American Eagle PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Eagle Bundle

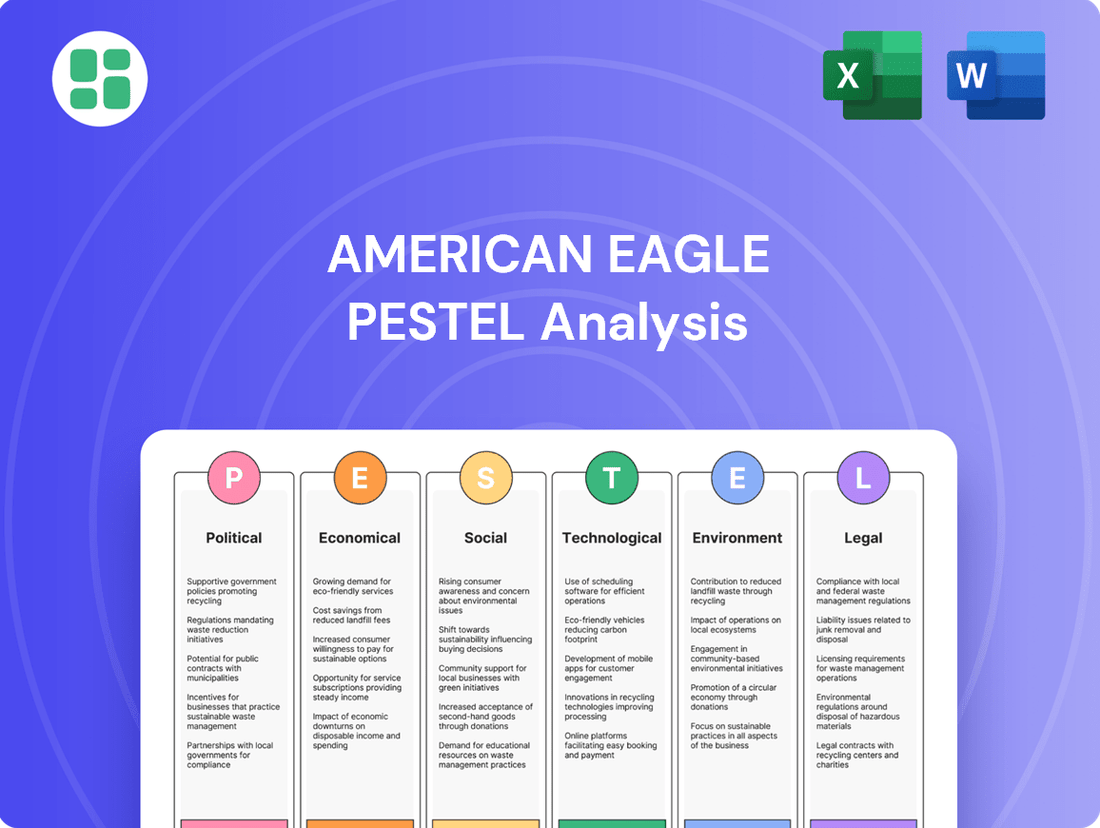

Navigate the dynamic retail landscape with our comprehensive PESTLE analysis of American Eagle. Uncover the political, economic, social, technological, legal, and environmental factors shaping its future. Equip yourself with actionable intelligence to anticipate market shifts and refine your strategy. Download the full report now for a competitive edge.

Political factors

Changes in international trade policies, particularly tariffs, directly affect American Eagle's expenses and how smoothly its supply chain operates. For instance, a rise in tariffs on textiles imported from Asia could increase the cost of raw materials, impacting the company's cost of goods sold.

Fluctuations in these trade policies require American Eagle to be agile, potentially adjusting where it sources its apparel and accessories. This adaptability is key to keeping prices competitive and ensuring profitability in a dynamic global market.

As of early 2024, ongoing trade discussions and potential adjustments to existing agreements, like those with China and Vietnam, continue to create uncertainty in the apparel import landscape, a significant factor for retailers like American Eagle.

American Eagle must navigate a complex web of labor laws, which can differ significantly from state to state within the U.S. and across international markets. For instance, minimum wage hikes, such as those implemented in various states during 2024, directly impact payroll expenses. In California, the minimum wage reached $16.00 per hour for all employers by January 1, 2024, a figure considerably higher than the federal minimum of $7.25.

Compliance with these evolving regulations, including overtime mandates and employee protection statutes like paid sick leave, is critical for avoiding legal penalties and safeguarding American Eagle's reputation. These legal requirements directly shape the company's human resource strategies and contribute to its overall operational costs, influencing everything from hiring practices to employee benefits packages.

Consumer protection legislation significantly impacts American Eagle's operations, particularly concerning product safety, advertising, and data privacy. In 2024, the Federal Trade Commission (FTC) continued to enforce regulations like the Children's Online Privacy Protection Act (COPPA), which affects how retailers collect data from younger audiences. Adherence to these strict rules is crucial for maintaining customer trust and avoiding substantial fines, as demonstrated by various retailers facing penalties for data breaches or misleading advertising in recent years.

Government Stability and Economic Stimulus

The political landscape in the United States, characterized by a stable democratic system, generally fosters consumer confidence. For American Eagle, this stability translates into a more predictable environment for discretionary spending. The Biden administration's focus on economic growth, including infrastructure spending and potential consumer support programs, aims to bolster disposable income, which directly benefits retailers like American Eagle.

Government economic stimulus measures, such as tax credits or direct payments, can provide a significant uplift to consumer spending power. Conversely, austerity measures or significant political uncertainty could dampen consumer sentiment and lead to reduced purchases of non-essential goods, impacting American Eagle's sales. For instance, the economic impact of the 2020-2021 stimulus packages demonstrated a direct correlation with increased retail sales across various sectors.

