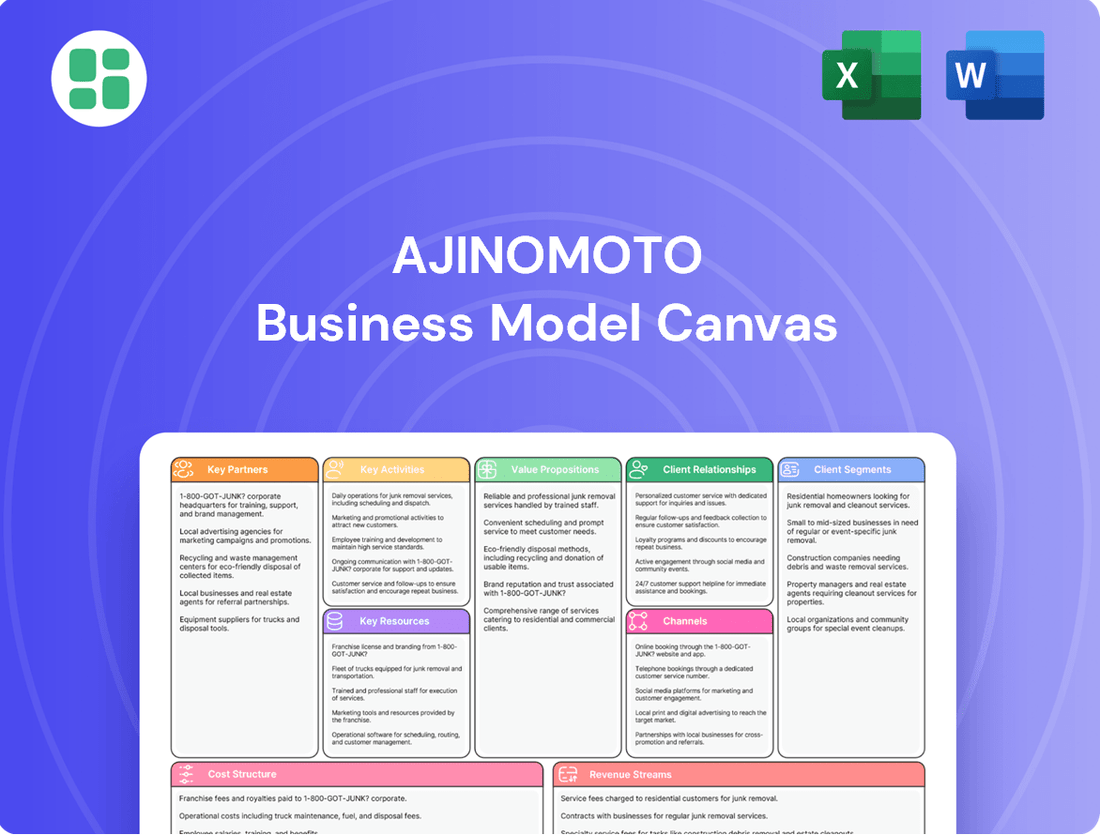

Ajinomoto Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ajinomoto Bundle

Unlock the strategic genius behind Ajinomoto's diverse operations with our comprehensive Business Model Canvas. This detailed breakdown reveals how they leverage their core competencies and partnerships to deliver value across global markets. Discover their customer relationships, revenue streams, and cost structures for a complete understanding of their success.

Partnerships

Ajinomoto actively cultivates strategic alliances to drive its sustainability mission forward. A prime example is its partnership with Danone, aimed at significantly reducing greenhouse gas emissions within the dairy sector. This collaboration leverages Ajinomoto's innovative AjiPro®-L solution, a feed additive designed to enhance the environmental efficiency of dairy farming practices.

These alliances underscore a mutual dedication to tackling pressing global environmental issues through the application of cutting-edge solutions. By joining forces, Ajinomoto and its partners amplify their impact, working towards a more sustainable future for industries and the planet.

Ajinomoto actively pursues research and development collaborations with leading research institutions and innovative startups to drive scientific advancement. A prime example is their investment in Somite Therapeutics Inc., an AI platform startup focused on optimizing induced pluripotent stem cell (iPSC) differentiation, highlighting a commitment to cutting-edge biotechnology.

These strategic partnerships are vital for Ajinomoto's innovation pipeline, particularly within the life sciences and biotechnology fields. By fostering these relationships, the company aims to accelerate the discovery and development of novel solutions, ensuring a competitive edge in rapidly evolving markets.

Ajinomoto actively partners with government entities, exemplified by its collaboration in Thailand to foster a national Agriculture and Food Hub, aiming to advance healthy nutrition and sustainable farming practices. This strategic alliance supports national development goals and leverages public sector initiatives for mutual benefit.

Furthermore, Ajinomoto's membership in influential industry groups like the World Business Council for Sustainable Development underscores its dedication to driving sustainability across the entire sector. In 2024, such collaborations are crucial for navigating evolving regulatory landscapes and aligning business strategies with global environmental and social imperatives.

Supply Chain Partnerships

Ajinomoto’s supply chain partnerships are crucial for its business model, focusing on ethical sourcing and consistent raw material quality. The company strives to maintain high supplier compliance rates in ethical sourcing, underscoring its dedication to integrity and transparency throughout its global operations.

These relationships are vital for ensuring the reliability and quality of ingredients, which directly impacts Ajinomoto’s product integrity and consumer trust. By fostering strong ties with its suppliers, Ajinomoto can better manage risks and uphold its commitment to sustainable and responsible practices.

- Ethical Sourcing Compliance: Ajinomoto targets a high supplier compliance rate, aiming for 100% adherence to ethical sourcing standards by 2030, as part of its broader sustainability goals.

- Quality Assurance: Partnerships ensure the consistent quality of key raw materials like amino acids and agricultural products, which are fundamental to Ajinomoto's diverse product portfolio.

- Supplier Collaboration: Ajinomoto actively collaborates with suppliers on innovation and efficiency improvements, fostering mutual growth and resilience within the supply chain.

- Risk Mitigation: Strong supplier relationships help mitigate supply chain disruptions, ensuring a steady flow of materials even amidst market volatility.

