution.

The overall investment climate in Turkey is shaped by fluctuating domestic and international confidence in the nation's economic stability. For Alarko, navigating this environment means strategically aligning its significant 2025 investment pipeline with prevailing market conditions and investor sentiment.

- Investment Target: Alarko Holding plans to invest approximately TL20 billion in 2025.

- Focus Sectors: Key areas for investment include agriculture, real estate, and energy distribution.

- Economic Context: Access to finance has tightened due to restrictive monetary policies.

- Market Influence: Domestic and international confidence in Turkey's economic stability significantly impacts the investment climate.

Turkey's economic trajectory in 2024-2025 presents a complex picture for businesses like Alarko Holding. While GDP growth was strong in early 2024, driven by retail and industry, the government's focus on rebalancing the economy means a moderation in private consumption growth is anticipated. This shift, coupled with persistent high inflation (projected to be around 30% by end-2025) and tight monetary policy leading to high interest rates, creates a challenging operating environment.

| Economic Indicator | 2024 (Estimate/Actual) | 2025 (Projection) | Impact on Alarko |

|---|---|---|---|

| Inflation Rate | >40% (late 2024) | ~30% | Increases operating costs, necessitates strong financial management. |

| GDP Growth | Robust (Q1 2024) | Moderating | Domestic demand strength is crucial for Alarko's diverse segments. |

| Turkish Lira Depreciation | Ongoing | 12-15% vs USD | Increases cost of imported materials, affects international trade profitability. |

| Interest Rates | High | High | Raises borrowing costs, impacts investment decisions. |

Preview Before You Purchase

Alarko PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alarko PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a detailed understanding of the external forces shaping Alarko's strategic landscape.

Sociological factors

Turkey's population experienced a notable acceleration in growth during 2024. This demographic trend is strongly linked to increasing urbanization, with projections indicating that over 76% of the population will reside in urban centers by 2025.

This sustained shift towards urban living significantly boosts demand for essential goods and services. Specifically, it fuels the need for housing, robust infrastructure development, and expanded public services, creating direct opportunities for Alarko's core business areas in construction and land development.

Turkey's median age is steadily increasing, a clear sign of an aging population driven by declining fertility rates. This demographic evolution, projected to continue through 2025 and beyond, means a potential shift in the workforce and a reorientation of consumer demands. For instance, by 2025, the proportion of individuals aged 65 and over is expected to represent a growing segment of the population, influencing healthcare and pension system needs.

In response to these trends, the Turkish government has strategically designated 2025 as the 'Year of the Family.' This initiative aims to counteract falling birth rates and reinforce traditional family values, potentially impacting social policies and incentives related to childbearing and family support. Such efforts could influence long-term labor supply dynamics and shape future consumption patterns as the population structure evolves.

Urbanization continues to reshape how people live, with a growing appetite for modern housing and sustainable options. This shift directly impacts consumer preferences, pushing demand towards integrated living spaces that offer convenience and environmental consciousness. For instance, by 2023, Turkey's urbanization rate reached 76.7%, highlighting the significant population shift towards cities and the corresponding demand for upgraded living standards.

Furthermore, evolving lifestyles are fueling a desire for diverse and enriching tourism experiences, moving beyond traditional offerings. Alarko's strategic investments in high-quality residential and commercial developments, coupled with its established tourism ventures like Hillside, are well-positioned to capitalize on these evolving consumer demands, meeting the need for both comfortable living and engaging leisure activities.

Labor Market Trends and Skilled Workforce

The availability of a skilled workforce is absolutely critical for Alarko's diverse operations, particularly in construction, energy, and manufacturing. Demographic shifts are playing a significant role, with increasing years spent in education potentially influencing the supply and skill sets within the labor market. For instance, as of early 2024, Turkey's youth unemployment rate, while fluctuating, highlights the importance of aligning educational outputs with industry demands.

Ensuring consistent access to trained professionals, especially in specialized and emerging fields, is vital for Alarko's sustained growth and competitiveness. This includes expertise in areas like renewable energy technology, where demand for skilled technicians and engineers is rapidly expanding, and advanced construction techniques that require specialized knowledge. The Turkish Ministry of Labor and Social Security reported in late 2023 that demand for vocational training in sectors like energy and construction remained high, underscoring this need.

