Agilent Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilent Technologies Bundle

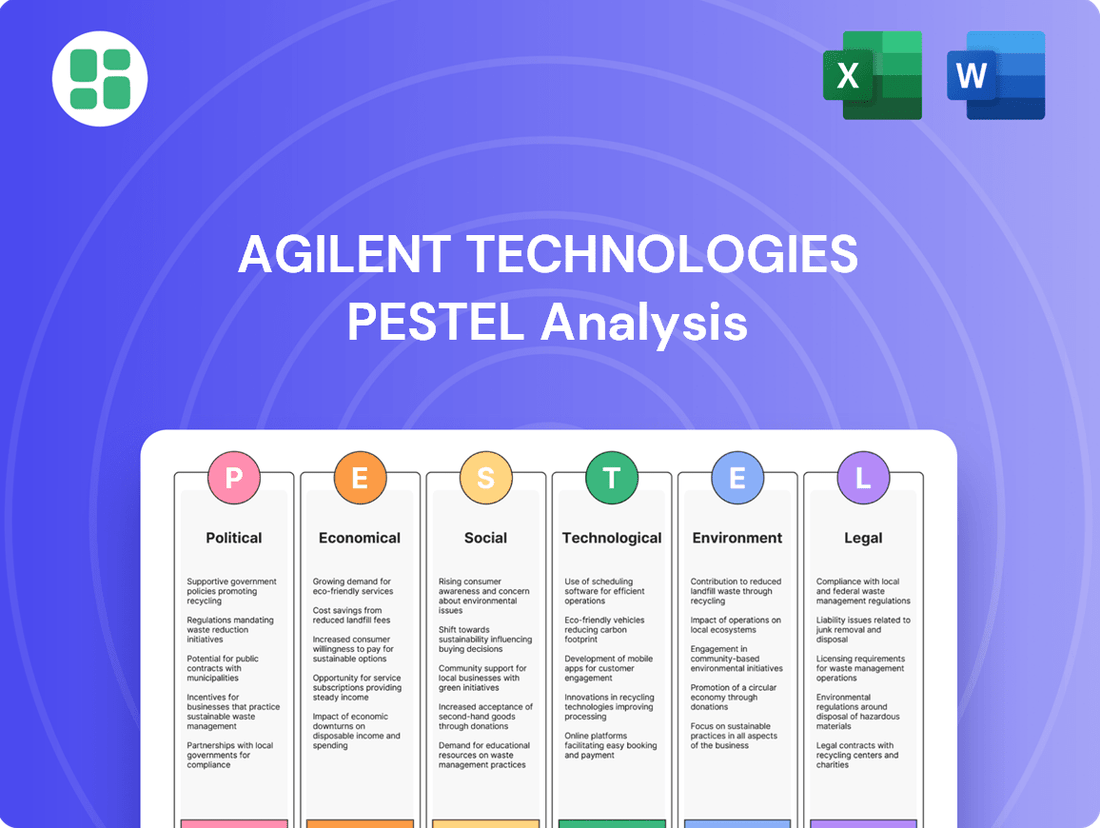

Navigate the complex external forces shaping Agilent Technologies's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that impact its operations and market position. Gain a strategic advantage by leveraging these insights to anticipate challenges and capitalize on opportunities. Download the full analysis now for actionable intelligence to refine your strategy.

Political factors

Government funding for scientific research, especially in areas like life sciences and diagnostics, plays a crucial role in shaping Agilent Technologies' market. Increased federal and state investment in academic and government laboratories directly translates into higher demand for Agilent's sophisticated instruments and essential services. For instance, in fiscal year 2023, the U.S. National Institutes of Health (NIH) allocated over $47 billion to biomedical research, a significant portion of which supports the purchase of analytical equipment that Agilent provides.

Changes in healthcare policy, like the US Inflation Reduction Act, are reshaping drug pricing and FDA approval pathways, directly impacting the pharmaceutical and diagnostic sectors where Agilent operates. These legislative shifts can influence demand for Agilent's analytical instruments and services used in drug discovery and quality control.

Stricter regulatory frameworks for medical devices and diagnostics, such as the EU's In Vitro Diagnostic Regulation (IVDR), are a significant factor. For instance, the IVDR, which fully applied in May 2022, necessitates rigorous clinical evidence and quality management systems, potentially increasing Agilent's development costs and time-to-market for new diagnostic solutions.

