American Eagle Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Eagle Bundle

Unlock the secrets to American Eagle's product portfolio performance with a glimpse into its BCG Matrix. See which brands are soaring (Stars), which are reliably generating revenue (Cash Cows), and which might be holding the company back (Dogs). Ready to transform this insight into actionable strategy?

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Aerie has been a standout performer for American Eagle Outfitters, showcasing robust growth. In fiscal year 2024, the brand achieved a 5% comparable sales increase, building on even stronger growth in prior years. This consistent success has cemented Aerie's position as a key growth driver.

The brand's commitment to inclusivity and body positivity, exemplified by its #AerieReal campaign, deeply connects with its target demographic. This resonates particularly well with younger consumers who value authenticity and social consciousness, leading to a significant market share in intimates, apparel, and activewear.

Despite a slight dip in Q1 2025, Aerie's fundamental strength remains evident. Strategic initiatives, including new store openings and continued product innovation, reinforce its status as a core Star within American Eagle's portfolio, poised for sustained expansion.

OFFLINE by Aerie is positioned as a star in the BCG Matrix, representing a significant growth opportunity for American Eagle. The activewear market is booming, and OFFLINE is designed to capture a larger share by offering a comprehensive range of comfortable and stylish activewear and accessories. This strategic focus on OFFLINE signals the company's commitment to accelerating growth in this segment.

In 2024, American Eagle Outfitters reported that its Aerie brand, which includes OFFLINE, continued to perform strongly. While specific OFFLINE revenue figures are often bundled with Aerie, the overall brand saw continued double-digit growth in recent years, driven by its expanding product assortment and strong customer loyalty. OFFLINE's emphasis on sustainable materials, like recycled polyester, appeals to a growing segment of environmentally conscious consumers, further enhancing its market potential and brand image.

American Eagle Outfitters' digital sales channels are a significant growth engine. In fiscal year 2024, e-commerce continued to be a strong contributor to the company's overall performance, reflecting the increasing reliance on online platforms for retail purchases.

These digital avenues are paramount for connecting with American Eagle's core demographic, typically 15 to 25 year olds, who are deeply immersed in online environments and heavily influenced by social media trends. This online engagement translates directly into sales opportunities.

The company's ongoing strategic investments in its digital infrastructure are designed to streamline operations and elevate the customer journey. These enhancements are crucial for fostering sustained growth in online sales, with digital representing a substantial portion of their revenue streams.

This robust digital footprint enables American Eagle to quickly pivot to emerging market trends and maintain a direct line of communication with its consumers. This agility and direct engagement are key factors in solidifying its strong market share within the online apparel sector.

American Eagle Denim (Women's)

American Eagle's women's denim segment holds a strong position in a market with consistent demand from younger consumers. This category is a significant driver for the brand, with jeans sales often seeing notable increases during key shopping periods.

The brand's commitment to providing quality denim at accessible price points, bolstered by its 'Real Good' initiative focusing on sustainable manufacturing, resonates well with its target demographic. This strategic focus on a core product, combined with its market standing, solidifies its status.

- Market Leadership: American Eagle is a leader in the denim market, a category with enduring appeal to teens.

- Growth in Women's Denim: The women's denim category, specifically jeans, shows robust growth, with sales often peaking seasonally.

- Customer Appeal: The brand's focus on quality, value, and sustainability through its 'Real Good' label attracts its core customer base.

- Star Potential: This sustained strength in a crucial fashion segment highlights its potential as a Star in the BCG Matrix.

Strategic Expansion into 'Right-to-Win' Adjacencies

American Eagle is strategically venturing into new product areas that align with its core strengths and customer base. This expansion is a key part of their 'Powering Profitable Growth' plan, aiming to capitalize on high-potential markets by leveraging existing brand equity and customer loyalty.

For Aerie, this means broadening its successful loungewear and activewear offerings into categories like sleepwear, tapping into a market segment that resonates with its existing customer. Similarly, American Eagle is making significant inroads into fashion apparel, with notable growth in skirts, dresses, and tops. These moves are designed to create new revenue streams and reinforce brand relevance.

These adjacent expansions are positioned to become Stars in the BCG matrix. For instance, Aerie's sleepwear category, building on its strong brand recognition, is expected to achieve rapid growth. American Eagle's increased focus on dresses and skirts reflects a strategic push into categories that have shown robust demand, particularly in the 2024 fashion landscape where casual yet stylish attire remains popular. This diversification aims to capture a larger share of the apparel market.

