Ajinomoto Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ajinomoto Bundle

Ajinomoto navigates a competitive landscape shaped by powerful buyer influences and the constant threat of substitutes, particularly in the food and amino acid sectors. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Ajinomoto’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ajinomoto's reliance on specific agricultural commodities and chemicals for products like amino acids and seasonings means that if a few suppliers control these essential inputs, their bargaining power grows significantly. This concentration can force Ajinomoto to accept higher prices for raw materials, directly impacting its profitability.

For instance, the global market for certain amino acids, crucial for Ajinomoto's food and pharmaceutical ingredients, is characterized by a limited number of large-scale producers. This limited supplier base gives these producers considerable leverage in setting prices, potentially increasing Ajinomoto's cost of goods sold.

However, Ajinomoto mitigates this risk through its own large-scale production of key seasoning ingredients. This internal sourcing capability helps to lower overall sourcing costs and provides a degree of insulation from external supplier price hikes, demonstrating a strategic move to enhance its own bargaining power.

Ajinomoto's proprietary amino acid technologies may necessitate specialized inputs or processes, potentially sourced from a restricted number of suppliers. For example, suppliers of unique enzymes or fermentation ingredients would likely wield greater bargaining power due to the scarcity of viable alternatives.

Ajinomoto's strategic investment in bio-refinery platforms, designed to transform agricultural residues into amino acids, aims to mitigate its dependence on external suppliers. This vertical integration could bolster its negotiating position with existing input providers.

Switching suppliers for Ajinomoto's specialized ingredients or bulk commodities can incur substantial costs. These include expenses related to re-testing products, obtaining new certifications, and modifying existing production lines and processes to accommodate alternative inputs.

These elevated switching costs inherently limit Ajinomoto's flexibility in changing suppliers, which in turn strengthens the bargaining power of its current suppliers. For instance, if a key amino acid supplier has a highly integrated production process, it becomes more difficult and costly for Ajinomoto to find and transition to a comparable alternative.

Furthermore, the prevalence of long-term supply agreements and deeply embedded supply chain relationships, common among major players in the amino acid market, further solidifies supplier power. These arrangements can create significant barriers to entry for new suppliers and lock Ajinomoto into existing relationships, even if market conditions might otherwise favor a change.

Threat of Forward Integration by Suppliers

The threat of forward integration by Ajinomoto's suppliers is a crucial aspect of their bargaining power. If key suppliers, particularly those in specialized chemical or biotech input markets, possess the capability or incentive to move into Ajinomoto's core business, such as producing their own amino acids or food ingredients, their leverage would significantly increase. This potential for suppliers to become direct competitors necessitates Ajinomoto maintaining strong, favorable relationships and offering competitive terms to mitigate this risk.

For instance, in the highly specialized market for certain fermentation-derived amino acids, a major supplier could potentially invest in downstream processing and formulation capabilities. Should such a supplier decide to integrate forward, they could bypass Ajinomoto's value chain, directly competing for customers. This scenario would dramatically shift the power dynamic, as Ajinomoto would then face a new competitor that already controls a vital input. Ajinomoto's reliance on specific, high-purity inputs makes this a tangible concern. For example, a significant portion of Ajinomoto's raw materials for MSG and other amino acids comes from agricultural products, but the processing and refinement involve specialized chemical expertise, making forward integration a plausible threat for advanced chemical producers.

- Supplier Capability: Suppliers in specialized chemical and biotech sectors may possess the technical expertise and capital to develop their own finished amino acid or food ingredient products.

- Market Incentive: If suppliers see higher profit margins in finished goods compared to raw materials, they are incentivized to integrate forward.

- Competitive Threat: Forward integration by suppliers would transform them into direct competitors, increasing pressure on Ajinomoto's market share and pricing.

- Strategic Response: Ajinomoto must foster strong supplier relationships and potentially secure long-term supply agreements to deter such integration.

Impact of Input Costs on Ajinomoto's Profitability

Fluctuations in the prices of essential raw materials, influenced by global commodity markets, geopolitical events, or climate change, directly impact Ajinomoto's cost of goods sold. Suppliers can exert power by passing on these increased costs, which Ajinomoto may struggle to fully absorb or pass on to its customers, affecting profit margins.

