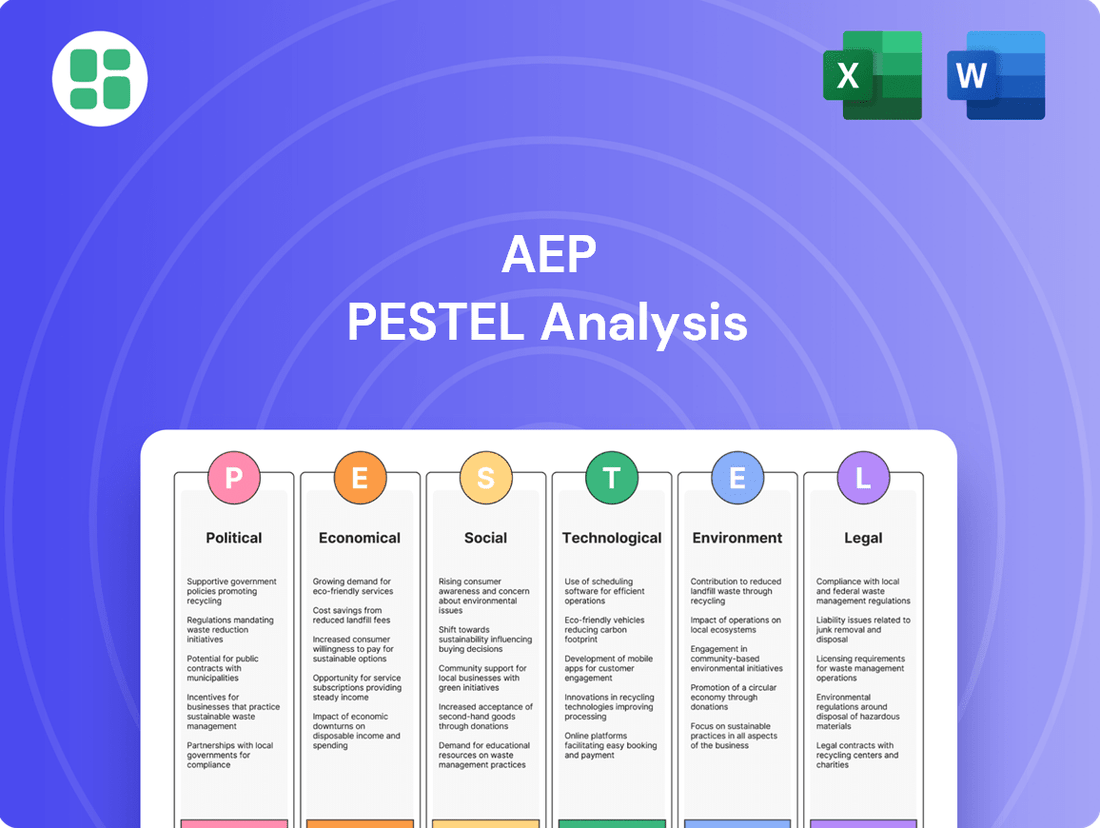

AEP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEP Bundle

Unlock the critical external factors influencing AEP's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping the energy sector. Equip yourself with the knowledge to anticipate challenges and capitalize on opportunities. Purchase the full analysis now for actionable intelligence to inform your strategic decisions.

Political factors

AEP navigates a complex web of state and federal regulations that directly impact its operational strategies and capital expenditure plans. The company's financial health hinges on securing constructive outcomes in its rate cases, ensuring it can recover investments made in grid modernization and clean energy initiatives. For instance, in 2023, AEP sought rate increases across several jurisdictions, with outcomes varying by state, underscoring the critical nature of regulatory approvals for its business model.

Recent policy shifts are creating tailwinds for infrastructure development. In Oklahoma, regulatory approvals in 2024 have paved the way for significant investments in transmission projects, while Ohio's energy policy continues to shape AEP's renewable energy deployment. Texas also saw regulatory progress in 2023 related to grid enhancements, indicating a supportive environment for AEP's capital recovery and growth strategies in these key markets.

National and state energy policies are increasingly pushing for renewable energy and lower carbon emissions. This shift directly impacts companies like AEP, which are adapting their strategies to align with these new directives. For example, AEP aims to cut its carbon dioxide emissions by 80% from 2005 levels by 2030, with a goal of net-zero emissions by 2045.

This transition necessitates substantial investment in cleaner energy technologies, a key component of AEP's forward-looking strategy. The company is also guided by a 'Just Transition' framework, ensuring that its workforce, customers, and the communities it serves are considered throughout this significant operational evolution.

AEP operates across 11 states, each with its own political climate and energy policies, which directly shape the company's operational landscape. For instance, states like Virginia have set ambitious renewable energy targets, while others may have different priorities, creating a complex regulatory environment for AEP's infrastructure investments.