- Government Stability: The U.S. maintains a stable political framework, supporting consistent consumer behavior.

- Economic Stimulus: Policies aimed at boosting the economy can directly increase consumer spending on apparel.

- Retail Support: Government initiatives that encourage retail sector growth present opportunities for American Eagle.

- Consumer Confidence: Political stability and economic policies significantly influence consumer willingness to spend on discretionary items.

Taxation Policies

Changes in corporate tax rates, sales taxes, or other business-related taxes at federal, state, or local levels directly impact American Eagle's net profitability. For instance, the Tax Cuts and Jobs Act of 2017 significantly lowered the U.S. federal corporate tax rate from 35% to 21%, a move that would have positively affected companies like American Eagle. However, potential future adjustments to these rates, or changes in state-level sales tax regulations impacting retail, require careful financial forecasting.

Favorable tax policies can enhance earnings, while increased tax burdens might necessitate strategic adjustments in financial planning or pricing. For example, if a state where American Eagle operates were to increase its sales tax on apparel by 1%, this could directly impact consumer purchasing decisions and the company's revenue. Understanding the evolving tax landscape is vital for accurate financial projections and maintaining competitive pricing strategies.

- Federal Corporate Tax Rate: Currently 21% (as of the Tax Cuts and Jobs Act of 2017), with potential for future review.

- State Sales Tax Variations: Rates vary significantly by state, impacting the final price for consumers and revenue for American Eagle.

- Impact on Profitability: Tax rate changes can directly alter net income, influencing investment decisions and operational strategies.

- Financial Planning Necessity: Accurate forecasting of tax liabilities is crucial for budgeting and managing cash flow effectively.

Government stability in the U.S. fosters a predictable environment for consumer spending, directly benefiting retailers like American Eagle by supporting discretionary purchases. Economic stimulus measures, such as those seen during economic downturns, can significantly boost consumer purchasing power, leading to increased sales for apparel. Conversely, political instability or austerity measures could dampen consumer sentiment and reduce spending on non-essential items.

Changes in trade policies, including tariffs on imported goods, directly impact American Eagle's supply chain costs and pricing strategies. For instance, shifts in trade agreements with countries like China or Vietnam can create uncertainty regarding raw material costs for apparel. Navigating these dynamic international trade regulations requires American Eagle to maintain supply chain flexibility to ensure competitive pricing and profitability.

Labor laws, such as minimum wage increases, directly affect American Eagle's payroll expenses. For example, the federal minimum wage remains at $7.25 per hour, but many states and cities have implemented significantly higher rates, like California's $16.00 per hour for all employers as of January 2024. Compliance with these varying labor regulations, alongside employee protection statutes, is crucial for operational costs and legal adherence.

Consumer protection legislation, particularly concerning data privacy and product safety, significantly influences American Eagle's operational practices. The Federal Trade Commission's continued enforcement of rules like COPPA in 2024 highlights the importance of adhering to data privacy standards. Maintaining customer trust through compliance with these regulations is vital to avoid penalties and protect the company's reputation.

| Political Factor | Impact on American Eagle | Example/Data (2024-2025 Focus) |

|---|---|---|

| Government Stability | Predictable consumer spending, confidence in discretionary purchases. | U.S. political system generally supports stable consumer behavior. Biden administration's focus on economic growth aims to bolster disposable income. |

| Trade Policies | Affects supply chain costs, import expenses, and pricing. | Ongoing trade discussions with China and Vietnam create uncertainty in apparel imports. Tariffs on textiles can increase raw material costs. |

| Labor Laws | Impacts payroll expenses and HR strategies. | State minimum wage hikes (e.g., California at $16.00/hr in 2024) increase labor costs. Compliance with overtime and paid leave mandates is critical. |

| Consumer Protection Laws | Influences data privacy, product safety, and advertising practices. | FTC enforcement of COPPA impacts data collection from younger audiences. Adherence is crucial for customer trust and avoiding fines. |

| Tax Policies | Directly affects net profitability and financial planning. | Federal corporate tax rate at 21% (post-2017 Act). State sales tax variations impact consumer prices and company revenue. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting American Eagle, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors affecting the American Eagle brand.

Economic factors

Consumer disposable income is a critical driver for American Eagle, particularly for its younger demographic (ages 15-25) who rely on discretionary funds for fashion purchases. Economic shifts, such as rising inflation, can significantly curb this spending, directly affecting American Eagle's sales and overall revenue. For instance, if the average disposable income for this age group sees a decline, their capacity to buy non-essential apparel will diminish.

Monitoring youth employment figures and wage trends is therefore paramount for American Eagle. As of early 2024, the youth unemployment rate in the U.S. has shown some volatility, and wage growth, while present, needs to outpace inflation to truly boost discretionary spending power. Any slowdown in these areas directly translates to reduced purchasing power for American Eagle's core customer base.

Rising inflation significantly impacts American Eagle's operational costs. For instance, the US Consumer Price Index (CPI) for apparel experienced a notable increase, with some categories seeing year-over-year jumps of over 5% by mid-2024. This directly translates to higher expenses for raw materials like cotton, manufacturing processes, and the logistics of getting products to stores and online customers.

This cost pressure can squeeze profit margins for American Eagle if they cannot pass on these increased costs to consumers. Given their target demographic, which is often price-sensitive, significant price hikes could alienate young shoppers, potentially leading to reduced sales volume.

In response to these inflationary pressures, American Eagle's strategic focus on strengthening supplier relationships and exploring hedging strategies for key commodities becomes even more crucial. These actions are vital to mitigate the volatility in their cost of goods sold and maintain competitive pricing in the apparel market throughout 2024 and into 2025.

