Alarko Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alarko Bundle

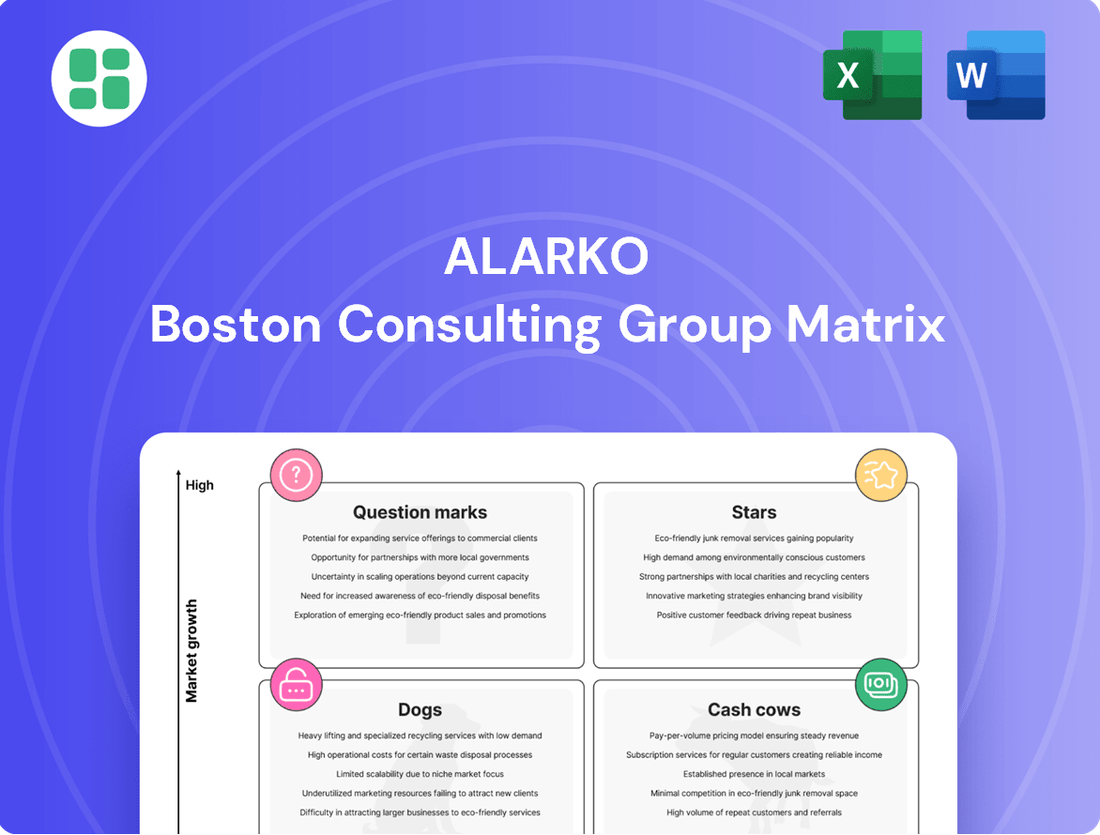

Unlock the strategic potential of Alarko with a comprehensive BCG Matrix analysis. Understand which of their offerings are market leaders (Stars), reliable income generators (Cash Cows), underperformers (Dogs), or promising ventures needing investment (Question Marks).

This glimpse into Alarko's product portfolio is just the beginning. Purchase the full BCG Matrix report to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimized investment and product development decisions.

Don't miss out on the complete strategic picture. Secure the full Alarko BCG Matrix to uncover actionable insights and transform your understanding of their market position for confident, impactful business strategies.

Stars

Modern greenhouse farming in Turkey and Kazakhstan represents a Stars segment for Alarko Holding, driven by a strategic focus on agriculture. The company plans a massive expansion, targeting 5 million square meters of greenhouse capacity in Turkey and an equal amount in Kazakhstan. This aggressive growth strategy aims to position Alarko among the top three global greenhouse producers by 2028, up from its 2024 capacity of 959,000 square meters.

