Agilent Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilent Technologies Bundle

Curious about Agilent Technologies' strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss the full picture – purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimizing Agilent's market position and future investments.

Stars

Agilent's PFAS Analytical Solutions are a star in their BCG portfolio, driven by a comprehensive workflow that significantly boosts revenue. This segment benefits from heightened global regulatory attention on these persistent chemicals.

The market for PFAS analysis is rapidly expanding, with projections indicating it will reach $1 billion by 2030, and Agilent is positioned as a leader within this growth area. Their advanced testing platforms are recognized as the benchmark for identifying 'forever chemicals,' especially in crucial environmental and food safety testing.

The Diagnostics and Genomics Group (DGG) is a star performer for Agilent Technologies. In fiscal year 2024, this segment experienced robust growth, surging by over 17%. This impressive expansion highlights the strong market demand for Agilent's diagnostic and genomic solutions.

Agilent is strategically bolstering DGG's growth trajectory by integrating its cell analysis business. This move is designed to capitalize on the high-potential market for cell analysis technologies, further strengthening Agilent's position.

The introduction of new products, such as the Dako Omnis family of pathology instruments, underscores Agilent's commitment to innovation within DGG. These advancements are crucial for maintaining and expanding Agilent's leadership in the rapidly evolving pathology and genomics landscape.

Agilent's acquisition of BioVectra in July 2024 positions it strongly in novel therapeutic modalities, particularly oligonucleotides and CRISPR. This expansion into specialized pharmaceutical manufacturing services addresses the growing need for outsourced development and manufacturing by biopharma companies.

This strategic move, while potentially causing short-term dilution, unlocks substantial long-term growth opportunities. The market for outsourced biopharmaceutical manufacturing is projected to reach $20.8 billion by 2027, highlighting the significant potential for Agilent's enhanced capabilities.

Next-Generation LC/MS and Advanced Analytical Instruments

Agilent Technologies is a leader in analytical instrumentation, consistently pushing boundaries with its next-generation LC/MS systems. The company's commitment to innovation is evident in product launches like the InfinityLab Pro iQ Series and new LC Single Quadrupole Mass Spectrometers, expected in 2025. These advancements are vital for fields like large molecule analysis, where precision and sensitivity are paramount.

These advanced instruments are designed to meet the demanding needs of sectors such as pharmaceuticals and biotechnology. For instance, the enhanced sensitivity of these new LC/MS systems directly supports the analysis of complex therapeutic peptides and proteins, a rapidly growing area in drug development. This focus on high-performance solutions solidifies Agilent's position in a competitive and expanding market.

- Market Position: Agilent's analytical instruments division is a key contributor to its overall revenue, with the LC/MS segment showing robust growth driven by demand in life sciences and applied markets.

- Innovation Focus: The company's strategy centers on developing instruments with superior sensitivity, speed, and ease of use to address evolving analytical challenges.

- Growth Drivers: Key growth areas include biopharma, food safety, and environmental testing, all of which benefit from Agilent's advanced LC/MS technologies.

China Market Healthcare and R&D Solutions

Agilent Technologies is experiencing robust expansion within the Chinese market, evidenced by a 10% revenue surge in the second quarter of fiscal year 2025. This growth is significantly bolstered by China's economic stimulus measures and national strategies aimed at enhancing its healthcare infrastructure.

The company's commitment to localizing manufacturing operations and fostering research and development collaborations within China is a key factor in its success. These initiatives are strategically designed to meet the escalating demand for advanced laboratory equipment and comprehensive scientific solutions in this vital and growing market.

- Market Growth: 10% revenue increase in China for Q2 FY2025.

- Driving Factors: Post-pandemic stimulus and healthcare infrastructure upgrades.

- Strategic Advantages: Localized manufacturing and R&D partnerships.

- Outlook: Continued market penetration and revenue contribution from China.

Agilent's PFAS Analytical Solutions are a star, fueled by increasing global scrutiny of these chemicals and a comprehensive workflow that drives revenue. The market for PFAS analysis is projected to reach $1 billion by 2030, with Agilent leading in providing benchmark platforms for environmental and food safety testing.

