AEP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEP Bundle

AEP's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the constant threat of new companies entering the energy market. Understanding these dynamics is crucial for any strategic decision.

The complete report reveals the real forces shaping AEP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key suppliers significantly impacts AEP's bargaining power. A limited number of providers for critical inputs like specialized power generation equipment or advanced grid technology can grant these suppliers considerable leverage. For instance, if only a few companies can manufacture essential components like large transformers, AEP might face higher prices and less favorable terms.

AEP's reliance on a diverse energy mix, including natural gas, coal, nuclear, and renewables, offers some mitigation. This diversification in primary energy sources potentially broadens its supplier base for fuel, reducing dependence on any single provider. However, the specialized nature of some equipment and technology within these diverse energy sectors can still lead to concentrated supplier power.

Suppliers of highly specialized equipment or proprietary technology, essential for grid modernization and the clean energy transition, can wield significant bargaining power. This is particularly true when the switching costs for AEP to change vendors are substantial, impacting project timelines and costs.

AEP's ambitious $70 billion capital plan for 2025-2029 highlights its reliance on a broad range of suppliers for these critical infrastructure upgrades. Building and maintaining long-term, stable relationships with these key suppliers becomes paramount to ensure consistent access to necessary components and technologies.

While the utility sector generally sees limited supplier forward integration, a hypothetical scenario could involve key technology or fuel providers moving into power generation or transmission. However, the immense capital investment and stringent regulatory environment inherent in the utility industry create substantial barriers, significantly mitigating this specific threat for American Electric Power (AEP).

Importance of AEP to Suppliers

AEP's sheer size as one of the largest electric utilities in the U.S., serving millions across 11 states, makes it a significant customer for its suppliers. This substantial and ongoing demand gives AEP considerable leverage. For instance, in 2023, AEP reported revenues of approximately $24.4 billion, indicating the scale of its purchasing power. The potential loss of AEP as a major client would have a significant impact on a supplier's revenue stream, incentivizing them to offer competitive pricing and maintain strong relationships.

This dynamic means suppliers are often motivated to secure AEP's business through favorable terms. The bargaining power of suppliers is therefore somewhat diminished when dealing with a company of AEP's magnitude. Suppliers recognize that their ability to negotiate effectively is influenced by AEP's substantial market presence and its consistent need for a wide range of goods and services, from fuel and equipment to specialized technical support.

- AEP's extensive customer base translates to significant purchasing volume.

- In 2023, AEP's revenue reached approximately $24.4 billion.

- Suppliers are incentivized to offer competitive pricing to secure AEP's business.

- AEP's scale can limit the bargaining power of individual suppliers.

Regulatory Environment Impact on Suppliers

The regulatory landscape, encompassing environmental mandates and evolving energy policies, exerts an indirect but significant influence on AEP's suppliers. For instance, stricter emissions standards for coal-fired power plants can increase compliance costs for suppliers of coal, potentially driving up prices or reducing availability. Conversely, government incentives for renewable energy development, such as tax credits for solar panel manufacturers, can bolster their capacity and competitiveness. In 2023, the U.S. Department of Energy announced over $1 billion in funding for clean energy projects, a move that could reshape supplier dynamics in the renewable sector.

Shifts in energy policy, whether at the federal or state level, directly impact supplier pricing and the availability of essential materials and technologies for AEP. For example, changes in natural gas regulations or pipeline access can affect the cost of fuel for AEP's generation fleet. AEP's strategic pivot towards cleaner energy sources, such as wind and solar, is also actively shaping its supplier base. This transition necessitates partnerships with companies specializing in advanced battery storage and grid modernization technologies, potentially diminishing the importance of traditional fossil fuel suppliers over time.

- Environmental Regulations: Increased compliance costs for suppliers of traditional fuels can translate to higher input prices for AEP.

- Energy Policy Shifts: Changes in government incentives or mandates for renewable energy can alter supplier investment and production levels.

- Technological Transition: AEP's focus on renewables drives demand for specialized suppliers in areas like battery storage and smart grid components.

- Supplier Pricing and Availability: Regulatory and policy changes directly influence the cost and accessibility of goods and services AEP procures.

