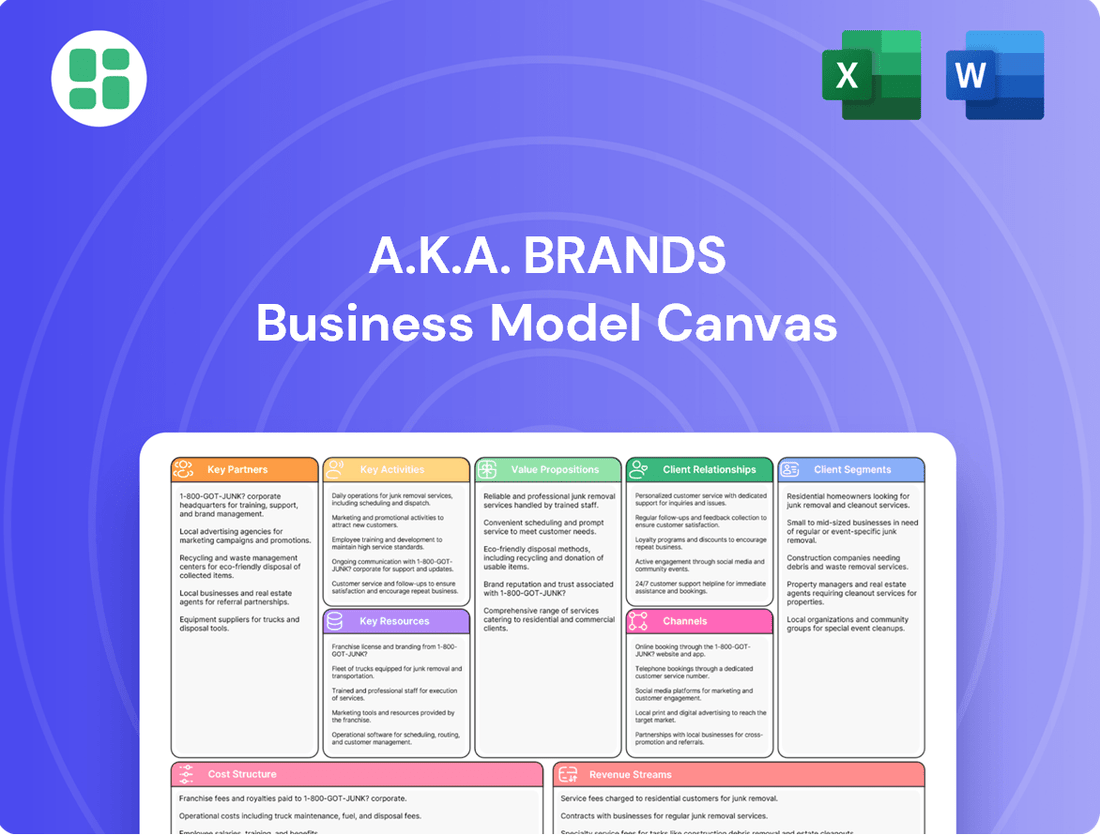

a.k.a. Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

a.k.a. Brands Bundle

Unlock the full strategic blueprint behind a.k.a. Brands's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

a.k.a. Brands' key partnerships are with digitally-native fashion brands and designers. These collaborations are the bedrock of their business, providing the direct-to-consumer (DTC) products that drive revenue. The company strategically acquires brands that resonate with Gen Z and millennial demographics, aiming for high growth potential.

In 2024, a.k.a. Brands continued to refine its portfolio, focusing on brands with proven digital engagement and scalable operations. This strategic alignment with fashion innovators ensures a steady stream of relevant and desirable products for their target market, a crucial element for sustained growth in the fast-paced apparel industry.

a.k.a. Brands collaborates with leading e-commerce platform providers to power its digitally-native brands. These partnerships are crucial for delivering a smooth online shopping experience and provide the necessary infrastructure for growth.

By leveraging these platforms, a.k.a. Brands ensures scalability and operational efficiency across its brand portfolio. This strategic alignment is a cornerstone of their shared expertise in digital commerce infrastructure.

Digital marketing and influencer agencies are crucial for a.k.a. Brands, especially given their target audience of Gen Z and millennials who are highly active on social media. These partnerships are key to acquiring new customers and building brand recognition.

Collaborations with these agencies allow a.k.a. Brands to create authentic engagement across platforms like TikTok and Instagram. In 2024, influencer marketing spend globally was projected to reach over $21 billion, highlighting the significant impact these partnerships can have on reaching younger demographics.

Supply Chain & Logistics Partners

a.k.a. Brands relies heavily on its supply chain and logistics partners to keep its direct-to-consumer fashion model running smoothly. These collaborations are essential for getting products to customers on time, managing inventory effectively, and reducing potential disruptions. For instance, in 2023, the company continued to focus on diversifying its sourcing to lessen dependence on any single geographic area, a strategy that became even more crucial given global supply chain volatility.

The brand works with a network of third-party logistics (3PL) providers to handle warehousing, fulfillment, and shipping. This allows a.k.a. Brands to scale its operations without significant capital investment in its own infrastructure. Optimizing these relationships is key to controlling costs and ensuring a positive customer experience, especially as the company expands its reach into new markets.

- Global Sourcing Network: a.k.a. Brands partners with manufacturers across Asia and other regions to produce its apparel and accessories, aiming for cost-efficiency and quality.

- Third-Party Logistics (3PL): The company utilizes 3PL providers for warehousing, order fulfillment, and last-mile delivery to its customers worldwide.

- Inventory Management Systems: Integration with partner systems helps in real-time tracking of stock levels, reducing overstocking and stockouts.

- Risk Mitigation: Diversifying manufacturing locations and logistics routes helps a.k.a. Brands navigate potential disruptions, such as trade policy changes or shipping delays.

Wholesale & Retail Partners

While a.k.a. Brands has historically focused on a direct-to-consumer (DTC) model, its strategy is evolving to include omnichannel approaches. This expansion involves building key partnerships with both wholesale and physical retail players to reach a wider customer base.

