American Eagle Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Eagle Bundle

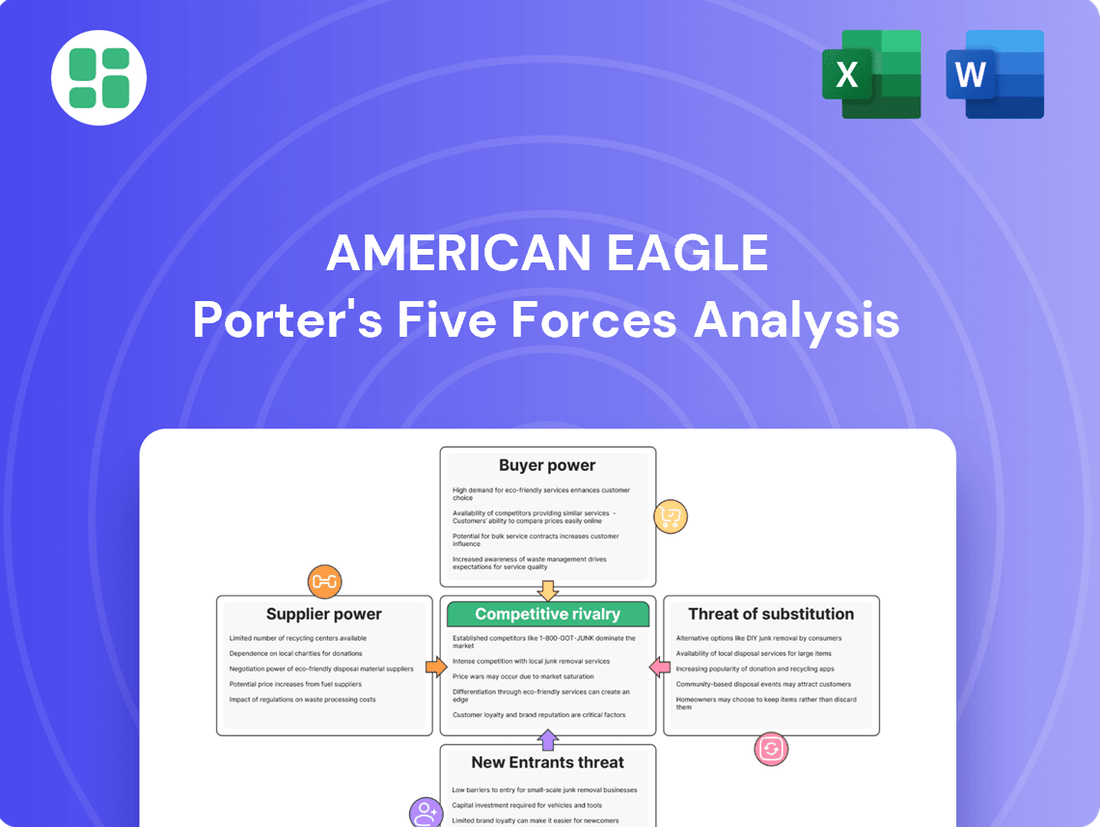

American Eagle faces moderate buyer power, as consumers have many apparel choices but also value brand loyalty. The threat of new entrants is present, but high startup costs and established brand recognition create some barriers. Understanding these dynamics is crucial for navigating the competitive fashion landscape.

Ready to move beyond the basics? Get a full strategic breakdown of American Eagle’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The fashion industry's supply chain, especially for textiles, is largely global and spread out, with many producers of raw materials and finished goods. This fragmentation typically weakens the bargaining power of individual suppliers when dealing with major retailers like American Eagle. For instance, in 2023, the global textile market was valued at over $1 trillion, with a vast number of players contributing to this figure.

However, the demand for specialized or sustainable materials, which consumers increasingly seek, can lead to a more concentrated group of suppliers. This concentration can shift the balance, giving these specialized suppliers more leverage over buyers like American Eagle, as they control access to these desirable inputs.

Switching costs for American Eagle to change suppliers can be moderate to high. This involves the expense and effort of new negotiations, rigorous quality control checks on new materials, and the potential for disruptions to their ongoing production and inventory management. For instance, if a supplier provides unique fabric blends or specialized manufacturing processes, finding an equivalent alternative can be challenging and costly.

