Aena Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Aena's competitive landscape is shaped by powerful forces, from the intense rivalry among airlines to the significant bargaining power of its customers. Understanding these dynamics is crucial for any stakeholder.

The complete Porter's Five Forces Analysis for Aena delves into each of these pressures, providing a comprehensive view of its market position. Unlock actionable insights to refine your strategy.

Suppliers Bargaining Power

Aena's reliance on specialized suppliers for critical infrastructure, such as air traffic control systems and advanced security equipment, creates a significant dependency. The concentration of these highly specialized providers means that if there are few alternatives for essential components or services, these suppliers gain considerable bargaining power. For instance, in 2024, the global market for advanced air traffic management systems saw a consolidation trend, with a few key players dominating.

The uniqueness of the offerings from these suppliers, coupled with the substantial costs and operational disruptions associated with switching to new providers, further amplifies their leverage. This means Aena may face higher prices or less favorable terms if these suppliers are indispensable for maintaining operational efficiency and safety standards. The investment required to qualify and integrate new suppliers for such critical systems can run into millions of euros, making switching a complex and costly decision.

The bargaining power of suppliers for Aena is significantly influenced by high switching costs, particularly for critical infrastructure like air traffic management and airport security systems. These specialized systems require substantial investment and expertise, making it costly and time-consuming for Aena to change providers. For instance, the integration of new security screening technology can involve millions in capital expenditure and extensive staff retraining, creating a strong incentive for Aena to maintain existing relationships.

While forward integration by suppliers is a less common threat in the airport sector, highly specialized technology or service providers could theoretically consider it. The capital investment and regulatory complexities are substantial barriers, however. For instance, a provider of advanced air traffic control systems might envision offering integrated management services, but the sheer scale of airport operations makes this a significant undertaking.

Nonetheless, these suppliers possess leverage through their proprietary solutions and the ability to bundle services. Aena, like other airport operators, relies on their technology to ensure operational efficiency and uphold stringent safety standards. For example, the adoption of new biometric screening technologies, often provided by specialized firms, directly impacts passenger flow and security, giving these suppliers a degree of bargaining power.

Importance of Supplier Inputs to Aena's Operations

The quality and reliability of essential inputs for Aena are critical. This includes everything from the construction materials used for runways to the sophisticated IT systems managing passenger flow, and even the consistent supply of energy. A disruption or a dip in the quality of these fundamental components can directly hinder Aena's ability to operate smoothly and maintain its service standards.

This dependence on specific, high-quality inputs grants significant leverage to the suppliers providing them. If a key supplier faces issues or decides to alter terms, Aena's core business operations are immediately vulnerable, underscoring the substantial bargaining power these suppliers can wield.

- Critical Inputs: Construction materials, IT systems for passenger management, and energy supply are vital for Aena's continuous operations.

- Operational Impact: Any disruption or quality decline from these suppliers can severely affect Aena's core business and service delivery.

- Supplier Leverage: The essential nature of their products gives these suppliers considerable bargaining power over Aena.

- Supply Chain Focus: Aena must prioritize robust supply chain management to mitigate these risks and maintain operational resilience.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier bargaining power for Aena. For highly specialized airport equipment and services, such as advanced air traffic control systems or unique runway maintenance machinery, the options for Aena are often limited. This scarcity of alternatives directly strengthens the bargaining power of the few suppliers capable of providing these critical components.

Conversely, when Aena procures more commoditized inputs, like standard construction materials or office supplies, the landscape shifts. In these markets, a broader range of suppliers exists, offering Aena greater choice and thereby reducing the leverage of any single supplier. For example, in 2024, the global construction materials market offered a wide array of options for basic building components, allowing Aena to negotiate more favorable terms.

To effectively manage this dynamic, Aena can strategically diversify its supplier base across various input categories. By cultivating relationships with multiple providers for non-specialized goods and actively seeking out alternative solutions for specialized needs, Aena can mitigate the risk of over-reliance on any single supplier. This proactive approach is crucial for maintaining cost control and operational flexibility.

- Limited Substitutes for Specialized Airport Equipment: Suppliers of unique, high-tech airport infrastructure hold significant power due to the scarcity of alternatives.

- Abundant Substitutes for Commoditized Inputs: For standard items like building materials, Aena benefits from a competitive supplier market.

