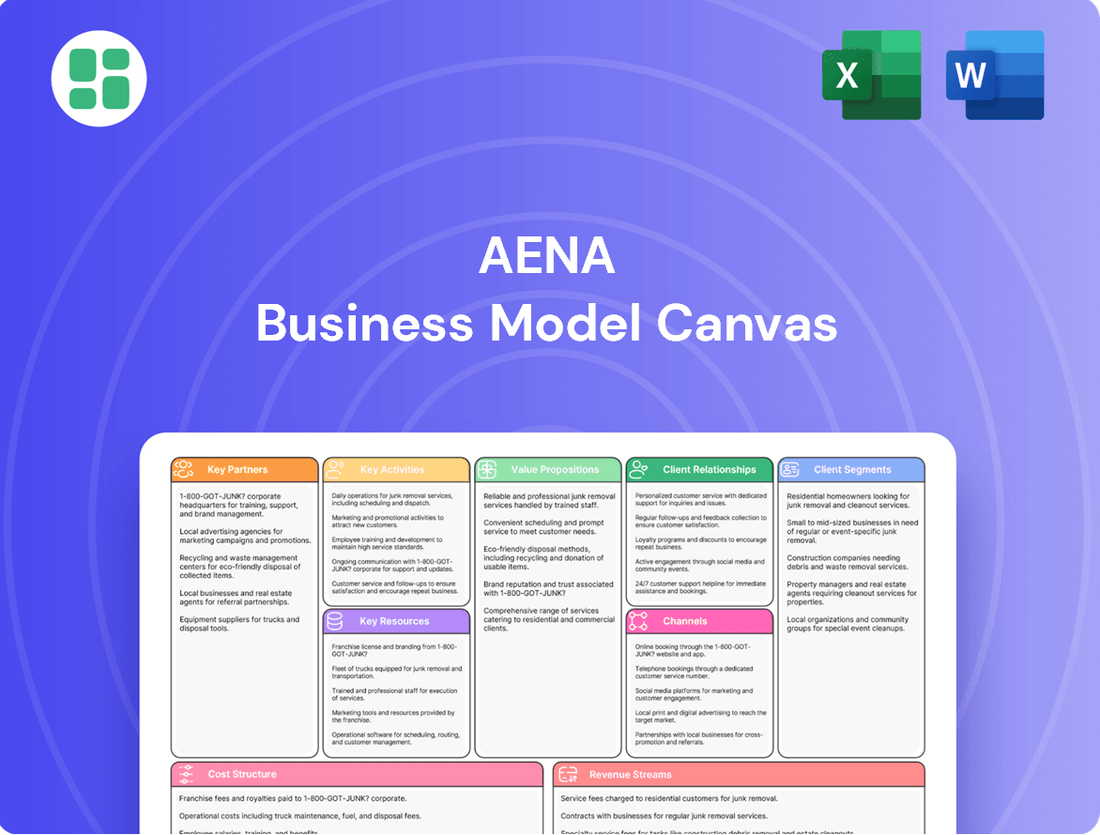

Aena Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Curious about the strategic engine driving Aena's success? This Business Model Canvas offers a clear, concise overview of their key customer segments, value propositions, and revenue streams. Discover the core components that make Aena a leader in its industry.

Partnerships

Aena's core business relies heavily on its airline partners, who are its main customers for airport services. These relationships are formalized through agreements covering everything from landing slots to passenger handling, directly influencing passenger numbers and revenue from airline fees.

To keep airlines flying to its airports, Aena focuses on offering competitive pricing and attractive incentives. For instance, the Spanish National Markets and Competition Commission (CNMC) approved Aena's proposed airport charges for 2025, a crucial factor for airlines when deciding where to operate.

Aena collaborates with a diverse range of commercial concessionaires and retailers, encompassing duty-free operators, food and beverage providers, and various specialty stores. These partnerships are fundamental to Aena's non-aeronautical revenue generation, a segment that has experienced robust expansion.

In 2023, Aena's non-aeronautical revenue reached €1.9 billion, a substantial increase driven by its commercial activities. The company actively manages tender processes for these retail spaces, focusing on optimizing the commercial mix and securing the highest possible guaranteed minimum rents to bolster its income.

Aena's airport operations are significantly bolstered by its key partnerships with ground handling and service providers. These collaborations are essential for maintaining efficient passenger and cargo flow, encompassing services from baggage handling to aircraft maintenance.

The company actively contracts with specialized firms for critical functions such as security screening, cleaning, and passenger assistance. For instance, Aena's commitment to consistent service quality is demonstrated through its long-term agreements with security providers and those offering assistance to passengers with reduced mobility (PRM).

In 2023, Aena's network handled over 286 million passengers, underscoring the sheer volume of operations these partnerships support. The reliability and quality of these service providers directly impact customer satisfaction and operational efficiency across Aena's extensive airport portfolio.

Government and Regulatory Bodies

Aena’s status as a publicly traded entity with substantial state backing necessitates close collaboration with government and regulatory bodies. Key partners include the Spanish Ministry of Transport and the National Commission on Markets and Competition (CNMC). These entities play a pivotal role in shaping Aena's operational and financial landscape.

These relationships are fundamental to Aena's business model, particularly concerning airport charges and long-term infrastructure planning under the Regulatory and Economic Regime (DORA). For instance, regulatory decisions directly affect revenue streams and investment strategies.

A prime example of this influence is the recent decision to freeze airport fees for 2025. This regulatory move, impacting Aena's revenue projections, underscores the critical nature of these governmental partnerships.

- Governmental Oversight: Aena operates under the purview of the Spanish Ministry of Transport, influencing strategic direction and national infrastructure development.

- Regulatory Framework: The CNMC sets and monitors airport charges, directly impacting Aena's pricing power and revenue, as seen with the 2025 fee freeze.

- Infrastructure Planning: Aena's DORA (Regulatory and Economic Regime) plans, which outline infrastructure investments and charges, require approval and oversight from these bodies.

