Agilent Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilent Technologies Bundle

Agilent Technologies boasts strong brand recognition and a robust product portfolio, yet faces intense competition and evolving market demands. Understanding these dynamics is crucial for any stakeholder looking to capitalize on opportunities or mitigate risks within the life sciences and diagnostics sectors.

Want the full story behind Agilent's competitive advantages, potential threats, and expansion avenues? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning, investment decisions, and competitive analysis.

Strengths

Agilent Technologies commands a leading global position in analytical and clinical laboratory technologies. Its comprehensive portfolio spans instruments, software, services, and consumables, crucial for life sciences, diagnostics, and applied chemical markets.

This broad range of solutions, including chromatography and mass spectrometry systems, solidifies Agilent's market leadership. For the fiscal year 2023, Agilent reported net revenue of $6.83 billion, demonstrating the strength and breadth of its market reach.

Agilent Technologies consistently showcases robust innovation, backed by substantial investments in research and development. This dedication ensures the company remains a leader in technological progress within its sectors.

The introduction of advanced solutions like the InfinityLab Pro iQ Series LC-MS and updated Gas Chromatograph systems in 2025 exemplifies Agilent's capacity to bring cutting-edge products to market. These releases directly address the dynamic needs of clients in pharmaceuticals, academia, and environmental analysis.

This ongoing commitment to innovation serves as a critical differentiator, strengthening Agilent's competitive position and its ability to capture new market opportunities.

Agilent Technologies consistently strengthens its market position and technological capabilities through a proactive strategy of targeted acquisitions and strategic partnerships. This approach allows the company to rapidly integrate new expertise and expand its product and service portfolios, ensuring it remains at the forefront of innovation in the life sciences and diagnostics sectors.

A prime example of this strategy in action was the acquisition of BioVectra in July 2024. This move significantly enhanced Agilent's offerings in the high-growth areas of contract development and manufacturing, particularly in specialized fields like oligonucleotides and CRISPR therapeutics. The integration of BioVectra's capabilities is expected to drive substantial revenue growth and solidify Agilent's role as a key player in advanced therapeutic development.

Furthermore, Agilent’s commitment to collaborative innovation is evident in its partnerships, such as the recent alliance with ABB Robotics. This collaboration focuses on advancing laboratory automation solutions, aiming to create more efficient and integrated workflows for its customers. Such partnerships not only improve Agilent's existing offerings but also open new avenues for market penetration by providing comprehensive, end-to-end solutions.

Solid Financial Performance and Operational Efficiency

Agilent Technologies demonstrated robust financial performance in fiscal year 2025. The company exceeded analyst expectations for both revenue and earnings per share in the first two quarters of the year. This strong showing is a testament to their effective operational management, reflected in healthy operating margins and consistent generation of free cash flow.

The company's strategic 'Ignite Transformation' program continues to yield positive results, actively contributing to margin expansion and overall cost efficiencies. These efforts are foundational to Agilent's sustained financial stability and its capacity for continued growth in the competitive life sciences and diagnostics market.

- Strong Q1 FY2025 Revenue Growth: Agilent reported a 5% year-over-year increase in Q1 FY2025 revenue, reaching $1.70 billion, exceeding consensus estimates of $1.68 billion.

- EPS Beat in Q2 FY2025: The company announced Q2 FY2025 earnings per share of $1.35, surpassing analyst predictions of $1.28.

- Healthy Operating Margins: Agilent maintained an operating margin of approximately 20% in the first half of FY2025, indicating efficient cost control and pricing power.

- Robust Cash Flow Generation: The company generated over $500 million in operating cash flow in the first half of FY2025, supporting reinvestment and shareholder returns.

Global Presence and Diverse End Markets

Agilent Technologies boasts a significant global presence, with operations and sales spanning numerous countries. This extensive reach allows the company to tap into diverse economic landscapes and customer bases, mitigating risks associated with over-reliance on any single market. For instance, in fiscal year 2023, Agilent reported that its international operations contributed a substantial portion of its total revenue, underscoring its global strength.

