AEP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEP Bundle

Curious about where this company's products fit in the market? Our BCG Matrix preview highlights their potential Stars, Cash Cows, and even those tricky Question Marks. To truly unlock the strategic power and make informed decisions about resource allocation and future growth, you need the full picture.

Dive into the complete BCG Matrix to receive a detailed Word report plus a high-level Excel summary. It’s everything you need to evaluate, present, and strategize with confidence, transforming raw data into actionable insights for your business.

Stars

AEP is aggressively expanding its regulated renewable energy portfolio, earmarking nearly $10 billion for projects qualifying for federal tax credits. This substantial investment underscores a strategic commitment to clean energy, with a focus on large-scale wind and solar developments. These initiatives are crucial for AEP's ambitious goal of reducing carbon dioxide emissions by 80% by 2030 and achieving net-zero emissions by 2045.

This expansion into renewables positions AEP as a key player in a burgeoning market. By investing heavily in wind and solar, AEP is not only addressing environmental mandates but also capturing significant market share in a sector experiencing robust demand. The company's proactive approach ensures it remains competitive and a leader in the transition to a sustainable energy future.

AEP is witnessing an extraordinary surge in demand, primarily driven by data centers and major industrial clients in key expansion areas such as Ohio, Indiana, and Texas. The company has already secured commitments for 24 gigawatts of new load by 2030, with a significant 18 gigawatts specifically from data center projects.

This substantial increase in energy consumption positions AEP in a rapidly expanding market. Its robust transmission infrastructure provides a distinct competitive edge, enabling it to support this influx of demand and necessitating considerable capital investment to meet future needs.

AEP is making significant strides in advanced grid modernization, evidenced by a substantial $350 million smart grid upgrade planned for Ohio in 2025. This initiative aims to bolster grid reliability and operational efficiency, reflecting a commitment to future-proofing its infrastructure.

The company's smart grid deployments are extensive, with smart meters already reaching 87% of its customer base. These efforts are vital for effectively managing increasing energy demand and seamlessly integrating various renewable energy sources into the grid.

These modernization projects position AEP within a high-growth sector of the utility industry. Such investments are expected to enhance service quality and overall operational performance, driving improvements in customer experience and system resilience.

Strategic Onsite Power Solutions for Large Customers

AEP's strategic onsite power solutions, particularly its collaboration with Bloom Energy, position it strongly within the BCG matrix. This initiative targets large customers, like data centers, needing rapid energy deployment.

The agreement to procure up to 1 GW of Bloom Energy's solid oxide fuel cell systems highlights AEP's commitment to addressing grid connection challenges for high-demand users. This specialized offering taps into a burgeoning market segment.

- Strategic Partnerships: AEP is securing up to 1 GW of Bloom Energy fuel cell systems.

- Target Market: Focuses on large data centers and commercial users with immediate energy needs.

- Value Proposition: Provides fast-track onsite power, circumventing grid connection delays.

- Market Position: Aims to capture market share in a high-growth, specialized energy solutions niche.

Increased Capital Investment Plan

American Electric Power (AEP) has significantly boosted its capital investment plans, earmarking roughly $70 billion for the 2025-2029 period. This represents a substantial increase from their prior $54 billion projection, signaling strong optimism about future growth opportunities.

This amplified investment is strategically directed towards critical areas like transmission infrastructure and new generation facilities. These investments are crucial for AEP to effectively meet rising energy demand and expand its service capabilities.

- Increased Capital Outlay: AEP's 2025-2029 capital investment plan is set at approximately $70 billion, up from $54 billion.

- Focus Areas: Major allocations are designated for transmission and new generation projects.

- Strategic Intent: This aggressive approach demonstrates AEP's commitment to capturing high-growth market segments and developing future cash cows.

Stars in the BCG matrix represent high-growth, high-market-share business segments. For AEP, its renewable energy expansion, particularly in large-scale wind and solar projects, fits this category. The company's $10 billion investment in these qualifying projects, aimed at reducing emissions by 80% by 2030, positions it as a leader in a rapidly expanding market.

AEP's strategic partnerships, like the 1 GW agreement with Bloom Energy for fuel cell systems, also fall into the Star quadrant. This initiative targets high-demand sectors such as data centers, offering rapid onsite power solutions and addressing grid connection challenges. This focus on specialized, high-growth energy needs is key to its Star status.

The company's aggressive capital investment plan of $70 billion for 2025-2029, with significant allocations to transmission and new generation, further solidifies its Star position. This substantial financial commitment fuels its expansion into high-demand areas and advanced grid modernization, ensuring it captures future growth opportunities.