Construction and Infrastructure Developers

Aena’s extensive airport development pipeline necessitates strong alliances with construction and infrastructure developers. These partnerships are fundamental to executing ambitious expansion plans, such as those at Madrid-Barajas and Barcelona-El Prat airports, and to realizing the vision of integrated airport cities.

For instance, Aena has earmarked significant capital for its DORA III regulatory period, spanning 2027 to 2031. This investment will fuel critical capacity enhancements and modernization efforts across its network.

- Airport Expansion Projects: Collaborations with developers are key to managing the scale and complexity of projects aimed at increasing passenger and cargo handling capabilities.

- Modernization and Upgrades: Partnerships ensure the implementation of state-of-the-art technologies and infrastructure improvements to meet evolving aviation standards.

- Airport City Development: Construction firms are vital in building the diverse commercial, retail, and logistics facilities that form the airport city ecosystem.

- Investment in DORA III: Aena’s commitment to substantial investment during the 2027-2031 period underscores the ongoing need for skilled construction partners.

Aena's strategic partnerships extend to technology providers and innovators crucial for enhancing operational efficiency and passenger experience. These collaborations are vital for implementing smart airport solutions, from advanced baggage tracking systems to seamless digital check-in processes.

The company actively seeks out partners offering cutting-edge solutions in areas like cybersecurity and data analytics to manage the vast amounts of information generated by airport operations. For example, Aena's commitment to digital transformation is evident in its ongoing investments in IT infrastructure and passenger-facing technologies.

Aena's focus on sustainability also drives partnerships with companies specializing in green technologies and energy efficiency. These alliances are key to reducing the environmental impact of airport operations, aligning with global climate goals and regulatory expectations.

| Partnership Type | Key Activities | Impact/Benefit |

|---|---|---|

| Technology Providers | Implementing smart airport solutions, IT infrastructure, data analytics | Enhanced operational efficiency, improved passenger experience, cybersecurity |

| Sustainability Partners | Green technologies, energy efficiency solutions | Reduced environmental impact, compliance with climate goals |

What is included in the product

A detailed framework outlining Aena's airport operations, revenue streams from retail and aeronautical services, and key partnerships with airlines and concessionaires.

A clear, visual representation that helps identify and address operational inefficiencies and market gaps.

It streamlines the process of understanding and optimizing complex airport operations, reducing costly redundancies.

Activities

Aena's core activity revolves around the meticulous management and operation of its vast airport network, encompassing airports and heliports primarily in Spain, but also extending to London Luton Airport and operations in Brazil. This fundamental function is critical for maintaining safety, security, and operational efficiency for the millions of passengers and countless flights that utilize its facilities each year.

In 2023, Aena handled a remarkable 285.9 million passengers across its Spanish airports, a significant increase from previous years and a testament to the robust nature of its operational capabilities. This core activity directly supports all other revenue streams and value propositions offered by the company.

Air navigation and traffic control are fundamental to Aena's airport operations, ensuring the safe and efficient flow of aircraft. This involves managing airspace and providing essential services for takeoffs, landings, and en-route movements.

While Enaire, Spain's national air navigation service provider, handles much of the en-route control, Aena plays a crucial role in the overall operational coordination at its airports. This includes managing ground movements and ensuring seamless transitions for aircraft.

In 2023, Aena airports handled approximately 2.7 million aircraft movements, underscoring the sheer volume of operations requiring precise navigation and traffic management. This activity is paramount for maintaining safety records and operational efficiency.

Aena's commercial management is a core activity, focusing on maximizing revenue from non-aeronautical services like retail, dining, and car rentals across its airports. This includes strategically tendering new commercial spaces and refining existing agreements to boost passenger spending.

In 2024, Aena reported robust growth in its commercial revenue, which expanded at a faster pace than passenger traffic. This indicates successful strategies in enhancing the passenger experience and optimizing the commercial offering, contributing significantly to the company's overall financial performance.

Infrastructure Development and Investment

Aena's key activities heavily involve the continuous planning, development, and strategic investment in airport infrastructure. This is crucial for accommodating rising passenger traffic and ensuring capacity for future expansion.

Significant capital is allocated to enhancing major hubs such as Madrid-Barajas and Barcelona-El Prat. These projects often include expanding terminal buildings, upgrading runways, and improving air traffic control systems to boost efficiency and passenger experience.

Aena's commitment extends to its international portfolio, with substantial investments made in overseas assets. For instance, a notable €1 billion investment was directed towards Brazilian airports, underscoring a global approach to infrastructure development.

- Airport Expansion: Ongoing projects at Madrid-Barajas and Barcelona-El Prat to increase capacity.

- Infrastructure Upgrades: Investment in runways, terminals, and air traffic control systems.

- International Investment: A €1 billion commitment to Brazilian airports highlights global asset development.

Real Estate Development and Asset Optimization

Aena actively engages in real estate development, focusing on unlocking the commercial value inherent in its extensive airport land holdings. This strategy includes leasing out spaces for offices, logistics operations, and cargo handling, alongside the ambitious vision of creating integrated 'Airport Cities.'

A prime illustration of this commitment is the ongoing development of Aena's new corporate headquarters within the Adolfo Suárez Madrid-Barajas Airport City. This project underscores the company's dedication to maximizing asset utilization and creating synergistic business environments.

- Airport Cities Development: Creating integrated commercial and business hubs around airport infrastructure.

- Commercial Asset Leasing: Generating revenue through the leasing of office buildings, logistics facilities, and cargo areas.

- Strategic Land Utilization: Maximizing the economic potential of airport-owned land assets.

- Corporate Headquarters Project: A tangible example of asset optimization at Madrid-Barajas Airport City.

Aena's key activities center on managing and operating its extensive airport network, ensuring efficient air traffic control and enhancing commercial revenues through retail and services.

