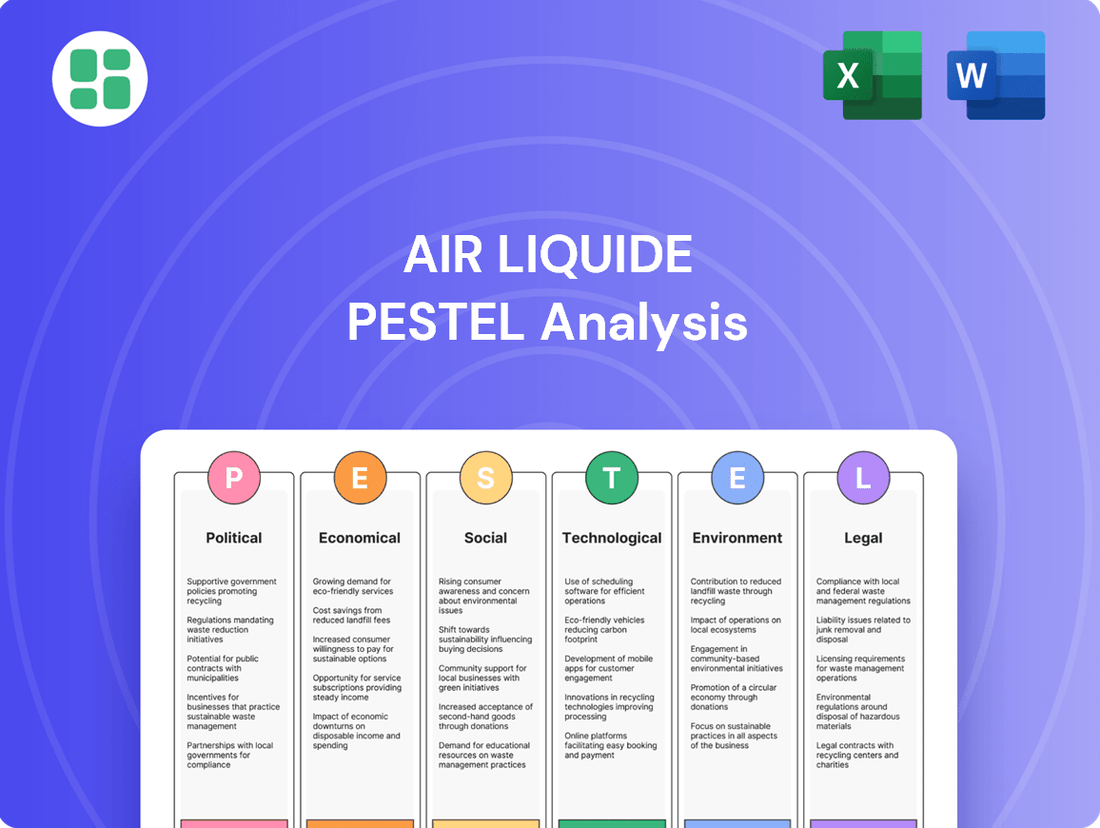

Air Liquide PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Liquide Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Air Liquide's trajectory. Our meticulously researched PESTLE analysis provides the essential context for strategic decision-making in the dynamic industrial gas market. Gain a competitive advantage by understanding these external forces—download the full report now for actionable intelligence.

Political factors

Governments worldwide are increasingly prioritizing decarbonization, enacting policies that mandate emissions reductions and offer incentives for green technologies. For instance, the European Union's Green Deal aims for climate neutrality by 2050, driving significant investment in renewable energy and low-carbon solutions. This regulatory landscape directly influences Air Liquide's strategic direction, particularly in areas like hydrogen production and carbon capture.

Air Liquide is actively positioning itself to benefit from these governmental pushes, especially concerning low-carbon hydrogen. The company's investment in projects like the ELYgator facility in the Netherlands, which produces renewable hydrogen, directly aligns with national and regional energy transition goals. These initiatives are crucial for meeting ambitious climate targets set for 2030 and beyond.

Global trade policies, including tariffs and trade agreements, significantly impact Air Liquide's international supply chains and market access, affecting the cost and availability of raw materials and finished products. For instance, ongoing adjustments in trade relations between major economic blocs can create uncertainties for cross-border operations.

Geopolitical tensions, such as those surrounding energy security and the development of new industries like hydrogen, present risks to cross-border projects and investments. Discussions around US hydrogen hubs and potential changes in funding mechanisms highlight the need for adaptability in international investment strategies.

