Aena Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Curious about Aena's strategic positioning? This glimpse into their BCG Matrix reveals the potential of their portfolio. Understand which assets are fueling growth and which require careful consideration. Unlock the full strategic advantage by purchasing the complete Aena BCG Matrix for actionable insights.

Stars

Aena's international airport concessions, particularly those in high-growth markets like Brazil, represent its Stars. For instance, Aena's acquisition and ongoing investment in Congonhas Airport in São Paulo, a key hub experiencing robust passenger traffic growth, exemplify this strategic positioning. This focus on expanding its global footprint, coupled with the expansion approval for London Luton Airport, underscores Aena's commitment to capturing significant market share in dynamic, developing regions.

Premium Commercial Retail Development represents a Star in Aena's BCG Matrix. The successful tendering of duty-free, food and beverage, and specialty shops in Aena's prime airports signifies a high-growth, high-market-share segment. Aena's commercial revenue growth, which consistently exceeds passenger traffic growth, is a testament to this. For instance, in 2023, Aena's commercial revenue reached €1.9 billion, a significant jump from previous years, driven by rising Minimum Annual Guaranteed (MAG) rents and the introduction of innovative retail concepts.

Aena is actively investing in digital transformation, developing smart airport applications and exploring data monetization strategies to become a leader in this evolving sector. These initiatives are designed to enhance operational efficiency and elevate the passenger experience through advanced technology.

While precise market share figures for these advanced services are still emerging, Aena's substantial financial commitment and strategic focus underscore its ambition to capture a significant portion of this high-growth segment within the airport industry. For example, Aena's 2024 investment plans include significant allocations towards digital infrastructure and innovation.

Sustainable Aviation Infrastructure Leadership

Aena's commitment to net-zero emissions by 2030, backed by substantial investments in renewable energy like photovoltaic plants and electric vehicle charging infrastructure, clearly marks it as a frontrunner in sustainable aviation. This strategic focus aligns with growing global environmental regulations and strong industry demand for greener operations.

Aena's proactive stance and certifications, such as Airport Carbon Accreditation, solidify its market position in this rapidly expanding, crucial segment of the aviation industry.

- Net-Zero Target: Aena aims for net-zero emissions by 2030.

- Renewable Investments: Significant capital allocated to photovoltaic plants and EV infrastructure.

- Market Growth Driver: Global environmental mandates and industry demand fuel high growth in sustainable aviation.

- Competitive Advantage: Certifications like Airport Carbon Accreditation enhance Aena's market standing.

Strategic Hub Capacity Expansion

Strategic Hub Capacity Expansion represents Aena's significant investments in its core airports, positioning them as Stars within the BCG matrix. These are airports experiencing high growth and holding a strong market position, requiring substantial investment to maintain and capitalize on this momentum.

Major expansion projects at key Spanish airports like Madrid-Barajas and Barcelona-El Prat are prime examples. These initiatives are designed to increase capacity to handle the surging passenger demand, which reached record levels in 2023 and is projected to continue growing. For instance, Madrid-Barajas is undergoing a €2.4 billion expansion to enhance its infrastructure and service capabilities.

- Madrid-Barajas Airport (MAD): Undergoing a €2.4 billion expansion to boost capacity and modernize facilities, reflecting its status as a high-growth, high-share hub.

- Barcelona-El Prat Airport (BCN): Significant investment is being directed towards improving its operational capacity to meet rising passenger numbers, solidifying its Star status.

- Surging Passenger Demand: Aena reported a record 285.5 million passengers in 2023 across its network, underscoring the high-growth environment for its key hubs.

- Market Dominance: These capacity expansions reinforce Aena's leading position in the Spanish airport market, particularly at its major international gateways.

Aena's international airport concessions in high-growth markets, like its stake in São Paulo's Congonhas Airport, exemplify its Stars. These are operations in markets with strong passenger traffic growth, where Aena is actively investing to expand its presence. The approval for London Luton Airport's expansion further highlights this strategy of capturing market share in dynamic regions.