Digital and Technology Partnerships

Ajinomoto is actively cultivating digital and technology partnerships to drive innovation and expand its reach. A key example is the collaboration with Top4 Technology + Marketing for its Agridev division in Indonesia. This partnership aims to bolster the digital presence of Agridev and champion sustainable farming methods through technological integration.

Further demonstrating its commitment to digital advancement, Ajinomoto launched the 'i-LiveWell' application. This AI-powered Well-being Platform signifies a strategic move towards leveraging technology for enhanced consumer engagement and proactive health promotion, reflecting a growing trend in the health and wellness sector.

- Digital Presence Enhancement: Partnerships like the one with Top4 Technology + Marketing are crucial for building a robust digital footprint, especially for specialized divisions like Agridev.

- Sustainable Farming Promotion: Technology plays a vital role in communicating and implementing sustainable agricultural practices, a growing concern for consumers and regulators alike.

- Consumer Engagement via AI: The 'i-LiveWell' app highlights Ajinomoto's strategy to utilize AI and digital platforms to connect with consumers on health and wellness, a market segment experiencing significant growth.

Ajinomoto's key partnerships extend across sustainability, R&D, government, and digital innovation. Collaborations like the one with Danone for reducing dairy emissions and investments in biotech startups like Somite Therapeutics Inc. are central to its strategy. These alliances are critical for driving innovation and achieving its ambitious sustainability targets, such as the 2030 goal for 100% ethical sourcing compliance.

| Partner Type | Example Partner | Focus Area | Key Outcome/Goal |

|---|---|---|---|

| Sustainability | Danone | Reducing GHG emissions in dairy | Leveraging AjiPro®-L for environmental efficiency |

| R&D/Biotech | Somite Therapeutics Inc. | AI-driven iPSC differentiation | Accelerating discovery in life sciences |

| Government | Thailand Government | Agriculture and Food Hub | Advancing healthy nutrition and sustainable farming |

| Digital Innovation | Top4 Technology + Marketing | Agridev digital presence | Championing sustainable farming via tech integration |

What is included in the product

A detailed breakdown of Ajinomoto's operations, outlining its diverse customer segments, global distribution channels, and core value propositions in the food and amino acid industries.

The Ajinomoto Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to understanding their complex global operations, enabling clearer identification of inefficiencies and opportunities for improvement.

Activities

Ajinomoto's core strength lies in its relentless Research and Development, especially in amino acid science. This focus fuels innovation across their diverse product lines, from enhancing the taste of food to developing advanced pharmaceutical ingredients.

In 2024, Ajinomoto continued to invest heavily in R&D, with a significant portion allocated to exploring new applications for amino acids. Their 'AminoScience' approach drives advancements in areas like health and wellness, aiming to create solutions for global challenges such as nutrition and sustainable food production.

Ajinomoto's manufacturing and production activities are central to its business, encompassing a vast global network of facilities. These sites are responsible for creating a wide array of products, from its signature MSG and other seasonings to a growing portfolio of frozen foods and specialized pharmaceutical ingredients. This extensive production capability allows Ajinomoto to serve diverse markets worldwide.

The company emphasizes large-scale production to meet global demand, coupled with a strong focus on efficient resource management. In 2023, Ajinomoto continued its commitment to sustainability, reporting a 15% reduction in greenhouse gas emissions from its manufacturing operations compared to 2020 levels, demonstrating ongoing efforts to minimize its environmental footprint.

Ajinomoto actively revives its core brands, such as AJI-NO-MOTO MSG, through targeted marketing campaigns to maintain market leadership. In 2024, the company continued its focus on digital marketing and consumer engagement to strengthen brand perception and drive sales in its key markets.

The company also strategically expands market presence for products like Ros Dee, a seasoning brand, by adapting its sales channels and promotional activities to local consumer preferences. This approach aims to capture new growth opportunities and reinforce its position in competitive food seasoning segments globally.

Supply Chain Management

Ajinomoto's supply chain management is a critical function, encompassing everything from sourcing raw materials to delivering final products globally. This involves a constant effort to streamline logistics, ensuring efficiency and cost-effectiveness across its operations. For instance, in 2024, the company continued to invest in advanced tracking systems to monitor inventory and optimize transportation routes, aiming to reduce lead times and minimize waste. The company's commitment to sustainability also plays a significant role, with efforts focused on ethical and environmentally responsible sourcing of ingredients.

Adapting to fluctuating market demands and economic conditions is also paramount. Ajinomoto actively manages its supply chain to mitigate risks associated with price volatility of key commodities and geopolitical disruptions. This proactive approach allows them to maintain product availability and competitive pricing for consumers. Their strategy includes building resilient supplier relationships and diversifying sourcing locations to buffer against potential supply chain shocks, a strategy that proved vital in navigating the global economic landscape of 2024.

- Global Logistics Optimization: Ajinomoto focuses on efficient transportation and warehousing to reduce costs and delivery times.

- Sustainable Sourcing: The company prioritizes ethical and environmentally friendly procurement of raw materials, a growing concern for consumers in 2024.

- Risk Mitigation: Strategies are in place to manage price fluctuations and supply disruptions, ensuring business continuity.

Sustainability and ESG Initiatives

Ajinomoto actively pursues sustainability through its ASV (Ajinomoto Group Creating Shared Value) framework, a core component of its business model. This involves concrete actions to minimize environmental impact and foster social well-being. For instance, the company has set ambitious targets for greenhouse gas emission reductions, aiming for a 50% decrease by 2030 compared to 2019 levels.

Key activities include robust waste management programs and significant investments in water conservation technologies across its global operations. Ajinomoto also champions diversity and inclusion, recognizing its importance for innovation and long-term growth. These ESG initiatives are not merely compliance measures but are deeply integrated into the company's strategy for creating shared value.

- Environmental Stewardship: Focus on reducing carbon footprint, with a target of 50% GHG emission reduction by 2030 (vs. 2019).

- Resource Management: Implementing water conservation and comprehensive waste management strategies globally.

- Social Responsibility: Prioritizing diversity and inclusion to enhance organizational strength and innovation.

- Strategic Integration: Embedding ESG principles within the ASV framework to drive sustainable business growth.

Ajinomoto's key activities center on leveraging its deep expertise in amino acid science for product innovation and manufacturing excellence. This includes extensive research and development, efficient global production, and strategic marketing to maintain and expand its diverse product portfolio. The company also prioritizes robust supply chain management and a strong commitment to sustainability, integrating ESG principles into its core operations.