Ajinomoto's financial reports for FY2024 and Q4 2025 indicate challenges with rising input costs, particularly in its healthcare and coffee businesses. For instance, the company noted increased raw material expenses in its fiscal year ending March 2024, contributing to margin pressures in certain segments.

- Rising commodity prices: Global supply chain disruptions and weather patterns in 2024 led to higher costs for key ingredients used by Ajinomoto.

- Geopolitical instability: Events impacting major agricultural regions in 2024 and early 2025 increased the volatility of raw material pricing.

- Supplier concentration: In specific product lines, a limited number of suppliers for critical components can amplify their bargaining power.

The bargaining power of Ajinomoto's suppliers is a significant force, particularly for specialized inputs. When few suppliers can provide essential, high-purity ingredients, their ability to dictate terms and prices increases, impacting Ajinomoto's cost structure.

Ajinomoto's own large-scale production of certain key ingredients, like those for seasonings, helps to offset this by reducing reliance on external sources and lowering overall sourcing costs.

The threat of suppliers integrating forward into Ajinomoto's business, especially in niche biotech markets, represents a substantial risk, potentially turning suppliers into direct competitors.

For example, in FY2024, Ajinomoto faced increased raw material expenses, contributing to margin pressures in segments like healthcare, underscoring the impact of supplier pricing power.

| Factor | Impact on Ajinomoto | Example/Data (FY2024/Q4 2025) |

|---|---|---|

| Supplier Concentration | Increased pricing leverage for suppliers | Limited producers for specialized amino acids |

| Switching Costs | Reduced flexibility for Ajinomoto | Expenses for re-testing, certifications, process modification |

| Forward Integration Threat | Potential for suppliers to become competitors | Suppliers in biotech could develop finished amino acid products |

| Input Cost Volatility | Pressure on profit margins | Reported increased raw material expenses in FY2024 |

What is included in the product

Uncovers the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants and substitutes within Ajinomoto's global food and amino acid industries.

Easily identify and address competitive threats with visual representations of Ajinomoto's market position.

Customers Bargaining Power

Ajinomoto's customer base is incredibly diverse, encompassing everyone from households picking up their favorite seasonings to major pharmaceutical companies relying on their high-purity amino acids. This broad reach means the bargaining power isn't uniform across the board.

Large industrial clients, like food manufacturers or pharmaceutical firms, often wield significant power due to the sheer volume of their purchases, potentially negotiating better terms. For instance, a major food producer might represent a substantial portion of Ajinomoto's amino acid sales, giving them considerable leverage.

Conversely, individual consumers buying Ajinomoto products in retail stores have very little individual bargaining power. However, their collective purchasing decisions and preferences significantly shape market demand and product development, indirectly influencing Ajinomoto's strategies.

Customers in the food industry, especially for everyday items like seasonings and processed foods, often watch their spending closely. This price sensitivity is amplified when many companies are vying for the same market share, which can sometimes lead to price competition.

While Ajinomoto benefits from a strong brand and some customers who prefer its higher-quality products, the competitive landscape means it can't always ignore price. For instance, in 2023, Ajinomoto Co. Inc. did implement price hikes on certain consumer products to help offset rising ingredient and energy costs, showing they do have some ability to adjust prices, but also acknowledging the market's influence.

Business clients, like restaurants or food manufacturers, are generally less bothered by minor price fluctuations. However, they will carefully compare bulk pricing and actively seek out the best deals from various suppliers.

The vast array of competing brands and private label options in the consumer food market significantly enhances customer bargaining power. For industrial clients, the availability of alternative ingredients further strengthens their position, making it easier for them to switch suppliers if dissatisfied with Ajinomoto's offerings.

This ease of switching reduces customer loyalty based solely on product features, compelling Ajinomoto to prioritize continuous innovation and product differentiation to retain its customer base. For instance, in 2024, the global food and beverage market saw intense competition, with private label brands capturing an increasing market share in many regions, putting pressure on established players like Ajinomoto.

However, for highly specialized amino acids used in niche industrial applications, the availability of substitutes is considerably lower. This scarcity grants Ajinomoto more leverage with these specific customer segments, allowing for potentially stronger pricing power and reduced sensitivity to competitive pressures.