Global trade relations significantly influence Agilent Technologies. For instance, the ongoing trade tensions between major economies in 2024 could lead to increased tariffs on imported components, raising Agilent's manufacturing costs. Conversely, new trade agreements, like those potentially finalized or renegotiated in late 2024 or early 2025, could open up new market access or reduce existing barriers, impacting Agilent's sales in key regions.

Political Stability in Key Markets

Political stability in Agilent's key markets significantly impacts its operations. For instance, North America and Europe, major revenue generators for Agilent, experienced varying degrees of political stability throughout 2024. Geopolitical tensions in certain Asian markets, where Agilent also has a strong presence, could lead to economic uncertainty, affecting R&D investment and customer demand for life science and diagnostic solutions.

Economic volatility stemming from geopolitical events directly influences business confidence. A stable political environment fosters greater certainty for companies like Agilent to invest in innovation and expand their market reach. Conversely, political instability can cause hesitations in capital expenditure for Agilent's customers, impacting sales cycles and revenue forecasts.

Agilent's ability to conduct business smoothly is also tied to political factors. Changes in trade policies or regulatory landscapes, often a consequence of political shifts, can create operational challenges or opportunities. For example, shifts in government funding for scientific research in major economies can directly correlate with demand for Agilent's instruments and services.

- North America and Europe remain critical markets for Agilent, with economic performance in 2024 showing resilience despite some regional political uncertainties.

- Geopolitical developments in Asia during 2024 presented both opportunities and risks, influencing supply chain considerations and market access for Agilent.

- Government spending on healthcare and life sciences research, a key driver for Agilent, is often influenced by political priorities and economic conditions in its operating regions.

Environmental Policy and Standards

Agilent Technologies operates within a landscape shaped by evolving environmental policies and standards, particularly concerning chemical usage, waste management, and pollution monitoring. These regulations present both hurdles and avenues for growth. For instance, the heightened global scrutiny on per- and polyfluoroalkyl substances (PFAS) directly translates to increased demand for Agilent's advanced analytical instruments and solutions, which are crucial for accurate detection and quantification.

The company's portfolio is well-positioned to assist clients in meeting these increasingly rigorous environmental compliance mandates. Agilent's analytical tools are instrumental in helping laboratories and industries worldwide adhere to stringent environmental protection laws.

- Increased demand for PFAS testing solutions: Global regulations on PFAS are tightening, driving customer need for specialized analytical instruments.

- Agilent's role in compliance: The company's products enable customers to meet stringent environmental standards related to chemical use and pollution.

- Market opportunities: Evolving environmental policies create new markets for Agilent's testing and monitoring technologies.

Government funding for scientific research, particularly in life sciences and diagnostics, significantly impacts Agilent's demand. For example, the U.S. National Institutes of Health (NIH) budget for fiscal year 2024 was projected to exceed $47 billion, supporting research that requires Agilent's advanced instrumentation.

Regulatory changes, such as the EU's In Vitro Diagnostic Regulation (IVDR) fully implemented in May 2022, necessitate rigorous compliance, potentially affecting product development timelines and costs for Agilent's diagnostic solutions.

Global trade dynamics and political stability in key markets like North America and Europe, which represented a substantial portion of Agilent's revenue in 2023, influence operational costs and market access. Geopolitical tensions in 2024 also presented both risks and opportunities for Agilent's supply chain and market expansion.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Agilent Technologies, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the global life sciences and diagnostics market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Agilent Technologies.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal influences on Agilent.

Economic factors

Global economic growth is a key driver for Agilent Technologies. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from previous years. This overall economic health directly impacts Agilent's customer base, which includes laboratories and life science companies that often adjust their spending based on economic conditions.

When the global economy is strong, typically seen with higher GDP growth rates, businesses and research institutions are more likely to increase their capital expenditures. This translates to greater demand for Agilent's analytical instruments and services, as companies invest more in research and development. Conversely, economic slowdowns can lead to tighter budgets, potentially reducing investment in new equipment.

Agilent's performance is therefore closely tied to these macroeconomic trends. For example, in 2023, while specific figures for Agilent's direct correlation to global GDP growth are proprietary, the broader life sciences and diagnostics market experienced varied growth depending on regional economic stability and government funding for research initiatives.

Research and development (R&D) spending in the life sciences is a major influence on Agilent Technologies. When pharmaceutical companies, biotech firms, and universities spend more on R&D, they tend to buy more of Agilent's sophisticated analytical tools, software, and support services. This is essential for everything from finding new drugs to testing them.

