a.k.a. Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

a.k.a. Brands Bundle

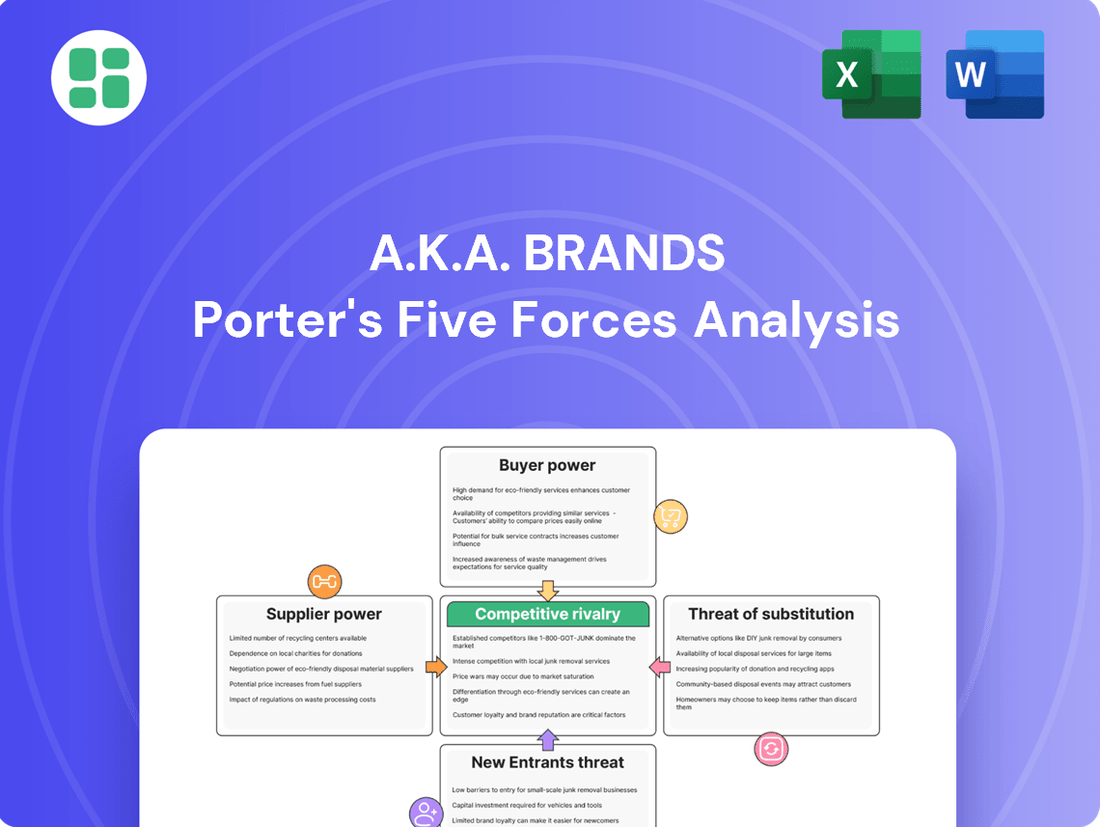

a.k.a. Brands faces a dynamic competitive landscape shaped by several key forces. Understanding the intensity of buyer power and the threat of new entrants is crucial for navigating this market. The full Porter's Five Forces Analysis reveals the real forces shaping a.k.a. Brands’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The fashion industry, especially for sustainable and specialty materials, often deals with a limited number of suppliers. This concentration means that providers of unique or ethically sourced fabrics, like those a.k.a. Brands might need, can often charge more due to the scarcity of alternatives. For instance, the global market for organic cotton, a key sustainable material, is dominated by a few major producing regions, giving those suppliers significant leverage.

While a.k.a. Brands emphasizes efficient supply chain operations, the reality of switching suppliers, particularly for long-standing partnerships or unique materials, presents substantial hurdles. These can involve expenses for reconfiguring manufacturing equipment, obtaining new quality certifications, and the risk of delays impacting product release timelines, all of which can elevate the leverage suppliers hold.

a.k.a. Brands' impressive scale and rapid growth, fueled by its popular brands targeting Gen Z and millennials, position it as a substantial customer for its suppliers. This significant purchasing volume can effectively diminish supplier bargaining power by making a.k.a. Brands a vital revenue source for them. Consequently, suppliers are incentivized to offer competitive pricing and more favorable terms to secure this business.