The Diagnostics and Genomics Group (DGG) is another star, achieving over 17% growth in fiscal year 2024 due to strong market demand for its solutions. Agilent is enhancing DGG by integrating its cell analysis business and launching innovative products like the Dako Omnis for pathology, solidifying its leadership.

Agilent's acquisition of BioVectra in July 2024 positions it strongly in novel therapeutics, particularly oligonucleotides and CRISPR, tapping into the $20.8 billion outsourced biopharmaceutical manufacturing market by 2027.

The company's advanced LC/MS systems, including the upcoming InfinityLab Pro iQ Series and new LC Single Quadrupole Mass Spectrometers in 2025, are stars in the analytical instrumentation space. These instruments offer enhanced sensitivity for complex drug development, supporting growth in biopharma and applied markets.

| Segment | FY2024 Growth | Key Drivers | Market Potential |

| PFAS Analytical Solutions | High (driven by regulatory focus) | Global regulations, comprehensive workflow | $1 billion by 2030 |

| Diagnostics and Genomics Group (DGG) | >17% | Market demand, cell analysis integration, new pathology instruments | Expanding |

| BioVectra (acquired July 2024) | New, high growth potential | Novel therapeutics (oligonucleotides, CRISPR), outsourced manufacturing | $20.8 billion by 2027 (outsourced biopharma manufacturing) |

| LC/MS Systems | Robust | Biopharma, food safety, environmental testing, advanced sensitivity | Growing |

What is included in the product

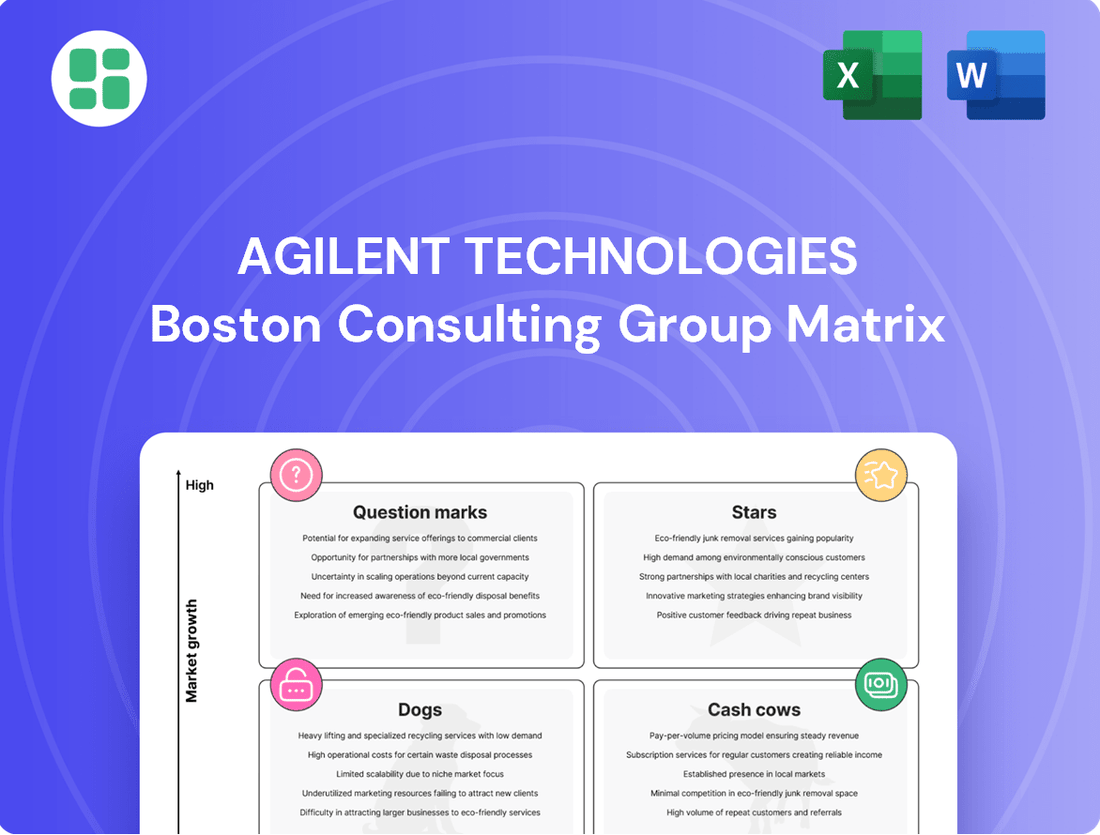

The Agilent Technologies BCG Matrix analyzes its product portfolio, categorizing businesses as Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment strategies.

