AEP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEP Bundle

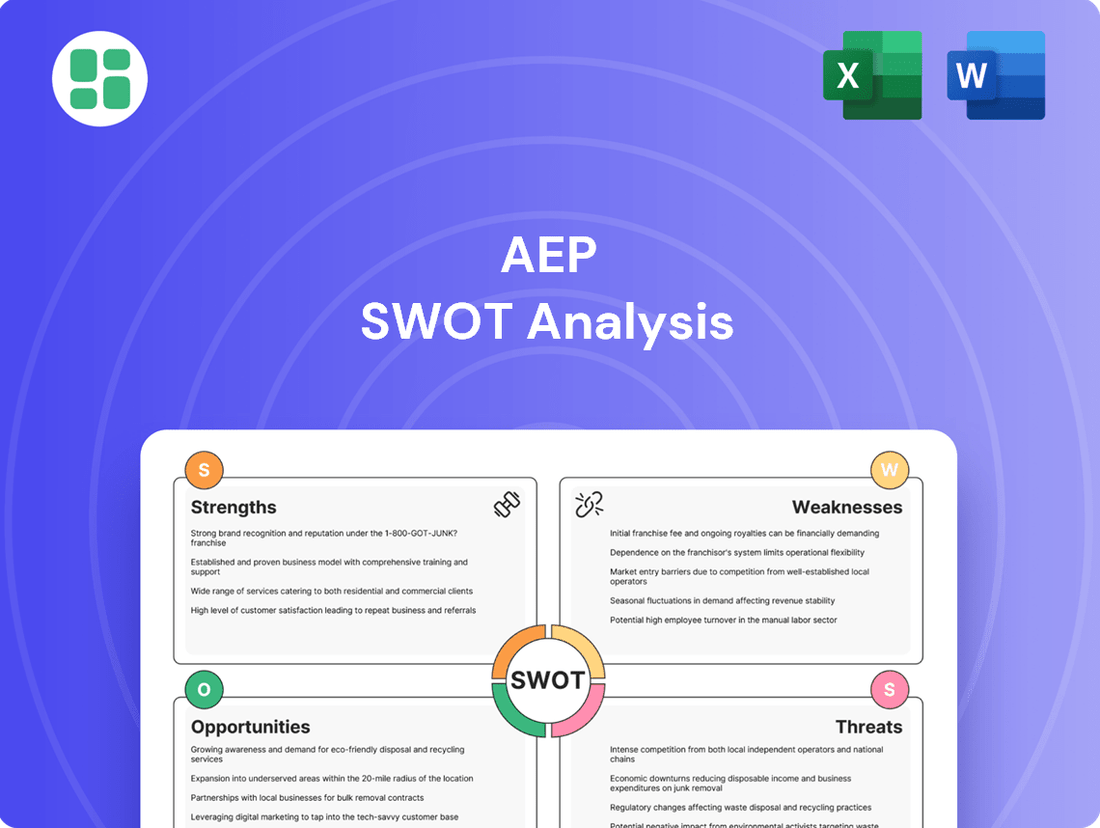

American Electric Power (AEP) faces a dynamic energy landscape, with significant opportunities in renewable energy integration and challenges in regulatory environments. Our comprehensive SWOT analysis delves into these critical factors, providing a clear roadmap for navigating the evolving utility sector.

Want the full story behind AEP's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AEP boasts the nation's largest electric transmission system, spanning over 40,000 miles of lines. This extensive, regulated infrastructure serves 5.6 million customers across 11 states, providing a bedrock of stable, predictable revenue. Its natural monopoly in these service territories ensures consistent demand, a significant strength in the utility sector.

AEP's commitment to a robust capital investment plan is a significant strength. The company recently increased its projected capital expenditure from $54 billion for 2025-2029 to an expected $70 billion for 2026-2030.

This substantial investment is strategically directed towards modernizing its grid infrastructure, expanding transmission capabilities, and upgrading distribution networks. These upgrades are crucial for improving service reliability and integrating advanced technologies into its operations.

The focus on these areas directly addresses the growing energy demands from sectors like data centers and industrial clients, positioning AEP for sustained growth and operational excellence.