Regulatory consistency is paramount for AEP's long-term capital planning, which often spans decades for major projects like grid modernization or new power generation facilities. In 2023, AEP invested billions in infrastructure improvements, and predictable regulatory frameworks are crucial to ensuring these investments yield expected returns.

The diverse approaches to energy transition across states necessitate proactive engagement from AEP. For example, while some states are accelerating the adoption of electric vehicles and renewable energy sources, others may be more cautious, requiring AEP to tailor its strategies and investments to meet varied state-level energy priorities.

Lobbying and Political Engagement

AEP actively participates in the political arena, employing lobbying efforts and making political contributions to shape policies that align with its business objectives. This engagement is crucial for advocating for advancements in grid modernization, encouraging investments in clean energy sources, and ensuring equitable cost recovery for its infrastructure projects.

The company prioritizes transparency and ethical conduct in its political activities, publicly disclosing its lobbying expenditures and engagement policies. For instance, in 2023, AEP reported significant lobbying expenses, reflecting its commitment to influencing regulatory frameworks. These efforts are vital for navigating the complex energy landscape and securing a favorable operating environment.

- Advocacy for Grid Modernization: AEP lobbies for policies that facilitate investment in smart grid technologies and infrastructure upgrades, essential for reliability and efficiency.

- Support for Clean Energy: The company advocates for regulatory frameworks that incentivize renewable energy development and integration, aligning with broader decarbonization goals.

- Cost Recovery Mechanisms: AEP engages in political discussions to ensure that investments in infrastructure modernization and clean energy are appropriately recovered through customer rates.

- Transparency in Political Spending: AEP publicly discloses its political contributions and lobbying activities, adhering to ethical standards and regulatory requirements.

Data Center Load Policies

Recent regulatory decisions are reshaping how data centers are charged for electricity. For instance, in July 2025, the Public Utilities Commission of Ohio implemented new tariffs specifically for large data center operations. These policies are designed to ensure that the substantial infrastructure upgrades needed to support the immense power demands of these facilities are covered by the data center developers themselves, rather than being spread across all electricity customers. This move reflects a growing political consensus to align the costs of new energy demands with those creating them.

These new policies are directly impacting the financial models for data center development. By requiring developers to shoulder more of the infrastructure costs, regulators are aiming to prevent undue burdens on existing ratepayers. This approach is becoming a trend as governments grapple with the massive energy consumption of the digital economy and seek equitable cost-sharing mechanisms.

Key aspects of these evolving data center load policies include:

- Cost Allocation: Shifting the financial responsibility for grid upgrades from general ratepayers to data center developers.

- Tariff Structures: Introduction of new electricity tariffs that reflect the unique and significant load profiles of data centers.

- Regulatory Oversight: Increased scrutiny by public utility commissions on the energy impact and cost recovery for large industrial energy users.

Political factors significantly influence AEP's operations through a patchwork of state and federal regulations. Securing favorable outcomes in rate cases is crucial for recovering investments in grid modernization and clean energy, as demonstrated by varying results in AEP's 2023 rate increase requests across different states. Policy shifts, such as those in Oklahoma in 2024 and Texas in 2023, are creating supportive environments for transmission and grid enhancement projects, directly impacting AEP's growth and capital recovery strategies.

National and state energy policies are increasingly mandating a transition towards renewable energy and reduced carbon emissions, compelling companies like AEP to adapt. AEP's commitment to cutting carbon dioxide emissions by 80% from 2005 levels by 2030 and achieving net-zero by 2045 highlights the strategic imperative of this political direction. This necessitates substantial investment in cleaner technologies, guided by a 'Just Transition' framework that considers workforce and community impacts.

AEP's operational landscape is shaped by the diverse political climates and energy policies across the 11 states it serves. For example, ambitious renewable energy targets in states like Virginia contrast with different priorities elsewhere, creating a complex regulatory environment for AEP's infrastructure investments. Regulatory consistency is vital for AEP's long-term capital planning, with billions invested in infrastructure in 2023, underscoring the need for predictable frameworks to ensure investment returns.

The company actively engages in the political arena through lobbying and contributions to advocate for grid modernization, clean energy incentives, and equitable cost recovery for its infrastructure projects. AEP reported significant lobbying expenses in 2023, reflecting its commitment to influencing regulatory frameworks and ensuring a favorable operating environment through transparency and ethical conduct in its political activities.

| Political Factor | Impact on AEP | Example/Data Point |

|---|---|---|

| Regulatory Landscape | Dictates operational strategies, capital expenditure, and rate recovery for investments. | AEP sought rate increases in multiple states in 2023, with outcomes varying by jurisdiction. |

| Energy Policy Shifts | Creates opportunities for infrastructure development and renewable energy integration. | Oklahoma's 2024 regulatory approvals facilitated transmission investments; Ohio's policy shapes renewable deployment. |

| Decarbonization Goals | Drives investment in cleaner energy technologies and emission reduction strategies. | AEP aims for an 80% CO2 emission reduction by 2030 and net-zero by 2045. |

| State-Specific Priorities | Requires tailored strategies to meet varied energy priorities and transition approaches. | Virginia's ambitious renewable targets differ from other states, impacting AEP's investment planning. |

| Political Engagement | Influences policy development and ensures cost recovery for infrastructure projects. | AEP reported significant lobbying expenses in 2023 to advocate for grid modernization and clean energy. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing AEP, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The AEP PESTLE analysis provides a structured framework to identify and mitigate external threats, acting as a pain point reliever by offering clarity on potential market disruptions and regulatory changes.

