Air Liquide Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Liquide Bundle

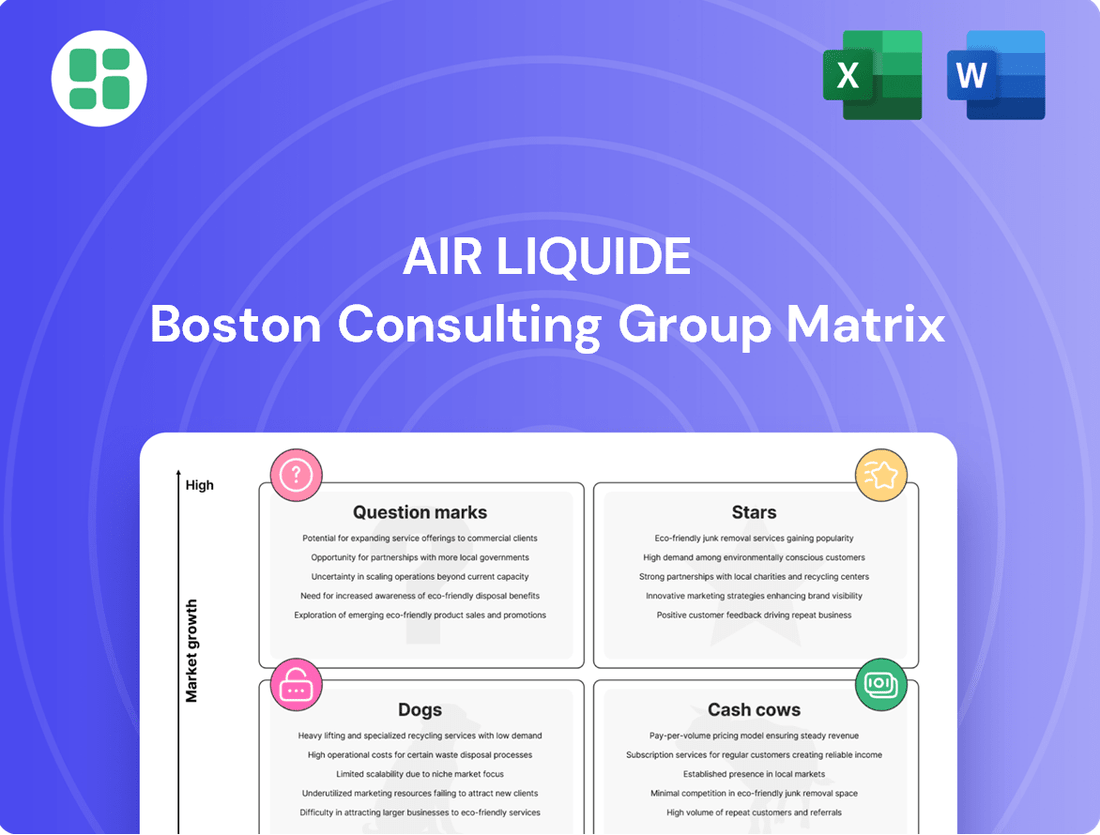

Curious about Air Liquide's strategic positioning? This glimpse into their BCG Matrix highlights key product categories like their established Cash Cows and emerging Stars, but the full picture is crucial for informed decisions.

Unlock the complete Air Liquide BCG Matrix to understand the true potential and challenges of each business unit, empowering you to optimize resource allocation and drive future growth.

Don't miss out on vital strategic insights; purchase the full BCG Matrix for a comprehensive quadrant breakdown and actionable recommendations tailored to Air Liquide's market landscape.

Stars

Hydrogen Energy Solutions represents a significant growth opportunity for Air Liquide, often considered a Star in the BCG matrix. The company is channeling substantial investments into the entire hydrogen value chain, from production to distribution and mobility. Their ambition is to see hydrogen-related revenue triple by 2035, underscoring their commitment to this sector.

This segment is fueled by a booming global market, propelled by the urgent need for decarbonization. Air Liquide's established expertise and involvement in large-scale projects, like the ELYgator electrolyzer in the Netherlands and collaborations with major energy firms, solidify its leading position. These initiatives are crucial for capturing market share in a rapidly evolving landscape.