Switching Costs for Customers

For everyday consumers, the cost of switching between food brands like those offered by Ajinomoto is typically minimal. It's as simple as picking a different product off the shelf, meaning their power to demand lower prices or better terms is relatively high.

However, for Ajinomoto's business clients who incorporate specialized ingredients, such as amino acids, into their own products, the situation changes. The process of switching suppliers involves significant hurdles.

- Re-formulation: Changing an ingredient often requires extensive testing and adjustments to existing product recipes.

- Regulatory Approvals: New ingredients may need to go through lengthy and costly approval processes with food safety authorities.

- Supply Chain Integration: Businesses must reconfigure their supply chains to accommodate new suppliers, including logistics and quality control measures.

These substantial switching costs for industrial customers effectively dampen their bargaining power, allowing Ajinomoto to maintain more favorable terms and pricing for these B2B relationships.

Customer Information and Transparency

The increasing availability of pricing and product details through digital channels significantly boosts customer bargaining power. This transparency allows both individual consumers and business clients to easily compare offerings, pushing Ajinomoto to maintain competitive pricing and clearly articulate its distinct advantages. For instance, in 2024, the global e-commerce market saw continued growth, with online retail sales projected to reach trillions, underscoring the impact of digital transparency on consumer choices.

Ajinomoto's strategic initiatives, like its collaboration with Top4 Technology + Marketing, are designed to strengthen its digital footprint and foster direct engagement with customers. This focus on digital connection is crucial for managing customer expectations and effectively communicating value in a transparent market. Such partnerships can help Ajinomoto leverage data to understand customer needs better, a key factor in navigating increased customer power.

- Enhanced Information Access: Digital platforms and comparison tools in 2024 provide customers with unprecedented access to pricing and product specifications, enabling informed purchasing decisions.

- Pricing Pressure: This transparency directly translates into increased pressure on Ajinomoto to offer competitive pricing and differentiate its products based on unique value propositions.

- Digital Engagement Strategies: Partnerships aimed at improving digital presence, such as those involving technology and marketing firms, are vital for Ajinomoto to connect with and influence customers in this transparent environment.

Ajinomoto faces varying levels of customer bargaining power depending on the segment. Individual consumers have low individual power but collective influence, while large industrial clients wield significant leverage due to purchase volume, especially for standardized ingredients.

The widespread availability of competing brands and private labels in consumer markets, coupled with low switching costs for everyday items, amplifies customer power. For instance, in 2024, private label brands continued to gain market share globally, pressuring established players.

However, for specialized amino acids critical to industrial clients' formulations, switching costs are high, involving re-formulation, regulatory approvals, and supply chain adjustments, thereby reducing their bargaining power.

Increased digital transparency in 2024, with readily available pricing and product information online, empowers all customer segments, forcing Ajinomoto to focus on competitive pricing and value differentiation.

| Customer Segment | Bargaining Power Factors | Ajinomoto's Leverage |

|---|---|---|

| Individual Consumers | Low individual power, high collective influence, low switching costs | Brand loyalty, product differentiation |

| Large Industrial Clients (Standard Ingredients) | High volume purchases, price sensitivity, availability of alternatives | Strong brand, established relationships |

| Industrial Clients (Specialized Amino Acids) | High switching costs (re-formulation, regulatory), limited substitutes | Product quality, technical support, supply chain reliability |