Establishing new supplier relationships requires significant investment in time and resources. American Eagle would need to vet potential partners, conduct extensive sampling, and ensure new suppliers can meet their stringent production timelines and quality standards. This process can be particularly intricate for core product lines where consistency is paramount, directly impacting brand reputation and customer satisfaction.

Suppliers are fundamental to American Eagle's strategy of providing fashionable and accessible clothing. Any interruption in their operations, like material scarcity or rising manufacturing expenses, directly affects American Eagle's capacity to get its goods to customers.

In 2023, American Eagle Outfitters reported a cost of goods sold of $3.2 billion, highlighting the significant financial relationship with its suppliers. The company's reliance on a consistent flow of textiles, manufacturing services, and logistics means that supplier pricing power can influence American Eagle's profitability and product availability.

Threat of Forward Integration

The threat of suppliers integrating forward into American Eagle's retail operations is generally low. This is because establishing and managing a successful retail brand requires significant investment in marketing, store operations, and direct-to-consumer (DTC) logistics, capabilities that are distinct from textile manufacturing. For instance, while some large textile manufacturers might explore niche direct-to-consumer channels, the capital outlay and expertise needed to compete with established brands like American Eagle in the mass market are substantial barriers.

For the broader apparel industry, the cost of forward integration for suppliers is high. Consider the complexities of managing inventory across multiple retail locations, developing compelling marketing campaigns, and understanding consumer fashion trends – these are core competencies for retailers like American Eagle, not typically for fabric mills. In 2024, the DTC apparel market continued to see strong growth, but also intense competition, making it a challenging space for new entrants without a pre-existing brand identity and customer base.

- Low Threat: Suppliers lack the brand equity and retail infrastructure to effectively compete with established apparel retailers.

- High Capital Requirements: Significant investment in marketing, store development, and supply chain management deters supplier forward integration.

- Capability Gap: Textile manufacturers typically focus on production, not brand building or consumer-facing retail strategies.

- Market Saturation: The mass-market apparel retail sector is highly competitive, making it difficult for new entrants to gain traction.

Uniqueness of Supplier Products/Services

The uniqueness of supplier products significantly influences their bargaining power. While many basic apparel materials are readily available from multiple sources, suppliers who can offer distinctive designs, patented fabric technologies, or cutting-edge sustainable production methods gain an advantage. This allows them to command higher prices or more favorable terms.

American Eagle Outfitters' commitment to sustainability, particularly its 'Real Good' initiative, highlights this dynamic. This focus likely necessitates working with a more concentrated group of suppliers possessing specialized capabilities in eco-friendly materials or manufacturing. For instance, in 2023, the apparel industry saw increased demand for recycled polyester, with prices for recycled PET flakes rising due to supply constraints and growing brand commitments, potentially increasing the bargaining power of suppliers in this niche.

- Unique Designs: Suppliers providing exclusive patterns or styles can charge a premium.

- Proprietary Technologies: Patented fabrics or manufacturing processes create a barrier to entry for competitors.

- Sustainable Sourcing: As brands like American Eagle prioritize ESG factors, suppliers with verified sustainable practices gain leverage.

The bargaining power of suppliers for American Eagle is generally moderate. While the vast global textile market offers many options, increasing consumer demand for specialized and sustainable materials concentrates power with a select few suppliers. This can lead to higher costs and more favorable terms for these specialized providers, impacting American Eagle's profitability.

Switching costs and the investment needed to establish new supplier relationships are significant, further bolstering supplier leverage. For instance, American Eagle's 2023 cost of goods sold was $3.2 billion, underscoring the financial importance of these relationships and the potential impact of supplier pricing power.

| Factor | Impact on Supplier Bargaining Power | Notes for American Eagle |

|---|---|---|

| Supplier Concentration | Moderate to High (for specialized materials) | Growing demand for sustainable fabrics can empower niche suppliers. |

| Switching Costs | Moderate to High | Finding equivalent alternatives for unique materials is costly and time-consuming. |

| Forward Integration Threat | Low | Suppliers lack the brand equity and retail infrastructure to compete directly. |

| Uniqueness of Products | Moderate to High | Proprietary technologies or sustainable sourcing methods increase supplier leverage. |

What is included in the product

Analyzes the competitive intensity within the apparel retail market, focusing on American Eagle's specific challenges and opportunities.

