Ajinomoto SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ajinomoto Bundle

Ajinomoto, a global leader in food and amino science, boasts significant strengths in its established brand recognition and diverse product portfolio, particularly in umami seasonings and health-focused ingredients. However, the company faces challenges from intense market competition and evolving consumer preferences towards natural and organic products, alongside potential regulatory hurdles in different regions.

Want to fully grasp Ajinomoto's strategic advantages and navigate its potential pitfalls? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, investment decisions, and market research.

Strengths

Ajinomoto's core strength lies in its unparalleled expertise in AminoScience, cultivated over more than a century. This deep understanding of amino acids allows the company to innovate across a wide array of industries, from food and wellness to advanced materials. For instance, their AminoScience is crucial for products like AJI-NO-MOTO®, a staple for enhancing food flavor, and high-tech materials such as Ajinomoto Build-up Film (ABF), which is vital for semiconductor manufacturing. This foundational scientific prowess fuels a consistent pipeline of unique and high-value products, setting them apart from competitors.

Ajinomoto's strength lies in its impressively diversified business portfolio, spanning consumer food products, healthcare, and specialty chemicals. This broad operational base significantly mitigates risks by preventing over-reliance on any single market segment, ensuring stability even when one area faces challenges. For instance, while the food segment provides a consistent revenue stream, the company's strategic investments in healthcare and ICT are poised to be significant growth engines, offering a balanced approach to market dynamics.

Ajinomoto showcased robust financial performance in Fiscal Year 2024, which concluded on March 31, 2025. The company achieved record-breaking sales and business profit, marking a significant milestone since the adoption of International Financial Reporting Standards in FY2016. This strong showing reflects effective operational strategies and sustained consumer demand.

Looking ahead, Ajinomoto has projected continued growth in both revenue and profit for Fiscal Year 2025. This forward-looking outlook reinforces the company's trajectory of consistent performance and its ability to capitalize on market opportunities.

Robust Global Presence and Market Share

Ajinomoto boasts an impressive global reach, operating in over 35 countries. This extensive international footprint underpins its stability and market influence.

The company commands significant market shares in crucial sectors. For instance, it holds dominant positions in MSG and specific seasonings within Thailand, demonstrating localized strength.

Ajinomoto's leadership extends to highly specialized markets, evidenced by its overwhelming global market share in Ajinomoto Build-up Film (ABF), a vital semiconductor insulating material. This diversification highlights its technological prowess and broad market penetration.

- Global Operations: Active in over 35 countries.

- Key Market Dominance: Leading positions in MSG and seasonings in Thailand.

- Specialty Market Leadership: Overwhelming global share in ABF semiconductor insulating material.

Commitment to Sustainability and ESG Initiatives

Ajinomoto's dedication to sustainability and Environmental, Social, and Governance (ESG) initiatives is a significant strength. The company has set ambitious targets, aiming for a 50% reduction in environmental impact by 2030 and achieving net-zero emissions by 2050.

These commitments are backed by concrete actions through their 'Sustainable Food System' program. This program addresses key areas such as:

- Sustainable Raw Material Procurement: Ensuring responsible sourcing practices.

- Carbon Neutrality: Implementing strategies to reduce greenhouse gas emissions.

- Plastic Reduction: Minimizing plastic waste across operations and packaging.

- Food Waste Reduction: Developing solutions to combat food loss and waste.

This proactive approach not only bolsters Ajinomoto's brand reputation but also resonates strongly with the increasing number of consumers and investors who prioritize environmentally and socially responsible businesses. For instance, in 2023, Ajinomoto reported a 12.5% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating tangible progress towards their net-zero goals.

Ajinomoto's core strength is its deep-rooted AminoScience expertise, enabling innovation across diverse sectors like food, wellness, and advanced materials, exemplified by products ranging from flavor enhancers to semiconductor components.

Its diversified business portfolio, encompassing food, healthcare, and specialty chemicals, provides resilience against market fluctuations and positions it for growth in multiple segments.

Financially, Ajinomoto demonstrated impressive performance in FY2024, achieving record sales and business profit, and projects continued growth for FY2025, underscoring its operational effectiveness and market demand.

The company's significant global presence, operating in over 35 countries, and its leadership in key markets like MSG in Thailand and ABF semiconductor material, further solidify its market influence and technological standing.

| Metric | FY2024 (Ended Mar 31, 2025) | FY2025 Projection |

|---|---|---|

| Sales | Record High | Continued Growth Expected |

| Business Profit | Record High | Continued Growth Expected |

| Global Operations | 35+ Countries | Expanding Reach |

| ESG Commitment | 12.5% GHG Reduction (Scope 1 & 2 vs 2019) | Targeting 50% Environmental Impact Reduction by 2030 |

What is included in the product

Delivers a strategic overview of Ajinomoto’s internal and external business factors, highlighting its established brand, product diversification, and global presence alongside challenges in market competition and evolving consumer preferences.

