Ajinomoto Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ajinomoto Bundle

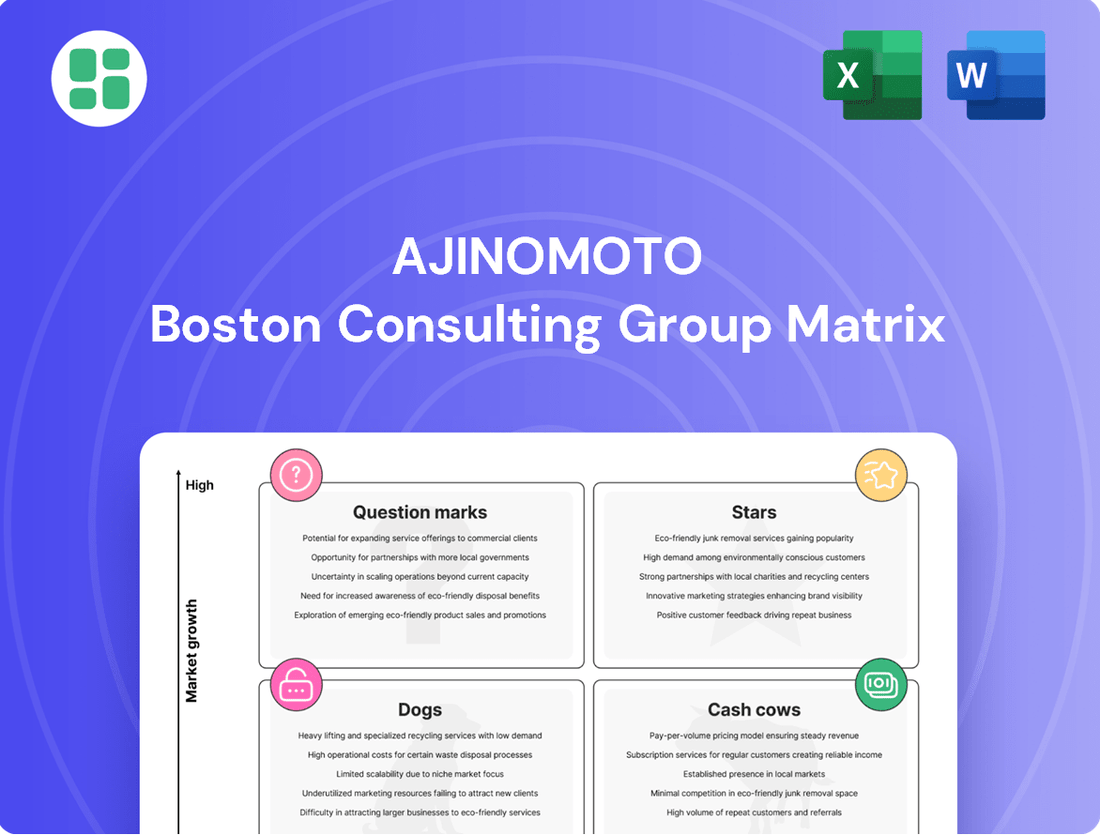

Curious about Ajinomoto's product portfolio? Our BCG Matrix analysis offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their key products stand and where future growth might lie.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Ajinomoto.

Stars

Ajinomoto's Functional Materials segment, spearheaded by its Ajinomoto Built-up Film (ABF), is a powerhouse in the semiconductor industry. ABF is a critical component for semiconductor substrates, and Ajinomoto commands an impressive 96% market share in this niche, oligopolistic market. This dominance translates directly into robust financial performance, with the segment experiencing substantial revenue and profit growth in recent fiscal years, fueled by the insatiable demand for advanced semiconductors.

The company's strategic foresight is evident in its aggressive expansion plans for ABF production. Ajinomoto is channeling over 25 billion yen into increasing its manufacturing capacity. This significant investment underscores the company's unwavering commitment to its high-growth, high-market-share ABF business, positioning it to capitalize further on the ongoing semiconductor boom.

Ajinomoto's Bio-Pharma Services & Ingredients segment is set for substantial expansion, particularly in advanced therapies like gene therapy CDMO services, following the December 2023 acquisition of Forge Biologics. This strategic move is expected to fuel future profitability, despite initial investment impacts in FY2024.

The segment's growth trajectory is further supported by a significant increase in orders for Forge Biologics. This surge, coupled with an expanding customer base, underscores robust market demand and the segment's promising outlook for FY2025, positioning it as a key profit driver for Ajinomoto.