What You See Is What You Get

Business Model Canvas

The Ajinomoto Business Model Canvas you are previewing is the authentic document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this exact Business Model Canvas, ensuring no surprises and immediate usability for your strategic planning.

Resources

Ajinomoto's core strength lies in its AminoScience, a collection of proprietary technologies in amino acid research and fermentation. This foundational expertise underpins its entire business, from food seasonings to advanced health solutions and specialty chemicals.

In fiscal year 2023, Ajinomoto's consolidated net sales reached ¥1,374.8 billion, with its amino acid-based products playing a significant role across its diverse segments, demonstrating the broad applicability and value of this key resource.

Ajinomoto's strength lies in its globally recognized brands, such as AJI-NO-MOTO MSG, HON-DASHI, and Cook Do, which are cornerstones of its market presence. These brands foster strong consumer loyalty and command significant market share, underpinning the company's competitive edge.

Beyond consumer-facing brands, Ajinomoto holds a substantial portfolio of patents and intellectual property. This IP covers innovative product formulations and proprietary manufacturing processes, providing a critical barrier to entry for competitors and driving ongoing innovation.

In 2024, Ajinomoto's brand equity and intellectual property were instrumental in its continued growth. The company reported a 5.2% increase in net sales for the fiscal year ending March 2024, reaching ¥1,364.6 billion, with its branded food products playing a pivotal role in this expansion.

Ajinomoto's extensive manufacturing facilities are a cornerstone of its operations, allowing for efficient production across its diverse product lines. These plants are strategically located to serve global markets, supporting both its consumer-facing food products and its industrial-grade amino acid offerings.

The company boasts a robust global distribution network, reaching customers in over 35 countries. This established infrastructure ensures timely delivery and accessibility of Ajinomoto's products, from seasonings to specialized biochemicals, catering to a wide array of consumer and industrial needs worldwide.

Skilled Workforce and R&D Talent

Ajinomoto's commitment to innovation is powered by its highly skilled workforce, especially its scientists and researchers in biotechnology and food science. This talent pool is crucial for developing cutting-edge solutions that align with the company's core purpose of improving lives through amino acid science. For instance, in fiscal year 2023, Ajinomoto invested approximately ¥38.6 billion in research and development, a testament to their reliance on R&D talent to drive future growth and product pipelines.

The company actively cultivates this expertise through various initiatives, ensuring they remain at the forefront of scientific advancement. This focus on human capital directly translates into their ability to create differentiated products and services. Ajinomoto's success in areas like umami seasonings and advanced functional ingredients underscores the impact of their specialized R&D talent.

- Human Capital: Scientists, researchers, and technical experts in biotechnology and food science are foundational.

- Innovation Engine: This talent drives the development of new solutions and product pipelines.

- Strategic Investment: Ajinomoto's R&D spending, around ¥38.6 billion in FY2023, highlights the value placed on skilled talent.

- Competitive Edge: Expertise in amino acid science provides a significant advantage in developing specialized food and health products.

Financial Capital

Ajinomoto's robust financial health is a cornerstone of its business model, enabling significant investments in research and development, crucial for innovation in the food and amino acid sectors. In the fiscal year ending March 2024, Ajinomoto reported consolidated net sales of ¥1.43 trillion, demonstrating strong revenue generation capacity.

This financial muscle directly supports Ajinomoto's strategic growth initiatives, including potential acquisitions and global market expansion. The company’s healthy balance sheet provides the necessary capital to pursue these ambitious plans, ensuring it can adapt to evolving market demands and maintain its competitive edge.

Ajinomoto's financial capital is vital for funding its long-term sustainability goals. For instance, investments in eco-friendly production processes and the development of healthier food options are facilitated by a strong financial foundation, allowing the company to align business growth with environmental and social responsibility.

- Strong Revenue Generation: Fiscal year ending March 2024 consolidated net sales reached ¥1.43 trillion, providing ample resources.

- Investment Capacity: Financial strength supports R&D, strategic acquisitions, and global expansion efforts.

- Sustainability Funding: Capital allows for investment in eco-friendly practices and healthier product development.

- Balance Sheet Health: A solid financial position underpins the pursuit of growth and sustainability objectives.

Ajinomoto's key resources are its deep expertise in AminoScience, globally recognized brands like AJI-NO-MOTO, a strong intellectual property portfolio, extensive manufacturing capabilities, a robust distribution network, and highly skilled human capital. These elements collectively form the bedrock of its competitive advantage and innovation capacity.

The company's financial strength, evidenced by its substantial net sales and R&D investments, further bolsters these resources, enabling strategic growth and sustainability initiatives.

In fiscal year 2023, Ajinomoto's net sales were ¥1,374.8 billion, with a significant portion driven by its amino acid products. For the fiscal year ending March 2024, consolidated net sales reached ¥1.43 trillion, underscoring its financial stability and market reach.

| Resource Category | Key Components | Fiscal Year 2023/2024 Data Point | Impact/Significance |

|---|---|---|---|

| AminoScience Expertise | Proprietary research & fermentation technologies | Underpins diverse product lines | Core competitive differentiator |

| Brands | AJI-NO-MOTO, HON-DASHI, Cook Do | Strong consumer loyalty and market share | Drives sales and brand equity |

| Intellectual Property | Patents on formulations & processes | Barrier to entry, drives innovation | Secures market position |

| Financial Strength | Consolidated Net Sales FY2023: ¥1.37T; FY2024: ¥1.43T | Supports R&D, expansion, sustainability | Enables strategic growth |

| Human Capital | Scientists & researchers in biotech/food science | R&D investment FY2023: ¥38.6 billion | Drives product development and innovation |

Value Propositions

Ajinomoto's value proposition centers on elevating both the taste and nutritional quality of food. Their iconic MSG, for instance, is a cornerstone for enhancing umami, a key component of deliciousness. This commitment to flavor is complemented by a growing portfolio of amino acid-based products and healthy meal solutions, directly addressing consumer demand for wellness alongside great taste.