Fluctuations in interest rates directly impact American Eagle's financial strategy. For instance, if the Federal Reserve maintains its target for the federal funds rate at 5.25%-5.50% as it did through much of 2024, borrowing costs for capital expenditures and inventory financing will remain elevated. This can make ambitious store expansion plans or significant inventory build-ups more costly, potentially squeezing profit margins.

Conversely, a scenario where interest rates decline would present a more favorable borrowing environment. Lower rates could incentivize American Eagle to invest more aggressively in new store openings, technology upgrades, or supply chain improvements, as the cost of financing such initiatives decreases. This would likely boost profitability and support growth.

The availability of consumer credit is another critical economic factor. When credit is readily available and interest rates on credit cards or personal loans are manageable, consumers are more likely to make discretionary purchases, including apparel from American Eagle. In 2024, while consumer spending remained resilient, elevated credit card interest rates could still act as a subtle deterrent for some shoppers, impacting sales volume.

Economic Growth and Retail Sales Trends

The United States economy's health, as indicated by Gross Domestic Product (GDP) growth, significantly shapes the retail landscape for companies like American Eagle. A robust economy typically translates to higher consumer confidence and disposable income, driving increased spending on discretionary items such as apparel and accessories.

For American Eagle, strong economic growth in 2024 and projected into 2025 is a positive indicator. For instance, the U.S. GDP grew at an annualized rate of 3.4% in the fourth quarter of 2023, and forecasts for 2024 generally anticipate continued, albeit potentially moderating, growth. This economic expansion supports higher retail sales volumes.

- GDP Growth: U.S. GDP saw a 3.4% annualized increase in Q4 2023, indicating a healthy economic environment.

- Consumer Spending: Economic expansion often correlates with increased consumer spending on apparel, directly benefiting retailers.

- Recession Impact: Conversely, economic downturns or recessions typically lead to reduced consumer spending and lower sales for fashion retailers.

- Retail Sales Data: U.S. retail sales, excluding autos and gas, showed a notable increase in early 2024, reflecting consumer resilience.

Exchange Rates

For American Eagle, fluctuating exchange rates present a significant challenge, especially given its potential for international sourcing and global operations. When the U.S. dollar strengthens, it generally makes imported goods, like those American Eagle might source from Asia, less expensive. Conversely, a stronger dollar makes American products pricier for overseas buyers, potentially dampening international sales and impacting the company's global market position.

The U.S. Dollar Index (DXY), a measure of the dollar's value against a basket of major currencies, saw fluctuations throughout 2024. For instance, the DXY experienced periods of appreciation, which would have made imports cheaper for American Eagle but could have simultaneously reduced the competitiveness of its goods sold abroad. This dynamic directly affects the cost of goods sold and the profitability of international revenue streams.

Managing these currency risks is crucial for American Eagle's financial health. Strategies such as hedging through forward contracts or options can help lock in exchange rates for future transactions, providing a degree of certainty amidst volatility.

- Impact on Imports: A stronger USD in 2024 made it cheaper for American Eagle to import materials and finished goods, potentially lowering cost of goods sold.

- Impact on Exports: Conversely, a stronger dollar made U.S.-made products more expensive for international customers, potentially hurting sales in foreign markets.

- Currency Hedging: Companies like American Eagle often use financial instruments to mitigate the impact of adverse currency movements, aiming to stabilize profitability.

- Global Competitiveness: Exchange rate shifts directly influence American Eagle's ability to compete on price with local retailers in international markets.

Consumer disposable income is a critical driver for American Eagle, particularly for its younger demographic (ages 15-25) who rely on discretionary funds for fashion purchases. Economic shifts, such as rising inflation, can significantly curb this spending, directly affecting American Eagle's sales and overall revenue. For instance, if the average disposable income for this age group sees a decline, their capacity to buy non-essential apparel will diminish.

Monitoring youth employment figures and wage trends is therefore paramount for American Eagle. As of early 2024, the youth unemployment rate in the U.S. has shown some volatility, and wage growth, while present, needs to outpace inflation to truly boost discretionary spending power. Any slowdown in these areas directly translates to reduced purchasing power for American Eagle's core customer base.

Rising inflation significantly impacts American Eagle's operational costs. For instance, the US Consumer Price Index (CPI) for apparel experienced a notable increase, with some categories seeing year-over-year jumps of over 5% by mid-2024. This directly translates to higher expenses for raw materials like cotton, manufacturing processes, and the logistics of getting products to stores and online customers.

This cost pressure can squeeze profit margins for American Eagle if they cannot pass on these increased costs to consumers. Given their target demographic, which is often price-sensitive, significant price hikes could alienate young shoppers, potentially leading to reduced sales volume.

In response to these inflationary pressures, American Eagle's strategic focus on strengthening supplier relationships and exploring hedging strategies for key commodities becomes even more crucial. These actions are vital to mitigate the volatility in their cost of goods sold and maintain competitive pricing in the apparel market throughout 2024 and into 2025.

Fluctuations in interest rates directly impact American Eagle's financial strategy. For instance, if the Federal Reserve maintains its target for the federal funds rate at 5.25%-5.50% as it did through much of 2024, borrowing costs for capital expenditures and inventory financing will remain elevated. This can make ambitious store expansion plans or significant inventory build-ups more costly, potentially squeezing profit margins.

Conversely, a scenario where interest rates decline would present a more favorable borrowing environment. Lower rates could incentivize American Eagle to invest more aggressively in new store openings, technology upgrades, or supply chain improvements, as the cost of financing such initiatives decreases. This would likely boost profitability and support growth.

The availability of consumer credit is another critical economic factor. When credit is readily available and interest rates on credit cards or personal loans are manageable, consumers are more likely to make discretionary purchases, including apparel from American Eagle. In 2024, while consumer spending remained resilient, elevated credit card interest rates could still act as a subtle deterrent for some shoppers, impacting sales volume.

