Agilent Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilent Technologies Bundle

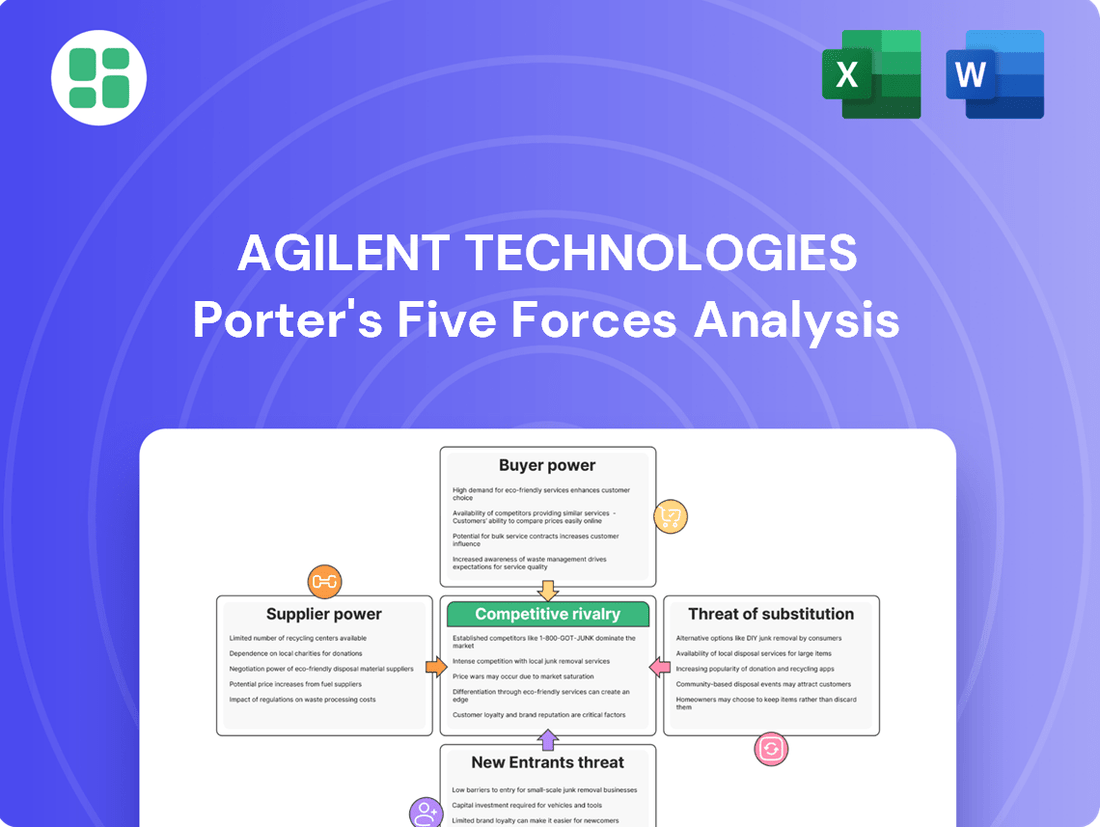

Agilent Technologies operates in a dynamic life sciences and diagnostics market, where understanding competitive pressures is crucial. Our Porter's Five Forces analysis reveals how buyer and supplier power, the threat of new entrants and substitutes, and industry rivalry shape Agilent's strategic landscape.

The complete report goes beyond this overview, offering a detailed, force-by-force breakdown with actionable insights into Agilent Technologies’s competitive environment. Discover the real strategic advantages and challenges that influence their market position.

Ready to gain a comprehensive understanding of Agilent Technologies's industry dynamics? Unlock the full Porter's Five Forces Analysis to inform your strategy and make data-driven decisions.

Suppliers Bargaining Power

Agilent Technologies, a leader in life sciences, diagnostics, and applied chemical markets, often depends on a limited number of suppliers for highly specialized components, reagents, and advanced software essential for its sophisticated instruments and consumables. This concentration means that if only a handful of companies can provide these critical, often proprietary, inputs, those suppliers gain considerable leverage.