Analysts project robust growth in R&D investment through 2028, with significant funding expected to flow into areas like oncology and immunology. For instance, global healthcare R&D spending reached approximately $250 billion in 2023, and this trend is anticipated to continue upward, directly benefiting companies like Agilent that supply critical laboratory technologies.

Inflationary pressures significantly impact Agilent's operational expenses. For instance, rising costs for raw materials, components, and energy directly affect manufacturing and logistics, potentially squeezing profit margins. This was evident as the U.S. Producer Price Index for finished goods saw a notable increase throughout 2023 and into early 2024, indicating broad-based cost escalations across industries.

Global supply chain disruptions, stemming from geopolitical events and logistical bottlenecks, continue to pose challenges. These disruptions can lead to higher procurement costs and extended lead times for critical components, impacting Agilent's ability to meet demand promptly and efficiently. The ongoing effects of the Red Sea shipping disruptions in early 2024, for example, demonstrated the vulnerability of global trade routes and their potential to inflate shipping expenses.

Effectively managing these cost pressures is paramount for Agilent. The company must employ strategic pricing adjustments to pass on some of these increased costs to customers while simultaneously optimizing its procurement processes to secure favorable terms and mitigate supply chain risks. Agilent's focus on operational efficiency and supply chain resilience remains a key strategy to navigate these economic headwinds.

Currency Exchange Rate Fluctuations

Agilent Technologies, as a global enterprise, is significantly exposed to the volatility of currency exchange rates, which directly impacts its reported financial performance. When the U.S. dollar strengthens, international revenues earned in foreign currencies translate into fewer dollars, potentially dampening reported sales and earnings. Conversely, a weaker dollar can boost these translated figures.

For fiscal year 2025, Agilent has explicitly factored in potential currency headwinds. This forward-looking guidance suggests that the company anticipates the prevailing exchange rate environment could present challenges to its financial results. For instance, if the dollar remains strong against major currencies like the Euro or Japanese Yen throughout 2025, Agilent's reported international revenue growth could be negatively affected.

- Impact of USD Strength: A stronger U.S. dollar can reduce the reported value of Agilent's international sales when converted back into dollars.

- Impact of USD Weakness: Conversely, a weaker U.S. dollar can inflate the reported value of international sales.

- Fiscal Year 2025 Outlook: Agilent has indicated that it anticipates currency fluctuations may act as a headwind to its financial performance in the upcoming fiscal year.

Healthcare Expenditure and Budget Allocations

Shifts in national healthcare spending and how governments prioritize public health and diagnostic programs significantly influence the market for Agilent's clinical and diagnostic products. For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) projected Medicare spending to reach $1.1 trillion in 2024, a portion of which directly fuels demand for diagnostic technologies.

The rising incidence of chronic conditions and the demographic trend of an aging global population are key drivers for increased investment in diagnostic tools and the burgeoning field of personalized medicine. This trend directly benefits Agilent's growth prospects in these areas.

- Increased Healthcare Spending: Global healthcare spending is projected to reach $10.05 trillion in 2024 according to Deloitte, indicating robust market potential for diagnostic solutions.

- Chronic Disease Prevalence: The World Health Organization estimates that chronic diseases account for an estimated 74% of all deaths globally, necessitating continuous advancements in diagnostic capabilities.

- Aging Population: By 2030, one in six people worldwide will be 65 or over, increasing the demand for healthcare services and diagnostics, a demographic shift Agilent is positioned to serve.

Agilent's financial results are sensitive to global economic conditions, with projected global growth around 3.2% for 2024 according to the IMF. Stronger economies generally lead to increased R&D spending, boosting demand for Agilent's instruments. Conversely, economic downturns can constrain customer budgets, impacting sales.

Inflationary pressures, such as rising raw material costs indicated by the U.S. Producer Price Index, directly affect Agilent's operational expenses and profit margins. Supply chain disruptions, exemplified by early 2024 Red Sea shipping issues, further inflate procurement and logistics costs, necessitating strategic pricing and efficiency improvements.

Currency exchange rate volatility significantly influences Agilent's reported international revenue. A strengthening U.S. dollar can reduce the dollar value of foreign earnings, a factor Agilent has factored into its fiscal year 2025 outlook, potentially acting as a headwind.

Preview the Actual Deliverable

Agilent Technologies PESTLE Analysis

The Agilent Technologies PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting Agilent.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, meaning you’ll gain immediate access to a detailed PESTLE analysis of Agilent Technologies.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you receive a complete and professionally structured PESTLE analysis ready for immediate application.

