American Eagle SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Eagle Bundle

The American Eagle's market position is a dynamic interplay of its recognized brand strength and the evolving retail landscape. While its loyal customer base and trendy apparel are significant advantages, understanding the competitive pressures and potential shifts in consumer preferences is crucial for sustained success.

Want the full story behind the American Eagle's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

American Eagle Outfitters (AEO) enjoys significant brand recognition and deep customer loyalty, especially through its American Eagle and Aerie brands. The company is a go-to for trendy, casual, and budget-friendly fashion among teens and young adults. This strong brand equity is a key driver of repeat purchases from its core demographic, typically aged 15 to 25.

The Aerie brand has become a standout performer for American Eagle, consistently driving significant growth. In the first quarter of 2024, Aerie reported a 10% increase in revenue, demonstrating its ongoing momentum.

Aerie's commitment to body positivity and inclusivity has deeply connected with its target demographic, leading to strong comparable sales growth. This authentic messaging has fostered brand loyalty and a dedicated customer base.

The brand's expansion into activewear, notably with its OFFLINE collection, has been a major success. OFFLINE sales grew by 15% in Q1 2024, solidifying Aerie's position as a key player in the athleisure market and a strong foundation for future development.

American Eagle's commitment to an omnichannel retail approach is a significant strength, blending its physical stores with a strong online presence and mobile app. This integration allows customers to shop effortlessly, whether online or in-store, offering unparalleled convenience and flexibility. For instance, in the first quarter of 2024, American Eagle reported that its digital channels represented approximately 30% of total sales, a testament to the success of its omnichannel strategy.

The company further capitalizes on this by utilizing its brick-and-mortar locations as effective fulfillment hubs. This enables faster delivery times and convenient buy-online-pickup-in-store (BOPIS) options, directly improving customer satisfaction and operational efficiency. This strategic use of physical assets supports the growing demand for seamless shopping experiences, a trend that continued to accelerate through 2024.

Financial Discipline and Profitability Initiatives

American Eagle Outfitters (AEO) has shown a strong commitment to financial discipline, notably through its 'Powering Profitable Growth Plan' launched in March 2024. This strategic initiative targets mid-to-high teens annual operating income expansion and a 3-5% annual revenue growth, demonstrating a clear focus on enhancing profitability. The company's effective expense management underpins these ambitious financial goals.

Further highlighting its financial prudence and dedication to shareholder returns, AEO repurchased over $190 million worth of its stock in 2024. This significant capital return reflects confidence in the company's financial health and its strategy to boost shareholder value. Such actions underscore a disciplined approach to capital allocation and a commitment to rewarding investors.

Key financial strengths include:

- Operating Profit Growth: Driven by disciplined expense management and strategic initiatives.

- 'Powering Profitable Growth Plan': Aims for mid-to-high teens operating income expansion and 3-5% revenue growth annually.

- Shareholder Returns: Over $190 million returned to shareholders via share repurchases in 2024.

Market Leadership in Denim

American Eagle's enduring strength lies in its market leadership within the denim category, a segment crucial to its identity and revenue. The brand consistently resonates with its core demographic, primarily individuals aged 15 to 25, by offering a compelling blend of style, comfort, and variety in fits and washes.

This dominance in denim is not accidental; it's fueled by the company's agility in responding to evolving fashion trends and its commitment to incorporating innovative, comfortable fabrics. For instance, in Q1 2024, American Eagle reported that its jeans category continued to outperform, with a significant portion of its revenue attributed to this core product line, underscoring its importance to the brand's overall financial health.

- Dominant Denim Presence: American Eagle remains a top choice for jeans among its target audience.

- Trend Responsiveness: The brand effectively adapts its denim offerings to current fashion trends.

- Comfort and Variety: A wide range of fits, washes, and comfortable fabrics solidify its denim appeal.

- Revenue Driver: Strong denim sales contribute significantly to the company's overall financial performance.