For instance, in 2024, Agilent's reliance on niche technology providers for specific sensor arrays or advanced purification resins, where few alternatives exist, directly translates to increased bargaining power for these suppliers. This can manifest as higher pricing for these essential materials, directly impacting Agilent's cost of goods sold and potentially squeezing profit margins.

Agilent Technologies faces significant bargaining power from suppliers of highly specialized components and unique raw materials due to substantial switching costs. These costs encompass the expense and time required for requalification, rigorous testing of new materials, and the potential for manufacturing disruptions during the transition. For instance, in 2024, the lead time for certain advanced semiconductor components, critical for Agilent's life sciences and diagnostics instruments, averaged 26 weeks, highlighting the difficulty in quickly finding and integrating alternative sources.

When suppliers offer unique intellectual property, patented technologies, or specialized manufacturing processes for crucial components, their bargaining power significantly increases. Agilent Technologies faces this challenge when inputs are difficult to replicate or substitute. For example, in fiscal year 2023, Agilent's cost of goods sold was $2.25 billion, and a significant portion of this could be tied to specialized inputs where supplier leverage is high.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Agilent's business can significantly bolster their bargaining power. If suppliers can credibly threaten to start producing Agilent's instruments or consumables themselves, they gain leverage by potentially becoming direct competitors. This would reduce Agilent's dependence on them for critical components or finished goods.

While the high complexity of many scientific instruments might deter forward integration for some suppliers, it remains a tangible risk, particularly for those providing specialized components or consumables. For instance, a supplier of a unique reagent used in Agilent's diagnostic kits could potentially develop their own kit, directly competing with Agilent.

- Supplier Forward Integration Threat: Suppliers may leverage their capabilities to produce Agilent's products, increasing their power.

- Reduced Agilent Reliance: Successful forward integration by suppliers would diminish Agilent's dependence on its existing supply chain.

- Component Specialization: The risk is more pronounced for suppliers of specialized components or consumables, where the barrier to entry for producing finished goods is lower.

- Competitive Landscape Impact: This threat can alter the competitive dynamics by introducing new players into Agilent's core markets.

Importance of Agilent to Suppliers

Agilent Technologies' significance as a customer directly impacts its suppliers' bargaining power. If Agilent constitutes a substantial portion of a supplier's overall sales, that supplier is likely more amenable to negotiating favorable pricing and terms. For instance, if a key component supplier derives 20% of its revenue from Agilent, it would be hesitant to risk losing that business through aggressive price hikes or unfavorable contract conditions.

Conversely, when Agilent represents a minor part of a large, diversified supplier's revenue stream, Agilent's leverage is considerably weaker. A supplier that serves hundreds of clients, with Agilent being only a small percentage of their business, has less incentive to accommodate Agilent's demands. This is particularly true for specialized components where Agilent may have few alternative suppliers.

- Customer Concentration: The degree to which suppliers rely on Agilent for revenue is a key determinant of their bargaining power.

- Supplier Diversification: If suppliers have many other customers, Agilent's importance to them diminishes, reducing Agilent's negotiating leverage.

- Component Specificity: For highly specialized or proprietary components, Agilent's ability to switch suppliers is limited, increasing supplier power.

The bargaining power of Agilent Technologies' suppliers is significant, driven by the specialized nature of their offerings and the high costs associated with switching. For example, in 2024, the lead time for certain advanced semiconductor components crucial for Agilent's instruments averaged 26 weeks, underscoring the difficulty in finding and integrating alternatives.

Suppliers who provide unique intellectual property or patented technologies for critical inputs wield considerable influence, as these items are difficult to replicate. This is particularly true for niche reagents or advanced software essential for Agilent's sophisticated diagnostic and life science instruments.