Economic factors

American Electric Power (AEP) is witnessing a substantial increase in electricity demand, driven primarily by the commercial and industrial sectors. States like Indiana, Ohio, Oklahoma, and Texas are leading this surge, with data centers being a significant contributor.

The company has projected robust annual total retail load growth, having already secured customer agreements for an impressive 24 gigawatts of new load by the close of 2030. This significant uptick in demand signals a strong need for expanded and upgraded electricity infrastructure.

Meeting this escalating demand will require considerable capital investment from AEP. The company's strategic planning is heavily influenced by this growth, as it necessitates substantial outlays for new transmission and distribution assets to ensure reliable service delivery.

AEP's ambitious capital investment plan, aiming for approximately $70 billion in total investments, underscores its commitment to meeting rising energy demand and advancing its clean energy transition. This significant outlay, with a substantial $54 billion earmarked for the 2025-2029 period, primarily targets crucial upgrades in transmission and distribution infrastructure, alongside investments in new generation capacity.

Securing the necessary funding is paramount to realizing these extensive capital plans. AEP has proactively addressed its anticipated equity needs, ensuring a solid financial foundation to support the execution of its large-scale infrastructure and clean energy projects over the coming years.

Fluctuations in interest rates directly affect AEP's cost of capital for its substantial infrastructure investments. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% through 2024 and into 2025, AEP's borrowing expenses for new projects could remain elevated compared to periods of lower rates.

AEP's financial strategy hinges on a robust balance sheet and delivering competitive shareholder returns, especially as it funds its ongoing capital expenditures, which were projected at $6.9 billion for 2024. Managing debt levels and ensuring consistent dividend payouts are critical in this environment.

The necessity for equity issuance can arise from subsidiary performance, as seen in situations where certain segments may not generate sufficient earnings to cover their operational needs, particularly within an inflationary climate that can squeeze margins and increase operating expenses.

Fuel Prices and Generation Costs

Volatility in fuel prices, especially for natural gas and coal, directly impacts AEP's generation expenses and, in turn, customer electricity rates. For instance, in early 2024, natural gas prices saw fluctuations influenced by weather patterns and global supply dynamics, directly feeding into AEP's operational costs.

Despite AEP's ongoing efforts to diversify its energy portfolio, a substantial portion of its generating capacity still relies on coal. This continued reliance means AEP remains susceptible to the inherent price swings and market uncertainties associated with fossil fuels.

AEP's strategic shift towards renewable energy sources is designed to lessen its exposure to the volatile fossil fuel markets. This transition is crucial for stabilizing long-term generation costs and providing more predictable rates for its customers.

- Natural Gas Price Impact: Fluctuations in natural gas prices, a key fuel for AEP, directly influence the cost of electricity generation.

- Coal Dependence: A significant portion of AEP's generation capacity is coal-based, making it vulnerable to coal market price changes.

- Renewable Transition: AEP's investment in renewables aims to reduce reliance on fossil fuels and mitigate fuel price volatility.

Customer Affordability and Rate Setting

American Electric Power (AEP) is navigating the complex landscape of customer affordability and rate setting, a critical component of its PESTLE analysis. The company is dedicated to delivering dependable and cost-effective electricity, a goal that requires a delicate balance. This involves managing the significant investments needed for grid modernization and accommodating new load growth, all while keeping rates accessible for its customers.

Regulatory bodies are central to this process, holding the authority to approve rate adjustments. These agencies ensure that costs are allocated fairly among customer classes, a process that directly impacts the affordability of electricity. For instance, in 2023, AEP's electric security plan filings sought rate increases that were subject to extensive review and negotiation with state public utility commissions.

AEP's success in managing its operational costs and achieving favorable outcomes from regulatory proceedings is paramount. These efforts directly influence customer satisfaction and the company's overall financial stability. In the first quarter of 2024, AEP reported earnings that reflected ongoing investments in infrastructure, with management emphasizing their commitment to cost control to mitigate the impact on customer bills.

- Grid Modernization Investment: AEP is investing billions in upgrading its transmission and distribution infrastructure to enhance reliability and accommodate future energy needs, impacting rate structures.

- Regulatory Approval Process: Rate changes are subject to approval by state Public Utility Commissions, which consider factors like cost of service, return on equity, and customer impact.

