Aena SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Aena's robust global airport network and strong brand recognition present significant strengths, but navigating evolving travel regulations and economic downturns poses key challenges. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Aena's global market leadership is undeniable, ranking as the world's top airport operator by passenger traffic. This leadership is built on managing a substantial network, including all 46 airports and two heliports in Spain, London Luton Airport, and operations in Brazil, alongside interests in other international airports.

This extensive operational footprint, handling over 280 million passengers in 2023, grants Aena significant economies of scale. Such a dominant position creates a formidable competitive advantage, underscoring its operational excellence and widespread influence in the aviation industry.

Aena's financial performance remains a significant strength. For the first nine months of 2024, the company reported a remarkable 14.7% increase in revenue, reaching €3.5 billion. This growth was driven by a substantial 10.5% rise in passenger traffic across its network, highlighting strong operational momentum.

Furthermore, Aena's EBITDA saw a healthy jump of 17.2% to €2.3 billion during the same period. This expansion in profitability is a testament to the company's effective cost management strategies and its ability to capitalize on increased passenger volumes, reinforcing its solid financial footing.

Aena has demonstrated a remarkably strong recovery in passenger traffic, outpacing initial expectations and surpassing pre-pandemic figures. This robust rebound highlights the inherent resilience of air travel demand.

Looking ahead, Aena is projecting sustained growth, with ambitious targets to handle over 300 million passengers in Spain by 2025. This upward trajectory is supported by Aena's strategic presence in popular tourist destinations.

Diversified Revenue Streams

Aena's strength lies in its diversified revenue streams, extending well beyond traditional airport operations. The company actively monetizes its extensive airport infrastructure through robust commercial activities and strategic real estate development.

This diversification is evident in the significant growth of non-aeronautical revenues. For instance, in 2023, commercial revenue per passenger saw a notable increase, driven by strong performance in retail, food and beverage, and car parking services. Aena is also developing airport cities, integrating commercial, residential, and business spaces, which further broadens its income base and boosts profitability.

- Diversified Income: Beyond landing fees, Aena generates substantial income from retail, car parks, and VIP services.

- Commercial Growth: Commercial revenue per passenger has shown consistent upward trends, indicating successful monetization strategies.

- Real Estate Development: Projects like airport cities create new revenue avenues and enhance passenger experience.

- Resilience: This multi-faceted revenue model provides greater financial stability and resilience against fluctuations in air traffic alone.

Commitment to Sustainability

Aena demonstrates a robust commitment to sustainability, underscored by its ambitious Climate Action Plan. The company is targeting carbon neutrality by 2026 and net zero emissions by 2030, significantly accelerating its initial timelines. This proactive stance is further evidenced by its consistent inclusion in prominent sustainability indices, reflecting strong adherence to ESG criteria.

The company's dedication to environmental stewardship is backed by substantial investments in renewable energy infrastructure and the electrification of its vehicle fleet. These strategic initiatives not only align with global climate goals but also enhance Aena's appeal to a growing segment of environmentally conscious investors and travelers.

- Carbon Neutrality Target: 2026

- Net Zero Emissions Target: 2030

- Key Investments: Renewable energy, fleet electrification

- Recognition: Inclusion in major sustainability indices

Aena's market leadership as the world's largest airport operator is a significant strength, managing a vast network that handled over 280 million passengers in 2023. This scale provides considerable economies of scale and a strong competitive position.

Financially, Aena is performing exceptionally well, with revenues up 14.7% to €3.5 billion in the first nine months of 2024, driven by a 10.5% increase in passenger traffic. EBITDA also saw a healthy 17.2% rise to €2.3 billion in the same period, showcasing effective cost management.

The company's diversified revenue streams, including retail, car parking, and real estate development, offer resilience and growth beyond traditional aeronautical charges. Commercial revenue per passenger has seen consistent increases, bolstering overall profitability.

Aena's commitment to sustainability is another key strength, with ambitious targets for carbon neutrality by 2026 and net zero emissions by 2030, supported by investments in renewable energy and fleet electrification.

| Metric | 2023 (Full Year) | First Nine Months 2024 |

|---|---|---|

| Passenger Traffic (millions) | ~280+ | N/A (Growth of 10.5%) |

| Revenue (€ billion) | N/A | 3.5 (+14.7%) |

| EBITDA (€ billion) | N/A | 2.3 (+17.2%) |

What is included in the product

Delivers a strategic overview of Aena’s internal and external business factors, mapping its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Aena's strategic challenges and opportunities.