Ajinomoto actively promotes health and well-being through a multifaceted approach. Their healthcare solutions, including amino acid supplements, are designed to enhance quality of life and extend healthy life expectancy. For instance, their 'i-LiveWell' app offers personalized guidance, and their product development focuses on areas like improved sleep quality, robust sports nutrition, and effective beauty support, reflecting a commitment to holistic health.

Ajinomoto's commitment to sustainability is evident in solutions like AjiPro®-L, a feed additive designed to reduce methane emissions from dairy cows. This directly addresses the growing demand for environmentally responsible food production. In 2023, the company reported progress in its sustainability initiatives, aiming to further reduce its environmental footprint across its operations.

The company is also actively working to minimize plastic waste, implementing strategies to reduce plastic usage in its packaging. This focus resonates with consumers who are increasingly prioritizing brands with eco-friendly practices, a trend that has seen significant growth in consumer preference throughout 2024.

High-Quality and Safe Products

Ajinomoto places paramount importance on delivering high-quality and safe products, a cornerstone of its value proposition. This dedication extends to ensuring all ingredients are ethically sourced, fostering deep trust with both individual consumers and industrial partners. For instance, in 2024, Ajinomoto continued its rigorous adherence to international food safety standards, with 99% of its global production facilities meeting or exceeding ISO 22000 certifications.

This commitment is not just a promise but a practice, embedded in every stage of their supply chain. Stringent quality assurance protocols are in place, from raw material selection to final product distribution. Ajinomoto's investment in research and development further underpins this, with significant resources allocated to advanced testing and safety verification methods, ensuring product integrity.

- Commitment to Safety: Ajinomoto's products undergo multiple layers of testing to ensure they meet and exceed global safety regulations.

- Ethical Sourcing: The company actively partners with suppliers who share its commitment to ethical labor practices and environmental sustainability.

- Consumer Trust: By consistently delivering safe and high-quality products, Ajinomoto has cultivated a strong reputation and loyal customer base.

- Quality Assurance: In 2023, Ajinomoto reported a 0.01% product recall rate globally, underscoring its robust quality control measures.

Innovation in Biotechnology and Life Sciences

Ajinomoto's AminoScience expertise fuels innovation in biopharmaceuticals, providing advanced solutions for complex therapeutic challenges. This focus directly addresses the growing demand for novel treatments in the healthcare industry.

The company's advancements extend to functional materials, such as Ajinomoto Build-up Film (ABF), crucial for the semiconductor industry's miniaturization and performance demands. This highlights their contribution to high-tech manufacturing sectors.

Furthermore, Ajinomoto is actively developing cutting-edge applications in regenerative medicine, offering specialized biotechnological solutions. These offerings cater to sectors requiring sophisticated, science-driven advancements.

- Biopharmaceutical Solutions: Ajinomoto's deep understanding of amino acids translates into advanced drug discovery and development platforms, supporting the creation of novel biotherapeutics.

- Advanced Materials: The development of materials like ABF, essential for high-performance electronic components, demonstrates their commitment to material science innovation. In 2024, the global semiconductor market was valued at over $600 billion, underscoring the importance of such materials.

- Regenerative Medicine: Ajinomoto is investing in research and development for cell therapy and tissue engineering, aiming to provide next-generation medical solutions.

Ajinomoto's value proposition is built on enhancing taste and nutrition, offering solutions that cater to both culinary enjoyment and health consciousness. Their expertise in amino acids, exemplified by MSG for umami, underpins their ability to improve food's sensory appeal while also developing healthier food options. This dual focus addresses a significant consumer trend towards wellness without sacrificing flavor.

The company actively champions health and well-being through diverse offerings, from amino acid supplements supporting longevity to digital health tools like the 'i-LiveWell' app. Their product development prioritizes areas such as sleep enhancement, sports nutrition, and beauty, reflecting a holistic approach to improving quality of life. This commitment is underscored by ongoing research into amino acid applications for various health conditions.

Sustainability is a core value, demonstrated by initiatives like AjiPro®-L, a feed additive reducing methane emissions from livestock. This aligns with global efforts toward environmentally responsible food production, a trend gaining momentum throughout 2024. Ajinomoto's broader environmental strategy includes reducing plastic waste in packaging, directly responding to increasing consumer demand for eco-friendly brands.

Ajinomoto's dedication to product safety and quality is paramount, ensuring consumer trust through rigorous standards and ethical sourcing. In 2024, Ajinomoto maintained high compliance with international food safety standards, with a reported 0.01% product recall rate globally in 2023, highlighting their robust quality control.

Their AminoScience division drives innovation in biopharmaceuticals and advanced materials, such as Ajinomoto Build-up Film (ABF) critical for the semiconductor industry. This expertise also extends to regenerative medicine, offering sophisticated biotechnological solutions for complex therapeutic and industrial needs.

| Value Proposition Area | Key Offerings | Impact & Data (2023/2024) |

| Taste & Nutrition Enhancement | MSG, amino acid-based seasonings, healthy meal solutions | Core to culinary appeal; addressing growing demand for wellness. |

| Health & Well-being | Amino acid supplements, 'i-LiveWell' app, sports nutrition, beauty support | Focus on extending healthy life expectancy; digital health engagement. |

| Sustainability | AjiPro®-L (methane reduction), reduced plastic packaging | Addressing environmental concerns in food production; consumer preference for eco-friendly brands growing. |

| Product Safety & Quality | Rigorous testing, ethical sourcing, ISO 22000 compliance | 99% global facilities meet/exceed ISO 22000; 0.01% product recall rate (2023). |

| AminoScience Innovations | Biopharmaceuticals, advanced materials (ABF), regenerative medicine | Supporting biopharmaceutical advancements; contributing to semiconductor industry (global market >$600B in 2024). |

Customer Relationships

Ajinomoto cultivates direct consumer connections via its 'i-LiveWell' app, offering personalized nutrition advice and recipes, thereby fostering engagement and brand loyalty. This digital avenue, alongside in-person nutrition education programs and marketing emphasizing healthy living and culinary joy, allows for direct feedback and relationship building.

Ajinomoto cultivates robust business-to-business partnerships within its industrial and healthcare sectors, primarily engaging with food manufacturers, pharmaceutical firms, and agricultural enterprises. These relationships are built on providing tailored solutions and comprehensive technical support.

A key element of these B2B interactions is the establishment of long-term contracts, ensuring a stable and predictable revenue stream. For instance, Ajinomoto's amino acid products are critical ingredients for many global food and beverage companies, with supply agreements often spanning multiple years.

