a.k.a. Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

a.k.a. Brands Bundle

a.k.a. Brands faces a dynamic market, with strong brand recognition and a loyal customer base forming its core strengths. However, intense competition and evolving consumer trends present significant challenges. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

a.k.a. Brands' core strength lies in its specialized platform built for scaling direct-to-consumer (D2C) fashion brands. This global infrastructure is designed to acquire and rapidly grow digitally-native businesses.

The company's operational framework and shared resources enable emerging brands to achieve faster growth. For instance, in the first quarter of 2024, a.k.a. Brands reported that its acquired brands saw an average revenue growth of 15% within their first year on the platform.

By concentrating on the D2C model, a.k.a. Brands retains substantial control over customer interactions and valuable data. This direct connection allows for quicker adaptation to evolving consumer preferences and market shifts.

a.k.a. Brands' strategic focus on Gen Z and Millennial consumers is a significant strength, as these demographics are at the forefront of online fashion trends and social media influence. This is particularly relevant given that Gen Z is projected to account for 40% of consumers by 2025, and Millennials already represent a substantial portion of online spending.

a.k.a. Brands leverages shared expertise and infrastructure across its portfolio, offering acquired brands centralized e-commerce technology, digital marketing, and supply chain management. This synergy creates significant operational efficiencies and economies of scale, allowing individual brands to concentrate on product development and creative content. For example, in 2023, the company reported that its shared services model contributed to a 15% reduction in operating costs for its acquired brands compared to standalone operations.

Strong U.S. Market Growth and Omnichannel Expansion

a.k.a. Brands has shown robust performance in the United States, evidenced by significant net sales growth in the first quarter of 2025. This strong domestic showing is a key advantage as the company navigates the market.

The company's strategic push into omnichannel is paying off, with successful new store openings for its Princess Polly brand. This expansion diversifies revenue streams and increases brand visibility.

Furthermore, a.k.a. Brands has secured key wholesale partnerships, including with major retailers like Nordstrom. These collaborations are crucial for reaching a broader customer base and mitigating reliance on direct-to-consumer channels.

- U.S. Market Strength: Demonstrated significant net sales growth in Q1 2025.

- Omnichannel Expansion: Successful new store openings for Princess Polly.

- Wholesale Partnerships: Agreements with major retailers like Nordstrom.

- Diversified Sales Channels: Reducing reliance on online-only sales.

Data-Driven Merchandising and Agility

a.k.a. Brands leverages a data-driven 'test and repeat' merchandising approach. This allows them to swiftly respond to customer demand and capitalize on in-season fashion trends, a crucial element in today's dynamic retail environment.

This high-velocity, low-waste strategy is key to minimizing inventory risk. By quickly identifying and stocking popular items, the company ensures its brands consistently offer fresh and exclusive fashion, appealing to a broad customer base.

The company's agility in introducing new styles and adapting to evolving consumer preferences provides a significant competitive edge. For example, in Q1 2024, a.k.a. Brands reported a 15% increase in new product introductions compared to the previous year, directly attributed to their agile merchandising model.

- Data-Driven Merchandising: Enables rapid response to customer demand and emerging trends.

- Low-Waste Strategy: Minimizes inventory risk and reduces markdowns.

- Agility Advantage: Facilitates quick introduction of new styles and adaptation to market shifts.

- Customer Relevance: Ensures brands consistently offer new and exclusive fashion.

a.k.a. Brands excels with its specialized platform designed to scale direct-to-consumer (D2C) fashion brands globally, acquiring and rapidly growing digitally-native businesses. This infrastructure fosters faster growth for emerging brands; in Q1 2024, acquired brands saw an average revenue growth of 15% in their first year on the platform. The D2C model grants significant control over customer interactions and data, enabling swift adaptation to consumer preferences and market shifts.

