Air Liquide Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Liquide Bundle

Air Liquide navigates a complex landscape shaped by intense rivalry and significant buyer power, impacting its pricing and market share. The threat of substitutes, while present, is somewhat mitigated by the specialized nature of industrial gases.

The complete report reveals the real forces shaping Air Liquide’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Air Liquide leans towards moderate, largely influenced by the nature of their primary inputs. While the fundamental raw material, air, is universally available and free, the energy needed to process it into industrial gases is a critical cost factor. This makes energy providers, particularly for electricity and natural gas, significant players in the supply chain, potentially wielding some influence over Air Liquide's operational expenses.

While the core input of air is abundant, the sourcing of specialized gases or the advanced components for air separation units can present a different dynamic. If these specialized inputs come from a limited number of manufacturers, those suppliers could gain leverage. For instance, in 2024, the global market for certain rare earth elements, crucial for some advanced industrial processes, saw price volatility due to supply chain constraints, illustrating how supplier concentration can impact even large industrial gas companies.

Switching costs for Air Liquide's core suppliers, particularly for energy, can be significant. This is largely due to the long-term contracts and the specialized infrastructure needed for its large-scale industrial gas production. For instance, securing a reliable and consistent supply of electricity, a major input for Air Liquide's energy-intensive processes, often involves substantial upfront investment and commitment.

However, Air Liquide is actively working to reduce its reliance on traditional energy sources and mitigate supplier power through strategic initiatives. The company's commitment to securing low-carbon electricity via Power Purchase Agreements (PPAs) is a prime example. By entering into these agreements, Air Liquide not only secures a more stable and predictable energy cost but also diversifies its energy sourcing, thereby lessening the bargaining power of individual energy suppliers over the long term.

The threat of suppliers integrating forward into industrial and medical gas production is generally low for companies like Air Liquide. This is due to the substantial barriers to entry, such as the specialized technology and significant capital investment needed for production and distribution.

Raw material or energy suppliers typically lack the expertise and financial resources to establish the complex production facilities and extensive logistics required to compete directly with established gas providers. For instance, the global industrial gas market, valued at over $80 billion in 2023, demands highly specialized infrastructure that most suppliers cannot easily replicate.

Importance of Input to Air Liquide’s Business

Electricity is a cornerstone for Air Liquide, powering its energy-intensive operations like air separation units and hydrogen production. For instance, in 2023, energy costs represented a significant portion of the company's operating expenses, driving efforts to secure stable, long-term energy contracts and invest in efficiency improvements. This reliance makes the bargaining power of energy suppliers a crucial factor in Air Liquide's cost structure and overall profitability.

The company actively manages this by implementing dynamic pricing models and seeking diverse energy sourcing strategies to mitigate the impact of price volatility. Air Liquide's commitment to sustainability also plays a role, with investments in renewable energy sources potentially reducing reliance on traditional, more volatile energy markets.

- Critical Inputs: Electricity is vital for core processes like air separation and electrolysis.

- Profitability Impact: Fluctuations in energy prices directly affect Air Liquide's bottom line.

- Strategic Response: Efficiency gains and dynamic pricing are key strategies to manage supplier power.

- 2023 Cost Factor: Energy expenses were a substantial component of operating costs in 2023.

Supplier's Ability to Differentiate Inputs

While basic inputs like air and water are largely commoditized, the bargaining power of suppliers can increase significantly when they provide specialized chemicals, catalysts, or advanced industrial equipment. For Air Liquide, this means that suppliers of niche gases or highly technical components could exert more influence. For instance, a supplier of a critical, proprietary catalyst for a specific industrial gas production process might command higher prices due to the lack of readily available alternatives.

However, Air Liquide's substantial investment in research and development, including its approximately €1 billion in R&D spending in 2023, allows it to develop its own innovative technologies and manufacturing processes. This internal capability helps to mitigate the reliance on external suppliers for highly differentiated inputs, thereby reducing their bargaining power. By creating proprietary solutions, Air Liquide can often substitute or even outperform specialized external offerings.