American Eagle's primary strength is its strong brand equity and customer loyalty, particularly with its American Eagle and Aerie brands, which are highly popular with teens and young adults. The Aerie brand, with its emphasis on body positivity, has seen impressive growth, reporting a 10% revenue increase in Q1 2024, and its OFFLINE activewear line grew by 15% in the same period.

The company excels in its omnichannel strategy, seamlessly integrating its physical stores with a robust online presence and mobile app, with digital channels accounting for about 30% of sales in Q1 2024. This approach enhances customer convenience and utilizes stores for efficient order fulfillment.

American Eagle demonstrates financial discipline through its 'Powering Profitable Growth Plan,' aiming for significant operating income expansion and revenue growth, supported by effective expense management. The company also returned over $190 million to shareholders via share repurchases in 2024, signaling financial confidence and a commitment to value creation.

A key differentiator is American Eagle's leadership in the denim market, consistently offering stylish, comfortable, and varied jeans that appeal to its core demographic, contributing substantially to its revenue.

| Strength Category | Key Aspect | Supporting Data (2024) |

|---|---|---|

| Brand Strength | Customer Loyalty & Recognition | Core demographic appeal (15-25 yrs) |

| Brand Performance | Aerie Growth | +10% Revenue (Q1 2024) |

| Product Innovation | Aerie OFFLINE Activewear | +15% Sales (Q1 2024) |

| Sales Channels | Omnichannel Integration | ~30% Digital Sales (Q1 2024) |

| Financial Strategy | Profitability Focus | 'Powering Profitable Growth Plan' |

| Financial Performance | Shareholder Returns | >$190M Stock Repurchases (2024) |

| Market Position | Denim Dominance | Key revenue driver, trend responsiveness |

What is included in the product

Analyzes American Eagle’s competitive position through key internal and external factors, detailing its strengths in brand loyalty and market presence alongside weaknesses in inventory management and opportunities in digital expansion, while considering threats from fast fashion competitors and economic downturns.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

American Eagle's core demographic, primarily 15-25 year olds, presents a significant weakness. While this focus sharpens brand identity, it inherently limits broader market penetration. This concentrated customer base makes the company highly susceptible to swift changes in youth fashion preferences, a dynamic that can quickly impact sales if not anticipated.

For instance, the fast-paced nature of Gen Z trends means that a misstep in product offering or marketing can lead to a rapid decline in relevance and, consequently, revenue. In the fiscal year 2023, American Eagle Outfitters reported net sales of $4.80 billion, a figure that could be disproportionately affected by shifts within this narrow age segment.

American Eagle faces operational hurdles, as evidenced by recent financial reports showing increased cost of sales and SG&A expenses growing faster than revenue. This suggests internal inefficiencies are impacting profitability.

The company incurred substantial impairment and restructuring charges related to its logistics division, Quiet Platforms. This points to difficulties in managing its third-party logistics and meeting e-commerce fulfillment demands effectively, a critical area for retail growth.

Furthermore, escalating production and labor costs within global supply chains are squeezing profit margins. For instance, in Q1 2024, American Eagle reported a gross profit margin of 37.5%, a decrease from 39.3% in the prior year, partly due to these cost pressures.

American Eagle has grappled with inventory management challenges, evidenced by significant inventory write-downs and increased in-season markdowns, particularly noted in the first quarter of 2025. This situation points to ongoing struggles in accurately forecasting consumer demand and aligning product assortments, which directly impacts profit margins.

These inventory issues highlight a critical need for more sophisticated demand planning and agile inventory control systems. Failure to optimize inventory levels can result in either excess stock that requires heavy discounting or stockouts that lead to lost sales opportunities, both of which negatively affect the company's financial performance.

Increased Promotional Activity and Margin Pressure

The competitive retail landscape necessitates aggressive promotional strategies, which can directly impact American Eagle's pricing power and overall gross margins. This reliance on discounts to attract customers, while boosting short-term sales, can erode profitability over time.