Instantly identify and address competitive threats with a visual representation of all five forces, offering a clear path to strategic advantage.

Customers Bargaining Power

American Eagle's core demographic, typically aged 15-25, exhibits significant price sensitivity. This younger consumer base actively seeks out fashionable clothing that aligns with current trends but remains within their budget. Their purchasing decisions are heavily influenced by affordability, making them a powerful negotiating force in the retail landscape.

This price sensitivity is amplified by the widespread availability of comparable or even lower-priced alternatives from numerous competitors, particularly fast-fashion brands. In 2024, the apparel market continues to see intense competition, with many brands offering aggressive discounts and promotions to capture market share. This environment empowers customers, as they can readily switch to a retailer offering a better deal, thereby increasing American Eagle's need to manage its pricing strategies carefully.

The sheer volume of apparel options available to consumers significantly bolsters their bargaining power. From established brands to emerging online retailers and fast fashion players, customers have a vast array of choices, making it easy to find alternatives if American Eagle's offerings or pricing don't align with their preferences.

This abundance of substitutes means customers can readily switch to competitors if they perceive better value, forcing American Eagle to remain competitive on price and style. For instance, the global apparel market was valued at approximately $1.7 trillion in 2023, with a significant portion driven by online sales, highlighting the ease with which consumers can explore and compare options.

Today's customers, especially digitally native Gen Z, are incredibly informed. They leverage social media and online reviews to instantly compare products, prices, and even brand ethics. This heightened transparency gives them significant leverage.

For instance, a 2024 report indicated that over 70% of Gen Z consumers actively seek out peer reviews before making a purchase, directly impacting brand loyalty and pricing strategies. This means brands like American Eagle must remain competitive not just on product, but on value and transparency.

Low Switching Costs for Customers

Customers face very low switching costs when deciding where to buy their apparel. This means they can readily move their business from American Eagle to other brands without much hassle or expense. For instance, a shopper might easily switch from American Eagle to a competitor like H&M or Zara if they find better deals or styles elsewhere.

The ease of changing retailers significantly strengthens the bargaining power of customers. In 2023, the global apparel market saw substantial competition, with brands constantly vying for consumer attention through pricing and product offerings. This competitive landscape means American Eagle must remain highly attuned to customer preferences and pricing strategies.

- Low Switching Costs: Customers can easily switch between apparel retailers without incurring significant costs or effort.

- Competitive Landscape: The apparel industry is highly competitive, with numerous brands offering similar products, increasing customer choice.

- Impact on American Eagle: This low switching cost empowers customers, forcing American Eagle to focus on value, style, and customer experience to retain loyalty.

Collective Bargaining Power (e.g., Social Media Influence)

While individual customers typically have little sway over a large retailer like American Eagle, their collective voice, amplified by social media, can be a powerful force. Gen Z, a key demographic for American Eagle, is particularly adept at leveraging online platforms to express opinions and drive trends. For instance, a viral TikTok campaign or a coordinated social media boycott can quickly impact brand perception and sales figures, forcing retailers to respond to consumer sentiment.

This collective bargaining power is not merely theoretical. In 2023, social media sentiment analysis revealed that negative discussions surrounding a brand's sustainability practices or ethical sourcing could lead to a measurable drop in engagement and purchase intent among younger consumers. American Eagle, like its peers, must actively monitor and engage with these online communities to manage its reputation and address customer concerns proactively.

- Social Media Influence: Gen Z's collective voice on platforms like TikTok and Instagram can shape brand perception and purchasing decisions.

- Trend Amplification: Viral trends and online challenges can rapidly shift consumer preferences, impacting demand for specific styles or products.

- Boycott Power: Coordinated online campaigns can exert significant pressure on retailers regarding pricing, product quality, or brand ethics.

- Reputation Management: Retailers must actively engage with online communities to address concerns and maintain a positive brand image.