Preview the Actual Deliverable

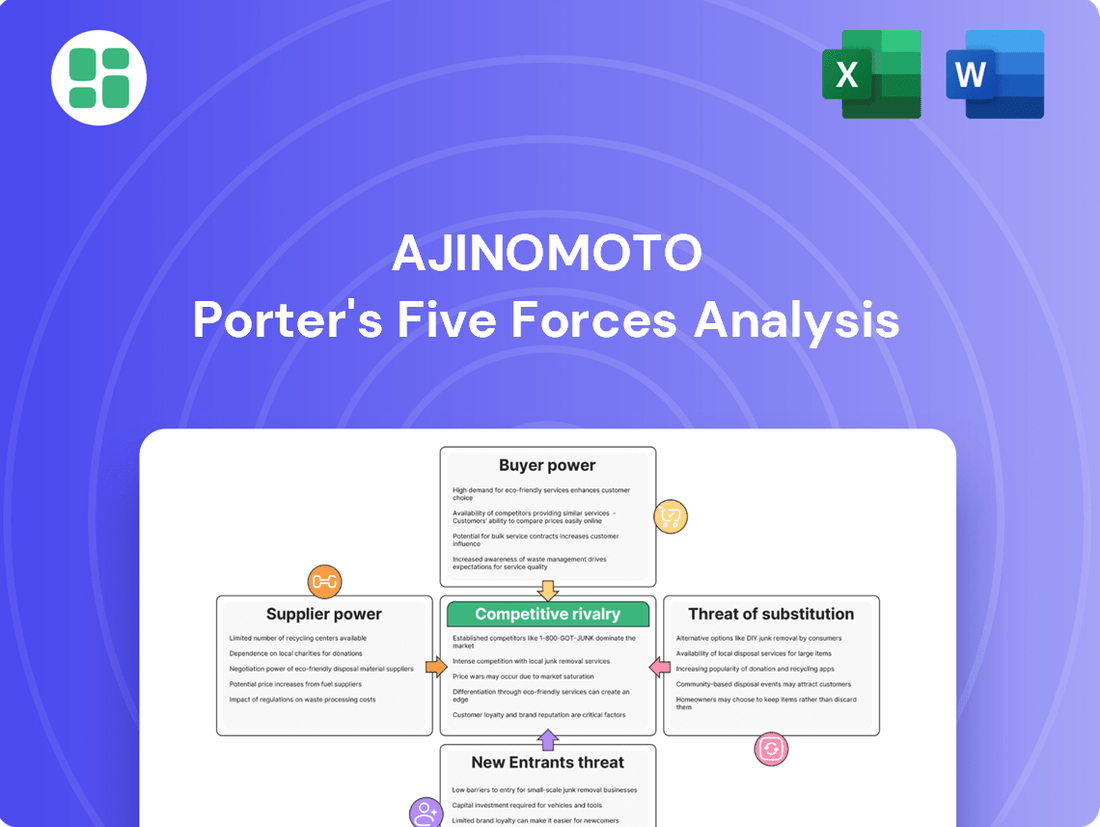

Ajinomoto Porter's Five Forces Analysis

This preview displays the complete Ajinomoto Porter's Five Forces Analysis, ensuring you receive the exact, professionally formatted document you see here immediately after purchase. You're looking at the actual, ready-to-use analysis, so there are no surprises or placeholders involved.

Rivalry Among Competitors

Ajinomoto navigates a landscape populated by a vast number of competitors, both large and small, across its varied business segments. In the competitive processed food and seasoning sectors, it contends with global giants like Nestlé and Unilever, alongside a multitude of regional and local brands, each vying for consumer attention and market share.

The amino acid market, a crucial area for Ajinomoto, is similarly intense, featuring major global players such as Evonik Industries and DSM. This diverse competitive set, encompassing multinational corporations and specialized regional firms, underscores the fragmented nature of the markets Ajinomoto operates within.

Competitive rivalry within Ajinomoto's operational landscape is a dynamic factor, heavily influenced by industry growth rates and market maturity. In established sectors, such as basic seasonings, where growth might be more subdued, companies often engage in more intense competition to capture existing market share. This can manifest as price wars or increased marketing efforts.

However, Ajinomoto also operates in burgeoning segments, like specialized amino acid applications and innovative health-focused food ingredients. These high-growth areas tend to attract new players, fueling a rivalry centered on innovation and technological advancement. For instance, the global food amino acids market is anticipated to expand at a compound annual growth rate of 6.27% between 2025 and 2032, signaling a promising yet competitive arena where differentiation is key.

Ajinomoto's strong brand recognition, built over decades, and its unique AminoScience platform allow it to differentiate products, particularly in specialized food and health segments, cultivating loyalty. For example, its commitment to quality and specific health benefits associated with its amino acid-based products helps it stand out.

However, in markets for more basic food ingredients, where products are less distinct, differentiation becomes harder, intensifying price competition. This means that in areas like MSG or basic seasonings, Ajinomoto faces rivals who can compete primarily on cost, impacting its pricing power.