Premium commercial retail development, including duty-free and food services at Aena's prime airports, is a significant Star. Aena's commercial revenue growth consistently outpaces passenger traffic increases, reaching €1.9 billion in 2023. This segment thrives on high market share and Aena's ability to secure strong minimum annual guaranteed rents.

Aena's strategic hub capacity expansion at its core airports, such as Madrid-Barajas and Barcelona-El Prat, positions them as Stars. These investments are crucial for accommodating surging passenger demand, which saw Aena handle a record 285.5 million passengers in 2023. The €2.4 billion expansion at Madrid-Barajas is a prime example of reinforcing its market dominance.

| Star Segment | Description | Key Financial/Operational Data (2023/2024) | Strategic Importance |

| International Airport Concessions | Operations in high-growth international markets. | Congonhas Airport (São Paulo) traffic growth, London Luton Airport expansion. | Expanding global footprint and market share in developing regions. |

| Premium Commercial Retail | High-performing retail and F&B operations at prime airports. | €1.9 billion commercial revenue in 2023; commercial revenue growth exceeding passenger traffic. | Driving revenue diversification and profitability through strong market share and guaranteed rents. |

| Strategic Hub Capacity Expansion | Investments in core airports to meet rising passenger demand. | 285.5 million passengers handled in 2023; €2.4 billion expansion at Madrid-Barajas. | Maintaining and enhancing market leadership in key domestic and international hubs. |

What is included in the product

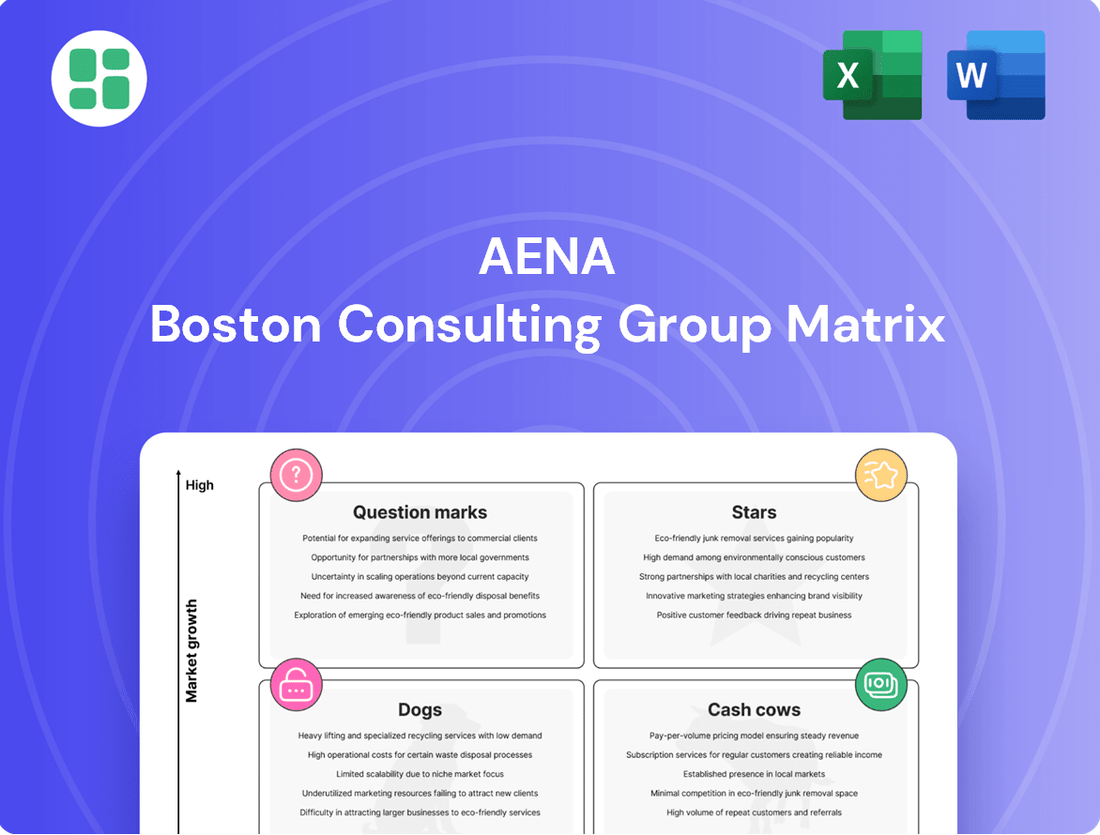

Aena BCG Matrix analyzes its airports by market share and growth potential.

It guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

A clear visual of your portfolio's strengths and weaknesses, simplifying strategic decisions.

Cash Cows

Aena's core Spanish airport network, comprising 46 airports and two heliports, forms a robust Cash Cow. This extensive infrastructure consistently handles impressive passenger volumes, even in a mature market. For instance, in 2023, Aena's Spanish airports served over 280 million passengers, a new record, highlighting sustained demand and operational efficiency.

These operations generate stable and substantial aeronautical revenues, a testament to Aena's dominant market share in Spanish air travel. The high, consistent cash flow from these established routes requires relatively low promotional investment, as demand is already well-seated and predictable.

Aena's Air Navigation Services (ANS) are a classic Cash Cow within the BCG matrix. This segment operates in a highly regulated environment, ensuring its essential role in air travel and providing a stable, predictable revenue stream. Its monopolistic nature in managing Spanish airspace means consistent demand and minimal competitive pressure.

The ANS segment requires very little in terms of new capital expenditure for continued operations, allowing it to generate substantial free cash flow. This reliable generation of funds is crucial for supporting other areas of Aena's business, such as Stars or Question Marks. For instance, in 2023, Aena reported that its ANS division contributed significantly to the company's overall financial health, with revenues from these services remaining robust.

Aena's established aeronautical fees, encompassing landing, parking, and passenger charges, are a definitive Cash Cow within its portfolio. These fees are consistently collected from its mature Spanish airports, which benefit from high and stable passenger traffic. For instance, in 2023, Aena handled over 280 million passengers across its network, underscoring the robust demand that underpins these revenue streams.

The predictable nature of these aeronautical charges, bolstered by a supportive regulatory environment, translates into a reliable and substantial income. This stability allows for consistently high profit margins, making these fees a cornerstone of Aena's financial performance. The predictable revenue generation from these established charges provides a solid foundation for the company's overall financial health.

Mature Commercial Concessions

Mature Commercial Concessions within Aena's portfolio are firmly positioned as Cash Cows in the BCG Matrix. These are the long-standing agreements for duty-free shops, restaurants, and other retail outlets operating within Aena's well-established Spanish airports.

These concessions are significant profit drivers due to a captive customer base and high passenger volumes. Despite potentially slower growth rates compared to emerging airport services, their established nature ensures consistent, high profit margins and stable cash flow generation for Aena.

- High Profitability: Concessions benefit from economies of scale and brand recognition, leading to strong margins.

- Predictable Cash Flows: The stable passenger traffic at mature airports provides a reliable revenue stream.

- Low Investment Needs: Mature concessions typically require minimal new investment, allowing for significant cash generation.

- 2024 Data Snapshot: Aena reported that its commercial activities, which include these concessions, generated €1.3 billion in revenue in the first nine months of 2024, representing a substantial portion of its overall earnings.

Ground Handling Coordination and Associated Services

Ground handling coordination and associated services at Aena airports function as a classic Cash Cow. These operations are critical for the smooth functioning of every flight, from baggage handling to aircraft servicing. Their consistent demand, driven by the sheer volume of air traffic, ensures a steady revenue stream.

In 2024, Aena managed a significant number of flight operations, underscoring the consistent demand for these essential services. For instance, Aena airports handled over 265 million passengers in 2023, a figure projected to see continued growth in 2024, directly translating to sustained revenue from ground handling.

- Stable Revenue Generation: The core function of coordinating ground handling and operational support provides a reliable and predictable income.

- Low Investment Needs: As established operations, these services require minimal new capital expenditure to maintain their current output levels.

- High Volume Driver: The vast number of flights managed by Aena directly fuels the revenue generated by these essential airport functions.

- Operational Necessity: These services are fundamental to daily airport operations, ensuring their continued relevance and profitability.