Weaknesses

Aena's significant dependence on the Spanish market presents a notable weakness. In 2024, over 87% of its revenue was generated from Spanish operations, highlighting a strong reliance on the nation's tourism sector and domestic travel patterns.

This concentration makes Aena particularly vulnerable to economic downturns, shifts in tourism demand, and any negative sentiment towards mass tourism specifically within Spain. Such a focused geographical revenue stream limits diversification and amplifies the impact of localized challenges.

Aena's fee structure is subject to significant regulatory oversight, particularly from bodies like Spain's National Commission on Markets and Competition (CNMC). Proposed aeronautical tariff increases, crucial for revenue, frequently encounter pushback from airlines, impacting Aena's ability to fully realize its pricing strategies. This regulatory friction can create uncertainty and strain relationships with key airline partners, potentially limiting revenue growth and profitability in the 2024-2025 period.

Aena's financial health is significantly tied to the broader economic climate, making it vulnerable to inflation, economic downturns, and geopolitical instability. For instance, the lingering effects of global supply chain disruptions and rising energy prices in 2024 continued to pose inflationary pressures that could dampen consumer travel budgets.

These external factors directly impact air travel demand and consumer spending on airport services like retail and parking. A slowdown in economic growth across Aena's key markets, particularly in Europe, could lead to reduced passenger traffic, directly affecting revenue streams.

Furthermore, geopolitical uncertainties, such as ongoing conflicts or trade disputes, can disrupt travel patterns and increase operational costs due to factors like fuel price volatility. In 2024, the aviation sector continued to navigate these complex global dynamics, with potential for unexpected shifts in demand and cost structures.

Significant Capital Expenditure Needs

Aena faces significant capital expenditure needs to maintain and upgrade its vast airport network. For instance, the upcoming DORA II regulatory period (2027-2031) is anticipated to demand substantial investments in modernization and expansion projects across its Spanish airports, including key hubs like Madrid-Barajas and Barcelona-El Prat. These large outlays, while crucial for future growth and competitiveness, can place a strain on the company's cash flow and potentially affect its short-term financial performance if not meticulously planned and executed.

These capital demands are a constant factor for Aena's operational planning.

- Substantial Investment Requirements: Ongoing and future infrastructure upgrades, such as those planned for Madrid and Barcelona, necessitate significant capital allocation.

- Impact on Cash Flow: Large-scale capital expenditures can temporarily reduce available cash, impacting short-term financial flexibility.

- Regulatory Period Influence: New DORA periods, like DORA II, often trigger increased CapEx as airports are modernized and expanded to meet future demand.

- Balancing Growth and Profitability: Efficient management of these expenditures is critical to ensure Aena can invest in growth without compromising immediate profitability.

Increasing Competition from Rail

Aena faces a significant weakness in the increasing competition from Spain's expanding high-speed rail network, particularly for domestic routes. This rail development poses a direct challenge to air travel's dominance on shorter journeys, potentially dampening passenger traffic growth within Spain.

The effectiveness of high-speed rail, like Renfe's AVE services, can lead to a more gradual or even stagnant rate of domestic passenger volume for Aena. This intensified competition could erode Aena's market share in its primary operational region, impacting revenue streams from these domestic segments.

- Rail's Growing Market Share: High-speed rail is capturing a larger portion of intercity travel in Spain, directly competing with short-haul flights.

- Impact on Domestic Traffic: Increased rail convenience and speed on certain corridors may lead to a slowdown in Aena's domestic passenger traffic growth.

- Potential Revenue Erosion: A shift in passenger preference towards rail could negatively affect Aena's revenue derived from domestic air routes.

- 2024/2025 Outlook: Continued investment in rail infrastructure is expected to further solidify this competitive pressure in the coming years.

Aena's substantial reliance on Spanish operations, accounting for over 87% of its revenue in 2024, makes it highly susceptible to domestic economic shifts and tourism trends. This geographical concentration amplifies the impact of any localized challenges, limiting diversification benefits and increasing vulnerability to specific market downturns.

The company's financial performance is closely linked to the broader economic climate, with inflation and potential economic slowdowns in Europe posing risks to travel demand and consumer spending at airports. Geopolitical uncertainties also continue to affect travel patterns and operational costs, as seen with fuel price volatility in 2024.