Sociological factors

The global population is getting older, with the number of people aged 65 and over projected to reach 1.6 billion by 2050, up from 703 million in 2019. This demographic shift significantly boosts demand for healthcare, diagnostics, and life sciences solutions, areas where Agilent Technologies is a key player. As more people age, the likelihood of chronic diseases like cancer, diabetes, and cardiovascular conditions increases, creating a greater need for Agilent's advanced analytical instruments and services for research, diagnosis, and ongoing patient management.

Growing public awareness of health and wellness is a significant driver for Agilent Technologies. This trend directly boosts demand for early disease detection and personalized medicine, fields where Agilent's advanced diagnostic and analytical instruments play a vital role. For example, the global in-vitro diagnostics market was projected to reach over $100 billion by 2024, a testament to this increased focus on proactive health management.

This societal shift towards preventive care translates into a higher volume of diagnostic tests being conducted worldwide. As individuals become more invested in their well-being, the need for sophisticated tools to identify potential health issues early on intensifies, directly benefiting companies like Agilent that provide the foundational technology for these tests.

The growing societal embrace of personalized medicine, where treatments are tailored to an individual's unique genetic makeup, directly fuels demand for Agilent's advanced genomics and proteomics technologies. This trend is particularly evident in oncology, where companion diagnostics are crucial for identifying patients likely to respond to specific therapies.

This shift is underscored by market projections, with the global personalized medicine market expected to reach approximately $800 billion by 2028, growing at a compound annual growth rate (CAGR) of around 10% from 2023. Agilent's solutions are well-positioned to capitalize on this expansion, providing the essential tools for genetic sequencing, biomarker discovery, and diagnostic development.

Workforce Skills and Talent Availability

Agilent Technologies relies heavily on a robust pool of talent skilled in science, technology, engineering, and manufacturing to drive its innovation and operational success. The company's ability to attract and keep top-tier scientific and technical minds is directly impacted by broader societal trends in education, particularly the level of interest in STEM fields, and patterns of talent migration. For instance, in 2024, the demand for data scientists and AI specialists in life sciences continued to surge, creating a competitive landscape for Agilent.

Societal emphasis on continuous learning and upskilling plays a crucial role in maintaining Agilent's competitive edge. By fostering a culture that prioritizes employee satisfaction and recognition, Agilent aims to mitigate potential talent shortages. In 2023, Agilent was recognized on multiple lists for its positive workplace culture, reflecting its commitment to employee engagement and retention. This focus is particularly important as the company expands its offerings in areas like diagnostics and applied chemical markets, which require specialized expertise.

- STEM Education Trends: Societal investment and engagement in STEM education directly impact the future pipeline of qualified candidates for Agilent.

- Talent Migration Patterns: Global and regional movements of skilled professionals influence where Agilent can efficiently source its specialized workforce.

- Employee Satisfaction Metrics: Agilent's focus on employee well-being and recognition is a key strategy to retain its highly skilled workforce amidst a competitive market.

- Industry-Specific Skill Demand: The growing need for expertise in areas like bioinformatics and advanced manufacturing techniques shapes Agilent's recruitment priorities.

Public Trust in Science and Technology

Public perception of science and technology significantly impacts Agilent's market. A recent Pew Research Center survey in late 2023 found that while a majority of Americans express confidence in scientists, there's a notable segment concerned about the ethical implications of technological advancements, particularly in areas like AI and genetic engineering. This sentiment can translate into slower adoption rates for new diagnostic tools or research platforms if public trust is not actively cultivated.

The life sciences industry, where Agilent operates, is particularly sensitive to public trust. For instance, widespread acceptance of genomic sequencing for personalized medicine, a key area for Agilent, hinges on public confidence in the privacy and security of genetic data. Conversely, high public trust can foster supportive regulatory environments, potentially streamlining the approval process for Agilent's innovative solutions.

- Public Trust in Science: A 2023 Gallup poll indicated that 58% of U.S. adults have a great deal or quite a lot of confidence in scientists, a figure that has seen some fluctuation in recent years.

- Technological Skepticism: Concerns about data privacy and the ethical use of AI in healthcare, as highlighted by various consumer surveys in 2024, can create headwinds for the adoption of advanced diagnostic technologies.

- Impact on Adoption: Positive public perception can accelerate market penetration for Agilent's instruments and software used in areas like disease research and drug discovery.

- Regulatory Influence: Strong public support for scientific progress can lead to more favorable regulatory frameworks, benefiting companies like Agilent that rely on innovation.