The United States economy's health, as indicated by Gross Domestic Product (GDP) growth, significantly shapes the retail landscape for companies like American Eagle. A robust economy typically translates to higher consumer confidence and disposable income, driving increased spending on discretionary items such as apparel and accessories.

For American Eagle, strong economic growth in 2024 and projected into 2025 is a positive indicator. For instance, the U.S. GDP grew at an annualized rate of 3.4% in the fourth quarter of 2023, and forecasts for 2024 generally anticipate continued, albeit potentially moderating, growth. This economic expansion supports higher retail sales volumes.

- GDP Growth: U.S. GDP saw a 3.4% annualized increase in Q4 2023, indicating a healthy economic environment.

- Consumer Spending: Economic expansion often correlates with increased consumer spending on apparel, directly benefiting retailers.

- Recession Impact: Conversely, economic downturns or recessions typically lead to reduced consumer spending and lower sales for fashion retailers.

- Retail Sales Data: U.S. retail sales, excluding autos and gas, showed a notable increase in early 2024, reflecting consumer resilience.

For American Eagle, fluctuating exchange rates present a significant challenge, especially given its potential for international sourcing and global operations. When the U.S. dollar strengthens, it generally makes imported goods, like those American Eagle might source from Asia, less expensive. Conversely, a stronger dollar makes American products pricier for overseas buyers, potentially dampening international sales and impacting the company's global market position.

The U.S. Dollar Index (DXY), a measure of the dollar's value against a basket of major currencies, saw fluctuations throughout 2024. For instance, the DXY experienced periods of appreciation, which would have made imports cheaper for American Eagle but could have simultaneously reduced the competitiveness of its goods sold abroad. This dynamic directly affects the cost of goods sold and the profitability of international revenue streams.

Managing these currency risks is crucial for American Eagle's financial health. Strategies such as hedging through forward contracts or options can help lock in exchange rates for future transactions, providing a degree of certainty amidst volatility.

- Impact on Imports: A stronger USD in 2024 made it cheaper for American Eagle to import materials and finished goods, potentially lowering cost of goods sold.

- Impact on Exports: Conversely, a stronger dollar made U.S.-made products more expensive for international customers, potentially hurting sales in foreign markets.

- Currency Hedging: Companies like American Eagle often use financial instruments to mitigate the impact of adverse currency movements, aiming to stabilize profitability.

- Global Competitiveness: Exchange rate shifts directly influence American Eagle's ability to compete on price with local retailers in international markets.

| Economic Factor | 2024/2025 Outlook | Impact on American Eagle | Key Data/Trend | Mitigation/Strategy |

|---|---|---|---|---|

| Disposable Income | Moderate growth expected, but inflation may temper real gains. | Directly influences spending on apparel. Lower real income reduces discretionary purchases. | Youth unemployment rate showed volatility in early 2024; wage growth needs to outpace inflation. | Focus on value propositions and promotions to attract price-sensitive consumers. |

| Inflation (CPI - Apparel) | Continued elevated levels, though potentially moderating. | Increases operational costs (materials, logistics) and can pressure profit margins. | Apparel CPI saw year-over-year increases exceeding 5% by mid-2024. | Strengthen supplier relationships, explore commodity hedging. |

| Interest Rates (Federal Funds Rate) | Expected to remain relatively stable or see gradual decreases. | Affects borrowing costs for expansion, inventory financing, and consumer credit. | Fed target rate remained at 5.25%-5.50% through much of 2024. | Careful management of debt and inventory financing; assess impact on consumer credit availability. |

| GDP Growth | Projected continued growth, potentially at a moderating pace. | Supports consumer confidence and overall retail spending. | U.S. GDP grew 3.4% annualized in Q4 2023; forecasts for 2024 anticipate continued expansion. | Leverage economic upturns for strategic investments in growth areas. |

| Exchange Rates (USD Index) | Potential for continued volatility based on global economic conditions. | Impacts cost of imported goods and competitiveness of international sales. | DXY experienced appreciation periods in 2024, making imports cheaper but exports pricier. | Utilize currency hedging strategies (forward contracts, options) to stabilize costs and revenues. |

Preview Before You Purchase

American Eagle PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the American Eagle brand.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting American Eagle.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for American Eagle.

Sociological factors

American Eagle's core demographic, aged 15-25, is highly susceptible to swift shifts in fashion. In 2024, the brand's agility in incorporating trending styles, from the resurgence of Y2K aesthetics to the continued popularity of relaxed fits, directly impacts its market position. For instance, TikTok's influence on fashion discovery means brands must constantly monitor viral trends to remain relevant.

The brand's ability to translate social media buzz into tangible product offerings is paramount. In 2024, a significant portion of Gen Z's purchasing decisions are influenced by influencers and online communities showcasing new looks. American Eagle's success hinges on its capacity to quickly identify and capitalize on these emerging styles, ensuring its collections resonate with the target audience's evolving tastes.

Social media platforms are incredibly influential for American Eagle, especially with its younger demographic. In 2024, platforms like TikTok and Instagram are where trends are set and purchasing decisions are often made. Brands that effectively leverage these channels, through authentic influencer partnerships and engaging content, see a direct impact on their visibility and sales.

American Eagle's success hinges on its digital presence. By mid-2024, a significant portion of its customer base discovers new styles and makes purchases online, often influenced by what they see on social media. This makes strategic digital marketing, including collaborations with creators who resonate with Gen Z and Millennials, crucial for driving both online traffic and footfall to physical stores.

Younger consumers, particularly Gen Z and Millennials, are deeply concerned with environmental and ethical issues. A 2024 survey indicated that 73% of Gen Z consumers believe companies should actively address social and environmental issues. This demographic expects brands like American Eagle to be transparent about their supply chains and demonstrate genuine commitment to fair labor and sustainable sourcing.