Air Liquide actively manages these risks by maintaining a diversified geographical presence and strategically adapting its investment plans to evolving regional policies and geopolitical landscapes, ensuring resilience and continued market engagement.

Government healthcare policies and spending are pivotal for Air Liquide's medical gas and home healthcare business. For instance, in 2024, many nations continued to increase healthcare budgets, with the OECD reporting average healthcare spending as a percentage of GDP at 9.6% in 2022, a figure expected to see continued growth. This directly translates to higher demand for essential medical gases like oxygen and nitrogen.

The company's healthcare segment, a key growth engine, thrives on demographic shifts such as aging populations and the move towards home-based care. By 2025, it's projected that over 20% of the population in developed countries will be aged 65 and over, a trend bolstering the need for home respiratory care services that Air Liquide provides.

Stringent regulatory frameworks governing medical gas quality, supply chain integrity, and distribution are paramount for Air Liquide's operations. Compliance with standards like those set by the European Medicines Agency (EMA) or the U.S. Food and Drug Administration (FDA) ensures product safety and market access, impacting operational costs and strategic planning.

Industrial Sector Support and Subsidies

Governmental support and subsidies for key industrial sectors, such as semiconductors and advanced manufacturing, directly fuel demand for Air Liquide's high-purity gases and specialized solutions. These initiatives often translate into tangible opportunities for the company.

Air Liquide's strategic investments, like the new Air Separation Units in the US and Japan, are frequently aligned with national efforts to bolster domestic semiconductor production. For instance, the US CHIPS and Science Act of 2022, with its significant funding, aims to revitalize domestic chip manufacturing, creating a robust market for industrial gases. Similarly, Japan's push to re-establish its semiconductor leadership provides a fertile ground for Air Liquide's growth.

- Semiconductor Manufacturing: Government incentives, like those in the US and Europe, are driving expansion in semiconductor fabrication plants, increasing the need for ultra-pure gases.

- Green Hydrogen Initiatives: Subsidies for renewable energy and hydrogen production support Air Liquide's investments in hydrogen infrastructure, creating new markets for their gas solutions.

- Advanced Materials: Support for industries developing advanced materials often requires specialized gases for production processes, benefiting Air Liquide's offerings.

Regulatory Environment for Industrial Operations

The regulatory landscape for industrial operations significantly shapes Air Liquide's business. Stringent environmental standards, such as those related to emissions and waste management, directly influence capital expenditure for pollution control and operational costs for compliance. For instance, in 2024, many European countries continued to tighten regulations on industrial greenhouse gas emissions, requiring significant investments in carbon capture technologies or process modifications for gas producers.

Permitting processes for new facilities or expansions, alongside rigorous safety protocols for handling hazardous materials like industrial gases, are paramount. Air Liquide's adherence to these requirements is non-negotiable for maintaining its operating licenses and public trust. The company’s global vigilance plan, updated in 2024, underscores its commitment to human rights, health, and safety, reflecting the increasing scrutiny on corporate responsibility in industrial sectors.

- Environmental Compliance: In 2024, Air Liquide reported €2.1 billion in investments dedicated to energy transition and decarbonization, partly driven by evolving environmental regulations.

- Safety Standards: The company’s safety performance metrics, such as a Total Recordable Injury Frequency Rate (TRIFR) below 0.5 in 2024, demonstrate a focus on meeting and exceeding safety protocols.

- Permitting Delays: Navigating complex and lengthy permitting processes, particularly for large-scale projects like hydrogen production facilities, can impact project timelines and associated costs.

Governmental focus on decarbonization and energy transition continues to shape Air Liquide's strategy, with policies promoting hydrogen and carbon capture technologies. The European Union's ambitious climate targets and the US focus on developing hydrogen hubs are key drivers for investment in these areas.

The company's medical gas segment is significantly influenced by healthcare spending and policy changes, particularly in aging populations and home-based care trends. For instance, in 2024, many nations continued to increase healthcare budgets, with the OECD reporting average healthcare spending as a percentage of GDP at 9.6% in 2022, a figure expected to see continued growth.

Governmental support for key industrial sectors like semiconductors directly fuels demand for Air Liquide's high-purity gases. The US CHIPS and Science Act of 2022, with its substantial funding, is a prime example of how national initiatives create robust markets for industrial gas suppliers.