AEP's significant purchasing power, evidenced by its $24.4 billion in 2023 revenue, generally reduces supplier bargaining power. However, the concentration of suppliers for specialized grid modernization and clean energy technologies, coupled with high switching costs for AEP, creates specific areas where suppliers can exert considerable leverage. Regulatory shifts and energy policies also indirectly influence supplier pricing and availability, impacting AEP's operational costs and strategic transitions.

| Factor | Impact on AEP | Supporting Data/Context |

|---|---|---|

| Supplier Concentration | Increases supplier leverage for specialized equipment. | Few providers for advanced grid technology or large transformers. |

| AEP's Scale | Decreases overall supplier bargaining power. | $24.4 billion revenue in 2023; large customer base. |

| Switching Costs | Empowers suppliers of critical, proprietary technology. | High costs to change vendors for grid modernization projects. |

| Regulatory & Policy Environment | Indirectly affects supplier pricing and availability. | Clean energy incentives can boost renewable suppliers; emissions standards can increase fuel supplier costs. |

What is included in the product

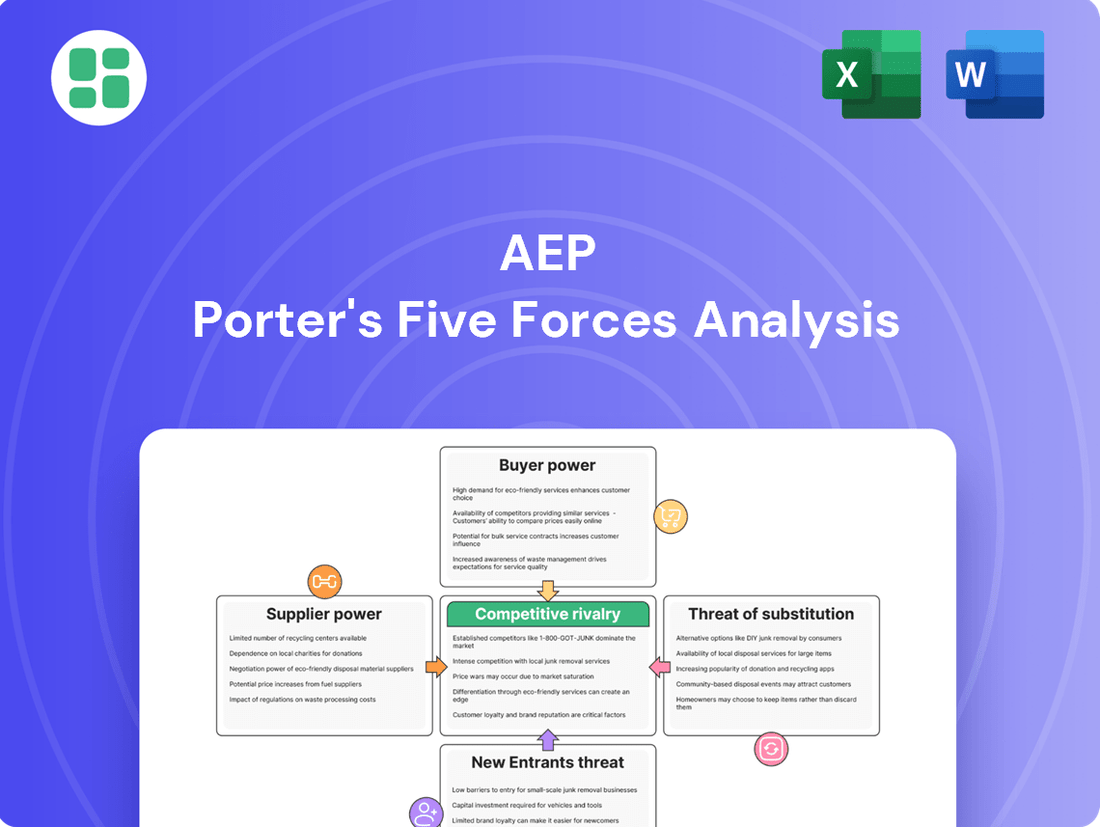

This analysis examines the five competitive forces impacting AEP, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the presence of substitutes.

Quickly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces factor.

Customers Bargaining Power

American Electric Power (AEP) serves a broad customer base of 5.6 million across 11 states, encompassing residential, commercial, and industrial sectors. The sheer number of residential customers means they have minimal individual bargaining power due to their small, fragmented consumption.

However, the landscape is shifting with the growing importance of large industrial and commercial clients, particularly data centers. These major consumers are increasingly influencing AEP's strategic planning and future load growth.