American Eagle's investments in sustainable materials and ethical manufacturing, such as their use of recycled polyester and commitment to reducing water usage in denim production, resonate strongly with these values. For instance, their partnership with organizations focused on worker well-being aims to bolster consumer trust. Conversely, any misstep or perceived insincerity in these efforts, as seen with other apparel brands facing scrutiny in 2024, could quickly result in negative social media campaigns and a decline in sales.

Lifestyle Shifts Towards Comfort and Versatility

Younger consumers increasingly prioritize clothing that offers both comfort and adaptability, seamlessly blending casual wear with activewear. This shift means apparel needs to perform across diverse settings, from lounging at home to casual outings and even light physical activities.

American Eagle, with its core casual offerings and the highly successful Aerie brand, known for its loungewear and athleisure pieces, is strategically aligned with this lifestyle evolution. For instance, Aerie's revenue grew by approximately 10% in the first quarter of 2024 compared to the previous year, demonstrating strong consumer demand for comfortable and versatile apparel.

To maintain its competitive edge, American Eagle must continue to innovate its product lines, ensuring they meet the demand for multi-functional garments. This includes expanding options in soft fabrics, relaxed fits, and stylish designs that cater to this growing segment. The brand's ability to adapt its collections to these evolving consumer preferences will be crucial for sustained growth and relevance in the dynamic apparel market.

- Growing Demand for Athleisure: The global athleisure market is projected to reach $324 billion by 2027, indicating a significant consumer preference for comfortable, sporty attire.

- Aerie's Success: Aerie's consistent growth, with reported sales increases in recent quarters, highlights the brand's resonance with consumers seeking comfort-focused apparel.

- Versatility as a Key Driver: Consumers are increasingly looking for pieces that can be styled in multiple ways, reducing the need for extensive wardrobes and emphasizing value.

Body Positivity and Inclusivity Movements

The growing body positivity and inclusivity movements are significantly shaping consumer expectations, and American Eagle, particularly through its Aerie brand, is capitalizing on this trend. Aerie has been a frontrunner in promoting diverse body types and realistic beauty standards, which has directly contributed to its strong performance.

This societal shift means brands must authentically represent a wide range of customers. American Eagle's commitment to offering inclusive sizing and showcasing diverse individuals in its marketing campaigns directly addresses this demand. This resonates with a generation that values authenticity and self-acceptance, fostering deeper brand loyalty and attracting a broader demographic.

For instance, Aerie's "AerieREAL" campaign has been instrumental in this regard. In Q1 2024, American Eagle Outfitters reported that Aerie's revenue grew by 5% year-over-year, demonstrating the financial impact of aligning with these social values. This success underscores the importance of:

- Embracing diverse sizing options across all product lines.

- Featuring a wide array of body types, ethnicities, and abilities in marketing materials.

- Promoting messages of self-love and acceptance through brand initiatives.

- Actively engaging with and listening to customer feedback regarding representation.

American Eagle's target demographic, particularly Gen Z and Millennials, places a high value on authenticity and social responsibility. In 2024, this translates to an expectation that brands will actively address environmental and ethical concerns. A 2024 survey revealed that 73% of Gen Z consumers believe companies should engage with social and environmental issues, directly impacting purchasing decisions.

The brand's commitment to sustainable materials, like recycled polyester, and ethical manufacturing practices, such as reducing water usage in denim production, aligns with these consumer values. For example, Aerie's revenue saw a 5% year-over-year increase in Q1 2024, partly attributed to its inclusive marketing and alignment with body positivity movements.

The rise of athleisure and the demand for versatile, comfortable clothing are significant sociological trends influencing American Eagle. Aerie's success, with consistent sales growth in recent quarters, highlights the consumer preference for apparel that bridges casual and active wear. The global athleisure market is projected to reach $324 billion by 2027, underscoring this shift.

| Sociological Factor | Impact on American Eagle | Supporting Data (2024/2025) |

|---|---|---|

| Fashion Trend Agility | Necessity to quickly adopt viral styles (e.g., Y2K, relaxed fits) driven by platforms like TikTok. | TikTok's influence on fashion discovery is paramount for staying relevant. |

| Social Media Influence | Purchasing decisions heavily influenced by influencers and online communities. | Effective influencer partnerships and engaging content directly boost visibility and sales. |

| Environmental & Ethical Concerns | Demand for transparency in supply chains and commitment to fair labor/sustainability. | 73% of Gen Z consumers expect companies to address social/environmental issues. |

| Comfort & Versatility | Growing preference for athleisure and multi-functional garments. | Aerie's Q1 2024 revenue grew 5% YoY; global athleisure market projected to reach $324B by 2027. |

| Body Positivity & Inclusivity | Expectation for authentic representation across diverse body types and sizes. | Aerie's "AerieREAL" campaign success demonstrates financial impact of inclusive marketing. |

Technological factors

American Eagle's success hinges on its digital shopping experience, with user-friendly websites and strong mobile apps being crucial for connecting with its digitally native customer base. Seamless navigation, simple checkout, and personalized suggestions are key drivers for online revenue and customer loyalty.

In 2023, e-commerce represented a significant portion of American Eagle's revenue, with digital sales continuing to grow. The company reported that its digital channels were instrumental in reaching its target demographic, highlighting the importance of ongoing investment in these platforms to maintain a competitive edge in the evolving retail landscape.

American Eagle's investment in data analytics is transforming how it connects with customers. By analyzing vast amounts of data on preferences, buying habits, and online activity, the company can tailor marketing efforts and product suggestions with remarkable precision. This personalized approach is crucial in today's competitive retail landscape.

