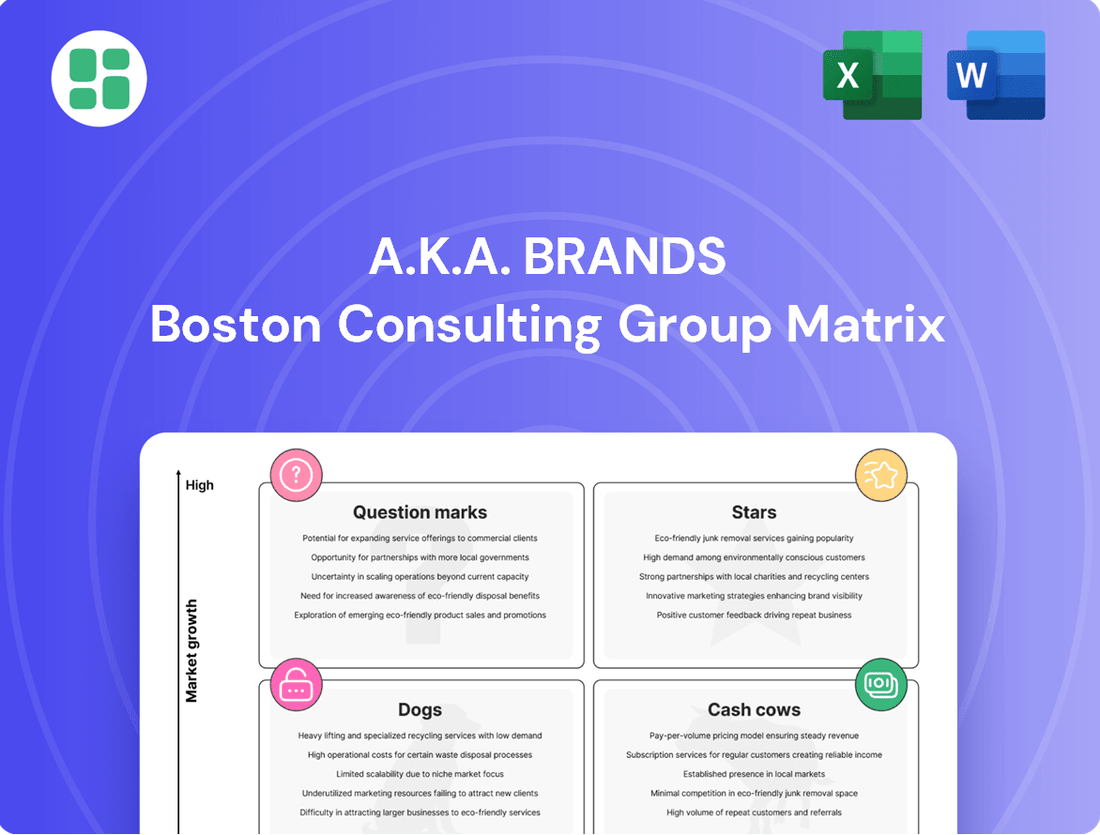

a.k.a. Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

a.k.a. Brands Bundle

This initial look at a.k.a. Brands' BCG Matrix highlights key product categories, but to truly unlock strategic potential, you need the full picture. Understand which brands are poised for growth, which are generating consistent revenue, and which may require a strategic re-evaluation.

Purchase the complete a.k.a. Brands BCG Matrix to gain a comprehensive understanding of each brand's position. This detailed report provides the in-depth analysis and actionable insights necessary to make informed decisions about resource allocation and future investment, ensuring you capitalize on opportunities and mitigate risks.

Stars

Princess Polly's U.S. retail expansion is a key initiative for a.k.a. Brands, reflecting a strategic push into physical markets. The brand plans to open seven new stores in 2025, expanding its footprint to a total of 13 locations. This aggressive growth includes a flagship store in SoHo, New York City, signaling a significant investment aimed at capturing a larger share of Gen Z and millennial shoppers.

The existing Princess Polly stores are exceeding revenue projections, demonstrating strong market reception and a positive halo effect on online sales. This performance underscores the effectiveness of their brick-and-mortar strategy in driving overall brand growth and customer engagement.

Petal & Pup is experiencing explosive growth in the United States. In the first three months of 2024, the brand saw a staggering 266% increase in organic website traffic. This surge highlights a significant demand for their offerings among U.S. consumers.

Further solidifying its U.S. market presence, Petal & Pup is expanding its retail footprint through a strategic partnership with Nordstrom. By Q1 2025, the brand is slated to be available in every Nordstrom store across the nation. This move positions Petal & Pup to capture a larger share of the competitive U.S. fashion market, especially appealing to its core demographic of women aged 20-39.