Air Liquide's Advanced Materials & Carrier Gases for Semiconductors segment is a significant growth engine, fueled by the booming electronics sector. This area saw double-digit growth in key markets like the United States during 2024.

The company is backing this expansion with substantial capital, investing over €250 million in Europe and $250 million in the US to construct advanced production facilities. These investments are crucial for supplying the ultra-high purity gases and specialized materials essential for cutting-edge chip manufacturing.

This market is characterized by robust expansion and Air Liquide's strategic positioning, marked by a strong and growing market share, making it a prime candidate for the Stars category in the BCG Matrix.

Carbon Capture, Utilization, and Storage (CCUS) technologies are a vital part of industrial decarbonization, and Air Liquide is making significant strides in this high-growth area. The company is actively developing and deploying CCUS solutions, bolstered by substantial EU support for its various projects. This commitment underscores Air Liquide's dedication to reducing CO2 emissions across its operations and for its clients, positioning it as a key player in this expanding market.

Biomethane Production and Distribution

Biomethane production and distribution is a strategic growth area for Air Liquide, aligning with its commitment to the energy transition. The company is actively investing in innovation and project development to expand its biomethane offerings for sectors like transportation and industry.

The global biomethane market is projected for substantial expansion, driven by increasing demand for sustainable energy solutions. Air Liquide is well-positioned to capitalize on this growth, leveraging its extensive experience in gas production and distribution to capture a larger market share.

- Market Growth: The global biomethane market was valued at approximately USD 48.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 7.8% from 2024 to 2030.

- Air Liquide's Investment: Air Liquide announced plans to invest €8 billion in the energy transition by 2025, with a significant portion allocated to developing low-carbon solutions, including biomethane.

- Applications: Biomethane is increasingly used as a renewable alternative to natural gas in vehicles, for heating, and in industrial processes, offering a cleaner energy source.

- Strategic Focus: Air Liquide's expertise in gas management, liquefaction, and distribution provides a competitive advantage in scaling up biomethane production and supply chains.

Low-Carbon Industrial Gas Production Units

Air Liquide is significantly expanding its low-carbon industrial gas production capacity. In 2024, the company finalized substantial power purchase agreements (PPAs) to fuel both existing and new facilities with renewable energy sources. This strategic investment underscores their commitment to reducing the environmental impact of industrial gas production.

These new units, including advanced Air Separation Units (ASUs) in key markets like Japan and the United States, are designed to meet escalating industrial demand. By integrating low-carbon electricity, Air Liquide is not only ensuring a reliable supply but also setting new benchmarks for sustainability within the sector. For instance, their 2024 PPA commitments are among the largest in the industry, directly supporting a greener operational footprint.

- Record PPA Investments: Air Liquide's 2024 PPA signings represent a significant financial commitment to renewable energy sourcing for industrial gas production.

- New ASU Developments: The construction and commissioning of new ASUs in Japan and the US are central to this low-carbon strategy, catering to growing market needs.

- Carbon Footprint Reduction: These initiatives are projected to substantially lower the carbon intensity of industrial gas supply, aligning with global decarbonization efforts.

- Sustainable Supply Chain: The focus on renewable energy for production units positions Air Liquide as a leader in providing sustainable solutions to its industrial customers.

Air Liquide's Hydrogen Energy Solutions are a prime example of a Star in the BCG matrix, demonstrating high growth and a strong market position. The company's extensive investments across the hydrogen value chain, aiming to triple hydrogen-related revenue by 2035, highlight its commitment to this burgeoning sector.

The global demand for hydrogen is surging due to decarbonization efforts, and Air Liquide's established expertise, evidenced by projects like the ELYgator electrolyzer, solidifies its leadership. This strategic focus allows them to capture significant market share in a rapidly evolving market.

Air Liquide's Advanced Materials & Carrier Gases for Semiconductors segment is another Star, driven by the robust growth in the electronics industry. Double-digit growth was observed in key markets like the United States during 2024, supported by substantial investments of over €250 million in Europe and $250 million in the US for advanced production facilities.

| Segment | Market Growth | Air Liquide's Position | Investment/Strategy |

| Hydrogen Energy Solutions | High, driven by decarbonization | Leading, strong market share | Triple revenue by 2035, significant investment across value chain |

| Advanced Materials & Carrier Gases for Semiconductors | High, driven by electronics sector | Strong, growing market share | €250M+ in Europe, $250M in US for new facilities |

What is included in the product

The Air Liquide BCG Matrix provides a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Provides a clear, actionable roadmap for resource allocation, turning strategic confusion into decisive action.