- Aerie's sleepwear expansion leverages its established customer loyalty and brand image in the comfort and lifestyle space.

- American Eagle's fashion category growth in skirts, dresses, and tops targets high-demand segments within apparel.

- Strategic adjacency allows American Eagle and Aerie to utilize existing brand equity and customer relationships for new product launches.

- Targeting 'right-to-win' markets ensures these new ventures have a strong foundation for rapid growth and market penetration.

Aerie, a key growth engine for American Eagle Outfitters, continues its strong trajectory. In fiscal year 2024, Aerie achieved a 5% comparable sales increase, demonstrating sustained momentum. This performance solidifies its status as a Star within the BCG matrix, indicating high market share in a high-growth industry.

OFFLINE by Aerie is also a significant growth driver, positioned as a Star. The activewear market's expansion provides a fertile ground for OFFLINE's comprehensive offerings. The brand's focus on sustainability, incorporating materials like recycled polyester, further enhances its appeal to environmentally conscious consumers, contributing to its Star status.

American Eagle's digital channels are crucial for its growth, acting as a Star in the BCG matrix. In fiscal year 2024, e-commerce remained a vital contributor to overall performance, reflecting the increasing importance of online platforms. This digital strength allows the company to effectively reach and engage its core demographic, driving sales and market presence.

The brand's women's denim segment is a consistent performer, maintaining a strong market position. This category, with its enduring appeal to younger consumers, often sees significant sales boosts during peak shopping periods. The combination of quality, value, and sustainable practices through its 'Real Good' initiative reinforces its Star potential.

American Eagle's strategic expansion into adjacent product categories, such as Aerie's sleepwear and American Eagle's fashion apparel like dresses and skirts, are also positioned as Stars. These ventures leverage existing brand equity and customer loyalty in high-demand markets, aiming for rapid growth and increased market share.

| Brand Segment | BCG Category | Key Growth Drivers | Fiscal Year 2024 Performance Highlight |

|---|---|---|---|

| Aerie | Star | Inclusivity, body positivity, expanding product lines | 5% comparable sales increase |

| OFFLINE by Aerie | Star | Booming activewear market, sustainability focus | Continued double-digit growth (part of Aerie) |

| Digital Channels | Star | E-commerce growth, social media engagement | Strong contributor to overall performance |

| Women's Denim | Star | Consistent demand, value pricing, 'Real Good' initiative | Notable increases during key shopping periods |

| Adjacent Product Categories (e.g., Aerie Sleepwear, AE Dresses/Skirts) | Star | Leveraging brand equity, targeting high-demand markets | Expected rapid growth in new segments |