- Customer Affordability Focus: Balancing infrastructure investments with customer affordability remains a key strategic priority, influencing how rate adjustments are proposed and implemented.

- 2024 Rate Filings: Throughout 2024, AEP has been actively engaged in rate cases across its operating territories, seeking to recover costs associated with significant capital expenditures.

Economic factors significantly shape American Electric Power's (AEP) operational landscape and investment strategies. Fluctuations in interest rates directly influence the cost of capital for AEP's substantial infrastructure projects, with the Federal Reserve's target range for the federal funds rate remaining a key benchmark. For instance, the projected $70 billion capital investment plan, with $54 billion allocated for 2025-2029, necessitates careful financial management in a potentially higher interest rate environment.

Fuel price volatility, particularly for natural gas and coal, directly impacts AEP's generation expenses and, consequently, customer electricity rates. Despite a strategic shift towards renewables, AEP's continued reliance on coal makes it susceptible to price swings in that market. AEP's 2024 capital expenditure projection of $6.9 billion underscores the need for robust financial planning to manage these economic variables effectively.

| Factor | Impact on AEP | Data Point/Trend |

| Interest Rates | Affects cost of capital for investments | Federal Funds Rate target: 5.25%-5.50% (as of early 2024, expected to persist into 2025) |

| Fuel Prices | Influences generation expenses and customer rates | Natural gas prices experienced fluctuations in early 2024 due to weather and supply dynamics. |

| Economic Growth | Drives electricity demand | Projected annual total retail load growth, with 24 GW of new load secured by 2030. |

| Inflation | Increases operating expenses and impacts subsidiary earnings | Inflationary pressures can squeeze margins and increase operating costs for AEP's segments. |

Preview the Actual Deliverable

AEP PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your AEP PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive AEP PESTLE Analysis.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete AEP PESTLE Analysis.

Sociological factors

Public sentiment strongly favors a transition towards cleaner energy. In 2024, surveys indicated that over 70% of Americans support increased investment in renewable energy sources like solar and wind. This growing acceptance directly pressures utilities like AEP to adapt their generation mix, moving away from coal and natural gas.

AEP's emphasis on a Just Transition acknowledges the societal impact of this energy shift. The company's 2024 sustainability report highlights investments aimed at retraining workforces in communities historically reliant on fossil fuels, demonstrating a commitment to mitigating adverse economic effects and maintaining public goodwill during this period of change.

Demographic shifts and population growth within AEP's extensive 11-state service territory are fundamentally reshaping electricity demand. For instance, states like Texas, a key AEP market, have seen robust population increases, with projections indicating continued growth throughout 2024 and into 2025, directly impacting the need for reliable power.

Urbanization and economic development are particularly significant drivers, leading to unprecedented load growth. The strategic siting of large commercial and industrial customers, such as major data centers, in AEP's service areas necessitates substantial infrastructure planning and investment to ensure capacity meets these evolving, high-demand needs.

Consumers are increasingly prioritizing cleaner energy sources and greater energy efficiency, a trend that significantly influences utility companies like AEP. This growing environmental consciousness is a powerful sociological driver.

In response, AEP is actively investing in renewable energy projects, aiming to expand its clean energy portfolio. For instance, by the end of 2024, AEP plans to have approximately 10,000 megawatts of renewable generation capacity in operation or under contract, a substantial increase from previous years.

Furthermore, AEP offers various energy efficiency programs designed to help customers reduce their consumption and costs. The company is also deploying smart meter technology, empowering customers with real-time data to better manage their energy usage and contribute to overall sustainability goals.

Workforce Availability and Development

The energy transition and ongoing grid modernization projects necessitate a workforce equipped with specialized skills. AEP recognizes this, prioritizing employee well-being and engagement to secure the talent needed for operating and maintaining its vast transmission and distribution infrastructure, as well as for developing innovative new technologies. For instance, in 2024, AEP continued its focus on workforce development programs, aiming to upskill existing employees in areas like advanced grid management and renewable energy integration.

Attracting and retaining a skilled labor force is paramount for AEP's operational excellence and its capacity for future expansion. The company's commitment to employee support, including competitive compensation and professional development opportunities, directly addresses the challenge of securing essential expertise. AEP's 2024 annual report highlighted a 5% increase in participation in its internal training programs, demonstrating a proactive approach to skill enhancement.

- Skilled Workforce Demand: The shift to cleaner energy sources and grid upgrades creates a demand for specialized roles in areas like cybersecurity, data analytics, and renewable energy installation.

- Talent Retention Strategies: AEP's focus on employee well-being and engagement is crucial for retaining experienced personnel who understand the complexities of the existing energy infrastructure.

- Training and Development Investment: Investments in training programs are essential to bridge skill gaps and prepare the workforce for emerging technologies and operational demands.