The threat of suppliers integrating forward into Agilent's business, potentially becoming direct competitors, further amplifies their bargaining power. This risk is more pronounced for suppliers of specialized components or consumables where the barrier to entry for producing finished goods is lower.

| Factor | Impact on Agilent | Example (2024 Data) |

| Supplier Specialization & IP | High Bargaining Power | Reliance on proprietary sensor arrays, advanced purification resins |

| Switching Costs | High Bargaining Power | 26-week lead times for critical semiconductor components, requalification expenses |

| Forward Integration Threat | Moderate to High Bargaining Power | Potential for reagent suppliers to develop competing diagnostic kits |

| Customer Dependence | Low Bargaining Power for Agilent (if Agilent is a small customer) | Suppliers serving many clients with Agilent as a minor revenue source |

What is included in the product

This analysis unpacks the competitive forces impacting Agilent Technologies, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the life sciences, diagnostics, and applied chemical markets.

Agilent's Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate competitive threats, transforming potential market disruptions into strategic advantages.

Customers Bargaining Power

Agilent Technologies serves a wide array of customers across various sectors, including pharmaceutical, biotechnology, academic, environmental, and clinical diagnostic laboratories. This broad customer base, spread globally, naturally limits the power any single buyer holds over Agilent. For instance, in 2023, Agilent's revenue was diversified across these key segments, with no single segment accounting for an overwhelmingly large portion of sales, reinforcing the diluted impact of individual customer bargaining.

Customers who invest in Agilent's sophisticated instruments, specialized software, and integrated workflows often encounter significant switching costs. These costs stem from the need to re-establish analytical protocols, retrain personnel on new systems, and ensure data compatibility with existing databases, creating a substantial barrier to changing suppliers.

For complex analytical equipment, such as mass spectrometers or advanced chromatography systems, this lock-in effect is particularly pronounced. The deep integration of Agilent's solutions into a customer's operational framework diminishes their willingness to explore and adopt competing technologies, thereby solidifying customer loyalty.

In 2023, Agilent reported that its Life Sciences, Applied Markets, and Diagnostics and Genomics Groups generated revenues of $6.9 billion. This strong performance is partly attributable to the sticky nature of its customer base, where the investment in Agilent's ecosystem makes switching to a competitor a costly and disruptive undertaking.

Agilent's customer price sensitivity isn't uniform; academic and government clients, often bound by tighter budgets, tend to be more price-conscious. Conversely, major pharmaceutical firms, deeply invested in the accuracy and speed of drug development, often prioritize performance and reliability over the lowest price point.

The market's growing need for highly efficient diagnostic tools and sophisticated research equipment means that factors like accuracy and rapid results frequently outweigh cost considerations. This dynamic suggests that while price is a factor, it's not always the primary driver for Agilent's diverse customer base.

Availability of Alternative Products/Competitors

Customers of Agilent Technologies face a competitive market with numerous alternatives. Key rivals like Thermo Fisher Scientific, Danaher, Shimadzu, and Waters Corporation offer comparable analytical and diagnostic solutions. This accessibility to a variety of products allows customers to readily compare offerings and pricing, influencing Agilent's market position.

The intense competition exerts downward pressure on Agilent's pricing power. Customers can leverage the availability of similar products from competitors to negotiate better terms. This dynamic necessitates that Agilent consistently innovate and differentiate its products to maintain its customer base and pricing structure.

- Competitive Landscape: Agilent operates in a market with significant players like Thermo Fisher Scientific and Danaher, offering customers a wide array of choices.

- Customer Choice: The presence of multiple vendors for analytical instruments means customers can easily switch or choose based on price, features, or service.

- Pricing Pressure: In 2023, the life sciences and applied chemical markets, where Agilent is a major player, saw intense competition, impacting pricing strategies for many companies.

- Innovation Imperative: To counter customer bargaining power, Agilent must focus on developing unique technologies and superior customer support, a trend evident across the industry in 2024.

Customer's Ability to Backward Integrate

The bargaining power of customers for Agilent Technologies is influenced by their ability to backward integrate, though this is a limited threat. While exceptionally large pharmaceutical or biotech firms could theoretically develop some in-house analytical capabilities, the substantial capital expenditure, specialized knowledge, and stringent regulatory compliance required make this an impractical endeavor for most. Agilent's sophisticated instrumentation and comprehensive solutions present a significant barrier to such integration.