Alarko's hybrid microgranule fertilizer, launched in September 2024 as Turkey's first and Europe's largest of its kind, is a prime example of a Star in the BCG matrix. This innovative product taps into a growing agricultural sector, offering a high-value-added solution.

The strategic positioning of this first-to-market product is expected to drive significant market share capture within this burgeoning segment. The facility's capacity, being the largest in Europe, underscores its potential to dominate the market as demand for advanced fertilizers rises.

Alarko is strategically expanding its renewable energy portfolio, with a significant focus on solar power. Turkey's solar generation experienced a substantial 39% increase in 2024, highlighting the market's robust growth potential.

The company's investments in energy storage systems complement its solar ventures, positioning Alarko to capitalize on the evolving energy landscape. This dual approach aims to secure a strong market position and establish future leadership in these high-growth sectors.

Strategic Investment Group (Alarko Yatırım)

Strategic Investment Group (Alarko Yatırım), established in 2023, is Alarko Holding's dedicated vehicle for high-growth equity investments. Its mandate is to pinpoint and invest in robust, enduring businesses and growth equity funds across various sectors. By the close of 2024, Alarko Yatırım's portfolio reached $90 million, reflecting its active engagement in capturing significant market opportunities.

This strategic unit is designed to foster Alarko Holding's presence in emerging and future leading industries. Its investment approach prioritizes companies with strong performance metrics and durable business models, aiming to generate substantial returns and contribute to the holding's long-term strategic positioning.

- Established: 2023

- Portfolio Value (End of 2024): $90 million

- Investment Focus: High-performing, durable businesses and growth equity funds

- Objective: Capture high-growth opportunities and strategic sector positioning

Electricity Distribution Network Expansion

Alarko's electricity distribution network expansion, specifically through its Meram subsidiary, is positioned as a Stars within the BCG framework. This segment is characterized by substantial investment aimed at growing its Regulated Asset Base (RAB). The company plans to increase the RAB from US$690 million in 2024 to US$1 billion by 2028, signaling a strong growth trajectory in a generally stable utility market.

This strategic expansion is designed to enhance Alarko's market presence and operational capabilities within the electricity distribution sector. The significant capital allocation reflects a commitment to capturing future demand and improving service delivery. Such investments are crucial for utilities aiming to modernize infrastructure and meet evolving energy needs.

- Meram's RAB Growth: Targeting an increase from US$690 million in 2024 to US$1 billion by 2028.

- Investment Strategy: High-growth investment in a stable utility sector.

- Objective: To expand network reach and improve operational efficiency.

- Market Position: Star in the BCG matrix due to high growth and market share potential.

Alarko's modern greenhouse farming initiatives in Turkey and Kazakhstan are prime examples of Stars, driven by aggressive expansion plans. The company aims to reach 5 million square meters of greenhouse capacity in each country, significantly increasing its global ranking. This strategic push into agriculture is supported by innovative products like its hybrid microgranule fertilizer, launched in 2024, which is the first of its kind in Turkey and the largest in Europe, positioning Alarko for substantial market share capture.

The company's growing renewable energy portfolio, particularly in solar power, also falls into the Stars category. Turkey's solar generation saw a remarkable 39% increase in 2024, indicating a strong market for these investments. Alarko's focus on energy storage systems further solidifies its position to benefit from the evolving energy landscape.