The company also prioritizes strategic infrastructure development, including airport expansion and upgrades, alongside international investments and real estate development to maximize land asset value.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Airport Operations & Management | Operating and managing airports and heliports, ensuring safety and efficiency. | 285.9 million passengers handled in Spanish airports (2023). |

| Air Navigation & Traffic Control | Managing air traffic for safe and efficient aircraft movements. | Approx. 2.7 million aircraft movements handled at Aena airports (2023). |

| Commercial Management | Maximizing revenue from non-aeronautical services (retail, dining, car rentals). | Commercial revenue grew faster than passenger traffic in 2024. |

| Infrastructure Development | Planning, developing, and investing in airport infrastructure for capacity and future expansion. | €1 billion invested in Brazilian airports; ongoing projects at Madrid-Barajas and Barcelona-El Prat. |

| Real Estate Development | Developing airport land for offices, logistics, and creating 'Airport Cities'. | Development of new corporate headquarters at Madrid-Barajas Airport City. |

What You See Is What You Get

Business Model Canvas

The Aena Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means all sections, formatting, and content are identical to what you will download, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive business tool, ready for immediate application to your strategic planning.

Resources

Aena's primary key resource is its extensive airport infrastructure, encompassing runways, terminals, and air traffic control systems. This vast network, including significant holdings in Spain and international operations like London Luton Airport, is fundamental to its business.

In 2023, Aena managed 46 airports in Spain, handling a total of 283.6 million passengers, showcasing the sheer scale of its physical assets. The continuous modernization and expansion of these facilities are vital for accommodating increasing air traffic and passenger demand.

The capacity and efficiency of this infrastructure directly impact Aena's ability to generate revenue through landing fees, passenger charges, and commercial activities. Investments in technology and facility upgrades are therefore critical for maintaining its competitive edge.

Aena's strategic land holdings extend far beyond the runways and terminals, encompassing substantial real estate assets ripe for development. These parcels are crucial for Aena's vision of creating integrated 'Airport Cities,' fostering a symbiotic relationship between airport operations and surrounding commercial and residential areas.

These land assets are actively leveraged to generate diverse revenue streams, moving beyond traditional aviation fees. For instance, Aena is developing commercial centers, hotels, and logistics hubs on its airport grounds, transforming them into vibrant economic zones. In 2023, Aena reported significant growth in its commercial revenue, partly driven by the expansion of its non-aviation businesses, which heavily rely on these land holdings.

The intrinsic value and future potential of these real estate assets are foundational to Aena's long-term commercial strategy. By meticulously planning and executing development projects on this land, Aena aims to enhance passenger experience, attract businesses, and create sustainable, long-term economic value, thereby diversifying its income and strengthening its competitive position in the global airport operator market.

Aena's skilled workforce, encompassing air traffic controllers, operational staff, engineers, commercial managers, and administrative personnel, is a cornerstone of its business model. This human capital is vital for navigating the complexities of airport management and ensuring stringent safety protocols are met.

The expertise of Aena's employees in areas like safety, operational efficiency, and commercial strategy is indispensable. For instance, in 2023, Aena reported a workforce of approximately 12,000 employees, highlighting the scale of its human resource investment.

The company's overall efficiency and the quality of services delivered to passengers and airlines are directly linked to the capabilities and dedication of its human capital. Investing in training and development for these professionals is crucial for maintaining Aena's competitive edge.

Advanced Technology and Systems

Aena's Advanced Technology and Systems are fundamental to its operations, encompassing cutting-edge air traffic control, advanced security screening, and efficient baggage handling. These systems are critical for maintaining safety and smooth operations across its airports. In 2023, Aena continued to invest in modernizing these core technologies to meet evolving demands.

The company places significant emphasis on digital services to improve passenger experience and operational efficiency. Initiatives like remote check-in options and the implementation of biometric gates are key components of this strategy. These digital advancements aim to streamline passenger journeys and reduce waiting times, a crucial factor in airport competitiveness.

- Air Traffic Control: Sophisticated systems ensuring safe and efficient airspace management.

- Security Screening: Advanced equipment for passenger and baggage security, meeting stringent international standards.

- Baggage Handling: Automated and integrated systems designed for speed and reliability.

- Digital Platforms: Passenger-facing applications and services for check-in, flight information, and retail.

Financial Capital and Strong Balance Sheet

Aena's robust financial position, marked by substantial revenues and profits, alongside a well-managed debt level, ensures the capital necessary for both ongoing operations and strategic investments. This financial muscle, evidenced by its strong 2024 performance and positive H1 2025 outlook, is crucial for undertaking major infrastructure development and pursuing international growth opportunities.

The company's financial strength translates directly into its capacity for significant capital expenditure and supports its commitment to shareholder returns through dividends. A healthy balance sheet is fundamental to Aena's ability to fund ambitious projects and maintain financial flexibility.

- Strong Revenue Generation: Aena consistently generates substantial revenue from its airport operations, concessions, and other services.

- Profitability: The company demonstrates consistent profitability, allowing for reinvestment and dividend distribution.

- Debt Management: Aena maintains a manageable debt-to-equity ratio, ensuring financial stability and access to credit.

- Investment Capacity: A healthy balance sheet underpins Aena's ability to fund large-scale infrastructure projects and international expansion.

Aena's intellectual property, including proprietary operational software, efficient management methodologies, and brand recognition, represents a significant intangible asset. This intellectual capital underpins its operational excellence and market positioning.

The company's commitment to innovation and continuous improvement in airport management processes is a key differentiator. This focus on knowledge creation and application drives efficiency and enhances the passenger experience.

Aena's brand, associated with reliable and high-quality airport services, fosters customer loyalty and attracts airline partners. This strong brand equity is a testament to its long-standing reputation and operational success.

Aena's strategic partnerships and alliances with airlines, concessionaires, and other aviation stakeholders are crucial for its ecosystem. These relationships facilitate seamless operations and revenue diversification.

Collaborations with airlines are vital for ensuring route development and passenger traffic at its airports. For instance, Aena actively works with major carriers to attract new routes and increase flight frequencies.