What is included in the product

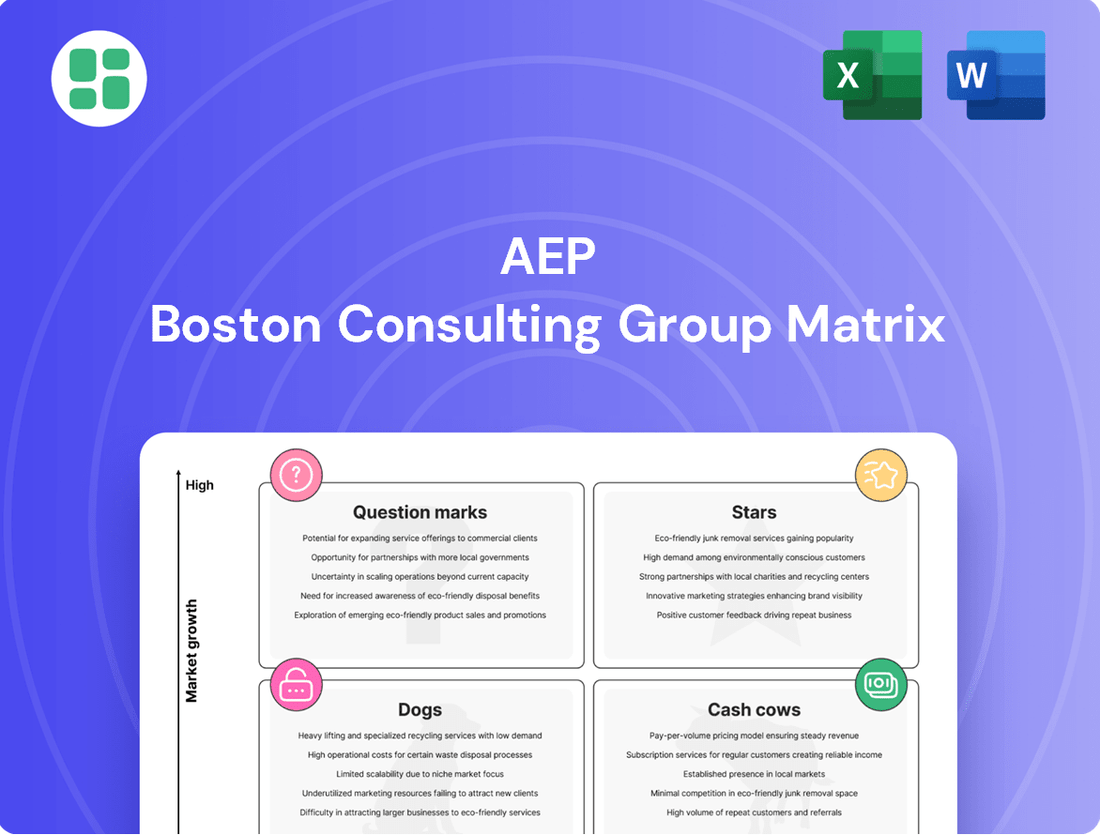

The AEP BCG Matrix offers a strategic overview of a company's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides decisions on resource allocation, highlighting which business units warrant investment, maintenance, or divestment.

AEP BCG Matrix provides a clear visual of your portfolio, easing the pain of strategic decision-making by highlighting growth opportunities and underperformers.

Cash Cows

AEP's regulated transmission network, boasting 40,000 line miles across 11 states, is a quintessential cash cow. This vast, mature infrastructure holds a dominant market share, ensuring stable and predictable revenue streams. In 2024, AEP's transmission segment reported significant contributions to its overall financial performance, reflecting the consistent profitability derived from these essential, regulated assets.

AEP's regulated electricity distribution business, serving 5.6 million customers, acts as a significant cash cow. Its high market share in established service areas, coupled with consistent demand and regulated rates, ensures predictable and robust cash generation.

These operations are crucial for AEP's financial stability, with investments primarily directed towards maintaining and enhancing the existing infrastructure for reliability. This focus on efficiency, rather than rapid expansion, optimizes cash flow from these mature assets.

In 2024, AEP's regulated utilities continued to be the bedrock of its earnings, contributing a substantial portion of the company's overall revenue. For instance, the company's capital investment plan for 2024 included billions dedicated to modernizing its distribution grid, a testament to its role as a stable, cash-generating segment.