Threat of Forward Integration by Suppliers

Suppliers possessing robust brands or distinctive competencies could potentially venture into the direct-to-consumer (DTC) fashion arena, thereby circumventing established players like a.k.a. Brands. This forward integration strategy, if executed, would allow them to capture a larger share of the value chain.

However, the substantial capital investment and specialized marketing acumen necessary to cultivate thriving DTC fashion brands present considerable deterrents to such supplier-driven market entry. For instance, establishing a recognized DTC fashion brand often requires millions in marketing spend, as seen with successful players in the apparel space.

- High Capital Outlay: Launching and scaling a DTC fashion brand typically demands significant upfront investment in inventory, technology, and marketing, often running into millions of dollars annually.

- Brand Building Expertise: Successfully connecting with fashion consumers requires sophisticated digital marketing, social media engagement, and brand storytelling capabilities that many raw material or component suppliers may lack.

- Market Saturation: The DTC fashion market is highly competitive, with numerous established brands and emerging players vying for consumer attention, making it challenging for new entrants, even well-funded ones, to gain traction.

Availability of Substitute Inputs

The availability and quality of substitute inputs significantly impact supplier bargaining power. If a.k.a. Brands can easily switch between different raw material suppliers or manufacturing processes, the existing suppliers' leverage diminishes. For instance, if the primary sustainable material used in a.k.a. Brands' products has limited alternatives, suppliers of that material could command higher prices. However, a.k.a. Brands' strategy of building agile supply chains and sourcing from a diverse range of providers can act as a crucial counterbalance, reducing dependency on any single supplier and thus mitigating their bargaining power.

Consider the following points regarding substitute inputs:

- Limited Alternatives for Sustainable Materials: If a.k.a. Brands heavily relies on specific sustainable materials, suppliers of these niche inputs may hold considerable power due to fewer viable alternatives in the market.

- Diversified Sourcing Strategy: By cultivating relationships with multiple suppliers across different regions and for various components, a.k.a. Brands can reduce its reliance on any one supplier, thereby weakening their bargaining position.

- Agile Supply Chain Management: A flexible supply chain allows a.k.a. Brands to quickly adapt to changes in material availability or pricing by shifting to alternative sources or processes.

For a.k.a. Brands, the bargaining power of suppliers is a mixed bag. While the company's scale and growth in 2024 make it a valuable customer, potentially reducing supplier leverage, the reliance on specialized or sustainable materials can empower certain suppliers. The cost and complexity of switching suppliers, especially for unique inputs, also tip the scales. For instance, the market for recycled polyester, a key material for many apparel brands, saw price increases in early 2024 due to demand outpacing supply, giving those producers more power.

The potential for suppliers to integrate forward into direct-to-consumer sales is a theoretical threat, but the high capital and marketing expertise required make this unlikely for most. This means a.k.a. Brands can likely maintain a strong position by continuing its diversified sourcing and agile supply chain strategies, mitigating the impact of any single supplier's power.

What is included in the product

This analysis reveals the competitive pressures impacting a.k.a. Brands, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the fashion industry.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Gen Z and millennials, a.k.a. Brands' core demographic, are showing a growing concern for price. Economic headwinds and the proliferation of budget-friendly options, such as ‘dupes’ and fast fashion, are fueling this trend. This increased price sensitivity directly amplifies their bargaining power.

Consumers in these younger generations are actively seeking the best value for their money. Data from 2024 indicates that a significant portion of Gen Z and millennials prioritize affordability when making purchasing decisions, often comparing prices across multiple brands and platforms. This makes them more inclined to switch to competitors if a.k.a. Brands does not offer competitive pricing.

The digital-native nature of a.k.a. Brands' customers grants them effortless access to a wealth of information, including product reviews and price comparisons across a multitude of online fashion retailers. This heightened transparency, coupled with the minimal expense and effort required to switch between brands, substantially amplifies customer bargaining power.

a.k.a. Brands faces a challenge with Gen Z's preference for novelty over established loyalty. This generation, known for its digital fluency and constant search for fresh trends, can easily switch between brands, diminishing a.k.a. Brands' ability to cultivate deep customer allegiance.