Alarko Yatırım, established in 2023, is Alarko Holding's high-growth equity investment arm, with a portfolio of $90 million by the end of 2024. Its focus on robust businesses and growth equity funds targets emerging industries and future leaders. Similarly, Alarko's electricity distribution network expansion via Meram, aiming to grow its Regulated Asset Base (RAB) from $690 million in 2024 to $1 billion by 2028, represents a Star segment due to its high growth potential within a stable utility market.

| Business Segment | BCG Category | Key Growth Drivers | 2024 Data Point | Future Outlook |

| Greenhouse Farming (Turkey & Kazakhstan) | Stars | Aggressive capacity expansion, market leadership ambition | 959,000 sq m capacity | Targeting 5 million sq m in each country; top 3 global producer by 2028 |

| Hybrid Microgranule Fertilizer | Stars | First-to-market innovation, high-value-added agricultural solution | Launched Sept 2024, Europe's largest facility | Significant market share capture expected |

| Renewable Energy (Solar & Storage) | Stars | Growing market demand, strategic investment in energy storage | Turkey solar generation up 39% in 2024 | Capitalizing on evolving energy landscape |

| Electricity Distribution (Meram) | Stars | RAB growth, investment in network expansion | Meram's RAB: $690 million | Targeting $1 billion RAB by 2028 |

| Strategic Investments (Alarko Yatırım) | Stars | Focus on high-growth equity, emerging industries | Portfolio value: $90 million | Capturing opportunities in robust businesses and growth funds |

What is included in the product

The Alarko BCG Matrix analyzes its business units based on market share and growth to guide investment decisions.

Alarko's BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Alarko Holding's conventional electricity generation, primarily through its Cenal Thermal Power Plant, is a clear cash cow. This segment commanded an impressive 89% of combined revenue in Q4 2024 and a staggering 99% of EBITDA for the full year 2024.

This dominance signifies a high market share within the mature energy sector, consistently translating into significant cash flow generation for the entire Alarko conglomerate. The plant's reliable output and established position solidify its role as a primary earnings engine.

Alarko GYO's established land development portfolio acts as a prime Cash Cow within the Alarko BCG Matrix. As the first listed Real Estate Investment Trust (REIT) for Alarko, this segment consistently generates sustainable rental revenue, estimated at around $10 million USD annually.

With a substantial portfolio valuation of $407 million USD as of Q1 2025, this operation demonstrates a high market share within a mature real estate market. Its stability and predictable revenue streams solidify its position as a reliable source of cash flow for the company.

Alarko's Karakuz and Gönen Hydroelectric Power Plants (HEPPs) represent established, mature assets within its energy portfolio. These facilities consistently contribute to the company's electricity generation, providing a reliable and stable energy source.

These operational HEPPs are key contributors to Alarko's energy segment's consistent cash flow. Despite potential fluctuations due to seasonal water availability, their established nature ensures a predictable revenue stream, positioning them as cash cows.

Alarko Carrier's Core Heating, Cooling, and Ventilation Systems

Alarko Carrier's core heating, cooling, and ventilation (HVAC) systems are its established cash cows. Despite some recent volatility in the broader Industry & Trade sector, the company has held onto significant market positions, such as a 9.3% share in the cooling segment. This enduring market presence, coupled with a robust sales and service infrastructure, allows these mature product lines to consistently generate dependable cash flow.

These core offerings benefit from Alarko Carrier's strong brand recognition and well-developed distribution channels, making them reliable profit generators in established markets.

- Market Share Stability: Alarko Carrier maintained a 9.3% market share in cooling systems as of recent data, demonstrating resilience in a competitive landscape.

- Extensive Network: The company boasts a wide-reaching sales and service network, crucial for supporting and expanding its core product lines.

- Mature Market Strength: HVAC systems operate in mature markets where Alarko Carrier's established brand and distribution provide a significant competitive advantage.

- Consistent Cash Generation: Historically, these core products have been reliable sources of cash flow for the company due to their consistent demand and market penetration.

General International Trade Activities

Alarko Holding's general international trade activities, as part of its diversified operations, leverage existing networks and established relationships. These ventures typically function as stable, low-growth contributors to the conglomerate's overall financial health.

These activities are characterized by consistent revenue generation and reliable cash flow, reflecting their mature and predictable nature within the Alarko portfolio. While not typically high-growth engines, they provide a solid foundation for the company's financial stability.