The Agilent Technologies BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Agilent's CrossLab Group (ACG), which includes services, consumables, and software, is a definite cash cow for the company. This segment is a powerhouse, consistently delivering strong revenue and cash flow. In the second quarter of fiscal year 2025, ACG saw its core revenue grow by a solid 9% year-over-year, highlighting its continued strength.

The success of ACG is largely due to Agilent's extensive global installed base of instruments. This provides a steady stream of recurring, high-margin revenue that labs rely on to keep their operations running smoothly. The stability and impressive performance of ACG make it a dependable engine for generating funds that can be reinvested elsewhere in the company.

Agilent's established chromatography and spectroscopy systems, like their gas chromatography (GC) and older high-performance liquid chromatography (HPLC) models, are true cash cows. These instruments have a strong foothold in the market, thanks to years of proven performance and widespread use in labs worldwide.

While the markets for these technologies are mature, they don't demand the same level of heavy research and development as newer, cutting-edge solutions. This allows Agilent to generate a steady and substantial cash flow from this foundational portfolio, which underpins countless routine laboratory analyses. For instance, Agilent's life sciences segment, which heavily features these established technologies, reported revenue growth in fiscal year 2023, underscoring their continued market strength.

Routine laboratory consumables, including columns, reagents, and sample preparation items, form a significant cash cow for Agilent Technologies. This category generates a stable, high-volume revenue stream due to their essential nature in daily lab work across diverse sectors.

These indispensable supplies ensure consistent demand and foster repeat business, making them a predictable and reliable contributor to Agilent's cash flow. For instance, Agilent's Life Sciences segment, which heavily features such consumables, reported a revenue of $3.74 billion in fiscal year 2023, underscoring the substantial financial contribution of these product lines.

Standard Mass Spectrometry Platforms

Agilent's standard mass spectrometry platforms, particularly its gas chromatography-mass spectrometry (GC/MS) configurations, represent a mature but highly profitable segment for the company. These instruments are the go-to choice for many laboratories due to their reliability and broad applicability across various industries, from environmental testing to food safety. They continue to be a significant revenue driver, acting as dependable cash cows.

These established workhorse systems consistently generate strong and stable cash flows, underpinning Agilent's financial performance. While the company invests in more cutting-edge technologies, these standard platforms maintain their market relevance and customer loyalty. In 2024, Agilent's life sciences and applied markets segment, which heavily features these platforms, demonstrated robust growth, with mass spectrometry solutions being a key contributor.

- Market Dominance: Agilent's standard GC/MS systems are widely adopted, holding a significant share in routine analytical applications.

- Consistent Revenue: These platforms provide a steady stream of income due to their established reputation and broad customer base.

- Profitability: Despite being in a mature market, the high volume and operational efficiency of these systems ensure strong profitability.

- Foundation for Growth: The cash generated from these standard platforms helps fund innovation in Agilent's more advanced product lines.

Core Analytical Software and Informatics Platforms

Agilent's core analytical software, including MassHunter and SLIMS, are vital to laboratory operations, streamlining data analysis, instrument management, and overall lab efficiency. These software platforms, often integrated with instrument sales or offered as subscription services, foster strong customer loyalty and deliver consistent, profitable revenue streams for the company.

The extensive utilization and ongoing reliance on these informatics solutions solidify their position as significant cash generators for Agilent Technologies. For instance, Agilent reported revenue of $6.7 billion for fiscal year 2023, with a substantial portion attributed to recurring software and services, highlighting the stability of these offerings.

- MassHunter: Essential for processing and analyzing complex data from Agilent’s chromatography and mass spectrometry instruments.

- SLIMS (Sample-to-Information Lifecycle Management System): A comprehensive laboratory informatics solution that manages workflows, samples, and data across the entire research and development process.