- Skilled Labor Demand: Alarko's core sectors, construction and energy, consistently require specialized technical skills.

- Educational Alignment: Growing emphasis on higher education may impact the availability of certain trades, necessitating targeted training programs.

- Renewable Energy Focus: The transition to green energy creates a growing need for professionals with expertise in solar, wind, and other renewable technologies.

- Construction Innovation: Advanced construction methods and materials require a workforce with updated skills and knowledge.

Societal Expectations for Sustainability

Societal expectations for sustainability are increasingly influencing business operations, and Alarko Holding is responding to this trend. There's a clear demand for companies to act responsibly, not just for profit but for the planet and people too. This growing awareness means businesses that prioritize environmental and social well-being are often viewed more favorably by consumers and investors alike.

Alarko Holding demonstrates its commitment to these expectations through initiatives like its 'Positive Impact: Green Collar' program. This program reflects a conscious effort to embed sustainability within the company's core. Furthermore, their engagement in tourism and agriculture highlights a strategic focus on integrating social and ecological sustainability into these specific business sectors, aligning with the public's desire for environmentally conscious practices.

For instance, in 2024, Alarko's tourism segment continued to focus on reducing its environmental footprint, with specific targets for water and energy conservation. Their agricultural ventures in 2024 reported a 15% increase in the use of organic farming methods compared to the previous year, directly addressing consumer demand for sustainably produced goods.

- Growing Public Demand: Consumers and stakeholders are increasingly prioritizing companies with strong environmental, social, and governance (ESG) credentials.

- Alarko's Sustainability Programs: Initiatives like the 'Positive Impact: Green Collar' program showcase Alarko's dedication to integrating sustainability into its corporate culture.

- Sector-Specific Integration: Alarko's commitment to social and ecological sustainability in its tourism and agricultural ventures directly addresses societal expectations for responsible business practices in these key areas.

- Measurable Progress: By 2024, Alarko's tourism operations saw a notable reduction in resource consumption, and its agricultural arm expanded its use of sustainable farming techniques by 15%.

Turkey's increasing urbanization, projected to reach over 76% by 2025, fuels demand for housing and infrastructure, directly benefiting Alarko's construction and land development sectors. The aging population, with a growing segment of individuals over 65 by 2025, will also reshape consumer needs towards healthcare and pension services.

The government's 'Year of the Family' initiative for 2025 aims to boost birth rates, potentially impacting future labor supply and consumption patterns. Evolving lifestyles are also driving demand for integrated, sustainable living spaces and diverse tourism experiences, areas where Alarko's developments and Hillside brand are strategically positioned.

Societal expectations for sustainability are paramount, with consumers and investors favoring companies with strong ESG credentials. Alarko's 'Positive Impact: Green Collar' program and its focus on ecological sustainability in tourism and agriculture, evidenced by a 15% increase in organic farming methods by 2024, align with these growing demands.

| Sociological Factor | Trend/Impact | Alarko Relevance | Data Point |

|---|---|---|---|

| Urbanization | Increased demand for housing & infrastructure | Growth opportunities in construction & land development | 76%+ urban population by 2025 |

| Aging Population | Shift in consumer needs (healthcare, pensions) | Potential for new service demands | Growing 65+ demographic by 2025 |

| Family Values Initiatives | Potential impact on labor supply & consumption | Long-term market planning consideration | 2025 declared 'Year of the Family' |

| Lifestyle Evolution | Demand for sustainable living & diverse tourism | Alignment with Alarko's developments & Hillside brand | 15% increase in organic farming by 2024 |

Technological factors

Turkey is aggressively expanding its renewable energy capacity, especially in solar power. By the end of 2024, the country aims to reach 10,000 MW of installed solar capacity, a significant jump from previous years. This push includes developing advanced solar plants with integrated storage solutions, enhancing grid stability and reliability.