- Stable Revenue Streams: International trade operations contribute a consistent, albeit not rapidly expanding, revenue base.

- Predictable Cash Flow: These activities are known for generating reliable cash inflows, supporting overall liquidity.

- Leveraged Networks: Alarko's established global connections facilitate ongoing trade operations efficiently.

Alarko's established electricity generation, particularly the Cenal Thermal Power Plant, along with its Karakuz and Gönen Hydroelectric Power Plants, are significant cash cows. These mature energy assets consistently generate substantial cash flow, contributing a dominant portion of Alarko's revenue and EBITDA, as evidenced by the thermal plant's 89% revenue share in Q4 2024 and 99% EBITDA share for the full year 2024.

Alarko GYO's real estate portfolio, with a valuation of $407 million USD as of Q1 2025 and generating approximately $10 million USD annually in rental revenue, also functions as a key cash cow. This segment benefits from a high market share in a mature real estate market, providing stable and predictable income streams.

Alarko Carrier's core HVAC systems, supported by a 9.3% market share in cooling and an extensive service network, are reliable cash cows. These mature product lines consistently generate dependable cash flow due to strong brand recognition and established distribution channels.

Alarko's international trade activities, while low-growth, act as stable cash cows by leveraging existing networks to provide consistent revenue and predictable cash flow, bolstering the conglomerate's overall financial stability.

| Segment | BCG Category | Key Financial Indicator (2024/Q1 2025) | Market Position |

|---|---|---|---|

| Conventional Electricity Generation (Cenal) | Cash Cow | 89% Revenue Share (Q4 2024), 99% EBITDA (FY 2024) | Dominant in mature energy sector |

| Hydroelectric Power Plants (Karakuz, Gönen) | Cash Cow | Consistent contributor to energy segment cash flow | Established, reliable energy source |

| Real Estate Investment Trust (Alarko GYO) | Cash Cow | $407 million USD Valuation (Q1 2025), ~$10 million USD Annual Rental Revenue | High market share in mature real estate |

| HVAC Systems (Alarko Carrier) | Cash Cow | 9.3% Market Share (Cooling) | Strong brand, extensive network in mature HVAC market |

| International Trade | Cash Cow | Stable revenue generation, predictable cash flow | Leverages established networks |

Full Transparency, Always

Alarko BCG Matrix

The Alarko BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase, offering a clear and actionable framework for strategic business unit analysis. This means no watermarks, no trial limitations, and no surprises – just the complete, professional report ready for immediate implementation. You'll gain access to a comprehensive breakdown of Alarko's product portfolio, categorized into Stars, Cash Cows, Question Marks, and Dogs, enabling informed decision-making. This exact file is designed for strategic clarity and will empower you to assess market share and growth potential effectively.

Dogs

Alarko's contracting business, Alsim Alarko, faced substantial financial headwinds, reporting a significant loss of TRY 740 million in the fourth quarter of 2024 and an additional TRY 129 million in the first quarter of 2025. This performance clearly places the contracting segment in the 'Dog' quadrant of the BCG matrix, reflecting its low market share and low profitability.

The company's exploration of strategic alternatives, including a potential sale of shares, further underscores Alsim Alarko's position as a cash-draining unit. Such a move is typically considered for businesses that are not contributing positively to the overall financial health of the parent company, requiring significant investment without generating adequate returns.

The established hillside tourism facilities, despite their history, are currently a significant drain on resources. In the first quarter of 2025, these operations posted a negative EBITDA of TRY 177 million, underscoring persistent operational inefficiencies and a struggle to generate positive cash flow. This trend of recurring losses indicates a challenging market position and a business model that is no longer sustainable without substantial intervention.

Alarko's Industry & Trade segment, primarily driven by Alarko Carrier, saw a stark 34% revenue drop in the first quarter of 2025, resulting in net losses. This downturn signals that established or less agile product lines within this division are struggling to maintain market share and profitability amidst a difficult global manufacturing and trade landscape.