- Strategic Supplier Diversification: Aena's ability to mitigate supplier power hinges on building a robust and varied supplier network.

Aena's bargaining power with suppliers is significantly challenged by the critical nature of specialized inputs, such as advanced air traffic control systems and security equipment. The limited number of providers for these essential technologies, exemplified by the consolidation in the air traffic management systems market in 2024, grants these suppliers considerable leverage. This scarcity, coupled with the high costs and operational risks associated with switching providers, means Aena often faces less favorable terms and pricing from these key partners.

The high switching costs for specialized airport infrastructure, including millions in capital expenditure and extensive staff retraining for new security screening technologies, solidify supplier power. While forward integration by suppliers is a distant threat due to the immense capital and regulatory hurdles, their proprietary solutions for critical functions like passenger flow and security management give them substantial influence. For instance, new biometric screening technologies directly impact airport efficiency.

Aena's reliance on a consistent supply of high-quality inputs, from construction materials to sophisticated IT systems and energy, makes it vulnerable to supplier actions. Any disruption or quality decline in these fundamental components directly impacts Aena's core operations and service standards, granting suppliers significant leverage due to the essential nature of their products.

The bargaining power of suppliers is also shaped by the availability of substitutes. While commoditized inputs like basic construction materials face a competitive market in 2024, offering Aena negotiation advantages, specialized airport equipment has far fewer alternatives. This disparity highlights the need for Aena to strategically diversify its supplier base to mitigate over-reliance and maintain cost control.

| Factor | Impact on Aena | Example/Data (2024) |

| Supplier Concentration | Increases supplier power | Consolidation in advanced air traffic management systems market |

| Switching Costs | Increases supplier power | Millions in capital and retraining for new security tech |

| Input Criticality | Increases supplier power | IT systems for passenger flow, energy supply |

| Availability of Substitutes | Decreases supplier power for commoditized inputs, increases for specialized | Wide options for basic construction materials vs. limited for unique airport machinery |