Further ambition is evident in Turkey's 2035 renewable energy targets, which prioritize a substantial increase in wind and solar generation. Innovations like offshore wind farms are also on the horizon, signaling a diversification of the renewable energy mix. These technological advancements are crucial for meeting growing energy demands sustainably.

Alarko's energy group is strategically positioned to capitalize on these trends, with substantial investments in renewable energy sources and cutting-edge storage systems. This proactive approach allows Alarko to leverage the rapid technological progress in the sector, ensuring its competitiveness and contribution to Turkey's green energy transition.

Turkey is actively modernizing its electricity grid, with significant government backing for smart grid technologies and enhanced energy storage. These efforts aim to bolster grid resilience and efficiently incorporate renewable energy sources.

By 2025, the Turkish government plans to invest billions in grid modernization, focusing on digitalization and automation. This includes expanding battery energy storage capacity, which is vital for managing the intermittency of renewables and will directly support Alarko's energy distribution business by ensuring a more stable power supply.

Alarko Holding is prioritizing digital transformation and automation to drive sustainable growth. This involves integrating advanced technologies like AI and IoT across its operations. For instance, in 2023, the company continued to invest in digital solutions aimed at enhancing efficiency and customer engagement.

These technological advancements are designed to streamline processes, reduce costs, and unlock new revenue streams. By leveraging AI for predictive maintenance in its energy sector and IoT for smart building management in its construction segment, Alarko aims to gain a competitive edge.

The company's strategic focus on digitalization is expected to yield significant operational improvements. While specific 2024/2025 figures are still emerging, Alarko's commitment to these technologies underscores a forward-looking approach to operational excellence and market responsiveness.

Innovation in Construction and Agriculture

Technological advancements are significantly reshaping Alarko's operational landscape, particularly in construction and agriculture. In construction, innovations like Building Information Modeling (BIM) and modular building techniques are streamlining project execution and minimizing environmental footprints. For instance, BIM adoption in the global construction market was valued at approximately USD 7.5 billion in 2023 and is projected to grow substantially, indicating increased efficiency and reduced waste. These methods allow for better planning, resource management, and faster completion times, directly impacting project profitability and sustainability.

Alarko is actively integrating cutting-edge technology into its agricultural ventures, notably within its modern greenhouse facilities. The company leverages smart agricultural practices, including the sophisticated use of geothermal energy for sustainable heating and cooling. This approach not only reduces reliance on fossil fuels but also optimizes growing conditions, leading to higher yields and improved crop quality. For example, geothermal energy can reduce heating costs in greenhouses by up to 70% compared to conventional systems, a significant factor in operational efficiency and cost savings.

These technological integrations offer several key benefits:

- Enhanced Project Efficiency: BIM and modular construction reduce project timelines and costs.

- Environmental Sustainability: Innovations lower carbon emissions and resource consumption.

- Optimized Agricultural Output: Smart farming and geothermal energy boost yields and reduce operational expenses.

- Competitive Advantage: Early adoption of these technologies positions Alarko for future market leadership.

Cybersecurity and Data Management

As Alarko continues its digital transformation, cybersecurity is paramount. The company's increasing reliance on technology necessitates strong defenses against evolving cyber threats. Effective data management ensures the integrity and security of sensitive information, vital for operational continuity and maintaining trust with customers and partners.

The global cybersecurity market is projected to reach $300 billion by 2024, highlighting the increasing importance of robust security infrastructure. For Alarko, this means investing in advanced threat detection, data encryption, and employee training to mitigate risks associated with digital operations. A data breach could lead to significant financial losses and reputational damage, making proactive cybersecurity a strategic imperative.

- Increased Investment in Cybersecurity: Alarko must allocate significant resources to advanced security solutions and personnel.

- Data Governance and Compliance: Implementing strict data management policies to comply with regulations like GDPR and KVKK is crucial.

- Risk Mitigation: Proactive measures to prevent and respond to cyberattacks are essential for business resilience.

- Stakeholder Confidence: Demonstrating a strong commitment to data security builds and maintains trust among investors and customers.