Offers a clear framework to identify and address Ajinomoto's competitive challenges and leverage its market strengths.

Weaknesses

Ajinomoto's profitability faces a significant hurdle due to the unpredictable nature of raw material and fuel costs. For instance, the company's Japanese frozen foods and coffee segments have directly felt the pressure of these price swings, impacting their bottom line.

Despite ongoing initiatives to offset these rising expenses, Ajinomoto's dependence on agricultural commodities and global energy markets presents a persistent vulnerability. This dynamic requires constant strategic recalibration in both pricing strategies and sourcing approaches to mitigate financial impacts.

Ajinomoto's strategic push into pharmaceuticals and healthcare, a sector with significant growth potential, faces a notable hurdle: the protracted development cycle. Bringing a new drug or medical product from initial research to market approval can take over a decade, often exceeding 10-15 years.

This extended timeline means substantial capital is locked up for extended periods, delaying the realization of profits. For instance, the average cost to develop a new drug was estimated to be around $2.6 billion as of recent analyses, highlighting the financial commitment involved.

Consequently, Ajinomoto’s ability to quickly adapt to evolving market demands within this dynamic sector is constrained by these lengthy development phases, impacting the speed at which they can capitalize on emerging opportunities.

Ajinomoto faces a significant challenge from intense competition within the food and flavor enhancer sectors. Numerous global and regional companies actively compete for market share, creating a dynamic and often aggressive marketplace.

This fierce rivalry directly impacts pricing strategies and profit margins, forcing Ajinomoto to constantly innovate. For instance, the global seasonings and spices market, a key area for Ajinomoto, was valued at approximately $50 billion in 2023 and is projected to grow, intensifying the competitive landscape.

Maintaining a competitive edge necessitates substantial and ongoing investment in research and development (R&D) and marketing efforts. These investments are crucial for developing new products and effectively communicating their value proposition to consumers in a crowded market.

Profit Margin Pressure in Domestic Food Business

Ajinomoto's domestic food business, a cornerstone of its operations, is experiencing significant profit margin pressure. This is primarily due to increased strategic investments aimed at maintaining market share and the persistent challenge of rising raw material costs, exacerbated by a weaker yen. For instance, the company has been investing in promotions and new product development to counter competitive pressures in key categories like seasonings and processed foods.

The impact of these pressures is evident in the company's financial reporting. While specific figures for the domestic food segment's profit margin decline aren't always broken out individually, the overall trend reflects these headwinds. For example, in fiscal year 2023, Ajinomoto noted that higher selling, general, and administrative expenses, including marketing and R&D, contributed to a more challenging operating environment in Japan.

- Declining Margins: The domestic food products segment, including seasonings, processed foods, and frozen foods, is facing a squeeze on its profit margins.

- Cost Pressures: Rising raw material costs and the impact of a weak yen are key drivers of this margin erosion.

- Strategic Investments: Increased spending on marketing, R&D, and promotions to defend market share in the competitive Japanese market is also a contributing factor.

- Balancing Growth: Effectively managing these domestic challenges is critical for Ajinomoto to achieve sustainable and balanced overall growth.

Need for Enhanced Productivity and Streamlined Processes

Ajinomoto's internal assessments highlight a critical need to boost productivity and streamline existing processes. While the company is cultivating a proactive approach to challenges, further optimization of operational workflows is essential to achieve its ambitious growth objectives and the targets outlined in its 2030 Roadmap.

The company recognizes that enhancing efficiency across all levels is paramount. This includes a thorough review of company-wide approval processes, which can sometimes create bottlenecks. For instance, in 2023, Ajinomoto reported a 3.5% increase in operating income, but further gains could be unlocked by reducing internal lead times.

- Operational Efficiency: Internal reviews point to opportunities for improving overall productivity.

- Process Streamlining: A focus on refining company-wide approval and operational workflows is necessary.

- Growth Support: Enhanced efficiency is crucial for meeting the ambitious targets of the 2030 Roadmap.

- Competitive Edge: Optimizing processes will help Ajinomoto maintain its competitive position in a dynamic market.

Ajinomoto's profitability is vulnerable to fluctuations in raw material and fuel costs, as seen in its Japanese frozen foods and coffee segments. This dependency on agricultural commodities and global energy markets necessitates constant strategic adjustments to pricing and sourcing to mitigate financial impacts.