AEP's success in securing 24 gigawatts of new load by 2030, largely attributed to data center demand, highlights the considerable leverage these large customers possess. Their significant energy consumption gives them a stronger voice in negotiations regarding pricing and service terms.

For residential and small commercial customers, electricity is largely a necessity, meaning their price sensitivity is generally low, especially in regulated markets where state commissions determine rates. This lack of immediate price sensitivity is compounded by high switching costs, as customers typically cannot easily select a different electricity provider in these monopolistic environments.

However, the landscape shifts significantly in deregulated markets where AEP Energy actively participates. Here, customers gain more choice, leading to increased price sensitivity. For instance, in Ohio, a key AEP market, the Public Utilities Commission of Ohio (PUCO) oversees competitive retail electric service, allowing consumers to choose their generation supplier. This choice directly influences how customers react to price changes, making them more inclined to switch if better rates are available.

The growing accessibility and decreasing cost of alternatives such as rooftop solar, on-site power generation, and battery storage systems significantly boost customer leverage. This is especially true for larger clients, including commercial and industrial businesses, who can now more readily switch away from traditional utility providers.

Major consumers, like data centers, are actively exploring options to co-locate with power generation sites or directly support renewable energy projects. This trend gives them considerable sway in influencing utility investment decisions, pushing companies like AEP to adapt their strategies to retain these key customers.

Regulatory Influence on Customer Power

State regulatory commissions, such as the Public Utilities Commission of Ohio (PUCO), wield considerable influence over AEP's operations by setting electricity rates and service quality standards. This regulatory oversight directly shapes the bargaining power of AEP's customers within its regulated service territories.

While individual customers lack the ability to directly negotiate prices with AEP, their collective influence is channeled through various avenues. Consumer advocacy groups and participation in regulatory proceedings, like rate cases, allow customers to voice concerns and impact decisions on pricing and service levels. For instance, in 2023, PUCO's decisions on AEP Ohio's rate cases directly affected the bills of millions of customers, demonstrating the indirect yet significant power of customer representation.

- Regulatory Rate Setting: State commissions approve AEP's requested rates, providing a check on pricing power.

- Consumer Advocacy: Groups like Ohio Consumers' Counsel represent customer interests in regulatory proceedings.

- Service Quality Standards: Regulators mandate reliability and customer service metrics that AEP must meet.

- Influence on Investment: Customer feedback and regulatory mandates can influence AEP's capital expenditure decisions for grid modernization.

Customer Engagement and Service Quality

AEP's dedication to enhancing customer experiences, demonstrated by its investment in digital tools and customer assistance programs, has led to recognition through customer service awards. This focus on high satisfaction and dependable service naturally lessens the desire for customers to explore other providers, even when alternative options might be available.

However, the bargaining power of customers can be amplified by service issues. For instance, service disruptions, such as those impacting Ohio customers in 2024, can significantly lower satisfaction levels. This increased dissatisfaction not only impacts customer loyalty but also invites greater regulatory attention, potentially strengthening the customers' position.

- Customer Service Awards: AEP has received accolades for its customer service initiatives, indicating a commitment to positive customer interactions.

- Digital Tools and Assistance: Investments in digital platforms and support programs aim to improve the overall customer experience.

- Impact of Service Disruptions: Events like the 2024 Ohio service disruptions highlight how reliability issues can erode customer satisfaction and increase their leverage.

- Regulatory Scrutiny: Service failures can lead to increased oversight from regulatory bodies, indirectly empowering customers by creating pressure on the utility.

While individual residential customers have limited direct bargaining power due to the necessity of electricity and high switching costs in regulated areas, the landscape is evolving. Large industrial and commercial clients, such as data centers, wield significant influence due to their substantial energy consumption and growing adoption of alternative energy solutions.

The bargaining power of customers is also shaped by regulatory frameworks and the availability of alternatives. In deregulated markets, increased choice leads to greater price sensitivity, while the rise of rooftop solar and on-site generation empowers customers to reduce reliance on traditional utilities.

Service quality and customer satisfaction play a crucial role; significant service disruptions can erode loyalty and invite regulatory scrutiny, thereby amplifying customer leverage. AEP's focus on customer service aims to mitigate this, but events like the 2024 Ohio service disruptions underscore the impact of reliability on customer power.