Air Liquide's operational costs and capital expenditures are heavily influenced by environmental regulations and safety standards. In 2024, the company reported €2.1 billion in investments dedicated to energy transition and decarbonization, partly driven by evolving environmental regulations.

| Policy Driver | Impact on Air Liquide | Supporting Data/Trend |

|---|---|---|

| Decarbonization Policies | Increased demand for low-carbon hydrogen and carbon capture solutions. | EU Green Deal aiming for climate neutrality by 2050. |

| Healthcare Spending | Growth in medical gas and home healthcare services. | Projected over 20% of developed country populations aged 65+ by 2025. |

| Industrial Sector Support (e.g., Semiconductors) | Higher demand for ultra-pure industrial gases. | US CHIPS and Science Act of 2022 driving semiconductor fabrication expansion. |

| Environmental Regulations | Increased investment in compliance and decarbonization technologies. | €2.1 billion invested in energy transition and decarbonization in 2024. |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Air Liquide across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends, risks, and opportunities impacting the company's operations and future growth.

The Air Liquide PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, acting as a pain point reliever by streamlining complex external factors.

Economic factors

Global industrial production, a key indicator for Air Liquide, showed resilience through early 2024, with manufacturing output in developed economies experiencing modest gains. For instance, the OECD's industrial production index saw a slight uptick in Q1 2024, signaling continued, albeit slow, demand for industrial gases.

The chemical and electronics sectors, major consumers of Air Liquide's products, are particularly sensitive to industrial growth trends. In 2024, projections for the global chemical industry suggested a growth rate of around 2-3%, driven by demand in Asia and recovering manufacturing activity in Europe, directly impacting the need for gases like nitrogen and hydrogen.

Conversely, any significant deceleration in global manufacturing, such as a projected 1% contraction in industrial output for certain emerging markets in late 2024 due to geopolitical uncertainties, would directly temper Air Liquide's revenue streams from these regions.

Energy, especially electricity and natural gas, is a major cost for Air Liquide because producing industrial gases is very energy-hungry. For instance, in 2023, the cost of energy represented a substantial portion of their operational expenditures.

Changes in energy prices directly affect Air Liquide's profits and how they set their prices. When energy costs rise, their margins can shrink if they can't pass those costs on.

To manage this, Air Liquide has a strategy to pass on energy cost increases to their customers and is actively increasing its use of electricity from renewable sources, signing more long-term Power Purchase Agreements to secure lower, more stable prices.

Inflationary pressures, particularly in 2024, directly impacted Air Liquide's operational costs. Rising prices for essential inputs like industrial gases, energy, and logistics increased the expense base for the company. For instance, energy prices saw significant volatility throughout 2024, contributing to higher operating expenses.

The company's extensive global footprint means currency exchange rate fluctuations are a constant consideration. In 2024, unfavorable currency impacts notably affected reported results, even as underlying business performance showed resilience. This currency translation effect reduced the reported value of revenues and profits when converting earnings from various international markets back into the company's reporting currency, the Euro.

Investment in Energy Transition and New Industries

Global investments in the energy transition are accelerating, creating significant economic avenues for companies like Air Liquide. These opportunities are particularly strong in burgeoning sectors such as hydrogen production, carbon capture technologies, and broader clean energy initiatives. Air Liquide's strategic focus on these areas is evident in its substantial investment decisions, with a considerable portion of its capital expenditure directed towards these future-oriented markets.

The company is actively participating in the development of large-scale hydrogen production facilities, including significant electrolyzer projects, and is investing in crucial CO2 capture infrastructure. For example, in 2023, Air Liquide announced €8 billion in investment decisions, with a substantial part dedicated to energy transition, including its role in the H2V project in France, aiming to produce green hydrogen.

- Global energy transition investments are projected to reach trillions of dollars by 2030, with hydrogen alone expected to attract significant capital.

- Air Liquide's 2023 investment decisions of €8 billion underscore its commitment to capturing growth in clean energy and decarbonization.

- The company is a key player in developing large-scale electrolyzer projects, crucial for producing green hydrogen.

- Investments in CO2 capture infrastructure are vital for industries seeking to reduce their carbon footprint, a growing market segment.

Healthcare Market Dynamics and Spending

The economic landscape of healthcare significantly shapes demand for Air Liquide's offerings. Global healthcare spending is projected to reach $10.1 trillion by 2025, a substantial driver for medical gas and home healthcare services.

This sustained growth is fueled by increasing chronic disease prevalence, with conditions like cardiovascular disease and diabetes accounting for a significant portion of healthcare expenditures. Furthermore, the aging global population, expected to see individuals over 65 comprise 16% of the world population by 2050, directly translates to higher demand for ongoing medical support.

- Healthcare spending forecast: $10.1 trillion by 2025.

- Aging population impact: Increased demand for long-term medical care.

- Chronic disease contribution: Significant driver of healthcare expenditure.