- Recurring Revenue Model: Software licenses and support contracts contribute to predictable, high-margin income, reducing reliance on new instrument sales alone.

- Customer Stickiness: Deep integration into customer workflows makes it difficult and costly for labs to switch to alternative solutions.

Agilent's CrossLab Group (ACG), encompassing services, consumables, and software, stands as a prime cash cow. This segment consistently delivers robust revenue and cash flow, with core revenue growing by 9% year-over-year in Q2 FY25. Its strength stems from Agilent's vast global installed base, ensuring recurring, high-margin revenue essential for lab operations.

Established chromatography and spectroscopy systems, such as their gas chromatography (GC) and older high-performance liquid chromatography (HPLC) models, are significant cash cows. These instruments maintain a strong market presence due to proven performance and widespread adoption. While mature, their lower R&D demands allow for substantial, steady cash generation, supporting Agilent's foundational analyses.

Routine laboratory consumables, including columns, reagents, and sample preparation items, are a substantial cash cow for Agilent. These essential supplies generate high-volume, stable revenue due to their critical role in daily lab work across various sectors. This predictability fosters repeat business, making them a reliable cash flow contributor, with Agilent's Life Sciences segment reporting $3.74 billion in revenue in FY23.

Agilent's standard mass spectrometry platforms, particularly GC/MS configurations, are mature yet highly profitable cash cows. Their reliability and broad applicability make them laboratory mainstays, driving significant revenue. These established systems consistently yield strong, stable cash flows, with Agilent's life sciences and applied markets segment showing robust growth in 2024, supported by mass spectrometry solutions.

| Segment | FY23 Revenue (Billions) | Key Cash Cow Products/Services | Rationale |

| Life Sciences & Applied Markets | $3.74 | GC, HPLC, GC/MS, Consumables, Software | Mature, high-volume instruments and recurring consumables/software provide stable cash flow. |

| Diagnostics & Genomics | $1.05 | Certain diagnostic reagents and established genomics platforms | Stable demand in healthcare and research sectors. |

| CrossLab Group (ACG) | (Part of overall revenue, but significant) | Instrument services, consumables, software subscriptions | Recurring revenue from installed base, high margins, essential for lab operations. |

Preview = Final Product

Agilent Technologies BCG Matrix

The Agilent Technologies BCG Matrix preview you are viewing is the identical, fully polished document you will receive upon purchase. This means no watermarks, no placeholder text, and no demo content—just the complete, professionally formatted strategic analysis ready for immediate application. You can trust that the insights and structure presented here are precisely what you'll be working with to inform your business decisions. This ensures you get exactly what you expect, empowering you to leverage Agilent's market position with confidence and clarity.

Dogs

Following the spin-off of Keysight Technologies, Agilent's legacy electronic measurement components likely reside in a low market share, low growth quadrant. These are not central to Agilent's current life sciences and diagnostics strategy, suggesting minimal revenue generation and potentially just breaking even.

Older instrument models, like Agilent's legacy chromatography systems that have been replaced by newer, more efficient models, often find themselves in the Dogs category. These instruments, while still receiving some support, see minimal sales, with revenue primarily generated from servicing an existing, albeit shrinking, customer base. For instance, Agilent's 2023 financial reports indicate a strategic shift away from older product lines, with R&D investment heavily favoring next-generation platforms.

Agilent Technologies' portfolio may include highly specialized consumables for very niche or declining applications. These products, while serving a specific purpose, often generate minimal revenue and have a low market share. For instance, if a particular diagnostic consumable serves a rare disease with a limited patient population, its sales volume would naturally be low.

Such items can become cash traps, consuming resources for production and marketing without yielding significant returns. In 2024, if these low-volume consumables represent less than 1% of Agilent's total consumables revenue and show no growth potential, they would be categorized as Dogs. Their contribution to overall company growth is negligible, making their strategic value questionable.

Outdated or Standalone Software Applications

Outdated or standalone software applications within Agilent Technologies' portfolio might represent the Dogs in a BCG Matrix analysis. These are typically systems not integrated into Agilent's broader, modern workflow platforms, or those that have been superseded by more advanced, comprehensive solutions. Consequently, they likely experience a diminishing user base and hold a low market share.

