Air Liquide Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Liquide Bundle

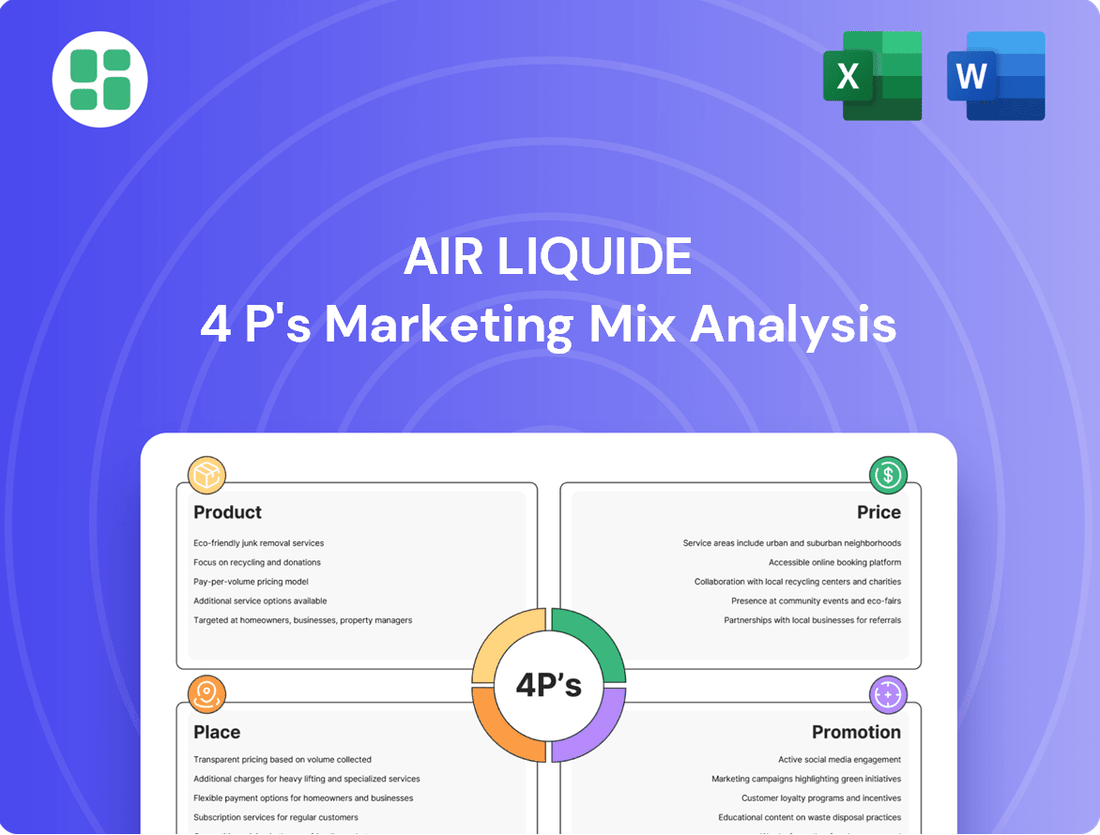

Air Liquide's marketing prowess lies in its intricate balance of product innovation, strategic pricing, extensive global reach, and targeted promotional campaigns. Understanding how these elements converge offers invaluable insights into their market leadership.

Dive deeper into the specific strategies Air Liquide employs across Product, Price, Place, and Promotion to maintain its competitive edge. This comprehensive analysis provides actionable takeaways for any business looking to optimize its own marketing mix.

Gain instant access to a professionally crafted, editable 4Ps Marketing Mix Analysis for Air Liquide, perfect for strategic planning, academic research, or competitive benchmarking.

Product

Air Liquide's product offering in industrial and specialty gases is extensive, featuring essential elements like oxygen, nitrogen, hydrogen, and argon. These gases are fundamental to a wide array of industries, including manufacturing, chemicals, and energy. For instance, in 2023, the demand for hydrogen as a clean energy source continued to grow, with Air Liquide heavily investing in its production and distribution networks.

The company tailors its supply methods to suit specific customer requirements, providing gases in bulk liquid form, convenient compressed cylinders, or through dedicated on-site production facilities. This flexibility ensures that businesses of all sizes, from large chemical plants to smaller fabrication shops, receive the precise gas solutions they need. Air Liquide's global presence allows it to serve over 3.8 million customers worldwide.