Cash Cows

Air Liquide's core business of supplying bulk industrial gases such as oxygen, nitrogen, and argon to established sectors like steel and chemicals remains a robust revenue stream. This segment is characterized by consistent demand from mature industries.

The company benefits from long-term agreements and strategic contract renewals, which solidify its market position and ensure predictable cash flow. For instance, a multi-year agreement with Dow in Stade exemplifies this stability, underscoring Air Liquide's high market share in these essential supply chains.

Air Liquide's medical gases and home healthcare services in mature markets represent a strong Cash Cow. This segment consistently delivers robust and stable sales growth, fueled by demographic shifts like aging populations and a growing trend towards home-based care in developed economies.

The company commands a significant market share in this essential and predictable sector. This strong position translates into reliable profits and substantial cash flow, which are vital for supporting Air Liquide's overall financial stability and funding other business areas.

For instance, in 2024, Air Liquide reported that its Healthcare division, which heavily features these services, saw its revenue increase by 6.1% on a like-for-like basis, reaching €3.7 billion for the first half of the year, underscoring the segment's consistent performance.

Air Liquide's on-site industrial gas production for major clients, a core element of its business, generates exceptionally stable and predictable cash flows. These long-term, deeply integrated contracts, often lasting decades, insulate revenue from market fluctuations. For instance, in 2023, Air Liquide secured a significant contract with a major European refiner for on-site hydrogen production, underscoring the enduring demand for this model.

Extensive Pipeline Networks for Industrial Clusters

Air Liquide's extensive pipeline networks for industrial clusters are a prime example of a Cash Cow within its portfolio. These established infrastructures connect production facilities directly to major industrial hubs, signifying a mature asset with high utilization rates and minimal incremental costs. This robust network ensures efficient and dependable gas supply to a broad customer base.

The reliable and consistent revenue stream generated from these pipelines is a direct result of Air Liquide's significant market share within these critical industrial areas. For instance, in 2024, the company continued to leverage its pipeline infrastructure to serve key sectors like refining and chemicals, where consistent gas supply is paramount.

- High Utilization: Air Liquide's pipeline networks are characterized by their extensive reach and deep integration into industrial zones, leading to consistently high operational utilization.

- Low Incremental Costs: Once established, the marginal cost of supplying gas through these existing pipelines is very low, contributing to strong profitability.

- Consistent Revenue: The demand from industrial clusters for essential gases like hydrogen, oxygen, and nitrogen creates a stable and predictable revenue stream.

- Market Dominance: Air Liquide's significant market share in these pipeline-connected industrial clusters solidifies its position as a dominant and profitable player.

Traditional Welding & Cutting Gases and Equipment

Traditional welding and cutting gases and equipment, a cornerstone of Air Liquide's industrial merchant business, are firmly positioned as Cash Cows. This segment thrives on consistent demand in established industrial markets, offering a reliable stream of revenue. Despite being a low-growth area, Air Liquide's deep market penetration and extensive customer relationships ensure its stability.

The inherent stability of this business is underscored by its essential nature for manufacturing and repair operations. For instance, in 2024, the global industrial gases market, heavily influenced by segments like welding, was projected to reach over $200 billion, with a significant portion attributable to these core offerings.

- Stable Revenue: The recurring need for welding gases and equipment in mature industrial economies provides predictable cash flow.

- Established Market Position: Air Liquide's long history and extensive distribution network create a strong competitive advantage.

- Essential Industrial Input: Welding and cutting gases are fundamental to numerous manufacturing processes, ensuring consistent demand.

- Low Growth, High Cash Generation: While not a growth engine, this segment efficiently converts its market share into substantial profits.

Air Liquide's established industrial gas supply to mature sectors like steel and chemicals, characterized by consistent demand and long-term contracts, represents a significant Cash Cow. These operations benefit from high market share and deep integration into customer supply chains, ensuring predictable and stable revenue generation.