AEP demonstrates a strong commitment to the clean energy transition, actively reshaping its generation portfolio. The company has set ambitious targets, aiming for an 80% reduction in carbon dioxide emissions from 2005 levels by 2030 and achieving net-zero emissions by 2045.

This strategic pivot involves significant capital investment, with billions allocated to regulated renewable energy sources like wind and solar power. AEP is also proactively exploring next-generation technologies, including small modular reactors (SMRs) and fuel cells, to further decarbonize its operations.

This forward-thinking approach is not only in response to increasingly stringent environmental regulations but also aligns with growing investor demand for sustainable and environmentally responsible business practices.

Growing Demand from Key Industrial Sectors

AEP is capitalizing on robust demand from key industrial sectors, notably data centers and advanced manufacturing. These sectors are projected to drive significant load growth, with an estimated 24 gigawatts of new demand expected by 2030, largely fueled by data center expansion. This trend is particularly strong in AEP's operational territories, including Ohio, Indiana, and Texas, signaling substantial opportunities for revenue and infrastructure investment.

The company's strategic positioning to serve these large-scale commercial and industrial customers is a primary strength. This growing demand directly translates into a clear path for AEP's future expansion and reinforces its market position.

- Significant Load Growth: AEP anticipates 24 GW of new load by 2030, primarily from data centers.

- Key Industrial Drivers: Data centers and manufacturing facilities are the main contributors to this demand surge.

- Geographic Concentration: Growth is particularly evident in states like Ohio, Indiana, and Texas.

- Investment and Revenue Opportunities: The demand provides a strong impetus for continued investment and revenue growth for AEP.

Diversified Generation Mix

AEP's strength lies in its diversified generation mix. The company operates a portfolio that includes natural gas, nuclear, and a growing segment of renewable energy sources, alongside its legacy coal assets. This strategic diversification reduces exposure to the volatility of any single fuel type, bolstering energy independence and supporting the ongoing shift towards a lower-carbon energy landscape without compromising reliability.

This varied approach is crucial for navigating the evolving energy market. For instance, AEP has been actively retiring older coal plants, demonstrating a commitment to cleaner energy. By the end of 2023, AEP had approximately 12,000 MW of renewable generation capacity in operation or under development, showcasing a tangible move away from coal. This transition is further evidenced by AEP's stated goal to retire all its remaining coal-fired generation by 2030.

- Diverse Fuel Sources: AEP utilizes natural gas, nuclear, and renewables, reducing reliance on any single energy source.

- Risk Mitigation: Diversification helps AEP manage fuel price volatility and supply chain disruptions.

- Low-Carbon Transition: The company is actively increasing its renewable capacity, aligning with environmental goals and market demand.

- Reliability: A balanced generation portfolio ensures consistent power supply even as the energy transition progresses.

AEP's significant capital investment plan, projected at $70 billion for 2026-2030, is a key strength. This investment targets grid modernization, transmission expansion, and distribution upgrades, enhancing reliability and integrating new technologies.

The company's strategic focus on clean energy, aiming for an 80% CO2 reduction by 2030 and net-zero by 2045, positions it favorably for future regulations and investor preferences. This includes substantial investment in regulated renewables like wind and solar.

AEP is well-positioned to benefit from robust demand growth, especially from data centers and advanced manufacturing, anticipating 24 GW of new load by 2030. This demand is concentrated in key states like Ohio, Indiana, and Texas, offering clear revenue and investment opportunities.

The utility's diversified generation mix, including natural gas, nuclear, and growing renewables, mitigates fuel price volatility and supports its transition away from coal, with a goal to retire all remaining coal-fired generation by 2030.

| Strength Area | Key Metric/Fact | Impact |

|---|---|---|

| Infrastructure Scale | 40,000+ miles of transmission lines | Stable, predictable revenue, natural monopoly |

| Capital Investment | $70 billion projected for 2026-2030 | Grid modernization, reliability, future growth |

| Clean Energy Transition | 80% CO2 reduction target by 2030 | Regulatory compliance, investor appeal, sustainability |

| Demand Growth | 24 GW new load by 2030 (data centers) | Revenue growth, infrastructure investment opportunities |

| Generation Diversification | Mix of gas, nuclear, renewables | Reduced fuel risk, energy independence |

What is included in the product

Delivers a strategic overview of AEP’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address critical business challenges, transforming potential weaknesses into actionable strategies.