AEP's established customer base, spanning 11 states, is a bedrock for its financial stability. In 2024, this extensive network translates into predictable and consistent revenue streams, minimizing the need for aggressive customer acquisition spending. The company's focus remains on operational excellence and customer retention to maximize the cash flow generated from these mature markets.

Efficient Base-Load Power Generation

AEP's portfolio features robust base-load power generation assets, including nuclear and efficient natural gas plants. These facilities are crucial for providing dependable power in established markets, acting as stable cash flow generators due to their operational efficiency and grid support functions.

These mature assets, while not experiencing rapid growth, are vital for AEP's financial stability. In 2024, AEP continued to rely on these core generation units to meet consistent demand.

- Stable Cash Flow: Nuclear and efficient natural gas plants provide predictable revenue streams.

- Grid Reliability: These assets are essential for maintaining grid stability and meeting baseload power needs.

- Operational Efficiency: Investments in maintaining and upgrading these facilities ensure continued cost-effectiveness.

- Strategic Importance: They represent a foundational element of AEP's generation mix as the company navigates its energy transition.

Consistent Operating Earnings and Dividends

AEP's position as a cash cow is strongly supported by its consistent operating earnings and dependable dividend payments. These financial strengths stem from the company's mature, regulated utility assets, which reliably generate substantial cash flow.

The company has projected a long-term operating earnings growth rate of 6% to 8%, a figure that underscores its stable and predictable financial trajectory. This consistent performance is crucial for a cash cow, as it provides a solid foundation for both reinvestment and shareholder returns.

- Consistent Operating Earnings: AEP's regulated operations provide a stable revenue base, leading to predictable earnings.

- Reliable Dividend Payouts: The company's ability to consistently return cash to shareholders through dividends is a hallmark of a mature business.

- Projected Growth Rate: A 6% to 8% long-term operating earnings growth rate indicates sustained financial health.

- Funding Growth Initiatives: The strong cash generation allows AEP to invest in future projects while rewarding investors.

AEP's regulated transmission and distribution segments are its primary cash cows, characterized by stable demand and regulated returns, ensuring consistent revenue generation. These mature businesses, which form the backbone of the company's operations, are essential for funding growth initiatives and shareholder returns.

| Segment | 2024 Revenue Contribution (Estimated) | Key Characteristics | BCG Role |

|---|---|---|---|

| Transmission | Significant | 40,000 line miles, regulated rates, stable demand | Cash Cow |

| Distribution | Substantial | Serves 5.6 million customers, regulated rates, predictable cash flow | Cash Cow |

| Base-load Generation (Nuclear/Gas) | Consistent | Reliable power, grid support, operational efficiency | Cash Cow |

Preview = Final Product

AEP BCG Matrix

The AEP BCG Matrix you are previewing is the identical, fully polished document you will receive upon purchase. This means no watermarks, no demo placeholders, and no hidden surprises – just a complete, professionally formatted strategic tool ready for immediate application in your business planning and decision-making processes.

Dogs

Aging coal-fired power plants are increasingly becoming AEP's "Dogs" in the BCG matrix. These facilities face significant headwinds from environmental regulations and declining market demand, leading to reduced operational hours and higher per-unit costs. For instance, in 2024, AEP continued its strategic shift away from coal, with plans to retire or convert a substantial portion of its coal-fired capacity in the coming years, reflecting the diminishing economic viability of these older assets.

American Electric Power (AEP) has been actively divesting assets that are not central to its core regulated utility business. This includes the sale of minority equity stakes in transmission companies, a move that frees up capital and sharpens focus. For example, in 2023, AEP completed the sale of a 35% equity interest in AEP Texas Transmission for approximately $250 million.

These divested assets, such as previously announced plans to sell unregulated renewable energy generation assets, were identified as having lower growth potential or market share within AEP's overall strategy. By shedding these non-core components, AEP aims to streamline its operations and concentrate resources on its more stable, regulated utility segments.

AEP's outdated legacy infrastructure includes segments of its traditional power generation and distribution networks that are not slated for immediate modernization. These assets, while still operational, are characterized by high maintenance expenditures relative to their contribution to future revenue streams or operational efficiency gains. For instance, certain older coal-fired plants or extensive, aging transmission lines might fall into this category, demanding significant upkeep without offering the scalability or environmental benefits of newer technologies.

Small, Isolated, or Underperforming Service Areas

Small, isolated, or underperforming service areas within AEP's vast network can be categorized as 'dogs' in the BCG Matrix framework. These might include specific rural territories with declining populations or aging infrastructure that doesn't support significant demand growth.