Overseas Seasonings & Sauces is a strong performer for Ajinomoto, showing consistent growth in both revenue and profit. This segment has benefited from strategic product expansions and price adjustments, solidifying its market position. Ajinomoto's global leadership in MSG and nucleotide markets provides a significant advantage, allowing it to leverage established brands and distribution channels effectively in expanding international food markets.

Specialty Amino Acids for Pharmaceuticals & Health

The market for specialty amino acids in pharmaceuticals and health is a robust sector, with projections indicating a compound annual growth rate (CAGR) of 7.7% to 8.4% through 2030-2032. This growth is fueled by increasing consumer focus on health and wellness, driving demand for functional foods and supplements. Ajinomoto, with its advanced amino acid technologies, is well-positioned to capitalize on this expanding market.

- Strong Market Growth: The specialty amino acid market for pharma and health is expected to grow at a CAGR of 7.7%-8.4% until 2030-2032.

- Ajinomoto's Position: Ajinomoto is a significant player, utilizing its advanced amino acid production technologies.

- Demand Drivers: Increased demand for functional foods and health supplements supports the growth of these high-potential products.

- Star Category: These specialty amino acids represent a star product within Ajinomoto's portfolio due to their high growth and market potential.

Overseas Frozen Foods (Asian/Ethnic Focus)

Overseas Frozen Foods, with its strong emphasis on Asian and ethnic flavors, represents a key growth area for Ajinomoto. The company is actively pursuing expansion in Western markets within this segment, recognizing the substantial potential for increased market share.

Ajinomoto's strategic objective is to capture a leading position in these evolving frozen food and instant soup categories. This ambition is underpinned by projected revenue growth in fiscal year 2024, reflecting confidence in the segment's performance.

- Market Expansion: Ajinomoto is targeting Western markets for its Asian/ethnic frozen foods.

- Growth Potential: The company sees significant opportunity for market share gains in these categories.

- Revenue Focus: Increased revenue in FY2024 is a key indicator of this segment's importance.

- Competitive Edge: Ajinomoto leverages its flavor expertise and localization capabilities.

The specialty amino acids for pharmaceuticals and health represent a clear Star for Ajinomoto. This segment benefits from a high projected CAGR of 7.7%-8.4% through 2030-2032, driven by increasing consumer focus on health and wellness. Ajinomoto's advanced amino acid technologies position it to capitalize on the growing demand for functional foods and supplements, making this a high-growth, high-potential area within its portfolio.

What is included in the product

The Ajinomoto BCG Matrix analyzes its business units based on market growth and share.

It guides strategic decisions on investment, divestment, or harvesting of its diverse product portfolio.

Provides a clear visual of Ajinomoto's business portfolio, easing the pain of strategic resource allocation.

Cash Cows

Ajinomoto's domestic seasonings, including staples like MSG and Hon-Dashi, are clear Cash Cows. The company holds a commanding market share, surpassing 50% in Japan's mature flavor seasoning sector, demonstrating the enduring strength of these foundational products.

These established brands consistently deliver substantial revenue, acting as a bedrock for Ajinomoto's financial stability. Their reliable cash flow is crucial, funding innovation and expansion into other business areas.

Even with a mature domestic market, Ajinomoto's strong brand recognition and extensive distribution network ensure these products remain highly profitable. This consistent financial contribution is vital for supporting the company's broader strategic initiatives.

Ajinomoto's traditional processed foods in Japan, including established coffee and quick nourishment items, form a solid foundation for its domestic food business. These products are key cash cows, generating consistent revenue in a mature, low-growth market.

Despite facing headwinds like rising raw material costs, these offerings benefit from strong consumer loyalty and steady demand. This stability allows them to generate significant cash with minimal need for further investment, solidifying their position as reliable profit drivers for the company.

Ajinomoto's core amino acids, used in animal feed and industrial applications, represent significant cash cows. These segments operate in mature, high-volume markets, where Ajinomoto commands substantial market shares. For instance, the global amino acid market, a key area for these commodity products, was valued at approximately $25 billion in 2023 and is projected to grow at a modest CAGR of around 4-5% through 2030. This consistent demand and established market position translate into robust and stable cash flow generation for the company.

Global Umami Seasonings

Ajinomoto's global umami seasonings, particularly MSG and nucleotides, are its bedrock cash cows. These staples are deeply embedded in culinary traditions worldwide, ensuring consistent, high-margin income streams.

- Global MSG Market: The global MSG market was valued at approximately USD 3.5 billion in 2023 and is projected to grow steadily, driven by demand in processed foods and Asian cuisine.