- Supplier Differentiation: Suppliers of specialized chemicals, catalysts, or advanced equipment can increase their bargaining power by offering unique or proprietary products.

- Air Liquide's R&D: Air Liquide's significant R&D investment, around €1 billion in 2023, enables the development of in-house technologies and proprietary solutions.

- Reduced Reliance: Through its own innovation, Air Liquide can lessen its dependence on external suppliers for critical, differentiated inputs, thereby weakening supplier bargaining power.

The bargaining power of suppliers for Air Liquide is generally moderate, primarily driven by energy costs, which formed a substantial portion of operating expenses in 2023. While air itself is a free commodity, the electricity and natural gas needed for its processing are critical inputs. Air Liquide's strategic move towards Power Purchase Agreements (PPAs) for low-carbon electricity in 2024 aims to stabilize these costs and diversify energy sources, thereby reducing the leverage of individual energy providers.

Suppliers of specialized equipment or proprietary catalysts can wield more influence due to limited alternatives and high switching costs for Air Liquide. However, the company's significant investment in R&D, including approximately €1 billion in 2023, allows for the development of in-house technologies, diminishing reliance on external, specialized suppliers and consequently weakening their bargaining power.

| Supplier Type | Bargaining Power Influence | Air Liquide's Mitigation Strategy |

|---|---|---|

| Energy Providers (Electricity, Natural Gas) | Moderate to High (due to essential input and price volatility) | Long-term PPAs, energy efficiency, diverse sourcing |

| Specialized Equipment Manufacturers | Moderate (dependent on uniqueness and competition) | In-house R&D, strategic partnerships, supplier diversification |

| Proprietary Catalyst/Chemical Suppliers | High (due to limited alternatives and high switching costs) | Internal R&D for substitutes, process optimization |