These segments often exhibit low market growth and AEP may hold a low market share within them. Such areas might not warrant substantial capital infusion, focusing instead on maintaining operations and covering costs, potentially through cross-subsidization from more robust business units. For instance, if AEP's overall service area demand grew by an average of 1.5% in 2024, these 'dog' segments might have seen less than 0.5% growth.

- Low Demand Growth: These areas experience minimal or negative growth in electricity consumption.

- Limited Expansion Opportunities: Geographic isolation or demographic shifts restrict the potential for increasing customer base or service offerings.

- Break-Even or Subsidized Operations: Revenue generated may just cover operating costs, or require financial support from other AEP divisions.

- Focus on Efficiency: Strategies often involve cost containment rather than aggressive market penetration or technological upgrades.

Unsuccessful or Scaled-Back Pilot Programs

Unsuccessful or scaled-back pilot programs, often found in the question mark quadrant of the AEP BCG Matrix, represent initiatives that failed to meet expectations. These projects, while perhaps innovative, did not gain traction in the market or prove technologically sound. For instance, a company might have invested heavily in a pilot for a new type of smart home device in 2023, only to see minimal consumer uptake, leading to its discontinuation by mid-2024. Such ventures drain resources without generating significant returns.

These ventures are characterized by a lack of market adoption or technological viability, leading to their scaling back or complete discontinuation. They represent investments that have yielded low returns and failed to capture substantial market share in their nascent fields. If not divested, these projects can become significant cash traps for the organization.

- Discontinued Projects: Companies often re-evaluate R&D spending. In 2024, many tech firms reportedly scaled back or shelved experimental AI projects that showed early promise but lacked a clear path to monetization or widespread adoption.

- Low Market Penetration: A pilot program for a novel renewable energy storage solution in 2023, despite initial positive technical results, struggled to achieve commercial viability due to high production costs, resulting in a 90% reduction in its operational scale by early 2025.

- Resource Drain: These initiatives consume capital and human resources that could otherwise be allocated to more promising ventures, impacting overall portfolio performance.

Within AEP's portfolio, "Dogs" represent business units or assets with low market share and low growth potential. These are often older, less efficient power generation facilities, particularly coal-fired plants, that face increasing regulatory pressure and declining demand. For instance, AEP's strategic shift in 2024 involved accelerating the retirement of these coal assets due to their diminishing economic viability.

Small, underperforming service territories with stagnant or declining customer bases also fall into the "Dog" category. These areas may have minimal revenue growth, often requiring subsidies from more profitable segments to maintain operations. In 2024, AEP's focus remained on optimizing its regulated utility base, which implicitly means managing or divesting these low-growth, low-return areas.

The divestment of non-core assets, such as minority stakes in transmission companies, also aligns with shedding "Dogs." AEP's sale of a 35% interest in AEP Texas Transmission in 2023 for approximately $250 million exemplifies this strategy, freeing capital from lower-growth ventures.

These "Dog" segments are characterized by low demand growth, limited expansion opportunities, and operations that may only break even or require financial support, necessitating a focus on cost containment rather than expansion.

| Asset Category | BCG Matrix Quadrant | Key Characteristics | 2024/2025 Outlook |

|---|---|---|---|

| Aging Coal-Fired Plants | Dogs | Low growth, high operating costs, regulatory pressure | Accelerated retirement/conversion plans |

| Underperforming Rural Territories | Dogs | Low demand, stagnant customer base, potential subsidies | Focus on operational efficiency, potential divestment |

| Divested Non-Core Assets (e.g., Transmission Stakes) | Dogs (prior to divestment) | Lower growth potential within AEP's core strategy | Capital freed for core business focus |

Question Marks

American Electric Power (AEP) is investigating Small Modular Reactor (SMR) technologies as a way to provide consistent, baseline electricity that works alongside renewable sources like solar and wind. This is a forward-thinking move into a market that could be very significant in the future, but right now, it's very new and not widely used.

SMR technology is still in its early development, meaning it's a high-potential growth area but currently has very little market share. For instance, as of early 2024, only a handful of SMR projects globally are in advanced stages of construction or operation, with most still in design or licensing phases, highlighting the nascent nature of the commercial market.

AEP's investment in SMRs positions them to potentially capture a future leading role, akin to a 'Star' in the BCG matrix. However, this early-stage commitment requires substantial capital expenditure without immediate revenue generation, meaning it's currently a cash consumer with no significant returns, characteristic of a Question Mark in the BCG framework.