American Eagle's customers, particularly its younger demographic, possess considerable bargaining power due to their price sensitivity and the vast array of available alternatives. This is further amplified by low switching costs and the collective influence wielded through social media. For instance, in 2024, the fast-fashion sector continued its aggressive pricing strategies, forcing established brands to remain competitive.

The ease with which consumers can compare prices and styles online significantly enhances their negotiating position. In 2023, global e-commerce in apparel reached substantial figures, underscoring the accessibility of competitive offers. This environment necessitates that American Eagle consistently delivers value and stays attuned to evolving consumer preferences to maintain market share.

| Factor | Impact on American Eagle | Supporting Data (2023-2024) |

|---|---|---|

| Price Sensitivity | High | Gen Z consumers, a key demographic, actively seek deals; over 70% consult reviews before purchase (2024 report). |

| Availability of Substitutes | High | Global apparel market valued at ~$1.7 trillion (2023), with numerous competitors offering similar styles. |

| Switching Costs | Low | Consumers can easily shift between retailers without significant financial or effort barriers. |

| Collective Bargaining Power | Moderate to High | Social media trends and sentiment can rapidly influence brand perception and sales; viral campaigns can drive significant shifts. |

Same Document Delivered

American Eagle Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for American Eagle Outfitters details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the apparel industry. What you're previewing is precisely what you'll receive, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The American apparel retail landscape is intensely competitive, featuring a wide array of brands. American Eagle faces rivals ranging from established specialty retailers like Gap and Urban Outfitters to fast-fashion giants such as H&M and Zara, alongside an increasing number of direct-to-consumer online brands.

This intense rivalry is underscored by the sheer volume of players. For instance, in 2024, the U.S. apparel market is estimated to be worth over $350 billion, with hundreds of brands vying for consumer attention across various price points and styles.

American Eagle's competitive battleground extends across multiple channels. The company operates a significant brick-and-mortar store presence, a robust e-commerce website, and a mobile application, meaning it must contend with competitors who excel in any or all of these areas.

The apparel market, especially the segment catering to 15-25 year olds, is a hotbed of activity. While e-commerce continues to expand, the pace of trend cycles within this demographic is incredibly fast, making it a challenging space. For instance, in 2024, the global online apparel market was valued at over $800 billion, showcasing substantial growth.

This rapid evolution fuels intense competition, particularly from fast fashion retailers. These players are adept at quickly translating emerging trends into affordable products, directly impacting established brands. The fast fashion market itself is expected to see continued robust growth, with projections indicating it could reach over $120 billion globally by 2025, underscoring the pressure on companies like American Eagle.

American Eagle's competitive rivalry is shaped by its distinct brand identities, American Eagle and Aerie. Aerie, in particular, has cultivated strong brand loyalty through its emphasis on comfort and inclusive body-positivity messaging, resonating deeply with younger consumers. This differentiation, however, faces the ongoing challenge of retaining Gen Z's attention in a market where brand exploration is common.

Exit Barriers

Exit barriers in the apparel retail sector, including American Eagle's, can be substantial. Think about the long-term lease agreements for their numerous physical stores and the significant investments tied up in inventory. These factors make it difficult for companies to simply walk away, even when profits are thin, which can keep less profitable players in the market and thus fuel ongoing competitive rivalry.

These entrenched commitments mean that even struggling retailers might persist, continuing to compete for market share. For instance, in 2023, the apparel retail sector saw a significant number of store closures, yet many companies with extensive lease obligations continued operations. This persistence, driven by exit barriers, directly contributes to the intensity of competition.

- High Capital Investment: Significant capital is often tied up in physical retail spaces, inventory, and established supply chains, making divestment costly.

- Lease Obligations: Long-term leases on retail locations represent a substantial financial commitment that is difficult to exit without penalty.

- Inventory Management: The need to liquidate existing inventory, often at a loss, can delay a company's exit from the market.

- Brand and Reputation: A sudden closure can damage a brand's reputation and impact future business ventures, acting as a deterrent to a swift exit.

Advertising and Marketing Intensity

The apparel industry, particularly for brands targeting younger consumers like American Eagle, is characterized by intense advertising and marketing efforts. To capture and maintain brand visibility, companies must allocate significant resources to reach their demographic. For instance, in 2023, the global digital advertising market reached an estimated $600 billion, highlighting the scale of investment required.