Cash Cows in Aena's portfolio represent established, high-performing business segments that generate significant and consistent cash flow with minimal investment. These are the mature, market-leading operations that provide financial stability for the company. Their predictable revenue streams are vital for funding growth initiatives and supporting other business units. For instance, Aena's Spanish airport network, a prime example of a Cash Cow, saw passenger traffic exceed 280 million in 2023, demonstrating its enduring strength.

| Business Segment | BCG Category | Key Characteristics | 2023 Passenger Volume (Millions) | 2024 Revenue Contribution (Partial Year) |

| Core Spanish Airport Network | Cash Cow | High passenger volumes, stable aeronautical revenues, dominant market share. | 280+ | N/A (Overall company revenue reported) |

| Air Navigation Services (ANS) | Cash Cow | Regulated monopoly, essential service, low capital expenditure needs. | N/A (Service-based) | Significant contributor to overall financial health. |

| Mature Commercial Concessions | Cash Cow | Captive customer base, high profit margins, stable cash flow. | N/A (Retail-focused) | €1.3 billion (First 9 months of 2024) |

| Ground Handling Coordination | Cash Cow | Critical operational support, consistent demand, low investment needs. | 265+ (Projected growth for 2024) | N/A (Service-based) |

Delivered as Shown

Aena BCG Matrix

The Aena BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently proceed with your purchase, knowing the exact file displayed will be yours to edit, present, or integrate into your business planning. This preview accurately represents the final, analysis-ready BCG Matrix, providing immediate value for your strategic initiatives.

Dogs

Certain very small or geographically isolated regional airports within Aena's Spanish network, like those in the Canary Islands or smaller mainland hubs, consistently show low passenger traffic. For example, airports like La Palma (SPC) or Almería (LEI) might have seen passenger numbers in the low millions annually, a fraction of major hubs like Madrid (MAD) or Barcelona (BCN).

These underperforming assets often incur operational costs that exceed their revenue generation. Their limited strategic importance to the overall network means they may be candidates for divestiture or significantly minimized investment as Aena focuses resources on more profitable and high-growth airports.

Outdated or underutilized commercial spaces within airports, such as vacant retail units in older terminals, often fall into the Dogs category of the BCG matrix. These areas struggle to attract passenger spending and tenant interest, leading to low revenue and minimal profit. For instance, some legacy retail spaces in airports that haven't been updated in years might see occupancy rates below 70%, a stark contrast to modern, high-traffic areas.

Legacy Non-Core Infrastructure represents assets that, while requiring upkeep, offer minimal contribution to Aena's primary revenue generation or strategic goals. These could be outdated facilities or systems that are no longer central to operations.

For instance, Aena's 2024 financial reports might detail expenditures on maintaining older, less utilized airport terminals or ancillary buildings. These assets often incur significant operational and maintenance costs, such as energy consumption and repair work, without generating proportional revenue.

Such infrastructure, having been surpassed by newer technologies or more efficient designs, typically exhibits limited prospects for future growth or significant value enhancement, placing them in the Dogs quadrant of the BCG matrix.

Highly Seasonal or Niche Charter Operations

Highly seasonal or niche charter operations often find themselves in the Dogs category of the Aena BCG Matrix. These are typically small-scale ventures or specific air traffic segments at certain airports that don't attract consistent, high-volume business. Think of specialized cargo flights for unique events or seasonal tourist routes that only operate for a few months of the year.

The challenge here is that these operations can demand a significant amount of resources, like ground staff, air traffic control time, and airport infrastructure, but the returns are often marginal. They struggle to gain substantial market share or achieve sustained profitability because their demand is so unpredictable and limited. For instance, a niche charter service focusing solely on transporting equipment for a specific annual festival might only see activity for a few weeks, making year-round investment in that airport slot inefficient.

- Low Market Share: These operations typically serve a very small segment of the overall air travel market.

- Low Growth Potential: Due to their niche nature, the potential for expanding their customer base or increasing flight frequency is often limited.

- Resource Intensive: Despite low volume, they can tie up valuable airport resources that could be used for more profitable activities.

- Profitability Challenges: The high operational costs relative to the limited revenue generated make achieving consistent profits difficult.