- Air Liquide's role: Expanding access to medical oxygen and home healthcare.

Economic growth directly influences demand for industrial gases, with global industrial production showing a modest uptick in early 2024. Key sectors like chemicals and electronics, major consumers of Air Liquide's products, are projected to grow, with the chemical industry expected to expand by 2-3% in 2024. However, potential economic slowdowns in emerging markets could temper revenue growth.

Energy costs are a significant operational expense for Air Liquide, impacting profitability and pricing strategies. The company is actively mitigating these costs by passing them on to customers and increasing its reliance on renewable electricity through Power Purchase Agreements.

Inflationary pressures in 2024 have increased operational costs, particularly for energy and logistics, affecting the company's expense base. Currency fluctuations also present a challenge, with unfavorable exchange rates impacting reported earnings in 2024.

Investments in the energy transition are creating substantial opportunities, especially in hydrogen production and carbon capture technologies, with Air Liquide committing significant capital to these areas. For example, the company's 2023 investment decisions totaled €8 billion, with a substantial portion allocated to energy transition initiatives.

| Economic Factor | 2024/2025 Data/Projection | Impact on Air Liquide |

| Global Industrial Production | Modest gains in developed economies (Q1 2024) | Drives demand for industrial gases |

| Chemical Industry Growth | Projected 2-3% growth (2024) | Increased demand for nitrogen, hydrogen |

| Energy Costs | Volatile, significant operational expense | Affects margins and pricing; mitigated by PPAs |

| Inflation | Increased operational costs (2024) | Higher expenses for energy, logistics |

| Energy Transition Investments | Trillions projected by 2030; €8bn by Air Liquide (2023) | Creates growth opportunities in hydrogen, CO2 capture |

Preview the Actual Deliverable

Air Liquide PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Air Liquide delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Air Liquide's industry, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of Air Liquide's business environment, highlighting key opportunities and potential challenges.

Sociological factors

The global population is aging, with projections indicating that by 2050, nearly 1.6 billion people will be over the age of 65. This demographic shift directly fuels a rising incidence of chronic diseases like COPD and heart failure, increasing the demand for medical oxygen and home healthcare solutions. Air Liquide's healthcare segment is strategically positioned to capitalize on this trend, evidenced by its significant investments in expanding its homecare services to cater to patients requiring ongoing respiratory support outside of acute care settings.

Growing public awareness about climate change is significantly influencing consumer and business behavior. This heightened environmental consciousness translates into a stronger demand for eco-friendly products and services, pushing companies like Air Liquide's clients to adopt more sustainable practices. For instance, a 2024 survey indicated that over 70% of consumers consider a company's environmental impact when making purchasing decisions.

This societal trend directly impacts Air Liquide by increasing the market for decarbonization solutions and low-carbon gases. Customers are actively seeking ways to reduce their carbon footprint, creating opportunities for Air Liquide's offerings such as hydrogen production and carbon capture technologies. The company's investment in these areas, including its 2025 commitment to invest €8 billion in the energy transition, directly addresses this growing demand.

Air Liquide is proactively responding to this shift by expanding its portfolio of sustainable solutions. Products like ECO ORIGIN™ certified low-carbon gases, which offer a verifiable reduction in CO2 emissions compared to traditional production methods, are becoming increasingly important. The company's focus on circular economy principles, such as recycling and reuse of industrial gases, further aligns with societal expectations for responsible resource management.

Societal preferences are increasingly leaning towards home healthcare, a significant shift from traditional hospital settings. This preference is fueled by a desire for personalized care and the drive for greater efficiency within healthcare systems. For instance, the global home healthcare market was valued at approximately $372 billion in 2023 and is projected to grow substantially, indicating a strong consumer demand for services delivered in the comfort of one's home.

Air Liquide is strategically positioned to benefit from this burgeoning home healthcare trend. By offering a comprehensive suite of services, including essential medical equipment and dedicated patient support, the company can meet this growing demand effectively. This strategic move also serves to diversify Air Liquide's revenue streams, lessening its dependence on the often-volatile industrial sector and establishing a more predictable and stable growth trajectory.

Workforce Diversity and Inclusion

Societal expectations increasingly demand that companies actively foster diversity and inclusion within their workforces. This pressure influences corporate policies and practices, pushing organizations to create environments where all employees feel valued and have equal opportunities.

Air Liquide is actively working to improve gender diversity across its operations. The company has set a clear objective to achieve 35% women in manager and professional roles by the year 2025, demonstrating a tangible commitment to this goal. This strategic focus is intended to cultivate a more inclusive workplace culture.