To counter this, Ajinomoto invests heavily in continuous innovation and robust marketing campaigns. In 2023, the company reported significant R&D expenditure, a portion of which is dedicated to developing novel applications for its amino acid technologies, aiming to maintain perceived value and build stronger customer relationships against competitors.

High Fixed Costs and Exit Barriers

Industries like amino acid production and pharmaceuticals demand significant upfront investment in research and development, advanced manufacturing facilities, and strict regulatory adherence. These high fixed costs create a powerful incentive for companies to maintain high production levels, potentially leading to intense price competition when supply outstrips demand. For instance, the global amino acid market was valued at approximately USD 12.5 billion in 2023 and is projected to grow, underscoring the scale of investment required.

Furthermore, substantial exit barriers in these sectors, often stemming from highly specialized and costly assets, make it difficult for companies to leave the market. This reluctance to exit can prolong periods of intense rivalry, as firms are compelled to stay and compete rather than absorb significant losses from divesting specialized equipment or intellectual property.

- High Capital Investment: Amino acid and pharmaceutical sectors require significant capital for R&D, manufacturing, and compliance.

- Capacity Utilization Pressure: High fixed costs push companies to operate at full capacity, often resulting in aggressive pricing.

- Specialized Assets: The presence of specialized, difficult-to-repurpose assets increases exit barriers.

- Intensified Rivalry: Reluctance to exit due to high barriers exacerbates competitive pressures among existing players.

Strategic Objectives of Competitors

Ajinomoto faces intense competition from rivals with diverse strategic aims, including market share grabs and global expansion. For instance, competitors might prioritize cost leadership to undercut prices, while others focus on innovation and premium product offerings. This varied strategic landscape necessitates Ajinomoto to constantly adapt its own plans to stay ahead.

Understanding these differing objectives is crucial for Ajinomoto. If a competitor aims for aggressive market share growth, Ajinomoto might need to bolster its marketing efforts or introduce new product lines. Conversely, a competitor focused on niche markets might require a different response, perhaps through strategic alliances or by strengthening its own specialized offerings.

Ajinomoto's own strategic partnerships underscore its awareness of this dynamic competitive environment. Collaborations, such as those with Danone in the plant-based protein sector or with Shiru for fermentation technology, demonstrate a proactive approach. These moves aim to leverage external expertise and resources to address evolving market demands and counter competitive pressures effectively.

- Market Share Expansion: Competitors like Nestlé and Unilever often pursue aggressive growth strategies to increase their share in the global food and seasonings market, which was valued at approximately USD 650 billion in 2023 and is projected to grow.

- Cost Leadership: Private label manufacturers and regional players frequently adopt cost leadership strategies, leveraging economies of scale and efficient supply chains to offer lower-priced alternatives, impacting Ajinomoto's volume sales.

- Innovation and Product Differentiation: Companies focusing on health and wellness trends, such as those developing plant-based alternatives or functional foods, represent another competitive front, requiring Ajinomoto to invest in R&D.

- Global Dominance: Large multinational food corporations aim for broad geographic reach, creating a challenging environment for Ajinomoto's international expansion efforts.

Ajinomoto operates in a highly competitive arena with numerous players, from global food conglomerates like Nestlé and Unilever to specialized amino acid producers such as Evonik Industries and DSM. This broad spectrum of rivals, ranging from massive multinationals to agile regional firms, intensifies rivalry, particularly in mature markets where growth is slower.

In sectors like basic seasonings, competition often escalates to price wars or increased promotional activities as companies fight for existing market share. Conversely, in high-growth areas such as specialized amino acids and health-focused ingredients, rivalry centers on innovation and technological advancement. The global food amino acids market, for instance, is projected to grow at a CAGR of 6.27% between 2025 and 2032, highlighting the dynamic nature of these expanding segments.

Ajinomoto's strong brand equity and its unique AminoScience platform provide a competitive edge, enabling differentiation, especially in specialized food and health applications. However, in less differentiated product categories, cost leadership becomes a primary competitive strategy for rivals, putting pressure on Ajinomoto's pricing power.