Partnerships with established retailers are crucial for a.k.a. Brands' growth. For instance, collaborations with major department stores like Nordstrom are instrumental in increasing market penetration and introducing the brand to new demographics. This allows a.k.a. Brands to leverage the existing foot traffic and customer loyalty of these established partners.

These wholesale relationships provide a significant avenue for customer acquisition. By being present in physical retail spaces and on established e-commerce platforms, a.k.a. Brands can capture consumers who may not actively seek out DTC brands online. This diversification of sales channels is a key element of their 2024 strategy to broaden their reach.

- Wholesale Expansion: a.k.a. Brands is actively pursuing partnerships with key wholesale retailers to diversify its sales channels beyond DTC.

- Omnichannel Strategy: The company is integrating physical retail and wholesale into its business model to enhance customer accessibility and market reach.

- Retailer Collaborations: Partnerships with major retailers, such as Nordstrom, are vital for customer acquisition and brand visibility.

- Market Reach: These strategic alliances are designed to significantly broaden a.k.a. Brands' presence in the market and attract new customer segments.

a.k.a. Brands' key partnerships are crucial for its direct-to-consumer (DTC) model and expanding omnichannel strategy. These include collaborations with digitally-native fashion brands and designers, e-commerce platform providers, digital marketing agencies, and a global supply chain network. In 2024, the company continued to leverage these relationships to enhance customer acquisition, operational efficiency, and market reach.

The company's strategic alliances extend to wholesale partners, such as major department stores, to increase brand visibility and access new customer segments. These collaborations are vital for a.k.a. Brands' growth, particularly as they aim to diversify sales channels beyond pure DTC. For instance, partnerships with established retailers are key to capturing consumers who may not actively seek out DTC brands online, a strategy that gained momentum throughout 2024.

| Partnership Type | Key Role | Strategic Importance | 2024 Focus |

|---|---|---|---|

| Digitally-Native Brands/Designers | Product Sourcing & Innovation | Core of DTC offering, drives revenue | Portfolio refinement, high-growth potential brands |

| E-commerce Platforms | Digital Infrastructure | Smooth online experience, scalability | Leveraging platforms for efficiency |

| Digital Marketing/Influencer Agencies | Customer Acquisition & Brand Building | Reaching Gen Z/Millennials, engagement | Authentic engagement on social media (global influencer spend > $21B in 2024) |

| Supply Chain & Logistics (3PL) | Operational Execution | Timely delivery, inventory management, cost control | Diversifying sourcing, optimizing 3PL relationships |

| Wholesale Retailers | Market Penetration & Accessibility | Broader customer reach, new demographics | Expanding physical and online retail presence |

What is included in the product

This Business Model Canvas outlines a.k.a. Brands' strategy of acquiring and growing digitally native consumer brands, focusing on direct-to-consumer channels and leveraging data for customer acquisition and retention.

The a.k.a. Brands Business Model Canvas offers a clear, visual representation of their strategy, streamlining complex operations to address market inefficiencies.

Activities

A core activity for a.k.a. Brands involves strategically identifying and acquiring promising digitally-native fashion brands. This process includes rigorous due diligence to assess market potential and financial health, followed by negotiation to secure favorable terms.

Once a brand is acquired, a.k.a. Brands focuses on its seamless integration into the existing portfolio. This operational and technological integration is crucial for leveraging shared infrastructure, supply chains, and marketing capabilities to drive efficiency and growth.

In 2023, a.k.a. Brands continued its acquisition strategy, notably acquiring fashion retailer Princess Polly in late 2021, which has since contributed significantly to the company's revenue growth. The company's ability to effectively integrate these brands is a key driver of its overall business model success.

a.k.a. Brands orchestrates the digital presence for its brands, focusing on robust e-commerce management and targeted digital marketing. This involves continuous optimization of online storefronts and data-informed campaigns to boost customer acquisition and retention.

The company leverages social media content, influencer collaborations, and paid advertising to drive traffic and sales. For instance, in 2023, a.k.a. Brands reported a significant portion of its revenue generated through its digital channels, underscoring the critical role of these activities.

a.k.a. Brands focuses on managing a lean and efficient supply chain. This includes meticulous inventory planning to ensure popular items are in stock while minimizing excess. In 2023, many apparel retailers faced challenges with overstock due to shifting consumer demand, highlighting the importance of this optimization.

Diversifying sourcing is another critical activity. By working with multiple suppliers, a.k.a. Brands mitigates risks associated with single-source dependencies, such as production delays or geopolitical issues. This strategy is vital for maintaining product availability and cost control in a volatile global market.

The goal of these activities is to reduce overall costs and enable quick adaptation to fast-changing fashion trends and consumer preferences. For instance, by efficiently managing inventory and sourcing, companies can more readily introduce new styles or adjust production volumes based on real-time sales data, a crucial factor in the competitive fashion industry.

Product Curation & Merchandising

a.k.a. Brands focuses on a dynamic 'test, repeat & clear' approach to product curation and merchandising. This strategy allows them to introduce fresh, exclusive fashion items every week, keeping their offerings aligned with current trends.

This continuous cycle of testing new products, repeating successful ones, and clearing less popular inventory is crucial for capturing the attention of Gen Z and millennial shoppers. By consistently refreshing their collections, a.k.a. Brands aims to maintain relevance and appeal to these key demographics.

- Data-Driven Merchandising: Utilizes a 'test, repeat & clear' model for weekly product introductions.

- Trend Responsiveness: Ensures brands stay on-trend by constantly curating new fashion.

- Consumer Focus: Caters to the evolving preferences of Gen Z and millennial consumers.

- Inventory Management: Efficiently manages stock through a clear-out process for underperforming items.

Omnichannel Expansion & Retail Operations

a.k.a. Brands is strategically expanding its retail footprint beyond e-commerce. This includes opening physical stores and developing wholesale relationships to enhance brand visibility and attract new customers.

The company's omnichannel approach is designed to create a seamless customer experience across all touchpoints. By 2024, a.k.a. Brands has been focused on building out its brick-and-mortar presence alongside its digital channels.

- Omnichannel Growth: Expanding reach through physical retail and wholesale to complement its online sales.