Agreements with concessionaires for retail, food, and beverage services are essential for generating non-aviation revenue. In 2023, commercial revenues grew significantly, reflecting the success of these partnerships.

| Partnership Type | Key Contribution | Example |

|---|---|---|

| Airlines | Passenger traffic, route development | Agreements with low-cost carriers and flag carriers |

| Concessionaires | Retail, F&B, services revenue | Partnerships with global retail and hospitality brands |

| Technology Providers | Operational efficiency, innovation | Collaboration on advanced security and digital platforms |

Value Propositions

Aena delivers a secure and streamlined air travel experience, a core promise to travelers and carriers alike. This is built on robust infrastructure, cutting-edge security measures, and sophisticated air traffic control. In 2024, Aena airports handled over 280 million passengers, underscoring their capacity for efficient operations.

The company's dedication to operational excellence translates into dependable and timely flights. This commitment is vital for airlines relying on Aena's services for their schedules. For instance, Aena's focus on punctuality contributed to a high percentage of on-time departures across its network in the first half of 2024.

Aena's extensive network of airports across Spain and internationally provides unparalleled connectivity, acting as a vital hub for tourism, business travel, and global cargo. This broad reach ensures that a vast number of passengers and airlines can access its facilities, making Aena the world's largest airport operator by passenger traffic, a testament to its accessibility.

Aena presents a prime environment for diverse commercial ventures, offering retailers, food and beverage providers, and service companies access to high-traffic airport locations. This strategic positioning allows businesses to connect with a substantial, captive customer base, significantly boosting their visibility and sales potential.

The company actively manages tender processes, creating a structured pathway for businesses to secure valuable concessions within its airports. This ensures fair competition and provides operators with the opportunity to leverage Aena's extensive passenger flow.

In 2023, Aena's commercial activities demonstrated robust performance, with commercial revenue reaching €1,734 million, a 15.1% increase compared to 2019. This growth underscores the attractiveness and success of the commercial opportunities provided to its concessionaires.

Catalyst for Regional Economic Development

Aena's airports are crucial drivers of regional economic growth, fostering tourism, facilitating trade, and creating numerous jobs within their surrounding areas. In 2024, Aena's operations directly and indirectly supported millions of jobs across Spain, underscoring its role as a major employment generator.

By investing in and expanding airport infrastructure, alongside developing diverse commercial offerings, Aena significantly boosts local economies. For instance, its strategic investments in airport modernization projects in 2024 were designed to enhance passenger capacity and operational efficiency, leading to increased economic activity.

Furthermore, Aena's ambitious real estate ventures, such as the development of Airport Cities, are designed to maximize the economic potential of airport-adjacent land. These integrated developments aim to attract businesses, create commercial hubs, and further stimulate regional development.

- Economic Engine: Airports act as hubs for tourism, trade, and job creation, directly impacting regional GDP.

- Infrastructure Investment: Aena's capital expenditures on airport upgrades and expansions stimulate local construction and service industries.

- Commercial Ecosystem: The development of retail, dining, and business services within airports generates revenue and employment.

- Airport Cities: Integrated urban developments around airports create synergistic economic zones, attracting diverse businesses and talent.

Sustainable and Environmentally Responsible Operations

Aena is deeply committed to sustainable and environmentally responsible operations, a core value proposition for its diverse stakeholders. This focus is evident in its ambitious goal to achieve net-zero emissions by 2030, a target that resonates strongly with environmentally conscious passengers, airlines seeking to reduce their carbon footprint, and investors prioritizing ESG (Environmental, Social, and Governance) factors.

The company's dedication to sustainability is further validated by its attainment of various environmental accreditations and its consistent inclusion in prominent sustainability indices. For instance, Aena's performance in climate leadership rankings underscores its proactive approach to environmental stewardship. In 2024, Aena continued to advance its sustainability agenda, reporting significant progress on its decarbonization roadmap, which includes investments in renewable energy sources and energy efficiency measures across its airport network.

- Net-Zero Emissions Target: Aena aims for net-zero emissions by 2030, showcasing a strong commitment to climate action.

- Environmental Accreditations: The company actively pursues and maintains various environmental certifications, validating its operational standards.

- Stakeholder Value: This commitment appeals to environmentally aware passengers, airlines, and ESG-focused investors.

- Market Recognition: Aena's inclusion in sustainability indices and climate leadership rankings highlights its recognized environmental performance.

Aena facilitates seamless travel by providing secure, efficient, and punctual airport operations, a critical value for millions of passengers and airlines. In 2024, Aena airports managed over 280 million passengers, demonstrating their robust operational capacity and commitment to reliability.

Customer Relationships

Aena establishes formal, long-term contracts with airlines, outlining airport usage terms, aeronautical fees, and service standards. These agreements, often subject to rigorous negotiation and regulatory compliance, are vital for Aena's predictable revenue streams and airlines' operational stability. For instance, in 2023, Aena served over 280 million passengers across its Spanish airports, underscoring the scale and importance of these airline partnerships.

Aena's customer relationships with commercial partners are primarily shaped by concession and lease agreements. These contracts often include minimum annual guarantees (MAGs) to ensure a baseline revenue stream, alongside performance incentives designed to encourage higher sales and better customer engagement. For instance, in 2023, Aena reported that its commercial activities, heavily reliant on these agreements, generated €1.9 billion in revenue, a significant portion of its total income.

The company actively collaborates with its commercial tenants, which include a wide array of retailers, restaurants, and service providers. This partnership approach focuses on optimizing sales performance and enhancing the overall commercial offering available to passengers. This collaborative effort is crucial for maintaining a vibrant and appealing retail environment within the airports, directly contributing to passenger satisfaction and Aena's non-aeronautical revenue growth.

Aena prioritizes digital engagement to foster relationships with passengers, moving beyond simple transactions. This includes robust airport apps and websites that offer real-time flight information, navigation assistance, and booking services, aiming for seamless passenger journeys. For instance, Aena's app saw a significant increase in downloads and active users throughout 2023, reflecting growing passenger reliance on digital tools for travel planning.