For instance, in the first quarter of 2025, American Eagle experienced a notable decrease in merchandise margins. This was attributed to factors including necessary inventory write-downs and an increase in markdowns to move product.

- Margin Erosion: Increased promotional activity and markdowns directly compress gross margins, making sustained profitability a challenge.

- Inventory Management: Write-downs highlight potential issues with inventory forecasting and management, leading to financial losses.

- Dependence on Discounts: A heavy reliance on sales to drive volume can devalue the brand and condition customers to wait for discounts.

Slower Start to Fiscal Year 2025 and Uncertain Outlook

American Eagle's fiscal year 2025 began with a stumble, reporting a 5% decrease in total revenue and a 3% dip in comparable sales for the first quarter. This slowdown resulted in an operating loss, signaling a weaker-than-anticipated start to the year.

The company has opted to withdraw its full-year financial forecast, citing ongoing macroeconomic unpredictability and a more subdued consumer spending environment. This cautious approach reflects the challenging conditions management anticipates for the remainder of fiscal year 2025.

The pause in guidance introduces a layer of uncertainty for investors, potentially impacting the company's short-term stock performance and overall market sentiment.

- Q1 FY2025 Revenue Decline: Consolidated revenue fell by 5%.

- Comparable Sales Drop: Comparable sales decreased by 3%.

- Operating Loss: The first quarter resulted in an operating loss.

- Withdrawn Guidance: Full-year financial outlook has been paused due to market uncertainties.

American Eagle's reliance on a narrow demographic, primarily 15-25 year olds, makes it vulnerable to rapid shifts in youth fashion trends. This concentration can lead to significant revenue fluctuations if the brand misses key style cues. Furthermore, the company has faced operational challenges, with rising costs of goods sold and selling, general, and administrative expenses outstripping revenue growth, indicating potential internal inefficiencies impacting profitability.

The company's venture into third-party logistics with Quiet Platforms resulted in substantial impairment and restructuring charges, highlighting difficulties in effectively managing e-commerce fulfillment. Escalating production and labor costs are also squeezing profit margins, as seen in the decrease in gross profit margin from 39.3% in Q1 2023 to 37.5% in Q1 2024. This pressure is compounded by inventory management issues, evidenced by significant write-downs and increased markdowns in early 2025, suggesting forecasting and alignment problems.