What is included in the product

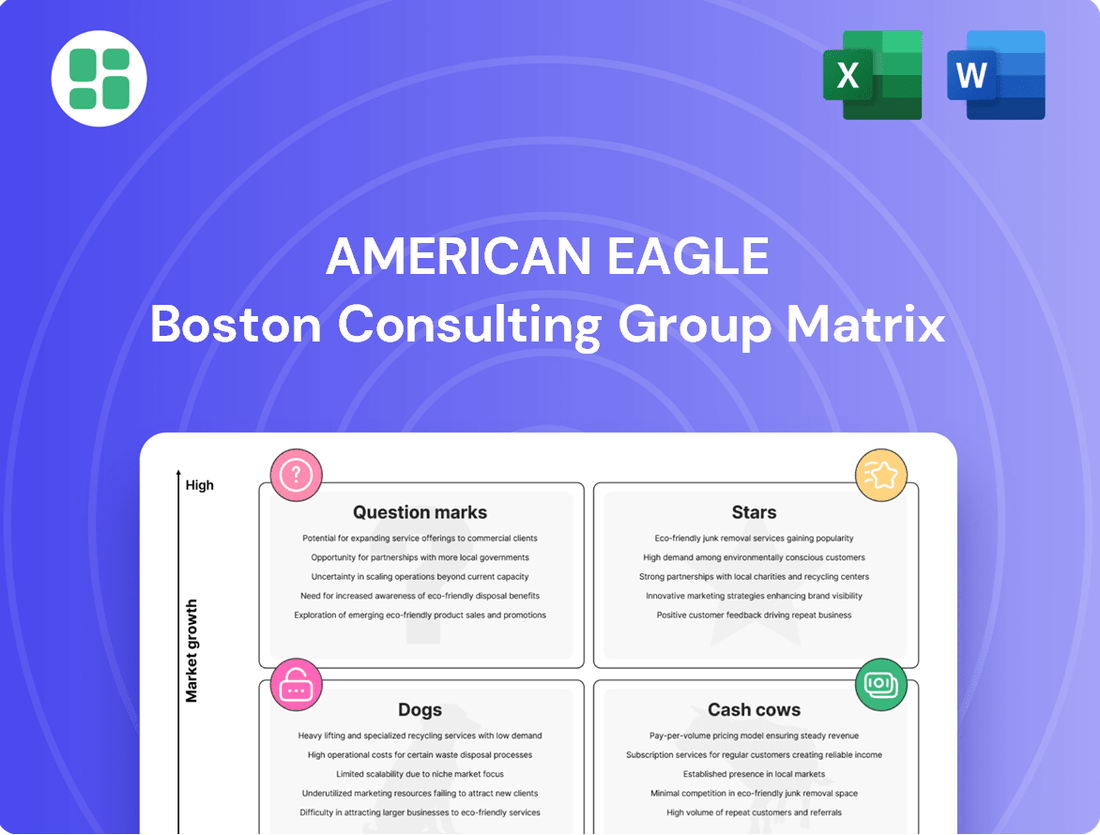

The American Eagle BCG Matrix analyzes its product portfolio, categorizing items into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

A clear BCG Matrix visualizes your portfolio, easing the pain of uncertain strategic allocation.

Cash Cows

The core American Eagle apparel, excluding denim, is a significant Cash Cow for the brand. This segment holds a strong market share within its core demographic, demonstrating maturity and stability. In fiscal year 2024, it achieved a positive comparable sales growth of 3%, a solid performance that contributes to consistent cash flow.

These established apparel lines, encompassing basics and accessories, benefit from broad appeal and repeat customer purchases. The company's substantial store presence and loyal customer base further solidify this segment's role in generating a steady and reliable revenue stream.

American Eagle Outfitters boasts a substantial retail store network, with 829 American Eagle stores as of February 1, 2025, across the United States, Canada, and Mexico. This extensive physical footprint serves as a critical cash-generating engine, leveraging a mature market for consistent revenue streams.

These established stores are key to brand visibility and customer engagement, acting as primary sales channels. Despite ongoing fleet optimization, the network remains highly efficient, producing significant cash flow with comparatively lower investment needs for growth.

Licensing and international partnerships are key cash cows for American Eagle Outfitters (AEO). These agreements allow third parties to operate American Eagle and Aerie stores and online platforms in various global markets. For instance, AEO has a significant presence through licensing in Asia, Europe, Latin America, and the Middle East, generating stable revenue streams.

This strategy offers a low-risk, high-return approach to expanding market reach. By leveraging established brand equity, AEO can achieve market penetration without the substantial capital investment typically required for direct international operations. This model contributes significantly to consistent cash flow and reinforces the brand's global presence.

American Eagle Men's Apparel

American Eagle's men's apparel segment, a core part of its business, is considered a Cash Cow. While it may not be the fastest-growing area, it consistently generates substantial revenue and profits. This stability is crucial for funding other parts of the business.

The men's apparel line has seen steady performance, with notable sequential improvements. For instance, categories like pants have demonstrated growth, and tops have returned to positive comparable store sales. This indicates a resilient demand and effective inventory management within this established segment.

- Consistent Revenue Generation: The men's apparel division reliably contributes to American Eagle's overall financial health, providing a stable income stream.

- Mature Market Position: Operating in a more established market, this segment benefits from brand loyalty and predictable consumer behavior.

- Lower Investment Needs: Compared to high-growth areas, men's apparel requires less aggressive investment, allowing its profits to be channeled elsewhere.

- Profitability Anchor: This segment acts as a foundational element of profitability, supporting the company's ability to invest in emerging opportunities.

Established Accessories and Personal Care Lines

Established accessories and personal care lines represent a significant cash cow for American Eagle. These offerings, while operating in a mature, low-growth segment, command high profit margins and complement the core apparel business. Their established market presence allows for effective cross-selling, enhancing overall customer value and driving consistent revenue streams.

These products are key contributors to American Eagle's profitability, consistently generating reliable cash flow with relatively modest investment. In fiscal year 2023, American Eagle Outfitters reported total revenue of $5.0 billion, with accessories and personal care playing a vital, albeit unsegmented, role in this overall performance by supporting higher-margin sales and contributing to a stable financial foundation.