This technological edge directly impacts key business metrics. For instance, in Q1 2024, American Eagle reported a 5% increase in comparable sales, partly attributed to enhanced personalization strategies that boosted customer engagement and conversion rates. The ability to predict demand more accurately through data analytics also plays a significant role in optimizing inventory levels, reducing waste, and ensuring popular items are readily available.

American Eagle is increasingly leveraging AI and robotics to streamline its supply chain operations. For instance, in 2024, the company continued to invest in warehouse automation, aiming to reduce order fulfillment times by an estimated 15% by the end of the year.

These technological advancements directly translate into cost savings and improved efficiency. By optimizing inventory management and delivery routes, American Eagle can ensure products reach stores and customers faster, a crucial factor in the fast-paced apparel industry. This agility is key to staying competitive.

In-store Technology and Omnichannel Integration

American Eagle is actively enhancing its in-store technology to create a seamless omnichannel experience. This includes implementing self-checkout options and interactive digital displays to improve customer convenience and engagement within physical stores. By integrating these elements, the company aims to bridge the gap between its online and offline channels, offering a unified shopping journey.

The company's commitment to omnichannel integration is crucial for meeting evolving consumer expectations. For instance, buy-online-pickup-in-store (BOPIS) services are a cornerstone of this strategy, allowing customers to enjoy the flexibility of online purchasing with the immediacy of in-store collection. This approach is vital for maintaining competitiveness in the current retail landscape.

- In-Store Tech: American Eagle is investing in technologies like self-checkout and interactive displays.

- Omnichannel Focus: A key goal is to create a consistent customer journey across all shopping channels.

- BOPIS Expansion: Buy-online-pickup-in-store services are central to bridging online and offline retail.

Emerging Technologies in Product Design and Manufacturing

Technological advancements are rapidly reshaping how fashion brands like American Eagle design and produce their products. Emerging technologies such as additive manufacturing, commonly known as 3D printing, are enabling faster and more cost-effective prototyping. This allows for quicker iterations of designs, potentially reducing the time from concept to consumer by weeks. For instance, in 2024, the global 3D printing market is projected to reach over $20 billion, highlighting its growing influence across industries, including apparel.

Virtual reality (VR) and augmented reality (AR) are also becoming integral to the design process. These immersive technologies allow designers to visualize garments in 3D, conduct virtual fittings, and even create virtual showrooms, streamlining collaboration and reducing the need for physical samples. This can lead to significant savings in materials and shipping. By 2025, the VR/AR in retail market is expected to exceed $10 billion, indicating a strong trend towards digital integration in fashion.

Furthermore, artificial intelligence (AI) is revolutionizing trend forecasting and inventory management. AI algorithms can analyze vast amounts of data, from social media sentiment to sales figures, to predict upcoming fashion trends with greater accuracy. This predictive power helps American Eagle to align its production more closely with consumer demand, minimizing overstock and reducing waste. Companies leveraging AI in their supply chains have reported up to a 10% reduction in inventory costs.

These technological factors offer American Eagle significant opportunities to enhance its product development cycle:

- Accelerated Prototyping: Utilizing 3D printing to rapidly develop and test new garment designs, reducing lead times.

- Enhanced Visualization: Employing VR/AR for immersive design reviews and virtual try-ons, improving design accuracy and reducing physical sample waste.

- Data-Driven Forecasting: Leveraging AI for more precise prediction of fashion trends, optimizing inventory and minimizing production of unwanted styles.

- Increased Market Responsiveness: Faster design cycles and better trend insights allow for quicker adaptation to evolving consumer preferences and market demands.

American Eagle's embrace of technology is evident in its robust digital infrastructure, with e-commerce sales continuing to be a vital revenue stream. The company's investment in data analytics, particularly AI, allows for highly personalized marketing and improved inventory management, as seen in a reported 5% increase in comparable sales in Q1 2024, partly driven by these strategies.

The company is also enhancing its physical retail presence with in-store technology like self-checkout and interactive displays, aiming for a seamless omnichannel experience. This focus on integration, including the expansion of buy-online-pickup-in-store (BOPIS) services, is crucial for meeting modern consumer expectations and maintaining a competitive edge.

Technological advancements are also streamlining product development, with 3D printing enabling faster prototyping and VR/AR facilitating virtual design and fittings. AI is further revolutionizing trend forecasting and inventory control, with companies using AI reporting up to a 10% reduction in inventory costs.

| Technology Area | Impact on American Eagle | Key Data/Trend (2024-2025) |

|---|---|---|

| E-commerce & Mobile Apps | Drives online revenue and customer loyalty | Digital sales a significant portion of revenue; continued growth expected. |

| Data Analytics & AI | Personalized marketing, trend forecasting, inventory optimization | Q1 2024 comparable sales up 5% partly due to personalization; AI can reduce inventory costs by ~10%. |

| Supply Chain Automation | Reduced fulfillment times, cost savings | Warehouse automation investment aimed at 15% faster order fulfillment by end of 2024. |

| In-Store Technology | Enhanced customer convenience and engagement | Implementation of self-checkout and digital displays for omnichannel integration. |

| 3D Printing & VR/AR | Accelerated prototyping, virtual design, reduced waste | Global 3D printing market projected over $20 billion in 2024; VR/AR in retail market to exceed $10 billion by 2025. |

Legal factors

American Eagle faces significant legal challenges concerning data privacy and cybersecurity. The California Consumer Privacy Act (CCPA) and similar state-level regulations, alongside the ongoing discussion of potential federal privacy legislation, mandate strict protocols for handling customer information. Failure to comply can result in substantial penalties; for example, CCPA violations can lead to fines of up to $7,500 per intentional violation.