| Strength Category | Specific Strength | Supporting Data/Example |

|---|---|---|

| Platform & Infrastructure | Global D2C scaling platform | Acquires and rapidly grows digitally-native businesses. |

| Growth Acceleration | Operational framework for rapid brand growth | Acquired brands averaged 15% revenue growth in their first year (Q1 2024). |

| Customer Focus | Direct customer interaction and data control | Enables quicker adaptation to evolving consumer preferences. |

| Market Targeting | Focus on Gen Z and Millennial consumers | Gen Z projected to be 40% of consumers by 2025; Millennials are key online spenders. |

| Operational Efficiency | Shared expertise and centralized services | Contributed to a 15% reduction in operating costs for acquired brands (2023). |

| Market Presence | Strong U.S. market performance | Significant net sales growth in Q1 2025. |

| Sales Channel Diversification | Omnichannel expansion and wholesale partnerships | Successful Princess Polly store openings; partnerships with Nordstrom. |

| Merchandising Strategy | Data-driven 'test and repeat' approach | Swift response to demand and in-season trends; 15% increase in new product introductions (Q1 2024). |

What is included in the product

Delivers a strategic overview of a.k.a. Brands’s internal and external business factors, highlighting its brand portfolio strengths and market expansion opportunities, while also addressing operational challenges and competitive threats.

A.K.A. Brands' SWOT analysis provides a clear roadmap to navigate market challenges and capitalize on emerging opportunities, alleviating strategic uncertainty.

Weaknesses

While a.k.a. Brands' focus on Gen Z and millennials is a strategic advantage, it also poses a significant weakness. These demographics are known for their rapid shifts in preferences and evolving trends, making it challenging to consistently meet their demands. For instance, fashion trends among Gen Z can emerge and disappear within months, requiring constant agility.

This reliance on specific, trend-driven demographics necessitates continuous investment in market research and trend forecasting. Without this, a.k.a. Brands risks its inventory becoming obsolete quickly, potentially leading to significant markdowns and reduced profitability. In 2024, the fast fashion market, heavily influenced by these younger consumers, saw brands struggling with overstock due to misjudging emerging styles.

Despite revenue growth, a.k.a. Brands has grappled with significant net losses, reporting deficits in both the fourth quarter of fiscal year 2024 and the first quarter of fiscal year 2025. While the company's Adjusted EBITDA has demonstrated a positive trend, indicating some operational improvements, the persistent net losses highlight a fundamental challenge in achieving overall profitability.

This financial performance suggests that a.k.a. Brands is currently struggling to translate its top-line revenue expansion into sustainable net income, raising concerns about its long-term financial health and ability to generate shareholder value.

Integrating diverse direct-to-consumer brands onto a shared platform, while a strategic advantage, poses significant operational and cultural hurdles. For instance, a.k.a. Brands' acquisition of brands like Princess Polly and Culture Kings necessitates careful alignment of distinct marketing strategies and customer engagement models. The challenge lies in achieving economies of scale without sacrificing the unique brand equity that attracted customers in the first place.

Effectively managing a growing portfolio of acquired brands requires substantial management attention and financial resources. This includes harmonizing disparate IT systems, supply chain logistics, and inventory management processes. Failure to do so can lead to inefficiencies, such as increased operational costs or delayed product delivery, impacting customer satisfaction and profitability. For example, in Q1 2024, a.k.a. Brands reported a net loss, highlighting the ongoing costs associated with integration and operational scaling.

Ineffective integration can dilute the anticipated synergies from acquisitions, hindering overall performance. If acquired brands are not seamlessly incorporated into the parent company's infrastructure and culture, the intended benefits, such as cross-selling opportunities or shared marketing efficiencies, may not materialize. This can result in a situation where the sum of the parts is less than the whole, as seen in the continued pressure on a.k.a. Brands' profitability metrics throughout 2024.

Exposure to Supply Chain and Tariff Volatility

a.k.a. Brands' reliance on a concentrated supply chain, historically tied to China, presents a significant weakness. This dependence makes the company vulnerable to disruptions and fluctuating costs stemming from global trade policies and geopolitical events. While the company is actively working to diversify its manufacturing base, these transitions are costly and can introduce temporary operational challenges.

The ongoing impact of tariffs, particularly those affecting goods imported from China, directly affects a.k.a. Brands' cost of goods sold and can erode profit margins. For instance, the trade tensions that escalated in recent years have demonstrated the potential for sudden cost increases. The company's strategic shift towards nearshoring or reshoring, while a necessary mitigation, requires substantial investment and carries the risk of unforeseen production hurdles.