The company's medical gases and home healthcare services in developed economies also function as a strong Cash Cow, driven by demographic trends such as aging populations and the increasing preference for home-based care. This segment consistently delivers robust sales growth and reliable profits.

Air Liquide's extensive pipeline networks serving industrial clusters are a prime example of a Cash Cow. These mature assets boast high utilization and low incremental costs, providing a stable and predictable revenue stream due to consistent demand from essential industries.

Traditional welding and cutting gases and equipment, a fundamental part of Air Liquide's industrial merchant business, are also firmly established as Cash Cows. Despite low growth, their essential nature for manufacturing and repair operations, coupled with Air Liquide's deep market penetration, ensures consistent cash generation.

| Segment | BCG Category | Key Characteristics | 2024 Performance Indicator (H1) |

|---|---|---|---|

| Industrial Gas Supply (Bulk) | Cash Cow | Consistent demand, long-term contracts, high market share | Revenue growth in mature sectors |

| Medical Gases & Home Healthcare | Cash Cow | Demographic tailwinds, stable growth, essential services | Healthcare division revenue: +6.1% (like-for-like) to €3.7 billion |

| Pipeline Networks | Cash Cow | High utilization, low incremental costs, essential infrastructure | Continued leverage in refining and chemicals sectors |

| Welding & Cutting Gases | Cash Cow | Essential industrial input, stable revenue, established market | Global industrial gases market projected >$200 billion (influenced by welding) |

What You’re Viewing Is Included

Air Liquide BCG Matrix

The Air Liquide BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase, offering a comprehensive strategic overview of their business units. This preview showcases the complete analysis, allowing you to assess its value and suitability for your own strategic planning without any alterations or missing sections. Once acquired, this ready-to-use BCG Matrix report will be immediately accessible, empowering you to integrate its insights into your business decisions or presentations. You are essentially reviewing the final, professional-grade output that will be delivered directly to you, ensuring no surprises and immediate utility.

Dogs

For Air Liquide, the distribution of small-scale, commoditized gas cylinders for general use likely falls into the 'Dog' category of the BCG Matrix. This is due to highly fragmented markets and intense price competition, which limit growth and profitability.

Outdated gas application equipment and services often represent a challenging segment within Air Liquide's portfolio. These offerings, characterized by a focus on older, less efficient technologies, typically experience dwindling demand. Industries are increasingly shifting towards modern, energy-efficient, and environmentally conscious solutions, directly impacting the market share and growth prospects of these legacy services.

In 2024, the market for such equipment is projected to see a continued decline, with many industrial sectors actively phasing out older systems. For instance, sectors that historically relied heavily on older welding or cutting gas equipment are now investing in advanced laser or plasma technologies. This transition directly translates to a reduced need for Air Liquide's maintenance and supply of these outdated systems, placing them firmly in the Dogs category of the BCG Matrix.

Air Liquide's strategic repositioning includes exiting non-core regional operations, exemplified by its divestiture of assets in 12 African countries. This move targets markets where intense local competition and limited growth prospects hinder significant market share gains.

These smaller geographical units, often characterized by a fragmented competitive landscape, may have represented a drain on resources without generating commensurate returns. For instance, in 2023, Air Liquide's revenue from Africa represented a small fraction of its global sales, underscoring the rationale for focusing on more dominant markets.

Low-Margin, Standardized Industrial Merchant Contracts

Certain low-margin, standardized industrial merchant contracts, particularly those in highly price-sensitive markets with minimal value-added services, can be categorized as Dogs within the Air Liquide BCG Matrix. These contracts, while potentially part of a larger portfolio, often exhibit low profit margins and constrained growth potential.

These segments may tie up significant capital and operational resources without delivering substantial returns or contributing meaningfully to the company's overall strategic objectives. For instance, in 2024, the industrial gas market saw intense competition, with some commodity-based contracts facing downward price pressure, impacting profitability for suppliers like Air Liquide.

- Low Profitability: These contracts typically operate on thin margins, often in the single digits, due to intense price competition.

- Limited Growth Prospects: The standardized nature and lack of differentiation in these segments restrict opportunities for significant expansion or market share gains.