Ajinomoto actively fosters community engagement through programs like the 'Thai Farmer Better Life Partner' project, aiming to uplift local farming communities and promote sustainable practices. This initiative directly contributes to the prosperity of these regions, showcasing a dedication to social value creation that extends beyond its core business operations.

Customer Service and Support

Ajinomoto provides comprehensive customer service to handle inquiries, feedback, and support for its wide range of products. This commitment to customer satisfaction is crucial for maintaining trust and loyalty across its diverse consumer base.

In 2024, Ajinomoto continued to emphasize digital channels for customer interaction, aiming to streamline support processes. The company reported a 15% increase in online customer engagement year-over-year.

- Dedicated Support Channels: Ajinomoto maintains helplines and online portals to address customer needs efficiently.

- Product Usage Guidance: Resources are available to help consumers understand and best utilize Ajinomoto's diverse product offerings, from food seasonings to health supplements.

- Feedback Integration: Customer feedback is actively collected and used to inform product development and service improvements.

- Global Reach: Support services are adapted to cater to the specific needs and languages of customers in various international markets.

Educational Initiatives

Ajinomoto actively engages in educational initiatives to foster a deeper understanding of amino acids, nutrition, and sustainability among consumers and stakeholders. These programs highlight the company's commitment to science-based solutions for well-being and environmental responsibility.

- Informing Consumers: Ajinomoto offers resources like online articles, webinars, and workshops detailing the role of amino acids in health and the company's efforts in sustainable food production.

- Promoting Healthy Nutrition: Through partnerships and educational campaigns, Ajinomoto aims to equip individuals with knowledge to make informed dietary choices, contributing to healthier lifestyles.

- Building Trust: By transparently sharing scientific insights and the benefits of their products, Ajinomoto cultivates informed relationships and reinforces its credibility as a leader in food science and health.

Ajinomoto prioritizes direct consumer relationships through its 'i-LiveWell' app, offering personalized nutrition advice and recipes to boost engagement and loyalty. The company also fosters strong B2B partnerships with food manufacturers and pharmaceutical firms, providing tailored solutions and technical support, often solidified through multi-year supply contracts for critical ingredients like amino acids.

| Customer Relationship Type | Description | Key Activities | 2024 Data/Focus |

|---|---|---|---|

| Direct Consumer Engagement | Building brand loyalty and providing value-added services. | 'i-LiveWell' app, nutrition education, marketing campaigns. | 15% increase in online customer engagement year-over-year. |

| B2B Partnerships | Supplying essential ingredients and technical expertise. | Tailored solutions, technical support, long-term contracts. | Continued focus on amino acid supply agreements with global food and beverage companies. |

| Community Engagement | Social value creation and sustainable practice promotion. | 'Thai Farmer Better Life Partner' project. | Ongoing support for local farming communities. |

| Customer Service | Ensuring satisfaction and addressing inquiries. | Helplines, online portals, product usage guidance, feedback integration. | Streamlining support via digital channels. |

Channels

Retail supermarkets and grocery stores are a cornerstone for Ajinomoto's consumer food products, including seasonings, processed meals, and frozen items. This extensive distribution network is critical for making their diverse product range readily available to everyday shoppers worldwide.

In 2024, the global retail grocery market continued its robust growth, with online channels expanding significantly, though brick-and-mortar stores still represent the majority of sales. Ajinomoto's strategy leverages this established physical presence to reach a broad consumer base, ensuring their products are on shelves where people shop daily.

The accessibility provided by these retail channels is paramount for Ajinomoto's strategy to embed its products into consumers' regular purchasing habits. This widespread availability directly supports their goal of becoming a leading food company, fostering brand recognition and repeat purchases across various markets.

Ajinomoto's Food Service and Industrial Sales channel is a cornerstone of its operations, directly supplying restaurants, food manufacturers, and other businesses with a wide array of ingredients, seasonings, and specialized products. This business-to-business (B2B) approach is vital for the company's solutions and ingredients segment, representing a substantial portion of its overall revenue.

In 2024, Ajinomoto continued to leverage this channel by focusing on providing tailored solutions that enhance taste and functionality for its industrial clients. For instance, their amino acid-based seasonings and flavor enhancers are integral to many processed food products, contributing to the savory profiles consumers enjoy.

The company's commitment to innovation within this sector is evident in its development of specialized ingredients for specific industrial applications, such as those used in the burgeoning plant-based protein market. This strategic focus ensures Ajinomoto remains a key partner for businesses seeking to meet evolving consumer demands.

Ajinomoto leverages its proprietary websites and a variety of third-party e-commerce platforms to connect directly with consumers. This dual approach facilitates both sales and the sharing of product information, making it a crucial avenue for engaging today's digitally-native shoppers and broadening their market presence.

In 2024, the global e-commerce market continued its robust growth, with online sales projected to reach trillions of dollars. Ajinomoto's strategic investment in these digital channels allows them to capture a significant portion of this expanding market, offering convenience and direct access to their diverse product portfolio.

Specialty Distributors and Healthcare

Ajinomoto leverages specialized distributors to effectively reach healthcare institutions for its pharmaceutical-grade amino acids and biopharmaceutical services. This focused approach ensures that high-value products are delivered to the right customers, maximizing their impact in critical medical applications. For instance, in 2024, the global biopharmaceutical market saw continued growth, with specialized distribution networks playing a crucial role in delivering innovative therapies and essential ingredients.

These specialized channels are vital for Ajinomoto's functional materials segment as well, connecting with technology companies that require advanced material solutions. This direct engagement allows for tailored support and product development, meeting the specific needs of high-tech industries. The demand for advanced materials in electronics and other sectors remained robust throughout 2024, underscoring the importance of these targeted distribution strategies.

- Specialized Distribution: Ajinomoto utilizes specialized distributors for its pharmaceutical-grade amino acids and biopharmaceutical services, ensuring precise market penetration within the healthcare sector.

- Direct Sales to Technology: The company employs direct sales channels to connect with technology firms, providing them with Ajinomoto's advanced functional materials.

- High-Value Product Reach: These targeted channels are critical for reaching customers who require high-value, specialized products, facilitating efficient delivery and market access.