Maintaining robust cybersecurity is therefore not just a best practice but a legal imperative for American Eagle. Protecting sensitive customer data from breaches is crucial for avoiding regulatory fines and, more importantly, for preserving customer trust. A significant data breach could severely damage the brand's reputation and lead to a loss of customer loyalty, impacting sales and long-term viability.

American Eagle must adhere to a variety of labor and employment laws, such as minimum wage, overtime, workplace safety, and anti-discrimination regulations. For instance, the federal minimum wage remains $7.25 per hour, though many states and cities have higher rates, impacting American Eagle's payroll costs. Ensuring compliance is crucial for preventing costly litigation and fostering a positive work environment.

American Eagle, as a clothing and accessories retailer, must comply with strict product safety and labeling laws. This involves ensuring materials are safe, fabrics are not overly flammable, and accurate allergen and origin information is provided on labels. For instance, the Consumer Product Safety Improvement Act (CPSIA) in the U.S. sets standards for children's clothing, requiring testing for lead and phthalates, which directly impacts product sourcing and manufacturing for any applicable lines.

Failure to meet these regulations can result in severe consequences. In 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over 1,000 recalls affecting various consumer goods, highlighting the active enforcement of these safety standards. For American Eagle, a product recall could mean significant financial losses due to returned inventory, potential fines, and substantial damage to its brand reputation, impacting consumer trust and sales.

Intellectual Property Rights

American Eagle's ability to protect its own designs, trademarks, and brand identity is paramount in the competitive apparel market. This involves actively defending against counterfeiting and trademark infringement, which can dilute brand value and consumer trust. For instance, in 2023, the fashion industry globally saw an estimated $473 billion in lost revenue due to counterfeit goods, highlighting the financial stakes involved.

Ensuring that American Eagle's products do not infringe on existing patents or copyrights is equally critical to avoid costly legal battles and reputational damage. This proactive approach safeguards the company's innovation pipeline and its ability to operate without legal encumbrance. The company's commitment to intellectual property protection is a cornerstone of maintaining its market position and fostering continued brand loyalty.

- Brand Protection: American Eagle actively pursues legal avenues to combat the sale of counterfeit merchandise, which poses a significant threat to brand integrity.

- Innovation Safeguarding: The company ensures its product designs and manufacturing processes do not infringe on existing intellectual property rights of competitors or other entities.

- Legal Costs: In 2024, the apparel sector experienced an increase in litigation related to design patents and trademark disputes, underscoring the ongoing legal challenges.

Advertising and Marketing Laws

American Eagle must navigate a complex landscape of advertising and marketing laws, including truth-in-advertising statutes and consumer protection acts. These regulations are crucial for preventing misleading claims and ensuring transparency in campaigns, particularly those involving influencer marketing. In 2024, the Federal Trade Commission (FTC) continued its focus on disclosure requirements for endorsements, impacting how brands like American Eagle collaborate with social media personalities. Failure to comply can result in significant penalties and damage to brand reputation.

Key legal considerations for American Eagle's marketing include:

- Truthfulness in Advertising: Ensuring all marketing claims are accurate and substantiated to avoid violations of laws like the FTC Act.

- Consumer Protection: Adhering to regulations designed to protect consumers from deceptive or unfair marketing practices.

- Endorsement Compliance: Strictly following guidelines for influencer marketing, requiring clear disclosure of material connections between influencers and the brand.

- Marketing to Minors: Complying with specific laws, such as the Children's Online Privacy Protection Act (COPPA), when targeting younger demographics.

American Eagle's operational and strategic decisions are heavily influenced by a dynamic legal environment. Navigating data privacy regulations, such as the California Privacy Rights Act (CPRA), a successor to CCPA, requires continuous investment in compliance and security measures. Labor laws, including those concerning minimum wage and fair scheduling practices, directly impact operational costs and employee management strategies, with many states and cities continuing to raise minimum wages above the federal $7.25 per hour in 2024 and 2025.

Product safety and labeling remain critical legal areas, with ongoing scrutiny from bodies like the Consumer Product Safety Commission (CPSC). Intellectual property law is also paramount, as the fashion industry faces persistent challenges with counterfeiting and design infringement. In 2024, the fashion sector continued to grapple with these issues, with reports indicating substantial losses attributed to illicit trade, underscoring the need for robust brand protection efforts.

Advertising and marketing are subject to stringent regulations, including those enforced by the Federal Trade Commission (FTC), particularly concerning endorsements and digital advertising practices. Compliance in these areas is essential to maintain consumer trust and avoid significant penalties, with the FTC actively monitoring influencer marketing disclosures throughout 2024 and into 2025.

| Legal Area | Key Considerations for American Eagle | 2024/2025 Relevance |

|---|---|---|

| Data Privacy | Compliance with CPRA, potential federal legislation, cybersecurity protocols. | Increased fines for violations, heightened consumer expectations for data protection. |

| Labor Laws | Minimum wage adherence, overtime, workplace safety, anti-discrimination. | Rising state/local minimum wages impacting payroll; focus on fair labor practices. |

| Product Safety & Labeling | Adherence to CPSC standards, material safety, accurate labeling. | Active enforcement and recalls; importance of supply chain transparency. |

| Intellectual Property | Protection against counterfeiting, trademark infringement, design patents. | Significant financial losses from counterfeit goods; increased litigation in fashion IP. |

| Advertising & Marketing | Truth-in-advertising, consumer protection, influencer disclosure compliance. | FTC focus on digital marketing and endorsements; need for transparent campaigns. |

Environmental factors

Growing consumer and regulatory pressure is pushing American Eagle to prioritize sustainable sourcing. This means a greater focus on materials like organic cotton and recycled polyester. For instance, the fashion industry's reliance on conventional cotton, which is water-intensive, is a significant environmental concern. By shifting to organic cotton, American Eagle can reduce its water footprint.