Weaknesses

AEP's substantial investments in grid modernization and renewable energy, projected at up to $70 billion over five years, present a significant weakness. These large capital outlays inherently increase the company's reliance on debt financing.

The substantial debt burden, reflected in metrics like a higher debt-to-equity ratio compared to some peers, can strain financial flexibility. Furthermore, periods of lower earnings can lead to a reduced interest coverage ratio, potentially impacting credit ratings and borrowing costs.

As a heavily regulated utility, AEP's financial performance is directly tied to decisions made by state and federal regulatory bodies, impacting everything from approved rates to environmental compliance. For instance, changes in how renewable energy projects are incentivized, like shifts in federal clean energy tax credits, could alter the financial attractiveness of AEP's planned investments in 2024 and beyond. This regulatory dependency introduces a layer of uncertainty that can influence the company's strategic planning and capital allocation.

AEP's continued reliance on coal, projected to be around 42% of its energy mix in 2025, presents a significant weakness. This dependence creates environmental liabilities and exposes the company to the risks associated with stricter carbon emission regulations and the potential for assets to become stranded.

The company faces increasing compliance costs and heightened public scrutiny due to its substantial coal-fired generation capacity. This can impact profitability and investor sentiment as the global push for decarbonization intensifies.

Vulnerability to Cyber Threats

AEP's increasing reliance on automated systems and interconnected technologies, while boosting efficiency, also heightens its susceptibility to advanced cyber threats. The energy sector is a prime target, and a successful cyberattack could cripple operations, compromise sensitive data, and incur substantial financial penalties and reputational harm.

The U.S. Department of Energy reported that in 2023, the energy sector experienced a 20% increase in reported cybersecurity incidents compared to the previous year. This trend underscores the growing risk AEP faces. A breach could lead to widespread power outages, impacting millions of customers and causing significant economic disruption.

- Increased Attack Surface: The integration of IoT devices and smart grid technologies expands the potential entry points for malicious actors.

- Sophistication of Threats: Cybercriminals are employing increasingly sophisticated methods, including ransomware and state-sponsored attacks, targeting critical infrastructure.

- Operational and Financial Impact: A successful breach could result in service interruptions, data theft, and substantial recovery costs, estimated to be in the millions for major utility disruptions.

- Reputational Damage: Public trust is paramount; a significant cybersecurity incident could severely erode customer confidence and AEP's standing in the market.

Impact of Extreme Weather and Aging Infrastructure

AEP's vast transmission and distribution network is inherently vulnerable to extreme weather. Events like hurricanes, ice storms, and high winds can trigger widespread power outages, demanding significant capital for repairs and resilience upgrades. For instance, the company has historically faced substantial costs following severe weather events, impacting operational efficiency and requiring dedicated storm response budgets.

Despite ongoing investments in grid modernization, aging infrastructure remains a persistent challenge for AEP. These older components can lead to increased reliability issues and necessitate continuous, substantial maintenance and eventual replacement expenses. These upgrade costs are a recurring factor in AEP's capital expenditure plans, as demonstrated by past incidents where infrastructure failures contributed to service disruptions.

- Vulnerability to Extreme Weather: AEP's extensive grid is susceptible to severe weather events, leading to widespread power outages and costly repairs, as seen in past storm impacts.

- Aging Infrastructure Costs: Despite modernization, aging components contribute to reliability issues and substantial maintenance and upgrade expenses.

- Capital Expenditure Strain: The need to harden the grid against weather and upgrade aging infrastructure places a continuous demand on AEP's capital resources.

AEP's significant capital expenditure plans, including up to $70 billion for grid modernization and renewables over five years, create a substantial debt burden. This reliance on debt financing can limit financial flexibility and potentially impact creditworthiness if earnings falter, as seen in interest coverage ratios.

The company's continued dependence on coal, making up approximately 42% of its energy mix in 2025, exposes it to increasing compliance costs and the risk of stranded assets due to stricter environmental regulations and the global push for decarbonization.