- High Margin Contribution: Accessories and personal care items typically carry higher gross margins compared to apparel, boosting overall company profitability.

- Cross-Selling Synergy: These products are strategically placed to encourage impulse buys and add-on purchases, increasing the average transaction value.

- Brand Reinforcement: A well-curated selection of accessories and personal care items strengthens the overall brand experience and customer loyalty.

- Stable Cash Generation: Their consistent demand and lower reinvestment needs make them a dependable source of cash for the company.

The men's apparel segment is a stable Cash Cow for American Eagle, consistently generating profits and contributing to the company's financial stability. Despite not being the fastest-growing category, its mature market position and loyal customer base ensure predictable revenue streams.

In fiscal year 2024, American Eagle Outfitters saw positive comparable sales growth across its business, with key apparel categories like tops and pants demonstrating resilience. This indicates a steady demand that fuels the cash cow status of these established product lines.

The company's extensive retail footprint, comprising 829 American Eagle stores as of February 1, 2025, further solidifies the cash cow nature of its core apparel offerings. These stores act as efficient cash-generating engines with relatively low investment needs for continued revenue generation.

| Segment | BCG Category | Key Characteristics | FY2024 Performance Indicator |

| Core Apparel (excl. denim) | Cash Cow | High market share, mature, stable demand | +3% comparable sales growth |

| Men's Apparel | Cash Cow | Consistent profitability, established brand loyalty | Sequential improvements in categories like pants and tops |

| Accessories & Personal Care | Cash Cow | High profit margins, cross-selling synergy | Contributes to overall $5.0 billion FY2023 revenue |

Delivered as Shown

American Eagle BCG Matrix

The preview you're seeing is the identical, fully functional American Eagle BCG Matrix document you'll receive upon purchase. This means no watermarks, no altered content, and no placeholder text – just the complete, professionally formatted analysis ready for your immediate strategic use. You can trust that the insights and structure displayed here are precisely what you'll be working with to make informed business decisions. This is the final, uncompromised version, ensuring you get exactly what you need to understand and leverage the BCG Matrix for American Eagle's portfolio.

Dogs

American Eagle Outfitters faced challenges with its spring and summer merchandise in Q1 2025, resulting in a substantial inventory write-down of around $75 million. This significant markdown signals a disconnect between the company's merchandising approach and actual consumer purchasing patterns for these seasonal items.

The underperformance of these collections directly places them in the 'Dog' category of the BCG Matrix. These products tie up capital in inventory and incur holding costs, while simultaneously generating minimal revenue or even losses due to the need for heavy discounting to clear excess stock.

Within American Eagle's extensive product lines, certain legacy or outdated apparel styles might be classified as Dogs in the BCG Matrix. These are items that struggle to capture the attention of their core 15-25 year old demographic, leading to low market share and minimal growth prospects. For instance, if a particular denim cut or graphic tee design from a previous season shows a significant decline in sales, it could be a prime candidate for this category.

These styles, often retained due to past popularity or existing inventory, can become a drain on resources. Sales for these items might be heavily reliant on markdowns, barely covering costs and preventing capital from being reinvested in trendier, higher-demand products. As of early 2024, American Eagle has been actively managing its inventory, aiming to reduce the proportion of slow-moving stock to improve overall profitability.

Within American Eagle Outfitters' (AEO) extensive international licensing network, certain markets may exhibit characteristics of "Dogs" in the BCG matrix. These are typically regions where AEO holds a low market share and operates in a low-growth industry environment. For instance, while AEO has a presence in over 80 countries, specific smaller European or Asian markets might fall into this category, potentially facing strong local fashion brands or economic headwinds.

These less popular licensed markets could be a drain on resources. Imagine a situation where AEO's sales in a particular country, say, a niche market in Eastern Europe, are minimal, and the overall apparel market growth in that region is also sluggish. In 2023, AEO's international segment revenue was approximately $800 million, representing about 15% of total revenue. If a few of these smaller licensed markets are not contributing significantly to this figure and are showing no signs of future growth, they would be considered Dogs.

Certain Brick-and-Mortar Store Locations with Declining Foot Traffic

Even with American Eagle's overall positive performance in physical stores during fiscal 2024, certain individual locations are likely categorized as Dogs in the BCG Matrix. These are typically stores situated in malls or areas experiencing a significant drop in customer visits. Such locations often struggle with low sales and profitability, sometimes just covering their operational expenses or even operating at a loss.