Air Liquide's Medical Gases and Home Healthcare segment offers essential products and services, including oxygen therapy and respiratory care, to hospitals and patients at home. This commitment to critical patient support underscores their vital role in the healthcare ecosystem.

In 2024, the global home healthcare market, a key area for Air Liquide's medical gases, was projected to reach over $450 billion, showcasing significant demand for these specialized services. The company's focus on respiratory solutions positions it to capitalize on this growing need.

Air Liquide's extensive portfolio in this sector, encompassing a wide range of medical gases and advanced equipment, directly addresses patient needs for conditions like COPD and sleep apnea. This comprehensive offering ensures continuity of care, extending beyond hospital walls.

Air Liquide's commitment extends far beyond simply supplying gases. They are deeply involved in the design, construction, and operation of sophisticated technologies and equipment crucial for gas production, purification, and innovative applications. This comprehensive approach ensures they provide end-to-end solutions.

Their technological portfolio is diverse, catering to a wide range of industrial needs. This includes the development of large-scale industrial gas production plants, as well as highly specialized equipment tailored for cutting-edge sectors such as electronics manufacturing and the burgeoning hydrogen infrastructure. For instance, in 2024, Air Liquide continued to invest heavily in hydrogen refueling stations across Europe, showcasing their dedication to advanced equipment for sustainable energy solutions.

Energy Transition Solutions

Air Liquide's product strategy heavily emphasizes solutions for the energy transition, with a particular focus on low-carbon hydrogen and CO2 capture. These offerings are designed to directly address the growing demand for decarbonization across various industrial sectors.

The company is making substantial investments to develop and implement these cutting-edge technologies. For instance, Air Liquide announced a €8 billion investment plan for low-carbon hydrogen in Europe through 2035, aiming to build significant production capacities.

- Low-Carbon Hydrogen Production: Expanding capacity for green and blue hydrogen to serve mobility and industrial clients.

- CO2 Capture Technologies: Offering solutions to capture carbon emissions from industrial processes, supporting clients' decarbonization goals.

- Energy Transition Partnerships: Collaborating with industries to implement hydrogen and CCUS solutions, such as the agreement with TotalEnergies for a hydrogen refueling station network.

- Investment in Innovation: Dedicating significant R&D resources to advance hydrogen production, storage, and utilization technologies, as well as carbon capture efficiency.

Advanced Materials for Electronics

Air Liquide's advanced materials for electronics are crucial for the semiconductor industry, supplying ultra-high purity gases and specialized chemicals. These are fundamental building blocks for manufacturing sophisticated components like memory chips, powering the growth in digital technologies and artificial intelligence. The demand for these materials is projected to remain strong, with the global semiconductor market expected to reach approximately $689 billion in 2024, according to Statista.

The product strategy focuses on innovation and reliability to meet the stringent requirements of electronics manufacturing. Air Liquide's commitment to quality ensures that these advanced materials enable higher yields and performance in cutting-edge chip production. This strategic focus is vital as the complexity of semiconductor devices continues to escalate.

- Ultra-high purity gases: Essential for critical deposition and etching processes in semiconductor fabrication.

- Advanced materials: Including precursors for thin-film deposition, vital for creating intricate chip architectures.

- Market relevance: Directly supporting the expanding global demand for semiconductors, driven by AI and 5G deployment.

- Quality assurance: Rigorous control ensures materials meet the exacting standards of the electronics sector.

Air Liquide's product strategy is deeply rooted in providing essential industrial and specialty gases, alongside advanced technological solutions. This dual focus ensures comprehensive support for diverse industries, from heavy manufacturing to cutting-edge electronics. The company's commitment to innovation is evident in its significant investments in areas like low-carbon hydrogen and advanced materials for semiconductor production, aligning with major global trends like the energy transition and digital transformation.