Imported Coal Power Generation (Karabiga Plant)

The Karabiga Imported Coal Power Plant, a significant asset for Alarko, experienced a dip in electricity generation during the first quarter of 2025. This decline, coupled with Turkey's strategic pivot towards renewable energy sources, suggests limited future growth prospects for coal-fired power.

Given Turkey's evolving energy landscape, the Karabiga plant faces challenges.

- Decreased Generation: Electricity output fell in Q1 2025 compared to previous periods.

- Renewable Energy Focus: Turkey's national energy strategy prioritizes solar and wind power expansion.

- Long-Term Growth Concerns: The plant's growth potential is constrained by the global and national shift away from coal.

- Cash Trap Risk: Without efficient management and adaptation, the plant could become a cash trap as the market transitions.

Non-Core, Less Strategic Real Estate Holdings

Within Alarko GYO's extensive real estate holdings, older or less strategically positioned properties that aren't performing well fall into the "Dogs" category of the BCG matrix. These assets might be characterized by low occupancy rates or require substantial upkeep without yielding commensurate returns. For instance, a commercial property with a vacancy rate exceeding 25% in a declining urban area would exemplify such a holding.

These holdings represent low-growth, low-market-share assets. Their contribution to Alarko GYO's overall revenue and market position is minimal, and they often tie up capital that could be better utilized elsewhere. The challenge lies in identifying these specific assets and making informed decisions about their future.

Considerations for these "Dogs" include:

- Divestment: Selling underperforming assets to free up capital.

- Repurposing: Exploring alternative uses for the property to increase its value.

- Renovation: Investing in upgrades to improve occupancy and rental income, though this requires careful cost-benefit analysis.

For example, if Alarko GYO had a retail space with a reported occupancy of 60% in 2023, and the average for comparable properties in the vicinity was 85%, this would signal a "Dog" status, necessitating a strategic review.

Alarko's contracting business, Alsim Alarko, is firmly in the Dog quadrant, evidenced by a TRY 740 million loss in Q4 2024 and a TRY 129 million loss in Q1 2025. This segment's strategic review, including a potential share sale, highlights its status as a cash drain with low market share and profitability.

Similarly, Alarko Carrier's revenue dropped 34% in Q1 2025, leading to net losses, indicating established product lines are struggling. The Karabiga Imported Coal Power Plant also saw decreased generation in Q1 2025, facing limited growth due to Turkey's renewable energy focus.

Older, underperforming real estate assets within Alarko GYO also fit the Dog profile, characterized by low occupancy, such as a commercial property with over 25% vacancy. These assets tie up capital with minimal returns, requiring strategic decisions like divestment or repurposing.

| Business Segment | Q4 2024 Performance | Q1 2025 Performance | BCG Quadrant | Key Challenges |

| Alsim Alarko (Contracting) | TRY 740 million loss | TRY 129 million loss | Dog | Low profitability, cash drain, strategic review |

| Alarko Carrier (Industry & Trade) | N/A | 34% revenue drop, net losses | Dog | Declining market share, struggling product lines |

| Karabiga Power Plant | Decreased generation | Decreased generation | Dog | Shift to renewables, limited growth |

| Underperforming Real Estate (Alarko GYO) | Low occupancy/returns | Low occupancy/returns | Dog | Capital tied up, need for divestment/repurposing |

Question Marks

Alarko's venture into modern greenhouse construction in Kazakhstan, slated for initial operations in 2025 and aiming for 5 million square meters by 2028, signifies a strategic geographical expansion. This move places Alarko within a burgeoning agricultural technology sector, a key indicator for potential future growth.

While the Kazakhstan greenhouse project is positioned in a high-growth industry, it is currently in its nascent phase. This early stage necessitates substantial capital investment to establish a market presence and validate its economic viability, characteristic of a question mark in the BCG matrix.