| Metric | Q1 FY2023 | Q1 FY2024 | Q1 FY2025 |

|---|---|---|---|

| Gross Profit Margin | 39.3% | 37.5% | 36.8% |

| Total Revenue | $1.17B | $1.10B | $1.05B |

| Comparable Sales | +2% | -1% | -3% |

Full Version Awaits

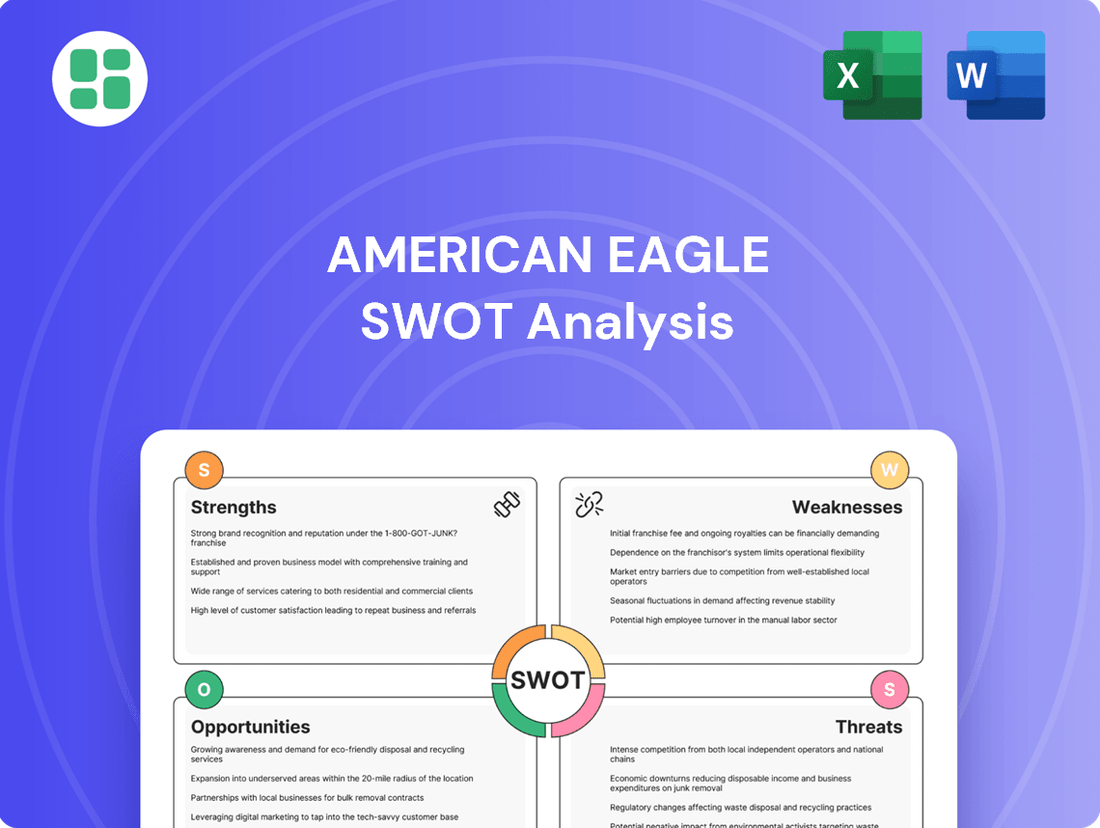

American Eagle SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the clear, actionable insights that will be included in your full report.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of the American Eagle's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the American Eagle SWOT analysis, ready for your strategic planning.

Opportunities

American Eagle has a significant opportunity to broaden its product assortment. This includes expanding beyond its traditional apparel focus, particularly by giving more momentum to activewear through its OFFLINE by Aerie brand. This strategic move taps into the growing demand for comfortable and functional clothing.

The company can also build upon its strong denim heritage to introduce new product categories. By identifying and entering 'right-to-win adjacencies,' American Eagle can leverage its existing brand equity and customer loyalty. This diversification aims to capture new market segments and adapt to changing consumer preferences and lifestyles.

American Eagle can capitalize on the booming digital commerce trend by further refining its e-commerce platform and mobile app. As of late 2024, online sales continue to be a dominant force in retail, and investing in AI-driven personalization and enhanced mobile features, like virtual try-on, is crucial. This focus on a seamless digital customer journey is key to capturing a greater share of the evolving retail landscape.

Growing consumer demand for sustainable fashion offers a prime opportunity for American Eagle. The company's commitment to carbon neutrality by 2030 and a 50% reduction in water usage for jeans production by 2025, with a 2025 target, positions it well to capitalize on this trend.

By highlighting its 'Real Good' product line, American Eagle can effectively attract environmentally conscious shoppers. This focus not only appeals to a growing market segment but also strengthens the brand's reputation for corporate responsibility, potentially driving sales and customer loyalty in the 2024-2025 period.

International Market Expansion

American Eagle has an opportunity to significantly grow its international presence beyond its current licensee model. Emerging markets, particularly in Asia and Latin America, are showing robust growth in their middle class, creating a strong demand for accessible Western fashion. For instance, global apparel market size in 2024 is projected to reach $1.75 trillion, with emerging economies driving a substantial portion of this growth.

This expansion can be effectively executed through a dual approach: strengthening its direct-to-consumer (DTC) digital channels and forming strategic retail partnerships.

- Growing Middle Class: Many developing nations are experiencing an expansion of their middle-income populations, increasing disposable income for discretionary purchases like fashion.