Brands must constantly evolve their marketing approaches, with a strong emphasis on digital channels and social media engagement to remain relevant with a dynamic audience. This includes influencer collaborations and targeted online campaigns. American Eagle’s marketing spend for fiscal year 2023 was approximately $400 million, demonstrating a commitment to staying top-of-mind.

- Digital Dominance: Marketing spend increasingly shifts towards online platforms, where younger consumers spend their time.

- Social Media Engagement: Continuous innovation in social media strategies is crucial for brand relevance and customer interaction.

- Influencer Marketing: Collaborations with influencers remain a key tactic to build trust and reach specific market segments.

- Brand Differentiation: High marketing intensity helps brands like American Eagle stand out in a crowded and competitive marketplace.

American Eagle faces fierce competition from a broad spectrum of apparel retailers, including specialty stores, fast-fashion giants, and an increasing number of direct-to-consumer online brands. This intense rivalry is evident in the massive U.S. apparel market, valued at over $350 billion in 2024, with hundreds of brands competing for consumer attention across all channels.

The rapid pace of trend cycles, especially among younger demographics, fuels this competition, with fast fashion retailers adeptly translating trends into affordable products. The global online apparel market, exceeding $800 billion in 2024, further amplifies this pressure. American Eagle's brand differentiation, particularly with Aerie's success, helps, but retaining Gen Z's attention remains a constant challenge.

Substantial exit barriers, such as long-term lease agreements and significant inventory investments, keep even less profitable players in the market, intensifying overall rivalry. This persistence, coupled with high marketing expenditures, estimated at around $400 million for American Eagle in fiscal year 2023, highlights the continuous effort required to maintain brand visibility and relevance in this dynamic sector.

| Key Competitors | Market Segment Focus | 2024 Estimated U.S. Apparel Market Value |

| Gap Inc. | Casual apparel, denim | $350+ Billion |

| Urban Outfitters | Bohemian, vintage-inspired | |

| H&M, Zara | Fast fashion, trend-driven | |

| Online DTC Brands | Niche markets, direct engagement |

SSubstitutes Threaten

Consumers often find substitutes for American Eagle's offerings that provide comparable style and function, but at different price points. This price-performance trade-off is a significant factor. For instance, the growing popularity of second-hand clothing markets, such as ThredUp and Poshmark, presents a direct lower-cost alternative. In 2023, the resale apparel market was valued at approximately $35 billion in the U.S. alone, indicating a substantial consumer shift towards more economical options.

Furthermore, clothing rental services and the burgeoning DIY fashion trend also pose viable substitutes. These options appeal particularly to price-sensitive consumers or those prioritizing sustainability, allowing them to access fashionable items without the commitment of a new purchase. This competitive pressure from substitutes can limit American Eagle's pricing power and market share.

Consumers increasingly find ways to satisfy their clothing needs without directly purchasing new items from brands like American Eagle. Thrifting, upcycling old garments, and participating in clothing swaps are gaining traction. For instance, the resale market for apparel is projected to reach $77 billion by 2025, demonstrating a significant shift in consumer behavior.

The growing emphasis on the circular economy and sustainable fashion offers compelling alternatives to traditional retail. These movements encourage reusing and repurposing clothing, directly challenging the model of buying new, mass-produced items. This trend is supported by data showing that 70% of consumers are more likely to purchase from brands committed to sustainability.

The increasing demand for sustainable and ethically produced goods presents a significant threat of substitutes for American Eagle. Younger consumers, especially Gen Z, are increasingly prioritizing longevity and ethical sourcing over disposable fashion. For instance, a 2024 survey indicated that 60% of Gen Z consumers consider sustainability when making purchasing decisions.

Ease of Switching to Substitutes

The threat of substitutes for American Eagle is amplified by the ease with which consumers can shift to alternative apparel solutions. This low switching cost means customers can readily access second-hand clothing through online platforms like Depop or Poshmark, or participate in local clothing swaps. For instance, the resale market for apparel is projected to grow significantly, with some estimates suggesting it could reach $77 billion by 2025, indicating a strong consumer appetite for pre-owned fashion.