Technological advancements are driving efficiency and sustainability across Alarko's sectors. In construction, Building Information Modeling (BIM) adoption is projected to grow significantly, enhancing project planning and reducing waste. Geothermal energy integration in agriculture offers substantial cost savings, potentially reducing greenhouse heating expenses by up to 70%.

Alarko's focus on digitalization, including AI and IoT, aims to optimize operations and customer engagement. The company's commitment to smart grid technologies and energy storage is crucial for Turkey's renewable energy expansion, with billions planned for grid modernization by 2025.

Cybersecurity is a critical technological factor, with the global market expected to reach $300 billion by 2024. Alarko's investment in advanced threat detection and data encryption is essential for operational resilience and maintaining stakeholder trust amidst increasing digital reliance.

| Technology Area | Key Advancement | Impact on Alarko | Market Projection/Data |

|---|---|---|---|

| Renewable Energy | Solar & Wind Capacity Expansion | Leveraging growth in clean energy | Turkey aims for 10,000 MW solar capacity by end of 2024 |

| Smart Grids | Digitalization & Automation | Enhanced grid stability for energy distribution | Billions planned for grid modernization by 2025 |

| Construction Tech | BIM & Modular Building | Improved project efficiency, reduced costs | Global BIM market ~USD 7.5 billion in 2023 |

| Agricultural Tech | Geothermal & Smart Farming | Optimized yields, reduced operational costs | Geothermal can cut greenhouse heating costs by up to 70% |

| Digital Transformation | AI & IoT Integration | Enhanced operational efficiency, customer engagement | Global cybersecurity market projected to reach $300 billion by 2024 |

Legal factors

Recent legal amendments enacted in November 2024, with certain provisions taking effect in June 2025, have significantly reshaped Turkey's zoning, construction supervision, and urban transformation landscape. Alarko's construction and land development divisions must navigate these evolving legal frameworks meticulously to guarantee adherence and maintain efficient project lifecycles.

These regulatory shifts, particularly concerning construction quality and urban renewal, could impact project timelines and costs for Alarko. For instance, new urban transformation laws might introduce stricter building codes or require higher percentages of green space, influencing development feasibility and potentially increasing initial capital outlays for new projects initiated post-June 2025.

The Turkish energy sector experienced significant legislative shifts in 2024. Amendments to the Mining Law, Natural Gas Market Law, and the Utilization of Renewable Energy Sources Law are particularly noteworthy. These updates, including the introduction of a 'super permit' and modifications to tender procedures, directly affect the investment climate and operational structures for companies like Alarko in power generation and distribution.

Comprehensive updates to Turkey's Environmental Impact Assessment (EIA) Regulation, effective June 2025, have reshaped project categorization. These revisions, especially impactful for energy and mining sectors, directly influence the required assessment depth for new Alarko ventures and ongoing operations.

The revised regulation, published in June 2025, introduces new thresholds and criteria for project listing, potentially increasing the number of projects requiring a full EIA. For Alarko, this means more rigorous scrutiny and potentially extended timelines for projects in sensitive areas, impacting capital expenditure and project financing schedules.

Labor Laws and Employment Regulations

Alarko Holding, a significant employer in Turkey, must navigate a complex web of labor laws and employment regulations. Recent adjustments to minimum wage policies, for instance, directly influence Alarko's operational expenditures and its approach to human resource management. In 2024, Turkey's minimum wage saw an increase, impacting the cost of labor for large enterprises like Alarko.

The company's adherence to evolving labor safety standards and employment practices is critical. These regulations, designed to protect workers, can necessitate investments in new equipment or training, thereby affecting overall costs. For example, stricter enforcement of workplace safety in 2025 could require Alarko to upgrade certain facilities.

- Minimum Wage Impact: Fluctuations in Turkey's minimum wage, such as the increases seen in 2024, directly affect Alarko's payroll expenses.

- Safety Standards: Compliance with updated labor safety regulations, potentially tightened in 2025, may require capital expenditure for facility upgrades.

- Employment Practices: Changes in employment practices, like those concerning contract workers or working hours, can influence Alarko's workforce flexibility and associated costs.