What is included in the product

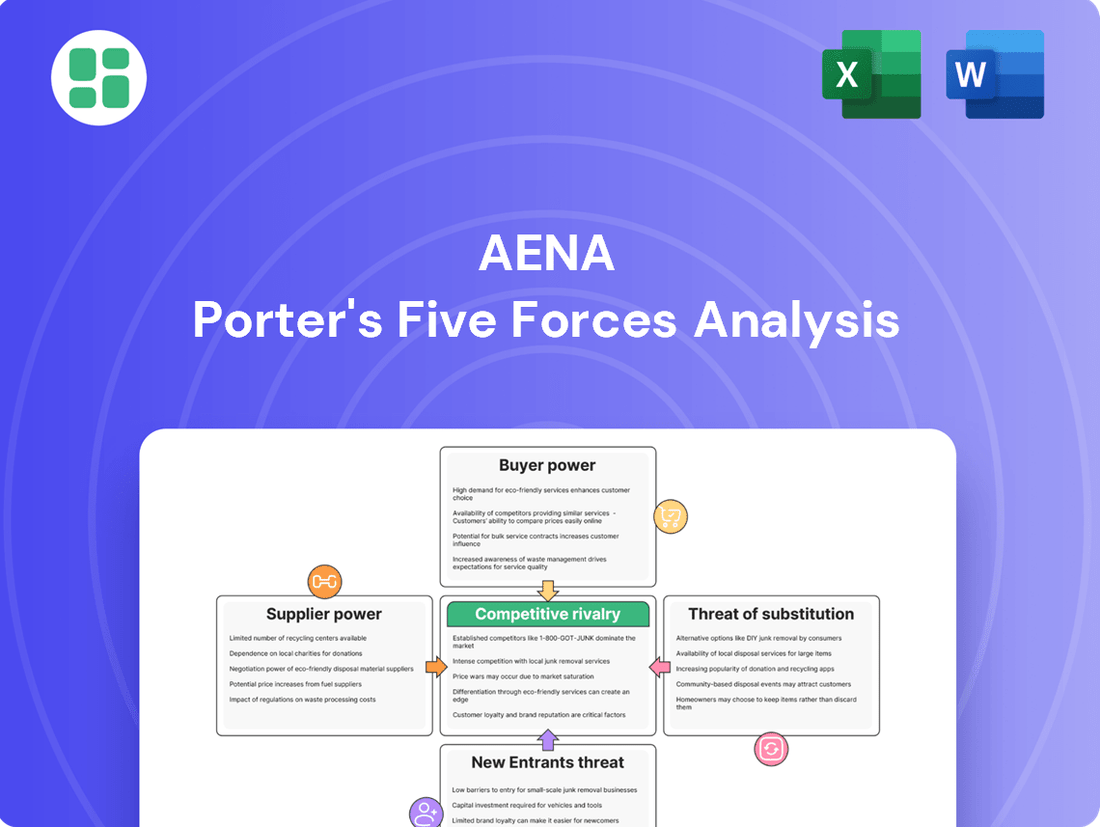

This analysis dissects the competitive landscape for Aena by examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Instantly identify and address competitive threats by visually mapping the intensity of each of Porter's five forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Aena's primary customers are airlines, and a few major carriers represent a substantial portion of its passenger traffic. For instance, in 2023, airlines like Ryanair and Vueling are key players at many of Aena's airports, their significant passenger volumes giving them some leverage.

These large airlines, especially those operating as hub carriers, can exert bargaining power due to their substantial contribution to Aena's revenue. Their ability to shift routes or capacity can impact airport usage and, consequently, Aena's financial performance.

However, Aena's strong market position as the sole operator of many of Spain's busiest airports significantly mitigates this customer power. This near-monopoly status allows Aena to maintain considerable control over pricing and terms, limiting the airlines' ability to dictate favorable conditions.

While individual passengers wield minimal direct influence over Aena, their aggregated travel decisions significantly impact airline demand, which in turn affects Aena's revenue. In 2023, the average airfare for domestic flights in the EU saw a slight increase, reflecting underlying cost pressures that can be passed on to consumers.

Passengers are acutely aware of the total cost of travel, including any airport-related charges that airlines incorporate into ticket prices. However, for many routes, particularly international ones, passengers often face a scarcity of direct alternative travel options, limiting their ability to negotiate or switch away from specific airports or airlines.

Concessionaires, including retailers and food and beverage operators, represent a crucial customer base for Aena's commercial revenue streams. Their bargaining power is directly influenced by the airport's appeal, passenger volume, and the availability of competing operators for their services.

In 2024, Aena's airports continued to see robust passenger traffic, with total passengers reaching 283.4 million in the first half of the year, a 10.4% increase compared to the same period in 2023. This high footfall generally diminishes the bargaining power of concessionaires, as prime airport locations are highly sought after.

Threat of Backward Integration by Customers

The threat of backward integration by Aena's customers, primarily airlines, is exceptionally low. Airlines generally lack the substantial capital, intricate regulatory navigation, and specialized operational knowledge needed to own and manage large commercial airports.

This inability for airlines to integrate backward means they cannot easily produce the airport services Aena provides themselves. Consequently, their leverage to negotiate lower fees or more favorable terms with Aena is significantly curtailed.

Consider that in 2024, the global airport infrastructure market is valued in the hundreds of billions of dollars, with individual major airport developments costing billions. For an airline to undertake such a project would divert immense resources from their core business of air transport.

- Low Likelihood of Airline Airport Ownership: The capital expenditure for a single major airport can run into billions of euros, a prohibitive cost for most airlines.

- Regulatory Hurdles: Airport operation is subject to stringent aviation regulations and security protocols that are distinct from airline operations.

- Operational Expertise Gap: Managing complex airport infrastructure, air traffic control, and diverse passenger services requires specialized skills airlines typically do not possess.

- Focus on Core Competencies: Airlines concentrate their investments and efforts on fleet management, route development, and passenger service, rather than airport infrastructure.

Switching Costs for Customers

Switching costs for customers significantly influence their bargaining power. For airlines, shifting operations between airports within a region can be a complex and costly undertaking. These costs can include reconfiguring flight routes, reapplying for valuable slot allocations, and making substantial operational adjustments, particularly for airlines that rely on a hub-and-spoke model. For instance, a major carrier might face millions in reprogramming and operational setup costs to move its primary hub.

For individual passengers, the decision to switch airports is often tied to a broader travel plan. Changing airports usually necessitates selecting an entirely different travel itinerary, which can introduce significant inconvenience or even render the journey impractical. This inherent difficulty in switching, coupled with the potential for higher overall travel costs if a less convenient airport is chosen, diminishes their individual ability to negotiate better terms or prices with airport operators like Aena.