In 2024, the fast-fashion market, where a.k.a. Brands operates, is characterized by rapid trend cycles. For instance, platforms like TikTok constantly showcase new styles, encouraging consumers to experiment. This dynamic amplifies customer bargaining power as they are not tied to a single brand, seeking the latest affordable options.

This inherent desire for newness among younger consumers means they have a wider array of choices readily available. Consequently, a.k.a. Brands must continuously innovate and offer compelling value propositions to retain customer attention amidst this fluid market landscape.

Influence of Social Media and User-Generated Content

Social media and user-generated content significantly amplify customer bargaining power, particularly among younger demographics. Gen Z and millennials, for instance, heavily rely on platforms like TikTok and Instagram for fashion trends and purchasing guidance, with influencer endorsements playing a crucial role.

This reliance means that collective opinions, often shared through user-generated content and online reviews, can sway purchasing decisions and impact a brand's reputation. For example, a surge of negative reviews or a viral complaint can quickly erode a brand's appeal and drive customers to competitors. In 2024, studies indicated that over 70% of Gen Z consumers consider online reviews before making a purchase, underscoring this shift in influence.

- Influence of Social Media: Platforms like TikTok and Instagram are primary discovery channels for fashion, driven by influencers.

- User-Generated Content: Online reviews and social media posts provide peer validation, directly impacting brand perception.

- Customer Empowerment: Collective customer feedback grants significant leverage over brands, influencing sales and reputation.

- Demographic Impact: Gen Z and millennials, in particular, demonstrate a strong reliance on these digital channels for purchase decisions.

Omnichannel Shopping Preferences

a.k.a. Brands' customers are increasingly leveraging omnichannel shopping preferences, which significantly bolsters their bargaining power. This means consumers can effortlessly move between online browsing, in-store purchases, and even wholesale channels, giving them a broader view of available products and pricing. For instance, a customer might research a product online, try it on in a physical store, and then look for the best deal across different retail partners, including those a.k.a. Brands collaborates with, like Nordstrom.

This ability to compare and contrast across multiple touchpoints empowers customers by providing them with more options and information. They are less tied to a single brand or retailer when their purchasing journey can span various platforms and partnerships. This heightened awareness of alternatives naturally pushes brands to offer competitive pricing and superior value to retain these informed shoppers.

- Omnichannel Expectations: Customers demand consistent and convenient experiences whether they shop online, in a physical store, or through partner channels.

- Increased Comparison: The ease of comparing products and prices across different touchpoints amplifies customer leverage.

- Channel Flexibility: Customers' willingness to utilize various shopping avenues, including wholesale partnerships, provides them with more alternatives.

- Impact on Pricing: This enhanced bargaining power pressures brands like a.k.a. Brands to maintain competitive pricing and value propositions.

The bargaining power of customers for a.k.a. Brands is significantly influenced by the price sensitivity of its core demographic, Gen Z and millennials. In 2024, economic pressures and the availability of cheaper alternatives mean these consumers actively seek value, readily switching brands if pricing isn't competitive. This trend is further amplified by the digital-native nature of these customers, who can effortlessly compare prices and reviews across numerous online retailers, making brand loyalty less impactful.

The fast-fashion environment, characterized by rapid trend cycles driven by platforms like TikTok, also empowers customers. They are less committed to specific brands, constantly seeking the latest affordable styles, which necessitates continuous innovation and value offerings from a.k.a. Brands to maintain engagement.

Social media and user-generated content are major drivers of customer bargaining power. In 2024, over 70% of Gen Z consumers consult online reviews before purchasing, demonstrating the significant influence of collective opinions and influencer endorsements on brand perception and purchasing decisions.

a.k.a. Brands' customers increasingly utilize omnichannel shopping, comparing products and prices across online, in-store, and partner channels. This flexibility and access to information provide customers with more alternatives, pressuring the brand to offer competitive pricing and superior value to retain their business.

Same Document Delivered

a.k.a. Brands Porter's Five Forces Analysis

This preview shows the exact a.k.a. Brands Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape impacting the company, including the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This detailed report is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The direct-to-consumer (DTC) fashion space is incredibly crowded. Think of it like a bustling marketplace where countless brands are all trying to catch the eye of shoppers, especially younger ones like Gen Z and millennials. This sheer volume of competition means companies are constantly battling to stand out and grab a piece of the market.