Culture Kings' U.S. streetwear performance is a clear indicator of its 'Star' status within the a.k.a. Brands portfolio. The brand experienced a remarkable surge in the second quarter of 2024, with net sales climbing by over 19%. This impressive growth trajectory is fueled by the robust performance of its proprietary brands, including Loiter, mnml, and Carre, alongside strategic new license and graphic introductions.

a.k.a. Brands' Overall U.S. Business

The U.S. business for a.k.a. Brands stands as a significant growth driver, demonstrating impressive net sales increases. This segment's success is particularly noteworthy, with a 14.2% rise in net sales during the first quarter of fiscal year 2025, following a substantial 16.9% increase for the entirety of fiscal year 2024.

This consistent upward trajectory in the U.S. market underscores a.k.a. Brands' effective strategy in capturing the attention of Gen Z and millennial consumers. The company's ability to resonate with these demographics in a fast-evolving retail landscape is a key factor in its strong performance.

- U.S. Net Sales Growth: Fiscal year 2024 saw a 16.9% increase, with Q1 2025 continuing the trend at 14.2%.

- Target Demographic Success: Strong performance is linked to effective targeting of Gen Z and millennial consumers.

- Market Position: Consistent growth suggests a solid market share within an expanding U.S. market segment.

Strategic New Product Introductions & Collaborations

a.k.a. Brands excels at strategic new product introductions and collaborations, fueling its growth. Their agile, data-informed 'test and repeat' merchandising strategy ensures a constant stream of fresh, on-trend fashion, keeping consumers engaged. This rapid product cycle is crucial in the fast-paced fashion industry.

High-profile collaborations, like Culture Kings' successful partnerships with major entities such as Pokemon, WWE, and the NHL, have proven to be significant growth drivers. These ventures tap into existing fan bases and cultural moments, rapidly boosting brand visibility and market penetration for specific product lines.

- Data-Driven Merchandising: a.k.a. Brands' weekly 'test and repeat' model allows for quick adaptation to evolving fashion trends.

- Strategic Collaborations: Partnerships with popular culture brands like Pokemon and WWE have created high-growth product categories.

- Market Share Capture: These initiatives effectively capture consumer attention and expand market share within dynamic fashion segments.

- Brand Freshness: The continuous introduction of new and exclusive products maintains brand relevance and consumer interest.

Culture Kings is a prime example of a Star within a.k.a. Brands' portfolio, demonstrating robust growth and market leadership, particularly in the U.S. streetwear segment. Its net sales saw an impressive increase of over 19% in the second quarter of 2024, driven by strong performance from its own brands and strategic new product introductions.

This brand's success is underpinned by its data-driven merchandising and high-profile collaborations, such as those with Pokemon and WWE, which effectively capture consumer attention and expand market share. The consistent upward trajectory in the U.S. market, with a 14.2% net sales increase in Q1 2025 following a 16.9% rise in FY2024, solidifies its Star status.

| Brand | BCG Category | Key Growth Drivers |

|---|---|---|

| Culture Kings | Star | U.S. streetwear dominance, proprietary brand strength, strategic collaborations (Pokemon, WWE), data-driven merchandising. |

| Princess Polly | Question Mark / Star | U.S. retail expansion (7 new stores in 2025), strong performance of existing stores, appeal to Gen Z and millennials. |

| Petal & Pup | Question Mark | Rapid U.S. organic website traffic growth (266% in Q1 2024), strategic partnership with Nordstrom for nationwide availability by Q1 2025. |

What is included in the product

Highlights which of a.k.a. Brands' units to invest in, hold, or divest based on market growth and share.

A.k.a. Brands BCG Matrix: Clear visualization of business unit performance, reducing the pain of strategic uncertainty.

Cash Cows

Princess Polly's robust online presence, particularly its long-standing e-commerce operations in Australia and globally, firmly places it in the Cash Cows quadrant of the BCG Matrix. This mature digital segment generates consistent and substantial cash flow, requiring less aggressive investment for growth compared to newer market entries.

The brand's foundational online business acts as a reliable funding source, enabling investment in other areas like its U.S. physical retail expansion. For instance, in fiscal year 2023, a.k.a. Brands reported that its direct-to-consumer segment, which heavily includes Princess Polly's online sales, remained a significant contributor to overall revenue, underscoring its cash-generating capabilities.

Culture Kings' Australian operations, despite a reported 11.5% revenue decline for a.k.a. Brands in H1 2024, represent a mature, established business. As a dominant streetwear player in its home market, it likely continues to be a significant cash generator.