The company's expansion into pharmaceuticals faces a significant hurdle due to the long development cycles, which can exceed a decade and tie up substantial capital, delaying profit realization. This extended timeline limits Ajinomoto's agility in responding to market shifts in this fast-paced sector.

Intense competition in the food and flavor enhancer markets, valued at approximately $50 billion in 2023 for seasonings and spices alone, pressures Ajinomoto's pricing and profit margins, requiring continuous investment in R&D and marketing.

Ajinomoto's domestic food business is experiencing margin pressure from increased strategic investments to maintain market share and rising raw material costs, compounded by a weaker yen. For instance, higher selling, general, and administrative expenses, including marketing, impacted its operating environment in fiscal year 2023.

Internal assessments highlight a need to boost productivity and streamline processes, including company-wide approval workflows, to support ambitious growth objectives and the 2030 Roadmap targets. Enhancing efficiency is crucial for maintaining a competitive edge.

Preview Before You Purchase

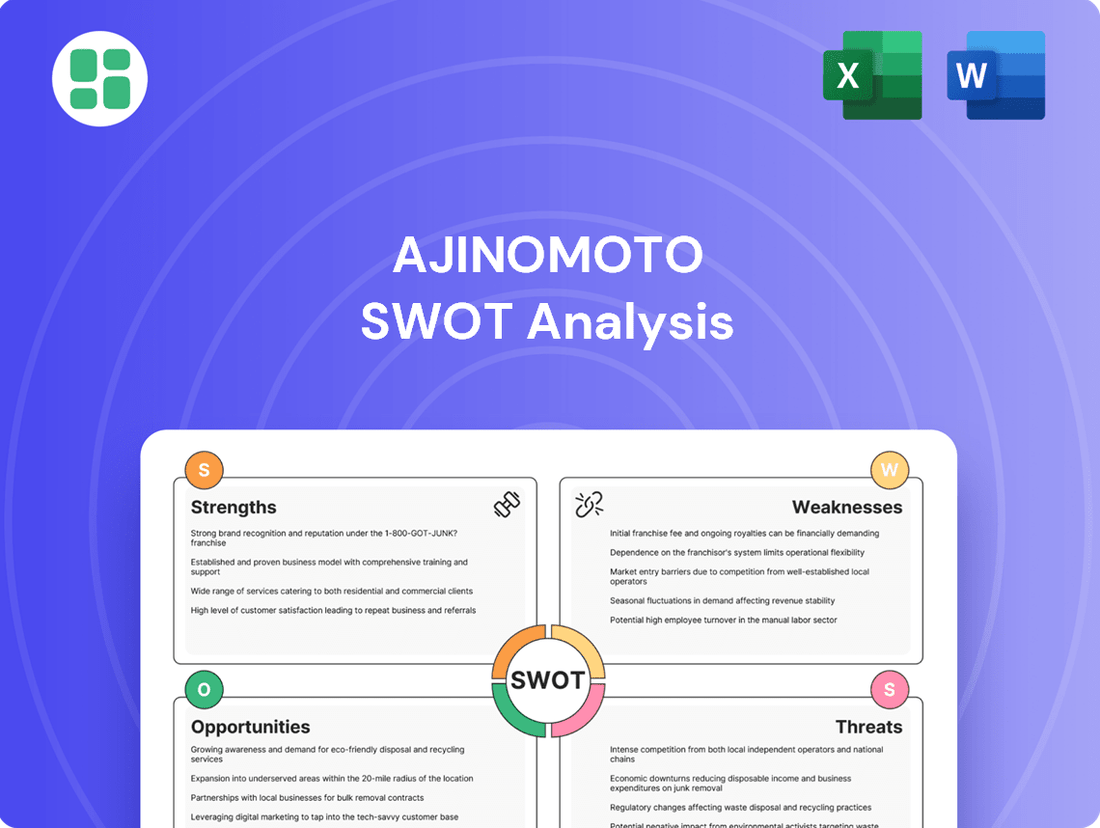

Ajinomoto SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Ajinomoto SWOT analysis, providing a clear overview of its strategic position. The full, detailed report will be available immediately after purchase.

Opportunities

Ajinomoto is well-positioned to capitalize on the burgeoning healthcare sector, particularly in areas like gene therapy and biopharmaceutical services. Their AminoScience expertise is a key enabler for growth in regenerative medicine and as a Contract Development and Manufacturing Organization (CDMO). This strategic focus is supported by significant investments, such as the acquisition of Forge Biologics, signaling a commitment to expanding their footprint in these high-demand fields.