AEP's expanding use of interconnected technologies increases its vulnerability to sophisticated cyber threats, a growing concern in the energy sector where incidents rose 20% in 2023. A breach could lead to significant operational disruptions, data theft, and reputational damage.

The company's extensive transmission and distribution network is susceptible to extreme weather events, causing outages and necessitating costly repairs and resilience upgrades. Furthermore, aging infrastructure requires ongoing, substantial maintenance and eventual replacement, adding to capital expenditure demands.

Preview the Actual Deliverable

AEP SWOT Analysis

You're viewing a live preview of the actual AEP SWOT analysis file. The complete version, offering a comprehensive breakdown of American Electric Power's strategic positioning, becomes available immediately after checkout.

Opportunities

The burgeoning demand from data centers, fueled by artificial intelligence advancements, presents a significant opportunity. AEP has secured substantial new load commitments from these facilities, particularly in Ohio and Indiana, underscoring the immediate need for enhanced grid infrastructure to meet this surge.

Electrification across various sectors, including electric vehicles and industrial processes, is another powerful growth driver. This trend is expected to significantly increase electricity consumption, creating a robust market for AEP's services as it invests in upgrading its transmission and distribution networks to support this evolving energy landscape.

The global energy landscape is rapidly transforming, with a pronounced shift towards renewable sources. This trend is a significant opportunity for AEP to bolster its clean energy generation. For instance, in 2023, renewable energy sources accounted for approximately 22% of the total electricity generation in the United States, a figure expected to climb steadily.

Advancements in battery storage technology are crucial for grid stability as renewable penetration increases. AEP can leverage these innovations to integrate more intermittent renewable power, ensuring a reliable supply while meeting ambitious decarbonization targets. By 2025, the global energy storage market is projected to reach over $100 billion, highlighting the substantial growth potential in this sector.

AEP stands to benefit significantly from ongoing investments in grid modernization and smart grid technologies. These upgrades are crucial for enhancing the efficiency, reliability, and resilience of its extensive transmission and distribution networks. For instance, AEP has been actively deploying smart meters, with a goal to have millions installed across its service territories, which directly supports improved data collection and operational insights.

Implementing advanced analytics and sophisticated outage management systems presents a clear opportunity for AEP to achieve substantial operational cost savings. By better predicting and responding to grid issues, the company can minimize downtime and reduce repair expenses. This focus on technological advancement is expected to translate into improved customer satisfaction through more consistent service delivery.

Leveraging Federal Incentives and Funding

Government initiatives, particularly the Inflation Reduction Act (IRA), present a significant opportunity for AEP. The IRA offers substantial tax credits and direct funding for clean energy projects and grid modernization efforts. For instance, the 45X Advanced Manufacturing Production Tax Credit can significantly reduce manufacturing costs for clean energy components.

AEP can strategically utilize these federal incentives to lower the capital expenditures associated with its clean energy transition. This includes investments in renewable generation, energy storage, and grid infrastructure upgrades, thereby improving the overall economic viability of these crucial projects. The IRA's provisions are designed to accelerate the deployment of clean technologies, aligning perfectly with AEP's strategic goals.

- IRA Tax Credits: Significant credits like the Investment Tax Credit (ITC) and Production Tax Credit (PTC) can directly offset project costs for renewable energy.

- Grid Modernization Funding: Federal grants and loan programs are available to support the upgrade and expansion of the electricity grid, enhancing reliability and capacity.

- Accelerated Deployment: These incentives create a more favorable financial environment, enabling AEP to speed up its adoption of cleaner energy sources and advanced grid technologies.

Strategic Partnerships and Acquisitions in Emerging Technologies

AEP can significantly enhance its market position by pursuing strategic partnerships and acquisitions in cutting-edge technological domains. Exploring opportunities in small modular reactors (SMRs), for instance, aligns with the growing global interest in advanced nuclear energy solutions. In 2024, the global SMR market was valued at approximately $5.7 billion, with projections indicating substantial growth driven by decarbonization efforts and energy security concerns.

Investing in fuel cell technology presents another avenue for diversification, catering to the increasing demand for clean hydrogen solutions across various sectors. The fuel cell market is anticipated to reach over $30 billion by 2030, offering AEP a chance to capitalize on this expanding market. Furthermore, acquiring or partnering with companies specializing in advanced energy management systems can bolster AEP's ability to offer integrated, smart grid solutions.