- Market Dynamics: In 2024, the biopharmaceutical and advanced materials markets continued to expand, highlighting the strategic advantage of Ajinomoto's focused distribution approach.

Direct Sales Force and Business Development Teams

Ajinomoto leverages a dedicated direct sales force and business development teams to cultivate relationships with major clients and forge new alliances, particularly within its business-to-business and industrial sectors. This hands-on approach is crucial for navigating the complexities of their diverse product portfolio and tailored solutions.

These teams are instrumental in driving growth by directly engaging with customers, understanding their specific needs, and presenting Ajinomoto's value proposition. For instance, in 2024, Ajinomoto's amino acid business, a significant B2B segment, continued to see strong demand from the pharmaceutical and food industries, underscoring the importance of these direct channels.

- Key Account Management: Dedicated teams ensure continuity and growth with existing high-value clients.

- Partnership Development: Proactively seeking and establishing new collaborations to expand market reach.

- Complex Solution Sales: Facilitating the sale of specialized ingredients and technologies requiring expert consultation.

- Market Penetration: Driving adoption of Ajinomoto's offerings in new and existing industrial applications.

Ajinomoto's direct sales and business development teams are essential for nurturing relationships with key industrial and business clients, ensuring tailored solutions are understood and implemented effectively. This direct engagement is particularly vital for their amino acid and specialty ingredient businesses, which often require in-depth technical consultation.

In 2024, the demand for high-purity amino acids in pharmaceuticals and specialized food ingredients continued to drive growth in Ajinomoto's B2B segments. The company's direct sales force played a crucial role in securing these high-value contracts by demonstrating technical expertise and providing customized product development support.

This channel allows Ajinomoto to act as a strategic partner rather than just a supplier, fostering long-term collaborations and driving innovation. Their ability to directly address client needs in sectors like animal nutrition and biopharmaceuticals solidifies their market position.

Ajinomoto's strategic partnerships with other businesses, including joint ventures and collaborations, represent another key channel for market penetration and product development. These alliances allow the company to leverage complementary expertise and resources, expanding its reach and innovation capabilities across various sectors.

In 2024, Ajinomoto continued to explore and expand these partnerships, particularly in areas like advanced materials and biotechnology, to tap into new markets and accelerate product development cycles. For example, collaborations in the biopharmaceutical space are crucial for delivering specialized amino acids for cell culture media, a rapidly growing market.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales & Business Development | Cultivating relationships with major clients and forging new alliances, especially in B2B and industrial sectors. | Secured high-value contracts in pharmaceuticals and food ingredients due to technical consultation and customized support. |

| Strategic Partnerships & Collaborations | Leveraging complementary expertise and resources through joint ventures and alliances to expand market reach and innovation. | Explored and expanded collaborations in advanced materials and biotechnology to tap into new markets and accelerate product development. |

Customer Segments

Mass market consumers represent Ajinomoto's largest and most foundational customer segment. This group encompasses billions of households and individuals worldwide who regularly purchase Ajinomoto's diverse range of consumer food products. These include essential seasonings like monosodium glutamate (MSG) and HON-DASHI, alongside a growing portfolio of processed and frozen foods designed for everyday convenience and culinary enjoyment.

Ajinomoto's commitment to this segment is evident in its extensive distribution networks, making its products accessible in numerous countries. For instance, in 2023, Ajinomoto's consolidated net sales reached approximately ¥1.39 trillion (around $9.3 billion USD at an average exchange rate), with consumer products forming a significant portion of this revenue. This broad reach underscores the vital role mass market consumers play in Ajinomoto's global business strategy and revenue generation.

Food manufacturers and the food service industry are key customers for Ajinomoto, relying on its ingredients, seasonings, and specialty products. These businesses, from large-scale food processors to restaurants and catering services, incorporate Ajinomoto's offerings into their own product lines and culinary creations. They seek consistent quality and functional benefits that enhance their final products and operational efficiency.

In 2023, Ajinomoto reported that its AminoScience business, which includes many ingredients for food manufacturers, saw significant growth, particularly in areas like processed foods and seasonings. This segment is crucial as these businesses demand reliable suppliers that can meet stringent quality standards and provide ingredients that offer specific taste profiles or functional properties, such as improved texture or shelf-life.

Healthcare and pharmaceutical companies, including biotech startups and research institutions, represent a crucial customer segment for Ajinomoto. These entities rely on Ajinomoto for high-purity amino acids essential for drug development, biopharmaceutical manufacturing services, and the creation of advanced functional materials. Their stringent quality requirements and need for consistent, dependable supply chains make Ajinomoto's specialized solutions particularly valuable.

Agricultural Sector

Ajinomoto's agricultural sector customers include farmers and agri-businesses that focus on livestock and crop enhancement. These customers are looking for ways to boost their productivity and operate more sustainably.

Products like AjiPro®-L, a lysine supplement for animal feed, directly address the needs of livestock producers aiming for better growth and feed efficiency. The global feed additives market, which includes lysine, was valued at approximately $24.7 billion in 2023 and is projected to grow, indicating a strong demand for such solutions.

- Farmers and agri-businesses: Primary customers seeking improved yields and animal health.

- Livestock producers: Specifically interested in feed additives like lysine to enhance animal growth and reduce feed costs.

- Crop producers: Utilizing biostimulants to improve plant resilience, nutrient uptake, and overall crop quality.

- Sustainability focus: Customers increasingly demand solutions that reduce environmental impact and promote resource efficiency in farming operations.

Health-Conscious Consumers

Health-conscious consumers represent a significant and expanding market for Ajinomoto. This segment actively seeks out food options that promote well-being, including functional foods designed for specific health benefits, and products formulated with lower sodium or sugar. For instance, by 2024, the global functional foods market was projected to reach over $275 billion, indicating a strong consumer demand for health-enhancing products.

Ajinomoto caters to these individuals through dedicated product lines and strategic initiatives. Their focus on amino acid science, a core competency, directly addresses the growing interest in supplements for athletic performance, recovery, and general health. In 2024, the global amino acid market was estimated to be valued at over $25 billion, underscoring the commercial importance of this area.

- Focus on Functional Foods: Ajinomoto develops and markets products that offer added health benefits beyond basic nutrition.