In 2024, this rivalry is particularly fierce. Many legacy brands are now embracing online sales, adding to the existing wave of digitally native startups. This influx means more choices for consumers, but for brands, it translates to a tougher fight for attention and loyalty. Companies are investing heavily in marketing and customer acquisition to stay ahead.

Consumers in the fashion industry, including those who purchase from brands like a.k.a. Brands, generally face very low switching costs. This means a customer can easily move from one brand to another based on changing fashion trends, price points, or simply a personal whim. For instance, a consumer might buy a trendy jacket from one brand this season and switch to a competitor next season if they offer a more appealing style or a better sale.

This dynamic puts significant pressure on a.k.a. Brands to consistently deliver fresh designs and competitive pricing to keep customers engaged. The ease with which consumers can explore and adopt new brands means a.k.a. Brands must remain highly agile and innovative. In 2024, the fast fashion sector, a key area for a.k.a. Brands, saw brands like Shein and Temu continue to gain market share, partly due to their aggressive pricing and rapid trend adoption, highlighting the impact of low switching costs.

The direct-to-consumer (DTC) e-commerce fashion sector is booming, with market size expected to reach hundreds of billions globally by 2025. This rapid expansion fuels intense competition as more brands enter and existing ones scale, often through acquisitions. For companies like a.k.a. Brands, which actively acquires and integrates fashion labels, this high-growth environment necessitates strategic maneuvering to stand out amidst increasing consolidation.

Product Differentiation and 'Test and Repeat' Model

a.k.a. Brands employs a 'test and repeat' strategy, launching new fashion items weekly to capture fleeting trends. This approach aims to differentiate its offerings and accelerate market entry. The company's ability to quickly identify and replicate popular styles is key to its competitive edge.

However, the fast-paced nature of the fashion industry, coupled with the widespread availability of similar products or 'dupes', presents a significant challenge. This constant demand for novelty and the ease with which competitors can mimic successful designs intensifies rivalry.

- Speed to Market: a.k.a. Brands' weekly product drops are designed to capitalize on emerging fashion trends rapidly.

- Differentiation Challenge: Maintaining truly unique product offerings is difficult due to the prevalence of 'dupes' and fast fashion imitation.

- Intensified Rivalry: The 'test and repeat' model, while effective for speed, inherently fuels competition as others can quickly adopt similar strategies.

Marketing and Omnichannel Expansion Efforts

The digital marketing and omnichannel landscape is highly competitive, pushing brands to significantly invest in social media engagement, collaborations with influencers, and the development of physical retail presences. This intense rivalry necessitates continuous innovation and strategic adaptation to capture consumer attention and market share.

a.k.a. Brands' strategic direction, emphasizing digital innovation, expanding its global footprint, and growing its physical retail network, such as the opening of new Princess Polly stores, directly addresses this competitive pressure. These efforts are crucial for maintaining relevance and driving growth in a dynamic market.

- Digital Marketing Investment: Brands are allocating substantial budgets to digital channels, with global digital ad spending projected to reach over $700 billion in 2024, according to Statista.

- Omnichannel Integration: A significant portion of consumers expect seamless experiences across online and offline channels; a 2023 report by Accenture found that 88% of consumers use both online and physical stores when shopping.

- Influencer Marketing Growth: The influencer marketing industry is expected to continue its upward trajectory, with projections indicating it could reach $21.1 billion in 2024, as reported by Influencer Marketing Hub.

- Physical Retail Expansion: Despite the digital shift, physical retail remains vital, with successful brands like a.k.a. Brands strategically opening new brick-and-mortar locations to enhance brand visibility and customer interaction.

The direct-to-consumer fashion market, where a.k.a. Brands operates, is characterized by intense rivalry. This is driven by a high volume of both established and emerging brands, many of which utilize aggressive digital marketing and rapid trend adoption strategies.

In 2024, this competition is further amplified by the low switching costs for consumers, who can easily move between brands based on price, style, or promotions. Companies like a.k.a. Brands must therefore continually innovate and offer compelling value propositions to retain customer loyalty.

The prevalence of 'dupes' and the ease with which successful styles can be replicated mean that differentiation is a constant challenge. Brands are investing heavily in speed to market, with a.k.a. Brands' weekly product drops exemplifying this trend, aiming to capture fleeting consumer demand before competitors.