- Nucleotide Market: Nucleotides, used as flavor enhancers, also represent a significant revenue contributor, with the market size estimated to be around USD 1.5 billion in 2023.

- Profitability: Ajinomoto's dominant market share in these segments allows for efficient production and pricing power, translating into robust profitability.

- Low Investment Needs: While the market for these established products sees moderate growth, the need for substantial new investment in market development is minimal, allowing for significant cash generation.

Established Japanese Frozen Foods

Ajinomoto's established Japanese frozen foods business is a classic cash cow. While international markets show growth potential, this domestic segment provides a stable, reliable income stream. It benefits from a deeply entrenched customer base and consistent demand.

This segment's strength lies in its mature market position, where Ajinomoto leverages operational efficiencies and unwavering product quality. For instance, in fiscal year 2023, Ajinomoto reported that its Frozen Foods segment, which includes its significant Japanese operations, contributed substantially to its overall operating profit, demonstrating its consistent cash-generating ability.

- Domestic Frozen Foods: A mature but stable market in Japan.

- Loyal Customer Base: Ensures consistent revenue generation.

- Operational Efficiency: Key to maintaining profitability in a competitive landscape.

- Product Quality: A cornerstone for sustained market leadership and cash flow.

Ajinomoto's core amino acids, particularly those for animal feed, are significant cash cows. These products operate in high-volume, mature markets where Ajinomoto holds a strong position. The global amino acid market, valued around $25 billion in 2023, is expected to see steady growth, ensuring consistent cash flow with minimal new investment needs.

| Product Category | Market Status | Ajinomoto's Position | Cash Flow Generation |

|---|---|---|---|

| Amino Acids (Animal Feed) | Mature, High Volume | Strong Market Share | Robust and Stable |

| MSG & Nucleotides | Global, Established | Dominant Market Share | High Profitability, Low Investment |

| Domestic Seasonings | Mature, Stable | Commanding Market Share (>50%) | Bedrock Financial Stability |

What You See Is What You Get

Ajinomoto BCG Matrix

The Ajinomoto BCG Matrix you are previewing is the precise, fully formatted document you will receive immediately after purchase, offering a clear strategic overview of their product portfolio. This comprehensive analysis, designed for immediate application, will be yours to download and utilize without any watermarks or demo content. You'll gain access to the complete, professionally crafted Ajinomoto BCG Matrix, ready for your strategic planning and decision-making processes. This is the actual report, providing actionable insights into Ajinomoto's market positions and growth potential.

Dogs

Ajinomoto's divestiture of certain non-core sweetener and lysine assets signals a strategic move away from underperforming product lines. These assets likely occupied the Dogs quadrant of the BCG Matrix, characterized by low market share in slow-growing or declining markets, thus draining resources without generating substantial returns.

For instance, in 2024, Ajinomoto completed the sale of its U.S. sweetener business, a segment that had faced intense competition and pricing pressures. This aligns with the Dogs quadrant's profile, where such commoditized products struggle to maintain profitability and market relevance.

Certain Ajinomoto manufacturing facilities within Japan are showing signs of strain, with equipment utilization rates dipping and fixed manufacturing unit costs on the rise. This indicates a struggle for some domestic food production lines to operate efficiently.

These underperforming segments are likely contributing to lower profitability and could be losing ground in their respective markets. For instance, a report from early 2024 highlighted a 5% decrease in overall factory output for a key domestic processed food division compared to the previous year.

Ajinomoto needs to carefully evaluate these underperforming areas. Restructuring efforts or even the possibility of divesting these lines might be necessary if turnaround strategies prove too expensive or unlikely to succeed.

Ajinomoto's divestiture of Ajinomoto Althea, Inc. to PCI Pharma Services for around $20 million signals a strategic move away from this bio-pharma service unit. This sale suggests Althea was likely not meeting Ajinomoto's growth expectations or fit within its evolving healthcare strategy. The relatively modest sale price, especially considering Ajinomoto's overall size, strongly positions it as a 'Dog' in the BCG matrix, indicating a low market share and low growth potential that the company decided to exit.

Legacy Products with Declining Domestic Demand

Ajinomoto's legacy products in Japan, such as certain traditional seasonings or older processed food items, are categorized as Dogs in the BCG Matrix. These offerings are experiencing a slowdown in domestic demand, often due to evolving consumer tastes favoring newer, healthier, or more convenient options. For instance, while overall processed food sales in Japan saw a modest increase in recent years, older product lines within Ajinomoto may not be capturing this growth, indicating a potential decline in their market share.