Feedback mechanisms are integral to Aena's customer relationship strategy. Passengers can share their experiences through online surveys, social media channels, and dedicated customer service platforms. In 2024, Aena reported a 15% increase in passenger feedback submissions compared to the previous year, highlighting a commitment to understanding and acting upon passenger sentiment to improve services.

B2B Sales and Account Management for Cargo and Ground Handlers

Aena cultivates strong business-to-business ties with cargo operators and ground handling firms via specialized sales and account management teams. These partnerships are foundational, supplying essential infrastructure and services crucial for seamless cargo logistics and aircraft operations.

- Dedicated Account Management: Aena assigns specific account managers to key cargo and ground handling clients, fostering personalized service and understanding unique operational needs.

- Infrastructure Provision: The company provides critical airport infrastructure, including cargo terminals, apron space, and specialized equipment, enabling efficient handling operations.

- Service Level Agreements: Robust agreements are established to guarantee the quality and timeliness of ground handling services, directly impacting aircraft turnaround times and operational efficiency.

- Strategic Partnerships: Aena actively seeks to build long-term strategic relationships, collaborating on service improvements and infrastructure development to support the evolving demands of the air cargo sector.

In 2023, Aena handled over 600,000 tons of cargo across its network, underscoring the significant volume and importance of these B2B relationships. Ensuring the smooth functioning of cargo flow and ground support is not just beneficial but absolutely essential for the entire aviation ecosystem to operate effectively.

Regulatory Compliance and Stakeholder Dialogue with Government

As a significant, partially state-owned airport operator, Aena maintains a crucial relationship with government and regulatory bodies, ensuring ongoing dialogue and strict adherence to compliance requirements. This involves transparent reporting on operational performance and financial activities, directly impacting its ability to secure and maintain operating licenses. For instance, in 2023, Aena reported a net profit of €1,259.5 million, a substantial increase from previous years, demonstrating its financial stability which is closely monitored by regulators.

Active participation in policy discussions and unwavering commitment to legal frameworks are paramount for Aena. This includes the regulation of airport charges, which directly influences revenue streams, and the approval of long-term development plans essential for future growth. Aena's strategic direction is intrinsically linked to these governmental relationships, as evidenced by its ongoing investments in infrastructure upgrades across its network, which require regulatory approval.

- Regulatory Dialogue: Aena actively engages with government ministries and aviation authorities to shape and understand evolving regulations.

- Compliance Framework: Strict adherence to national and EU aviation laws, including those governing airport charges and environmental standards, is non-negotiable.

- Transparency in Reporting: Aena provides detailed annual reports and specific disclosures to regulatory bodies, ensuring accountability.

- Strategic Alignment: Government approval is essential for Aena's major capital expenditure projects and strategic expansion initiatives.

Aena cultivates diverse customer relationships, ranging from formal, long-term contracts with airlines to collaborative partnerships with commercial tenants and digital engagement with passengers. These relationships are underpinned by clear agreements, feedback mechanisms, and a focus on enhancing the overall customer experience.

The company also maintains crucial business-to-business ties with cargo operators and ground handling firms, providing essential infrastructure and adhering to service level agreements. Furthermore, Aena engages in vital dialogue with government and regulatory bodies, ensuring compliance and aligning strategic development with legal frameworks.

| Customer Segment | Relationship Type | Key Engagement Aspects | 2023 Data Point |

|---|---|---|---|

| Airlines | Formal Contracts | Airport usage, fees, service standards | Served >280 million passengers |

| Commercial Partners (Retailers, F&B) | Concession/Lease Agreements | Minimum guarantees, performance incentives | Commercial revenue: €1.9 billion |

| Passengers | Digital Engagement & Feedback | Airport apps, websites, surveys, social media | 15% increase in feedback submissions (2024) |

| Cargo Operators/Ground Handling | Specialized Sales & Account Management | Infrastructure provision, SLAs, strategic partnerships | Handled >600,000 tons of cargo |

| Government & Regulators | Compliance & Dialogue | Policy discussions, reporting, legal adherence | Net profit: €1,259.5 million |

Channels

Aena's physical airport infrastructure, encompassing terminals, runways, and boarding gates, forms the bedrock of its value proposition. These tangible assets are the direct conduits through which Aena serves airlines, passengers, and a myriad of other airport stakeholders. The sheer scale and operational efficiency of this physical network are paramount to Aena's ability to deliver its core services.

In 2024, Aena managed a network of 46 airports across Spain and a further 2 in Brazil, handling a significant volume of air traffic. For instance, Madrid-Barajas Airport alone saw over 60 million passengers in 2023, underscoring the immense capacity and operational demand placed on its physical infrastructure. This extensive physical footprint is not just a cost center but a critical revenue-generating and service-delivery platform.

Aena's official websites and mobile apps are crucial touchpoints for passengers, offering flight tracking, parking reservations, and information on airport services. These digital platforms significantly boost passenger convenience and streamline communication. In 2023, Aena's mobile app saw a substantial increase in usage, with over 15 million downloads and a 25% rise in active users compared to the previous year, highlighting their growing importance.

These online channels also act as vital conduits for Aena's commercial partners, enabling them to connect directly with a captive audience of travelers. Furthermore, Aena leverages these platforms to broadcast corporate news and updates, ensuring transparency and engagement with stakeholders. The digital presence is a key element in Aena's strategy to enhance the overall passenger experience and drive ancillary revenues.

Aena's direct sales and business development teams are instrumental in forging partnerships with airlines, a critical component of their customer relationships. These teams focus on attracting new carriers to Aena's airports and negotiating favorable terms for existing ones, directly impacting passenger traffic and revenue. For instance, in 2024, Aena continued its efforts to expand its airline network, a testament to the proactive work of these development units.

Beyond airlines, these dedicated teams are responsible for securing and managing commercial concessions and real estate leases within the airport ecosystem. This involves identifying and cultivating relationships with a diverse range of B2B clients, from retail outlets to service providers. Their success in these negotiations is vital for diversifying Aena's revenue streams and maximizing the commercial potential of its airport infrastructure.