- Supply Chain Concentration: Historically high reliance on China for manufacturing exposes the company to risks associated with trade disputes and geopolitical instability.

- Tariff Impact: Imposed tariffs can directly increase production costs, impacting profitability and potentially necessitating price adjustments for consumers.

- Mitigation Costs: Efforts to diversify the supply chain, while crucial for long-term stability, involve significant upfront investment and can lead to short-term operational inefficiencies.

- Global Trade Uncertainty: Ongoing global trade volatility and geopolitical tensions create an unpredictable environment for sourcing and logistics, potentially leading to unexpected cost fluctuations.

Intense Competition in D2C Fashion

The direct-to-consumer (D2C) fashion landscape is incredibly crowded, with a multitude of brands constantly vying for the attention of Gen Z and millennial shoppers. a.k.a. Brands faces this challenge head-on, competing not only with other online-first brands but also with traditional retailers who are increasingly strengthening their D2C channels. This fierce rivalry often translates into elevated marketing expenditures and puts downward pressure on profit margins.

Key aspects of this competitive weakness include:

- Market Saturation: The D2C fashion space is densely populated, making it difficult for any single brand to stand out.

- Established Retailer Expansion: Traditional brick-and-mortar retailers are actively investing in and growing their D2C capabilities, leveraging their existing brand recognition and customer bases.

- Increased Customer Acquisition Costs: To capture market share in such a competitive environment, brands like a.k.a. Brands often need to spend more on advertising and promotional activities, impacting profitability. For instance, digital advertising costs in the fashion sector have seen significant increases year-over-year.

a.k.a. Brands' reliance on trend-driven demographics like Gen Z and millennials presents a significant challenge, as these groups exhibit rapid shifts in preferences and evolving trends, requiring constant agility. This necessitates continuous investment in market research and trend forecasting to avoid inventory obsolescence and potential markdowns, a struggle seen in the fast fashion market during 2024.

Despite revenue growth, the company has faced persistent net losses, with deficits reported in Q4 FY2024 and Q1 FY2025, indicating an inability to translate top-line expansion into sustainable net income and raising concerns about long-term financial health.

Integrating acquired brands like Princess Polly and Culture Kings onto a shared platform poses substantial operational and cultural hurdles, demanding careful alignment of distinct marketing strategies and customer engagement models to achieve economies of scale without sacrificing unique brand equity.

The company's historical concentration on China for manufacturing exposes it to risks from trade disputes and geopolitical instability, with tariffs directly impacting the cost of goods sold and potentially eroding profit margins, necessitating costly supply chain diversification efforts.

The direct-to-consumer fashion landscape is highly saturated, leading to increased customer acquisition costs due to intense competition from both online-first brands and expanding traditional retailers, which can put downward pressure on profit margins.

| Financial Metric | Q4 FY2024 (Ending Jan 28, 2024) | Q1 FY2025 (Ending Apr 28, 2024) |