The company's strategic decision to close two fulfillment centers in 2024, part of a broader supply chain streamlining effort, also suggests a focus on optimizing underperforming assets, which could include these less productive brick-and-mortar stores.

- Declining Foot Traffic: Stores in economically depressed malls or areas with reduced consumer activity.

- Low Sales Volume: Individual locations that are not meeting revenue targets despite brand popularity.

- High Operating Costs: Leases and staffing expenses that outweigh the revenue generated by these specific stores.

- Profitability Challenges: Stores that are barely breaking even or consistently operating at a loss.

Unsubscribed Brand

The Unsubscribed brand within American Eagle Outfitters' portfolio appears to be positioned as a 'Dog' in the BCG Matrix. As of February 1, 2025, the brand operated with a limited footprint of only six stores. This minimal presence, coupled with a noticeable decrease in its prominence within recent financial discussions compared to core brands like American Eagle and Todd Snyder, indicates a potentially low market share.

The lack of significant emphasis suggests that Unsubscribed may be experiencing low growth or has not yet achieved substantial traction in the market. Such a scenario, where a business unit has a low share in a slow-growing market, is characteristic of a 'Dog' in the BCG framework. It might represent an experimental venture or a niche offering that has not yet demonstrated the scalability or profitability needed to warrant greater strategic focus.

- Limited Store Count: Only six stores as of February 1, 2025, signifying a small market presence.

- Reduced Strategic Emphasis: Less attention in recent financial discussions compared to other American Eagle brands.

- Potential Low Growth/Market Share: Indicative of a business unit that is not gaining significant traction or commanding a substantial portion of its target market.

Items classified as Dogs within American Eagle's portfolio represent products or segments with low market share and low growth potential. These are often legacy products, underperforming store locations, or less successful brand extensions that consume resources without generating significant returns. The company's Q1 2025 inventory write-down of $75 million on spring and summer merchandise directly illustrates this, as these items likely fall into the Dog category due to poor sales performance and the need for heavy discounting.

These "Dog" segments require careful management to avoid becoming a drain on profitability. American Eagle's efforts to streamline its supply chain, including closing fulfillment centers in 2024, reflect a broader strategy to divest or minimize investment in underperforming areas. Similarly, individual stores in declining malls with low foot traffic and sales volume are prime candidates for this classification, as their operational costs may outweigh their revenue generation.

The Unsubscribed brand, with its limited six-store footprint as of February 1, 2025, and reduced strategic focus, also fits the "Dog" profile. This indicates a business unit that has not achieved significant market traction or growth, potentially tying up capital without a clear path to becoming a star or cash cow. Managing these "Dogs" is crucial for freeing up capital to invest in more promising growth areas within the company's portfolio.

Identifying and addressing these "Dog" segments allows American Eagle to reallocate resources effectively. By reducing investment in areas with low growth and market share, such as certain legacy apparel styles or struggling international markets, the company can better focus on its core strengths and high-potential growth opportunities. This strategic pruning is essential for maintaining overall financial health and driving future expansion.

Question Marks

Aerie is strategically expanding into new product categories like sleepwear and introducing fresh activewear lines within its OFFLINE segment. These ventures tap into rapidly growing markets fueled by consumer demand for comfortable, lifestyle-oriented apparel. For instance, the global sleepwear market was valued at approximately $85.9 billion in 2023 and is projected to reach $138.8 billion by 2030, indicating a strong growth trajectory.

While these new categories represent significant growth opportunities, they are likely to start with a low market share. Aerie will need to invest heavily in marketing and product development to build brand recognition and customer loyalty in these areas. The activewear market alone saw a global valuation of $327.6 billion in 2023, with expectations of continued expansion.

The success of these new product lines hinges on their ability to capture market share and transition into Aerie's Stars. Without sufficient traction and investment, there's a risk they could stagnate and become Question Marks or even Dogs in the BCG matrix, requiring careful management and strategic pivots.

American Eagle is actively weaving emerging fashion trends into its 2025 collections, reflecting a dynamic teen clothing market. This includes embracing the Y2K revival, a growing emphasis on sustainable materials, and a willingness to experiment with bolder, future-forward aesthetics and gender-fluid styles. For instance, the brand has been seen incorporating vintage-inspired denim washes and relaxed fits, echoing the Y2K resurgence.