The industry is characterized by high capital investment in R&D and manufacturing, coupled with significant exit barriers due to specialized assets. This combination incentivizes companies to maintain high production levels, often leading to aggressive pricing strategies when supply exceeds demand. The global amino acid market, valued at approximately USD 12.5 billion in 2023, exemplifies the scale of investment and the competitive pressures involved.

| Competitor Type | Strategic Focus | Impact on Ajinomoto |

|---|---|---|

| Global Food Giants (e.g., Nestlé, Unilever) | Market Share Expansion, Broad Geographic Reach | Intensified competition in established food and seasoning markets, challenges international expansion. |

| Specialized Amino Acid Producers (e.g., Evonik, DSM) | Innovation, Technological Advancement, Niche Markets | Rivalry in high-growth segments, requiring continuous R&D investment and product differentiation. |

| Regional & Local Brands | Cost Leadership, Price Competitiveness | Pressure on pricing power in less differentiated product categories, impacting volume sales. |

| Emerging Players (Health & Wellness Focus) | Product Differentiation, Health-Oriented Innovation | Demand for investment in new product development and marketing to capture evolving consumer preferences. |

SSubstitutes Threaten

For Ajinomoto's food products, consumers have a growing preference for fresh, unprocessed ingredients and home-cooked meals, directly competing with their seasoned products. Furthermore, the rise of diverse restaurant offerings and meal delivery services presents a substantial substitute, as seen in the global food service market's projected growth. For instance, the online food delivery market alone was valued at over $150 billion in 2023 and is expected to continue expanding, offering consumers convenient alternatives.

The attractiveness of substitutes for Ajinomoto's products hinges significantly on their price-performance trade-off. If alternative seasonings, flavor enhancers, or food ingredients offer comparable taste profiles or functional benefits at a notably lower price point, both individual consumers and industrial clients might be incentivized to switch. For instance, in 2024, the global spice and seasoning market saw increased competition from smaller, regional producers offering more budget-friendly options, putting pressure on established players like Ajinomoto.

Ajinomoto must consistently demonstrate the value proposition of its offerings to justify its pricing. This involves highlighting superior quality, enhanced convenience, or unique functional attributes that competitors may not provide. Failure to effectively communicate these benefits could lead to a gradual erosion of market share as price-sensitive segments opt for cheaper alternatives, especially in markets where consumers are highly attuned to cost savings.

Consumer shifts towards natural ingredients, clean labels, and personalized nutrition significantly boost the appeal of substitutes for processed foods and artificial additives. For instance, the global market for plant-based foods is projected to reach $162 billion by 2030, indicating a strong consumer preference for alternatives. This trend directly challenges products relying on artificial flavor enhancers or processed components.

Industrial buyers also contribute to this threat by actively seeking more cost-effective or environmentally sustainable ingredient options. As supply chain pressures and ESG (Environmental, Social, and Governance) considerations intensify, companies may pivot to suppliers offering more competitive pricing or demonstrably greener sourcing, impacting Ajinomoto's ingredient sales.

Ajinomoto's strategic emphasis on 'deliciousness and health,' coupled with innovations like AI-driven sweet protein development, directly addresses these evolving preferences. By aligning its product pipeline with consumer demand for healthier, more natural options, Ajinomoto aims to mitigate the risk of customers opting for substitutes.

Switching Costs for Buyers to Substitutes

For everyday consumers purchasing Ajinomoto's food products, the cost of switching to a substitute is remarkably low. It typically involves simply selecting a different brand or product from the supermarket aisle, with minimal financial or time investment. This ease of switching means consumers can readily explore alternatives if they perceive better value or different taste profiles.

However, for industrial clients, particularly those utilizing Ajinomoto's amino acids in their manufacturing processes, the switching costs can be substantial. Changing from a specific amino acid supplied by Ajinomoto to a substitute often necessitates significant investment in research and development to ensure compatibility and performance. Furthermore, re-formulating products and navigating the complexities of regulatory approvals can add considerable expense and time, creating a barrier to switching.

- Low Consumer Switching Costs: Retail customers can easily switch between Ajinomoto's food products and competitors with minimal effort or expense.