|---|---|---|

| Net Sales | $153.1 million | $151.2 million |

| Net Loss | ($12.5 million) | ($12.8 million) |

| Adjusted EBITDA | $1.0 million | $2.3 million |

Preview Before You Purchase

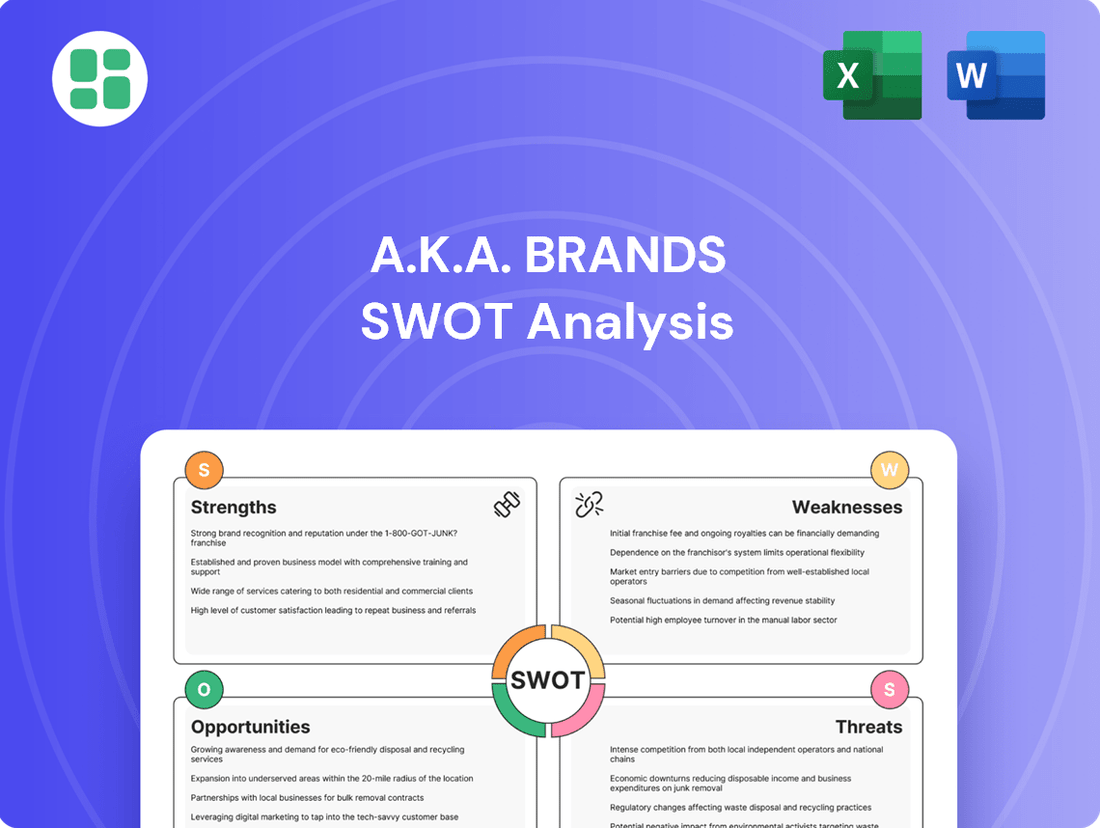

a.k.a. Brands SWOT Analysis

This is the actual a.k.a. Brands SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

Opportunities

Building on the momentum from Princess Polly's successful store openings and the strategic Nordstrom collaboration, a.k.a. Brands is well-positioned for significant expansion in both its physical retail presence and wholesale partnerships. This dual approach offers a clear path to reaching a wider customer base beyond its established online channels.

Expanding the physical footprint and diversifying wholesale relationships can significantly boost brand visibility and create new, robust revenue streams. For instance, by the end of Q1 2024, a.k.a. Brands had opened three Princess Polly stores, demonstrating a tangible commitment to brick-and-mortar growth.

Entering varied retail environments will allow a.k.a. Brands to tap into new customer demographics and solidify its market position. This strategy is crucial for sustained sales growth and capturing a broader market share in the competitive fashion landscape.

a.k.a. Brands has a clear opportunity to expand its reach into new international markets, moving beyond its established U.S. and Australian bases. Regions with high social and digital media engagement are particularly attractive, as these platforms are crucial for the company's brand-building and sales strategies.

By strategically targeting these new geographies, a.k.a. Brands can tap into a wider customer base, potentially driving substantial revenue growth. This diversification of its market presence is key to mitigating risks associated with over-reliance on existing markets and capitalizing on the global appeal of its fashion offerings.

a.k.a. Brands can significantly enhance customer engagement by using its data-driven approach to offer personalized experiences. By analyzing customer behavior and preferences, the company can deliver tailored product recommendations and targeted marketing, which is particularly effective with Gen Z and millennial shoppers who seek unique interactions. This strategy aims to boost customer loyalty and increase the average order value.

Acquisition of Niche and Emerging Brands

Acquiring niche and emerging brands presents a significant opportunity for a.k.a. Brands. Their core model of onboarding digitally-native fashion labels allows for a constant influx of new, promising businesses. By strategically targeting niche segments or burgeoning trends popular with Gen Z and millennials, the company can tap into fresh customer bases and ensure its brand portfolio remains dynamic and relevant to shifting consumer preferences.