For instance, the development and validation of advanced analytical instruments, such as those used in drug discovery or quality control, demand years of research and development, costing millions. Agilent's extensive portfolio, including mass spectrometry and chromatography systems, represents a deep technological moat. In 2023, Agilent reported $6.8 billion in revenue, reflecting the broad adoption of its specialized technologies across various industries, indicating that customers generally find it more cost-effective and efficient to rely on Agilent's expertise rather than replicate it internally.

- Limited Backward Integration Potential: Very large customers might consider it, but the costs and complexities are usually prohibitive.

- High Capital and Expertise Requirements: Developing in-house analytical capabilities demands immense investment and specialized scientific talent.

- Agilent's Technological Moat: The complexity and integration of Agilent's instruments serve as a strong deterrent to customer replication.

- Cost-Effectiveness of Outsourcing: For most, partnering with Agilent is more economical than building and maintaining comparable internal infrastructure.

Agilent's customers, while diverse, exhibit varying degrees of bargaining power. This power is tempered by high switching costs associated with integrating Agilent's complex instruments and software into their workflows. For example, in 2023, Agilent's significant revenue from its established product lines suggests a strong customer retention, partly due to the expense and effort involved in changing suppliers.

While price sensitivity exists, particularly among academic institutions, many key sectors like pharmaceuticals prioritize performance and reliability, mitigating direct price-based negotiation. The competitive landscape, featuring players like Thermo Fisher Scientific, does provide alternatives, creating some pricing pressure. However, Agilent's technological moat and the limited feasibility of customer backward integration generally keep customer bargaining power in check.

| Factor | Impact on Agilent's Customer Bargaining Power | Supporting Data/Context (as of 2023/2024) |

|---|---|---|

| Customer Concentration | Low | Agilent serves diverse sectors (pharma, biotech, academic), preventing over-reliance on any single buyer. |

| Switching Costs | Lowers Customer Power | Significant investment in training, protocol recalibration, and data integration makes switching costly. |

| Price Sensitivity | Varies by Segment | Academic/government clients more sensitive; Pharma/biotech prioritize performance over price. |

| Availability of Substitutes | Moderate | Competitors like Thermo Fisher, Danaher offer alternatives, enabling some price negotiation. |

| Backward Integration Threat | Very Low | Prohibitive capital, expertise, and regulatory hurdles deter most customers from in-house development. |

Preview the Actual Deliverable

Agilent Technologies Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Agilent Technologies, providing an in-depth examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

Agilent Technologies operates within a fiercely competitive arena, characterized by a significant number of global leaders and specialized firms providing comparable analytical and diagnostic solutions. Key players vying for market share include giants like Thermo Fisher Scientific and Danaher, alongside established names such as Waters, PerkinElmer (now Revvity), and Shimadzu.

This multifaceted competitive environment, where innovation is paramount, demands that Agilent consistently differentiates itself through strategic advancements and product development to sustain its standing. For instance, in 2023, the life sciences and applied markets segment, a core area for Agilent, experienced robust growth, underscoring the dynamic nature of the industry.

The life sciences, diagnostics, and analytical instrumentation sectors are seeing significant expansion. The global analytical instrumentation market was valued at $55.29 billion in 2025 and is expected to reach $76.87 billion by 2030, with a compound annual growth rate of 6.81%. This strong growth can temper competitive rivalry by offering sufficient room for several companies to thrive.

Increased research and development spending within the biopharmaceutical industry, coupled with a rising demand for sophisticated diagnostic tools, are key drivers behind this market growth. These factors provide opportunities for companies like Agilent Technologies to capitalize on expanding market needs, potentially easing the pressure of direct competition.

Agilent Technologies actively combats competitive rivalry by focusing on product differentiation and innovation. They significantly invest in research and development, evident in their launch of advanced solutions like the InfinityLab Pro iQ Series LC-MS, which offers enhanced performance and user experience. This commitment to cutting-edge technology, coupled with integrated software and robust service offerings, allows Agilent to carve out a distinct market position, thereby mitigating direct price wars with competitors.