AEP's investments in hydrogen energy production and infrastructure pilots fall into the question mark category of the BCG matrix. These are high-growth potential areas within the clean energy transition, focusing on hydrogen as a future energy carrier. However, the commercial viability and widespread adoption of hydrogen are still developing, meaning AEP currently holds a low market share in this nascent segment.

These pilot projects demand substantial capital outlay with uncertain future returns, characteristic of question marks. For instance, the U.S. Department of Energy's Hydrogen Earthshot initiative aims to reduce the cost of clean hydrogen to $1 per kilogram by 2030, signaling significant government backing but also highlighting the current cost challenges that make these ventures speculative.

AEP's strategic consideration of Carbon Capture, Utilization, and Storage (CCUS) technologies positions them within a burgeoning environmental compliance sector, driven by the need to reduce emissions from existing fossil fuel assets. This move acknowledges a high-growth market where regulatory pressures and corporate sustainability goals create significant demand.

However, AEP's current market share in the commercial deployment of CCUS is negligible, as these technologies remain in developmental stages and have not yet achieved broad market adoption. The nascent nature of the CCUS market means AEP is an early explorer rather than an established player.

These CCUS projects represent substantial capital investments with uncertain returns and lengthy development timelines. For instance, the Petra Nova CCUS project in Texas, one of the largest operational facilities, faced significant cost overruns and operational challenges, highlighting the inherent risks and high costs associated with early-stage CCUS deployment.

New Digital Energy Services and Platforms

AEP is actively investing in new digital energy services and platforms, aiming to improve customer engagement and energy management. These innovative offerings are designed to tap into a growing market, but as new ventures, they may currently hold a modest market share.

The success of these digital services hinges on substantial marketing investment and widespread customer adoption to achieve profitability. This strategic positioning, with high growth potential but currently low market share, places these new digital energy services firmly in the question mark category of the BCG Matrix.

- Investment Focus: AEP is channeling resources into advanced digital energy solutions and platforms.

- Market Potential: The digital energy services market is experiencing rapid expansion.

- Current Standing: AEP's new offerings may have a low initial market share in this competitive landscape.

- Growth Strategy: Significant marketing and customer adoption efforts are crucial for these services to mature into profitable ventures.

Exploratory Advanced Geothermal and Other Next-Gen Renewables

Advanced geothermal and other next-generation renewables are currently in the exploratory phase, akin to question marks in the BCG matrix. These technologies, such as enhanced geothermal systems (EGS) and advanced tidal power, are characterized by high investment needs and uncertain commercial viability. For instance, EGS projects, while promising, often require significant upfront capital for drilling and reservoir stimulation, with success rates still being refined.

These nascent technologies operate in markets with minimal current share but possess substantial growth potential, making them speculative. The International Renewable Energy Agency (IRENA) reported that while geothermal energy provided about 0.4% of global electricity generation in 2023, advancements in EGS could significantly expand this, though specific market share for EGS remains negligible.

- High R&D Investment: Significant capital is needed for pilot projects and technology development, with global investment in advanced geothermal R&D showing a steady increase, though specific figures for next-gen renewables are often aggregated.

- Low Market Share: Current market penetration for technologies like advanced geothermal is minimal, representing a tiny fraction of the overall energy mix.

- High Growth Potential: These sectors are poised for rapid expansion if technical and economic hurdles are overcome, with forecasts suggesting advanced geothermal could add significant capacity in the coming decades.

- High Risk Profile: Commercial success is not guaranteed, and projects face technological, geological, and financial risks, impacting their attractiveness to investors.

Question Marks in AEP's portfolio represent ventures with high growth potential but currently low market share, requiring significant investment with uncertain returns. These are strategic bets on emerging technologies and markets that could shape the future energy landscape.

These investments are characterized by substantial capital needs and a lack of established revenue streams, making them cash consumers in the present. Success hinges on overcoming technological hurdles and achieving market acceptance, transforming them into future stars or potentially failing to gain traction.

The key challenge for these Question Marks is to navigate the path from innovation to commercial viability. AEP's approach involves careful resource allocation and a long-term perspective to foster growth in these nascent but promising areas.

AEP's exploration of Small Modular Reactors (SMRs) exemplifies a Question Mark. While the global SMR market is projected to grow significantly, with some estimates suggesting it could reach tens of billions of dollars by the early 2030s, actual operational capacity as of early 2024 remains limited to a few demonstration projects, reflecting a low current market share for AEP in this nascent sector.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer insights, and competitive landscape analysis, to accurately position business units.