Aena faces significant capital expenditure requirements for infrastructure upgrades, particularly with the upcoming DORA II regulatory period (2027-2031) demanding substantial investments in Spanish airports. These large outlays can strain cash flow and impact short-term financial flexibility.

Furthermore, the growing competition from Spain's high-speed rail network, such as Renfe's AVE services, poses a direct threat to Aena's domestic passenger traffic. This trend could lead to slower growth or even stagnation in domestic volumes, potentially eroding revenue from these routes.

Preview the Actual Deliverable

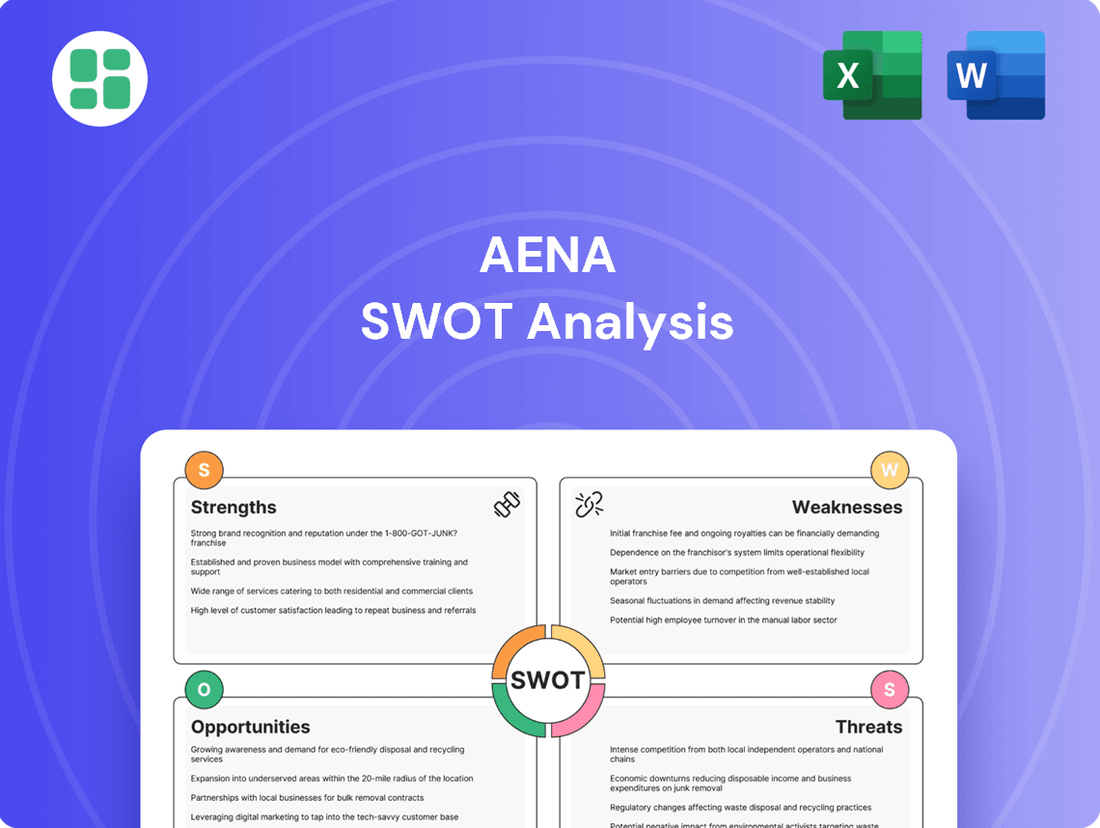

Aena SWOT Analysis

The preview you see is the actual Aena SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version detailing Aena's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, offering a comprehensive look at Aena's strategic position, becomes available after checkout.

Opportunities

Aena has a clear opportunity to grow its global presence, with a particular focus on Latin America and the potential acquisition of smaller European airports. This strategic move would lessen its dependence on Spain and allow it to capitalize on expanding air travel markets.

For example, Aena’s investment in Brazil's Aeroportos Brasil Viracopos and its expansion at London Luton Airport in 2024 demonstrate this commitment to international growth. These ventures are crucial for tapping into diverse aviation landscapes and achieving greater market penetration.

Aena has a significant opportunity to boost its profitability by expanding high-margin non-aeronautical revenue streams. This involves smart commercial innovation and strategic real estate development across its airport network.