The continued maintenance of such legacy systems can divert valuable resources, including IT personnel and budget, away from more strategic growth initiatives. In 2024, companies often face pressure to streamline operations and reduce technical debt, making these applications less attractive. For instance, if such a software package had less than 5% of its original user base by mid-2024 and its development budget was redirected to cloud-based analytics platforms, it would strongly indicate its Dog status.

- Declining User Base: Standalone software often struggles to compete with integrated solutions, leading to a shrinking customer pool.

- Low Market Share: These applications typically hold a negligible portion of the market compared to newer, feature-rich alternatives.

- Resource Drain: Maintaining legacy software consumes IT resources that could be allocated to more innovative and profitable ventures.

- Potential for Discontinuation: Given their limited strategic value and growth potential, these applications are often candidates for eventual retirement.

Underperforming Small Acquisitions from Pre-2024

Small acquisitions made by Agilent Technologies prior to 2024 that haven't gained substantial market traction or integrated smoothly into the company's main operations could be categorized as Dogs. These acquisitions may be draining resources without contributing to market share growth, suggesting a need for careful review and potential divestment.

For instance, if a pre-2024 acquisition in a niche diagnostic area only represented 0.1% of Agilent's total revenue in 2023 and showed no signs of accelerated growth, it would fit this profile. Such ventures often require significant management attention and capital investment that could be better allocated to more promising areas.

- Underperforming Acquisitions: Pre-2024 small acquisitions that have failed to achieve significant market traction or integrate effectively into Agilent's core business.

- Resource Drain: These ventures may consume valuable resources without delivering the anticipated market share or growth.

- Strategic Review: Indications of a need for divestiture or significant restructuring to optimize resource allocation.

- Financial Impact: In 2023, Agilent's overall revenue was approximately $6.5 billion, meaning even a small underperforming acquisition could represent a missed opportunity for growth in more strategic segments.

Agilent's Dogs category likely includes legacy electronic measurement components divested to Keysight, now representing low market share and low growth, with minimal revenue contribution. Older chromatography systems and niche, low-volume consumables also fall into this quadrant, generating revenue primarily through servicing existing customers rather than new sales. For example, if a specific diagnostic consumable for a rare disease represented less than 1% of Agilent's consumables revenue in 2024 with no growth, it would be a Dog.

Outdated, standalone software applications that are not integrated into Agilent's modern platforms also fit the Dog profile. These often have a declining user base and low market share, consuming resources that could be better used for growth initiatives. By mid-2024, if such software had less than 5% of its original user base and its development budget was reallocated, it would clearly be a Dog.

Small, underperforming acquisitions made before 2024 that haven't gained market traction or integrated well are also considered Dogs. These ventures may drain resources without contributing to market share growth, indicating a need for strategic review or divestment. In 2023, with Agilent's total revenue around $6.5 billion, an underperforming acquisition representing only 0.1% of revenue would highlight a missed opportunity for growth in more strategic areas.

| Product/Segment Example | Market Share | Growth Rate | Strategic Value | Financial Consideration (2024 Estimate) |

| Legacy Electronic Measurement Components | Low | Low | Minimal | Negligible revenue contribution |

| Older Chromatography Systems | Low | Low | Declining | Revenue from servicing existing base |

| Niche Diagnostic Consumables | Low | Low | Minimal | Less than 1% of consumables revenue |

| Standalone Legacy Software | Low | Low | Low | Less than 5% user base retention |

| Underperforming Small Acquisitions (pre-2024) | Low | Low | Low | 0.1% of total revenue contribution |

Question Marks

Agilent Technologies' acquisition of Sigsense Tech in July 2024 positions them within the burgeoning field of AI-enabled lab operations. This move targets a high-growth sector focused on enhancing lab automation and overall efficiency, a key driver for many research and development organizations.

While the potential is considerable, Agilent's current market share within this specific AI niche is still developing. Significant investment will likely be necessary to scale operations and build a more substantial presence, indicating this segment is a speculative but potentially rewarding venture for the company.