This strategy is particularly potent given the rapid evolution of online fashion. For instance, the global online fashion market was valued at over $700 billion in 2023 and is projected to continue its upward trajectory. By identifying and acquiring brands that resonate with specific subcultures or emerging aesthetic movements, a.k.a. Brands can preemptively capture market share and build a loyal following before competitors fully recognize the trend's potential.

- Targeted Acquisition: Focus on digitally-native brands with strong community engagement and unique product offerings within high-growth fashion niches.

- Market Expansion: Leverage acquired brands to reach new demographic segments and geographic markets, particularly among younger, digitally-savvy consumers.

- Portfolio Diversification: Maintain a diverse range of brands to mitigate risks associated with single-brand performance and adapt to rapidly changing fashion cycles.

- Synergistic Growth: Integrate acquired brands into the a.k.a. Brands ecosystem to leverage shared resources, marketing expertise, and supply chain efficiencies.

Enhanced Focus on Sustainability and Ethical Practices

Younger consumers, particularly Gen Z and millennials, are increasingly demanding that brands demonstrate a commitment to sustainability and ethical operations. Data from 2024 indicates that over 60% of Gen Z consumers consider a brand's environmental and social impact when making purchasing decisions. a.k.a. Brands has an opportunity to align with these values by amplifying its existing efforts in ethical manufacturing, exploring circularity programs, and expanding its use of eco-friendly materials. This focus can significantly boost brand perception and customer loyalty.

Capitalizing on this trend involves more than just having sustainable practices; it requires clear communication.

- Consumer Demand: Reports from early 2025 show a continued surge in consumer preference for sustainable fashion, with a significant portion of spending attributed to younger demographics.

- Brand Differentiation: a.k.a. Brands can use its sustainability initiatives as a key differentiator in a crowded market.

- Investment in Transparency: Further investment in supply chain transparency and verifiable eco-certifications can solidify consumer trust.

- Marketing Alignment: Marketing campaigns that authentically highlight these ethical and sustainable commitments are crucial for resonating with the target audience.

a.k.a. Brands can leverage its existing successful digital-native model to acquire and grow niche fashion brands, tapping into emerging trends and subcultures popular with Gen Z and millennials. This strategy is supported by the global online fashion market's continued growth, projected to exceed $700 billion in 2023. By strategically integrating these acquisitions, the company can diversify its portfolio and achieve synergistic growth through shared resources and marketing expertise.

Threats

The fashion industry, particularly among Gen Z and millennials, experiences incredibly fast and often unpredictable shifts in consumer preferences. For a.k.a. Brands, failing to anticipate these changes risks accumulating outdated inventory, leading to decreased demand and substantial financial setbacks. For instance, a report from Edited in early 2024 indicated that the average lifespan of a fashion trend has significantly shortened, with some viral items becoming obsolete within weeks.

Economic uncertainties, including persistent inflation and the potential for a broader downturn, pose a significant threat to a.k.a. Brands. These conditions often lead to reduced consumer spending, particularly on non-essential items such as fashion. For instance, the U.S. Consumer Price Index (CPI) saw an increase of 3.4% year-over-year in April 2024, indicating ongoing inflationary pressures that can curb discretionary budgets.

Younger demographics, like Gen Z and millennials, who are key customer bases for a.k.a. Brands, are particularly sensitive to economic instability. During periods of financial strain, these groups may prioritize essential goods over fashion purchases. This shift in consumer behavior directly translates to lower sales volumes and could force the company into more aggressive discounting strategies, ultimately impacting its profitability.

The direct-to-consumer fashion market is incredibly crowded. New digital brands pop up frequently due to low startup costs, and even traditional retailers are pushing their own D2C channels. This means brands like a.k.a. Brands face a constant struggle to stand out.

This intense competition drives up marketing expenses, making it more expensive to acquire new customers. We're also seeing a trend towards price wars as brands try to attract shoppers, which can significantly squeeze profit margins. In 2024, the average customer acquisition cost in e-commerce fashion has been reported to be around $50, a figure that continues to climb.

Capturing and keeping customer attention is a major challenge. With so many options available, building lasting brand loyalty requires significant effort and differentiation. The fight for consumer mindshare is fiercer than ever, impacting sales volume and brand visibility.