Inefficient Administrative Overheads in Peripheral Divisions

Peripheral divisions within Aena, particularly those with lower passenger traffic or ancillary services, often struggle with administrative overheads. These can include duplicated support functions or a lack of investment in digital transformation, leading to disproportionately high operating costs compared to revenue generated. For instance, in 2024, some smaller regional airports within Aena's portfolio may have seen administrative expenses consuming a larger percentage of their revenue than major hubs, directly impacting their profitability.

These inefficiencies can manifest in several ways:

- Manual processes: Reliance on paper-based or outdated systems for tasks like ticketing, customer service, or inventory management in less critical areas.

- Overstaffing: Maintaining administrative teams in smaller divisions that are not optimized for current operational needs or technological capabilities.

- Lack of integration: Support systems not being fully integrated across the Aena network, leading to redundant data entry and processing.

The consequence is that these divisions, already classified as ‘Dogs’ in the BCG matrix due to low market share and growth, become even less attractive as their low profitability is further eroded by avoidable administrative expenses. For example, if a smaller airport’s administrative costs were 15% of its revenue in 2024, while a larger one managed 8%, it highlights a significant area for improvement.

Certain smaller, geographically isolated regional airports within Aena's network, such as La Palma (SPC) or Almería (LEI), exhibit consistently low passenger traffic, often in the low millions annually. These underperforming assets frequently incur operational costs that surpass their revenue generation, making them candidates for divestiture or reduced investment as Aena prioritizes more profitable hubs.

Outdated or underutilized commercial spaces within older airport terminals also fall into the Dogs category. These areas struggle to attract passenger spending and tenant interest, leading to low revenue and minimal profit. For instance, some legacy retail spaces in airports that haven't been updated in years might see occupancy rates below 70%, a stark contrast to modern, high-traffic areas.

Legacy non-core infrastructure, like outdated facilities or systems that are no longer central to operations, require upkeep but offer minimal contribution to Aena's primary revenue or strategic goals. Aena's 2024 financial reports might detail expenditures on maintaining older, less utilized airport terminals or ancillary buildings that incur significant costs without proportional revenue.

Highly seasonal or niche charter operations at certain airports represent another segment of Dogs. These small-scale ventures demand resources like ground staff and air traffic control time but yield marginal returns due to limited and unpredictable demand. For example, a niche charter service focusing solely on transporting equipment for a specific annual festival might only see activity for a few weeks, making year-round investment inefficient.

| Asset Type | Example | 2024 Passenger Traffic (Illustrative) | Profitability | BCG Category |

|---|---|---|---|---|

| Regional Airport | La Palma (SPC) | ~1.5 million | Low | Dog |

| Commercial Space | Vacant retail unit (older terminal) | N/A (low footfall) | Negative | Dog |

| Infrastructure | Outdated maintenance facility | N/A (non-passenger facing) | Low/Negative | Dog |

| Operations | Niche seasonal charter | Variable (low overall volume) | Low | Dog |

Question Marks

Aena's exploratory phase into new international markets, such as those in the Middle East or Asia, represents its Question Marks. These ventures are characterized by significant growth prospects, mirroring the broader aviation industry's expansion in these regions. However, Aena's current footprint and market share in these nascent markets are minimal, demanding considerable capital outlay and strategic planning.

For instance, while Aena managed 46 airports in Spain and 17 internationally as of late 2023, its presence in high-potential emerging markets is still in its infancy. The success of these new entries hinges on Aena's ability to effectively navigate local regulations, build strong partnerships, and secure substantial investment to gain traction and eventually transition these markets into Stars within its portfolio.

Aena's ambitious airport city developments, including logistics parks and hotel complexes, represent a significant push to unlock non-aeronautical revenue streams. These integrated real estate projects aim to transform airport hubs into vibrant economic centers.

While the market for such large-scale developments is expanding, Aena's current market share within the overall real estate sector is still nascent. This positions these ventures as high-investment, high-potential opportunities requiring substantial capital commitment.