Their product portfolio also extends to critical medical gases and home healthcare services, addressing vital patient needs. By tailoring supply methods and focusing on high-purity materials, Air Liquide demonstrates a commitment to meeting specific customer requirements across its broad market segments. This customer-centric approach, coupled with a strong emphasis on technological advancement, solidifies their position as a key solutions provider.

| Product Category | Key Offerings | 2023/2024 Data Points | Strategic Focus |

|---|---|---|---|

| Industrial & Specialty Gases | Oxygen, Nitrogen, Hydrogen, Argon | Hydrogen demand growth; 3.8 million global customers | Energy transition, industrial efficiency |

| Medical Gases & Home Healthcare | Oxygen therapy, respiratory care | Home healthcare market > $450 billion (2024 projection) | Patient well-being, chronic disease management |

| Technologies & Equipment | Gas production plants, purification systems | Investment in hydrogen refueling stations (2024) | Decarbonization, infrastructure development |

| Advanced Materials for Electronics | Ultra-high purity gases, specialized chemicals | Semiconductor market ~$689 billion (2024 projection) | AI, 5G, digital technologies |

What is included in the product

This analysis provides a comprehensive overview of Air Liquide's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities.

It offers a deep dive into how Air Liquide positions itself in the market, utilizing real-world practices and competitive context for a grounded understanding.

Simplifies Air Liquide's complex marketing strategy by presenting the 4Ps in a clear, actionable framework, easing the burden of understanding and implementation.

Provides a concise overview of Air Liquide's 4Ps, offering immediate clarity and reducing the time needed to identify key marketing levers for improved performance.

Place

Air Liquide's direct sales model is central to its strategy, focusing on forging long-term contracts with major industrial clients. This direct engagement allows for tailored solutions and a deep understanding of customer needs, fostering strong partnerships.

These long-term agreements, often spanning many years, provide Air Liquide with predictable and stable revenue streams. For instance, in 2023, the company continued to secure significant multi-year contracts across various sectors, including electronics and healthcare, underscoring the success of this approach in ensuring consistent demand.

For its major industrial clients, Air Liquide frequently constructs and manages dedicated on-site gas production facilities. These are often linked by extensive pipeline networks, ensuring a seamless and reliable gas supply directly to the customer's operations. This approach significantly reduces logistical complexities and enhances supply chain security.

Air Liquide's global distribution network is a cornerstone of its market strategy, ensuring product availability across 60 countries. This extensive infrastructure includes a fleet of specialized tankers for bulk liquid gases and numerous cylinder distribution centers, catering to diverse industrial and medical needs.

This widespread presence facilitates efficient and reliable delivery, reaching customers from major industrial hubs to remote locations. For instance, in 2023, Air Liquide's logistics operations handled millions of deliveries, underscoring the scale and complexity of its distribution capabilities.

Specialized Healthcare Logistics

Air Liquide's Place strategy in healthcare is defined by its dedicated logistics and supply chains, ensuring the secure and timely delivery of essential medical gases and home healthcare equipment. This specialized distribution network is crucial for meeting the critical demands of hospitals and individual patients, underscoring the company's commitment to patient care and operational excellence.

The company's infrastructure is designed to handle the unique requirements of medical products, from cryogenic gases to sensitive homecare devices. This focus on specialized handling and delivery is a cornerstone of their market presence. For instance, Air Liquide's investment in cold chain logistics ensures the integrity of temperature-sensitive pharmaceuticals and biologics, a growing segment of the healthcare market.

Key aspects of Air Liquide's specialized healthcare logistics include:

- Dedicated Fleet and Infrastructure: Maintaining a specialized fleet of vehicles and storage facilities optimized for medical gases and equipment.

- Regulatory Compliance: Adhering to stringent healthcare regulations for transportation and storage, ensuring patient safety and product quality.

- On-Time Delivery: Implementing robust tracking and management systems to guarantee timely delivery for critical medical needs, vital for patient treatment continuity.

Strategic Investments and Partnerships

Air Liquide actively pursues strategic investments and partnerships to bolster its global presence and operational capabilities. These collaborations are crucial for expanding production capacities and enhancing its extensive pipeline infrastructure worldwide. For instance, in 2024, the company announced a significant investment in a new hydrogen production facility in the United States, partly funded through a joint venture, aiming to serve the burgeoning industrial and mobility sectors.

These strategic alliances not only extend Air Liquide's market reach but also solidify its competitive standing in vital industrial hubs and rapidly developing regions. The company's focus on emerging markets, particularly in hydrogen mobility, is evident in its 2025 plans, which include several new partnerships to establish hydrogen refueling stations across Europe and Asia. This approach allows for shared risk and accelerated growth.

- Global Expansion: Air Liquide's investment strategy prioritizes expanding production and pipeline networks, evidenced by its 2024 US hydrogen facility investment.