By optimizing retail layouts, upgrading VIP services, and building robust digital platforms, Aena can enhance the passenger experience and capture more spending. For instance, in 2023, Aena’s non-aeronautical revenues reached €1,917.9 million, a notable increase, highlighting the potential for further growth.

Monetizing underutilized land assets presents another avenue for revenue enhancement. This strategic approach can significantly increase per-passenger revenue, contributing to overall financial performance and resilience.

Aena can significantly boost its performance by embracing digital transformation. Investing in advanced digital solutions, like AI-powered security screening and predictive maintenance for infrastructure, is key. For instance, in 2024, airports globally are seeing a push for biometric boarding, aiming to reduce processing times by up to 50%.

Enhancing the passenger journey through personalized digital services, such as real-time flight updates and tailored retail offers via mobile apps, offers a substantial opportunity. Aena's commitment to innovation saw a 15% increase in digital service adoption among passengers in 2023, a trend expected to continue as more seamless digital touchpoints are introduced.

Leadership in Sustainable Aviation

Aena can amplify its influence by aggressively pursuing decarbonization and championing Sustainable Aviation Fuels (SAF). This strategic push positions Aena as a frontrunner in environmental, social, and governance (ESG) practices.

This commitment resonates with airlines and travelers increasingly prioritizing sustainability, potentially unlocking new investment streams and bolstering Aena's public image. For instance, in 2023, the aviation sector's SAF usage, while still nascent, saw significant growth, with projections indicating a continued upward trend through 2025, driven by regulatory pressures and corporate commitments.

- ESG Leadership: Aena's proactive stance on decarbonization can establish it as a benchmark for environmental responsibility in the aviation industry.

- Attracting Stakeholders: A focus on SAF and sustainability appeals to environmentally conscious airlines and passengers, fostering loyalty and new partnerships.

- Financial Opportunities: Enhanced brand reputation and alignment with global ESG goals can attract green financing and investment, supporting future growth initiatives.

- Market Differentiation: Leading in sustainable aviation practices provides a competitive edge, setting Aena apart in a rapidly evolving global market.

Capacity Expansion and Infrastructure Upgrades

Aena has a significant opportunity to expand capacity and upgrade infrastructure, especially as many Spanish airports are nearing their operational limits. Passenger traffic is projected to grow robustly, making these investments essential for maintaining service standards and efficiency.

Key projects are already underway to address this demand.

- Madrid-Barajas Airport (MAD): Expansion plans are in motion to increase capacity and modernize facilities.

- Barcelona-El Prat Airport (BCN): Similar expansion initiatives are being pursued to handle anticipated passenger increases.

- London Luton Airport (LLA): Aena continues to invest in upgrades at LLA to enhance its operational capabilities and passenger experience.

These strategic expansions are vital for Aena to capitalize on projected passenger growth and ensure long-term operational excellence across its network.

Aena can capitalize on growing global air travel by expanding its international footprint, particularly in Latin America, and by potentially acquiring smaller European airports to diversify revenue streams and reduce reliance on the Spanish market. For example, Aena's continued investment in Brazil's Aeroportos Brasil Viracopos and its ongoing development at London Luton Airport in 2024 highlight this strategic international push.

Boosting non-aeronautical revenue through commercial innovation and real estate development across its airport network presents a significant opportunity for enhanced profitability. Aena's non-aeronautical revenues reached €1,917.9 million in 2023, a notable increase, demonstrating substantial room for further growth by optimizing retail, VIP services, and digital platforms.

Embracing digital transformation, including AI-powered security and predictive maintenance, can streamline operations and improve passenger experience, with airports globally aiming to reduce processing times via technologies like biometric boarding. Aena's own digital service adoption saw a 15% rise in 2023, indicating strong potential for further gains.

Aena has a clear opportunity to lead in sustainability by aggressively pursuing decarbonization and championing Sustainable Aviation Fuels (SAF), aligning with increasing airline and passenger demand for ESG practices. This focus can attract green financing and differentiate Aena in the evolving aviation landscape, with SAF usage projected for continued growth through 2025.

Threats

Economic downturns pose a significant threat to Aena, as a slowdown in global or regional economies directly impacts air travel demand. This can translate to fewer passengers and reduced ancillary revenue from airport services. For instance, a projected global GDP growth slowdown in 2024 could curb discretionary spending on travel.

Inflationary pressures are another key concern, driving up Aena's operational expenses. Rising costs for fuel, utilities, and wages can erode profit margins. With inflation rates remaining elevated in many key markets through 2024, Aena faces the challenge of balancing cost containment with necessary investments in infrastructure and service quality.