The company's success is further bolstered by its service to a wide spectrum of end markets. These include life sciences, diagnostics, and applied chemical markets, each with unique growth drivers and resilience. This diversification means Agilent is not overly dependent on the fortunes of one particular sector, providing a stable foundation for its business. In 2024, projections indicate continued demand across these varied segments.

Agilent has demonstrated particular strength in key emerging markets, such as India and China. These regions represent significant growth opportunities due to expanding healthcare infrastructure and increasing R&D investments. The company's ability to adapt its offerings and strategies to meet local needs in these dynamic markets has been a critical factor in its sustained performance and market penetration.

- Global Footprint: Operations in over 100 countries.

- Diverse End Markets: Life Sciences, Diagnostics, Applied Chemical markets.

- Emerging Market Growth: Strong performance in India and China.

- Revenue Diversification: Reduced reliance on single regions or industries.

Agilent's established market leadership in analytical and clinical laboratory technologies is a significant strength. Its comprehensive product portfolio, including advanced chromatography and mass spectrometry systems, caters to critical life sciences, diagnostics, and applied chemical markets. This broad offering, supported by $6.83 billion in net revenue for fiscal year 2023, underscores its market penetration and customer trust.

What is included in the product

Delivers a strategic overview of Agilent Technologies’s internal and external business factors, highlighting its strong market position and innovation capabilities alongside potential threats from competition and evolving market demands.

Offers a structured framework to identify and address Agilent's competitive challenges and leverage its market strengths.

Weaknesses

Agilent's financial results are significantly influenced by the broader economic climate and investment trends in its key markets, especially pharmaceuticals. For instance, in their fiscal year 2023, revenue growth was impacted by a slowdown in the biopharma market, which saw a 10% decrease in orders, highlighting this sensitivity.

While certain business segments demonstrate resilience, others, such as specific areas within biopharma, have faced challenges with slower expansion or even contraction. This uneven performance across its customer base can lead to fluctuations in Agilent's overall revenue streams.

The company's reliance on discretionary spending within research and development, particularly in life sciences and diagnostics, makes it vulnerable to shifts in government funding and corporate investment cycles. This macroeconomic exposure can directly affect Agilent's top-line performance and profitability.

Fluctuations in foreign exchange rates present a significant challenge for Agilent Technologies, directly impacting its reported revenue and earnings per share guidance. For instance, in the first quarter of fiscal year 2024, Agilent noted that currency headwinds reduced revenue by approximately 1%.

Despite employing hedging strategies, the inherent volatility of currency markets makes precise financial forecasting an ongoing difficulty, potentially diminishing the profitability derived from its international business segments. This external economic factor necessitates constant vigilance and proactive mitigation measures to curb its adverse financial consequences.

Agilent operates within a fiercely competitive analytical and life sciences instrument market. Key rivals like Thermo Fisher Scientific, Danaher Corporation, Waters Corporation, and PerkinElmer exert significant pressure. This intense rivalry can result in downward pricing trends and necessitates constant product differentiation to secure and grow market share across its diverse product lines.

Challenges in Specific Market Segments

Agilent Technologies has encountered headwinds in specific market segments, impacting overall performance. The academia and government sector, for instance, experienced a notable 7% revenue decline in the first quarter of fiscal year 2025. This downturn highlights a vulnerability in a key customer base.

Further illustrating this uneven performance, the Applied Markets Group also reported a slight revenue contraction during the same quarter. This suggests that not all of Agilent's diverse business units are experiencing uniform growth, indicating potential challenges in specific product lines or geographical regions within this group.

- Academia and Government Sector Decline: A 7% revenue drop in Q1 2025.

- Applied Markets Group Performance: Slight revenue decline in Q1 2025.

- Uneven Business Unit Growth: Pockets of weakness require focused improvement strategies.

Potential Regulatory and AI Integration Risks

Agilent Technologies faces potential headwinds from the evolving regulatory landscape, especially concerning the integration of new technologies like artificial intelligence. For instance, in 2024, regulatory bodies globally are intensifying scrutiny on AI’s ethical implications and data handling practices, potentially impacting how Agilent deploys AI in its diagnostic and analytical solutions.