Societal trends in health consciousness and the aging global population directly fuel demand for Agilent's diagnostic and life sciences solutions. As the world's population aged 65 and over is projected to reach 1.6 billion by 2050, the need for advanced healthcare technologies, including those Agilent provides for research and diagnostics, will continue to grow. This demographic shift, coupled with a public focus on preventive care and personalized medicine, creates a substantial market opportunity for Agilent's advanced analytical instruments and services.

The increasing societal emphasis on personalized medicine, where treatments are tailored to individual genetic profiles, is a significant growth driver for Agilent. This is particularly evident in oncology, where companion diagnostics are vital. The global personalized medicine market is anticipated to reach approximately $800 billion by 2028, growing at a CAGR of around 10% from 2023, highlighting Agilent's strategic positioning in this expanding sector.

Public perception of science and technology significantly impacts Agilent's market acceptance and regulatory pathways. While a majority of Americans, around 58% according to a 2023 Gallup poll, express confidence in scientists, concerns about data privacy and the ethical use of AI in healthcare, as noted in 2024 consumer surveys, can influence adoption rates for advanced diagnostic tools. Building and maintaining public trust is therefore crucial for Agilent's success.

| Sociological Factor | Impact on Agilent Technologies | Supporting Data/Trend |

|---|---|---|

| Aging Population | Increased demand for healthcare, diagnostics, and life sciences solutions. | Global population aged 65+ projected to reach 1.6 billion by 2050 (up from 703 million in 2019). |

| Health & Wellness Awareness | Drives demand for early disease detection and personalized medicine. | Global in-vitro diagnostics market projected to exceed $100 billion by 2024. |

| Personalized Medicine Adoption | Boosts demand for genomics and proteomics technologies. | Global personalized medicine market expected to reach ~$800 billion by 2028 (10% CAGR from 2023). |

| Public Trust in Science | Influences market acceptance and regulatory approval. | 58% of U.S. adults have high confidence in scientists (Gallup, 2023); concerns exist regarding AI/genetic engineering ethics (2024 surveys). |

Technological factors

Agilent's core business thrives on continuous innovation in analytical instrumentation, particularly in liquid chromatography (LC) and mass spectrometry (MS). These technologies are fundamental to the company's offerings, enabling precise analysis across various scientific disciplines.

The company consistently rolls out updated instrument models, boasting improved sensitivity and efficiency. For instance, Agilent's recent LC/MS systems in 2024 offer faster throughput and lower detection limits, crucial for demanding applications in biopharmaceutical research and environmental testing.

These advancements directly address the evolving needs of laboratories in biopharma, industrial quality control, and academic research. By providing cutting-edge tools, Agilent empowers scientists to achieve more accurate and faster results, a key driver of their market position.

Agilent Technologies is actively leveraging the integration of Artificial Intelligence (AI) and machine learning into its offerings. This technological shift is transforming laboratory workflows, with AI-driven platforms enhancing diagnostic accuracy and optimizing trial designs. For instance, Agilent's software solutions are increasingly incorporating these capabilities to provide faster, more precise data analytics for its customers.

The increasing push for lab automation and digitalization, fueled by advancements in cloud computing and sophisticated robotics, is significantly enhancing laboratory efficiency and streamlining operations. Agilent's integrated digital ecosystem and automated workflow solutions are at the forefront of this shift, empowering laboratories to optimize resource allocation and accelerate turnaround times. For instance, Agilent's open lab data management solutions are designed to connect instruments and software, facilitating a more seamless data flow, which is crucial for high-throughput environments.

Genomic and Proteomic Research Breakthroughs

Breakthroughs in genomic and proteomic research, particularly with advancements like next-generation sequencing (NGS), are creating significant new demands for Agilent's specialized tools and consumables. For instance, the global genomics market was valued at approximately USD 29.5 billion in 2023 and is projected to grow substantially, with Agilent well-positioned to capitalize on this expansion through its comprehensive portfolio of instruments, reagents, and software.

These scientific leaps are directly fueling the development of novel diagnostic applications and highly targeted therapies. This, in turn, necessitates sophisticated analytical capabilities that Agilent's high-performance liquid chromatography (HPLC), mass spectrometry (MS), and microarray solutions are designed to provide, supporting everything from drug discovery to personalized medicine.

- Genomic Market Growth: The global genomics market is expected to reach over USD 100 billion by 2030, indicating sustained demand for related technologies.

- Agilent's Role: Agilent's solutions are critical for sample preparation, sequencing, and data analysis in these rapidly evolving fields.