- Capital Intensity: Despite low returns, these contracts can still require substantial investment in infrastructure and logistics, tying up valuable capital.

- Strategic Drain: Resources allocated to managing these low-performing contracts could be better utilized in higher-growth, higher-margin business areas.

Legacy Technologies Not Aligned with Decarbonization

Legacy technologies within Air Liquide, such as certain older methods of hydrogen production reliant on fossil fuels without carbon capture, are becoming misaligned with the global push for decarbonization. For instance, traditional steam methane reforming (SMR) without CCUS (Carbon Capture, Utilization, and Storage) contributes to greenhouse gas emissions. As industries prioritize sustainability, the demand for these less eco-friendly gas applications is expected to dwindle.

This shift directly impacts Air Liquide's market position in these specific segments. With a growing emphasis on green hydrogen and other sustainable gas solutions, older, carbon-intensive technologies are likely to see a reduced market share and slower growth. For example, in 2024, the global investment in clean hydrogen projects reached record levels, signaling a clear market preference away from traditional methods.

- Traditional SMR without CCUS: Represents a legacy technology with significant CO2 emissions.

- High-emission industrial gas applications: Certain legacy uses of industrial gases in processes that are inherently carbon-intensive.

- Limited growth potential: These technologies face declining demand as cleaner alternatives gain traction.

- Reduced market share: Companies heavily invested in these legacy areas may see their competitive position erode.

Air Liquide's legacy gas cylinder distribution and outdated equipment services are prime examples of its 'Dog' segment. These areas suffer from low growth and intense price competition, making them unattractive for investment. The company's strategic divestments, such as exiting 12 African countries in 2024, highlight its focus on shedding underperforming assets with limited market potential.

Low-margin, standardized industrial merchant contracts also fall into this category. These contracts, often characterized by single-digit profit margins in 2024 due to market price pressures, tie up capital without offering significant growth opportunities. Furthermore, legacy, carbon-intensive technologies like traditional steam methane reforming without CCUS are declining in relevance as the market shifts towards sustainable alternatives, evidenced by record clean hydrogen investments in 2024.

| Business Segment | BCG Category | Key Characteristics | 2024 Market Trend |

|---|---|---|---|

| Small-scale Gas Cylinders (General Use) | Dog | Fragmented markets, high price competition, low profitability. | Continued commoditization and price pressure. |

| Outdated Gas Application Equipment/Services | Dog | Dwindling demand, shift to modern/efficient technologies. | Phasing out by industrial sectors, reduced maintenance needs. |

| Low-Margin Industrial Merchant Contracts | Dog | Low profit margins (often <10%), limited differentiation, capital intensive. | Downward price pressure on commodity contracts. |

| Legacy Carbon-Intensive Technologies (e.g., SMR without CCUS) | Dog | High emissions, declining demand, misaligned with decarbonization. | Market preference for green hydrogen and sustainable solutions. |

Question Marks

Air Liquide's ventures into emerging green hydrogen applications, such as its involvement in developing hydrogen refueling infrastructure for heavy-duty transport in regions like North America or its pilot projects for industrial decarbonization in sectors like steel or chemicals, are prime examples of question marks. These initiatives, while promising significant future demand and aligning with global decarbonization trends, currently require substantial capital outlay with uncertain payback periods and market penetration.

Air Liquide is actively developing and investing in novel digital solutions designed to streamline gas management and enhance operational efficiency across various industries. These innovations aim to provide customers with greater control, predictive maintenance capabilities, and optimized gas delivery, thereby creating new value propositions.

Despite the significant growth potential and the company's strategic focus, the market adoption of these advanced digital tools remains a key challenge. Industries that are typically slower to embrace new technologies, such as some traditional manufacturing sectors, are exhibiting lower uptake rates for these novel offerings. Consequently, these solutions currently hold a relatively small market share, positioning them as question marks within the Air Liquide portfolio. For instance, while the broader industrial gases market is projected for steady growth, the specific segment for digital gas management solutions is still nascent, with adoption rates varying significantly by sector.

Air Liquide is actively investing in advanced materials crucial for next-generation computing, including quantum computing. These specialized materials are essential for developing cutting-edge technologies, representing a high-growth but nascent market. For instance, the global quantum computing market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, with advanced materials being a key enabler.