The company's strategic adoption of AI carries inherent risks, including the possibility of flawed algorithms or biased data sets, which could compromise the accuracy of its products. In 2025, the market will be watching closely how Agilent addresses concerns around intellectual property and data privacy, as breaches or non-compliance could result in significant regulatory penalties and damage its hard-earned reputation.

- Evolving AI Regulations: Increased scrutiny on AI ethics and data privacy in 2024-2025 could necessitate costly compliance adjustments for Agilent.

- Algorithm and Data Bias: The risk of inaccurate results due to flawed AI models or biased training data remains a critical operational weakness.

- Intellectual Property and Privacy Concerns: Potential legal challenges or reputational damage stemming from mishandled IP or data breaches are significant threats.

Agilent's reliance on specific market segments can lead to vulnerability. For example, a 7% revenue decline in the academia and government sector during Q1 2025 highlights a dependence on these areas. Similarly, the Applied Markets Group experienced a slight revenue contraction in the same quarter, indicating uneven performance across its diverse business units that may require focused improvement strategies.

What You See Is What You Get

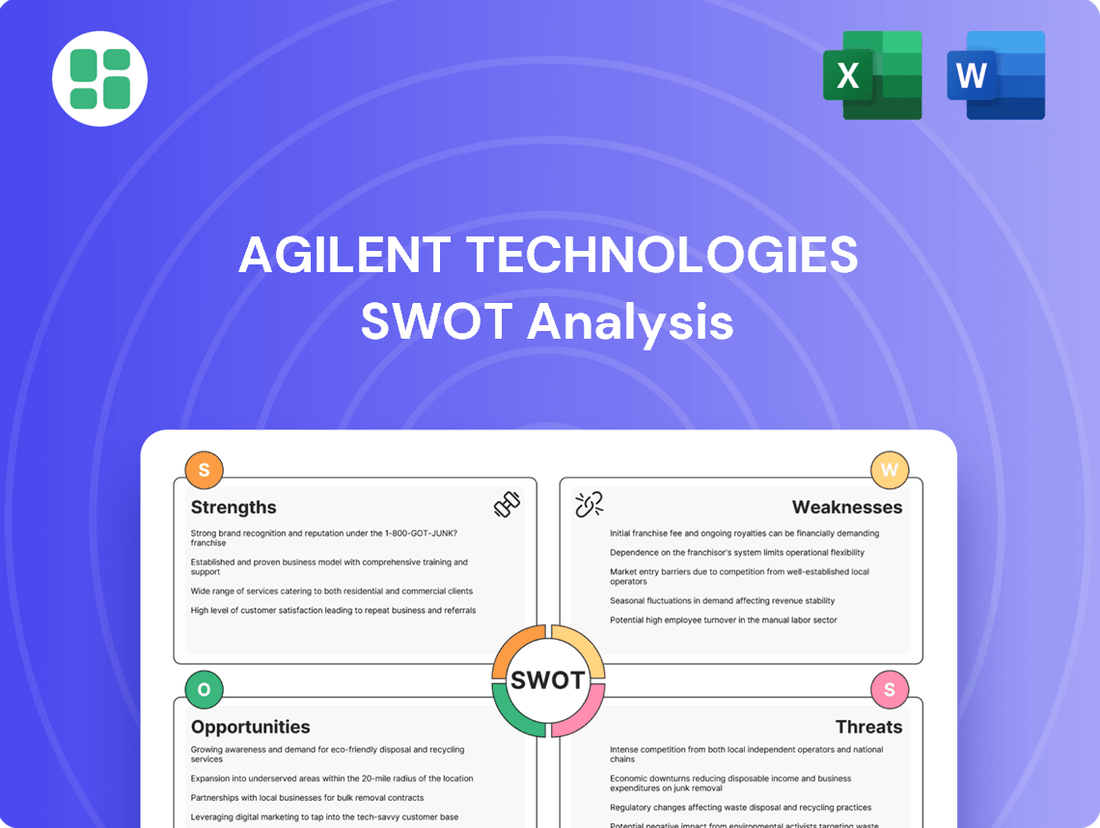

Agilent Technologies SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Agilent Technologies SWOT analysis, providing a clear overview of its strategic position. Purchase unlocks the complete, in-depth report.