These collaborations are crucial for meeting shifting customer expectations and solidifying AEP's competitive edge in a rapidly evolving energy sector. By integrating novel technologies, AEP can not only expand its service portfolio but also drive innovation and operational efficiencies, thereby securing a stronger foothold in the future energy landscape.

- SMR Market Growth: The global SMR market was valued at approximately $5.7 billion in 2024 and is expected to expand significantly due to decarbonization initiatives.

- Fuel Cell Potential: The fuel cell market is projected to exceed $30 billion by 2030, presenting a substantial opportunity for AEP to enter and grow within this clean energy sector.

- Advanced Energy Management: Partnerships in this area can enable AEP to offer sophisticated, integrated smart grid solutions, meeting the demand for more efficient energy consumption.

- Competitive Advantage: Strategic investments in these emerging technologies can provide AEP with a distinct competitive advantage and diversify its revenue streams in the transforming energy market.

The increasing demand from data centers, driven by AI, presents a significant growth opportunity for AEP, with substantial new load commitments secured, particularly in Ohio and Indiana. This trend, coupled with the broader electrification of vehicles and industrial processes, is expected to boost electricity consumption, necessitating grid upgrades and creating a strong market for AEP's services.

Government incentives, notably the Inflation Reduction Act (IRA), offer substantial tax credits and funding for clean energy projects and grid modernization. These incentives are crucial for AEP to lower capital expenditures on renewable generation, energy storage, and grid infrastructure, accelerating its clean energy transition. For instance, the IRA's Investment Tax Credit (ITC) and Production Tax Credit (PTC) directly reduce project costs for renewables.

Strategic partnerships and acquisitions in emerging technologies like small modular reactors (SMRs) and fuel cells offer avenues for diversification and market expansion. The SMR market was valued at approximately $5.7 billion in 2024, while the fuel cell market is projected to exceed $30 billion by 2030, presenting considerable growth potential for AEP to integrate advanced energy solutions and gain a competitive edge.

| Opportunity Area | Key Drivers | AEP Relevance | Market Data/Projections |

| Data Center Demand | AI advancements | New load commitments in OH & IN | N/A (Specific to AEP's commitments) |

| Electrification | EVs, industrial processes | Increased electricity consumption, grid upgrade needs | N/A (General trend) |

| Renewable Energy Integration | Decarbonization goals | Bolstering clean energy generation | US renewable generation ~22% in 2023 |

| Battery Storage | Grid stability with renewables | Integrating intermittent power, reliability | Global energy storage market >$100B by 2025 |

| Grid Modernization | Efficiency, reliability, resilience | Smart meter deployment | N/A (Specific to AEP's deployment) |

| Government Incentives (IRA) | Clean energy & grid modernization | Offsetting project costs (ITC/PTC) | N/A (Specific to IRA provisions) |

| Strategic Partnerships/Acquisitions | Emerging technologies | SMRs, fuel cells, advanced energy management | SMR market ~$5.7B (2024); Fuel Cell market >$30B by 2030 |

Threats

AEP, like other utilities, navigates a challenging regulatory environment. In 2024, the Environmental Protection Agency (EPA) continued to enforce stricter emissions standards, impacting operational costs. For instance, compliance with the proposed stringent methane emission rules could require significant capital outlays for infrastructure upgrades.

The ongoing scrutiny over rate increases by state Public Utility Commissions (PUCs) adds another layer of complexity. In 2023, AEP sought rate increases in several states, facing lengthy approval processes and potential disallowances that could affect revenue projections. Failure to meet compliance mandates can result in substantial fines, further pressuring financial performance.

American Electric Power (AEP) faces significant threats from volatile fuel prices, particularly natural gas. For instance, in 2023, natural gas prices experienced considerable swings, impacting AEP's fuel expenses for its thermal power plants, which still form a substantial part of its generation mix, directly affecting operating costs and profitability.

Furthermore, ongoing global supply chain disruptions pose a considerable risk. These disruptions can lead to delays in receiving essential equipment for AEP's renewable energy projects and grid modernization efforts. Such delays not only push back project completion dates but also inflate construction costs, impacting the company's capital expenditure plans and overall financial performance.