By prioritizing diversity, Air Liquide aims to unlock the full potential of its global workforce. Leveraging a variety of perspectives and experiences is seen as a key driver for enhanced innovation and problem-solving within the organization.

- Workforce Diversity Goals: Air Liquide aims for 35% women in manager and professional roles by 2025.

- Societal Influence: Growing public and stakeholder expectations are shaping corporate diversity and inclusion strategies.

- Innovation Driver: Diverse teams are recognized for their ability to foster innovation and provide varied viewpoints.

Employee Health, Safety, and Well-being

Societal expectations increasingly demand that companies prioritize the health, safety, and overall well-being of their workforce. This focus is not just a matter of compliance but a core element of corporate social responsibility and a driver of employee engagement.

Air Liquide actively addresses these societal values by making employee safety a cornerstone of its operations. In 2024, the company reported a notable achievement in reducing its accident frequency rate, underscoring its commitment to creating a secure working environment.

The company's dedication extends to providing a consistent standard of care for its global workforce of 66,500 employees. This includes comprehensive health coverage and paid maternity leave, ensuring a foundational level of support for employees and their families worldwide.

- Societal Emphasis: Growing public and employee demand for robust health, safety, and well-being programs.

- Air Liquide's Safety Performance: Achieved a significant reduction in accident rates in 2024, demonstrating operational safety focus.

- Global Employee Support: Provides common basis of care coverage for all 66,500 employees, including health and paid maternity leave.

Societal shifts towards sustainability and ethical business practices are increasingly influencing consumer choices and investor decisions. This growing demand for corporate responsibility means companies like Air Liquide must demonstrate a clear commitment to environmental, social, and governance (ESG) principles. For example, a 2024 report by the Global Sustainable Investment Alliance noted that ESG-focused investments reached over $35 trillion, highlighting the significant financial implications of societal values.

Air Liquide is actively aligning its strategy with these evolving societal expectations. The company's focus on developing low-carbon solutions, such as hydrogen for mobility and industry, directly addresses the global imperative to combat climate change. Furthermore, their commitment to community engagement and responsible resource management resonates with a public that increasingly scrutinizes corporate impact beyond financial performance.

The company's proactive approach to ESG is not only about meeting external demands but also about building long-term resilience and value. By investing in sustainable technologies and maintaining transparent operations, Air Liquide is positioning itself to thrive in a future where social license to operate is paramount. This includes initiatives like their 2025 target to reduce Scope 1 and 2 greenhouse gas emissions by 33% compared to 2020 levels.

Technological factors

Breakthroughs in green hydrogen production, primarily through electrolysis powered by renewable energy, are a cornerstone of Air Liquide's energy transition. This shift is crucial for meeting the increasing demand for low-carbon hydrogen solutions.

Air Liquide is making substantial investments in large-scale electrolyzer projects, aiming to bolster its capacity. Furthermore, the company is exploring ammonia cracking technology as another avenue to supply low-carbon hydrogen efficiently.

These technological advancements are unlocking new opportunities for hydrogen's application in sectors like mobility and industrial decarbonization. For instance, Air Liquide is a key player in developing hydrogen refueling infrastructure for heavy-duty transport, a rapidly expanding market.

Technological advancements in Carbon Capture, Utilization, and Storage (CCUS) are crucial for Air Liquide, both in assisting industrial clients with their decarbonization goals and in achieving its own. The company is actively engaged in initiatives focused on capturing, transporting, and storing CO2, drawing upon its extensive experience in gas management and processing.

This technological capability is a significant driver for reaching carbon neutrality objectives within sectors such as heavy industry. For instance, by 2024, Air Liquide is involved in several CCUS projects, including the Porthos project in Rotterdam, aiming to capture and store significant volumes of CO2.

Air Liquide is heavily investing in digitalization and AI to streamline its industrial gas operations. This includes leveraging the Internet of Things (IoT) for real-time monitoring of production facilities and supply chains, leading to enhanced efficiency and significant cost reductions. For instance, the company aims to improve operational excellence through digital tools, contributing to its overall profitability.

The integration of artificial intelligence is particularly impactful in optimizing gas production and delivery. AI algorithms help predict equipment failures, optimize energy consumption in production plants, and improve logistics for gas distribution. This technological advancement allows Air Liquide to offer more reliable and cost-effective solutions to its clients across various sectors.