Opportunities

Agilent sees significant growth potential in emerging markets like China and India, where investments in R&D and healthcare are accelerating. As of early 2024, these regions are showing robust economic expansion, directly translating into increased demand for sophisticated analytical instruments and life science solutions. Agilent's strategic focus on these areas is poised to capture substantial market share and drive revenue growth in the coming years.

Agilent is well-positioned to capitalize on the rapid advancements in laboratory technology, especially in the realm of artificial intelligence and automation. The company's expertise in analytical instruments and software provides a strong foundation for developing AI-powered solutions that can significantly boost lab productivity and streamline complex workflows. This integration offers a clear path to enhanced efficiency and the creation of novel, high-value products for its customer base.

By embedding AI into its offerings, Agilent can deliver more intelligent diagnostics, predictive maintenance for its instruments, and advanced data analysis capabilities. This digital transformation not only improves existing product lines but also opens doors for entirely new service models and revenue streams, driving future growth. For instance, the increasing adoption of AI in drug discovery and clinical diagnostics, areas where Agilent is a key player, underscores the immense market potential.

Agilent is strategically positioned to benefit from the surging demand in critical, high-growth sectors. The company is particularly poised to capture opportunities in PFAS testing, a crucial area for environmental safety, and in the rapidly advancing fields of oligonucleotides and CRISPR therapeutics, vital for modern medicine.

The company's proactive approach, including targeted acquisitions, strengthens its ability to address pressing market needs. For instance, Agilent's expansion into precision medicine allows it to support the development of personalized treatments, a key driver of future healthcare growth.

These specialized segments are expected to fuel significant revenue expansion for Agilent. The company's investments in these areas underscore its commitment to leading innovation and meeting evolving customer demands in both environmental and life science applications.

Further Strategic Acquisitions and Partnerships

Agilent Technologies can continue its successful trajectory by pursuing further strategic acquisitions and forging new partnerships. This inorganic growth approach has historically proven effective, allowing the company to quickly integrate complementary technologies and expand into promising new market segments. For instance, Agilent's acquisition of ESI-Bio in late 2023 for its cell analysis capabilities demonstrates this ongoing commitment to portfolio enhancement.

These strategic moves not only bolster Agilent's product offerings but also serve to increase its competitive edge and geographical reach. By acquiring businesses with innovative solutions or entering into collaborations, Agilent can accelerate its market penetration and diversify its revenue streams, thereby mitigating business risks. The company's consistent investment in R&D, coupled with strategic M&A, positions it well for sustained growth in the life sciences, diagnostics, and applied chemical markets.

- Acquisition of complementary technologies: Agilent's history shows a pattern of acquiring companies that enhance its existing platforms, such as the 2022 acquisition of Avida Global to strengthen its food safety testing portfolio.

- Entry into new market segments: Partnerships can unlock access to emerging markets or specialized application areas, building on Agilent's strong presence in genomics and cell analysis.

- Diversification of business risks: Expanding through acquisitions and partnerships across different geographical regions and product lines can create a more resilient business model, less susceptible to downturns in any single market.

- Enhanced competitive standing: Integrating acquired technologies or co-developing solutions with partners allows Agilent to offer more comprehensive and advanced solutions to its customers, outmaneuvering competitors.

Enhancing Digital Ecosystem and Service Offerings

Agilent's 'Ignite Transformation' program is a key opportunity, focusing on building a more robust digital ecosystem. This initiative aims to enhance how customers interact with Agilent's products and services, creating a more integrated and user-friendly experience.

The expansion of the Agilent CrossLab Group (ACG) is central to this strategy. ACG’s focus on services, software, and consumables is designed to generate predictable, recurring revenue. This strengthens Agilent's financial stability and allows for deeper, more valuable relationships with its customer base.