What is included in the product

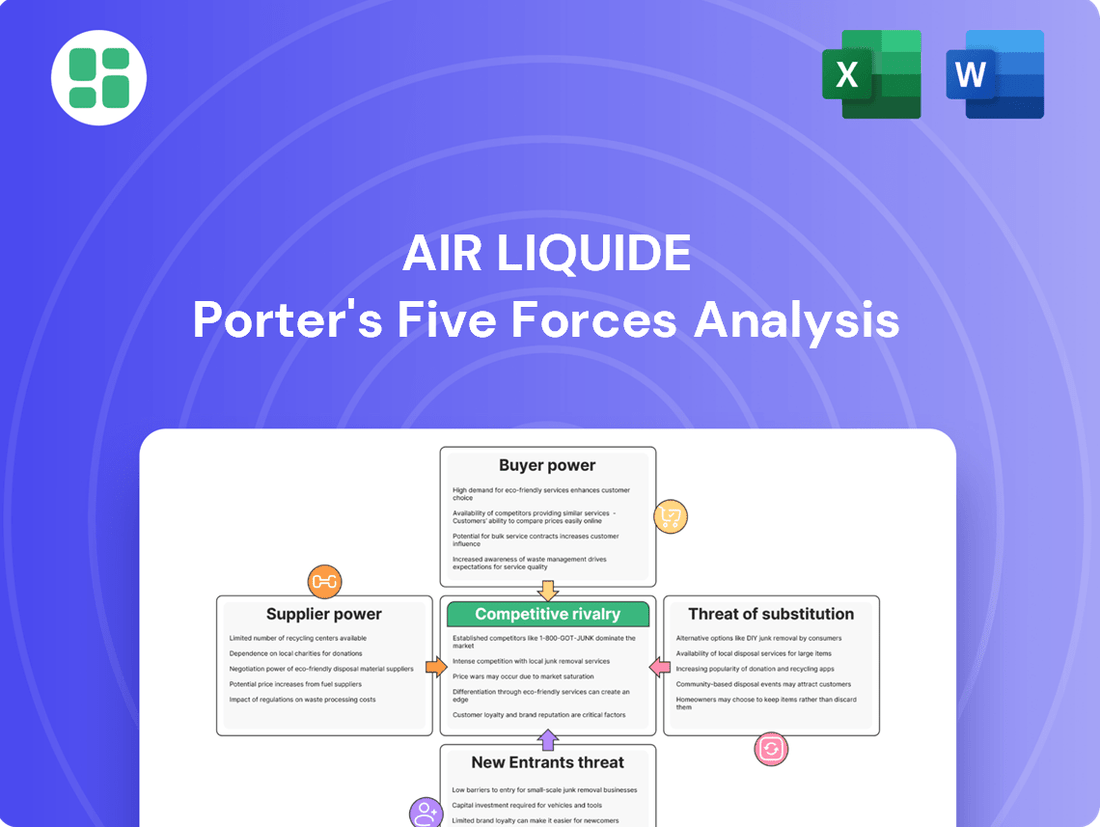

This analysis dissects the competitive forces impacting Air Liquide, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industrial gases market.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Air Liquide’s customer base is remarkably diverse, spanning critical sectors like healthcare, manufacturing, electronics, and energy. This broad reach includes everything from major industrial players to individual healthcare patients, showcasing a wide spectrum of customer needs and purchasing power.

However, significant bargaining power often resides with large industrial clients. These customers, including major semiconductor manufacturers and chemical companies, typically procure gases in substantial volumes under long-term agreements. For instance, in 2023, Air Liquide's industrial customer segment represented a substantial portion of its revenue, with key accounts often secured through multi-year contracts that grant them considerable leverage in price negotiations.

Customer switching costs significantly limit the bargaining power of large industrial clients for Air Liquide. These customers often have highly integrated on-site supply systems, specialized equipment, and complex logistical networks tied to their current gas supplier. For instance, transitioning to a new industrial gas provider could necessitate expensive modifications to existing infrastructure, potentially costing millions of dollars for a single facility.

Air Liquide moves beyond simply selling gases; it offers integrated solutions like CO2 capture and low-carbon hydrogen, boosting its value proposition. This focus on advanced technologies and services, such as ultra-pure gases for semiconductors, makes customers less sensitive to price changes.

Threat of Backward Integration by Customers

The threat of customers backward integrating to produce their own industrial or medical gases is generally low for Air Liquide. This is primarily due to the substantial capital outlay, specialized technical knowledge, and stringent regulatory adherence necessary for such operations.

While a few exceptionally large industrial customers might consider on-site gas generation, Air Liquide frequently manages and operates these facilities, thereby maintaining its position as the essential gas supplier. For instance, Air Liquide's global revenue in 2023 was €27.6 billion, reflecting the scale and complexity of its operations that are difficult for individual customers to replicate.

- High Capital Investment: Building and maintaining gas production facilities requires billions in upfront investment, a barrier most customers cannot overcome.

- Technical Expertise: The production of industrial and medical gases demands sophisticated engineering and operational know-how, which Air Liquide possesses.

- Regulatory Compliance: Strict safety and quality standards govern gas production, adding another layer of complexity and cost for potential integrators.

- On-site Solutions: Air Liquide's ability to offer and manage on-site production units mitigates the backward integration threat by providing a service that meets customer needs without them taking on the full operational burden.

Customer Price Sensitivity

Customer price sensitivity is a key factor in the industrial gas market, and Air Liquide navigates this by segmenting its customer base. For instance, large industrial clients in established sectors often focus keenly on pricing, seeking cost efficiencies.

However, in dynamic, high-tech fields such as semiconductor manufacturing or advanced medical applications, the emphasis shifts. Here, customers prioritize product purity, unwavering reliability, and comprehensive service solutions, often outweighing minor price variations. Air Liquide's strategic emphasis on these high-growth, high-value sectors allows it to mitigate the impact of broad price sensitivity across its entire customer portfolio.

- Price Sensitivity Varies by Industry: Mature industries often exhibit higher price sensitivity compared to high-tech or critical healthcare sectors.

- Value Beyond Price: In sectors like electronics and healthcare, reliability, purity, and integrated solutions are prioritized over marginal price differences.

- Air Liquide's Strategy: The company focuses on high-growth, high-value segments to manage overall customer price sensitivity.

- Market Dynamics: For example, while bulk industrial gases might see intense price competition, specialized medical gases command premiums due to stringent quality and regulatory requirements.