- Airline Switching Costs: Airlines face substantial financial and operational hurdles when switching between airports, impacting their leverage.

- Passenger Inconvenience: For passengers, switching airports often means a complete itinerary change, limiting their bargaining power due to practical constraints.

- Hub Operations Impact: Hub-and-spoke airlines experience particularly high switching costs due to the interconnected nature of their operations.

Aena's customers, primarily airlines and concessionaires, possess varying degrees of bargaining power. While major airlines can exert influence due to their significant passenger volumes, Aena's dominant market position in Spain largely counteracts this. Individual passengers have minimal direct power, though their aggregate travel choices impact demand.

The bargaining power of concessionaires is generally low, especially given the robust passenger traffic at Aena's airports. In the first half of 2024, Aena served 283.4 million passengers, a 10.4% increase year-on-year, making its locations highly desirable and reducing concessionaires' leverage.

The threat of backward integration by airlines is negligible due to the immense capital, regulatory complexities, and specialized expertise required to operate airports. For example, building a new major airport can cost billions, a prohibitive investment for airlines focused on their core operations.

Switching costs for airlines are substantial, involving route reprogramming and slot reapplication, which limits their ability to negotiate favorable terms. Similarly, passengers face significant inconvenience and potential cost increases when switching airports, further diminishing their bargaining power.

| Customer Segment | Bargaining Power Factors | Aena's Mitigating Factors | 2023/2024 Data Point |

|---|---|---|---|

| Airlines | Passenger volume, route dependency | Dominant market share, high switching costs for airlines | Ryanair and Vueling are key carriers at many Aena airports |

| Concessionaires | Airport appeal, passenger footfall | High passenger traffic reduces competition for locations | 283.4 million passengers in H1 2024 |

| Individual Passengers | Limited direct influence, price sensitivity | High switching costs (inconvenience, itinerary changes) | Average EU domestic airfare saw a slight increase in 2023 |

Preview the Actual Deliverable

Aena Porter's Five Forces Analysis

This preview showcases the complete Aena Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing sections. You're looking at the actual, professionally formatted analysis, ready for immediate download and use without any further modifications.

Rivalry Among Competitors

Aena's position in Spain is one of near-monopoly, as it operates the vast majority of the country's major airports. This significantly dampens direct competition for airport management services within Spain. For instance, in 2023, Aena managed 46 airports in Spain, handling over 274 million passengers.

This dominant market share grants Aena substantial leverage, allowing it to exert considerable influence over pricing structures and the quality of services provided across its network. Such a powerful market position inherently limits the intensity of competitive rivalry from domestic airport operators.

While Aena's domestic market for airport management is relatively consolidated, the global stage presents a significantly different picture. When bidding for new management concessions or privatization projects outside of Spain, Aena encounters fierce competition from established international airport operators. This global rivalry is a key factor, as companies like Vinci Airports, Fraport, and Changi Airports International actively vie for lucrative contracts worldwide.

The competition in this international arena is not just about who can offer the lowest bid. Instead, it hinges on a combination of factors, including demonstrable operational efficiency, the strength and attractiveness of financial proposals, and a proven track record of successful airport management and development. For instance, Vinci Airports, a major global player, reported managing 66 airports across 12 countries in 2023, highlighting the scale of the competition Aena faces.

This intense global competition necessitates that Aena continuously refines its strategies and maintains a sharp competitive edge. Success in securing new concessions requires showcasing superior service quality, innovative technological integration, and a clear vision for airport development that aligns with host country objectives. Aena's ability to adapt and excel in these diverse international markets is crucial for its ongoing global expansion and revenue growth.

While many airport services appear standardized, differentiation is key. Aena focuses on enhancing passenger experience through efficiency, advanced retail options, and cutting-edge technology. This strategy aims to make its airports more attractive to both airlines and travelers compared to competitors.

In 2024, Aena continued its investment in digital transformation, with significant progress reported in its airport digitalization programs. For instance, the implementation of advanced passenger flow management systems across its Spanish airports aims to reduce wait times, a critical factor in passenger satisfaction and airline choice.

Aena's commercial partnerships are also a significant differentiator. By securing exclusive retail brands and diverse dining options, the company enhances non-aeronautical revenues and improves the overall passenger journey. This focus on commercial development contributed to Aena's robust financial performance in 2024, with commercial revenues showing a strong upward trend.