The energy sector, including AEP, faces escalating cybersecurity threats. Sophisticated attacks targeting critical infrastructure are a persistent risk, with the potential to disrupt grid operations and compromise sensitive customer data. In 2024, the U.S. Department of Energy reported a significant increase in attempted cyber intrusions against energy utilities, highlighting the growing vulnerability.

Competition from Distributed Generation and Energy Alternatives

The increasing adoption of distributed generation, such as rooftop solar installations and microgrids, poses a significant threat by potentially decreasing customer reliance on AEP's traditional grid-supplied electricity. This trend directly impacts AEP's sales volumes and future revenue streams.

While AEP is actively investing in renewable energy sources, the growth of customer-owned generation, like residential solar, could still erode its market share. For instance, the U.S. solar market saw substantial growth, with residential solar capacity additions often exceeding projections in recent years, a trend expected to continue through 2024 and 2025.

This shift towards self-generation and alternative energy solutions puts pressure on AEP's established business model. The long-term revenue growth for utilities like AEP could be dampened if a significant portion of their customer base opts for independent energy production rather than purchasing power from the grid.

- Reduced Demand: Distributed generation directly competes with grid electricity, potentially lowering AEP's sales.

- Revenue Impact: Increased customer self-sufficiency can lead to lower revenue growth for traditional utilities.

- Market Share Erosion: As more customers adopt alternatives, AEP's share of the energy market may shrink.

- Investment Strategy Challenge: Balancing investments in renewables with the threat of distributed generation requires careful strategic planning.

Economic Downturns and Interest Rate Volatility

Economic downturns pose a significant threat to American Electric Power (AEP). A slowdown in industrial and commercial activity directly translates to lower electricity demand, which can negatively impact AEP's revenue streams. For instance, during periods of economic contraction, businesses often reduce operations, leading to decreased energy consumption. This directly affects AEP's top line, making it harder to maintain consistent financial performance.

Furthermore, interest rate volatility presents another substantial challenge. AEP, like many utility companies, relies heavily on capital investments to maintain and upgrade its extensive infrastructure. Rising interest rates increase the cost of borrowing for these large-scale projects. For example, if AEP needs to finance new transmission lines or renewable energy facilities, higher interest rates mean more expensive debt, which can squeeze profit margins and potentially delay or scale back crucial investments needed for future growth and reliability.

- Reduced Demand: Economic slowdowns can lead to decreased industrial and commercial electricity usage, directly impacting AEP's sales volume.

- Increased Borrowing Costs: Higher interest rates make it more expensive for AEP to finance its significant capital expenditure programs, affecting profitability and investment capacity.

- Impact on Returns: Elevated financing costs can put pressure on AEP's ability to achieve its targeted returns on investment for new infrastructure projects.

AEP faces significant threats from evolving regulatory landscapes and potential policy shifts. Stricter environmental regulations, such as those proposed for emissions in 2024, could necessitate substantial capital investments for compliance, impacting operational costs. Furthermore, state Public Utility Commissions' ongoing review of rate increases can lead to delays or disallowances, affecting revenue forecasts and financial stability.

Volatile fuel prices, particularly natural gas, remain a persistent threat, directly influencing AEP's operating expenses for its thermal generation fleet. Supply chain disruptions also pose a risk, potentially delaying crucial infrastructure upgrades and renewable energy projects, thereby increasing costs and impacting project timelines.

The increasing prevalence of distributed generation, like rooftop solar, presents a threat by potentially reducing AEP's customer base and sales volumes. This trend, projected to continue through 2024 and 2025 with robust solar market growth, challenges AEP's traditional business model and necessitates strategic adaptation to maintain revenue streams.

Economic downturns can lead to reduced electricity demand from industrial and commercial sectors, directly impacting AEP's revenue. Additionally, rising interest rates increase the cost of borrowing for AEP's capital-intensive infrastructure projects, potentially squeezing profit margins and affecting the feasibility of future investments.

SWOT Analysis Data Sources

This AEP SWOT analysis is built upon a robust foundation of data, drawing from AEP's official financial reports, comprehensive market research, and expert industry analysis to provide a thorough and reliable assessment.