The bargaining power of customers for Air Liquide is moderate, largely influenced by customer size and industry. While large industrial clients can exert pressure due to high volumes and long-term contracts, their ability to switch suppliers is limited by substantial switching costs associated with integrated infrastructure. Air Liquide mitigates this by offering value-added solutions and focusing on sectors where reliability and purity are paramount, reducing price sensitivity.

| Customer Segment | Bargaining Power Factors | Mitigating Factors by Air Liquide |

|---|---|---|

| Large Industrial (e.g., Chemicals, Manufacturing) | High volume procurement, long-term contracts, potential for backward integration | High switching costs for customers, integrated solutions, on-site management |

| Healthcare (Hospitals, Clinics) | Critical need for supply, but often less price-sensitive for essential gases | Focus on reliability, purity, specialized medical gases, regulatory compliance |

| Electronics (Semiconductor Manufacturers) | High demand for ultra-pure gases, significant volume | Emphasis on product quality, consistent supply, advanced technology solutions |

What You See Is What You Get

Air Liquide Porter's Five Forces Analysis

This preview showcases the comprehensive Air Liquide Porter's Five Forces Analysis, detailing the competitive landscape of the industrial gas industry by examining threats of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The global industrial and medical gas market is a prime example of an oligopoly, with a few dominant multinational corporations controlling a significant share of the industry. Linde plc stands as the undisputed leader, followed closely by Air Liquide, and then Air Products & Chemicals Inc. This concentration shapes the competitive landscape, fostering strategic rivalries focused on innovation, service, and long-term contracts rather than solely on aggressive price wars.

The industrial gas market is booming, with a projected compound annual growth rate (CAGR) of 9.3% expected from 2024 to 2025. This robust expansion, coupled with an 8.2% CAGR in the medical gas sector for the same period, creates a favorable environment for all key players in the industry.

The industrial gas sector, including players like Air Liquide, faces intense rivalry driven by substantial fixed costs. Building and maintaining Air Separation Units (ASUs) and vast distribution infrastructure requires significant capital investment, estimated to be in the hundreds of millions of dollars per large-scale facility.

This high cost structure compels companies to aggressively pursue high capacity utilization to achieve economies of scale and spread fixed expenses. For instance, in 2024, major industrial gas producers were actively seeking long-term contracts with large industrial customers to ensure consistent demand and optimize their operational efficiency, often leading to price competition.

Product Differentiation and Innovation

Competitive rivalry in the industrial gas sector, including for Air Liquide, is significantly fueled by a relentless pursuit of technological innovation and the capacity to deliver highly specialized, pure, and tailored gas solutions. Beyond just the gases themselves, companies compete on the value-added services and equipment they provide, creating a comprehensive offering.

Air Liquide's strategic investments are a testament to this. For instance, their substantial focus on hydrogen technologies, particularly in the burgeoning clean energy sector, positions them at the forefront of a critical market shift. Similarly, their advancements in electronics-grade gases, essential for semiconductor manufacturing, and specialized solutions for the healthcare industry, like medical oxygen and anesthetic gases, serve as crucial differentiators.

- Hydrogen Investments: Air Liquide announced plans to invest €8 billion in the hydrogen supply chain in Europe by 2035, aiming for a significant share of the market by 2030.

- Electronics Market Share: The company aims to double its revenue in the electronics segment by 2035, reflecting strong growth prospects and innovation in this high-margin area.

- Healthcare Solutions: Air Liquide's healthcare division generated €3.4 billion in revenue in 2023, underscoring the importance of its differentiated offerings in this vital sector.

Exit Barriers

Exit barriers in the industrial gas sector are notably high, primarily due to the significant investments in specialized, capital-intensive assets. These assets, such as air separation units and extensive pipeline networks, have very limited alternative uses, making it difficult for companies to divest or repurpose them if they decide to exit the market. For instance, Air Liquide's substantial infrastructure, including its global network of production facilities, represents a massive sunk cost.