Regulatory bodies' decisions on airport charges, or tariffs, represent a significant threat to Aena's revenue expansion. For instance, if the Spanish airport regulator, AESA, were to reject or heavily curtail Aena's proposed tariff increases for the upcoming regulatory period, it could directly impact the company's financial health. This would limit Aena's capacity to invest in critical infrastructure upgrades and maintain its high service standards, potentially jeopardizing its financial objectives.

Geopolitical instability poses a significant threat to Aena, as evidenced by the impact of the Russia-Ukraine conflict. This conflict, ongoing through 2024, has led to airspace closures and rerouting, affecting flight paths and potentially increasing operational costs for airlines serving affected regions, which in turn can reduce passenger demand on certain routes. Furthermore, the lingering effects of health crises, such as the COVID-19 pandemic, continue to influence travel sentiment and government regulations, creating uncertainty for Aena's passenger traffic forecasts.

Intensifying Competition

Aena faces intensifying competition not only from other airport operators but also from alternative transportation modes, particularly high-speed rail, which is gaining traction in key European markets. This can divert passenger traffic and impact Aena's revenue streams.

In international expansion efforts, Aena encounters established global players and emerging regional operators. For instance, the privatization and expansion of airports in the Middle East and Asia present significant competitive challenges for Aena's bid for new concessions. This could lead to increased bidding costs and potentially lower returns on investment.

The competitive landscape forces Aena to consider more aggressive pricing strategies and enhanced marketing campaigns to retain and attract airlines and passengers. For example, in 2023, while Aena saw passenger traffic rebound significantly, competition for airline route development remains fierce, requiring substantial incentives and service improvements.

- Increased competition from other airport operators globally, particularly in emerging markets.

- Rivalry from high-speed rail networks impacting short-haul air travel.

- Potential for pricing pressures and reduced profitability due to competitive bidding for concessions.

- Challenges in securing new international contracts amidst a crowded marketplace.

Stricter Environmental Regulations and Costs

While Aena is actively pursuing sustainability initiatives, the increasing stringency of environmental regulations, especially those targeting carbon emissions and noise pollution, presents a significant threat. These evolving rules could translate into higher compliance expenses and impose operational limitations on Aena's airport activities.

The global push for faster decarbonization may necessitate substantial and potentially unbudgeted capital expenditures for Aena. For instance, investments in sustainable aviation fuels or advanced noise reduction technologies, while necessary, could impact the company's financial performance and profitability in the short to medium term.

- Increased Compliance Costs: Stricter regulations on emissions and noise could force Aena to invest in new technologies or operational changes, raising operational expenses.

- Operational Restrictions: New environmental rules might limit flight schedules, aircraft types, or infrastructure development, affecting capacity and revenue generation.

- Decarbonization Investment Pressure: The need to accelerate emissions reduction could require significant capital outlays for sustainable aviation fuel infrastructure, electric ground support equipment, and other green technologies, potentially impacting return on investment.

Aena faces significant threats from economic volatility, with a projected slowdown in global GDP growth for 2024 potentially dampening travel demand. Inflationary pressures are also a concern, driving up operational costs for fuel and wages, impacting profit margins. Furthermore, regulatory decisions on airport charges, if unfavorable, could limit revenue expansion and investment capacity.

Geopolitical instability, exemplified by the ongoing Russia-Ukraine conflict, continues to disrupt air travel through airspace closures and rerouting, potentially increasing airline costs and reducing passenger traffic on certain routes. Lingering effects from health crises also create uncertainty in travel sentiment and regulatory environments.

Intensifying competition from other airport operators and high-speed rail networks poses a threat to Aena's market share and revenue streams. The company must navigate aggressive pricing strategies and enhanced marketing to retain airlines and passengers, as seen in the competitive route development landscape in 2023.

The increasing stringency of environmental regulations, particularly concerning carbon emissions and noise pollution, presents a substantial threat. These evolving rules could lead to higher compliance costs and operational restrictions, while the global push for decarbonization may necessitate significant, potentially unbudgeted, capital expenditures for Aena to adopt sustainable technologies.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of Aena's official financial reports, comprehensive market intelligence from leading industry analysts, and insights from aviation sector experts. These diverse and reliable data streams ensure a thorough and accurate assessment of the company's strategic position.