- Therapeutic Impact: Advancements in proteomics are crucial for identifying new drug targets, with the global proteomics market projected to exceed USD 40 billion by 2028.

Development of New Diagnostic Tools

The swift evolution and uptake of novel diagnostic instruments, particularly point-of-care testing (POCT) and sophisticated in-vitro diagnostics, present a significant technological avenue for growth. Agilent is actively broadening its diagnostic offerings, exemplified by its Dako Omnis platform, aiming to deliver adaptable solutions catering to diverse laboratory requirements.

This technological advancement is crucial for companies like Agilent, as the global in-vitro diagnostics market was valued at approximately USD 97.5 billion in 2023 and is projected to reach USD 149.2 billion by 2030, growing at a CAGR of 6.3% according to some industry reports. The increasing demand for faster and more accurate diagnoses fuels innovation in this sector.

Agilent's strategic investments in areas like advanced genomics and pathology diagnostics, including their work with the Dako Omnis system, directly address this trend. These tools enable more precise patient stratification and treatment monitoring, which is a key driver for market expansion.

Agilent is at the forefront of technological advancements in analytical instrumentation, with a strong focus on liquid chromatography (LC) and mass spectrometry (MS). Their 2024 LC/MS systems offer enhanced sensitivity and faster throughput, critical for biopharmaceutical and environmental analysis.

The integration of AI and machine learning into Agilent's platforms is revolutionizing laboratory workflows, improving diagnostic accuracy and data analysis efficiency. This is particularly evident in their software solutions designed for faster, more precise results.

Agilent is also capitalizing on the burgeoning genomics and proteomics markets, which were valued at approximately USD 29.5 billion and projected to exceed USD 40 billion by 2028, respectively. Their comprehensive portfolio of instruments, reagents, and software supports these rapidly growing scientific fields.

The company's expansion into advanced diagnostics, including point-of-care testing and in-vitro diagnostics, is strategically aligned with market growth. The global in-vitro diagnostics market was valued at roughly USD 97.5 billion in 2023, with Agilent's Dako Omnis platform exemplifying their commitment to this sector.

| Technology Area | 2023 Market Value (Approx.) | Projected Growth Driver | Agilent's Relevant Offering |

|---|---|---|---|

| Genomics | USD 29.5 billion | Demand for sequencing and analysis | Instruments, reagents, software |

| Proteomics | Projected > USD 40 billion by 2028 | Drug target identification | High-performance instruments |

| In-Vitro Diagnostics | USD 97.5 billion | Need for faster diagnoses | Dako Omnis platform |

Legal factors

Agilent Technologies relies heavily on robust intellectual property (IP) protection to safeguard its innovations in scientific instruments, software, and diagnostic tools. The company's extensive patent portfolio, covering everything from chromatography systems to gene sequencing technologies, is a critical asset. In 2023, Agilent continued to invest significantly in R&D, with a substantial portion dedicated to securing new patents and defending existing ones, a trend expected to persist through 2024 and 2025. This legal framework is essential for maintaining competitive advantage and recouping the considerable expenses associated with developing cutting-edge scientific solutions.

Agilent Technologies must navigate a complex landscape of data privacy and security regulations, including the EU's General Data Protection Regulation (GDPR) and the U.S.'s Health Insurance Portability and Accountability Act (HIPAA). These laws govern how Agilent's software and services manage sensitive patient and research data, making compliance a critical operational imperative. Failure to adhere can result in significant legal penalties and damage customer trust, necessitating strong data security protocols and embedding privacy considerations from the initial stages of product design.

Agilent Technologies operates under stringent product safety and quality standards, especially critical for its instruments and consumables in clinical diagnostics and pharmaceutical sectors. For instance, in 2024, the company continued to invest heavily in quality assurance processes, aiming to maintain its reputation for reliability in highly regulated markets.

Compliance with global standards like ISO 13485 for medical devices is paramount. Failure to meet these requirements can result in significant consequences, including product recalls, costly litigation, and severe damage to Agilent's brand image, impacting future sales and market access.

Clinical Trial and Regulatory Approvals

The intricate web of regulations surrounding clinical trials and product approvals, including stringent requirements from bodies like the U.S. Food and Drug Administration (FDA) and European In Vitro Diagnostic Regulation (IVDR) certifications, significantly influences Agilent's speed in bringing new diagnostic assays and instruments to market. For instance, the FDA's review process for new diagnostic tests can take many months, impacting revenue timelines.