- Joint Ventures: The company frequently utilizes joint ventures to share costs and expertise, facilitating entry into new markets and projects.

- Hydrogen Mobility Focus: Strategic partnerships are key to Air Liquide's push into hydrogen mobility, with plans for new refueling stations in Europe and Asia by 2025.

- Market Strengthening: These investments and partnerships are designed to enhance market penetration and reinforce Air Liquide's position in key industrial zones.

Air Liquide's 'Place' strategy centers on its extensive global infrastructure, ensuring reliable access to gases and services for diverse clients. This includes on-site production facilities, extensive pipeline networks, and a robust distribution system for bulk liquids and cylinders, reaching 60 countries.

In the healthcare sector, this translates to specialized, compliant logistics for medical gases and homecare equipment, guaranteeing timely delivery and product integrity. Their investments in 2024, like the US hydrogen facility, and 2025 plans for European and Asian hydrogen stations, highlight a commitment to expanding this vital network.

The company's strategic partnerships, such as joint ventures, are crucial for scaling these operations and entering new markets, reinforcing its global presence and competitive edge in essential industries.

| Metric | 2023 Data | 2024/2025 Outlook |

|---|---|---|

| Countries Served | 60 | Expansion in key industrial and mobility sectors |

| Key Investments | Secured multi-year contracts | New US hydrogen facility (2024), Hydrogen refueling stations in Europe/Asia (2025) |

| Logistics Scale | Millions of deliveries handled | Continued focus on specialized healthcare logistics and cold chain |

Full Version Awaits

Air Liquide 4P's Marketing Mix Analysis

The preview shown here is the actual Air Liquide 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis details their Product, Price, Place, and Promotion strategies, offering valuable insights for your own business planning. Own the complete, ready-to-use document immediately upon checkout.

Promotion

Air Liquide's B2B sales strategy is built on a foundation of specialized teams and deep technical expertise. These experts engage directly with clients, fostering a consultative relationship to tailor solutions to unique industrial challenges.

This approach is crucial for Air Liquide, a company serving diverse sectors from healthcare to electronics. For instance, in 2024, their focus on advanced materials and hydrogen solutions required highly technical sales discussions to address specific performance and sustainability requirements for clients in the automotive and semiconductor industries.

The company's investment in training and retaining technical sales personnel underscores its commitment to providing customized, value-added solutions. This expertise allows them to not only sell products but also to partner with clients on process optimization and innovation, a key differentiator in the competitive industrial gas market.

Air Liquide's commitment to industry conferences and thought leadership is a key element of its promotional strategy. The company actively participates in major global events, showcasing its latest innovations and engaging with industry peers. For instance, in 2024, Air Liquide presented its advancements in hydrogen energy solutions at the World Hydrogen Summit & Exhibition, highlighting its role in the energy transition.

This engagement extends to publishing technical whitepapers and research, solidifying its reputation as an innovator. These publications often detail Air Liquide's contributions to industrial efficiency and environmental sustainability, such as their 2025 research on carbon capture technologies for the steel industry, demonstrating tangible progress and expertise.

Air Liquide champions its dedication to sustainable development and the energy transition, highlighting its low-carbon hydrogen and CO2 capture technologies. This focus resonates with clients aiming for more environmentally responsible operations, directly addressing the growing demand for decarbonization solutions. In 2023, the company announced investments of €8 billion in the energy transition, with a significant portion dedicated to hydrogen production, underscoring its commitment to this vital sector.

Digital Communication and Investor Relations

Air Liquide leverages a strong digital footprint, encompassing its corporate website and active professional social media channels, to manage corporate communications and investor relations. This digital strategy is crucial for transparency and for connecting with a wide array of stakeholders, including those in financial decision-making roles.

The company's digital platforms serve as key conduits for sharing information about its innovations, financial performance, and strategic direction. For instance, as of early 2024, Air Liquide's investor relations section on its website provides detailed financial reports, press releases, and presentations, facilitating informed analysis for investors.

- Corporate Website: A central hub for financial disclosures, annual reports, and strategic updates.

- Social Media Engagement: Platforms like LinkedIn are used to share company news, technological advancements, and engage with the financial community.

- Transparency and Accessibility: Digital channels ensure timely and broad dissemination of information to all stakeholders.