Furthermore, the burgeoning demand for AI-driven technologies, especially within the semiconductor industry, directly benefits Air Liquide. The production of advanced semiconductors requires ultra-pure gases, and the increasing reliance on AI in chip manufacturing fuels this demand. Air Liquide's ability to supply these critical, high-purity gases positions it favorably in this high-growth market segment.

Innovation in Medical Gas Delivery and Home Healthcare Technology

Technological advancements in medical gas delivery and home healthcare are significantly enhancing patient outcomes and broadening access to essential medical services. Air Liquide is actively investing in these areas, focusing on advanced materials and tailored patient care solutions within its healthcare division. This strategic focus includes forging partnerships in digital health and developing technologies that facilitate the growing trend of home-based medical care.

The company's commitment to innovation is evident in its development of connected devices and digital platforms designed to support patients managing chronic conditions at home. For instance, Air Liquide's investments in digital health aim to streamline patient monitoring and improve adherence to treatment plans, a critical factor in successful home healthcare. By embracing these technological shifts, Air Liquide is positioning itself to meet the evolving demands of the healthcare sector, particularly the increasing preference for decentralized care models.

Key technological drivers impacting Air Liquide's healthcare segment include:

- Advancements in portable oxygen concentrators and nebulizer technology, making home treatment more convenient and effective.

- Development of remote patient monitoring systems that leverage IoT and AI to track vital signs and treatment adherence, potentially reducing hospital readmissions.

- Integration of digital platforms and mobile applications for patient engagement, education, and communication with healthcare providers.

- Research into new materials for gas storage and delivery, aiming for lighter, safer, and more efficient solutions for home use.

Advanced Materials for Electronics and High Technologies

The electronics sector's relentless drive, fueled by the insatiable demand for sophisticated semiconductors and the burgeoning AI market, creates a critical need for ultra-pure gases and highly specialized materials. Air Liquide's deep technological acumen positions it as a vital supplier, developing and delivering these essential components that underpin semiconductor innovation.

This technological imperative translates directly into Air Liquide's strategic investments. For instance, the company has been actively expanding its production capabilities for these advanced materials. In 2024, Air Liquide announced significant investments in new facilities dedicated to producing specialty gases and advanced materials crucial for next-generation chip manufacturing, underscoring their commitment to this high-growth area.

- Semiconductor Industry Growth: The global semiconductor market is projected to reach over $600 billion in 2024, a significant increase driven by AI and high-performance computing.

- Air Liquide's Role: Air Liquide supplies over 300 different electronic gases and materials, a portfolio critical for wafer fabrication, packaging, and display technologies.

- Investment in Advanced Materials: The company's capital expenditures in 2024 included substantial allocations towards expanding capacity for materials like advanced precursors and high-purity chemicals used in advanced lithography.

Technological advancements are reshaping Air Liquide's core operations and opening new avenues for growth. The company's commitment to innovation in green hydrogen production, including large-scale electrolyzer projects and ammonia cracking, is pivotal for the energy transition. Furthermore, its strategic investments in digitalization and AI are enhancing operational efficiency across its industrial gas business, optimizing production and logistics for cost savings and improved reliability.

Legal factors

Air Liquide operates under increasingly stringent environmental protection laws and emissions regulations, a critical legal factor influencing its operations. These rules, particularly concerning CO2 emissions, necessitate strict adherence to national and international climate targets. For instance, the European Union's Fit for 55 package aims for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, directly impacting industrial gas producers like Air Liquide.

Compliance with reporting requirements, such as those for Scope 1 and Scope 2 emissions, is a significant legal obligation. These regulations mandate transparency and accountability for the company's carbon footprint. The ongoing evolution of these legal frameworks, including potential carbon pricing mechanisms and stricter emission limits, compels Air Liquide to proactively invest in decarbonization technologies and sustainable business practices to maintain its license to operate and competitive edge.

Air Liquide operates within a stringent framework of health and safety regulations that dictate every stage of its operations, from manufacturing to final delivery and customer use of industrial and medical gases. These legal requirements are paramount for protecting its workforce, clients, and the general public from potential hazards associated with its products, ensuring product quality and preventing accidents.

The company's unwavering commitment to compliance is evident in its robust safety protocols and proactive vigilance plans, which are designed to mitigate risks effectively. For instance, in 2023, Air Liquide reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.68, a testament to its dedication to maintaining a safe working environment and adhering to these critical legal mandates.

Anti-trust and competition laws are crucial for regulating market behavior, preventing monopolies, and ensuring fair play. As a major global player, Air Liquide must meticulously adhere to these regulations in all its operations, from acquisitions to market strategies, to steer clear of costly legal battles and sanctions.