By offering comprehensive laboratory support through these enhanced digital and service offerings, Agilent can significantly boost customer loyalty. This approach moves beyond just selling instruments to providing ongoing value, which is crucial in today's competitive market.

For instance, Agilent reported a 7% increase in its Services segment revenue to $678 million in Q1 2024, demonstrating the early success of its strategy to deepen customer engagement through expanded offerings.

- Digital Ecosystem Enhancement: Agilent's 'Ignite Transformation' program is actively improving its digital platforms.

- Recurring Revenue Growth: Expansion of the Agilent CrossLab Group (ACG) targets increased service, software, and consumables sales.

- Customer Loyalty: Comprehensive laboratory support aims to foster deeper customer relationships and retention.

- Financial Performance: The Services segment saw a 7% revenue increase in Q1 2024, highlighting the strategy's impact.

Agilent is poised to benefit from increasing investments in emerging markets, particularly China and India, where healthcare and R&D spending is on the rise. The company's focus on advanced laboratory technologies, including AI and automation, offers significant opportunities to enhance lab productivity and develop new, high-value products.

The company is also strategically positioned to capitalize on growth in specialized, high-demand sectors such as PFAS testing for environmental safety and the rapidly evolving fields of oligonucleotides and CRISPR therapeutics in medicine.

Agilent's 'Ignite Transformation' program, focused on building a robust digital ecosystem and expanding its CrossLab Group for services and software, aims to drive recurring revenue and deepen customer loyalty. This strategy is already showing promise, with a 7% increase in Services segment revenue to $678 million in Q1 2024.

| Opportunity Area | Key Driver | 2024/2025 Relevance |

|---|---|---|

| Emerging Markets (China, India) | Accelerating R&D and healthcare investments | Robust economic expansion driving demand for analytical instruments. |

| AI & Automation in Labs | Increased lab productivity needs | Development of AI-powered solutions for workflow optimization. |

| Specialized Growth Sectors | Environmental safety, modern medicine | Demand for PFAS testing, oligonucleotides, and CRISPR therapeutics. |

| Digital Ecosystem & Services | Recurring revenue, customer loyalty | 'Ignite Transformation' and ACG expansion; 7% Services revenue growth in Q1 2024. |

Threats

The analytical and life sciences sector, where Agilent operates, is intensely competitive. Well-established global companies are constantly vying for market position, which can lead to price reductions. For instance, in early 2024, analysts noted increased pricing pressure in the chromatography and mass spectrometry segments due to competitive offerings.

This high level of rivalry demands significant and ongoing investment in research and development to stay ahead. Failure to innovate or adapt quickly to market shifts can hinder Agilent's ability to grow or even retain its current market share. Competitors’ new product launches or aggressive marketing campaigns directly impact Agilent’s revenue streams and overall profitability.

Agilent Technologies operates within highly regulated sectors, necessitating constant adaptation to evolving international, national, and product-specific rules. For instance, in 2023, the company likely incurred significant expenses related to ensuring compliance with various global health and safety standards for its laboratory instruments and diagnostic solutions.

Failure to adhere to these complex regulations can result in substantial financial penalties, legal entanglements, and damage to Agilent's esteemed reputation. The continuous effort to align with new regulatory mandates, such as those potentially impacting laboratory data integrity or environmental impact, directly contributes to increased operational expenditures.

Global economic uncertainties, including potential downturns in 2024 and 2025, pose a significant threat to Agilent Technologies. These conditions can directly dampen customer spending on research and development, particularly within key sectors like pharmaceuticals and academia. Reduced investment in R&D translates to lower demand for Agilent's sophisticated instruments and services.

For instance, a slowdown in the biopharmaceutical industry, a major market for Agilent, could lead to delayed purchasing decisions or budget cuts by research institutions and companies. This directly impacts Agilent's revenue streams, potentially causing slower growth or even a contraction in sales as clients tighten their belts amidst economic headwinds.