Furthermore, long-term contracts with major industrial customers, often spanning decades, create a strong incentive for companies to continue operating even when market conditions are unfavorable. These contracts provide a degree of revenue stability but also lock companies into ongoing operational and maintenance commitments. This contractual obligation, coupled with the specialized nature of the assets, effectively discourages premature exits, ensuring that players remain engaged in the competitive landscape.

The high exit barriers mean that companies within the industrial gas industry are often compelled to compete vigorously, even during periods of economic slowdown. The inability to easily exit the market due to stranded assets and contractual obligations forces them to find ways to remain profitable and maintain market share. This can lead to intensified competition on pricing and service, as companies strive to optimize their operations and customer relationships to offset the costs associated with their long-term investments.

- High Capital Intensity: Industrial gas production requires substantial upfront investment in specialized plants and distribution infrastructure.

- Limited Asset Redeployment: The unique nature of industrial gas production facilities restricts their use in other industries, increasing exit costs.

- Long-Term Customer Contracts: Existing agreements with clients often obligate companies to continue operations, making a swift exit impractical.

- Strategic Importance of Infrastructure: Companies may maintain operations to protect their strategic market position and customer relationships, despite short-term economic pressures.

Competitive rivalry in the industrial gas sector, including for Air Liquide, is intense due to the oligopolistic market structure dominated by a few major players. This rivalry is characterized by a focus on innovation, specialized solutions, and long-term customer relationships rather than aggressive price wars, though price competition does occur when seeking high capacity utilization. The substantial fixed costs associated with production facilities and distribution networks necessitate continuous efforts to secure and maintain customer demand.

Companies like Air Liquide differentiate themselves through technological advancements and value-added services, particularly in high-growth areas such as hydrogen, electronics, and healthcare. These strategic investments aim to capture market share in specialized segments and reinforce their competitive positions.

The global industrial gas market is projected to grow significantly, with the industrial gas sector expected to see a 9.3% CAGR from 2024 to 2025, and the medical gas sector an 8.2% CAGR for the same period. This growth fuels the ongoing competition among key players.

Air Liquide's strategic focus includes an €8 billion investment in European hydrogen supply chains by 2035 and a goal to double electronics segment revenue by 2035, demonstrating a commitment to innovation and market leadership.

SSubstitutes Threaten

For many industrial and medical gas applications, direct substitutes are limited due to the unique chemical properties and stringent safety requirements of these gases. For example, there are no viable direct substitutes for oxygen in critical life support systems or for nitrogen in essential inerting processes that prevent combustion or degradation. This inherent lack of substitutes strengthens Air Liquide's position.

While alternative methods might exist for some niche applications, the price-performance trade-off often favors industrial gases like those supplied by Air Liquide due to their efficiency, purity, and scalability. For instance, while certain chemical processes might offer localized oxygen generation, the sheer volume and consistent quality of industrial oxygen supplied by Air Liquide typically present a more cost-effective solution for large-scale manufacturing.

Technological progress is a double-edged sword for Air Liquide. Innovations could birth entirely new methods that bypass the need for industrial gases, or allow customers to produce their own gases on-site with compact, efficient systems. For instance, advancements in water electrolysis technology are making on-site hydrogen generation increasingly viable for certain industrial applications.

However, Air Liquide is not standing still. The company is at the forefront of technological development, particularly in creating sophisticated on-site generation solutions for its clients. In 2023, Air Liquide invested €1.2 billion in research and development, a significant portion of which is directed towards these advanced on-site technologies, effectively mitigating the threat of substitutes by offering superior, integrated solutions.

Shift to Green Alternatives and Circular Economy

The global drive towards decarbonization and circular economy principles presents a significant threat of substitution for traditional industrial gas suppliers. Industries are increasingly exploring ways to reduce their carbon footprint, which can involve substituting carbon-intensive processes with greener alternatives or implementing systems to capture and reuse gases. This shift directly impacts the demand for certain gases and necessitates adaptation from established players.

- Decarbonization Push: Growing pressure on industries to reduce greenhouse gas emissions, particularly CO2, encourages the adoption of alternative processes and technologies.