Alarko Holding's foray into the aviation sector positions it as a 'Question Mark' in the BCG Matrix. This new venture, while holding significant future growth potential, currently represents a minimal market share. For instance, as of early 2024, its contribution to the broader aviation market is negligible, necessitating considerable capital injection to foster development and capture market presence.

The strategic intent behind this expansion is to bolster Alarko's Net Asset Value by 2028, indicating a long-term investment horizon. Given the capital-intensive nature of aviation, substantial funding will be required to build infrastructure, acquire assets, and establish operational capabilities. This aligns with the characteristics of a Question Mark, where strategic investment is key to moving towards a 'Star' position.

The Bodrum Hillside project represents Alarko's strategic push into a burgeoning tourism segment, poised for operation by late 2025. This venture is designed to tap into the high-yield leisure market, with rental income anticipated to commence in 2026. As a new development, it currently sits in the investment-heavy, cash-outflow phase, lacking a defined market position.

New Value-Added Product Development within Agriculture

Alarko's venture into value-added agricultural products, like specialized seeds and food processing, signifies a strategic move towards high-growth sectors. These initiatives aim to diversify revenue streams beyond their core fertilizer operations.

These new product developments are positioned as potential Stars or Question Marks within the Alarko BCG Matrix, depending on their current market share and growth trajectory. The agricultural technology and food processing sectors are experiencing robust growth, with the global food processing market projected to reach over $3.5 trillion by 2027, indicating significant potential for Alarko.

- High Growth Potential: Developing specialized seeds and food processing aligns with increasing consumer demand for processed and value-added food products, a trend expected to continue through 2025 and beyond.

- Significant Investment Required: These ventures necessitate substantial research and development, along with considerable capital for production facilities and market penetration strategies, typical of Question Mark or early-stage Star businesses.

- Market Adoption Challenges: Capturing substantial market share in these competitive segments requires effective marketing, distribution, and building brand trust, which can be resource-intensive.

- Diversification Strategy: This expansion represents Alarko's commitment to broadening its agricultural footprint and capitalizing on emerging opportunities within the agri-food value chain.

Early-Stage Investments in Innovative Companies (via Alarko Yatırım)

Alarko Yatırım's strategy actively seeks out early-stage investments in innovative companies, recognizing their potential for significant future growth. This approach aligns with the characteristics of 'Question Marks' in the BCG Matrix, as these ventures are typically high-growth but currently require substantial cash input and possess uncertain market positions.

The company's portfolio, which surpassed $90 million USD as of early 2024, reflects this commitment to identifying and nurturing promising new businesses. Alarko Yatırım diversifies its early-stage engagement through direct investments in businesses demonstrating high performance and durability, alongside strategic participation in growth equity and secondary funds.

- High Growth Potential: These innovative companies are positioned in rapidly expanding markets, offering the prospect of substantial returns.

- Cash Consumption: Early-stage development and market penetration often necessitate significant capital expenditure, leading to negative cash flow.

- Uncertain Market Share: The competitive landscape for new technologies and business models means market share is not yet established or guaranteed.

- Strategic Importance: Despite current cash demands, these investments are crucial for future portfolio diversification and market leadership.

Question Marks represent Alarko's new ventures with high growth potential but currently low market share, demanding significant investment. These initiatives, like the Kazakhstan greenhouse project and aviation foray, are in their early stages, requiring substantial capital to establish a market presence and achieve profitability. Their success hinges on strategic investment and market adoption, aiming to transition them into Stars.

| Venture | Industry | Status | Market Share (Early 2024) | Investment Need |

|---|---|---|---|---|

| Kazakhstan Greenhouse Project | Agri-tech | Nascent Phase | Negligible | High |

| Aviation Sector | Aviation | Emerging | Negligible | High |

| Bodrum Hillside Project | Tourism/Real Estate | Pre-operation | N/A | High |

| Value-Added Agri Products | Food Processing | Development | Low | Significant R&D and Capital |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.