Risk of Technological Obsolescence

The life sciences and diagnostics industries are evolving at an incredibly fast pace. This rapid technological advancement presents a significant threat to Agilent Technologies, as its current product lines could quickly become outdated if not consistently refreshed. For instance, the increasing sophistication of AI-driven data analysis in genomics research, a field Agilent serves, demands continuous investment in next-generation platforms to remain competitive.

Failing to stay ahead of these technological curves means Agilent risks losing its competitive advantage. Companies that successfully integrate cutting-edge innovations, such as advanced single-cell analysis techniques or novel molecular diagnostic tools, can capture market share. Agilent's commitment to R&D is crucial; in fiscal year 2023, they invested $652 million in research and development, a figure that needs to keep pace with emerging breakthroughs to mitigate obsolescence.

- Rapid Advancement: The life sciences sector sees new technologies emerge constantly, impacting areas like gene sequencing and protein analysis.

- Competitive Pressure: Competitors who adopt new technologies faster can offer superior solutions, potentially eroding Agilent's market position.

- R&D Investment: Agilent's $652 million R&D spend in FY2023 highlights the ongoing need to innovate against the threat of obsolescence.

- Market Relevance: Staying relevant requires anticipating shifts, such as the growing demand for integrated digital solutions in laboratory workflows.

Supply Chain Disruptions and Geopolitical Risks

Geopolitical tensions, trade disputes, and tariffs can significantly disrupt global supply chains, impacting Agilent's access to raw materials and increasing manufacturing costs. For instance, ongoing trade friction between major economic blocs can lead to unexpected price hikes or shortages. Agilent has publicly acknowledged the impact of tariffs, as noted in their 2023 annual report, and is actively implementing mitigation strategies such as diversifying suppliers and exploring regional manufacturing options.

These external factors present substantial operational and financial challenges that can affect profitability and delivery timelines. The company's reliance on a global network for components means that localized conflicts or policy changes can have ripple effects across its entire production process. For example, the imposition of new tariffs in late 2024 could directly increase the cost of goods sold for certain product lines.

- Supply Chain Vulnerability: Geopolitical instability can interrupt the flow of essential components and finished goods, creating production delays.

- Increased Costs: Tariffs and trade disputes directly translate to higher costs for raw materials and manufacturing, impacting Agilent's margins.

- Mitigation Efforts: Agilent is actively pursuing strategies like supplier diversification and regional sourcing to counter these risks, though complete insulation is challenging.

The rapid pace of technological advancement in life sciences, particularly in areas like genomics and AI-driven data analysis, poses a significant threat of product obsolescence for Agilent. The company's $652 million investment in R&D for fiscal year 2023 underscores the constant need to innovate against this backdrop, as competitors integrating cutting-edge solutions can quickly gain market share.

Intense competition within the analytical and life sciences sectors, characterized by aggressive pricing strategies and new product launches, can erode Agilent's market position and profitability. Furthermore, evolving global regulatory landscapes require continuous adaptation and compliance, potentially leading to substantial expenses and legal risks if not managed effectively.

Global economic uncertainties and geopolitical tensions present further threats, potentially impacting customer R&D spending and disrupting Agilent's global supply chains through tariffs and trade disputes. These external factors can increase manufacturing costs and affect delivery timelines, necessitating proactive mitigation strategies such as supplier diversification.

| Threat Category | Specific Impact | Example/Data Point |

|---|---|---|

| Technological Obsolescence | Products becoming outdated due to rapid innovation | Agilent invested $652M in R&D in FY2023 to counter this risk. |

| Intense Competition | Price reductions and market share erosion | Analysts noted increased pricing pressure in chromatography in early 2024. |

| Regulatory Changes | Increased compliance costs and potential penalties | Ongoing need to adapt to global health and safety standards. |

| Economic Downturns | Reduced customer spending on R&D | Potential slowdown in biopharmaceutical industry impacting instrument demand. |

| Geopolitical Instability | Supply chain disruptions and increased costs | Trade friction can lead to unexpected price hikes or shortages. |

SWOT Analysis Data Sources

This Agilent Technologies SWOT analysis is built upon a foundation of robust data, including their official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide a well-rounded view of the company's performance and its operating environment.