- Circular Economy Models: The emphasis on resource efficiency and waste reduction promotes gas recycling and reuse within industrial processes, potentially lowering the need for new gas supply.

- Technological Advancements: Innovations in areas like direct air capture and carbon capture, utilization, and storage (CCUS) offer substitutes for current gas sourcing methods.

Air Liquide is proactively addressing this threat by investing heavily in low-carbon hydrogen production and CO2 capture technologies. For instance, in 2023, the company announced significant investments in hydrogen projects, aiming to be a key player in the energy transition and transforming what could be a threat into a substantial growth avenue. Their strategy involves developing solutions that enable customers to decarbonize their operations, positioning Air Liquide as a facilitator of this industrial shift rather than a victim of it.

Customer Switching Costs to Substitutes

Customer switching costs to substitute technologies for industrial gases are a significant barrier. For example, a customer moving from traditional industrial gas supply to on-site generation of gases like nitrogen or oxygen would face substantial upfront investment in new equipment. This could easily run into millions of dollars, depending on the scale and purity requirements. In 2024, the cost of advanced on-site generation units, such as PSA (Pressure Swing Adsorption) or membrane systems, continues to be a major consideration, often exceeding the immediate savings for many businesses.

Beyond the initial capital outlay, switching involves considerable operational adjustments. Retooling existing manufacturing processes to accommodate a different gas source or purity level requires time, expertise, and further investment. There are also potential regulatory hurdles to navigate, especially in highly sensitive industries like healthcare or food and beverage, where gas quality and safety standards are paramount. These combined costs and complexities considerably dampen the immediate threat from most substitute options, reinforcing Air Liquide's position.

- High Capital Expenditure: Transitioning to substitute technologies often necessitates significant investment in new machinery and infrastructure.

- Process Retooling: Existing production lines may need substantial modifications to integrate alternative gas solutions.

- Regulatory Compliance: Meeting stringent industry regulations for new gas sources can add complexity and cost.

- Operational Disruption: The transition period itself can lead to temporary disruptions in production and supply chains.

While direct substitutes are rare for many core industrial and medical gases due to unique properties and safety needs, the threat emerges from alternative processes and on-site generation technologies. For instance, advancements in water electrolysis are making on-site hydrogen generation more feasible, potentially reducing reliance on bulk supply. Similarly, evolving environmental regulations are pushing industries to explore greener alternatives and gas reuse, which could curb demand for traditionally sourced gases.

Entrants Threaten

The industrial and medical gas sector demands substantial upfront capital for essential infrastructure like air separation units and liquefaction plants. For example, building a new large-scale air separation unit can cost hundreds of millions of dollars, creating a significant financial hurdle for aspiring competitors.

Furthermore, establishing the necessary extensive global distribution networks, including pipelines, cryogenic tankers, and storage facilities, adds another layer of immense financial commitment. This high cost of entry effectively discourages many potential new players from entering the market.

The threat of new entrants in the industrial gas sector, where companies like Air Liquide operate, is significantly mitigated by substantial economies of scale. Existing players have invested heavily in large-scale production facilities and extensive distribution networks, allowing them to produce gases at a much lower per-unit cost than a new entrant could initially achieve. For instance, in 2024, major industrial gas producers continued to optimize their global supply chains, a process that requires immense capital and operational expertise.

Furthermore, established companies benefit from economies of scope by offering a wide array of industrial and medical gases, along with related services and technologies. This broad product portfolio, built over decades, creates a significant barrier for newcomers who would find it challenging and costly to replicate such a comprehensive offering. This integrated approach allows incumbents to capture more value and build deeper customer relationships, making it difficult for new, specialized entrants to gain traction.

The production and application of industrial and medical gases rely heavily on sophisticated, proprietary technologies and processes, frequently safeguarded by patents. This intellectual property creates a significant hurdle for newcomers. For instance, Air Liquide's investment in advanced air separation unit (ASU) technology, a core competency, represents a substantial capital and knowledge barrier.