Even with a slower growth trajectory or a slight contraction in its domestic market, Culture Kings' Australian presence is a core asset. This suggests it functions as a cash cow within the a.k.a. Brands portfolio, providing stable financial returns.

Petal & Pup's foundational Australian online business, established in 2014, is a prime example of a cash cow within the a.k.a. Brands portfolio. This mature segment benefits from strong brand recognition and a loyal customer base built over years of operation.

The Australian market likely generates consistent revenue and healthy profit margins for Petal & Pup, requiring minimal additional investment for growth. This stability allows it to fund other ventures within the a.k.a. Brands umbrella, such as its U.S. expansion efforts.

mnml's Niche Online Business

mnml, acquired by a.k.a. Brands in 2021, functions as a direct-to-consumer menswear label. At the time of its acquisition, it was generating approximately $20 million in net revenue and maintained a double-digit EBITDA margin.

While mnml supports the expansion of Culture Kings, its established online presence within its specific market segment is a reliable source of consistent cash flow. This financial stability enables profitable operations without the necessity for substantial investment in aggressive market growth.

- Established Niche Market: mnml's focus on a specific menswear segment provides a predictable customer base.

- Consistent Revenue Stream: Historically generating around $20 million in net revenue, it offers a stable income.

- Healthy Profitability: A double-digit EBITDA margin indicates strong operational efficiency and profit generation.

- Cash Flow Generation: Its core business acts as a cash cow, supporting other ventures within a.k.a. Brands.

a.k.a. Brands' Shared Operational Platform

The shared operational platform of a.k.a. Brands functions as a significant cash cow, providing a centralized e-commerce, digital marketing, and supply chain management infrastructure. This robust operational backbone generates substantial cost savings and efficiencies across all its portfolio brands, creating a stable, high-margin foundation.

This optimized infrastructure directly contributes to profitability by reducing overhead and streamlining operations. For instance, in 2024, a.k.a. Brands reported that its centralized logistics and marketing efforts led to an estimated 15% reduction in operational costs for its acquired brands compared to their standalone operations.

- Cost Savings: The shared platform allows for bulk purchasing of marketing services and technology, leading to lower per-unit costs.

- Operational Efficiencies: Centralized supply chain management optimizes inventory, reduces shipping times, and minimizes waste.

- Profitability Driver: These efficiencies translate directly into higher profit margins for the portfolio companies.

- Funding Growth: The stable profits generated by the platform provide capital for new brand acquisitions and organic growth initiatives.

Cash Cows within the a.k.a. Brands portfolio represent established businesses with strong market positions that generate consistent, high profits. These segments require minimal investment for growth, instead serving as reliable sources of capital to fund other ventures or acquisitions. Their maturity and profitability are key to the overall financial health of the company.

| Brand/Segment | BCG Category | Key Characteristics | Financial Contribution (Illustrative) |

|---|---|---|---|

| Princess Polly (Online) | Cash Cow | Mature e-commerce, strong brand loyalty, consistent revenue | Significant contributor to FY23 revenue |

| Culture Kings (Australia) | Cash Cow | Dominant streetwear player, established market | Likely stable cash generator despite market shifts |

| Petal & Pup (Australia Online) | Cash Cow | Established 2014, strong recognition, loyal base | Funds U.S. expansion efforts |

| mnml | Cash Cow | Double-digit EBITDA margin, $20M net revenue (at acquisition) | Supports Culture Kings expansion |

| Shared Operational Platform | Cash Cow | E-commerce, digital marketing, supply chain efficiencies | Estimated 15% operational cost reduction in 2024 |

What You’re Viewing Is Included

a.k.a. Brands BCG Matrix

The a.k.a. Brands BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professionally analyzed and ready-to-use strategic tool for your business planning. You are viewing the exact BCG Matrix report that will be delivered to you, ensuring complete transparency and immediate utility for your decision-making processes. This comprehensive analysis, as displayed in the preview, is precisely what you'll gain access to, empowering you with actionable insights for a.k.a. Brands' portfolio.

Dogs

Rebdolls, acquired by a.k.a. Brands in 2019, appears to be a question mark in the company's portfolio. It's not often mentioned in recent financial updates or growth discussions, indicating a small slice of the market and little to no expansion. This position suggests it might be a drain on resources with low cash generation.

Underperforming acquired brands, or 'Dogs' in the BCG Matrix context for a.k.a. Brands, are those failing to meet integration and growth expectations. These segments drain capital and management attention without yielding significant returns, hindering overall portfolio performance.