Furthermore, consumers can simply extend the life of their existing wardrobe, delaying new purchases without incurring substantial financial penalties or requiring significant behavioral adjustments. This ability to delay consumption or utilize current assets reduces the immediate demand for new apparel from brands like American Eagle.

- High Accessibility to Second-Hand Markets: Online platforms and physical thrift stores offer a vast array of pre-owned clothing, making it easy for consumers to find affordable alternatives.

- Low Financial Barrier to Entry: Unlike switching between competing brands with potentially higher price points, utilizing existing clothes or engaging in swaps requires minimal to no new expenditure.

- Minimal Behavioral Change Required: Consumers do not need to learn new skills or adopt drastically different habits to opt for substitutes like wearing older clothes or participating in clothing exchanges.

- Growing Resale Market: The increasing popularity and accessibility of the resale market, which saw substantial growth in 2023 and is expected to continue its upward trajectory, directly competes with new apparel sales.

Technological Advancements in Substitutes

Technological advancements are creating new avenues for how consumers engage with fashion, potentially acting as substitutes for traditional apparel purchases. Virtual try-on technologies, for instance, allow shoppers to visualize garments digitally, which could lessen the immediate need to buy physical items for experimentation. In 2023, the global virtual try-on market was valued at approximately $1.5 billion, with projections indicating significant growth, suggesting an increasing consumer comfort with digital fashion experiences.

The burgeoning metaverse and digital fashion present another layer of substitution. Consumers might opt for digital clothing to express their identity or style within virtual worlds, diverting spending and attention away from physical garments. While specific spending figures for metaverse fashion are still emerging, early adoption indicates a growing trend; for example, some digital fashion brands reported substantial sales in 2024, with certain virtual outfits selling for thousands of dollars.

- Virtual Try-On Market Growth: The virtual try-on market is expected to expand, potentially impacting physical garment sales by offering a digital alternative for product visualization.

- Metaverse Fashion Adoption: As the metaverse evolves, digital fashion could capture a portion of consumer spending previously allocated to physical apparel for self-expression.

- Shifting Consumer Perceptions: These technologies may alter how consumers perceive the value and necessity of acquiring new physical clothing for aesthetic or social fulfillment.

The threat of substitutes for American Eagle is significant, driven by accessible and affordable alternatives. The resale market, valued at approximately $35 billion in the U.S. in 2023, offers a direct challenge by providing pre-owned clothing at lower price points.

Beyond resale, consumers are increasingly embracing clothing rental services and DIY fashion, further diversifying their options and reducing reliance on new purchases from brands like American Eagle.

The ease of switching to these substitutes, coupled with a growing consumer interest in sustainability, means American Eagle faces pressure on both pricing and market share.

| Substitute Type | Key Characteristics | Market Trend/Data Point |

| Second-Hand Clothing | Affordable, sustainable, unique items | U.S. resale market valued at ~$35 billion in 2023 |

| Clothing Rental | Temporary access, variety, cost-effective for events | Growing segment, particularly for occasion wear |

| DIY/Upcycling | Personalization, sustainability, cost savings | Increasingly popular among younger demographics |

| Virtual/Digital Fashion | Digital self-expression, novelty | Emerging market with early sales indicating potential |

Entrants Threaten

Establishing a physical presence in the apparel retail sector, like American Eagle, demands significant upfront investment. This includes securing prime real estate, stocking diverse inventory, and building a capable workforce. For instance, opening just one new store can easily cost hundreds of thousands, if not millions, of dollars.

However, the digital landscape has dramatically reshaped this. E-commerce and direct-to-consumer (DTC) strategies have substantially reduced the capital needed to launch an online fashion brand. This accessibility means new, agile competitors can emerge with far lower entry costs, directly challenging established players.

Established brands like American Eagle have cultivated significant brand recognition and a loyal customer base over many years. For instance, in 2023, American Eagle Outfitters reported net revenue of $5.0 billion, demonstrating the scale of its established presence. Newcomers must overcome the hurdle of differentiating themselves and building trust in a saturated apparel market, a task demanding substantial marketing expenditure to gain traction.