Omnichannel strategies are also critical battlegrounds, with significant investment in digital marketing, influencer collaborations, and physical retail expansion. For instance, global digital ad spending was projected to exceed $700 billion in 2024, highlighting the scale of marketing investment required.

| Competitive Factor | Impact on a.k.a. Brands | 2024 Data/Trend |

|---|---|---|

| Number of Competitors | High rivalry, market saturation | Continued influx of new DTC brands and legacy brand digital expansion |

| Consumer Switching Costs | Low, easy to switch brands | Emphasis on brand loyalty programs and consistent newness |

| Product Imitation | Challenge to maintain unique offerings | Prevalence of 'dupes' and fast fashion imitation |

| Marketing & Distribution | High investment required | Digital ad spend over $700B globally; 88% consumers use online/offline channels |

SSubstitutes Threaten

The growing second-hand and resale market poses a substantial threat to brands like a.k.a. Brands. This is especially true for younger consumers, like Gen Z and millennials, who are increasingly focused on both affordability and sustainability. In 2023, the global secondhand apparel market was valued at approximately $177 billion and is projected to reach $351 billion by 2027, demonstrating a clear shift in consumer behavior towards pre-owned fashion.

The rise of fast fashion and the proliferation of 'dupes' present a significant threat of substitutes for a.k.a. Brands. These brands, like Shein and Temu, can rapidly replicate trending styles at much lower price points, offering consumers a direct alternative to a.k.a. Brands' products. For instance, Shein's ability to bring new designs from concept to market in as little as five days, compared to traditional fashion cycles, highlights the speed at which these substitutes can emerge.

Consumers increasingly prioritize affordability and trendiness, especially younger demographics. The 'dupe' culture, where consumers actively seek out cheaper versions of popular designer items, further intensifies this threat. Data from 2023 indicates that the global fast fashion market was valued at over $100 billion, demonstrating its substantial reach and appeal, and a significant portion of this growth is attributed to online-centric, rapidly iterating brands.

The burgeoning clothing rental market presents a significant threat of substitutes for brands like a.k.a. Brands. Services such as Rent the Runway and Nuuly allow consumers to access a vast array of styles for specific events or to refresh their wardrobes without the need for outright purchase. This trend is particularly strong among younger demographics who prioritize variety and sustainability, directly impacting traditional apparel sales.

Consumers Prioritizing Other Spending Categories

Consumers, particularly younger demographics like Gen Z, are increasingly redirecting their discretionary funds toward non-fashion sectors. This trend means that fashion brands aren't just competing with other apparel companies; they're vying for consumer dollars against experiences, cutting-edge technology, and personal wellness services. For instance, in 2024, a significant portion of Gen Z's spending has been noted to favor travel and digital entertainment over traditional apparel purchases.

This evolving consumer behavior presents a substantial threat of substitutes for fashion brands. When consumers perceive greater value or fulfillment in alternative spending avenues, the demand for fashion can diminish. This broader competition means fashion must continually innovate and demonstrate its unique value proposition to capture consumer attention and spending.

Consider these shifts in consumer priorities:

- Experiences over Goods: A growing number of consumers, especially millennials and Gen Z, are prioritizing spending on travel, concerts, and dining out, which directly competes with fashion budgets.

- Technology Adoption: Investment in new gadgets, software, and digital subscriptions often takes precedence, especially as technology becomes more integrated into daily life and self-expression.

- Self-Care and Wellness: Spending on fitness, mental health services, and organic products has seen a notable rise, indicating a shift towards personal well-being as a primary expenditure.

DIY and Upcycled Fashion Trends

The rise of DIY and upcycled fashion presents a significant threat of substitutes for brands like a.k.a. Brands. Platforms like TikTok and Instagram have amplified these trends, enabling consumers to personalize or reimagine existing clothing. This creative outlet offers a distinct alternative to buying new, especially appealing to younger demographics like Gen Z who value individuality and sustainability.

This movement allows consumers to craft unique pieces, bypassing traditional retail channels. For instance, a 2023 report indicated that 55% of Gen Z consumers are actively interested in sustainable fashion, with upcycling being a key component of that interest. This DIY ethos directly competes with the ready-to-wear market.