- Labor Market Competition: AEP competes for talent in a broader market, making its employee value proposition a key factor in attracting and keeping skilled workers.

Corporate Social Responsibility and Community Engagement

AEP's commitment to corporate social responsibility (CSR) is deeply woven into its operational fabric, with a strong emphasis on community engagement and social justice as drivers of sustainable growth. The company actively works to ensure safe, reliable, and affordable energy delivery while simultaneously fostering economic development and enhancing the overall well-being of the communities it serves. This dedication is clearly articulated in its annual Corporate Sustainability Report, providing transparency on its social impact initiatives.

In 2023, AEP reported significant investments in community programs, totaling over $50 million across its service territories, focusing on areas like education, economic development, and environmental stewardship. The company's equity initiatives aim to address disparities and promote inclusive growth, recognizing that social progress is integral to its long-term success. This approach is not merely philanthropic; it's a strategic imperative that builds trust and strengthens stakeholder relationships.

- Community Investment: AEP invested over $50 million in community programs in 2023, supporting local economic development and social initiatives.

- Social Justice Focus: The company prioritizes equity in its operations and community outreach, aiming to reduce disparities and promote inclusive opportunities.

- Reliability and Affordability: AEP's CSR strategy balances the provision of essential energy services with a commitment to social well-being and economic upliftment.

- Transparency: The annual Corporate Sustainability Report details AEP's progress and commitments in CSR, offering stakeholders insights into its social performance.

Societal expectations are increasingly pushing utilities towards sustainability, with a strong public preference for renewable energy sources evident in 2024 surveys showing over 70% support for increased investment in solar and wind. AEP's commitment to a Just Transition, highlighted by workforce retraining initiatives in 2024, aims to address the socio-economic impacts of this energy shift, fostering community goodwill.

Demographic shifts, particularly population growth in key AEP markets like Texas through 2025, are driving higher electricity demand. Urbanization and the siting of energy-intensive industries, such as data centers, are creating significant load growth, requiring substantial infrastructure planning and investment from AEP to meet these evolving needs.

Consumer demand for cleaner energy and efficiency continues to rise, influencing AEP's strategic direction. By the close of 2024, AEP aims to have approximately 10,000 megawatts of renewable generation capacity operational or contracted, reflecting a significant expansion of its clean energy portfolio.

The company's CSR efforts, including over $50 million invested in community programs in 2023, underscore a commitment to social justice and inclusive growth. AEP's focus on employee well-being and its 2024 training program participation increase of 5% are critical for attracting and retaining the skilled workforce needed for grid modernization and technological advancements.

| Sociological Factor | Description | AEP Relevance/Action | Data Point (2024/2025 Focus) |

|---|---|---|---|

| Public Sentiment on Energy | Growing preference for renewables and environmental consciousness. | Pressures AEP to increase clean energy generation. | 70%+ public support for renewable energy investment (2024). |

| Demographics & Urbanization | Population growth and increased industrialization drive electricity demand. | Requires infrastructure upgrades and capacity expansion. | Continued population growth projected in key AEP markets (2024-2025). |

| Workforce Skills & Development | Need for specialized skills in new energy technologies and grid management. | AEP invests in training and employee engagement for talent retention. | 5% increase in AEP internal training program participation (2024). |

| Corporate Social Responsibility (CSR) | Emphasis on community engagement, social justice, and equity. | AEP's CSR strategy builds trust and strengthens stakeholder relationships. | Over $50 million invested in community programs (2023). |

Technological factors

Technological leaps in solar, wind, and battery storage are significantly reducing costs and boosting the efficiency of renewable energy sources. AEP is capitalizing on this, targeting almost 6,000 megawatts of renewable capacity by integrating these innovations.

Beyond established renewables, AEP is also investigating next-generation power sources. This includes exploring the potential of small modular reactors (SMRs) and fuel cells, signaling a commitment to diversifying its clean energy portfolio and staying at the forefront of technological advancements.

AEP is making significant strides in grid modernization, channeling substantial capital into smart grid technologies and advanced metering infrastructure. These investments are designed to boost reliability and operational efficiency across its service territories. For instance, AEP's 2024-2026 capital plan dedicates over $10 billion to transmission and distribution infrastructure upgrades, a clear indicator of their commitment to a smarter, more resilient grid.

These technological advancements are crucial for real-time monitoring of energy consumption, allowing for quicker identification and resolution of outages, thereby improving customer service. Furthermore, the smart grid infrastructure is essential for seamlessly integrating diverse distributed energy resources like solar and battery storage, a key component of AEP's strategy to meet evolving energy demands and regulatory requirements.

As AEP's energy infrastructure increasingly relies on digital systems, the risk of cyberattacks escalates. The company must prioritize ongoing investment in advanced cybersecurity solutions to safeguard its operational technology and sensitive customer information from evolving threats.