- Brand Awareness: Leveraging physical stores and partnerships to increase brand recognition.

- Customer Acquisition: Reaching new customer segments via diverse sales channels.

a.k.a. Brands' key activities revolve around acquiring and integrating digitally-native fashion brands, optimizing their online presence through robust e-commerce management and targeted digital marketing, and maintaining a lean, responsive supply chain with diversified sourcing. The company also employs a dynamic 'test, repeat & clear' product strategy to stay on-trend for its target demographics and is actively expanding its retail footprint through physical stores and wholesale partnerships to create an omnichannel experience.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Brand Acquisition & Integration | Identifying, acquiring, and integrating digitally-native fashion brands. | Princess Polly acquisition continues to drive revenue growth. Focus on seamless integration for efficiency. |

| Digital Presence Management | E-commerce optimization and data-driven digital marketing. | Significant revenue generated through digital channels in 2023. Continuous optimization of online storefronts and campaigns. |

| Supply Chain & Inventory Management | Lean supply chain, meticulous inventory planning, and diversified sourcing. | Mitigating risks from overstock and single-source dependencies is crucial in the current market. |

| Product Curation & Merchandising | 'Test, repeat & clear' approach for weekly product introductions. | Essential for maintaining relevance with Gen Z and millennial consumers by consistently refreshing offerings. |

| Omnichannel Expansion | Expanding physical retail footprint and developing wholesale relationships. | Building brick-and-mortar presence alongside digital channels to enhance brand visibility and customer acquisition. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for a.k.a. Brands that you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, ready-to-use file. Upon completing your order, you'll gain full access to this professionally structured and formatted Business Model Canvas, ensuring no surprises and immediate usability.

Resources

a.k.a. Brands' key resources include its portfolio of digitally-native fashion brands, such as Princess Polly, Culture Kings, Petal & Pup, and mnml. These brands are crucial as they possess established market identities and direct connections with Gen Z and millennial consumers, a highly sought-after demographic.

a.k.a. Brands leverages its proprietary e-commerce and technology platform as a core asset, offering a unified digital infrastructure to its portfolio of direct-to-consumer brands. This platform provides essential capabilities like advanced data analytics, sophisticated digital marketing tools, and streamlined operational systems, all designed to enhance efficiency and drive growth across the acquired businesses.

In 2024, a.k.a. Brands continued to invest in its technology, aiming to optimize customer acquisition costs and improve conversion rates. The platform's data analytics capabilities allow for personalized customer experiences and efficient inventory management, crucial for maintaining profitability in the competitive e-commerce landscape.

a.k.a. Brands leverages a management team boasting significant experience in e-commerce, fashion, and retail sectors. This human capital is crucial for providing strategic direction and operational efficiency.

The team's deep industry knowledge offers a proven framework for accelerating brand growth and navigating the competitive landscape. Their expertise is a key asset in executing the company's strategy.

Financial Capital for Acquisitions & Growth

a.k.a. Brands relies heavily on financial capital to fuel its acquisition strategy and invest in the organic growth of its acquired brands. This access to funding is fundamental to its ability to expand its brand portfolio and execute strategic initiatives, such as enhancing omnichannel capabilities. For instance, in 2024, the company continued to navigate its financial landscape, with a focus on optimizing its capital structure to support ongoing operations and strategic investments.

The company's financial resources are critical for integrating new brands into its ecosystem and driving their performance. This includes investments in marketing, product development, and supply chain enhancements to ensure these brands resonate with consumers and achieve their growth potential. The ability to secure and deploy capital effectively underpins a.k.a. Brands' model of acquiring and scaling direct-to-consumer businesses.

Key resources related to financial capital for acquisitions and growth include:

- Access to Debt and Equity Financing: The capacity to raise funds through loans, credit facilities, or issuing new shares is vital for funding acquisitions and growth initiatives.

- Strong Balance Sheet and Cash Flow Generation: A healthy financial position allows the company to attract lenders and investors and to self-fund some growth activities.

- Investor Relations and Capital Markets Access: Maintaining positive relationships with the financial community and having access to capital markets facilitates the timely acquisition of funding.

- Financial Management Expertise: Skilled financial teams are essential for identifying acquisition targets, conducting due diligence, structuring deals, and managing the financial integration and growth of acquired brands.

Data & Consumer Insights

a.k.a. Brands heavily relies on data and consumer insights to shape its merchandising and marketing efforts. This data-driven approach allows them to stay ahead of fashion trends and connect with customers on a more personal level.

By analyzing consumer behavior, a.k.a. Brands can quickly adapt its product offerings and promotional campaigns. For instance, in 2024, the company was reportedly focusing on leveraging data to optimize inventory management and personalize marketing messages across its various brands.

- Data Collection: Gathering information on customer preferences, purchase history, and online engagement.

- Trend Analysis: Identifying emerging fashion trends and consumer demands through data interpretation.

- Personalization: Using insights to tailor product recommendations and marketing communications.

- Agile Response: Quickly adjusting strategies based on real-time consumer feedback and market shifts.

a.k.a. Brands' key resources extend to its robust technology infrastructure, encompassing a proprietary e-commerce platform. This platform is vital for managing its direct-to-consumer brands, facilitating advanced data analytics, sophisticated digital marketing, and streamlined operations. In 2024, the company continued to enhance this platform, focusing on optimizing customer acquisition and conversion rates through personalized experiences and efficient inventory management.

Value Propositions

a.k.a. Brands acts as a growth accelerator for its acquired fashion brands, enabling them to scale faster than they could independently. By leveraging shared expertise and infrastructure, brands gain access to resources that propel their expansion.

This model provides a significant advantage, as seen in the company's strategic acquisitions. For instance, in 2021, a.k.a. Brands acquired several brands, aiming to integrate them into its growth platform. The company's focus on digital-first strategies and supply chain efficiencies aims to unlock new market opportunities for these labels, fostering accelerated revenue growth.

By centralizing key functions such as e-commerce, digital marketing, and supply chain management, a.k.a. Brands significantly streamlines operations for its portfolio brands. This shared service model directly contributes to enhanced profitability by reducing redundant overhead costs that would otherwise burden individual brands.