The accessibility of tutorials and affordable materials further lowers the barrier to entry for DIY fashion. Consumers can transform thrift store finds or old garments into trendy outfits, often at a fraction of the cost of new items. This cost-effectiveness makes it a compelling substitute, particularly for budget-conscious shoppers.

Key aspects of this threat include:

- Growing Social Media Influence: Platforms like TikTok and Instagram are key drivers, showcasing DIY and upcycling projects to millions.

- Consumer Desire for Uniqueness: DIY fashion allows for personalized expression, a strong differentiator from mass-produced goods.

- Sustainability Concerns: Upcycling appeals to environmentally conscious consumers, offering a greener alternative to fast fashion.

- Cost Savings: Repurposing materials is often more economical than purchasing new apparel, making it an attractive substitute.

The threat of substitutes for a.k.a. Brands is multifaceted, encompassing the growing secondhand market, fast fashion 'dupes', clothing rental services, alternative consumer spending, and the DIY/upcycling movement. These substitutes cater to consumer desires for affordability, trendiness, uniqueness, and sustainability, directly challenging traditional retail models.

The secondhand apparel market is a significant substitute, with its global valuation reaching approximately $177 billion in 2023 and projected growth to $351 billion by 2027. Similarly, fast fashion brands like Shein can bring new designs to market in as little as five days, offering rapid trend replication at lower price points. The global fast fashion market itself was valued at over $100 billion in 2023.

| Substitute Category | Key Characteristics | Market Size/Growth Indicator (2023/2024 Data) | Impact on a.k.a. Brands |

|---|---|---|---|

| Secondhand Apparel | Affordability, Sustainability | Global market valued at ~$177 billion (2023) | Direct competition for budget-conscious and eco-aware consumers. |

| Fast Fashion 'Dupes' | Trendiness, Low Price, Speed | Shein's rapid design cycles; Global market >$100 billion (2023) | Undercuts a.k.a. Brands on price and trend responsiveness. |

| Clothing Rental | Variety, Event-Specific Use, Sustainability | Growing consumer adoption for wardrobe rotation. | Reduces the need for outright purchase of new apparel. |

| Alternative Spending | Experiences, Technology, Wellness | Gen Z prioritizing travel, digital entertainment in 2024. | Diverts discretionary income away from fashion purchases. |

| DIY/Upcycling | Uniqueness, Cost Savings, Sustainability | 55% of Gen Z interested in sustainable fashion (2023 report). | Offers personalized, low-cost alternatives to new clothing. |

Entrants Threaten

The digital landscape significantly lowers the hurdles for new fashion brands compared to traditional brick-and-mortar retail. While establishing a physical store demands substantial investment in real estate and inventory, online fashion businesses can launch with considerably less capital. This accessibility allows digitally native brands to emerge and quickly capture market share, particularly by effectively utilizing social media platforms for marketing and building communities.

For example, in 2024, the global e-commerce fashion market continued its robust growth, with projections indicating it would reach over $1.3 trillion. This expansion is fueled by the ease with which new players can enter, often starting with lean operations and agile supply chains. Brands can leverage dropshipping or small-batch production models, minimizing initial inventory risk and allowing for rapid adaptation to emerging trends, thus intensifying competition for established players like a.k.a. Brands.

The direct-to-consumer (DTC) fashion market, while seemingly accessible, presents a formidable challenge for new entrants due to the sheer expense of building a recognizable brand. Companies must invest heavily in digital advertising, social media campaigns, and influencer collaborations to cut through the noise. For instance, in 2024, the average cost per acquisition (CPA) for online fashion brands continued to climb, with many reporting figures exceeding $50, pushing the total customer acquisition cost (CAC) significantly higher.

This high barrier to entry means that startups without substantial financial backing or highly innovative, low-cost marketing strategies will struggle to gain traction. Established brands with existing customer loyalty and larger marketing budgets can outspend newcomers, making it difficult for emerging players to acquire customers cost-effectively. The need for continuous content creation and engagement further inflates operational costs for any new fashion DTC brand aiming to compete in 2024.

a.k.a. Brands leverages its platform approach to create significant economies of scale. By centralizing functions like e-commerce technology, digital marketing, and supply chain logistics, the company allows its acquired brands to benefit from shared expertise and infrastructure. This pooled resource model enables a.k.a. Brands' portfolio companies to achieve cost efficiencies that would be difficult for independent, new entrants to replicate, as they would need to build these capabilities from scratch.