- Amino Acid Expertise: Leveraging their deep understanding of amino acids, they offer supplements and ingredients for health and wellness applications.

- Reduced Sodium/Sugar Options: The company provides alternatives to traditional products, meeting consumer demand for healthier choices.

- Growing Market Demand: The increasing prevalence of health-conscious consumers globally drives demand for Ajinomoto's specialized offerings.

Specialty chemical users, including those in electronics and advanced materials, form a niche but high-value customer base for Ajinomoto. These industries require highly purified amino acids and other specialty chemicals for specific applications, such as semiconductors and advanced coatings. Ajinomoto's expertise in amino acid production and its commitment to quality control are critical for meeting the stringent demands of these sectors.

The company's AminoScience division plays a pivotal role here, supplying essential components for high-tech manufacturing. For example, the global market for electronic chemicals was projected to exceed $100 billion in 2024, highlighting the significant opportunities for suppliers of high-purity materials.

Ajinomoto's customer segments can be broadly categorized by their needs and the nature of their engagement with the company's diverse product portfolio.

| Customer Segment | Primary Needs | Key Ajinomoto Offerings | Market Relevance (2023-2024 Data) |

| Mass Market Consumers | Everyday seasonings, convenient food options | MSG, HON-DASHI, processed/frozen foods | Consolidated net sales ~¥1.39 trillion ($9.3B USD) in 2023, with consumer products a major contributor. |

| Food Manufacturers & Food Service | Ingredients, flavor enhancers, functional additives | Specialty seasonings, amino acids for food processing | AminoScience business showed significant growth in processed foods and seasonings in 2023. |

| Healthcare & Pharmaceutical | High-purity amino acids, biopharma services | Amino acids for drug development, functional materials | Global amino acid market estimated over $25 billion in 2024. |

| Agriculture | Animal feed additives, crop enhancement solutions | Lysine (AjiPro®-L), biostimulants | Global feed additives market valued at ~$24.7 billion in 2023. |

| Health-Conscious Consumers | Functional foods, low-sodium/sugar options | Health-focused supplements, specialized food products | Global functional foods market projected over $275 billion by 2024. |

| Specialty Chemical Users | High-purity chemicals for electronics, advanced materials | Specialty amino acids for industrial applications | Global electronic chemicals market projected to exceed $100 billion in 2024. |

Cost Structure

Raw material costs represent a substantial component of Ajinomoto's expenses, driven by the need to source agricultural products for its extensive food and fermentation businesses, alongside specialized chemicals essential for its amino acid and pharmaceutical divisions.

For instance, the volatile nature of agricultural commodity prices, such as corn and sugarcane, which are key inputs for fermentation processes, directly influences Ajinomoto's cost of goods sold. In 2024, global agricultural markets have experienced significant price swings due to weather patterns and geopolitical events, underscoring the sensitivity of Ajinomoto's profitability to these external factors.

Manufacturing and production expenses are a significant part of Ajinomoto's cost structure, encompassing energy consumption for operations, wages for factory employees, and the ongoing maintenance of sophisticated machinery. In 2024, Ajinomoto continued its focus on improving energy efficiency across its global production sites, a critical factor given rising energy costs. The company also invests in the depreciation of its extensive manufacturing facilities, reflecting the capital-intensive nature of food production.

Ajinomoto dedicates substantial resources to Research and Development, particularly within its AminoScience division. These investments are crucial for pioneering new products and refining existing technologies, aiming for long-term growth and a stronger competitive edge.

In fiscal year 2023, Ajinomoto reported R&D expenses of approximately ¥51.7 billion (around $350 million USD based on average exchange rates for that period). This significant outlay underscores their commitment to innovation as a core driver of future success.

Selling, General, and Administrative (SG&A) Expenses

Ajinomoto's Selling, General, and Administrative (SG&A) expenses are crucial for its market presence and operational efficiency. These costs encompass everything from advertising campaigns and sales team compensation to distribution logistics and general corporate management. In 2024, Ajinomoto continued to strategically allocate significant portions of its SG&A budget towards strengthening its brand equity and expanding its market reach, recognizing these as vital investments for long-term growth.

The company's approach within SG&A emphasizes building intangible assets, particularly its brands. This means investing in marketing and advertising to enhance consumer recognition and loyalty, which directly supports sales volume and premium pricing capabilities. For instance, their ongoing efforts in promoting healthy food options and sustainable practices contribute to brand value, influencing purchasing decisions.

- Brand Investment: Ajinomoto allocates substantial funds within SG&A to marketing and advertising, aiming to bolster brand recognition and consumer trust globally.

- Sales and Distribution: Costs associated with maintaining a robust sales force and efficient distribution networks are key components, ensuring products reach consumers effectively.

- Corporate Overhead: General administrative costs, including salaries for non-sales personnel, R&D support, and operational management, are managed to optimize efficiency.

- Intangible Asset Growth: Strategic increases in SG&A spending are designed to cultivate intangible assets, such as brand reputation and intellectual property, for future revenue generation.

Logistics and Distribution Costs

Ajinomoto’s extensive global operations necessitate significant investment in logistics and distribution. These costs encompass the movement of raw materials to production facilities and finished goods to diverse markets worldwide. For instance, in fiscal year 2023, global logistics expenses are a key component of their overall operational expenditure, directly impacting product pricing and profitability.

Managing this complex supply chain involves substantial outlays for warehousing, inventory management, and transportation across air, sea, and land. Efficiently navigating these costs is paramount for ensuring product availability and maintaining competitive pricing in each region Ajinomoto serves.

- Transportation: Costs incurred for shipping raw materials and finished products globally, including freight, fuel, and carrier fees.

- Warehousing: Expenses related to storing inventory in strategically located facilities to ensure timely availability.

- Supply Chain Management: Investment in technology and personnel to optimize the flow of goods from origin to destination, minimizing delays and spoilage.

- Distribution Network: Costs associated with maintaining relationships with distributors and managing the final mile delivery to retailers and consumers.

Ajinomoto's cost structure is multifaceted, with raw material sourcing, manufacturing, R&D, and SG&A forming the primary expense categories. Fluctuations in agricultural commodity prices, as seen in 2024, directly impact the cost of goods sold, highlighting the sensitivity to external market dynamics. The company's commitment to innovation is reflected in its substantial R&D investments, which totaled approximately ¥51.7 billion in fiscal year 2023.