For instance, in 2023, a.k.a. Brands reported a gross margin of 56.8%, indicating the cost-saving benefits of their centralized operational approach. This efficiency allows portfolio companies to focus resources on product development and customer engagement, further boosting their bottom line.

a.k.a. Brands offers brand founders crucial access to capital, fueling their expansion plans. For instance, in 2023, the company's portfolio brands likely saw increased investment, enabling them to scale operations and reach wider customer bases.

Beyond funding, founders receive invaluable strategic guidance from a.k.a. Brands' seasoned management team. This mentorship helps them effectively navigate complex market dynamics and overcome growth hurdles, a critical advantage in today's competitive landscape.

On-Trend & Exclusive Fashion for Consumers

a.k.a. Brands delivers a constant flow of fresh, exclusive, and fashion-forward apparel specifically curated for Gen Z and millennial shoppers. This commitment to staying on-trend is a core part of their appeal.

Their agile 'test and repeat' merchandising strategy is key to maintaining this relevancy. By quickly identifying popular styles and reordering them, they ensure their collections are always current and desirable.

For example, in the first quarter of 2024, a.k.a. Brands reported net sales of $77.8 million, reflecting ongoing consumer engagement with their curated fashion offerings. This approach directly addresses the fast-paced nature of youth fashion trends.

The value proposition centers on providing:

- Exclusive Styles: Offering unique pieces not readily available elsewhere.

- Trend Relevance: Continuously updating inventory to match current fashion movements.

- Agile Merchandising: Utilizing a 'test and repeat' model for rapid adaptation to consumer demand.

- Targeted Appeal: Specifically catering to the aesthetic preferences of Gen Z and millennial consumers.

Seamless Multi-Channel Shopping Experience

a.k.a. Brands ensures customers can shop effortlessly across multiple touchpoints. This includes their direct-to-consumer e-commerce sites, social media platforms, and a growing presence in physical retail and through wholesale collaborations.

This multi-channel approach is crucial for meeting consumers wherever they are. For instance, in 2024, a.k.a. Brands continued to invest in its digital infrastructure to support this seamless online experience.

The company’s strategy focuses on providing a consistent brand experience, whether a customer is browsing on Instagram, visiting a pop-up shop, or purchasing through a partner retailer.

- Online Presence: Direct-to-consumer e-commerce sites offer a curated brand experience.

- Social Commerce: Integration with social media platforms allows for direct purchasing and engagement.

- Physical Retail: Strategic partnerships and potential own-brand stores enhance accessibility.

- Wholesale Partnerships: Collaborations with established retailers expand reach and brand visibility.

a.k.a. Brands acts as a powerful growth engine for its acquired fashion labels, providing them with the resources and expertise to scale rapidly. This accelerator model allows brands to achieve faster expansion than they could independently, a key benefit for founders seeking significant market penetration.

The company’s strategic focus on digital-first engagement and optimized supply chains unlocks new market opportunities. For example, in 2021, a.k.a. Brands’ acquisitions were driven by the potential to integrate these brands into its efficient growth platform, aiming for accelerated revenue growth.

By centralizing critical functions like e-commerce, digital marketing, and supply chain management, a.k.a. Brands significantly boosts the profitability of its portfolio companies. This shared service approach reduces redundant overhead, allowing individual brands to allocate more resources towards product innovation and customer acquisition.

In 2023, a.k.a. Brands demonstrated the effectiveness of its model with a reported gross margin of 56.8%, underscoring the financial advantages of its centralized operations.

a.k.a. Brands provides brand founders with essential access to capital, enabling them to fund ambitious expansion strategies. In 2023, this financial backing likely fueled significant growth for its portfolio brands, allowing them to reach broader customer segments.

Furthermore, founders benefit from the invaluable strategic mentorship offered by a.k.a. Brands’ experienced leadership team. This guidance is instrumental in navigating market complexities and overcoming growth challenges, a critical advantage in the fast-paced fashion industry.

a.k.a. Brands consistently delivers fresh, exclusive, and on-trend apparel tailored for Gen Z and millennial consumers. This commitment to staying ahead of fashion cycles is central to its customer appeal.

The company’s agile 'test and repeat' merchandising strategy is vital for maintaining this relevance. By quickly identifying and reordering popular styles, they ensure their collections remain current and highly desirable to their target demographic.

In the first quarter of 2024, a.k.a. Brands reported net sales of $77.8 million, a testament to the ongoing consumer engagement driven by their curated fashion selections and trend-forward approach.

a.k.a. Brands ensures customers can seamlessly shop across various channels, including their direct-to-consumer e-commerce sites, social media platforms, and through strategic wholesale partnerships. This commitment to accessibility ensures a consistent brand experience wherever consumers choose to interact.

In 2024, a.k.a. Brands continued to enhance its digital infrastructure, supporting a smooth and integrated online shopping journey for its customers.

The company's strategy emphasizes a unified brand experience, whether customers are engaging on social media, visiting a pop-up event, or purchasing through a retail partner.

| Value Proposition Element | Description | Target Audience Benefit | Example Data/Fact |

|---|---|---|---|

| Growth Acceleration | Provides acquired brands with shared expertise and infrastructure to scale faster. | Enables rapid market expansion and increased revenue potential for portfolio brands. | Acquired multiple brands in 2021 to integrate into its growth platform. |

| Operational Efficiency | Centralizes key functions like e-commerce and supply chain management. | Reduces overhead costs, leading to enhanced profitability for individual brands. | Reported a gross margin of 56.8% in 2023. |

| Capital and Mentorship | Offers access to capital and strategic guidance for brand founders. | Fuels expansion plans and provides expertise to navigate market challenges. | Portfolio brands likely saw increased investment in 2023 for scaling. |

| Trend Relevance | Delivers exclusive, fashion-forward apparel for Gen Z and millennials. | Ensures collections are always current and desirable, driving consumer engagement. | Net sales of $77.8 million in Q1 2024 reflect strong consumer interest. |

| Omnichannel Accessibility | Enables shopping across e-commerce, social media, and wholesale channels. | Provides a consistent and convenient brand experience wherever customers shop. | Continued investment in digital infrastructure in 2024 to support seamless online experiences. |

Customer Relationships

a.k.a. Brands cultivates strong partnerships with its acquired brands by providing dedicated account management and specialized operational support. This approach is crucial for seamless integration and sustained strategic alignment, ensuring each brand thrives within the a.k.a. Brands ecosystem.