AEP's 2023 financial reports indicate significant investments in infrastructure, which are subject to regulatory approval, indirectly involving customer interests. For example, the company's 2023 capital expenditures were substantial, impacting rates that customers ultimately pay.

| Customer Segment | Bargaining Power Factors | AEP's Response/Impact |

|---|---|---|

| Residential | Low individual power, high switching costs (regulated markets) | Focus on customer service, digital tools, regulatory rate setting |

| Commercial/Industrial (Large) | High power due to consumption, alternative energy adoption | Securing new load (e.g., data centers), influencing investment decisions |

| Deregulated Market Customers | Increased price sensitivity, choice of providers | Competitive pricing strategies, service differentiation |

| Customers with Alternatives (Solar, Storage) | Ability to reduce reliance on utility | Grid modernization investments, integration of distributed energy resources |

Full Version Awaits

AEP Porter's Five Forces Analysis

This preview showcases the complete AEP Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape relevant to the company. The document you see here is precisely the same professionally formatted and ready-to-use analysis that will be available to you instantly after completing your purchase, ensuring no surprises or placeholder content.

Rivalry Among Competitors

Competitive rivalry within the electric utility sector, especially in AEP's regulated domains, is generally subdued. This is because transmission and distribution services often operate as regional monopolies, meaning there's limited direct competition for existing customers within a specific geographic area.

AEP's position as the operator of the nation's largest electric transmission system, serving 5.6 million customers across 11 states, underscores this market concentration. This extensive reach and infrastructure mean that while competition exists for new generation sources or in deregulated markets, direct rivalry for AEP's core customer base in its regulated territories is inherently low.

The US electricity industry is seeing a significant rebound after years of flat demand. This resurgence is fueled by the increasing adoption of electric vehicles, the massive expansion of AI-powered data centers, and a push for domestic manufacturing through reshoring initiatives.

AEP projects a robust 8-9% annual retail load growth between 2025 and 2027. This surge is largely attributed to substantial new load additions, estimated at 24 GW by 2030, primarily from data centers and industrial clients.

While this elevated growth rate presents substantial opportunities for utilities like AEP, it also escalates competitive pressures. Utilities will increasingly vie for these large new loads, potentially leading to more aggressive pricing and service offerings.

Electricity itself is a commodity with minimal inherent differentiation. However, AEP competes by emphasizing reliability, superior customer service, and investments in modernizing its grid infrastructure. AEP's significant investments, such as the approximately $4.5 billion planned for transmission infrastructure upgrades through 2026, aim to bolster its value proposition and differentiate it from competitors.

Furthermore, AEP's commitment to cleaner energy sources, including a goal to reduce carbon dioxide emissions by 80% from 2000 levels by 2040, appeals to environmentally conscious customers. This focus on sustainability can be a key differentiator in a market where the core product is largely undifferentiated.

For customers operating within AEP's regulated service territories, switching costs are exceptionally high, effectively eliminating direct competitive rivalry for these customer segments. This regulatory structure inherently limits the ability of customers to choose alternative electricity providers, thereby reducing competitive pressure on AEP.

Exit Barriers in the Industry

Exit barriers in the electric utility sector are exceptionally high, largely due to the substantial fixed assets and long-term capital commitments inherent in the business. Companies like American Electric Power (AEP) operate vast networks of power plants, transmission lines, and distribution systems, representing billions in invested capital. For instance, AEP's 2024 capital expenditure forecast was around $4.3 billion, highlighting the ongoing investment required and the difficulty of divesting such infrastructure.

These high exit barriers mean that companies are often compelled to remain in the market even during periods of lower profitability. The regulatory obligations to ensure reliable service to customers further solidify this commitment, making a swift exit impractical. This situation contributes to a stable, albeit intensely capital-intensive, operating environment for industry participants.

- High Capital Intensity: Electric utilities require massive upfront investment in generation, transmission, and distribution infrastructure, creating significant sunk costs.

- Regulatory Obligations: Utilities are often mandated by regulators to provide service, limiting their ability to cease operations or divest assets without extensive approval processes.

- Specialized Assets: The physical assets are highly specialized and have limited alternative uses, making them difficult to sell or repurpose if a company wishes to exit.

- Long-Term Contracts: Many utilities operate under long-term power purchase agreements or service contracts that bind them to operations for extended periods.