Effectively managing these complex approval pathways is absolutely crucial for Agilent's commercial success, enabling them to expand their market reach and capitalize on emerging healthcare needs. Delays in regulatory clearance can mean lost revenue opportunities.

Agilent's ability to navigate these regulatory hurdles efficiently directly impacts its competitive positioning and the speed at which it can introduce innovative solutions. The IVDR, implemented in May 2022, introduced new requirements for in vitro diagnostic medical devices, necessitating substantial effort and investment from companies like Agilent to ensure compliance.

- FDA Approval Timelines: Average review times for certain medical devices can range from several months to over a year, directly affecting Agilent's product launch schedules.

- IVDR Compliance Costs: Companies faced significant investments in 2024 and 2025 to meet the updated IVDR standards for in vitro diagnostic devices in Europe.

- Global Regulatory Harmonization: Agilent monitors efforts towards global regulatory harmonization, which could streamline approvals but also presents ongoing compliance challenges.

Anti-Corruption and Compliance Laws

Agilent Technologies, operating globally, must navigate a complex web of anti-corruption and compliance laws, such as the U.S. Foreign Corrupt Practices Act (FCPA). These regulations mandate strict adherence to ethical business practices and the implementation of strong internal controls to mitigate risks of legal penalties and reputational harm. Failure to comply can result in significant financial penalties and operational disruptions, impacting market trust and investor confidence.

For instance, in 2023, companies faced substantial fines for FCPA violations, underscoring the critical importance of robust compliance programs. Agilent's commitment to these standards is crucial for maintaining its integrity and operational continuity across diverse international markets.

- FCPA Enforcement: Companies globally are subject to increasing scrutiny and enforcement actions related to anti-bribery and corruption laws.

- Reputational Risk: Non-compliance can severely damage Agilent's brand image and stakeholder trust.

- Internal Controls: Maintaining effective internal controls is paramount to prevent and detect potential violations.

Agilent Technologies' success hinges on its ability to navigate evolving legal frameworks, particularly concerning intellectual property and product compliance. The company's substantial investment in R&D in 2023, continuing into 2024 and 2025, underscores its commitment to patent protection, a critical element for maintaining its competitive edge in scientific innovation.

Compliance with global data privacy laws like GDPR and HIPAA is a significant legal consideration, impacting how Agilent handles sensitive research and patient data. Furthermore, adherence to stringent product safety, quality standards, and regulatory approvals from bodies such as the FDA and the EU's IVDR are paramount for market access and revenue generation, with IVDR compliance presenting ongoing investment needs for 2024 and 2025.

The company also faces legal scrutiny regarding anti-corruption laws like the FCPA, necessitating robust internal controls to prevent violations and safeguard its reputation. These legal factors collectively shape Agilent's operational strategies and market positioning.

Environmental factors

Growing global demand for environmentally responsible products is increasingly shaping manufacturing. For Agilent Technologies, this translates to a significant push to reduce energy usage, cut down on waste, and minimize the use of hazardous substances throughout its production lines. This trend is not just about compliance; it's becoming a key differentiator in the market.

In response, Agilent is actively investing in sustainable manufacturing initiatives. For instance, the company has focused on developing more eco-friendly packaging solutions and implementing advanced recycling systems. These efforts aim to shrink their overall environmental footprint, aligning with both regulatory expectations and customer preferences for greener products.

Agilent Technologies operates under stringent environmental regulations governing the disposal of laboratory waste, particularly hazardous chemical and biological materials. These rules directly impact Agilent's product development, pushing for designs that minimize consumable use and reagent waste. For instance, advancements in microfluidics and automation aim to reduce sample volumes and chemical footprints.

In response, Agilent actively develops products that reduce the reliance on disposable consumables and offers services like instrument recycling and refurbishment. These initiatives assist customers in adhering to waste management protocols and promote a circular economy within the scientific community. The company's commitment to sustainability is reflected in its efforts to extend product lifecycles and responsibly manage end-of-life equipment.

Agilent Technologies is actively addressing the growing global imperative to reduce carbon emissions. The company has committed to achieving net-zero greenhouse gas emissions, a significant undertaking that requires careful management of energy consumption across its operations. This commitment is not just internal; Agilent also focuses on developing energy-efficient laboratory instruments, directly enabling its customers to lower their own environmental impact.

In 2023, Agilent reported a 12% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating tangible progress toward their net-zero goals. Their product development strategy includes designing instruments that consume less power, contributing to a greener laboratory environment for their clients and reducing the overall carbon footprint of scientific research.