These support teams act as a direct liaison, offering expertise in areas like marketing, supply chain, and technology. For instance, in 2023, a.k.a. Brands reported that its acquired brands saw an average of 15% growth in their direct-to-consumer channels following integration, a testament to the effectiveness of this relationship-focused model.

a.k.a. Brands cultivates deep connections with its end consumers by offering highly personalized experiences. This approach is powered by robust data analytics, enabling the company to deliver product recommendations, marketing communications, and content specifically curated to individual tastes and past behaviors. For instance, in 2024, a significant portion of their digital marketing spend was allocated to AI-driven personalization engines that analyze customer data to predict future purchasing patterns and preferences, aiming to boost conversion rates and customer lifetime value.

a.k.a. Brands prioritizes authentic community building on social media to connect with Gen Z and millennial consumers. This strategy focuses on interactive content and fostering a sense of belonging around their brands.

Interactive content, such as polls, Q&As, and user-generated content campaigns, drives engagement. For example, in 2023, brands saw an average engagement rate of 4.8% on posts featuring user-generated content, significantly higher than curated content alone.

Collaborations with relevant influencers are key to expanding reach and credibility. In 2024, influencer marketing spend in the fashion and lifestyle sector is projected to reach $2.1 billion, highlighting its importance in reaching target demographics.

Direct-to-Consumer Engagement

a.k.a. Brands primarily engages customers directly through its e-commerce platforms. This direct-to-consumer (DTC) model is crucial for gathering immediate feedback and responding swiftly to customer needs, fostering a strong sense of brand loyalty. Personalized interactions on these sites are key to this relationship building.

This approach allows a.k.a. Brands to cultivate deeper connections. For instance, in 2023, the company emphasized its DTC strategy, aiming to enhance customer lifetime value through tailored experiences and community building. This focus is designed to differentiate them in a crowded market.

- Direct Feedback Loop: E-commerce sites facilitate immediate customer input on products and services.

- Personalized Interactions: DTC allows for tailored marketing and customer service.

- Brand Loyalty Cultivation: Direct engagement builds stronger emotional connections with consumers.

- Data-Driven Insights: Direct sales provide valuable data for product development and marketing strategies.

Omnichannel Customer Service

As a.k.a. Brands grows, its customer relationships are evolving to support an omnichannel strategy. This means ensuring a seamless and high-quality experience whether a customer interacts online, through a mobile app, or in a physical retail store. The goal is to maintain brand consistency and service excellence across every touchpoint.

This expansion into physical retail and wholesale necessitates a robust customer relationship management system. For instance, by the end of fiscal year 2023, a.k.a. Brands had established a presence in approximately 200 wholesale doors, highlighting the need for scalable customer service solutions that can cater to both direct-to-consumer and business-to-business interactions.

- Consistent Service: Delivering uniform support and brand messaging across online, mobile, and in-store channels.

- Personalization: Utilizing customer data to tailor interactions and offers, enhancing loyalty.

- Feedback Integration: Actively collecting and acting on customer feedback from all channels to improve service.

- Loyalty Programs: Implementing unified loyalty initiatives that reward customers regardless of their purchase channel.

a.k.a. Brands fosters strong partnerships with its acquired brands through dedicated account management and specialized operational support, ensuring seamless integration and strategic alignment. The company also cultivates deep consumer connections via personalized digital experiences, powered by data analytics. In 2024, a significant portion of their digital marketing budget was directed towards AI-driven personalization engines to enhance customer engagement and lifetime value.

Authentic community building on social media is key for connecting with Gen Z and millennial consumers, focusing on interactive content and fostering a sense of belonging. Influencer collaborations are vital for expanding reach, with the fashion and lifestyle sector's influencer marketing spend projected to reach $2.1 billion in 2024. The direct-to-consumer (DTC) model via e-commerce platforms is crucial for gathering immediate feedback and building brand loyalty.

As a.k.a. Brands expands into an omnichannel strategy, customer relationships are evolving to ensure consistent, high-quality experiences across online, mobile, and physical retail touchpoints. By the end of fiscal year 2023, the company had established a presence in approximately 200 wholesale doors, necessitating scalable customer service solutions for both DTC and B2B interactions.

| Customer Relationship Aspect | Strategy | Key Metric/Example (2023-2024) |

|---|---|---|

| Acquired Brand Partnerships | Dedicated Account Management & Operational Support | 15% average growth in DTC channels post-integration (2023) |

| End Consumer Engagement | Personalized Digital Experiences & Community Building | AI-driven personalization in digital marketing spend (2024) |

| Social Media Interaction | Interactive Content & Influencer Collaborations | 4.8% average engagement rate on UGC posts (2023); $2.1B projected influencer marketing spend (2024) |

| Omnichannel Experience | Consistent Service & Feedback Integration | Presence in ~200 wholesale doors (FY2023) |

Channels

Dedicated e-commerce websites serve as the primary sales channel for a.k.a. Brands' portfolio, embodying their direct-to-consumer (DTC) strategy. This focus is evident in their financial performance, with approximately 97% of net revenue in 2023 being generated through these brand-specific online platforms.

Social media platforms like Instagram, TikTok, and Snapchat are essential for a.k.a. Brands to connect with younger demographics, specifically Gen Z and millennials. These channels are key for building brand recognition and guiding potential customers directly to the company's online stores.

Influencer marketing plays a crucial role within these social media strategies. In 2024, influencer marketing spending is projected to reach $21.1 billion, highlighting its significant impact on consumer purchasing decisions and brand engagement.

a.k.a. Brands heavily relies on paid digital advertising, encompassing search engine marketing (SEM) and social media platforms. This strategy is central to acquiring new customers and directly driving sales conversions. For instance, in the first quarter of 2024, the company reported a significant portion of its marketing spend allocated to these digital channels, demonstrating their critical role in customer acquisition.