American Eagle's established omni-channel distribution, encompassing a vast physical store footprint and sophisticated online operations, presents a significant barrier. Newcomers face substantial capital requirements to replicate this reach, potentially limiting their market penetration from the outset.

Supply Chain Complexity and Relationships

Building robust and dependable supply chains, particularly those prioritizing ethical and sustainable sourcing, presents a significant hurdle for newcomers. This process is inherently complex and demands considerable time investment.

New entrants often find it challenging to cultivate the essential relationships and establish the necessary infrastructure to effectively compete with the established scale and operational efficiencies of existing players like American Eagle.

For instance, in 2024, the global apparel market, valued at approximately $1.7 trillion, saw established brands benefiting from long-standing supplier agreements and logistics networks that newcomers would take years to replicate.

- High Capital Investment: Developing sophisticated supply chain infrastructure, including warehousing, distribution centers, and technology for inventory management, requires substantial upfront capital.

- Supplier Relationships: Securing reliable and ethically compliant suppliers, especially for specialized materials or manufacturing processes, often depends on established trust and volume commitments.

- Logistical Expertise: Efficiently managing global logistics, including international shipping, customs, and last-mile delivery, demands specialized knowledge and established networks that new entrants lack.

- Sustainability Compliance: Meeting evolving consumer and regulatory demands for sustainable and transparent supply chains adds another layer of complexity and cost for new businesses.

Regulatory Hurdles and Compliance

The apparel industry is increasingly subject to stringent regulations, especially concerning environmental impact, ethical sourcing, and consumer safety. For instance, the European Union's proposed Ecodesign for Sustainable Products Regulation (ESPR) aims to set sustainability requirements for various product categories, including textiles, by 2026, potentially impacting how new brands operate.

Newcomers must invest significantly in understanding and adhering to these complex compliance frameworks, which can represent a substantial upfront cost and operational challenge, particularly for smaller, less capitalized ventures. In 2024, the global apparel market, valued at over $1.7 trillion, saw growing consumer demand for transparency in supply chains, making compliance not just a legal necessity but a market expectation.

- Regulatory Burden: Navigating evolving sustainability mandates and labor laws adds significant operational complexity and cost for new apparel brands.

- Compliance Costs: Meeting requirements for ethical sourcing, material traceability, and product safety can demand substantial investment in systems and audits.

- Market Expectations: Consumers increasingly demand transparency and ethical practices, making adherence to regulations a critical factor for market entry and brand reputation.

The threat of new entrants for American Eagle is moderate. While the digital age has lowered some barriers, the capital required for physical retail, brand building, and supply chain infrastructure remains substantial. Established brand loyalty and extensive distribution networks create significant advantages for incumbents.

Newcomers face considerable hurdles in establishing brand recognition and trust in the competitive apparel market. For instance, in 2023, American Eagle Outfitters generated $5.0 billion in net revenue, showcasing the scale of its established market presence. New entrants must invest heavily in marketing to differentiate themselves and capture consumer attention.

The significant capital investment required for prime real estate, inventory stocking, and workforce development acts as a deterrent. Opening a single new physical store can cost hundreds of thousands to millions of dollars, a barrier that many new ventures may struggle to overcome.

American Eagle's established omni-channel strategy, integrating a strong physical store presence with sophisticated online operations, presents a formidable barrier. Replicating this comprehensive reach demands considerable capital and logistical expertise, limiting the immediate impact of new competitors.

| Barrier to Entry | Impact on New Entrants | Relevance to American Eagle |

|---|---|---|

| Capital Requirements (Physical Retail) | High | Significant for new brick-and-mortar stores. |

| Brand Recognition & Loyalty | High | Established customer base provides a strong advantage. |

| Supply Chain & Logistics | High | Complex networks and established relationships are difficult to replicate. |

| Digital Presence & E-commerce | Moderate | Lowered entry costs for online-only brands, but scale still matters. |

| Regulatory Compliance (Sustainability) | Moderate | Increasingly important, adding costs and complexity for all. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for American Eagle leverages data from company annual reports, investor presentations, and SEC filings to understand internal strategies and financial health. We also incorporate industry research from firms like IBISWorld and market trend data from sources such as Statista to assess external competitive pressures.