Regulatory Environment and Competitive Dynamics

The regulatory environment significantly shapes competitive rivalry for companies like AEP. State commissions approve rates and service territories, which inherently limits direct competition. However, competition intensifies around securing capital for infrastructure projects, gaining regulatory approval for new initiatives, and attracting major industrial customers.

In 2024, the push for clean energy and grid resilience is a key driver of this rivalry. Utilities are increasingly competing on their ability to innovate and secure government incentives. For instance, the Inflation Reduction Act of 2022 offers substantial tax credits for renewable energy projects, creating a competitive race among utilities to deploy solar, wind, and battery storage solutions.

- Limited Direct Competition: State-level regulation of rates and service territories restricts head-to-head competition for existing customer bases.

- Competition for Capital and Projects: Utilities vie for investor capital and regulatory approval for significant infrastructure investments, such as grid modernization or new generation facilities.

- Attracting Industrial Loads: Competition exists in securing large industrial customers, often through tailored rate structures or service agreements.

- Innovation in Clean Energy: The transition to renewables and grid resilience creates a competitive landscape focused on technological advancement and securing green energy incentives, with utilities aiming to lead in decarbonization efforts.

Competitive rivalry for AEP, particularly in its regulated territories, is generally low due to the monopolistic nature of transmission and distribution. However, this is evolving with increased demand from data centers and EVs, leading to competition for new load growth and clean energy investments. AEP's strategy focuses on reliability, customer service, and grid modernization, with significant capital investments like the projected $4.3 billion in 2024, to maintain its competitive edge.

| Factor | AEP's Position | Competitive Intensity |

|---|---|---|

| Customer Base (Regulated) | Monopolistic/Regional | Low |

| New Load Growth (Data Centers, EVs) | High potential, increasing competition | Moderate to High |

| Clean Energy Investments | Key differentiator, driven by incentives | Moderate to High |

| Infrastructure Upgrades (e.g., Transmission) | Significant investment ($4.5B through 2026) | Moderate (competition for capital/approval) |

SSubstitutes Threaten

The increasing adoption of distributed generation, like rooftop solar, presents a growing threat to traditional utility business models. As technology advances and costs fall, customers can generate more of their own power, reducing demand for grid electricity. For instance, in 2024, the U.S. saw continued strong growth in solar installations, with residential solar capacity adding a significant portion to the overall energy mix.

Improvements in energy efficiency, driven by smart home technologies and more efficient appliances, significantly reduce the overall demand for electricity, acting as a potent substitute for traditional energy consumption. For instance, the U.S. Department of Energy reported that by 2023, advancements in building codes and appliance standards alone had saved consumers billions of dollars in energy costs.

AEP, like other utilities, actively engages in promoting energy efficiency programs. While these initiatives can lower direct electricity sales, they are crucial for managing peak demand periods and ensuring regulatory compliance, thereby mitigating potential revenue losses through other avenues.

The threat of substitutes for traditional grid electricity is growing significantly due to advancements in battery storage solutions. Commercial and industrial customers, in particular, are increasingly able to store self-generated renewable energy or even grid power for later use. This capability directly reduces their need for continuous supply from the grid, empowering them to manage their energy consumption more independently. For instance, in 2024, the global battery energy storage market was valued at approximately $150 billion, a figure projected to rise substantially, indicating a strong trend towards these alternative solutions.

Microgrids and Off-Grid Solutions

The rise of microgrids and off-grid solutions presents a significant threat of substitutes for traditional utility providers like AEP, especially for large industrial clients and communities seeking greater energy resilience. These alternative systems offer enhanced reliability and energy independence, directly challenging the established utility model. For instance, data centers, with their critical need for uninterrupted power, are increasingly exploring these options. By 2024, the global microgrid market was valued at approximately $30 billion and is projected to grow significantly, indicating a strong customer interest in alternatives.

This trend is exacerbated by advancements in renewable energy technologies and battery storage, making self-generation and localized power more economically feasible. Critical infrastructure, such as hospitals and military bases, are also prime candidates for adopting microgrids to ensure operational continuity during grid outages. The ability to control their own power supply and potentially reduce costs through on-site generation makes these solutions an attractive substitute.

- Microgrid Market Growth: The global microgrid market reached an estimated $30 billion in 2024, signaling strong adoption.

- Key Adopters: Data centers and critical infrastructure facilities are leading the charge in exploring off-grid and microgrid solutions.