- Legal Compliance: Maintaining a stable workforce and avoiding costly legal disputes hinges on Alarko's consistent compliance with all applicable Turkish labor laws.

International Trade and Investment Agreements

Alarko's international operations necessitate strict adherence to a complex web of international trade and investment agreements. These legal frameworks, such as World Trade Organization (WTO) agreements and bilateral investment treaties, dictate terms for cross-border transactions, tariffs, and dispute resolution. For instance, Turkey's participation in the EU Customs Union significantly impacts Alarko's trade with European nations, influencing import duties and product standards. Failure to comply can result in penalties and hinder market access.

Understanding and navigating these legal landscapes is paramount for Alarko's profitability and risk management in global markets. Investment protection laws, in particular, offer recourse against unfair treatment or expropriation of assets by host governments, providing a crucial layer of security for foreign direct investment. As of late 2024, Turkey has active investment agreements with over 70 countries, underscoring the importance of this legal dimension for Alarko's expansion strategies.

- Compliance with WTO regulations: Alarko must ensure its international trade practices align with WTO principles on trade liberalization and non-discrimination.

- Adherence to Bilateral Investment Treaties (BITs): Understanding the protections and obligations under BITs relevant to Alarko's operating countries is critical for safeguarding investments.

- Navigating Customs Regulations: Efficiently managing customs procedures and tariffs in different jurisdictions directly impacts the cost and speed of Alarko's international trade.

- Investment Protection Laws: Alarko benefits from legal frameworks designed to protect its assets and operations from adverse government actions in foreign markets.

Recent legal amendments enacted in November 2024, with certain provisions taking effect in June 2025, have significantly reshaped Turkey's zoning, construction supervision, and urban transformation landscape. Alarko's construction and land development divisions must navigate these evolving legal frameworks meticulously to guarantee adherence and maintain efficient project lifecycles.

These regulatory shifts, particularly concerning construction quality and urban renewal, could impact project timelines and costs for Alarko. For instance, new urban transformation laws might introduce stricter building codes or require higher percentages of green space, influencing development feasibility and potentially increasing initial capital outlays for new projects initiated post-June 2025.

The Turkish energy sector experienced significant legislative shifts in 2024. Amendments to the Mining Law, Natural Gas Market Law, and the Utilization of Renewable Energy Sources Law are particularly noteworthy. These updates, including the introduction of a 'super permit' and modifications to tender procedures, directly affect the investment climate and operational structures for companies like Alarko in power generation and distribution.

Comprehensive updates to Turkey's Environmental Impact Assessment (EIA) Regulation, effective June 2025, have reshaped project categorization. These revisions, especially impactful for energy and mining sectors, directly influence the required assessment depth for new Alarko ventures and ongoing operations.

Environmental factors

Alarko Holding is actively addressing climate change, aiming for net-zero greenhouse gas emissions by 2050, a goal that mirrors Turkey's national commitment. This strategic focus involves setting annual emission reduction targets and implementing concrete actions.

The company has made significant strides, including achieving carbon neutrality at its headquarters. Furthermore, Alarko is investing in renewable energy sources, demonstrating a tangible commitment to lowering its carbon footprint and contributing to a sustainable future.

Turkey's commitment to renewable energy is accelerating, with solar capacity targets for 2025 already surpassed. This strong national drive, aiming for substantial increases in both solar and wind energy by 2035, creates a fertile ground for companies like Alarko. The country's proactive stance on renewables signifies a significant shift, offering Alarko's energy division a clear mandate to expand its own clean energy footprint.

Alarko's energy group is strategically positioned to capitalize on this transition, with plans to significantly boost its renewable energy capacity within the next five years. This aligns perfectly with Turkey's broader energy policy, indicating a supportive regulatory environment for such investments. For instance, by the end of 2023, Turkey's installed solar capacity reached approximately 11 GW, a figure expected to grow substantially, providing a robust market for Alarko's expansion efforts.

Water scarcity, a growing concern amplified by reduced rainfall patterns, directly impacts Alarko's operational efficiency, particularly its hydropower generation. For instance, Q1 2025 data indicated a noticeable dip in output directly attributable to lower water levels.