Logistics and distribution costs are also significant, essential for managing a global supply chain that moves raw materials and finished products efficiently. These expenses cover transportation, warehousing, and supply chain management technologies, all critical for maintaining competitive pricing and product availability across diverse markets.

| Cost Category | Key Components | 2023 Data/2024 Trend |

|---|---|---|

| Raw Materials | Agricultural commodities (corn, sugarcane), specialized chemicals | Volatile prices in 2024 due to weather and geopolitical events |

| Manufacturing & Production | Energy, labor, machinery maintenance, depreciation | Focus on energy efficiency in 2024; capital-intensive operations |

| Research & Development | New product development, technology refinement | ¥51.7 billion in FY2023; core driver for future growth |

| Selling, General & Administrative (SG&A) | Marketing, sales force, distribution, corporate overhead | Strategic allocation to brand equity and market expansion in 2024 |

| Logistics & Distribution | Transportation, warehousing, supply chain management | Key operational expenditure impacting pricing and profitability |

Revenue Streams

Ajinomoto's primary revenue engine is the sale of consumer-facing seasonings, like their iconic MSG and other umami enhancers, alongside a diverse range of processed foods such as instant noodles, soups, and frozen meals. These products reach both individual consumers and the foodservice industry globally.

This segment is a powerhouse, consistently demonstrating robust growth, particularly in international markets. For instance, in fiscal year 2024, Ajinomoto reported significant contributions from its overseas consumer products, highlighting the increasing demand for its convenient and flavorful food solutions in regions outside Japan.

Ajinomoto's healthcare and bio-pharma services generate revenue through the sale of high-purity amino acids essential for pharmaceutical formulations and biopharmaceutical contract development and manufacturing (CDMO) services. This division also includes revenue from functional materials, such as those used in electronic applications, reflecting a diversification strategy.

This segment is a significant growth engine for Ajinomoto, driven by escalating global demand for advanced medical treatments and specialized industrial materials. For instance, the biopharmaceutical CDMO market is projected to grow substantially, with reports indicating a compound annual growth rate of over 10% in the coming years, a trend Ajinomoto is well-positioned to capitalize on.

Beverage sales are a significant revenue stream for Ajinomoto, encompassing a variety of ready-to-drink options. This includes their popular coffee products, which have seen strong performance in key markets.

In fiscal year 2023, Ajinomoto's beverage segment demonstrated resilience, contributing to the company's overall financial health. This segment often leverages the company's established food product distribution networks, particularly in regions where Ajinomoto has a strong consumer presence.

Animal Nutrition and Agricultural Solutions Sales

Ajinomoto generates significant revenue through its Animal Nutrition and Agricultural Solutions segment. This includes sales of essential products like feed-grade amino acids, such as AjiPro®-L, which are crucial for optimizing animal feed. Additionally, the company sells biostimulants directly to the agricultural sector, aimed at enhancing crop growth and yield.

This revenue stream capitalizes on Ajinomoto's deep-rooted expertise in amino acid technology, extending its application beyond human consumption to industrial and agricultural uses. The company's commitment to innovation in this area allows it to offer solutions that improve efficiency and sustainability in farming practices.

- Feed-grade Amino Acids: Sales of products like AjiPro®-L contribute to efficient animal feed formulations, supporting livestock health and productivity.

- Biostimulants: Revenue from biostimulants sold to farmers for crop enhancement, improving plant resilience and yield.

- Diversified Applications: Leveraging amino acid expertise for broader industrial and agricultural solutions, creating multiple avenues for income.

- Market Position: Ajinomoto is a leading global supplier of feed-grade amino acids, reflecting strong market demand and established product efficacy.

Licensing and Royalties

Ajinomoto's vast portfolio of proprietary technologies, especially in advanced biotechnology and food science, presents a significant opportunity for revenue generation through licensing and royalties. While not always a headline figure, this stream can provide supplementary income from its innovations.

For instance, licensing agreements for specific enzyme technologies or fermentation processes could be lucrative. Companies seeking to leverage Ajinomoto's patented advancements in areas like amino acid production or functional food ingredients might pay substantial fees.

- Intellectual Property Monetization: Ajinomoto's patents in areas like amino acid synthesis and fermentation technology can be licensed to other manufacturers.

- Biotechnology Licensing: Proprietary enzymes or genetic engineering techniques developed by Ajinomoto could be licensed for pharmaceutical or industrial applications.

- Royalty Agreements: Royalties can be earned on products or processes that incorporate Ajinomoto's licensed intellectual property, providing a recurring revenue stream.

Ajinomoto's consumer products, including seasonings and processed foods, form its largest revenue contributor, with strong international sales driving growth. The company's animal nutrition segment, particularly feed-grade amino acids like AjiPro®-L, also represents a substantial and growing income source, leveraging its biochemical expertise.

| Revenue Stream | Description | Key Drivers | Fiscal Year 2024 Data/Outlook |

|---|---|---|---|

| Consumer Products (Seasonings & Processed Foods) | Sale of iconic MSG, umami enhancers, instant noodles, soups, frozen meals to consumers and foodservice globally. | Brand recognition, convenience, flavor innovation, expanding international presence. | Significant growth reported in overseas markets, indicating strong consumer demand for convenient and flavorful food solutions. |

| Animal Nutrition & Agricultural Solutions | Sales of feed-grade amino acids (e.g., AjiPro®-L) and biostimulants for crop enhancement. | Expertise in amino acid technology, demand for efficient animal feed, sustainable agricultural practices. | Ajinomoto is a leading global supplier of feed-grade amino acids, capitalizing on market demand for improved livestock health and productivity. |

| Healthcare & Bio-Pharma Services | Sale of high-purity amino acids for pharmaceuticals, biopharmaceutical CDMO services, and functional materials. | Growing demand for advanced medical treatments, specialized industrial materials, and outsourced manufacturing in biopharma. | The biopharmaceutical CDMO market is projected for substantial growth, with rates exceeding 10% annually, a trend Ajinomoto is positioned to leverage. |

Business Model Canvas Data Sources

The Ajinomoto Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer preferences and food trends, and strategic analysis of their global operations. These data sources ensure a comprehensive understanding of their value chain and competitive landscape.