Regulatory Hurdles and Safety Standards

The industrial gas sector, including companies like Air Liquide, faces a significant threat from new entrants due to the substantial regulatory hurdles and rigorous safety standards in place. These requirements are particularly demanding for medical gases and other hazardous industrial gases, necessitating substantial capital outlays for compliant infrastructure, operational processes, and necessary certifications.

New companies must navigate a complex web of regulations covering production, transportation, storage, and application of gases. For instance, in the European Union, regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) impose strict compliance burdens. In 2024, the ongoing evolution of environmental regulations, such as those pertaining to carbon emissions and energy efficiency, further increases the compliance costs and technical expertise required for new market participants.

- Stringent Health, Safety, and Environmental (HSE) Regulations: The production and distribution of industrial and medical gases are heavily regulated to ensure public safety and environmental protection.

- High Capital Investment for Compliance: New entrants need to invest heavily in specialized equipment, safety protocols, and obtaining permits, which can run into millions of dollars.

- Complex Certification Processes: Obtaining necessary certifications for handling hazardous materials and medical-grade gases is time-consuming and costly.

- Established Safety Track Record: Existing players like Air Liquide have decades of experience and proven safety records, which are difficult for new entrants to replicate quickly.

Established Distribution Networks and Long-Term Contracts

Air Liquide, like many players in the industrial gas sector, benefits from deeply entrenched distribution systems. Incumbents possess well-established global distribution networks and often secure long-term supply contracts with major industrial customers. Building such extensive networks and breaking into existing long-term relationships is a formidable challenge for any new entrant.

For instance, securing the infrastructure for gas delivery, whether via pipelines, specialized trucks, or on-site generation, requires massive upfront capital investment. New entrants would need to replicate this, which is a significant barrier. In 2024, the industrial gas market continued to see substantial investment in logistics and infrastructure, further solidifying the advantage of established players.

- Established Infrastructure: Incumbents have invested billions in global pipeline networks and specialized delivery fleets, making it costly for newcomers to match.

- Long-Term Contracts: Major industrial clients often have multi-year agreements with existing suppliers, locking in demand and creating a barrier to entry.

- Customer Loyalty: Reliability and established relationships built over decades foster strong customer loyalty, making it difficult for new entrants to gain market share.

- Economies of Scale: Existing players leverage their scale to offer competitive pricing, a benchmark that new entrants would struggle to meet initially.

The threat of new entrants in the industrial gas sector is considerably low due to the immense capital required for infrastructure and distribution. Building new air separation units and cryogenic logistics networks demands hundreds of millions, if not billions, of dollars. Furthermore, established players like Air Liquide benefit from decades of experience and deeply entrenched customer relationships, making it difficult for newcomers to gain traction or offer competitive pricing. In 2024, the ongoing need for significant investment in decarbonization technologies and supply chain resilience further cemented the advantage of incumbents.

| Barrier to Entry | Description | Impact on New Entrants | Example (2024 Context) |

|---|---|---|---|

| Capital Requirements | High cost of building production facilities and distribution networks. | Significant financial hurdle; requires substantial funding. | A new ASU can cost $200M-$500M+; logistics infrastructure adds billions. |

| Economies of Scale | Lower per-unit costs for established, high-volume producers. | New entrants face higher initial production costs. | Major players optimize global supply chains, achieving cost efficiencies in 2024. |

| Technology & IP | Proprietary production processes and patents. | Requires R&D investment and licensing to compete. | Air Liquide's advanced ASU technologies are a key differentiator. |

| Regulatory Compliance | Strict safety, environmental, and medical gas standards. | Demands significant investment in compliant infrastructure and certifications. | Evolving environmental regulations in 2024 increase compliance costs for new entrants. |

| Distribution Networks | Extensive, established global logistics and long-term contracts. | Challenging to replicate; difficult to break into existing customer agreements. | Securing pipeline access or cryogenic tanker fleets is a major obstacle. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Air Liquide is built upon a foundation of comprehensive data, including Air Liquide's annual reports, investor presentations, and industry-specific market research from leading firms like IHS Markit and Bloomberg.

We also integrate information from regulatory filings, competitor financial statements, and global economic indicators to provide a robust understanding of the competitive landscape impacting Air Liquide.