The strategic importance of these teams is underscored by their role in establishing and nurturing long-term contracts. By building strong relationships with key business partners, Aena ensures a stable and predictable flow of commercial revenue, contributing significantly to the company's overall financial health and growth trajectory. This focus on sustained partnerships is a hallmark of Aena's business development strategy.

Tender and Procurement Processes

Aena leverages formal tender and procurement processes for its commercial concessions, such as duty-free shops and food and beverage outlets, as well as for essential service contracts like security and cleaning. This structured approach is fundamental to ensuring fairness, fostering competition among potential partners, and securing the most advantageous terms for the company. These processes are vital for identifying and contracting with businesses that will operate within Aena's airports, directly impacting revenue streams and operational efficiency.

These rigorous procurement procedures are designed to attract a wide range of qualified bidders, thereby promoting a competitive marketplace. For instance, in 2024, Aena continued its strategy of awarding concessions through competitive bidding, with significant contracts for retail and catering services at major airports like Madrid-Barajas and Barcelona-El Prat being subject to these transparent procedures. This ensures Aena can select partners offering the best value, innovation, and customer experience.

- Transparency: All eligible parties have equal opportunity to bid.

- Competition: Encourages multiple bids to drive better terms.

- Optimal Terms: Secures the best financial and operational agreements for Aena.

- Partner Selection: Crucial for choosing reliable and high-performing concessionaires.

Public Relations and Corporate Communications

Aena leverages Public Relations and Corporate Communications to keep its diverse stakeholders, from investors to the general public, informed about its operational performance, strategic growth plans, and dedication to environmental, social, and governance (ESG) principles. This proactive approach is crucial for shaping and maintaining a positive corporate image, effectively communicating its unique value proposition in the airport management sector.

Key to this channel are official press releases, which in 2024 continued to highlight Aena's robust financial results and expansion projects. Investor presentations also play a vital role, offering detailed insights into the company's financial health and future outlook. For example, Aena reported a net profit of €1,770 million in 2023, demonstrating strong operational recovery and growth, which are consistently communicated through these channels.

The effectiveness of these communications is measured by their ability to influence stakeholder perception and trust. Aena’s commitment to transparency in reporting its financial performance, such as the 12.1% increase in passenger traffic in the first quarter of 2024 compared to the same period in 2023, reinforces its credibility.

- Stakeholder Information: Disseminating performance data and strategic updates to investors, media, and the public.

- Reputation Management: Building and maintaining a strong corporate image through consistent and transparent communication.

- Value Proposition Communication: Articulating Aena's strengths and contributions to the aviation industry and economy.

- Key Communication Tools: Utilizing official press releases and investor presentations to convey critical information.

Aena's channels are multifaceted, encompassing direct engagement through its digital platforms and sales teams, alongside formal procurement processes and strategic public relations efforts. These diverse channels are designed to serve a wide array of customers, from individual passengers to large commercial partners, and to maintain robust communication with all stakeholders.

The digital channels, including Aena's websites and mobile applications, are pivotal for passenger convenience and commercial outreach. In 2023, Aena's mobile app saw over 15 million downloads, with active users increasing by 25%, demonstrating their growing importance in connecting with travelers and facilitating ancillary revenue generation.

Direct sales and business development teams are crucial for building airline relationships and securing commercial concessions. These teams actively work to attract new carriers and negotiate agreements, contributing to a stable revenue flow. In 2024, Aena continued expanding its airline network through these proactive development efforts.

Formal tender and procurement processes are employed for awarding commercial concessions and service contracts, ensuring transparency and competition. For example, in 2024, significant contracts for retail and catering at major airports were awarded through these competitive bidding procedures, securing optimal terms for Aena.

Public Relations and Corporate Communications are vital for informing stakeholders and managing Aena's reputation. Investor presentations and press releases in 2024 highlighted strong financial performance, such as the 12.1% passenger traffic increase in Q1 2024, reinforcing Aena's credibility.

Customer Segments

Airlines are a fundamental customer segment for Aena, generating revenue through aeronautical fees for services like landing, parking, and the use of airport facilities. In 2023, Aena handled over 283 million passengers, a significant portion of which is directly attributable to airline operations.

These carriers prioritize operational efficiency, cost-effectiveness through competitive charges, and adequate airport capacity to support their flight schedules and network expansion. Aena's strategic aim is to foster a robust and varied airline network to maximize passenger volume and overall revenue generation.

Passengers, both for leisure and business, represent Aena's core customer base, driving both traffic and commercial revenue, even though they don't directly pay for landing or take-off. In 2023, Aena airports handled a significant 284.7 million passengers, a substantial increase that highlights their importance.

These travelers expect a seamless and enjoyable airport experience, prioritizing safety, efficiency, and a variety of retail and dining choices. Aena's focus on enhancing passenger satisfaction directly influences their willingness to spend in commercial areas, which is a crucial element of Aena's revenue diversification strategy.

Commercial concessionaires and retailers, including major players like Dufry, SSP, and Hertz, are a cornerstone of Aena's revenue. These businesses, operating everything from duty-free shops to restaurants and car rentals within Aena's airports, rely heavily on the immense passenger traffic Aena facilitates. In 2023, Aena's airports handled over 287 million passengers, providing a captive audience for these operators.

These partners are attracted by Aena's ability to deliver high footfall and offer competitive commercial terms through structured tender processes. Aena actively manages these relationships, ensuring a supportive operational environment that helps these businesses thrive. For instance, Aena's focus on enhancing the passenger experience directly translates into increased sales opportunities for its concessionaires.

Cargo Operators and Logistics Companies

Cargo operators and logistics firms rely on Aena's airports as crucial hubs for their air freight operations. They incur fees for cargo handling, warehousing, and other essential services, directly contributing to Aena's revenue streams. These companies prioritize efficient infrastructure and seamless processing to maintain the integrity and speed of their global supply chains.

Aena's strategic emphasis on expanding its air cargo business underscores the significant economic contribution of this customer segment. For instance, in 2023, Aena's airports handled over 580,000 tons of cargo, a testament to the vital role these operators play.