- High Industrial Switching Costs: Businesses relying on Ajinomoto's amino acids face considerable R&D, re-formulation, and regulatory hurdles when considering substitutes.

- Impact on Buyer Power: These varying switching costs directly influence the bargaining power of Ajinomoto's different customer segments.

Innovation in Substitute Products

Ongoing advancements in food technology, biotechnology, and health sciences constantly introduce novel and potentially superior substitute products. For instance, the burgeoning field of plant-based proteins and innovative fermentation techniques are creating viable alternatives to conventional ingredients, posing a significant threat.

Ajinomoto's proactive approach to research and development, with R&D spending consistently exceeding 2% of its sales, is crucial in anticipating and even shaping these emerging substitution trends. This investment allows the company to innovate and offer competitive solutions, mitigating the impact of external substitutes.

- Technological Advancements: Innovations in areas like cultured meat and precision fermentation can offer direct substitutes for animal-derived products, a key market for Ajinomoto.

- Consumer Preferences: Shifting consumer demand towards healthier, more sustainable, or plant-based options can accelerate the adoption of substitute products.

- Biotechnology Applications: Progress in genetic engineering and synthetic biology could lead to the creation of entirely new ingredients or food components that bypass traditional sourcing.

- Ajinomoto's R&D Focus: The company's commitment to R&D, evidenced by its consistent investment, aims to develop proprietary technologies and products that either preempt or directly compete with potential substitutes.

The threat of substitutes for Ajinomoto's products is significant, driven by evolving consumer preferences for natural ingredients and the convenience of alternatives like meal delivery services, which saw the global online food delivery market exceed $150 billion in 2023. Price-performance remains a key factor, with smaller producers offering budget-friendly seasonings in 2024, challenging established players. Ajinomoto's strategy of emphasizing health and innovation, such as AI-driven sweet protein development, aims to counter the growing appeal of plant-based foods, a market projected to reach $162 billion by 2030.

While retail consumers face minimal switching costs for food products, industrial clients using Ajinomoto's amino acids encounter substantial R&D, re-formulation, and regulatory expenses when considering alternatives. This disparity in switching costs significantly influences the bargaining power of Ajinomoto's customer segments. Technological advancements in food science, including plant-based proteins and fermentation, continuously introduce new substitutes, making Ajinomoto's consistent R&D investment, which exceeds 2% of sales, critical for staying competitive.

Entrants Threaten

Entering the diverse sectors Ajinomoto operates in, such as food processing, amino acids, and pharmaceuticals, demands significant capital. New players must invest heavily in state-of-the-art manufacturing plants, robust research and development capabilities, and extensive global distribution channels. For instance, establishing a pharmaceutical-grade amino acid production facility can easily run into hundreds of millions of dollars, creating a substantial hurdle.

Ajinomoto's robust portfolio of proprietary amino acid technologies, branded as AminoScience, coupled with a significant patent base, presents a substantial hurdle for potential new competitors. These patents, especially those covering specialized amino acid production and innovative applications like Ajinomoto Build-Up Film (ABF) substrates, necessitate considerable investment in research and development for any new entrant aiming to replicate or license such advanced capabilities.

The company's dominance in specific markets, such as its over 95% global market share for ABF materials, underscores the difficulty new entrants face in gaining traction. This market concentration, built on years of technological advancement and intellectual property protection, effectively deters new players from entering the specialized segments where Ajinomoto holds a strong competitive advantage.

Ajinomoto benefits from formidable brand loyalty, especially in its core product categories like seasonings. This deep-seated consumer trust, cultivated over many years, acts as a significant barrier. For instance, in 2024, Ajinomoto's umami seasonings remained a staple in households across Asia, contributing to a consistent demand that new brands struggle to disrupt.

Furthermore, Ajinomoto's established and expansive global distribution channels are a critical deterrent to new entrants. Replicating this intricate network, which ensures product availability and reach, requires substantial investment and time. By 2024, their presence in over 130 countries underscored the difficulty new companies face in achieving similar market penetration.

Regulatory Hurdles and Compliance Costs

The food and pharmaceutical sectors, where Ajinomoto operates, are heavily regulated. This means new companies must navigate complex rules for product safety, quality control, and accurate labeling. For instance, in 2024, companies seeking approval for new food additives in the United States faced an average review period that could extend for months, involving extensive data submission and safety assessments.