Recognizing this challenge, Alarko has set an ambitious target to slash its water consumption across all processes by a significant 50% by the year 2030. This commitment underscores the critical importance of effective water resource management and robust conservation strategies throughout the company's diverse operations.

Sustainable Construction Practices

Turkey's upcoming 'green cement' regulations for government projects, effective from 2025, will mandate the use of more sustainable materials. This regulatory shift will require Alarko's construction division to integrate eco-friendly practices and materials to meet compliance and reduce its environmental footprint.

Adapting to these new standards presents both challenges and opportunities for Alarko. The company will need to invest in research and development for sustainable building materials and potentially re-evaluate its supply chain to source compliant components. For instance, the global green cement market is projected to reach $40 billion by 2027, indicating a significant growth area for companies that can innovate.

- Regulatory Compliance: Alarko must adhere to the new 'green cement' rules for government projects from 2025.

- Sustainable Materials: The company will need to adopt and utilize environmentally friendly construction materials.

- Environmental Impact: Minimizing the ecological footprint of construction projects is a key objective.

- Market Adaptation: Responding to evolving environmental standards is crucial for long-term viability.

Waste Management and Circular Economy

Alarko Holding, with its diverse industrial manufacturing operations, faces growing pressure to implement sophisticated waste management strategies and actively participate in the circular economy. This entails a focus on reducing waste at its source, boosting recycling efforts, and identifying avenues for resource recovery within its production cycles.

The push for sustainability is evident globally. For instance, in 2023, the European Union reported that its waste management sector generated approximately €150 billion in revenue, highlighting the economic significance of efficient waste handling and resource utilization. Alarko's commitment to these principles will be crucial for its long-term operational efficiency and market standing.

- Waste Reduction Targets: Alarko is likely setting ambitious targets for reducing industrial waste generation per unit of production, aiming for a measurable decrease by 2025.

- Recycling Infrastructure Investment: The company may be investing in enhanced on-site recycling facilities or forming partnerships to improve the processing of recyclable materials from its manufacturing plants.

- Circular Economy Initiatives: Exploration of business models that incorporate product lifespan extension, remanufacturing, and the use of recycled content in new products is becoming a strategic imperative.

- Regulatory Compliance: Adherence to evolving environmental regulations concerning waste disposal and recycling, such as those being strengthened across many jurisdictions by 2024, is a key operational consideration.

Alarko's commitment to net-zero emissions by 2050 aligns with Turkey's climate goals, driving investments in renewables like solar and wind, which saw Turkish solar capacity surpass 2025 targets by the end of 2023, reaching approximately 11 GW.

Water scarcity, impacting hydropower output as noted in Q1 2025, has prompted Alarko to target a 50% reduction in water consumption by 2030.

The upcoming 2025 'green cement' regulations for government projects necessitate Alarko's adoption of sustainable materials, a move into a global market projected to reach $40 billion by 2027.

Alarko is also enhancing waste management and circular economy practices, responding to global trends where the EU's waste sector generated €150 billion in revenue in 2023.

| Environmental Factor | Alarko's Action/Impact | Relevant Data/Target |

|---|---|---|

| Climate Change & Emissions | Net-zero target, carbon neutrality at HQ, renewable energy investment | Net-zero by 2050; Turkey's solar capacity exceeded 2025 targets by end of 2023 (approx. 11 GW) |

| Water Scarcity | Impact on hydropower, water consumption reduction target | Q1 2025 output dip due to low water levels; 50% water consumption reduction by 2030 |

| Sustainable Construction | Adapting to 'green cement' regulations | 'Green cement' mandates from 2025; Global green cement market projected at $40 billion by 2027 |

| Waste Management & Circular Economy | Implementing advanced waste strategies, circular economy focus | EU waste sector revenue €150 billion (2023); Setting waste reduction targets by 2025 |

PESTLE Analysis Data Sources

Our Alarko PESTLE Analysis draws from a comprehensive range of data sources, including official government publications, reputable financial institutions, and leading market research firms. This ensures that every aspect of the analysis is grounded in current and credible information.