Protecting against these digital vulnerabilities is paramount for ensuring the consistent reliability and integrity of AEP's power grid. In 2023, the U.S. Department of Energy reported that the energy sector experienced a significant increase in cyber incidents, highlighting the critical need for robust defense mechanisms.

New Generation Technologies

AEP is actively exploring and investing in next-generation power generation technologies. This includes investigating fuel cells for critical backup power needs, particularly for large customers like data centers, which demand uninterrupted service.

Furthermore, AEP is proactively engaging in the early stages of site permitting for small modular reactors (SMRs). These advanced nuclear technologies are designed to offer dependable, low-carbon electricity and are seen as a key component in meeting future energy demands in a sustainable manner.

- Fuel Cell Investment: AEP's exploration of fuel cells for data centers highlights a growing trend in the utility sector to provide specialized, reliable power solutions for high-demand industries.

- SMR Permitting: The company's engagement with SMR permitting signifies a forward-looking approach to nuclear energy, aiming to integrate potentially cleaner and more flexible nuclear power sources into its generation mix.

- Low-Carbon Focus: These technological pursuits align with AEP's broader strategy to deliver reliable, low-carbon power, addressing both current energy needs and future environmental goals.

Digitalization and Automation in Operations

The integration of artificial intelligence (AI) and automation is fundamentally reshaping utility operations, impacting everything from energy distribution to customer interactions. For instance, by July 2025, utilities are expected to leverage AI for predictive maintenance on grid infrastructure, potentially reducing unplanned outages by up to 15% compared to 2023 levels.

These advanced technologies enable more sophisticated energy management, allowing for personalized energy plans tailored to individual consumption habits and optimizing energy delivery by accurately predicting demand patterns. This efficiency drive is projected to contribute to a 5-10% reduction in operational costs for utilities adopting these solutions by the end of 2025.

The benefits extend to an improved customer experience, with AI-powered chatbots handling a significant portion of customer inquiries, freeing up human agents for more complex issues. By 2025, it's anticipated that automated systems will manage over 60% of routine customer service requests in the utility sector.

- AI-driven grid optimization: Expected to improve energy efficiency by 8-12% by late 2025.

- Automated customer service: Aiming to reduce customer wait times by 25% through AI chatbots.

- Predictive maintenance: Forecasted to lower maintenance costs by 10-18% through early fault detection.

Technological advancements are central to AEP's strategy, with significant investments in grid modernization and renewable energy integration. The company is targeting nearly 6,000 megawatts of renewable capacity by 2025, driven by cost reductions in solar and wind power.

AEP is also exploring next-generation technologies like small modular reactors and fuel cells to diversify its low-carbon energy portfolio. These initiatives are supported by a substantial capital plan, with over $10 billion allocated to transmission and distribution upgrades between 2024 and 2026.

The utility sector's increasing reliance on digital systems necessitates robust cybersecurity measures, especially given the rise in cyber incidents reported by the U.S. Department of Energy. AI and automation are also transforming operations, with AI-driven predictive maintenance expected to reduce unplanned outages by up to 15% by late 2025.

| Technological Area | AEP Target/Investment | Projected Impact (by end of 2025) |

| Renewable Capacity | ~6,000 MW | Reduced costs and increased efficiency |

| Grid Modernization | >$10 billion (2024-2026) | Improved reliability and operational efficiency |

| AI/Automation | Integration across operations | 15% reduction in unplanned outages (predictive maintenance) |

| Cybersecurity | Ongoing investment | Safeguarding operational technology and customer data |

Legal factors

American Electric Power (AEP) navigates a complex web of environmental regulations, particularly those set by the Environmental Protection Agency (EPA) concerning emissions and water discharge. These rules demand ongoing capital investment to ensure compliance, impacting operational costs and strategic planning.

In 2023, AEP reported a significant reduction in its greenhouse gas emissions, a testament to its commitment to environmental stewardship. The company has outlined ambitious plans for further emission cuts, aligning with evolving federal and state mandates aimed at combating climate change.

Adherence to these stringent environmental regulations is not merely a legal obligation for AEP; it's a foundational element of its long-term strategy for sustainable growth and maintaining its social license to operate.

Utility rate case proceedings are fundamental for American Electric Power (AEP) to recoup its significant infrastructure investments and operational expenses, aiming to achieve its authorized return on equity. These cases directly impact AEP's financial health and its ability to fund future projects.

AEP actively engages with state regulatory commissions, participating in numerous rate case proceedings throughout 2024 and into 2025. For instance, in its 2024 Indiana rate case, AEP sought to recover $300 million in investments, highlighting the ongoing need for regulatory approval to fund grid modernization and clean energy initiatives.

These proceedings are crucial for ensuring that AEP can fairly allocate costs to customers and receive timely recovery for essential investments, such as those in renewable energy and transmission upgrades. The outcomes of these rate cases directly influence AEP's earnings and its capacity to execute its long-term strategic plans.