Key requirements for this segment include:

- Efficient cargo handling facilities: Modern infrastructure for rapid loading, unloading, and sorting of goods.

- Timely processing and clearance: Streamlined customs and security procedures to minimize transit times.

- Excellent connectivity: Access to a wide network of destinations and ground transportation links.

- Competitive pricing structures: Fee arrangements that support profitable logistics operations.

Ground Handling Companies

Ground handling companies are key customers for Aena, relying on its infrastructure to deliver vital airline services like baggage management and aircraft turnaround. These companies are licensed by Aena, ensuring they operate within the airport's framework and contribute to overall efficiency.

In 2024, Aena continued to manage contracts with numerous ground handling providers across its extensive network of airports. For instance, at Madrid-Barajas Airport, a major hub, these services are fundamental to the smooth operation of hundreds of daily flights. Aena's role involves providing the necessary operational space and regulatory oversight, which these companies depend on for their business.

- Customer Need: Access to airport infrastructure, operational space, and a regulated environment for providing ground handling services.

- Value Proposition: Aena offers licensed access to airport facilities, enabling ground handlers to serve airlines efficiently and reliably.

- Key Activities: Aena's licensing, regulation, and provision of airport operational areas are critical for ground handling companies.

- Revenue Streams: Aena generates revenue through concessions and fees charged to ground handling companies for the use of airport facilities and services.

Aena serves a diverse customer base, crucial for its revenue generation and operational success. Airlines are primary clients, paying aeronautical fees for landing and airport services, with Aena handling over 283 million passengers in 2023. Passengers, the ultimate drivers of traffic, seek efficient and enjoyable airport experiences, contributing significantly to commercial revenues through spending in retail and dining outlets. In 2023, Aena airports saw 284.7 million passengers, highlighting their importance.

Commercial concessionaires, such as Dufry and SSP, are vital partners, operating retail and food services within Aena's airports. They leverage the high passenger footfall, with over 287 million passengers in 2023, to drive sales. Cargo operators and logistics firms utilize Aena's infrastructure for air freight, with 2023 volumes exceeding 580,000 tons, contributing through handling and warehousing fees. Ground handling companies also rely on Aena for operational space and regulatory frameworks to service airlines.

| Customer Segment | Key Needs | Aena's Value Proposition | Revenue Stream | 2023 Data Highlight |

| Airlines | Operational efficiency, cost-effectiveness, adequate capacity | Airport infrastructure, network connectivity, competitive charges | Aeronautical fees | 283 million passengers handled |

| Passengers | Safety, efficiency, retail variety, seamless experience | Enhanced airport experience, diverse commercial offerings | Commercial revenue (indirect) | 284.7 million passengers handled |

| Commercial Concessionaires | High footfall, supportive operational environment, competitive terms | Access to captive audience, prime retail locations | Concession fees, revenue share | 287 million passengers handled |

| Cargo Operators | Efficient facilities, timely processing, excellent connectivity | Hub infrastructure, logistics support services | Cargo handling fees, warehousing fees | 580,000 tons of cargo handled |

| Ground Handling Companies | Airport infrastructure, operational space, regulated environment | Licensed access to facilities, operational support | Concession fees, service charges | Continued contracts across network |

Cost Structure

Aena's cost structure heavily features infrastructure maintenance and capital expenditure (CAPEX). Significant funds are allocated to keeping its vast network of airports operational, safe, and efficient. This includes routine upkeep as well as substantial investments in modernization and expansion projects.

For instance, Aena's strategic plan, DORA III, outlines considerable CAPEX for the 2022-2026 period. This plan targets capacity increases and technological upgrades across its airports. These long-term investments, while essential for future growth and competitiveness, represent a major component of Aena's overall expenses.

Personnel costs represent a major expenditure for Aena, driven by the sheer scale of its airport operations. This includes compensation for a diverse workforce, from ground handlers and air traffic controllers to security personnel and administrative staff. In 2023, Aena's personnel expenses amounted to €1.35 billion, reflecting the significant investment in its human capital to ensure smooth and safe airport functioning.

Aena dedicates substantial resources to security and safety operations, a critical component for passenger trust and regulatory compliance. This includes significant investments in advanced screening technology and highly trained personnel to safeguard passengers, aircraft, and airport infrastructure.

The company's commitment to these high standards is reflected in its contracted security services, which extend until 2028, underscoring a considerable and ongoing financial commitment. For instance, in 2023, Aena's security costs represented a significant portion of its operational expenditures, demonstrating the continuous investment required to maintain these essential services.

Utilities and Operational Expenses

Airports are inherently energy-intensive, leading to significant utility costs for electricity, water, and climate control. Aena's approach to managing these expenses is detailed in its Strategic Electricity Plan, which focuses on integrating sustainability with operational efficiency. In 2023, Aena continued to invest in energy efficiency measures across its network, aiming to reduce consumption and its environmental impact.

Beyond utilities, operational expenses encompass essential services like cleaning, waste management, and broader administrative overheads necessary for smooth airport functioning. These costs are crucial for maintaining the high standards expected by passengers and airlines. Aena's commitment to optimizing these areas contributes directly to its overall cost structure management.

- Energy Consumption: Airports require substantial electricity for lighting, baggage systems, and air traffic control.

- Water Usage: Significant water is needed for sanitation, irrigation, and aircraft de-icing.

- Waste Management: Efficient handling and disposal of waste generated by passengers and operations is a key expense.

- Sustainability Initiatives: Aena's Strategic Electricity Plan aims to reduce energy costs through renewable energy adoption and efficiency upgrades.

Debt Servicing and Financial Costs

Aena's cost structure is significantly influenced by debt servicing and financial costs. As a company undertaking substantial infrastructure development and expansion, it relies on financing, which naturally leads to expenses associated with managing that debt.