Access to Supply Chains and Manufacturing Expertise

Newcomers face substantial challenges in securing reliable and ethical supply chains, especially when sourcing quality and sustainable materials. For instance, in the apparel sector, establishing strong relationships with manufacturers that meet ethical standards can take years and significant upfront investment. a.k.a. Brands benefits from its established network and deep expertise in supply chain management, creating a barrier for potential new competitors.

The difficulty in accessing specialized manufacturing expertise also acts as a deterrent. Companies like a.k.a. Brands have cultivated relationships with factories that possess specific skills for producing their unique product lines. In 2024, the global apparel manufacturing market, valued at approximately $1.7 trillion, saw continued consolidation of skilled labor and specialized production facilities, making it harder for new entrants to find suitable partners.

- Supply Chain Hurdles: New entrants struggle to build reliable and ethical supply chains for quality and sustainable materials.

- a.k.a. Brands' Advantage: Existing networks and supply chain management expertise provide a competitive edge.

- Manufacturing Expertise Barrier: Accessing specialized manufacturing skills is difficult for new companies.

- Market Context (2024): The global apparel manufacturing market's size and consolidation of skilled labor make entry challenging.

Brand Loyalty and Influencer Networks

Established direct-to-consumer (DTC) brands, like those within a.k.a. Brands' portfolio, have successfully cultivated deeply loyal customer bases and robust influencer networks. This loyalty is a significant barrier to entry for newcomers. For instance, a 2024 report indicated that 70% of Gen Z consumers are more likely to purchase from brands that have authentic influencer endorsements, highlighting the power of these established relationships.

New entrants face the considerable challenge of investing heavily in building trust and authenticity to effectively compete. Gen Z, in particular, places a high premium on genuine connections and transparency. This makes market penetration particularly challenging, as replicating the established trust and reach of incumbent brands requires substantial time and resources. Data from 2024 shows that influencer marketing spend by brands targeting Gen Z increased by 25% year-over-year, underscoring the perceived necessity and cost of building these networks.

- Brand Loyalty as a Moat: Established DTC brands benefit from repeat purchases and higher customer lifetime value due to strong brand affinity.

- Influencer Network Strength: Existing brands leverage pre-existing relationships with influencers, offering immediate reach and credibility that new entrants must painstakingly build.

- Gen Z's Demand for Authenticity: New entrants must prioritize genuine engagement and transparent communication to resonate with younger demographics, a costly and time-consuming endeavor.

- High Marketing Investment: Competing with established brand recognition and influencer presence necessitates significant marketing expenditure for new players.

The threat of new entrants for a.k.a. Brands is moderate, primarily due to the significant capital required for brand building and customer acquisition in the competitive DTC fashion space. While digital platforms lower initial barriers, scaling requires substantial investment in marketing and influencer collaborations. For instance, in 2024, the average customer acquisition cost for online fashion brands continued to rise, often exceeding $50 per customer, making it difficult for underfunded startups to gain traction against established players with existing brand loyalty and larger marketing budgets.

New companies also face hurdles in establishing reliable and ethical supply chains, a process that can take years and significant investment, as seen in the global apparel manufacturing market valued at approximately $1.7 trillion in 2024. a.k.a. Brands’ established networks and supply chain expertise offer a distinct advantage. Furthermore, replicating the deep customer loyalty and influencer networks that incumbent brands have cultivated, especially among Gen Z who prioritize authenticity, demands considerable time and resources, with influencer marketing spend increasing by 25% year-over-year in 2024 for brands targeting this demographic.

| Factor | Impact on New Entrants | a.k.a. Brands' Position |

| Capital Requirements | High for brand building and marketing | Leverages economies of scale from portfolio |

| Supply Chain Access | Difficult to establish reliable, ethical chains | Benefits from established networks and expertise |

| Brand Loyalty & Influencer Networks | Challenging and costly to replicate | Possesses cultivated loyalty and influencer relationships |

| Market Data (2024) | CPA > $50; Influencer spend up 25% (Gen Z) | Existing customer base and marketing infrastructure |

Porter's Five Forces Analysis Data Sources

Our a.k.a. Brands Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, investor presentations, and SEC filings, alongside industry-specific market research reports and competitive intelligence platforms.