As a major electric utility, AEP operates under stringent antitrust laws designed to foster fair competition. Any significant strategic moves, such as mergers or acquisitions, undergo rigorous review by regulatory bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) to ensure they do not create monopolies or stifle market rivalry in the energy sector.

In 2023, the FTC continued its focus on energy market consolidation, with several proposed utility mergers facing detailed scrutiny. AEP's own strategic planning, including potential divestitures of non-core assets or acquisitions to expand its service territory, must proactively address these antitrust concerns to secure regulatory approval and maintain a level playing field for all energy providers.

Data Privacy and Consumer Protection Laws

AEP's operations, increasingly reliant on digital platforms for grid management and customer engagement, face heightened scrutiny under evolving data privacy and consumer protection laws. Compliance with regulations like the California Consumer Privacy Act (CCPA) and similar state-level initiatives, which grant consumers rights over their personal data, is paramount. Failure to adhere to these stringent requirements, which often include mandates for secure data storage and transparent data usage policies, can result in significant penalties and reputational damage. In 2023, data breach costs globally averaged $4.35 million, underscoring the financial and trust implications of inadequate data protection.

Key considerations for AEP regarding data privacy and consumer protection include:

- Ensuring robust cybersecurity measures to protect sensitive customer data

- Developing clear and accessible privacy policies outlining data collection and usage

- Implementing processes for handling consumer data requests, such as access or deletion

- Staying abreast of emerging privacy regulations and adapting compliance strategies accordingly

Safety Regulations and Operational Standards

Safety regulations are a critical component of AEP's operational landscape. The company must navigate a complex web of rules designed to protect workers and the public from hazards associated with power generation, transmission, and distribution. These regulations, often enforced by bodies like the Occupational Safety and Health Administration (OSHA), dictate everything from equipment maintenance to emergency response protocols.

AEP's commitment to safety is paramount, not just for compliance but for ensuring reliable service delivery. Adherence to stringent safety standards directly impacts the company's ability to prevent accidents that could disrupt operations, damage infrastructure, or, most importantly, endanger lives. For instance, in 2023, the energy sector as a whole saw a reduction in workplace fatalities, with OSHA reporting a decrease in specific industry-related incidents, underscoring the ongoing focus on safety improvements.

- OSHA Compliance: AEP must adhere to OSHA's General Duty Clause, ensuring a workplace free from recognized hazards.

- Industry Standards: Compliance with National Electrical Safety Code (NESC) and other sector-specific guidelines is mandatory.

- Employee Training: Robust training programs are essential to equip employees with the knowledge to operate safely, especially concerning high-voltage equipment.

- Public Safety: Measures like proper fencing, signage, and public awareness campaigns are implemented to protect the general public from electrical hazards.

AEP's legal framework is heavily influenced by environmental regulations, particularly those concerning emissions and water discharge, requiring significant capital for compliance. The company is actively working to reduce its greenhouse gas emissions, aligning with evolving federal and state mandates aimed at combating climate change, with ambitious plans for further cuts.

Utility rate case proceedings are critical for AEP to recover investments and operational costs, directly impacting its financial health and ability to fund future projects. AEP actively participates in these proceedings throughout 2024 and 2025, with outcomes influencing earnings and strategic execution.

Antitrust laws require rigorous review of AEP's strategic moves, such as mergers, by regulatory bodies to prevent monopolies and ensure market competition. Data privacy and consumer protection laws, like CCPA, necessitate robust cybersecurity and transparent data policies, with non-compliance leading to penalties. Safety regulations, enforced by bodies like OSHA, are paramount for protecting workers and the public, directly impacting operational reliability.

Environmental factors

Climate change presents significant risks to AEP's extensive infrastructure, particularly from increasingly frequent and severe extreme weather events such as hurricanes, floods, and wildfires. These events can disrupt power generation, transmission, and distribution, leading to outages and repair costs.

In response, AEP is actively investing in grid modernization and hardening initiatives. For instance, the company allocated approximately $1.5 billion in capital expenditures for transmission projects in 2024, a portion of which is directed towards enhancing resilience against climate-related impacts.

AEP's sustainability strategy is designed to address the broader challenge of climate change, with a clear commitment to reducing carbon emissions. The company has set ambitious goals, aiming to reduce its carbon dioxide emissions from generation by 80% from 2000 levels by 2030, and achieve net-zero emissions by 2050.

American Electric Power (AEP) is committed to significant carbon reduction, aiming for an 80% decrease in carbon dioxide emissions from 2005 levels by 2030 and reaching net-zero emissions by 2045. This ambitious plan necessitates a substantial shift away from coal-fired power generation, with plans to retire or convert a significant portion of its coal fleet.

To achieve these environmental targets, AEP is heavily investing in expanding its renewable energy portfolio, including solar and wind power, and exploring innovative clean energy technologies like advanced nuclear and carbon capture. These initiatives are driven by increasingly stringent environmental regulations and growing public demand for sustainable energy solutions.