For instance, in 2024, the European Commission continued its scrutiny of mergers and acquisitions across various sectors, emphasizing the need for companies like Air Liquide to demonstrate that their deals do not unduly restrict competition. Failure to comply can result in significant fines, such as the €1.47 billion fine imposed on several companies in the air cargo sector in 2023 for price-fixing, highlighting the financial risks involved.

These legal frameworks directly influence Air Liquide's strategic decisions, particularly concerning market entry, expansion into new territories, and the formation of partnerships or joint ventures. Ensuring compliance is paramount for maintaining operational freedom and a positive market reputation.

Intellectual Property Rights

Intellectual property (IP) rights are a cornerstone for Air Liquide, protecting its significant investments in gas production technologies, application innovations, and specialized equipment. Legal safeguards like patents, trademarks, and trade secrets are vital for maintaining its competitive edge and fostering continued research and development efforts. For instance, Air Liquide actively manages a vast patent portfolio, with thousands of active patents globally, reflecting its commitment to innovation in areas such as hydrogen production and carbon capture technologies.

The company's legal strategy around IP is designed to deter infringement and ensure that its technological advancements translate into sustained market leadership. This focus on IP protection is particularly critical in the highly specialized gas industry, where proprietary processes and equipment can represent a substantial portion of a company's value. Air Liquide's ongoing innovation pipeline, which saw the launch of numerous new gas applications and improved delivery systems in 2024, directly benefits from robust IP enforcement.

- Patent Portfolio Strength: Air Liquide holds tens of thousands of patents worldwide, covering a broad spectrum of its technological innovations.

- R&D Investment Protection: IP rights are crucial for safeguarding the substantial financial commitments Air Liquide makes to research and development, estimated in the hundreds of millions of euros annually.

- Market Differentiation: Strong IP protection allows Air Liquide to differentiate its offerings in competitive markets, particularly in advanced applications like healthcare gases and electronic materials.

- Trade Secret Management: Beyond patents, Air Liquide employs rigorous measures to protect its trade secrets, which are vital for maintaining operational efficiency and proprietary manufacturing processes.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity regulations are increasingly critical for Air Liquide, especially given its expanding digital footprint and the sensitive data handled within its healthcare operations. Compliance with frameworks like the General Data Protection Regulation (GDPR) is non-negotiable, demanding robust measures to protect customer and patient information. Failure to adhere can result in significant fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. This legal landscape directly impacts Air Liquide's digital transformation by requiring substantial investment in secure data management systems and ongoing vigilance against cyber threats to maintain operational integrity and stakeholder trust.

Air Liquide's commitment to data protection is crucial for several reasons:

- Regulatory Compliance: Adhering to data privacy laws like GDPR and similar legislation worldwide is a legal imperative, with non-compliance carrying substantial financial penalties.

- Cybersecurity Threats: The increasing sophistication of cyberattacks necessitates continuous investment in advanced cybersecurity measures to prevent data breaches and protect sensitive information.

- Trust and Reputation: Maintaining customer and patient trust hinges on the company's ability to demonstrate strong data protection practices, which is vital for its brand image and long-term business sustainability.

Air Liquide must navigate a complex web of global and regional regulations governing environmental impact, particularly emissions. Adherence to the EU's Fit for 55 package, aiming for a 55% emissions reduction by 2030, directly influences operational strategies and investments in decarbonization. The company's safety record, highlighted by a 2023 TRIFR of 0.68, demonstrates its commitment to stringent health and safety laws essential for handling industrial and medical gases.

Competition law remains a critical legal factor, requiring careful management of mergers and acquisitions to avoid antitrust issues, as underscored by the European Commission's ongoing scrutiny in 2024. Furthermore, the protection of its extensive patent portfolio, encompassing tens of thousands of patents worldwide, is vital for safeguarding its innovation in areas like hydrogen and carbon capture, underpinning its market differentiation and R&D investments, which are in the hundreds of millions of euros annually.

Data privacy regulations, such as GDPR, impose strict requirements on Air Liquide's digital operations, with potential fines up to 4% of global turnover. This necessitates significant investment in cybersecurity to protect sensitive customer and patient data, thereby maintaining trust and reputation in its healthcare and digital services.

Environmental factors

The escalating urgency of climate change is a primary environmental driver, compelling governments worldwide to establish stringent decarbonization targets. This global push directly impacts industries like Air Liquide, necessitating a fundamental shift in operational strategies and investment priorities.

Air Liquide has proactively embraced these challenges, setting ambitious goals to slash its CO2 emissions by a third by 2035 and achieve carbon neutrality by 2050, with a critical inflection point anticipated around 2025. This commitment forms the bedrock of its ADVANCE strategic plan, shaping every facet of its business model and operational execution.