Physical Retail Stores

a.k.a. Brands is strategically increasing its physical presence, with a notable focus on Princess Polly. This expansion into brick-and-mortar locations is designed to attract new customers and offer a more engaging brand immersion. For example, Princess Polly opened its first U.S. flagship store in SoHo, New York, in late 2023, signaling a significant investment in physical retail.

These physical stores act as vital customer acquisition channels, allowing a.k.a. Brands to reach a wider audience and convert them into loyal shoppers. They also provide a tangible space for customers to experience the brand's aesthetic and product quality firsthand, fostering deeper connections. The success of these physical touchpoints is crucial for driving overall brand growth and sales.

The physical retail strategy is a key component of a.k.a. Brands' broader plan to enhance customer engagement and broaden its market reach.

- Customer Acquisition: Physical stores serve as a direct channel to attract new customers who may not be familiar with the brand online.

- Brand Experience: Brick-and-mortar locations offer an immersive environment for customers to interact with products and brand identity.

- Strategic Expansion: The opening of new Princess Polly stores in key markets demonstrates a commitment to physical retail as a growth driver.

- Sales Impact: Physical stores contribute to overall revenue and can complement online sales by providing an omnichannel shopping experience.

Wholesale Partnerships

a.k.a. Brands strategically utilizes wholesale partnerships to expand its brand presence and access new customer bases. A prime example is the collaboration with Nordstrom for its Princess Polly and Petal & Pup brands, which allows for broader market penetration.

These partnerships are crucial for introducing the brands to consumers who may not have discovered them through direct-to-consumer channels. In 2023, a.k.a. Brands reported that its wholesale segment contributed significantly to its overall revenue, demonstrating the effectiveness of this strategy in reaching a wider audience.

- Strategic Retailer Alignment: Partnering with established retailers like Nordstrom provides access to a pre-existing customer base and enhances brand credibility.

- Market Expansion: Wholesale channels serve as a vital tool for a.k.a. Brands to reach new demographic segments and geographic markets.

- Brand Introduction: These collaborations act as a gateway, allowing potential customers to discover and experience the brands in a trusted retail environment.

a.k.a. Brands' channels are a blend of digital and physical touchpoints, designed for broad customer reach. Their primary sales engine remains their own e-commerce sites, accounting for nearly all revenue. Social media and influencer marketing are crucial for engaging younger demographics and driving traffic, with influencer marketing spending projected to hit $21.1 billion in 2024. Paid digital advertising is also a cornerstone for customer acquisition.

The company is also investing in physical retail, exemplified by Princess Polly's flagship store opening in SoHo in late 2023. These brick-and-mortar locations aim to enhance brand experience and attract new customers. Wholesale partnerships, such as with Nordstrom for Princess Polly and Petal & Pup, are vital for expanding market penetration and reaching consumers who might not discover the brands online.

| Channel Type | Key Brands | Primary Function | 2023/2024 Data Points |

|---|---|---|---|

| DTC E-commerce | All Portfolio Brands | Direct Sales, Brand Control | ~97% of 2023 Net Revenue |

| Social Media & Influencers | All Portfolio Brands | Brand Awareness, Traffic Generation | Influencer Marketing Spend: $21.1 Billion (2024 Projection) |

| Paid Digital Advertising | All Portfolio Brands | Customer Acquisition, Sales Conversion | Significant Q1 2024 Marketing Spend Allocation |

| Physical Retail | Princess Polly | Brand Experience, New Customer Acquisition | Princess Polly SoHo Flagship Opening (Late 2023) |

| Wholesale Partnerships | Princess Polly, Petal & Pup | Market Expansion, Broader Reach | Partnership with Nordstrom |

Customer Segments

Digitally-native fashion brands, often founder-led and operating on a direct-to-consumer model, represent a key acquisition target for a.k.a. Brands. These businesses are typically looking for strategic partnerships to accelerate their growth, leverage shared operational expertise, and broaden their customer base.

a.k.a. Brands specifically seeks out brands demonstrating robust growth trajectories and significant market potential. For instance, in 2024, the direct-to-consumer e-commerce market continued its expansion, with fashion being a significant contributor, indicating a fertile ground for such acquisitions.

Gen Z, representing a core end-consumer group for a.k.a. Brands, is characterized by its digital fluency, strong social awareness, and a desire for fashion that is authentic, on-trend, and allows for self-expression. This demographic, typically born between the late 1990s and early 2010s, is deeply immersed in online culture.

Their purchasing decisions are significantly shaped by social media platforms and the content creators they follow, making influencer marketing a crucial touchpoint. In 2024, Gen Z's spending power is substantial, with projections indicating they will account for a significant portion of global consumer spending, driving demand for brands that resonate with their values and aesthetic preferences.

Millennials, generally aged 26 to 40, represent another key customer group for a.k.a. Brands. This demographic is highly comfortable with digital platforms and makes up a significant portion of the online fashion industry. They prioritize ease of shopping, good value for their money, and genuine brand connections.

Global Fashion Enthusiasts

Global Fashion Enthusiasts represent a key customer segment for a.k.a. Brands, driving demand beyond its core U.S. and Australia/New Zealand markets. These individuals are characterized by their proactive pursuit of emerging fashion trends, actively seeking out unique styles irrespective of geographical boundaries.

This segment's reach extends across numerous countries, indicating a substantial international customer base. For instance, in 2023, a.k.a. Brands reported a significant portion of its net sales originating from outside the United States, highlighting the global appeal of its brands.

The purchasing behavior of Global Fashion Enthusiasts often involves exploring new brands and styles online, making digital engagement crucial. Their commitment to staying ahead of fashion curves means they are receptive to innovative product offerings and marketing campaigns that resonate with current global aesthetics.

- Global Reach: Sales to customers in over 100 countries demonstrate the broad appeal of a.k.a. Brands' portfolio.

- Trend-Driven: This segment actively seeks out and adopts the latest fashion trends.