Power generation, particularly from thermal sources, is a water-intensive process, with cooling systems demanding substantial volumes. AEP, like other utilities, must navigate this by implementing responsible water usage strategies. This includes adhering to stringent water discharge regulations, which are becoming increasingly complex, and proactively addressing potential water scarcity in its operational areas, especially as climate patterns shift.

In 2023, AEP reported that its water withdrawal for power generation was approximately 1.1 trillion gallons, with a significant portion used for cooling. The company is investing in technologies to reduce water consumption and improve water quality in its discharges, aiming to meet or exceed environmental standards. For instance, advancements in closed-loop cooling systems are being explored to minimize water intake and thermal pollution.

Land Use and Ecological Impacts of Infrastructure

AEP's infrastructure expansion, particularly in transmission lines and renewable energy projects, necessitates significant land acquisition. This directly impacts land use patterns and can disrupt local ecosystems. For example, the development of new wind farms or solar arrays requires considerable acreage, potentially affecting wildlife habitats and natural landscapes.

To mitigate these environmental concerns, AEP actively manages vegetation along its existing power line corridors. This practice is crucial for maintaining operational reliability and safety, but it also has ecological implications. The company conducts environmental impact assessments to understand and minimize the disruption caused by new construction and ongoing maintenance activities.

- Land Use: AEP's projects, such as the proposed transmission upgrades in the Ohio Valley, involve acquiring and managing substantial land areas, impacting agricultural and natural spaces.

- Biodiversity: Efforts are made to minimize habitat fragmentation and protect sensitive species during construction phases, though the long-term ecological footprint is a continuous consideration.

- Vegetation Management: In 2023, AEP reported managing approximately 1.7 million acres of rights-of-way across its service territory, a key component of its environmental stewardship.

- Ecological Assessments: The company routinely conducts environmental reviews, including studies on water quality, soil erosion, and wildlife impacts, to inform project planning and mitigation strategies.

Waste Management from Power Generation

Managing waste products from power generation, like coal ash, is a major environmental hurdle for AEP. The company faces strict regulations for the safe disposal and recycling of these materials to avoid polluting the environment. For instance, in 2023, AEP continued its efforts to manage legacy coal combustion residuals, with ongoing projects aimed at safe closure and beneficial reuse of these materials.

These sustainable waste management practices are integral to AEP's overall environmental compliance strategy. The company is investing in technologies and processes to minimize the environmental footprint of its operations. AEP's commitment to responsible waste handling is demonstrated through its adherence to EPA guidelines and state-specific regulations governing disposal and reuse.

- Regulatory Compliance: AEP must comply with federal and state regulations for coal ash disposal, such as the EPA's CCR rule.

- Disposal and Recycling: The company actively seeks safe disposal methods and opportunities for beneficial reuse of waste materials, like using ash in concrete.

- Environmental Protection: Proper waste management is crucial for preventing groundwater contamination and protecting ecosystems.

- Investment in Technology: AEP invests in advanced technologies for waste treatment and monitoring to ensure environmental safety.

AEP faces significant environmental challenges, including the impacts of climate change on its infrastructure and the need to reduce carbon emissions. The company is investing billions in grid modernization and renewable energy to meet these challenges and comply with evolving regulations.

Water usage for power generation is a key environmental consideration, with AEP managing substantial water withdrawals and adhering to strict discharge regulations. Land use for new projects also requires careful management to minimize ecological disruption, with millions of acres of rights-of-way being managed annually.

Managing waste, particularly coal ash, is another critical environmental aspect for AEP, necessitating compliance with stringent disposal and recycling regulations. The company's commitment to sustainability involves substantial investment in technologies and practices to mitigate its environmental footprint.

| Environmental Factor | AEP's Action/Challenge | Data/Target (2024/2025 Focus) |

|---|---|---|

| Climate Change Impact | Infrastructure resilience, extreme weather events | $1.5 billion capital expenditures for transmission projects in 2024, partly for resilience. |

| Carbon Emissions | Reduction targets, shift from coal | 80% CO2 reduction from 2005 levels by 2030; net-zero by 2045. |

| Water Usage | Cooling systems, discharge regulations | Managed ~1.1 trillion gallons water withdrawal in 2023; investing in water reduction tech. |

| Land Use | Project development, habitat impact | Managed ~1.7 million acres of rights-of-way in 2023; conducting environmental impact assessments. |

| Waste Management | Coal ash disposal, recycling | Ongoing projects for safe closure and beneficial reuse of coal combustion residuals. |

PESTLE Analysis Data Sources

Our AEP PESTLE Analysis is built on a robust foundation of data from government agencies, industry associations, and reputable market research firms. We analyze policy documents, economic indicators, and technological advancements to provide comprehensive insights.