Agilent’s new, highly specialized diagnostic assays, particularly those developed for the Dako Omnis platform, represent a potential Star in the BCG Matrix. These cutting-edge assays target high-growth disease areas such as oncology, a market projected to reach over $300 billion globally by 2027. While their current market penetration might be low, their specialized nature and focus on unmet clinical needs position them for significant future growth.

Agilent Technologies is strategically positioning itself in the burgeoning field of GLP-1 analysis, a critical area for the development of diabetes and obesity treatments. This therapeutic segment is experiencing significant growth, with the global GLP-1 receptor agonist market projected to reach approximately $60 billion by 2030, according to some industry forecasts.

While Agilent's overall market presence is strong, its specific market share within the highly competitive GLP-1 analysis niche is likely in its nascent stages. This suggests that Agilent's GLP-1 analysis solutions would be categorized as question marks in a BCG matrix, requiring substantial investment to capture a larger share of this rapidly expanding market.

Solutions for 'Unknown' and 'Emerging' PFAS Compounds

Agilent Technologies is strategically positioned to address the significant market opportunity presented by 'unknown' and 'emerging' PFAS compounds, which extend beyond the currently regulated substances. This evolving segment, while less defined, offers substantial future growth potential.

While Agilent's current market share in this nascent area is modest, the company's commitment to robust research and development, coupled with proactive engagement in regulatory discussions, forms the bedrock for capturing this expanding market. This focus is crucial for navigating the complexities and establishing leadership in the 'emerging' PFAS space.

- Vast Untapped Market: The global market for PFAS detection and remediation is projected to reach tens of billions of dollars by 2030, with 'unknown' and 'emerging' compounds representing a significant, yet largely unquantified, portion of this growth.

- R&D Investment: Agilent's ongoing investment in advanced analytical instrumentation and method development is key to identifying and quantifying novel PFAS structures, thereby enabling market penetration.

- Regulatory Foresight: Active participation in shaping future PFAS regulations allows Agilent to align its product development with anticipated market needs, securing a competitive advantage.

- Strategic Partnerships: Collaborations with research institutions and industry consortia are vital for staying ahead of scientific discoveries and emerging analytical challenges in the PFAS landscape.

Strategic Partnerships in Nascent Biotechnology Fields

Agilent Technologies' strategic partnerships in nascent biotechnology fields, such as its collaboration with a leading gene editing company announced in early 2024, position it to capitalize on high-growth potential. These ventures are designed to bolster Agilent's life sciences solutions portfolio by integrating cutting-edge technologies.

While these partnerships represent a forward-looking strategy, the specific market share Agilent holds within these emerging biotechnology applications remains nascent. For instance, the company's investment in a novel cell therapy platform in Q1 2024 is still in its early commercialization phase, reflecting the inherent uncertainties of pioneering new markets.

- Early Stage Investment: Agilent is actively engaging in strategic alliances within emerging biotech sectors, indicating a focus on future revenue streams.

- High Growth Potential: These nascent fields, such as advanced diagnostics and personalized medicine, are projected to experience significant market expansion in the coming years.

- Unestablished Market Share: As these collaborations are in their early stages, Agilent's current market penetration in these specific biotechnology applications is minimal, characteristic of a 'Question Mark' in the BCG matrix.

- Strategic Importance: The partnerships are crucial for Agilent to build a strong foundation and gain competitive advantage in these rapidly evolving life sciences segments.

Agilent's ventures into highly specialized areas like AI-enabled lab operations and novel PFAS detection represent classic 'Question Marks'. These segments offer substantial future growth potential, but Agilent's current market share is minimal, requiring significant investment to establish a stronger foothold.

The company's strategic partnerships in emerging biotechnology fields, such as gene editing and cell therapy platforms, also fall into this category. While these collaborations are designed to tap into high-growth potential, their early commercialization phases mean market penetration is currently nascent.

These 'Question Mark' areas demand careful resource allocation and strategic investment. Agilent must nurture these nascent markets, focusing on research and development to build competitive advantage and increase market share in these evolving sectors.

The GLP-1 analysis market, for instance, is a prime example where Agilent's solutions are positioned as Question Marks. The projected $60 billion market by 2030 highlights the opportunity, but Agilent's current share in this specific niche is still developing, necessitating further investment.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry analyses, and competitor performance metrics to provide a clear strategic overview.