Industry Growth Rate and Investment Cycles

The airport industry is inherently cyclical, marked by extended investment timelines and substantial capital outlays for infrastructure development. While robust passenger traffic growth typically fuels revenue streams, periods of deceleration can heighten rivalry as companies vie for a larger share of existing passenger volumes. Aena's strategic capital allocation towards capacity expansion and facility upgrades is a critical determinant of its competitive positioning over the long haul.

For instance, Aena's 2024 capital expenditure plan includes significant investments in airport modernization and expansion projects across its network. This focus on enhancing infrastructure aims to accommodate projected traffic increases and improve operational efficiency, directly impacting its competitive edge.

- Long Investment Cycles: Airports require decades-long planning and execution for major upgrades, making strategic foresight crucial.

- Capital Intensity: Projects like runway extensions or new terminal constructions demand billions in investment.

- Traffic Growth Impact: Fluctuations in passenger numbers directly influence the intensity of competition for market share.

- Aena's Strategic Investments: Ongoing capital expenditure in 2024 targets capacity enhancements and modernization to bolster competitive standing.

Exit Barriers for Competitors

Exit barriers in the airport operating industry are exceptionally high, primarily due to the substantial investment in fixed assets and the nature of long-term concession agreements. These factors lock operators into markets for extended periods, significantly deterring quick exits even in the face of intense competition.

The specialized infrastructure required for airport operations, such as runways, terminals, and air traffic control systems, represents a massive capital outlay. This specialization also means that these assets have limited alternative uses, further increasing the cost and difficulty of exiting a market. For instance, Aena, a major global airport operator, manages concessions that often span decades, making early termination financially prohibitive.

- Massive Fixed Assets: Airports require billions in upfront investment for infrastructure, making divestment challenging.

- Long-Term Concessions: Contracts with governments typically last 30-50 years, creating a long-term commitment.

- Specialized Infrastructure: Airport-specific facilities have low salvage value in other industries.

- Sustained Rivalry: High exit barriers encourage existing players to remain, intensifying competition for new concessions and operational efficiency.

While Aena dominates the Spanish airport management sector, its competitive rivalry intensifies significantly on the global stage. International operators like Vinci Airports and Fraport actively compete for new concessions, requiring Aena to showcase operational efficiency and strong financial proposals. For example, Vinci Airports managed 66 airports across 12 countries in 2023, illustrating the scale of this global competition.

Aena's strategy to counter this rivalry involves differentiating itself through enhanced passenger experiences, digital transformation, and strategic commercial partnerships. Investments in 2024, such as advanced passenger flow management systems, aim to improve efficiency and passenger satisfaction. These efforts are crucial for Aena to maintain its competitive edge against established international players vying for global airport contracts.

| Competitor | Number of Airports Managed (2023) | Countries of Operation (2023) |

|---|---|---|

| Vinci Airports | 66 | 12 |

| Fraport | 13 (International) | 10 (International) |

| Changi Airports International | N/A (Focus on consultancy and management contracts) | N/A |

SSubstitutes Threaten

High-speed rail networks, especially in Spain, present a strong substitute for short-haul domestic flights. For key routes like Madrid to Barcelona, rail travel offers comparable journey times, often more attractive pricing, and the convenience of city-center arrival, directly affecting Aena's passenger numbers on these segments.

In 2023, Renfe's high-speed services saw significant growth, carrying over 22 million passengers nationwide, with the Madrid-Barcelona corridor being a major contributor. This trend suggests a continued challenge to short-haul air travel for Aena.

The growing sophistication of teleconferencing and virtual communication platforms presents a significant threat of substitutes for traditional business travel. These technologies can directly replace the need for many face-to-face meetings, potentially impacting Aena's passenger volumes, particularly in the business segment.

While virtual meetings cannot fully replicate the benefits of in-person interactions, their increasing effectiveness could slow the recovery of business travel post-pandemic. For instance, in 2024, many companies continued to explore hybrid work models, suggesting a sustained shift away from mandatory business trips.

For certain types of goods, alternative modes of cargo transport like sea freight or road transport present a significant threat of substitution to air cargo. While air freight excels in speed, these alternatives often prove more cost-effective for shipments where time is not the primary concern. This cost advantage can divert a considerable portion of freight volume away from air cargo services, impacting Aena's operations.