While these trends represent expanding segments within the teen apparel market, American Eagle's specific integration might initially see a lower market share for these newer styles. This necessitates significant marketing investment and agile adaptation to capture broader consumer interest before these trends solidify their place in the market.

American Eagle Outfitters' (AEO) long-term strategy actively pursues international expansion, often leveraging licensing agreements to enter new global markets. These new ventures, especially in regions where American Eagle or Aerie have minimal brand presence, fit the 'Question Mark' category in the BCG Matrix. They represent opportunities for significant growth but currently hold a low market share, demanding considerable investment and strategic focus to establish brand awareness and distribution networks.

For instance, AEO's expansion into Southeast Asia in the early 2020s, particularly through partnerships in countries like the Philippines and Indonesia, exemplifies this 'Question Mark' approach. While these markets offer a youthful demographic with growing disposable income, AEO's brand recognition was nascent, requiring substantial marketing and operational setup. The success of these ventures hinges on effectively capturing market share against established local and international competitors, a process that demands careful execution and ongoing resource allocation.

Todd Snyder New York Brand Expansion

Todd Snyder New York represents American Eagle Outfitters' (AEO) strategic move into the premium menswear space, aligning with the company's broader premiumization and direct-to-consumer (DTC) growth objectives. While it aims to revitalize AEO's brand portfolio, Todd Snyder operates in a more specialized, higher-priced segment compared to AEO's foundational brands.

Within the vast menswear market, Todd Snyder's current market share is likely modest, but the premium segment itself presents considerable growth opportunities. For AEO to effectively scale Todd Snyder, significant investment in brand development and expanding its distribution channels is crucial. Without this focused investment, Todd Snyder risks remaining a Question Mark in the BCG matrix, requiring careful management to achieve its full potential.

- Brand Positioning: Todd Snyder targets a higher-income demographic, differentiating itself from AEO's mass-market appeal.

- Market Growth: The premium menswear sector shows consistent growth, offering potential for increased revenue.

- Investment Needs: AEO must allocate resources for marketing, store expansion, and digital presence to elevate the Todd Snyder brand.

- Strategic Importance: Successful expansion of Todd Snyder could significantly enhance AEO's overall brand equity and profitability.

Adoption of Advanced Technologies in Customer Experience (e.g., AI in E-commerce)

American Eagle Outfitters is actively investing in advanced technologies, particularly AI, to refine its e-commerce customer experience. This strategic focus aims to personalize shopping, bolster fraud prevention, and streamline supply chain operations, aligning with the high-growth trajectory of retail tech. For instance, in 2024, the broader retail sector saw significant AI investment, with projections indicating AI in retail could reach $20 billion by 2026, underscoring the potential for such initiatives.

The adoption of AI in areas like personalized product recommendations and efficient inventory management is a key component of American Eagle's strategy to gain a competitive edge. While the precise market share impact of these specific AI implementations for American Eagle is still emerging, the company’s commitment reflects a broader industry trend. In 2023, digital sales accounted for a substantial portion of American Eagle's revenue, highlighting the importance of enhancing these online channels.

- AI-driven personalization: Enhancing product discovery and engagement for customers.

- Supply chain optimization: Improving efficiency and reducing costs through technology.

- Fraud detection: Safeguarding transactions and building customer trust.

- Investment in innovation: Positioning American Eagle for future growth in a competitive landscape.

Question Marks represent business units or products with low market share in high-growth industries. American Eagle Outfitters' (AEO) strategic ventures into new international markets, like Southeast Asia, and the development of its premium menswear brand, Todd Snyder, exemplify this category. These initiatives require substantial investment to build brand awareness and capture market share against established competitors.

The success of these Question Marks hinges on AEO's ability to effectively allocate resources for marketing, product development, and distribution. Without sufficient investment and strategic execution, these ventures risk remaining in the Question Mark phase or even declining into Dogs. For instance, the global premium menswear market, while growing, demands significant brand building to achieve scale.

AEO's investment in AI for e-commerce personalization also falls into the Question Mark quadrant. While the retail tech sector shows immense growth potential, the specific market share impact of AEO's AI implementations is still developing. The company's commitment to innovation in this area is crucial for future competitiveness, mirroring the broader industry trend of significant AI investment in retail.

The company must carefully manage these Question Marks, strategically deciding which to invest in to become Stars and which may need to be divested. This careful selection process is vital for optimizing AEO's overall portfolio and ensuring long-term sustainable growth.

BCG Matrix Data Sources

Our American Eagle BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.