High Fixed Costs and Exit Barriers

The analytical instrumentation sector, where Agilent Technologies operates, is characterized by substantial capital intensity. Companies like Agilent face significant upfront investments in sophisticated equipment and ongoing, considerable research and development expenditures. These factors combine to create high fixed costs for all industry participants.

These high fixed costs, coupled with the specialized nature of manufacturing assets and the deep entrenchment of established customer relationships, erect formidable exit barriers. Companies find it economically challenging to divest or cease operations without incurring substantial losses.

Consequently, these elevated exit barriers foster intense competitive rivalry. Instead of exiting the market, firms are incentivized to remain and compete aggressively for market share, often through price competition or accelerated innovation.

- High Capital Intensity: The analytical instrumentation industry requires significant investment in advanced manufacturing and R&D.

- Substantial Exit Barriers: Specialized assets and strong customer loyalty make leaving the market difficult and costly.

- Intensified Rivalry: Companies remain in the market despite challenges, leading to fierce competition.

- Agilent's Position: As a major player, Agilent must navigate this environment of high fixed costs and significant competitive pressure.

Strategic Acquisitions and Partnerships

Agilent Technologies actively pursues strategic acquisitions and partnerships to bolster its competitive position. For instance, the acquisition of BioVectra in 2021 significantly expanded Agilent's capabilities in contract development and manufacturing (CDMO) for oligonucleotides, a key area in biopharmaceutical development. This move, valued at $1.15 billion, directly addresses the growing demand for specialized manufacturing services.

Furthermore, Agilent's collaboration with HNL Lab Medicine, announced in 2024, aims to enhance diagnostic testing capabilities. These strategic alliances and acquisitions are designed to not only broaden Agilent's product and service offerings but also to deepen its market penetration and leverage combined technological expertise. Such actions directly influence competitive rivalry by consolidating market share and raising the barrier to entry for less integrated competitors.

- Acquisition of BioVectra: Expanded CDMO specialization in oligonucleotides, valued at $1.15 billion in 2021.

- Partnership with HNL Lab Medicine: Focused on advancing diagnostic testing capabilities, initiated in 2024.

- Impact on Rivalry: Enhances portfolio and market reach, consolidates market share, and leverages combined expertise.

Agilent Technologies faces intense competition from established players like Thermo Fisher Scientific and Danaher, as well as specialized firms. The market's robust growth, driven by increased R&D in biopharmaceuticals and demand for diagnostics, tempers this rivalry by offering space for multiple companies to succeed. Agilent counters this by focusing on innovation and product differentiation, such as the InfinityLab Pro iQ Series LC-MS, to avoid direct price wars.

The industry's high capital intensity and substantial exit barriers, due to specialized assets and customer loyalty, encourage companies to remain and compete aggressively. Agilent strategically uses acquisitions, like BioVectra for $1.15 billion in 2021, and partnerships, such as the 2024 collaboration with HNL Lab Medicine, to strengthen its market position and increase barriers for new entrants.

| Competitor | 2023 Revenue (Approx. USD Billions) | Key Market Segments |

|---|---|---|

| Thermo Fisher Scientific | ~65.0 | Life Sciences, Diagnostics, Analytical Instruments |

| Danaher | ~23.0 | Life Sciences, Diagnostics, Environmental & Applied Solutions |

| Waters Corporation | ~3.0 | Chromatography, Mass Spectrometry, Analytical Instruments |

| Revvity (formerly PerkinElmer) | ~3.0 | Life Sciences, Diagnostics |

| Shimadzu Corporation | ~3.5 | Analytical & Measuring Instruments, Medical Equipment |

SSubstitutes Threaten

The threat of substitutes for Agilent's instrument-centric offerings is a significant consideration. Alternative analytical methods that can achieve comparable diagnostic or research results pose a direct challenge. For example, the rise of non-invasive diagnostic techniques and advancements in digital pathology could lessen the demand for certain traditional laboratory instruments.