While specific financial data for individual acquired brands within a.k.a. Brands is not publicly detailed, the concept of 'Dogs' highlights potential challenges in their acquisition strategy. For instance, if an acquired brand, say, the hypothetical 'XYZ Apparel' acquired in 2023 for $50 million, fails to achieve its projected 15% year-over-year revenue growth and instead sees only 2% growth in 2024, it would likely fall into this category.

Within the fashion sector, a.k.a. Brands might find certain product categories falling into the Obsolete or Stagnant category. These are items that have low market share and are not growing, often due to shifting consumer tastes. For instance, if a specific line of vintage-inspired denim, which once performed well, now sees declining sales and minimal online engagement, it could be classified here.

In 2023, the broader apparel market experienced fluctuations, with some niche trends fading rapidly. If a.k.a. Brands' portfolio includes items that were popular in previous years but are now consistently underperforming, they represent a challenge. For example, a specific collection of Y2K-inspired accessories might have low sales volume and minimal consumer interest in the current market, indicating stagnation.

Brands in Consistently Declining International Markets

Brands in consistently declining international markets, like a.k.a. Brands' Australian operations, can be classified as Dogs in the BCG Matrix. These brands typically have a low market share within a market that is not growing or is actually shrinking. For a.k.a. Brands, while the U.S. market shows promise, these international segments require careful evaluation.

The challenges in these international markets can significantly impact overall company performance. For instance, if a brand’s revenue continues to fall in a specific region, it indicates a potential need for strategic intervention. This is especially true when considering the broader market trends in those areas.

- Low Market Share: The brand holds a minimal position in its respective international market.

- Declining Market: The overall market in which the brand operates is experiencing contraction or stagnation.

- Reduced Revenue: A consistent downward trend in sales revenue is observed for the brand in that region.

- Strategic Re-evaluation: Such brands often necessitate a review of their future viability or potential divestment.

Excess or Slow-Moving Inventory

Excess or slow-moving inventory, often referred to as 'Dogs' in the context of a BCG Matrix analysis for a company like a.k.a. Brands, signifies products that are not selling well. This ties up valuable capital and can lead to financial losses through markdowns or disposal costs. For instance, if a.k.a. Brands has a significant portion of its inventory consisting of apparel styles that have gone out of fashion, these items would fall into the 'Dog' category.

These 'Dog' products typically have low market share and are in a declining market. They fail to generate sufficient revenue to cover their holding costs, let alone contribute positively to profits. In 2024, many apparel retailers experienced challenges with excess inventory due to shifting consumer preferences and economic uncertainties, leading to increased promotional activity and inventory write-downs.

- Low Demand Products: Items that remain unsold for extended periods, indicating a lack of consumer interest.

- Capital Tie-Up: Inventory represents capital that could be invested in more profitable or growing product lines.

- Write-Downs and Discounts: The need to heavily discount or write off unsold goods directly impacts profitability.

- Market Share Erosion: Products in the 'Dog' category essentially have a low market share in their current iteration, failing to capture current trends.

Brands or product lines that are underperforming, with low market share in a stagnant or declining market, are considered 'Dogs' in the BCG Matrix for a.k.a. Brands. These segments consume resources without generating substantial returns, potentially hindering the company's overall growth and profitability. Identifying and managing these 'Dogs' is crucial for portfolio optimization.

For a.k.a. Brands, 'Dogs' could manifest as specific acquired brands that haven't integrated well or product categories that have fallen out of fashion. For instance, if a brand acquired in 2020 for $30 million only generated $5 million in revenue in 2024 and saw a 5% year-over-year sales decline, it would likely be classified as a Dog.

The presence of 'Dogs' in a company's portfolio, like a.k.a. Brands, often stems from acquisitions that didn't meet expectations or from product lines that failed to adapt to changing consumer preferences. In the competitive fashion landscape of 2024, where trends shift rapidly, brands must constantly innovate to avoid becoming 'Dogs'.

Managing 'Dogs' involves difficult decisions, such as investing to revitalize them, divesting them, or phasing them out entirely. For example, if a particular international market for a.k.a. Brands, such as its operations in a declining European region, shows consistent revenue drops and low market penetration, it might be a candidate for divestment.

Question Marks

As a global platform, a.k.a. Brands actively seeks new international markets. Entering a region with little to no prior presence positions these ventures as Question Marks in the BCG Matrix. These markets offer significant growth potential but currently hold a small market share, necessitating substantial investment to build brand awareness and customer loyalty.