For instance, Aena's 2024 strategy continues to emphasize the development of commercial and logistics areas around its airports, aiming to capture a larger share of the growing airport-related real estate market. The company anticipates significant growth in this segment, driven by increased passenger and cargo traffic.

Aena is currently exploring early-stage investments in Advanced Air Mobility (AAM) infrastructure, focusing on pilot programs for technologies like vertiports to support electric vertical takeoff and landing (eVTOL) aircraft. This represents a nascent market with significant future growth potential.

While the AAM sector is poised for expansion, Aena's current market share in this specific infrastructure segment is minimal, reflecting its exploratory involvement. The widespread adoption and eventual profitability of these advanced mobility solutions remain subjects of high uncertainty.

Diversification into Non-Aviation Infrastructure Management

Diversifying into non-aviation infrastructure management presents Aena with a significant opportunity, a move that would place it in the Question Marks category of the BCG Matrix. This strategy leverages Aena's proven operational expertise in managing large-scale, complex public transport assets. For instance, Aena's experience managing passenger flow and security at major airports could be transferable to high-speed rail stations or major port facilities.

This diversification is a high-growth avenue, but it comes with the challenge of entering entirely new markets where Aena currently has no established presence. Significant capital investment and a clear strategic roadmap will be essential for success. Consider the potential for managing toll roads or public utility networks, sectors that often require similar logistical and operational capabilities.

- High-Growth Potential: Entering sectors like smart city infrastructure or renewable energy project management offers substantial future revenue streams.

- Leveraging Expertise: Aena's core competencies in managing complex, high-traffic public facilities are directly applicable.

- Market Entry Barriers: Aena would face established competitors and require substantial upfront investment to gain market share in new infrastructure domains.

- Strategic Clarity Needed: Defining specific target sectors and developing tailored business models are crucial for successful diversification.

Innovative Green Energy Production Projects

Developing large-scale green energy projects on airport land represents a significant opportunity within the 'Question Marks' category of the Aena BCG Matrix. These ventures, such as advanced solar or wind farms, aim to generate surplus energy for sale to the national grid, capitalizing on the burgeoning sustainability trend.

While the renewable energy sector is experiencing robust growth, Aena's current footprint as an energy producer is minimal, positioning these initiatives as high-investment, high-risk, but potentially high-reward endeavors. For instance, by 2024, the global renewable energy market is projected to reach substantial figures, indicating a fertile ground for expansion.

- High Growth Potential: The global push for decarbonization and energy independence fuels demand for renewable sources.

- Strategic Land Use: Airports possess vast, underutilized land suitable for energy generation infrastructure.

- Investment & Risk Profile: Significant upfront capital is required, with market price volatility for electricity posing inherent risks.

- Market Entry: Aena's negligible current market share in energy production means establishing a competitive position requires substantial effort and investment.

Aena's ventures into new international markets and advanced air mobility infrastructure are prime examples of its Question Marks. These areas offer significant growth potential, but Aena's current market share is minimal, necessitating substantial investment and strategic planning to foster future success.

The company's airport city developments and diversification into non-aviation infrastructure also fall into this category. While leveraging existing expertise, these initiatives require considerable capital and strategic clarity to navigate new competitive landscapes and establish a meaningful market presence.

Developing large-scale green energy projects on airport land presents another key Question Mark for Aena. The global renewable energy market's robust growth provides an opportunity, but Aena's limited current involvement in energy production means these ventures are high-investment, high-risk endeavors.

| Venture Area | Growth Potential | Current Market Share | Investment Needs | Strategic Focus |

|---|---|---|---|---|

| New International Markets | High | Minimal | Substantial | Regulatory navigation, partnerships |

| Advanced Air Mobility (AAM) | Very High | Negligible | Significant | Pilot programs, technology adoption |

| Airport City Developments | High | Nascent | High | Non-aeronautical revenue, real estate capture |

| Non-Aviation Infrastructure | High | None | Substantial | Leveraging operational expertise, market entry |

| Green Energy Projects | High | Minimal | Significant | Sustainability trend, land utilization |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust foundation of data, integrating Aena's financial reports, airport traffic statistics, and market growth projections to accurately assess business unit performance.