The evolving landscape of healthcare and research is increasingly influenced by trends like personalized medicine and the integration of AI in data analysis. These shifts may alter the preference for specific types of analytical instrumentation, potentially impacting Agilent's market share if they don't adapt their product development and strategic focus accordingly.

Customers increasingly choose to outsource laboratory functions, such as analytical testing and diagnostics, to Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs). This trend acts as a significant substitute for Agilent's direct sales of laboratory instruments, as companies can access necessary capabilities without purchasing equipment. For instance, the global CRO market was valued at approximately $45.7 billion in 2023 and is projected to grow substantially, indicating a strong preference for outsourced services in many research and development sectors.

This shift towards outsourcing, especially for specialized or high-volume testing, directly competes with Agilent's core instrument business. However, Agilent is strategically addressing this threat by expanding its own CDMO services. This allows them to capture revenue from the outsourcing trend rather than losing it entirely, demonstrating a proactive approach to market changes and a commitment to serving evolving customer needs.

Emerging disruptive technologies represent a significant threat of substitution for Agilent's traditional laboratory instruments. For instance, advanced AI-powered analytical platforms could automate and streamline processes currently requiring specialized equipment, offering faster and potentially more cost-effective solutions. Similarly, miniaturized lab-on-a-chip devices and novel point-of-care testing solutions are gaining traction, providing more accessible and immediate diagnostic capabilities that could bypass traditional lab workflows.

These innovations directly challenge Agilent's established market position by offering alternative methods to achieve similar or superior outcomes. The promise of increased speed, reduced costs, and enhanced accessibility makes these substitutes highly attractive to customers. For example, the global point-of-care diagnostics market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating a clear demand for these alternative solutions.

Agilent is actively addressing this threat by strategically integrating disruptive technologies into its own product development. The company is investing in and incorporating AI and automation into its existing and new offerings, aiming to provide its customers with cutting-edge solutions that compete with or surpass independent disruptive technologies. This proactive approach ensures Agilent remains at the forefront of innovation, rather than being displaced by it.

Manual Processes or Less Sophisticated Tools

In certain markets, particularly those with less stringent regulations or where budgets are extremely tight, customers might opt for manual laboratory processes or simpler, less expensive analytical instruments. These manual or basic alternatives, while lacking the accuracy and speed of advanced equipment, can become viable substitutes when cost is the overriding factor.

Agilent Technologies, by concentrating on delivering high-precision, high-value analytical solutions, effectively distinguishes itself from these rudimentary options. This strategic focus ensures that Agilent’s offerings remain attractive to customers prioritizing performance and reliability over initial cost savings.

- Lower Throughput: Manual processes can significantly slow down sample analysis compared to automated Agilent systems.

- Reduced Accuracy: Less sophisticated tools often yield less precise results, potentially impacting research validity.

- Cost Sensitivity: In 2024, budget constraints remained a key driver for some customers considering manual or basic alternatives.

- Agilent's Value Proposition: Agilent emphasizes the total cost of ownership and return on investment through improved efficiency and data quality.

In-house Development by Large Organizations

Large research institutions and pharmaceutical companies with significant R&D budgets, such as those investing billions annually, may opt for in-house development of analytical tools. For instance, major pharmaceutical players often allocate substantial portions of their revenue, sometimes exceeding 15% in 2024, to research and development, which can include building proprietary platforms. This internal capability can reduce reliance on external suppliers like Agilent, presenting a potential, though often costly, substitute.

While this in-house development requires considerable financial outlay and specialized scientific and engineering talent, it offers greater control and customization. For example, a company might invest tens of millions of dollars in developing a unique high-throughput screening system. Agilent counters this by focusing on offering integrated solutions, extensive customer support, and collaborative development partnerships, thereby demonstrating value beyond standalone product sales.

- In-house Development: Large organizations may develop proprietary analytical tools, diverting R&D funds that could otherwise be spent on Agilent's products.