Cruise Travel as a Leisure Travel Substitute

Cruise travel presents a significant threat of substitution for traditional air travel, particularly for leisure holidays. While not a direct replacement for all journeys, the allure of a cruise can divert a portion of tourism spending and passenger volume that might otherwise flow through airports like Aena's. This is especially noticeable for international destinations accessible by sea, impacting coastal airports more directly.

The appeal of cruise vacations often lies in their all-inclusive nature and the ability to visit multiple destinations without the hassle of frequent packing and unpacking. This convenience factor can be a strong draw for certain traveler segments. For instance, in 2024, the global cruise industry saw a robust recovery, with major cruise lines reporting strong booking numbers, indicating a healthy demand that competes for leisure travel budgets.

- Cruise passengers can represent a diversion of tourism expenditure from air travel.

- The convenience of multi-destination travel on a cruise can be a substitute for individual flight bookings.

- Coastal airports are more susceptible to this substitution threat than inland hubs.

- Strong cruise industry growth in 2024 suggests a competitive pull on leisure travel demand.

Impact of Economic Downturns on Discretionary Travel

Economic downturns present a significant threat of substitutes for Aena, primarily through the simple act of consumers choosing not to travel at all. When economies falter, discretionary spending, including leisure travel and non-essential business trips, is often the first to be cut. This behavior directly substitutes for air travel by eliminating the demand altogether.

For instance, during periods of economic contraction, individuals may opt for domestic vacations instead of international ones, or choose staycations over flying. This shift in consumer behavior directly impacts passenger volumes, a key revenue driver for airport operators like Aena. The International Air Transport Association (IATA) has noted that passenger traffic is highly sensitive to economic cycles, with downturns leading to reduced travel demand.

Consider the impact of a recessionary environment on Aena's operations. If consumer confidence plummets and unemployment rises, fewer people have the disposable income or the inclination to book flights. This reduction in travel is a direct substitution for the services Aena provides. In 2023, while air travel saw a strong recovery, the lingering effects of inflation and potential economic slowdowns in key markets could still dampen discretionary spending on travel in 2024.

- Reduced Discretionary Spending: Economic downturns lead consumers to cut back on non-essential expenses like vacations.

- Shift to Domestic or Local Travel: Travelers may opt for closer destinations, bypassing longer-haul flights managed by Aena.

- Foregoing Travel Entirely: The most potent substitute is simply choosing not to travel, eliminating demand for airport services.

The threat of substitutes for Aena primarily stems from alternative transportation modes and technological advancements that reduce the need for air travel. High-speed rail, particularly in Spain, offers competitive journey times and convenience for short-haul domestic routes, directly impacting passenger numbers. For instance, Renfe's high-speed services carried over 22 million passengers in 2023, with the Madrid-Barcelona corridor being a key contributor.

Virtual communication technologies also pose a threat by replacing some business travel, a segment that continued to be influenced by hybrid work models in 2024. Furthermore, economic downturns can lead consumers to forgo travel altogether or opt for less expensive alternatives, significantly reducing demand for air services.

| Substitute | Impact on Aena | Key Data/Trend |

|---|---|---|

| High-Speed Rail | Competition on short-haul domestic routes | Renfe carried over 22 million passengers in 2023. |

| Virtual Communication | Reduced business travel demand | Continued adoption of hybrid work models in 2024. |

| Economic Downturns | Reduced overall travel demand (foregoing travel, cheaper alternatives) | Passenger traffic is sensitive to economic cycles; inflation concerns in 2024. |

| Cruise Travel | Diversion of leisure travel expenditure and passenger volume | Strong recovery and booking numbers in the cruise industry in 2024. |

Entrants Threaten

The threat of new companies entering the airport management and operation sector is significantly low. This is primarily because the sheer amount of money needed to build or buy airport facilities is astronomical. For instance, constructing a new major airport or even undertaking substantial upgrades to an existing one can easily run into billions of dollars, presenting a massive financial hurdle for any potential new player.

The airport sector faces significant barriers due to extensive regulatory hurdles and the need for numerous approvals. New entrants must contend with rigorous environmental impact assessments, stringent safety certifications, and complex air traffic control regulations. For instance, in 2024, the European Union continued to emphasize harmonized safety standards, requiring new airport operators to demonstrate compliance with EASA (European Union Aviation Safety Agency) regulations, a process that can take years and significant investment.