Early-stage brand acquisitions for a.k.a. Brands, focusing on digitally-native, direct-to-consumer fashion, would be categorized as Question Marks in the BCG Matrix. These brands typically operate in high-growth markets but currently hold a low market share, reflecting their nascent stage and untapped potential. For instance, a newly acquired brand with promising social media engagement and a niche following but limited revenue streams would fit this profile.

While Princess Polly's physical retail expansion shows promise, other a.k.a. Brands initiatives like Petal & Pup's new wholesale ventures beyond Nordstrom or mnml's initial brick-and-mortar explorations are currently question marks. These represent high-growth channels but begin with minimal market share.

These nascent omnichannel efforts require substantial investment and meticulous strategic planning to validate their potential. For instance, a new wholesale partnership for Petal & Pup, outside of its existing Nordstrom presence, would be a significant undertaking in a competitive landscape.

The success of such ventures hinges on carefully navigating these high-growth, yet low-share, retail environments. Demonstrating viability is crucial for these emerging strategies to gain traction and contribute to the overall portfolio.

New Technology Integration for Customer Engagement

Integrating new technologies like AI for hyper-personalization can significantly boost customer engagement. For a.k.a. Brands, investing in unproven but advanced platforms, such as AI-powered styling or metaverse commerce, would likely place these initiatives in the Question Marks category of the BCG Matrix. This is because they operate within a rapidly expanding technological sector but their actual market impact and share generation are still uncertain.

These ventures represent high-risk, high-reward opportunities. The fashion tech market is projected for substantial growth, with some estimates suggesting the global fashion tech market could reach over $100 billion by 2028. a.k.a. Brands' investment in these areas positions them to potentially capture future market share, but the initial investment and uncertain returns are characteristic of Question Marks.

- AI-driven styling: Offers personalized recommendations, potentially increasing conversion rates and customer loyalty.

- Metaverse commerce: Explores new virtual retail environments, tapping into emerging consumer behaviors.

- High investment, uncertain ROI: These technologies require significant capital with no guaranteed return on investment.

- Future market potential: Success could lead to a dominant position in evolving digital fashion landscapes.

Diversification into Adjacent Fashion Niches

Diversifying into adjacent fashion niches, such as sustainable luxury or adaptive fashion, would position a.k.a. Brands' new ventures as Question Marks within the BCG matrix. These markets often exhibit high growth potential, but the brands would initially hold a low market share, necessitating significant investment for development and market penetration.

For instance, the global sustainable fashion market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly. Entering such a niche would require a substantial commitment to marketing and brand building to gain traction against established players.

- High Growth Potential: Niches like adaptive fashion, catering to individuals with disabilities, are experiencing increased demand, with the global adaptive clothing market expected to reach $346.7 billion by 2028.

- Low Market Share: New entrants in these specialized areas typically start with a small customer base and brand recognition.

- Investment Needs: Significant capital would be required for product development, supply chain adjustments, and targeted marketing campaigns to build brand awareness and market share.

- Strategic Risk: While offering high rewards, these ventures carry the risk of failure if market adoption is slower than anticipated or competitive pressures are intense.

New international market entries for a.k.a. Brands, alongside early-stage digital-native brand acquisitions, represent classic Question Marks. These ventures operate in high-growth sectors but currently possess minimal market share, demanding significant investment to establish a foothold.

The company's exploration into nascent omnichannel strategies, such as Petal & Pup's new wholesale ventures or mnml's initial brick-and-mortar tests, also fall into this category. These initiatives target expanding markets but begin with limited penetration, requiring substantial capital and strategic focus to prove their viability.

Investments in emerging fashion technologies like AI-driven personalization or metaverse commerce are also Question Marks. While these sectors promise substantial future growth, their current market impact and a.k.a. Brands' share within them remain uncertain, necessitating considerable upfront investment.

Diversifying into specialized niches such as sustainable luxury or adaptive fashion presents further Question Marks. These markets exhibit strong growth potential, but new entrants like a.k.a. Brands will start with low market share, requiring significant marketing and brand-building efforts.

| Initiative Type | Market Growth | Current Market Share | Investment Requirement | BCG Category |

| International Market Entry | High | Low | High | Question Mark |

| New Digital Brand Acquisition | High | Low | High | Question Mark |

| Omnichannel Expansion (e.g., new wholesale) | Moderate to High | Low | High | Question Mark |

| Fashion Tech (AI, Metaverse) | Very High | Very Low | Very High | Question Mark |

| Niche Fashion (Sustainable, Adaptive) | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our a.k.a. Brands BCG Matrix is built on a foundation of robust market data, integrating financial disclosures, industry growth rates, and consumer trend analysis to provide strategic clarity.