The Information and Communication Technology (ICT) sector presents another substantial opportunity, especially with the increasing demand for advanced semiconductor materials. Ajinomoto’s Ajinomoto Build-up Film (ABF) is crucial for high-performance computing and artificial intelligence applications. The global semiconductor materials market is projected for strong growth, with ABF expected to see continued demand as technology advances.

Consumers worldwide are increasingly seeking food options that are not only healthy but also offer added benefits like fortification and reduced sodium or sugar content. This shift in preference presents a significant opportunity for companies like Ajinomoto.

Ajinomoto is well-positioned to leverage this trend through its expertise in amino acids. The company's development of platforms such as 'Salt Answer' and 'Palate Perfect' allows them to create solutions that enhance taste while simultaneously addressing consumer concerns about sodium and sugar intake.

This strategic focus on health-oriented food solutions directly aligns with evolving consumer demands and the growing emphasis on healthier eating habits, further supported by increasing regulatory pushes towards healthier food formulations globally.

Forming strategic alliances offers a pathway for mutual growth and addressing shared challenges, a key opportunity for Ajinomoto. The company's 2023 collaboration with Danone to reduce greenhouse gas emissions in the dairy industry, leveraging Ajinomoto's AjiPro®-L feed additive, exemplifies this. This type of partnership can unlock new markets and foster innovation.

Digital Transformation and Service Business Expansion

Ajinomoto is well-positioned to capitalize on digital transformation by expanding its service offerings. Leveraging digital technologies and AI, the company can develop innovative service models like its 'i-LiveWell application' aimed at corporate wellness. This strategic move allows Ajinomoto to diversify beyond its core manufacturing business and tap into the burgeoning market for preventive healthcare and well-being solutions.

This digital push is particularly relevant given the increasing global focus on health and wellness. For instance, the corporate wellness market was valued at over $50 billion in 2023 and is projected to grow significantly. Ajinomoto's expansion into this service sector, supported by digital platforms, aligns with these trends.

- Digital Service Expansion: Ajinomoto can create new revenue streams by offering digital wellness platforms and personalized health solutions.

- AI Integration: Utilizing AI can enhance user engagement and provide data-driven insights for corporate clients seeking to improve employee well-being.

- Market Growth: The increasing demand for preventive healthcare and corporate wellness programs presents a substantial opportunity for service-oriented business models.

Untapped Potential in Emerging Markets

Ajinomoto sees substantial opportunities in emerging markets, especially within the ASEAN region and Latin America. The company plans to boost its business development efforts and tailor its product offerings to cater to the evolving demands of consumers in these areas, aiming to broaden its market presence and drive sales growth.

For instance, in 2023, Ajinomoto's sales in Latin America saw a notable increase, contributing significantly to its overall revenue. The company is strategically investing in local production facilities and marketing campaigns to better resonate with regional tastes and preferences. This focus on localization is key to unlocking the full potential of these dynamic markets.

- ASEAN Growth: Ajinomoto is targeting a 15% revenue increase from its ASEAN operations by the end of 2025.

- Latin America Focus: Expansion plans in Brazil and Mexico are expected to add $200 million in annual revenue by 2026.

- Product Adaptation: Development of smaller, more affordable packaging sizes is a key strategy for increasing penetration in lower-income segments.

- Investment: Ajinomoto has allocated an additional $50 million for market development in these regions through 2025.

Ajinomoto's strategic expansion into the healthcare sector, particularly in gene therapy and biopharmaceutical services through acquisitions like Forge Biologics, positions it for significant growth. The company's expertise in amino acids also allows it to cater to the increasing consumer demand for healthier food options, with platforms like 'Salt Answer' enhancing taste while reducing sodium and sugar. Furthermore, leveraging digital transformation for corporate wellness programs, such as the 'i-LiveWell application', opens new service-based revenue streams, tapping into a market valued at over $50 billion in 2023.

Threats

Ajinomoto faces a highly competitive landscape in global food, seasoning, and amino acid markets. Established giants and nimble regional companies are vying for market dominance. This intense rivalry often triggers price wars and escalates marketing costs, directly impacting Ajinomoto's profitability and ability to grow its market share across its varied business units.

Ajinomoto's global presence means it's vulnerable to shifts in currency exchange rates. For instance, a strengthening Japanese Yen in 2024 could reduce the value of profits earned in foreign currencies when translated back into Yen, impacting reported earnings even if overseas business is performing well.