Chemical Use and Hazardous Materials Handling

Agilent Technologies operates within sectors where the meticulous management of chemicals and hazardous materials is paramount. Stringent regulations, such as those from the Environmental Protection Agency (EPA) in the US and REACH in Europe, dictate the use, storage, and disposal of these substances. Failure to comply can lead to significant fines and operational disruptions, impacting Agilent's ability to serve markets like environmental testing and industrial safety.

Agilent's own operations, which involve the use of various chemicals in manufacturing and research, are subject to these environmental regulations. The company's commitment to safety is underscored by its adherence to global standards. For instance, in 2023, Agilent reported a strong focus on environmental, social, and governance (ESG) initiatives, which inherently include robust chemical handling protocols.

- Regulatory Compliance: Agilent must adhere to global chemical safety regulations, impacting its supply chain and product development.

- Safety and Risk Management: Proper handling of hazardous materials is critical for employee safety, environmental protection, and mitigating operational risks.

- Market Relevance: Agilent's analytical instruments are vital tools for other industries to monitor and manage chemical usage and environmental impact, creating a symbiotic relationship with regulatory frameworks.

ESG Investor and Stakeholder Pressure

Agilent Technologies is experiencing increasing pressure from investors and stakeholders focused on environmental, social, and governance (ESG) criteria. This growing emphasis directly shapes the company's strategic decisions and the transparency of its reporting. For instance, in its 2023 ESG report, Agilent detailed progress on its climate goals, aiming for a 50% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 against a 2019 baseline. This commitment is crucial for attracting socially responsible investment, a segment of the market that saw significant growth through 2024.

The company's proactive approach to sustainability is vital for maintaining investor confidence and accessing capital from socially conscious funds. Agilent's ongoing efforts in areas like water stewardship and waste reduction, as outlined in their public disclosures, demonstrate a commitment to responsible operations. This focus is particularly relevant as regulatory landscapes continue to evolve, with many jurisdictions implementing stricter environmental reporting requirements by 2025.

Key areas of ESG investor and stakeholder focus for Agilent include:

- Climate Action: Reducing greenhouse gas emissions and improving energy efficiency across operations.

- Sustainable Products: Developing and offering products that minimize environmental impact throughout their lifecycle.

- Supply Chain Responsibility: Ensuring ethical and sustainable practices within its global supply chain.

- Diversity, Equity, and Inclusion: Fostering an inclusive workforce and promoting equitable opportunities.

Agilent Technologies faces increasing scrutiny regarding its environmental footprint, driving a focus on reducing waste and energy consumption. The company is actively developing more sustainable products and manufacturing processes to meet growing consumer and regulatory demands for eco-friendly solutions.

Stringent regulations govern hazardous material handling and disposal, impacting Agilent's product design and operational practices. The company's analytical instruments play a crucial role in helping other industries monitor and manage their own environmental impact, creating a reciprocal relationship with environmental compliance.

Investor and stakeholder pressure for strong Environmental, Social, and Governance (ESG) performance is a significant driver for Agilent. The company is committed to reducing greenhouse gas emissions, with a target of a 50% reduction in Scope 1 and 2 emissions by 2030 against a 2019 baseline, as highlighted in its 2023 ESG report.

Agilent's commitment to sustainability is demonstrated by its progress in reducing emissions, reporting a 12% reduction in Scope 1 and 2 greenhouse gas emissions by 2023 compared to 2019. This focus on environmental responsibility is crucial for attracting investment and ensuring long-term market relevance.

| Environmental Focus Area | Agilent's Commitment/Action | 2023/2024 Data/Target |

|---|---|---|

| Greenhouse Gas Emissions | Reducing Scope 1 & 2 emissions | 12% reduction achieved by 2023 (vs. 2019 baseline); Target: 50% reduction by 2030 |

| Sustainable Products | Developing eco-friendly packaging, minimizing consumable use | Ongoing product development initiatives |

| Waste Management | Implementing advanced recycling systems, promoting instrument refurbishment | Focus on circular economy principles |

| Chemical Handling | Adherence to EPA and REACH regulations | Robust chemical handling protocols integrated into ESG initiatives |

PESTLE Analysis Data Sources

Our Agilent Technologies PESTLE Analysis is built on a robust foundation of data from reputable sources including government economic reports, industry-specific market research, and technological trend analyses. We meticulously gather information on political stability, economic indicators, social demographics, and regulatory changes to ensure comprehensive and accurate insights.