- Innovation Showcase: Highlighting R&D and new solutions to demonstrate future growth potential to investors.

Corporate Social Responsibility and Partnerships

Air Liquide actively showcases its commitment to corporate social responsibility through strategic partnerships. A prime example is its role as an official hydrogen partner for the Paris 2024 Olympic and Paralympic Games. This collaboration underscores the company's dedication to sustainability and innovation in major global events.

This initiative highlights Air Liquide's focus on societal impact, aligning its business operations with broader environmental and social goals. By leveraging its expertise in hydrogen technology, the company contributes to cleaner energy solutions for large-scale events.

Key aspects of this promotion include:

- Official Hydrogen Partner: Supplying hydrogen solutions for the Paris 2024 Olympic and Paralympic Games.

- Societal Impact: Demonstrating commitment to sustainability and community engagement.

- Innovation Showcase: Highlighting advancements in hydrogen technology for major events.

Air Liquide's promotion strategy centers on showcasing its technical prowess and commitment to innovation and sustainability. This involves direct engagement through specialized sales teams, participation in industry events, and the dissemination of technical research. For instance, their role as the official hydrogen partner for the Paris 2024 Olympic and Paralympic Games highlights their leadership in clean energy solutions.

The company actively uses its digital platforms, including its corporate website and professional social media, to communicate its financial performance, strategic direction, and R&D advancements. This transparency is vital for building trust with investors and stakeholders. In 2024, Air Liquide's continued investment in hydrogen technology, with significant capital allocated to this sector, was a key message communicated through these channels.

By emphasizing its contributions to decarbonization and the energy transition, Air Liquide appeals to clients and investors seeking sustainable solutions. Their 2023 announcement of €8 billion in energy transition investments, with a focus on hydrogen, exemplifies this promotional pillar. This strategic communication reinforces their market position as a forward-thinking industry leader.

Price

Long-term contractual pricing is the bedrock of Air Liquide's strategy for industrial gases, offering predictable revenue streams. These contracts are meticulously structured, taking into account crucial factors like the sheer volume of gas required, the specific purity levels demanded by the customer's processes, and the chosen delivery methods, whether pipeline, bulk, or cylinder. The duration of these agreements, often spanning many years, solidifies the partnership and provides a stable foundation for both Air Liquide's operational planning and its industrial clients' production continuity.

For instance, Air Liquide's 2023 performance showcased the strength of its long-term contracts, with the company reporting sales of €27.6 billion. This stability is particularly vital in sectors like refining and chemicals, where gas supply is integral to continuous operations. The pricing within these contracts often includes escalation clauses tied to inflation or energy costs, ensuring that Air Liquide can maintain its profitability and reinvest in its extensive infrastructure and innovation pipeline, thereby supporting future growth and service enhancements for its clientele.

Air Liquide utilizes value-based pricing for its critical applications, acknowledging the indispensable role its products play in sectors like healthcare and advanced manufacturing. This strategy directly links pricing to the tangible benefits customers receive, such as enhanced patient safety with medical gases or superior yields in semiconductor production.

For instance, the reliability of medical oxygen supplied by Air Liquide is paramount, directly impacting patient outcomes. This essential service commands a premium reflecting its critical nature and the stringent quality controls involved. In 2024, the global medical gas market, a key segment for Air Liquide, was projected to reach over $35 billion, underscoring the significant value placed on these life-sustaining products.

Similarly, in the electronics industry, the purity and consistent supply of specialty gases are crucial for preventing defects in microchip fabrication. Air Liquide's pricing in this area reflects the substantial cost savings and quality improvements customers achieve by using their high-performance gas solutions, a factor especially relevant as the semiconductor industry continues its robust growth into 2025.

Air Liquide leverages dynamic pricing, adjusting rates based on real-time market demand, operational expenses, and the specific value delivered to each customer. This adaptability is crucial for maintaining competitiveness and profitability in a fluctuating industrial gas market.

The company's relentless pursuit of efficiency gains, evident in its ongoing investments in advanced production technologies and optimized logistics, directly fuels margin expansion. For instance, in 2024, Air Liquide reported a notable increase in its operating margin, partly attributed to these cost-saving initiatives and their ability to pass on value through flexible pricing strategies.

Customized Project Pricing

For large-scale industrial projects and specialized equipment, Air Liquide employs a customized project pricing strategy. This approach is crucial because each project has unique requirements and complexities.