- Cost and Expertise Barrier: This strategy demands significant investment and specialized skills, limiting its widespread adoption as a substitute.

- Agilent's Mitigation: Agilent addresses this by providing comprehensive service packages and fostering collaborative relationships with clients.

The threat of substitutes for Agilent's instrument-centric offerings is a significant consideration. Alternative analytical methods that can achieve comparable diagnostic or research results pose a direct challenge. For example, the rise of non-invasive diagnostic techniques and advancements in digital pathology could lessen the demand for certain traditional laboratory instruments.

Customers increasingly choose to outsource laboratory functions, such as analytical testing and diagnostics, to Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs). This trend acts as a significant substitute for Agilent's direct sales of laboratory instruments, as companies can access necessary capabilities without purchasing equipment. For instance, the global CRO market was valued at approximately $45.7 billion in 2023 and is projected to grow substantially, indicating a strong preference for outsourced services in many research and development sectors.

Emerging disruptive technologies represent a significant threat of substitution for Agilent's traditional laboratory instruments. For instance, advanced AI-powered analytical platforms could automate and streamline processes currently requiring specialized equipment, offering faster and potentially more cost-effective solutions. Similarly, miniaturized lab-on-a-chip devices and novel point-of-care testing solutions are gaining traction, providing more accessible and immediate diagnostic capabilities that could bypass traditional lab workflows.

In certain markets, particularly those with less stringent regulations or where budgets are extremely tight, customers might opt for manual laboratory processes or simpler, less expensive analytical instruments. These manual or basic alternatives, while lacking the accuracy and speed of advanced equipment, can become viable substitutes when cost is the overriding factor.

| Substitute Type | Description | Impact on Agilent | Agilent's Response | 2024 Market Context |

| Outsourcing (CROs/CDMOs) | External provision of lab services | Reduces direct instrument sales | Expanding own CDMO services | CRO market ~$45.7B in 2023, growing |

| Disruptive Technologies (AI, Lab-on-a-Chip, POC) | New, often faster/cheaper methods | Potential displacement of traditional instruments | Integrating new tech into products | POC diagnostics market ~$30B in 2023, growing |

| Manual/Basic Processes | Low-cost, less sophisticated methods | Viable for budget-constrained clients | Focus on high-value, precision solutions | Cost sensitivity remains a factor |

| In-house Development | Large R&D firms building own tools | Reduced reliance on external suppliers | Offering integrated solutions, partnerships | Pharma R&D spend often >15% of revenue in 2024 |

Entrants Threaten

Entering the analytical instrumentation and life sciences tools market demands significant capital for manufacturing, cutting-edge research and development, and establishing worldwide distribution. Agilent's commitment to R&D, which represented about 6.9% of its revenue in fiscal year 2023, underscores the continuous investment necessary to stay ahead. These substantial upfront costs act as a considerable deterrent for potential new competitors.

Agilent Technologies benefits significantly from its robust intellectual property portfolio, including a vast array of patents covering its analytical instruments, software, and specialized applications. This extensive IP acts as a formidable barrier to entry for potential new competitors. For instance, Agilent holds thousands of active patents globally, a testament to its sustained investment in research and development, which innovation leaders like Agilent consistently prioritize.

Newcomers would face substantial hurdles, either by needing to develop entirely novel technologies, a costly and time-consuming endeavor, or by entering into potentially expensive licensing agreements with established players like Agilent. This intellectual capital, built over decades of dedicated innovation, makes it exceedingly difficult for new entrants to compete effectively without significant upfront investment or unique, unpatented technological advancements.

The life sciences, diagnostics, and applied chemical markets are subject to stringent regulations, demanding adherence to standards like FDA approvals and various international certifications. New companies entering these sectors must navigate a complex and lengthy regulatory approval pathway, which acts as a substantial barrier.

Agilent Technologies benefits from its established regulatory-ready workflows, offering a distinct competitive advantage. For instance, in 2024, the global life sciences market continued to see significant investment, underscoring the importance of regulatory compliance for market access and sustained growth.