- Technological Drivers: Advancements in renewables and battery storage are making these substitutes more competitive.

- Customer Benefits: Enhanced reliability, energy independence, and potential cost savings are key drivers for adopting these alternatives.

Customer Propensity to Substitute

Customer propensity to substitute for traditional energy sources is a growing concern for AEP. This shift is driven by several factors, including economic incentives like potential cost savings from distributed generation, a desire for cleaner energy solutions driven by environmental consciousness, and the increasing demand for energy resilience, especially after experiencing grid disruptions.

While residential customers often face significant upfront costs for fully substituting AEP's services, such as installing solar panels and battery storage, large commercial and industrial clients are more actively exploring and implementing these alternatives. This trend is evident in the growing adoption of on-site renewable energy generation by businesses seeking greater control over their energy supply and costs.

In response to this evolving landscape, AEP is strategically investing in initiatives aimed at retaining its customer base and remaining competitive. These investments focus on enhancing renewable energy integration into its existing grid infrastructure and modernizing the grid to support distributed energy resources more effectively. For instance, AEP's 2024 capital expenditure plans include substantial funding for grid modernization projects, which are crucial for accommodating these customer-driven substitution trends.

- Economic Incentives: Customers are increasingly evaluating the total cost of ownership for alternative energy solutions, factoring in potential savings on electricity bills and government incentives.

- Environmental Concerns: A growing segment of customers, both residential and commercial, prioritize reducing their carbon footprint, making renewable energy sources a more attractive substitute.

- Energy Resilience: Events like severe weather have highlighted the vulnerability of traditional grids, increasing customer interest in self-generation and storage for uninterrupted power.

- Commercial & Industrial Adoption: Large energy users are leading the charge in substitution, with many exploring power purchase agreements for renewable energy or investing in on-site generation to hedge against price volatility and ensure supply reliability.

The threat of substitutes for traditional utility services remains a significant challenge for AEP. Distributed generation, energy efficiency, battery storage, and microgrids all offer viable alternatives that reduce reliance on the conventional grid. These substitutes are becoming increasingly cost-effective and technologically advanced, driven by customer demand for cleaner, more reliable, and potentially cheaper energy solutions.

In 2024, the continued growth in residential solar installations and the expanding market for battery energy storage underscore this trend. For example, the U.S. residential solar capacity saw robust expansion, while the global battery storage market reached approximately $150 billion, indicating a strong customer appetite for self-generation and energy independence.

These substitutes directly impact AEP by potentially decreasing electricity sales and revenue. However, the company is actively responding by investing in grid modernization and renewable energy integration to adapt to these changing market dynamics and retain its customer base.

| Substitute Type | 2024 Market Value (Approx.) | Key Drivers | Impact on Utilities |

|---|---|---|---|

| Distributed Generation (e.g., Rooftop Solar) | N/A (Component of broader renewable markets) | Cost reduction, environmental concerns, incentives | Reduced grid demand, potential for bidirectional flow management |

| Energy Efficiency Technologies | N/A (Integrated into building/appliance standards) | Cost savings, regulatory mandates, smart home adoption | Lower overall energy consumption |

| Battery Energy Storage | $150 billion (Global) | Grid stability, renewable integration, demand charge management | Enables self-consumption, reduces reliance on grid during peak times |

| Microgrids & Off-Grid Solutions | $30 billion (Global) | Resilience, energy independence, critical infrastructure needs | Potential loss of large industrial/commercial customers |

Entrants Threaten

The electric utility sector demands enormous upfront capital for infrastructure like power plants, transmission, and distribution systems. This makes it incredibly difficult for newcomers to enter the market and compete.

For instance, American Electric Power (AEP) has outlined a significant capital expenditure plan. Their projected investments for 2025-2029 are set at $54 billion, with the possibility of reaching up to $70 billion.

This substantial financial commitment acts as a formidable barrier, deterring potential new entrants who would need to match these massive investments to establish a competitive presence.

New entrants into the energy sector, particularly for companies like American Electric Power (AEP), face significant obstacles due to extensive regulatory hurdles and licensing requirements. This includes navigating a complex web of state and federal regulations that govern every aspect of the business, from generation and transmission to distribution and environmental compliance.