Government concessions and existing monopoly structures present a substantial threat of new entrants in airport operations. In many nations, including Spain, airport management is frequently governed by exclusive government-granted concessions or operated by state-owned entities, effectively establishing natural monopolies or tight oligopolies. For instance, Aena, the Spanish airport operator, manages a significant portion of air traffic within Spain, creating a formidable barrier for any potential new competitor seeking to enter the market.

New players face the daunting task of successfully navigating highly competitive and irregularly scheduled concession tenders. These tenders are often complex, lengthy, and require substantial upfront investment and proven operational capabilities. Overcoming the deeply entrenched market position of incumbent operators, who benefit from established infrastructure, customer loyalty, and regulatory familiarity, represents a significant hurdle that deters many potential new entrants.

Limited Land Availability and Infrastructure

The threat of new entrants for airport operators like Aena is significantly mitigated by the scarcity of suitable land and the immense infrastructure requirements. Identifying and acquiring land for new airport development, particularly in proximity to established population hubs, presents a considerable challenge, driving up acquisition costs. For instance, in 2024, the cost of prime real estate suitable for such large-scale projects continued its upward trajectory, making greenfield developments prohibitively expensive.

Beyond land acquisition, the sheer scale of investment needed for supporting infrastructure acts as a formidable barrier. This includes not only the airport terminals and runways but also crucial elements like air traffic control systems, extensive road and rail connectivity, and specialized ground handling facilities. The complexity and capital intensity of these undertakings mean that establishing a new airport from scratch is an exceptionally rare occurrence, effectively limiting the competitive pressure from potential new players.

- Land Scarcity: Difficulty and high cost of acquiring suitable land near population centers in 2024.

- Infrastructure Costs: Substantial investment required for roads, rail, air traffic control, and ground handling facilities.

- Capital Intensity: The immense financial commitment makes new airport construction a rare event.

Economies of Scale and Operational Expertise

Established airport operators, such as Aena, leverage substantial economies of scale that are difficult for newcomers to replicate. This scale translates into significant cost advantages in areas like bulk purchasing of supplies, centralized maintenance, and the efficient allocation of shared services across their extensive network. For instance, in 2023, Aena managed 46 airports, facilitating cost savings through its sheer operational volume.

New entrants would face a steep climb to achieve comparable cost efficiencies. They would lack the accumulated operational expertise, honed over decades, which allows incumbents to streamline processes, manage labor effectively, and optimize resource utilization. This deficit in both scale and experience creates a considerable barrier, making it challenging for new players to compete on price or operational performance.

- Economies of Scale: Aena's 2023 network of 46 airports provides a cost advantage in procurement and shared services.

- Operational Expertise: Decades of experience enable efficient management and resource allocation, a key advantage over new entrants.

- Cost Disadvantage: Newcomers would struggle to match the cost efficiencies derived from established scale and expertise.

The threat of new entrants in the airport sector is notably low due to immense capital requirements and regulatory complexities. High upfront costs for land and infrastructure, coupled with stringent safety and environmental approvals, create significant barriers. For instance, constructing a new major airport can easily cost billions, a hurdle few can overcome.

Government concessions and existing market dominance, often held by state-owned entities or large private operators like Aena, further restrict new market entry. These established players benefit from deep-rooted infrastructure, regulatory familiarity, and economies of scale, making it exceptionally difficult for newcomers to compete effectively. The scarcity of suitable land in 2024 also exacerbates these challenges.

| Barrier Type | Description | Example/Data Point (2023-2024) |

|---|---|---|

| Capital Requirements | Enormous investment needed for land, construction, and supporting infrastructure. | Major airport projects often exceed billions of USD in development costs. |

| Regulatory Hurdles | Extensive approvals for safety, environmental impact, and air traffic control. | Compliance with EASA regulations in 2024 requires significant time and investment. |

| Government Concessions/Monopolies | Exclusive operating rights granted by governments limit competition. | Aena's significant share of Spanish airport operations creates a strong incumbent advantage. |

| Economies of Scale | Established operators benefit from cost efficiencies due to large networks. | Aena's 46 airports in 2023 allowed for cost savings through operational volume. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including official company filings, reputable market research reports, and industry-specific trade publications. This comprehensive approach ensures a thorough understanding of the competitive landscape.