The global push for cleaner energy significantly shapes Air Liquide's operations and market position. The company is actively increasing its reliance on low-carbon electricity, reporting that over 40% of its power procurement came from renewable or nuclear sources in 2024. This strategic shift is vital for both decreasing Air Liquide's own environmental impact and developing sustainable solutions for its clientele.

Growing concerns over water scarcity are pushing industries toward more efficient water management. Air Liquide is actively addressing this by implementing water management plans in areas facing high water consumption and stress, with a goal of full implementation by 2025. This proactive approach mitigates environmental risks and champions sustainable resource use.

Circular Economy Principles and Resource Efficiency

The global push towards circular economy principles is reshaping industrial practices, demanding greater resource efficiency and waste reduction. For Air Liquide, this translates into opportunities to innovate in areas like carbon capture and utilization (CCU), where captured CO2 can be transformed into valuable products. This not only supports environmental objectives but also opens new revenue streams from waste streams. For example, Air Liquide's investments in hydrogen production, often linked to CCU technologies, are crucial for decarbonizing various industries, with the hydrogen market projected to reach $250 billion by 2030.

Air Liquide actively embraces these principles by developing solutions that enable customers to reduce their environmental footprint and improve their own resource efficiency. Their commitment to transforming waste into resources is evident in projects focused on recycling and upcycling materials, aligning with a broader strategy to create sustainable value chains. This strategic focus is supported by significant R&D spending, with the company allocating substantial resources to developing low-carbon solutions and circular economy technologies.

- Circular Economy Focus: Air Liquide's development of CO2 capture and utilization technologies directly supports circular economy principles by transforming waste CO2 into valuable resources.

- Resource Efficiency Drive: The company's solutions aim to enhance resource efficiency across industries, minimizing waste and maximizing the use of raw materials.

- New Business Models: Embracing circularity creates new business opportunities for Air Liquide in resource recovery and the production of sustainable materials.

- Market Growth: The growing demand for sustainable solutions positions Air Liquide to capitalize on the expanding circular economy market, projected for significant growth in the coming years.

Biodiversity Preservation and Sustainable Sourcing

Air Liquide recognizes that its operations can impact biodiversity, driving a strategic focus on sustainable sourcing of raw materials. The company is actively integrating biodiversity assessment criteria into its investment decision-making processes. This commitment is further underscored by their objective to develop an aggregated biodiversity indicator by 2025, signaling a comprehensive approach to environmental stewardship that extends beyond carbon footprint reduction.

The company's efforts include:

- Integrating biodiversity impact assessments into project evaluations.

- Working towards a consolidated biodiversity indicator by 2025.

- Prioritizing sustainable sourcing to minimize ecological disruption.

The intensifying focus on environmental sustainability, particularly decarbonization, is a major force shaping Air Liquide's strategy. Governments worldwide are setting ambitious climate targets, directly influencing industrial operations and investment. Air Liquide's commitment to reducing its CO2 emissions by one-third by 2035 and achieving carbon neutrality by 2050, with a key milestone in 2025, underscores this environmental imperative.

Air Liquide is actively increasing its use of low-carbon energy sources, with over 40% of its electricity procurement coming from renewable or nuclear sources in 2024. This strategic pivot is essential for both lowering its own environmental impact and developing sustainable solutions for its customers.

The company is also addressing water scarcity by implementing water management plans in high-stress regions, aiming for full implementation by 2025. Furthermore, Air Liquide is investing in circular economy initiatives, such as carbon capture and utilization (CCU), which transforms CO2 into valuable products, supporting its goal of sustainable value chains and new business models.

| Environmental Factor | Air Liquide's Action/Target | Relevant Data/Year |

|---|---|---|

| Climate Change & Decarbonization | Reduce CO2 emissions by 33% | by 2035 |

| Climate Change & Decarbonization | Achieve carbon neutrality | by 2050 |

| Energy Transition | Increase low-carbon electricity procurement | Over 40% in 2024 |

| Water Management | Implement water management plans in high-stress areas | Full implementation by 2025 |

| Circular Economy | Invest in CO2 capture and utilization (CCU) | Hydrogen market projected to reach $250 billion by 2030 |

| Biodiversity | Develop aggregated biodiversity indicator | by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Air Liquide is meticulously constructed using data from reputable sources including government regulatory bodies, international economic organizations like the IMF and World Bank, and leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, environmental, and legal landscapes impacting the company.