Pricing involves detailed negotiations, taking into account factors such as the complexity of the proposed solution, the capital investment required from Air Liquide, anticipated operational costs, and the projected long-term economic benefits for the client. This ensures that the pricing reflects the true value delivered.

For instance, in 2024, Air Liquide secured a significant long-term contract to supply hydrogen to a major industrial customer in Europe. The pricing for this multi-year agreement was meticulously tailored, reflecting the substantial investment in new production facilities and the guaranteed volume commitments, which are expected to drive significant operational efficiencies for both parties.

- Customized Pricing: Tailored for large-scale industrial projects and specialized equipment.

- Negotiation Factors: Complexity, investment, operational costs, and long-term client benefits.

- Value-Based Approach: Ensures pricing aligns with the delivered value and strategic importance of the solution.

Impact of Energy and Raw Material Costs

Air Liquide’s pricing strategies are deeply intertwined with the volatile nature of energy and raw material costs. For large industrial clients, these fluctuating expenses are frequently passed through via contractual clauses, offering a degree of stability to Air Liquide's profitability amidst economic uncertainty.

This pass-through mechanism is crucial for maintaining margins. For instance, in 2024, global energy prices saw significant shifts, impacting operational expenditures directly. Air Liquide’s ability to adjust pricing based on these inputs ensures that their cost of goods sold doesn't disproportionately erode their profit margins.

- Energy Cost Pass-Through: Contracts with major industrial customers often include clauses allowing for adjustments in pricing based on prevailing energy indices.

- Raw Material Volatility: Fluctuations in the cost of key raw materials, such as natural gas for hydrogen production, are similarly managed through pricing mechanisms.

- Profitability Management: This approach helps Air Liquide maintain its profitability by mitigating the direct impact of external cost shocks.

- Market Competitiveness: While passing costs on, Air Liquide must still balance this with maintaining competitive pricing in the industrial gas market.

Air Liquide's pricing for industrial gases is a multifaceted approach, heavily influenced by long-term contracts that ensure predictable revenue. These agreements consider volume, purity, and delivery methods, often spanning many years to foster stability for both Air Liquide and its clients. For instance, the company's 2023 sales of €27.6 billion highlight the success of this strategy, particularly in sectors like refining and chemicals where continuous operation is paramount.

Value-based pricing is employed for critical applications, especially in healthcare and advanced manufacturing, directly linking costs to customer benefits. The reliability of medical oxygen, a key product, commands a premium, reflecting its life-sustaining nature and stringent quality controls. The global medical gas market was projected to exceed $35 billion in 2024, underscoring the significant value placed on these essential products.

Dynamic pricing allows Air Liquide to adjust rates based on real-time market demand, operational costs, and customer value, crucial for market competitiveness. Efficiency gains from investments in advanced technologies and logistics, as seen in a notable operating margin increase in 2024, enable flexible pricing strategies that pass on value.

Customized project pricing is vital for large-scale industrial projects and specialized equipment, reflecting unique requirements and complexities. Pricing involves detailed negotiations considering solution complexity, capital investment, operational costs, and long-term client benefits, ensuring alignment with delivered value. A 2024 contract for hydrogen supply to a European customer exemplifies this, with pricing tailored to substantial facility investments and guaranteed volumes.

| Pricing Strategy | Key Considerations | Example/Impact (2023-2025 Data) |

|---|---|---|

| Long-Term Contracts | Volume, Purity, Delivery Method, Duration | €27.6 billion sales in 2023; stability in refining/chemicals. |

| Value-Based Pricing | Customer Benefits (e.g., patient safety, yield improvement) | Medical gas market projected >$35 billion in 2024; high purity gases for electronics. |

| Dynamic Pricing | Real-time Demand, Operational Costs, Delivered Value | Margin expansion in 2024 linked to efficiency and flexible pricing. |

| Customized Project Pricing | Project Complexity, Capital Investment, Operational Costs, Client Benefits | 2024 hydrogen contract pricing reflects facility investment and volume commitments. |

4P's Marketing Mix Analysis Data Sources

Our Air Liquide 4P's analysis leverages comprehensive data from official company reports, investor relations materials, and industry-specific publications. We incorporate insights from their public announcements, product portfolios, distribution network details, and marketing campaign disclosures to provide a thorough understanding of their strategy.