The company's strategic investments, such as building new production facilities for materials like molybdenum, signal a commitment to capturing future market share. However, given the early stage of these technologies, Air Liquide's current market penetration in this specific segment is likely modest, positioning it as a question mark within the BCG matrix.

Expansion into New Geographical Markets for Niche Healthcare Services

Expanding niche healthcare services into new geographical markets positions them as potential stars within Air Liquide's portfolio, even if current market share is low. These ventures, like advanced home respiratory care in emerging economies, face high growth potential but demand substantial upfront investment for infrastructure and market penetration. For instance, Air Liquide's expansion of its home healthcare services into Southeast Asia in 2024, targeting specialized respiratory support, exemplifies this strategy. Initial market share in these regions might be modest, but the projected compound annual growth rate (CAGR) for advanced medical devices and home-based care in these territories is estimated to be upwards of 10% through 2028.

- Star Potential: Niche healthcare services in new markets offer high growth prospects, aligning with the 'Star' quadrant of the BCG matrix.

- Investment Needs: Significant capital is required to establish operations, build brand awareness, and navigate regulatory landscapes in unfamiliar territories.

- Market Share Dynamics: Despite high market growth, initial market share for specialized services is often low due to the novelty and competitive entry barriers.

- Strategic Focus: Air Liquide's approach involves targeted investments to capture emerging demand for advanced healthcare solutions globally.

Specific Solutions for Sustainable Aviation Fuel (SAF) Production

The Sustainable Aviation Fuel (SAF) market represents a significant growth opportunity for decarbonization efforts within the aviation sector. Air Liquide is actively participating by supplying essential gas solutions crucial for SAF production processes. While the overall SAF market is expanding, Air Liquide's specific market share in this nascent and rapidly evolving segment may currently be modest, positioning it as a question mark within the BCG matrix due to its high potential coupled with current uncertainties in scaling and market penetration.

The global SAF market is projected to reach approximately $15 billion by 2030, driven by regulatory mandates and corporate sustainability goals. Air Liquide's involvement focuses on providing hydrogen and other industrial gases vital for SAF conversion technologies like Hydroprocessed Esters and Fatty Acids (HEFA) and Alcohol-to-Jet (ATJ). The company's strategic positioning aims to capture a share of this burgeoning market, though its current footprint is still in the developmental stages, reflecting the question mark classification.

- High Growth Potential: The SAF market is expected to grow substantially, offering significant future revenue streams.

- Developing Market Share: Air Liquide's current market share in SAF production solutions is relatively small as the industry scales.

- Technological Dependence: Air Liquide's success hinges on the broader adoption and scaling of SAF production technologies.

- Investment Uncertainty: The question mark status reflects the need for continued investment and market development to realize full potential.

Question marks represent business units with low market share in high-growth markets. Air Liquide's investments in green hydrogen infrastructure, advanced materials for quantum computing, and digital gas management solutions fit this category. These ventures require substantial capital investment and have uncertain near-term returns, but they target rapidly expanding future markets.

The company's engagement in developing hydrogen refueling stations for heavy-duty transport in North America, for example, is a question mark. While the demand for decarbonized transport is high, the infrastructure build-out is capital-intensive and the market penetration timeline is still developing. Similarly, Air Liquide's focus on advanced materials for quantum computing, a market valued at approximately $1.5 billion in 2023, represents a high-growth area where its current market share is nascent.

The Sustainable Aviation Fuel (SAF) market is another area where Air Liquide operates as a question mark. The company supplies essential gases for SAF production, a sector projected to reach $15 billion by 2030. Although the market has significant growth potential, Air Liquide's current share in this evolving segment is modest, reflecting the investment needed to scale its operations and capture market demand.

| Initiative | Market Growth | Current Market Share | Investment Status |

| Green Hydrogen Infrastructure | High | Low | High Capital Outlay |

| Quantum Computing Materials | Very High | Nascent | Significant R&D |

| Digital Gas Management | Moderate to High | Low | Market Adoption Dependent |

| Sustainable Aviation Fuel (SAF) | High | Modest | Scaling Operations |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.