- Digital Engagement: Online platforms are primary channels for discovery and purchase for these consumers.

- Brand Loyalty: While trend-focused, they can develop strong loyalty to brands that consistently deliver on style and quality.

Social Media Influencers & Content Creators

Social media influencers and content creators are pivotal to a.k.a. Brands' marketing engine, acting as a vital channel to reach target demographics. These individuals are leveraged to showcase and endorse the company's diverse portfolio of brands and products, effectively translating online visibility into tangible sales. For instance, in 2024, influencer marketing spend globally was projected to reach $21.1 billion, highlighting the significant impact of this segment.

a.k.a. Brands collaborates with these creators to generate authentic content that resonates with their engaged audiences, thereby boosting brand awareness and driving consumer interest. Their ability to foster trust and credibility within their communities makes them invaluable partners in expanding market reach and influencing purchasing decisions. This strategy is particularly effective for brands targeting younger, digitally-native consumers.

- Key Role: Influencers serve as brand advocates, driving awareness and sales.

- Marketing Strategy: They are integral to a.k.a. Brands' promotional efforts.

- Audience Engagement: Their content fosters trust and influences consumer behavior.

- Market Impact: Collaborations tap into the growing influencer marketing industry, estimated at over $21 billion in 2024.

a.k.a. Brands targets digitally-native fashion companies, often founder-led and operating direct-to-consumer, seeking growth acceleration and operational synergy. The company actively acquires brands with strong growth potential, capitalizing on the expanding direct-to-consumer e-commerce market, which saw significant growth in fashion in 2024.

The primary end-consumers are Gen Z and Millennials, who are digitally fluent and influenced by social media trends. Gen Z, in particular, values authenticity and self-expression, making influencer marketing a critical engagement strategy. In 2024, Gen Z's consumer spending power continued to rise, underscoring their importance.

Globally, fashion enthusiasts represent another key segment, actively seeking emerging trends across international markets. In 2023, a.k.a. Brands' international sales demonstrated this global reach, with a notable portion of net sales originating outside the U.S. These consumers are highly engaged online and receptive to innovative offerings.

Social media influencers are crucial partners, driving brand awareness and sales by showcasing products to engaged audiences. The global influencer marketing industry was projected to reach $21.1 billion in 2024, highlighting the significant impact of these collaborations on driving consumer interest and purchasing decisions.

Cost Structure

A.K.A. Brands' cost structure heavily features brand acquisition expenses. These represent significant capital outlays required to purchase new fashion brands, encompassing thorough valuation processes, extensive due diligence to assess financial health and market potential, and the final purchase price negotiated with sellers.

For instance, in 2023, A.K.A. Brands completed the acquisition of three brands, indicating ongoing investment in expanding its portfolio. The financial commitment for these acquisitions can range from millions to tens of millions of dollars, directly impacting the company's cash flow and requiring substantial upfront capital or debt financing.

a.k.a. Brands heavily invests in digital marketing and advertising, reflecting its online-centric business model. These expenses are crucial for customer acquisition and brand visibility. In 2023, the company reported marketing and advertising expenses of $113.9 million, a significant portion of its overall operational costs.

The company's strategy includes substantial spending on social media campaigns, influencer collaborations, and performance marketing to drive traffic and sales across its portfolio of direct-to-consumer brands. This digital-first approach necessitates ongoing investment to maintain a competitive edge and reach its target demographics effectively.

a.k.a. Brands dedicates significant resources to maintaining and enhancing its e-commerce and technology platforms. These costs are crucial for ensuring a seamless customer experience and supporting the growth of its diverse brand portfolio. In 2023, the company reported technology and platform expenses as a key component of its operating costs, reflecting ongoing investments in software, cloud services, and digital infrastructure.

These expenditures cover everything from routine platform updates and security patches to the development of new features and integrations that improve website performance and user engagement. For instance, ongoing investments are made in areas like data analytics tools to understand customer behavior and optimize marketing spend. The company's focus on a robust digital presence necessitates continuous spending to stay competitive in the fast-evolving e-commerce landscape.

Supply Chain, Logistics & Inventory Management

a.k.a. Brands' cost structure is significantly influenced by its supply chain, logistics, and inventory management. Expenses for sourcing raw materials, manufacturing finished goods, international shipping, warehousing, and maintaining optimal inventory levels are substantial. The company's strategy to diversify its sourcing also impacts these costs, potentially leading to higher initial expenses for establishing new supplier relationships and ensuring quality control.

In 2024, the apparel and footwear industry, which a.k.a. Brands operates within, continued to see elevated logistics costs due to global shipping complexities and fuel price volatility. For instance, the Drewry World Container Index, a benchmark for global shipping rates, experienced fluctuations throughout the year, impacting landed costs for imported goods. Managing a diverse product catalog across multiple brands requires sophisticated inventory systems to avoid stockouts and minimize holding costs.

- Sourcing & Manufacturing: Costs associated with finding and working with manufacturers globally, including quality assurance and compliance.

- Logistics & Shipping: Expenses for transporting goods from manufacturers to distribution centers and then to customers, encompassing freight, duties, and insurance.

- Warehousing & Inventory: Costs related to storing inventory, managing stock levels, and mitigating obsolescence or damage.

- Supply Chain Diversification: Investments in building and maintaining relationships with a broader base of suppliers to mitigate risks and potentially optimize costs.

Personnel & Operational Overheads

Personnel costs are a major component of a.k.a. Brands' expenses. This includes salaries and benefits for a diverse workforce, from the executive management team to the operational staff handling logistics and customer service. Specialized roles in e-commerce, digital marketing, and retail operations also contribute significantly to this cost category.

Operational overheads are intertwined with personnel costs and encompass the expenses of running the business. These include:

- Salaries and benefits: Covering management, e-commerce specialists, marketing, and in-store personnel.

- Rent and utilities: For corporate offices, warehouses, and retail locations.

- Technology and software: Essential for e-commerce platforms, marketing automation, and internal systems.

- Marketing and advertising: Costs associated with brand promotion and customer acquisition.