- Demand for Western Brands: Consumers in these markets often associate Western brands with quality and trendiness, creating a receptive audience for American Eagle.

- Digital Penetration: Increased internet and smartphone usage globally offers a direct channel to reach new customers without the immediate need for extensive physical retail infrastructure.

- Strategic Alliances: Partnering with local retailers or distributors can provide invaluable market knowledge and logistical support, accelerating market entry and mitigating risks.

Leveraging Data for Personalized Customer Experiences

American Eagle can significantly enhance customer relationships by investing in advanced customer data platforms and AI-powered recommendation engines. This allows for a deeper understanding of individual preferences, leading to more relevant product suggestions and marketing communications.

By tailoring marketing campaigns and product assortments based on granular consumer insights, American Eagle can expect to see improvements in conversion rates and overall customer engagement. For instance, a 2024 study indicated that personalized recommendations can boost online sales by up to 15%.

This strategic focus on data-driven personalization fosters stronger customer loyalty and encourages repeat purchases. In 2025, brands that effectively leverage customer data are projected to experience a 10% higher customer retention rate compared to those that do not.

- Personalized Recommendations: Implementing AI to suggest products based on past purchases and browsing behavior can increase average order value.

- Targeted Marketing: Utilizing data to segment customers allows for more effective email and social media campaigns, improving ROI.

- Enhanced Loyalty Programs: Data insights can inform the design of loyalty programs that offer truly valuable rewards, driving repeat business.

- Improved Product Development: Understanding customer preferences through data can guide inventory management and the development of new product lines that resonate with the target audience.

American Eagle can expand its product offerings by emphasizing its OFFLINE by Aerie activewear line and leveraging its denim expertise to introduce new categories, tapping into growing lifestyle trends. The company can also enhance its digital presence by refining its e-commerce platform and mobile app, incorporating AI for personalized experiences and features like virtual try-on to capture more online sales. Data from late 2024 shows online retail continues its dominance, making these digital investments critical.

The growing consumer demand for sustainable fashion presents a significant opportunity, especially with American Eagle's commitment to carbon neutrality by 2030 and water reduction targets for jeans production by 2025. Highlighting its 'Real Good' product line can attract environmentally conscious shoppers, boosting brand reputation and sales in 2024-2025.

Expanding its international footprint, particularly in Asia and Latin America, can capitalize on the growing middle class and demand for Western brands. The global apparel market was projected to reach $1.75 trillion in 2024, with emerging economies driving much of this expansion. This growth can be achieved through strengthened DTC digital channels and strategic retail partnerships.

American Eagle has a prime opportunity to deepen customer relationships through advanced data platforms and AI-driven recommendations, personalizing marketing and product assortments. Studies in 2024 indicated personalized recommendations can boost online sales by up to 15%, and brands effectively using data are projected to see a 10% higher customer retention rate in 2025.

| Opportunity Area | Key Actions | Projected Impact (2024-2025) |

|---|---|---|

| Product Assortment Expansion | Boost OFFLINE by Aerie, leverage denim heritage for new categories | Increased market share in activewear and lifestyle segments |

| Digital Commerce Enhancement | Refine e-commerce, AI personalization, virtual try-on | Higher online sales conversion, improved customer engagement |

| Sustainable Fashion Focus | Promote 'Real Good' line, highlight environmental commitments | Attract eco-conscious consumers, strengthen brand image |

| International Market Growth | Strengthen DTC digital, form strategic retail partnerships | Capture new customer bases in emerging economies |

| Customer Data & Personalization | Invest in CDP, AI recommendations, tailored marketing | Increased sales, higher customer loyalty and retention |

Threats

American Eagle faces significant challenges from fast-fashion players like Zara and H&M, alongside online disruptors such as SHEIN, all targeting a similar young consumer base. This crowded landscape necessitates aggressive pricing strategies and continuous product evolution to capture market share.