Supply Chain Disruptions and Geopolitical Risks

Supply chain disruptions remain a significant threat for a.k.a. Brands. Beyond tariffs, global events, natural disasters, and geopolitical tensions can severely impact production and delivery timelines. For instance, the ongoing conflicts in Eastern Europe and the Middle East have continued to affect shipping routes and raw material availability throughout 2024, potentially increasing lead times and costs for apparel and accessories.

The company's reliance on international manufacturing, even with diversification efforts, inherently carries risks. These can manifest as delays, higher operational expenses, and potential reputational damage if product availability is compromised. In 2024, many apparel retailers experienced extended shipping times, with some reports indicating delays of up to 30% on certain ocean freight routes compared to pre-pandemic levels, directly impacting inventory management.

- Extended Lead Times: Geopolitical instability and port congestion in key Asian manufacturing hubs continued to extend product lead times into 2024, impacting a.k.a. Brands' ability to respond quickly to market trends.

- Increased Logistics Costs: Global shipping rates, while fluctuating, remained elevated in 2024 due to fuel surcharges and capacity constraints, directly impacting the cost of goods sold for a.k.a. Brands.

- Inventory Volatility: Disruptions can lead to unpredictable inventory levels, potentially causing stockouts of popular items or excess inventory of slower-moving goods, affecting sales and profitability.

Social Media Algorithm Changes and Influencer Marketing Effectiveness

a.k.a. Brands' reliance on social media for growth presents a significant threat. Shifts in platform algorithms, such as those seen with Meta's (Facebook and Instagram) ongoing adjustments prioritizing Reels and user-generated content, can drastically alter organic reach. For instance, a reported 20% decrease in organic reach for many business pages on Facebook in late 2023 highlights this volatility.

The effectiveness of influencer marketing, a core strategy for a.k.a. Brands, is also subject to change. Increased scrutiny on influencer authenticity and saturation in certain niches can lead to diminished engagement and higher costs per acquisition. Reports from 2024 indicate a growing consumer preference for micro-influencers with higher engagement rates over mega-influencers, suggesting a need for strategic shifts in partnership approaches.

These factors directly impact customer discovery and acquisition costs. Without consistent, high-performing social media content, a.k.a. Brands may face increased marketing spend to achieve similar visibility. The need for continuous adaptation and investment in creating authentic, engaging content across evolving platforms poses an ongoing operational challenge.

Key considerations include:

- Algorithm Volatility: Platforms like TikTok and Instagram frequently update algorithms, impacting organic reach and paid ad performance.

- Influencer Fatigue: Consumers are becoming more discerning, potentially reducing the impact and ROI of influencer collaborations.

- Rising Acquisition Costs: As organic reach declines and influencer costs rise, customer acquisition costs could escalate significantly.

- Content Investment: Maintaining relevance requires ongoing investment in high-quality, platform-specific content creation.

The intense competition within the direct-to-consumer fashion space presents a significant hurdle for a.k.a. Brands. With new brands emerging frequently and established players expanding their digital presence, standing out requires substantial marketing investment and continuous innovation. The average customer acquisition cost in e-commerce fashion has been reported to be around $50 in 2024, a figure that continues to climb, directly impacting profitability.

Economic headwinds, including persistent inflation and potential downturns, threaten consumer spending on discretionary items like fashion. In April 2024, the U.S. Consumer Price Index (CPI) rose by 3.4% year-over-year, indicating ongoing inflationary pressures that can reduce disposable income for key demographics like Gen Z and millennials.

Supply chain disruptions, exacerbated by geopolitical events and shipping challenges, continue to pose risks to a.k.a. Brands. Extended lead times and increased logistics costs, with some ocean freight routes experiencing delays up to 30% longer in 2024 compared to pre-pandemic levels, can impact inventory availability and product delivery.

Shifting social media algorithms and the evolving landscape of influencer marketing create uncertainty for a.k.a. Brands' customer acquisition strategies. Declining organic reach and potential influencer fatigue can lead to higher marketing expenses and a need for constant adaptation to maintain brand visibility and engagement.

SWOT Analysis Data Sources

This a.k.a. Brands SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and insights from industry experts to provide a robust and accurate strategic overview.