The challenge with these Dog products lies in their low market growth and low relative market share. Continued investment in marketing or production for these items without a clear strategy for revitalization or divestment can drain resources. In 2024, the Japanese food market continues to be highly competitive, with consumers actively seeking out innovation. Ajinomoto's focus is shifting towards growth areas, making these legacy products a prime candidate for strategic review.

- Declining Domestic Sales: Certain older Ajinomoto food products in Japan are seeing reduced consumer interest.

- Low Market Growth: These products operate in a stagnant or shrinking segment of the Japanese market.

- Resource Drain: Continued investment without innovation ties up capital in low-return assets.

- Strategic Review Needed: Ajinomoto must consider revitalizing, repositioning, or divesting these legacy items.

Specific Niche Regional Businesses with Persistent Profit Challenges

Within Ajinomoto's diverse portfolio, certain niche regional businesses may be experiencing persistent profit challenges. These segments, often characterized by low market share and limited growth potential, can act as resource drains. For instance, a specialized food ingredient business in a less developed market might struggle to gain traction against established local competitors, leading to a Dogs classification.

These underperforming units require careful management to avoid becoming significant financial burdens. While Ajinomoto's global presence is strong, these specific pockets of difficulty highlight the complexities of localized market penetration. In 2024, such niche operations might represent a small fraction of Ajinomoto's total revenue, perhaps less than 1% of its consolidated sales, but their impact on profitability could be disproportionately negative.

- Niche Regional Operations: Small, localized markets where Ajinomoto faces intense competition or has low brand recognition.

- Low Growth & Market Share: Segments exhibiting minimal expansion and a negligible presence compared to key rivals.

- Resource Drain: These businesses consume capital and management attention without generating substantial returns.

- Profitability Struggles: Consistent inability to achieve break-even or positive profit margins in these specific areas.

Ajinomoto's "Dogs" represent product lines or business units with low market share in slow-growing or declining industries. These entities typically require significant investment to maintain their position but offer minimal returns, acting as a drain on company resources. The company's strategic divestitures, such as the 2024 sale of its U.S. sweetener business, exemplify the management of these Dog assets.

These underperforming segments often face intense competition and evolving consumer preferences, making revitalization challenging and costly. For example, certain legacy food products in Japan are experiencing declining domestic sales due to changing tastes, as noted in early 2024 market reports indicating a slowdown in demand for older processed items.

The company's focus on optimizing its portfolio means actively identifying and addressing these Dog segments. This could involve restructuring, repositioning, or ultimately, divesting them to reallocate capital towards more promising growth areas. A 2024 analysis of Ajinomoto's factory utilization rates revealed dips in specific domestic food production lines, suggesting operational inefficiencies that align with Dog characteristics.

Divesting underperforming assets like Ajinomoto Althea, Inc. in 2024 for approximately $20 million underscores this strategy. The sale of this bio-pharma service unit, likely due to low growth potential and market share, is a clear indication of shedding Dog assets to improve overall financial health.

| Business Segment | Market Growth | Market Share | Status | Strategic Action (Example) |

|---|---|---|---|---|

| U.S. Sweetener Business | Low | Low | Dog | Divested (2024) |

| Legacy Japanese Food Products | Declining | Low | Dog | Potential Revitalization/Divestment |

| Niche Regional Food Ingredient Business | Low | Low | Dog | Evaluate for Divestment |

| Ajinomoto Althea, Inc. | Low | Low | Dog | Divested (2024) |

Question Marks

Ajinomoto's investment in Enhanced Medical Nutrition Inc. in 2025 positions it squarely within the "Question Marks" quadrant of the BCG matrix. This startup, focused on surgical nutrition, represents a high-growth potential market that Ajinomoto is entering with a relatively low initial market share.

The venture's strategy involves utilizing Ajinomoto's AminoScience expertise for sophisticated medical applications, signaling a strong belief in its future scalability. This aligns with the characteristics of a Question Mark, where significant investment is anticipated to capture market share and drive growth.

While the medical food sector, particularly specialized nutrition, is projected for robust expansion, Enhanced Medical Nutrition Inc. will require substantial capital infusion. This is necessary to establish brand presence, conduct extensive research and development, and build the necessary distribution channels to compete effectively in this nascent but promising market.

Ajinomoto's regenerative medicine therapies, such as StemFit and iPS cell differentiation, represent a strategic push into a high-growth, albeit early-stage, market. The company's launch of an enhanced StemFit iPSC expansion medium in March 2024 and its June 2025 investment in AI platforms for iPS cell differentiation underscore a commitment to innovation in this cutting-edge field.