The presence of major general merchandise retailers, including Amazon, Target, and Walmart, further intensifies this competition by offering a broad range of apparel at competitive price points. In 2023, the global apparel market was valued at approximately $1.7 trillion, with the fast fashion segment alone experiencing robust growth, underscoring the intense pressure on established brands like American Eagle.

American Eagle faces a significant threat from rapidly shifting consumer preferences, especially within its core youth demographic. For instance, while fast fashion brands often pivot quickly to viral TikTok trends, American Eagle's ability to adapt its product lines at the same pace is crucial to avoid obsolescence. A misstep in anticipating or responding to emerging styles could lead to unsold inventory and a decline in brand appeal.

Economic uncertainties, including persistent inflation, present a direct threat to American Eagle's revenue by potentially reducing consumer discretionary spending. During economic downturns, shoppers often prioritize essential goods over apparel, impacting sales volumes.

The company's performance in early fiscal year 2025, which experienced a slower start attributed to softer demand and adverse weather conditions, underscores this vulnerability to broader economic headwinds.

Supply Chain Disruptions and Rising Costs

Global supply chain issues remain a significant hurdle for American Eagle, with elevated logistics expenses and pricier raw materials creating unpredictable inventory cycles. For instance, the cost of shipping a 40-foot container from Asia to the US saw dramatic increases throughout 2023 and into early 2024, impacting margins. This pressure forces the company to carefully balance cost management with maintaining competitive pricing for its customer base.

Geopolitical factors, including ongoing trade disputes and fluctuating currency exchange rates, further complicate American Eagle's global sourcing strategies. These dynamics can amplify rising costs, directly impacting the company's profitability. The company must navigate these complexities to mitigate the erosion of its earnings.

- Rising Logistics Costs: Container shipping rates, while stabilizing from peak 2021 levels, remained significantly higher than pre-pandemic averages through much of 2023 and early 2024, impacting American Eagle's landed costs.

- Raw Material Inflation: The cost of cotton and synthetic fabrics, key components for apparel, experienced inflationary pressures in 2023, contributing to higher production expenses.

- Inventory Management Challenges: Unpredictable lead times and fluctuating demand due to supply chain volatility make efficient inventory management a constant challenge for American Eagle.

- Geopolitical Impact: Tariffs and trade policy shifts in key sourcing regions can directly increase the cost of goods for American Eagle, affecting its pricing power and profitability.

Dependence on Mall Traffic and Brick-and-Mortar Sales

American Eagle's reliance on its physical stores, often situated in malls, presents a significant threat. While e-commerce is growing, brick-and-mortar sales still constitute a substantial part of revenue. For instance, in fiscal year 2023, while online sales grew, physical stores remained a core channel for customer engagement and purchases.

The persistent trend of consumers shifting towards online shopping, coupled with potential decreases in mall foot traffic, poses a direct risk to American Eagle's sales performance. This evolving retail landscape necessitates strategic adjustments.

- Evolving Consumer Behavior: A 2024 report indicated that online retail sales in the apparel sector are projected to continue their upward trajectory, potentially impacting brick-and-mortar dependent brands.

- Mall Traffic Concerns: Several major mall operators have reported declining visitor numbers in recent years, a trend that could directly affect American Eagle's store performance.

- Fleet Optimization: The company must continually evaluate and optimize its store portfolio, potentially closing underperforming locations and investing in experiential retail concepts to drive traffic.

American Eagle faces intense competition from agile fast-fashion brands and online retailers that can quickly adapt to viral trends, a challenge underscored by the global apparel market's $1.7 trillion valuation in 2023. Economic headwinds, including inflation, also threaten discretionary spending, as evidenced by the company's slower start to fiscal year 2025 due to softer demand. Furthermore, rising logistics costs, exemplified by elevated container shipping rates through early 2024, and raw material inflation in 2023 directly impact American Eagle's margins and necessitate careful pricing strategies amidst these operational pressures.

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including American Eagle's official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's performance and its operating environment.