These stringent requirements translate into significant compliance costs and lengthy approval processes, acting as a substantial barrier for potential new entrants. These upfront investments in research, testing, and legal compliance can be prohibitive, especially for smaller startups.

Ajinomoto's extensive experience in managing these global regulatory landscapes provides a distinct competitive advantage. Having successfully navigated these challenges for decades, the company has established robust internal systems and expertise.

- Regulatory Compliance Costs: Companies entering the food industry in 2024 might spend upwards of $50,000 to $200,000 annually on compliance alone, depending on product complexity and market reach.

- Product Approval Timelines: The U.S. Food and Drug Administration (FDA) aims for a 150-day target for food additive petition reviews, but many can take longer, impacting market entry speed.

- Global Harmonization Challenges: Ajinomoto's ability to adapt products and processes to varying international regulations, such as differing standards in the EU versus ASEAN countries, highlights its preparedness.

Economies of Scale in Production and Purchasing

Ajinomoto leverages substantial economies of scale in both its production processes for amino acids and processed foods, and in its worldwide sourcing of raw materials. This scale allows the company to spread fixed costs over a larger output, leading to lower per-unit production expenses. For instance, Ajinomoto’s global production capacity for monosodium glutamate (MSG), a key product, is among the largest worldwide, enabling significant cost efficiencies.

These cost advantages make it exceedingly challenging for new competitors to enter the market and match Ajinomoto's pricing. New entrants typically begin with smaller production volumes, preventing them from achieving the same low per-unit costs. This cost barrier is a powerful deterrent, as it necessitates a substantial initial investment to reach a competitive scale.

- Significant cost advantage: Ajinomoto's large-scale operations result in lower per-unit costs, making price-based competition difficult for new entrants.

- Global procurement power: Bulk purchasing of raw materials worldwide further reduces Ajinomoto's input costs.

- Production efficiency: High-volume manufacturing of core products like amino acids leads to greater operational efficiency and cost savings.

- Barrier to entry: The initial capital required to achieve comparable economies of scale deters smaller, new companies.

The threat of new entrants for Ajinomoto is generally low due to several significant barriers. High capital requirements for advanced manufacturing and R&D, coupled with strong intellectual property and patents, make market entry costly and complex. Additionally, established brand loyalty and extensive global distribution networks further solidify Ajinomoto's position.

Navigating stringent regulatory environments in the food and pharmaceutical sectors also presents a substantial challenge, demanding significant investment in compliance and lengthy approval processes. These factors, combined with Ajinomoto's economies of scale in production and procurement, create a formidable deterrent for potential new competitors aiming to match its cost efficiencies and market presence.

| Barrier Type | Description | Impact on New Entrants | Example/Data (2024) |

|---|---|---|---|

| Capital Requirements | High investment needed for manufacturing, R&D, and distribution. | Substantial financial hurdle. | Pharmaceutical-grade amino acid facility: Hundreds of millions of dollars. |

| Intellectual Property & Technology | Proprietary technologies and patents (e.g., AminoScience, ABF). | Requires significant R&D investment to replicate or license. | Ajinomoto's >95% market share in ABF materials. |

| Brand Loyalty & Reputation | Deep-seated consumer trust in core products. | Difficult for new brands to gain traction. | Continued strong demand for Ajinomoto umami seasonings in Asian households. |

| Distribution Channels | Established and expansive global network. | Replication requires substantial investment and time. | Presence in over 130 countries by 2024. |

| Regulatory Hurdles | Complex rules for product safety, quality, and labeling. | Leads to high compliance costs and lengthy approval times. | FDA food additive review targets 150 days, but often exceeds it. |

| Economies of Scale | Cost efficiencies from large-scale production and sourcing. | New entrants struggle to match pricing due to lower volumes. | Largest global production capacity for MSG. |

Porter's Five Forces Analysis Data Sources

Our Ajinomoto Porter's Five Forces analysis is built upon a foundation of comprehensive data, drawing from company annual reports, financial statements, investor presentations, and industry-specific market research reports to capture competitive dynamics.