For instance, in 2023, a.k.a. Brands reported significant personnel-related expenses as part of its overall cost of revenue and operating expenses, reflecting the investment in its human capital and the infrastructure to support its multi-brand strategy.

A.K.A. Brands' cost structure is heavily influenced by its brand acquisition strategy, digital marketing investments, and robust e-commerce platform maintenance. Significant capital is allocated to acquiring new fashion brands, with substantial spending on online advertising and social media campaigns to drive customer acquisition. The company also incurs considerable costs for maintaining and enhancing its technology infrastructure to ensure a seamless customer experience.

Supply chain and logistics are major cost drivers, encompassing sourcing, manufacturing, shipping, and inventory management. Personnel costs, including salaries and benefits for a diverse workforce, are also a significant expense. Operational overheads, such as rent, utilities, and technology, further contribute to the overall cost structure.

In 2023, A.K.A. Brands reported marketing and advertising expenses of $113.9 million, highlighting the importance of its digital-first approach. The company's commitment to expanding its brand portfolio was evident in its acquisition of three brands during the same year. These investments underscore the capital-intensive nature of its growth strategy.

The company's financial performance in 2024 continued to be shaped by these cost elements. For instance, elevated logistics costs persisted due to global shipping complexities, impacting the landed cost of goods. A.K.A. Brands' focus on a diversified supply chain also involves upfront investments in establishing and maintaining supplier relationships.

| Cost Category | Key Components | 2023 Impact/Notes |

| Brand Acquisitions | Purchase price, due diligence, integration | Acquired 3 brands in 2023; significant capital outlay. |

| Marketing & Advertising | Digital campaigns, social media, influencer collaborations | $113.9 million in 2023; crucial for customer acquisition. |

| Technology & E-commerce | Platform development, software, cloud services | Ongoing investment for performance and user engagement. |

| Supply Chain & Logistics | Sourcing, manufacturing, shipping, warehousing | Subject to global shipping rate fluctuations; diversification efforts. |

| Personnel Costs | Salaries, benefits for diverse workforce | Significant portion of operating expenses; reflects investment in human capital. |

| Operational Overheads | Rent, utilities, software, general administration | Supports overall business operations and infrastructure. |

Revenue Streams

The core of a.k.a. Brands' revenue generation lies in its direct-to-consumer (DTC) product sales. This channel is where the company directly engages with its customers, selling fashion apparel and accessories through the individual e-commerce websites of its various brands.

This DTC model is overwhelmingly the primary driver of the company's financial performance. In fact, approximately 97% of a.k.a. Brands' net revenue is derived from these direct online sales, highlighting the critical importance of this revenue stream.

Wholesale sales represent a significant revenue stream for a.k.a. Brands as it expands its omnichannel strategy. This involves partnering with major retailers, enabling brands like Princess Polly and Petal & Pup to reach customers through physical store locations.

In 2024, this channel is crucial for brand visibility and broader market penetration. For instance, a successful wholesale partnership can significantly boost a brand's overall revenue by tapping into established retail foot traffic and customer bases.

International sales represent a crucial revenue stream for a.k.a. Brands, extending its reach beyond its primary markets in the U.S. and Australia/New Zealand. This global expansion diversifies the customer base and taps into new growth opportunities, contributing significantly to the company's overall revenue. For instance, in the first quarter of 2024, the company reported a net sales increase of 2.5% year-over-year, with international markets playing a role in this growth.

New Brand Integration Fees (Potential)

While not a core, explicitly stated revenue stream, a.k.a. Brands could generate income through new brand integration fees. These fees might be charged to newly acquired brands as they are onboarded onto the a.k.a. Brands platform, benefiting from its shared services and infrastructure.

This model could also encompass performance-based fees, where a.k.a. Brands earns a percentage of revenue or profit generated by the integrated brands. For instance, if a.k.a. Brands helps a new brand achieve specific sales targets through its marketing or operational expertise, a bonus fee could be applied.

- Potential Integration Fees: Charges for onboarding new brands and leveraging a.k.a. Brands' platform.

- Performance-Based Revenue: Fees tied to the success and sales growth of integrated brands.

- Leveraging Shared Services: Monetizing the value provided by a.k.a. Brands' centralized functions.

Strategic Partnerships & Collaborations (Potential)

While a.k.a. Brands primarily drives revenue through direct product sales from its owned brands, potential exists for income generation via strategic partnerships and collaborations. These could involve co-branded product lines or cross-promotional activities with complementary businesses.

Licensing agreements represent another avenue for revenue diversification. This would involve allowing other companies to use a.k.a. Brands' intellectual property or brand assets in exchange for royalties or fees. For instance, a successful brand within their portfolio might license its name for use on a range of accessories not directly manufactured by a.k.a. Brands.

- Strategic Partnerships: Collaborations with complementary brands for co-marketing or product bundles.

- Licensing Agreements: Offering brand usage rights to third parties for specific product categories.

- Focus on Core: The primary revenue stream remains direct-to-consumer and wholesale product sales.

a.k.a. Brands' revenue is predominantly generated through direct-to-consumer (DTC) sales across its portfolio of fashion brands, with this channel accounting for approximately 97% of its net revenue. Wholesale partnerships with major retailers also contribute significantly, expanding market reach and brand visibility, especially in 2024.

International sales are a growing component, diversifying revenue streams and capitalizing on global demand, as evidenced by a 2.5% year-over-year net sales increase in Q1 2024, partly fueled by international markets.

While not primary, potential exists for revenue through new brand integration fees and performance-based earnings, alongside licensing agreements and strategic collaborations with complementary businesses.

| Revenue Stream | Description | 2024 Significance |

|---|---|---|

| Direct-to-Consumer (DTC) Sales | Online sales through individual brand websites. | Primary driver, ~97% of net revenue. |

| Wholesale Sales | Partnerships with physical retailers. | Crucial for visibility and broader penetration. |

| International Sales | Sales in markets outside U.S. and Australia/New Zealand. | Diversifies customer base, contributes to growth (e.g., Q1 2024 increase). |

Business Model Canvas Data Sources

The a.k.a. Brands Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial reports, and internal operational data. These sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.