These initiatives are categorized as question marks within the BCG matrix due to their significant investment requirements and uncertain future returns. While the regenerative medicine market holds immense potential, with clinical trials for therapies commencing in 2025, it remains nascent. Ajinomoto's substantial investment aims to secure a strong future market position, acknowledging the need for sustained funding to navigate the developmental stages and capitalize on eventual market expansion.

Ajinomoto's Atlr.72™ brand, featuring Solein®, is positioned as a Question Mark in the BCG Matrix. Launched in Singapore in August 2024, this innovative green food product utilizes air-based protein, tapping into a burgeoning market driven by consumer demand for health and sustainability.

While Atlr.72™ is a new entrant in an emerging segment, it currently commands a low market share. However, its potential for rapid growth is substantial, contingent on accelerating consumer adoption and continued strategic investment.

New Food Formulation Platforms (Salt Answer, Palate Perfect)

Ajinomoto Health & Nutrition North America introduced its Salt Answer and Palate Perfect platforms in June 2025, targeting the growing demand for healthier food options. These platforms are designed to help food manufacturers reduce sodium content and enhance taste, respectively, directly addressing key consumer preferences. The global savory flavors market, which these platforms serve, was projected to reach approximately $25 billion by 2024, indicating significant market potential.

As new product launches, Salt Answer and Palate Perfect are positioned as question marks in Ajinomoto's BCG Matrix. They operate in a high-growth market driven by health-conscious consumers, with a 2024 report indicating that over 60% of consumers actively seek to reduce their sodium intake. However, their success hinges on substantial investment in marketing and sales to build brand awareness and secure market adoption.

- Market Potential: The global savory flavors market, a key area for these platforms, was estimated to be worth around $25 billion in 2024.

- Consumer Trends: Over 60% of consumers in 2024 reported actively trying to lower their sodium consumption.

- Strategic Need: Significant marketing and sales efforts are required to transition these platforms from question marks to stars within Ajinomoto's portfolio.

D2C Home Delivery Service 'Aete'

Ajinomoto's D2C home delivery service, 'Aete', launched in January 2024, is positioned as a Question Mark in the BCG matrix. This new venture focuses on nutritionally balanced frozen meals delivered directly to consumers.

While 'Aete' has surpassed its initial sales projections and garnered positive consumer reception, its future growth is uncertain. The online food delivery sector is intensely competitive and constantly changing, demanding significant ongoing investment to expand its reach and market share.

- Market Position: 'Aete' is a new entrant in the rapidly expanding online food delivery market.

- Growth Potential: The service aims to capitalize on the growing consumer demand for convenient, healthy meal solutions.

- Investment Needs: Significant capital is required for scaling operations, marketing, and logistics to compete effectively.

- Uncertainty: Its success hinges on its ability to differentiate itself and capture a substantial portion of the e-commerce food market.

Question Marks represent Ajinomoto's investments in high-growth potential but uncertain markets. These ventures require substantial funding to gain market share and establish a strong foothold. Their success is not guaranteed, and careful monitoring of market trends and competitive landscapes is crucial.

Ajinomoto's ventures into regenerative medicine therapies and its new green food brand, Atlr.72™, exemplify this category. These areas, while promising, demand significant capital for research, development, and market penetration. The company's strategic focus on these emerging sectors highlights a commitment to future growth, despite the inherent risks.

The success of these Question Marks hinges on Ajinomoto's ability to effectively navigate evolving consumer preferences, technological advancements, and competitive pressures. Strategic investments in marketing, innovation, and distribution are key to transforming these potential stars into market leaders.

| Venture | Market Sector | Growth Potential | Market Share (Initial) | Investment Strategy |

| Enhanced Medical Nutrition Inc. | Surgical Nutrition | High | Low | Leverage AminoScience expertise, significant capital infusion |

| Regenerative Medicine Therapies (StemFit, iPS cell differentiation) | Biotechnology/Healthcare | Very High | Low | Focus on R&D, clinical trials, AI platforms, substantial funding |

| Atlr.72™ (Solein®) | Sustainable Food Products | High | Low | Tap into health & sustainability demand, consumer adoption driven |

| Salt Answer & Palate Perfect Platforms | Food Ingredients (Savory Flavors) | High | Low | Address sodium reduction & taste enhancement, marketing & sales focus |

| 'Aete' D2C Home Delivery Service | Online Food Delivery | High | Low | Capitalize on convenience & health demand, scaling operations & marketing |

BCG Matrix Data Sources

Our Ajinomoto BCG Matrix is built on comprehensive market intelligence, integrating financial statements, industry growth data, and competitor analysis for strategic clarity.