Investing in supply chain transparency and partnering with eco-friendly suppliers is becoming essential. This move helps reduce environmental impact and meet the expectations of environmentally conscious stakeholders. For example, many consumers are willing to pay a premium for sustainably produced goods, with studies in 2024 indicating a significant portion of Gen Z and Millennials actively seeking out eco-friendly brands.

These environmental factors directly influence American Eagle's product development and procurement strategies. The demand for sustainable materials impacts sourcing decisions and can influence the cost of goods sold. Companies that fail to adapt may face reputational damage and lose market share to more sustainable competitors.

The apparel industry faces a substantial environmental hurdle in managing textile waste, from production through to end-of-life. American Eagle's focus on reducing waste, encouraging clothing recycling, and investigating circular economy approaches like resale and repair services directly addresses this, aiming to lessen its environmental impact and attract environmentally aware shoppers.

Minimizing waste sent to landfills is a critical objective for American Eagle. For instance, in 2023, the global apparel market generated an estimated 92 million tons of textile waste, highlighting the scale of the issue. Companies like American Eagle are increasingly investing in take-back programs and partnerships to divert textiles from landfills, with a growing consumer demand for sustainable practices influencing these decisions.

American Eagle is focusing on reducing its carbon footprint by measuring and cutting greenhouse gas emissions throughout its operations. This includes everything from making clothes and shipping them to running its stores. For instance, in 2023, the company reported a 5% reduction in Scope 1 and 2 emissions compared to its 2019 baseline, a step towards its 2030 sustainability goals.

The company is actively working to increase its use of renewable energy and make its logistics more efficient. By improving energy use in its retail locations, American Eagle aims to lessen its environmental impact and boost its reputation for corporate responsibility. These efforts are crucial as regulatory bodies worldwide are imposing stricter rules on emissions.

Water Usage and Pollution Control

The apparel industry, including companies like American Eagle, faces significant environmental scrutiny regarding water usage and pollution. Dyeing and finishing processes are particularly water-intensive. For instance, it's estimated that producing a single cotton t-shirt can require up to 2,700 liters of water, a stark figure highlighting the industry's footprint.

American Eagle's proactive approach to managing its water impact is crucial. This involves setting targets for reducing water consumption across its supply chain and ensuring that wastewater is treated responsibly before discharge. Such measures not only align with environmental stewardship principles but also serve to mitigate reputational risks and potential regulatory penalties.

Key aspects of responsible water management for American Eagle include:

- Supply Chain Water Reduction: Implementing programs with suppliers to decrease water used in manufacturing processes.

- Wastewater Treatment: Ensuring that all wastewater generated meets or exceeds environmental standards before release.

- Innovation in Dyeing: Exploring and adopting water-saving dyeing technologies, such as low-water or waterless dyeing methods.

- Transparency and Reporting: Publicly disclosing water usage and pollution control efforts to build trust and accountability.

Consumer Demand for Eco-Friendly Practices

A substantial segment of American Eagle's core consumer base, particularly Gen Z and Millennials, shows a strong inclination towards brands that prioritize environmental responsibility. This demographic actively seeks out and supports companies demonstrating genuine commitment to sustainability. For instance, a 2024 survey indicated that over 60% of consumers aged 18-34 consider a brand's environmental impact when making purchasing decisions.

American Eagle's strategic advantage lies in its ability to transparently communicate its sustainability initiatives. Efforts such as expanding its eco-friendly denim lines, which utilize less water and fewer chemicals, or transitioning to more sustainable packaging solutions directly resonate with this environmentally conscious consumer. These actions not only foster brand loyalty but also serve as a powerful magnet for attracting new customers who align with these values.

The growing consumer demand for eco-friendly practices directly influences American Eagle's strategic decision-making in its environmental approach. This preference is a key driver for:

- Developing and promoting sustainable product collections.

- Implementing eco-conscious packaging and supply chain practices.

- Enhancing transparency in reporting environmental impact and progress.

Environmental factors are increasingly shaping American Eagle's operational and strategic decisions. The company is responding to a growing demand for sustainable fashion, evident in consumer preferences and regulatory pressures. For instance, a 2024 survey revealed that over 60% of consumers aged 18-34 consider a brand's environmental impact when purchasing.

American Eagle is actively working to reduce its environmental footprint, focusing on areas like water usage, textile waste, and carbon emissions. Initiatives include expanding eco-friendly product lines and improving supply chain transparency. The company reported a 5% reduction in Scope 1 and 2 emissions in 2023 compared to its 2019 baseline, aligning with its 2030 sustainability goals.

The apparel industry's significant water consumption, with estimates suggesting up to 2,700 liters of water for one cotton t-shirt, presents a challenge. American Eagle is addressing this by implementing water reduction programs with suppliers and exploring water-saving dyeing technologies. These efforts are critical as global regulatory bodies are intensifying scrutiny on emissions and water pollution.

| Environmental Focus Area | American Eagle Initiative | Impact/Data Point |

|---|---|---|

| Sustainable Materials | Increased use of organic cotton and recycled polyester | Reduces water footprint compared to conventional cotton. |

| Waste Reduction | Textile recycling programs and circular economy exploration | Addresses the 92 million tons of textile waste generated globally in 2023. |

| Carbon Emissions | Reducing Scope 1 and 2 emissions | Achieved a 5% reduction by 2023 from a 2019 baseline. |

| Water Management | Supply chain water reduction and wastewater treatment | Mitigates the high water usage in textile production. |

| Consumer Demand | Developing eco-conscious product collections | Appeals to environmentally aware consumers, with over 60% of 18-34 year olds considering environmental impact in 2024. |

PESTLE Analysis Data Sources

Our American Eagle PESTLE Analysis is constructed using a comprehensive blend of data from government agencies, industry-specific market research, and reputable financial news outlets. This approach ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the brand.