This currency volatility presents a significant threat, as seen in potential impacts on Ajinomoto's reported sales and profits from key markets like North America and Asia. Effective financial hedging strategies are crucial to mitigate these risks and maintain stable financial performance throughout 2024 and into 2025.

Despite robust scientific backing, Ajinomoto's flagship product, monosodium glutamate (MSG) marketed as Aji-No-Moto®, continues to contend with negative perceptions and misinformation. For instance, a 2024 survey indicated that 30% of consumers in the US still associate MSG with adverse health effects, a sentiment largely fueled by historical, unsubstantiated claims.

This persistent misinformation poses a significant threat to Ajinomoto's brand reputation and consumer acceptance, particularly in markets increasingly focused on health and wellness. While the company invests in educational campaigns, the rapid spread of unsubstantiated rumors online, amplified by social media algorithms, can quickly counteract these efforts, potentially impacting sales volume.

Evolving Consumer Preferences and Dietary Trends

Consumer tastes are shifting rapidly. There's a growing demand for products perceived as natural, organic, and free from artificial ingredients. This trend is particularly evident in the rise of plant-based diets, which directly challenges traditional food offerings. For example, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162.5 billion by 2030, demonstrating a significant shift in consumer spending and preference.

Ajinomoto faces the challenge of continuously adapting its extensive product portfolio to align with these evolving demands. Failure to innovate and introduce products that cater to these preferences risks market share erosion. Competitors who are more agile in responding to clean-label and plant-based trends could gain a significant advantage. In 2024, companies that successfully integrated sustainable sourcing and transparent labeling saw increased consumer trust and sales growth.

- Growing demand for plant-based alternatives: The market for meat and dairy alternatives is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond.

- Emphasis on natural and clean-label ingredients: Consumers are increasingly scrutinizing ingredient lists, favoring products with fewer artificial additives and preservatives.

- Health and wellness focus: Dietary trends are heavily influenced by health consciousness, leading to a preference for foods perceived as healthier and functional.

- Need for portfolio adaptation: Ajinomoto must invest in research and development to reformulate existing products and launch new ones that meet these evolving consumer expectations.

Geopolitical and Economic Instability

Geopolitical and economic instability poses a significant threat to Ajinomoto. Global economic downturns, like the projected slowdown in major markets in 2024, can dampen consumer demand for food products. Trade tensions and protectionist policies, which have been on the rise, could disrupt Ajinomoto's extensive international supply chains, leading to increased costs and potential shortages. Furthermore, geopolitical conflicts, such as ongoing regional disputes, can directly impact operational stability and investment opportunities in affected regions.

These external pressures can significantly affect Ajinomoto's financial performance. For instance, currency fluctuations driven by economic instability can erode profits earned in foreign markets. Increased operational costs due to supply chain disruptions, as seen with rising energy prices in late 2023 and early 2024, directly impact margins. Ajinomoto's reliance on global sourcing and sales means that events like the Suez Canal disruptions in early 2024, which caused shipping delays and increased costs, highlight the vulnerability of its business model to such instability. Consequently, the company must maintain agile risk management strategies to navigate these volatile conditions.

Ajinomoto's global footprint, while a strength, also exposes it to a wider range of geopolitical risks. For example, sanctions or trade restrictions imposed on countries where Ajinomoto operates could hinder its ability to import raw materials or export finished goods. Political instability in key emerging markets could also lead to unexpected regulatory changes or operational challenges. The company's strategic investment plans, such as expanding production facilities in Southeast Asia, could be jeopardized by sudden shifts in regional political climates or economic policies, underscoring the need for continuous monitoring and contingency planning.

Ajinomoto faces intense competition from both established global players and agile regional competitors, leading to price pressures and increased marketing expenses that can impact profitability. The company's significant international operations also expose it to currency fluctuations; for instance, a stronger Yen in 2024 could negatively affect its reported earnings from overseas markets.

Persistent negative consumer perceptions surrounding MSG, despite scientific evidence, continue to pose a brand reputation challenge, with a 2024 survey indicating a notable segment of consumers still associate it with adverse health effects. Furthermore, the accelerating consumer shift towards plant-based and clean-label products necessitates continuous portfolio adaptation, as companies more responsive to these trends gain market share.

Geopolitical instability and economic downturns present risks through dampened consumer demand and disrupted supply chains, as exemplified by the cost increases seen with global shipping issues in early 2024. Trade tensions and protectionist policies can further complicate international operations, impacting import/export activities and potentially jeopardizing expansion plans in key regions.

SWOT Analysis Data Sources

This Ajinomoto SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and actionable overview.