While Aena has made strides in reducing its net financial debt, as evidenced by a reported decrease in 2024, the ongoing interest payments and other financial charges continue to represent a notable cost. For instance, in the first quarter of 2024, Aena reported financial expenses that, while managed, remain a key component of its operational outlays.

The efficient management of this debt is crucial for Aena's overall financial health and its ability to reinvest in its airport network. Lowering these costs directly impacts profitability and enhances the company's capacity for future growth and investment.

- Debt Servicing: Costs incurred from interest payments on loans and bonds.

- Financial Charges: Includes fees and other expenses related to managing Aena's financial obligations.

- Debt Reduction Efforts: Aena's focus on lowering its net financial debt in 2024 aims to mitigate these costs.

- Impact on Profitability: Efficient debt management is vital for improving Aena's financial performance.

Aena's cost structure is dominated by infrastructure maintenance and capital expenditure, with significant allocations for airport safety, efficiency, and modernization under plans like DORA III. Personnel costs are substantial, amounting to €1.35 billion in 2023, reflecting the large workforce required for airport operations. Additionally, security and safety operations, utilities, and general operational expenses like cleaning and waste management are critical cost drivers, with ongoing investments in energy efficiency and sustainability measures.

| Cost Category | 2023 Data (€ billion) | Key Drivers |

|---|---|---|

| Personnel Costs | 1.35 | Salaries, benefits for diverse airport staff |

| Infrastructure & CAPEX | Ongoing investment | Maintenance, modernization, expansion (e.g., DORA III) |

| Security & Safety | Significant portion of OpEx | Technology, trained personnel, contracted services (until 2028) |

| Utilities & Energy | Ongoing investment | Electricity, water, climate control; focus on efficiency |

| Other Operational Expenses | Essential services | Cleaning, waste management, administration |

| Financial Costs | Managed, but notable | Debt servicing, interest payments |

Revenue Streams

Aeronautical fees are a core revenue driver, stemming from airlines paying for essential airport services like landing, parking, and passenger processing. This vital income stream experienced a robust 11.6% growth in 2024, underscoring its importance.

However, the regulatory landscape is shifting, as the CNMC has decided to maintain these fees at their current levels for 2025, which will impact the growth trajectory of this segment.

Commercial revenue at Aena, encompassing retail, food and beverage, and VIP services, is a significant contributor to its non-aeronautical income. This revenue is generated through rents and royalties from a diverse range of businesses operating within the airports, including duty-free shops, restaurants, cafes, and car rental agencies.

This segment is a crucial engine for growth, as evidenced by a substantial 14.7% increase in commercial revenue during 2024. This performance highlights the success of Aena's strategy to diversify income beyond traditional aviation fees by enhancing the passenger experience and offering a wide array of services and retail options.

Aena generates revenue from its parking facilities, serving both passengers and visitors, and also from various other mobility services. This stream is a consistent contributor to the company's overall commercial revenue.

Mobility services, in particular, demonstrated robust growth during the first half of 2025, indicating an increasing demand for these offerings.

Real Estate Services and Leasing

Aena earns income by leasing out land and properties within its airport cities and nearby regions. These spaces are utilized for various commercial activities, including offices, logistics hubs, and cargo handling. This revenue stream is a direct result of Aena's ongoing real estate development initiatives and its strategic approach to maximizing the value of its commercial property portfolio.

In 2024, this segment demonstrated robust growth, with revenues climbing by 11%. This expansion highlights the increasing demand for strategically located commercial real estate within Aena's managed airport ecosystems.

- Airport City Development: Leasing of land and properties for commercial and industrial use.

- Logistics and Cargo Facilities: Revenue generated from dedicated logistics and cargo operational spaces.

- Office Space Leasing: Income derived from renting out office buildings within airport areas.

- Real Estate Optimization: Growth driven by strategic development and commercial asset enhancement.

International Airport Concessions and Management Fees

Aena's international ventures, notably at London Luton Airport and its Brazilian operations, are significant revenue generators. These operations bring in both aeronautical fees, like landing charges, and commercial revenues from retail and services within the airports, bolstering the company's financial health and spreading risk.

The contribution of international activities to Aena's overall financial picture is substantial and growing. Looking ahead, projections indicate that by 2026, these international operations are expected to represent 15% of the company's EBITDA, highlighting their increasing importance to the group's profitability.

- London Luton Airport: A key international asset contributing aeronautical and commercial revenues.

- Brazilian Operations: Another significant international component generating diverse income streams.

- EBITDA Contribution: International activities are forecast to make up 15% of Aena's EBITDA by 2026.

Aena's revenue streams are diverse, encompassing aeronautical fees from airlines for airport services and significant commercial income from retail, food, and beverage operations. These commercial activities saw a strong 14.7% growth in 2024, demonstrating Aena's success in enhancing passenger experience and diversifying income beyond core aviation charges.

Parking and other mobility services also contribute consistently, with mobility services showing robust growth in the first half of 2025. Furthermore, revenue from leasing land and properties for commercial and logistics use, driven by real estate development, grew by 11% in 2024, highlighting the value of its airport ecosystems.

International operations, particularly at London Luton Airport and in Brazil, are also key revenue generators, expected to contribute 15% to Aena's EBITDA by 2026.

| Revenue Stream | 2024 Growth | Key Drivers | 2025 Outlook |

|---|---|---|---|

| Aeronautical Fees | 11.6% | Airline services (landing, parking) | Fees maintained |

| Commercial Revenue | 14.7% | Retail, F&B, VIP services | Continued growth expected |

| Parking & Mobility | N/A (H1 2025 growth) | Passenger and visitor parking, mobility services | Robust growth in mobility |

| Real Estate Leasing | 11% | Airport city development, logistics, offices | Strategic development ongoing |

| International Operations | N/A (EBITDA forecast) | London Luton, Brazil operations | 15% EBITDA by 2026 |

Business Model Canvas Data Sources

The Aena Business Model Canvas is constructed using a blend of internal operational data, extensive market research, and financial performance metrics. This comprehensive approach ensures each component of the canvas is informed by Aena's real-world activities and the broader aviation landscape.