Obtaining the necessary licenses, permits, and approvals is a time-consuming and expensive process. For instance, securing a Certificate of Public Convenience and Necessity (CPCN) for new transmission lines can take years and involve extensive public hearings and environmental impact studies. The sheer cost and complexity of compliance, often requiring specialized legal and technical expertise, deter many potential new players.

Existing utilities like AEP leverage substantial economies of scale in managing extensive infrastructure, including the nation's largest electric transmission system. New entrants would face immense difficulty matching these cost efficiencies, requiring massive investment to replicate or acquire comparable networks.

Access to Distribution Channels and Customer Base

AEP's substantial customer base, serving 5.6 million customers across 11 states, coupled with its deeply entrenched distribution network, presents a formidable barrier to entry for new competitors. This established infrastructure and customer loyalty require significant investment and time for any newcomer to replicate, effectively limiting the threat of new entrants.

Gaining traction in the highly regulated utility sector demands not only capital but also the arduous process of building trust and acquiring customers, a lengthy and resource-intensive endeavor. New entrants face the challenge of overcoming AEP's existing market presence and customer relationships, making market penetration exceptionally difficult.

Consider these points regarding access to distribution channels and the customer base:

- Established Infrastructure: AEP's extensive network of power lines and substations is a critical asset that new entrants would need to duplicate or secure access to, a costly and time-consuming undertaking.

- Customer Loyalty and Trust: In a sector where reliability is paramount, AEP's long-standing service fosters customer trust, making it challenging for new, unproven entities to attract and retain customers.

- Regulatory Hurdles: Navigating the complex regulatory landscape to gain approval for new distribution networks and service offerings adds another layer of difficulty and expense for potential entrants.

Technological and Infrastructure Complexity

The sheer technological and infrastructure complexity presents a formidable barrier to new entrants in the power sector. Operating and modernizing a diverse generation fleet, including coal, natural gas, nuclear, and renewables, alongside an extensive high-voltage transmission network, requires highly specialized technical expertise and substantial ongoing investment in research and development.

New players would struggle to replicate this intricate operational capability and integrate new technologies at a meaningful scale. For instance, the capital expenditure for a new large-scale nuclear plant can exceed $20 billion, a figure that deters many potential entrants. Similarly, establishing a nationwide high-voltage transmission network demands billions in investment and years of planning and construction.

- Specialized Expertise: The industry requires deep knowledge in areas like grid management, cybersecurity for critical infrastructure, and advanced engineering for diverse power sources.

- Capital Intensity: Building and maintaining power generation facilities and transmission lines involves massive upfront and ongoing capital outlays.

- Regulatory Hurdles: Navigating complex permitting processes and environmental regulations for new infrastructure adds significant time and cost, further discouraging new entrants.

The threat of new entrants for American Electric Power (AEP) is significantly low due to the immense capital required for infrastructure development, with AEP planning $54 billion to $70 billion in capital expenditures from 2025-2029. This massive investment, coupled with stringent regulatory approvals and licensing processes, creates substantial barriers. Furthermore, AEP's established economies of scale, extensive customer base of 5.6 million across 11 states, and deeply entrenched distribution network make it exceptionally difficult for newcomers to gain market share and achieve cost competitiveness.

| Barrier Type | Description | AEP Context |

|---|---|---|

| Capital Requirements | Enormous upfront investment for power plants and transmission/distribution systems. | AEP's projected capital expenditures of $54-$70 billion (2025-2029) highlight this barrier. |

| Regulatory Hurdles | Complex and time-consuming licensing, permits, and environmental compliance. | Obtaining Certificates of Public Convenience and Necessity (CPCN) can take years. |

| Economies of Scale | Existing utilities benefit from lower per-unit costs due to large-scale operations. | AEP's vast transmission system offers significant cost advantages. |

| Customer Base & Network Access | Established customer loyalty and existing distribution networks are hard to replicate. | AEP serves 5.6 million customers, making market penetration difficult for new entrants. |

| Technological & Infrastructure Complexity | Operating diverse generation fleets and high-voltage transmission requires specialized expertise and investment. | Building new nuclear plants can cost over $20 billion; nationwide transmission networks require billions. |

Porter's Five Forces Analysis Data Sources

Our AEP Porter's Five Forces analysis is built upon a robust foundation of data, drawing from AEP's annual reports, SEC filings, and industry-specific publications. We also incorporate macroeconomic data and market research reports to provide a comprehensive understanding of the competitive landscape.