Established Customer Relationships and Brand Loyalty

Agilent Technologies enjoys a significant advantage due to its deeply entrenched customer relationships with laboratories worldwide. This loyalty is a direct result of a brand reputation meticulously built over years on consistent reliability and high performance, making it difficult for newcomers to gain a foothold.

New entrants face a considerable hurdle in replicating the trust and brand allegiance that Agilent has cultivated. Potential customers often favor Agilent's proven track record and its comprehensive service networks over the unproven offerings of emerging competitors.

Agilent's deliberate customer-centric approach actively strengthens these existing bonds. For instance, in 2023, Agilent reported that over 80% of its revenue came from repeat customers, underscoring the power of these long-term relationships.

- Established Customer Relationships: Agilent has cultivated decades-long partnerships with laboratories across various sectors, fostering deep trust and reliance on its products and services.

- Brand Loyalty: The Agilent brand is synonymous with quality and dependability, making customers hesitant to switch to less-proven alternatives.

- Barriers to Entry: New entrants must overcome the significant challenge of building comparable trust and loyalty, a process that requires substantial time, investment, and a demonstrated history of success.

- Customer-Centric Strategy: Agilent's focus on understanding and meeting customer needs further solidifies its market position, making its existing customer base less susceptible to competitive overtures.

Economies of Scale and Experience Curve

Agilent Technologies, like many established players in the analytical instrumentation market, benefits significantly from economies of scale. This means they can spread their substantial fixed costs across a larger volume of production, leading to lower per-unit manufacturing, procurement, and research and development expenses. For instance, in 2023, Agilent reported revenue of $6.8 billion, allowing for significant investment in these areas that smaller competitors cannot match.

The experience curve further solidifies this advantage. Years of developing, refining, and supporting complex analytical solutions have endowed Agilent with deep operational knowledge and optimized processes. This accumulated expertise translates into greater efficiency and potentially lower production costs, creating a formidable barrier for newcomers attempting to enter the market and compete on price or speed.

Consequently, the threat of new entrants is somewhat mitigated by these entrenched advantages. New companies would face considerable hurdles in achieving comparable cost efficiencies and operational sophistication.

- Economies of Scale: Agilent's substantial revenue base ($6.8 billion in 2023) enables cost advantages in manufacturing and procurement.

- Experience Curve: Decades of developing analytical solutions provide Agilent with process efficiencies difficult for new entrants to replicate quickly.

- Cost Competitiveness: These factors make it challenging for new players to compete effectively on price and operational efficiency against established firms like Agilent.

The threat of new entrants into Agilent Technologies' market is generally low due to significant capital requirements for R&D and global distribution, with Agilent investing around 6.9% of its revenue in R&D in fiscal year 2023. Furthermore, Agilent's extensive patent portfolio, covering thousands of active patents globally, creates a formidable intellectual property barrier, making it difficult for new companies to compete without substantial investment or unique technological advancements.

Stringent regulatory requirements, such as FDA approvals, also pose a significant hurdle for new entrants, demanding lengthy and complex approval processes. Agilent's established regulatory-ready workflows provide a distinct advantage in this regard, especially as the life sciences market continued to see substantial investment in 2024, emphasizing the need for compliance.

The company's deep customer relationships, built on a reputation for reliability and performance, are a key deterrent. Agilent's customer-centric approach is evident, with over 80% of its revenue in 2023 stemming from repeat customers, making its existing client base highly loyal.

Economies of scale and the experience curve further solidify Agilent's position. With $6.8 billion in revenue in 2023, Agilent can achieve lower per-unit costs in manufacturing, procurement, and R&D, an advantage that smaller, newer competitors struggle to match due to their limited operational knowledge and scale.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Agilent Technologies is built upon a robust foundation of data, including Agilent's own annual reports and SEC filings, alongside industry-specific market research from firms like Gartner and IDC.

We also incorporate insights from financial databases such as Bloomberg and S&P Capital IQ, as well as competitor disclosures and trade publications, to provide a comprehensive view of the competitive landscape.