ADTRAN SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

ADTRAN's strengths lie in its robust product portfolio and established customer relationships, but its opportunities for expansion in emerging markets are tempered by competitive pressures. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind ADTRAN's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ADTRAN boasts an innovative product portfolio, featuring solutions like 50G PON and Wi-Fi 7, positioning it at the forefront of next-generation networking. This commitment to advanced technology was recognized with FTTH Innovation Awards in 2025, underscoring their leadership in high-speed internet access and network management.

ADTRAN boasts a significant global market presence, serving a wide spectrum of customers. This includes major telecommunications providers, mid-sized businesses, smaller enterprises, and government entities across numerous countries. Their solutions are actively used by millions of end-users worldwide, demonstrating extensive reach.

This broad customer base, spanning various sectors and geographies, significantly diversifies ADTRAN's revenue streams. It mitigates the risk associated with over-reliance on any single market segment or region, offering a crucial layer of resilience against localized economic challenges.

ADTRAN is strategically positioned to benefit from the accelerating global demand for fiber-to-the-home (FTTH) deployments and the continuous expansion of 5G networks. These are massive growth areas, with global FTTH connections projected to reach over 1 billion by 2027, and 5G infrastructure investment continuing at a rapid pace throughout 2024 and 2025. ADTRAN’s core offerings in fiber access and optical networking are essential components for service providers building out these next-generation networks, directly aligning with significant capital expenditures in digital infrastructure.

Operational Flexibility and Supply Chain Diversification

ADTRAN's operational flexibility is a significant strength, bolstered by its manufacturing presence in both the U.S. and Europe. This dual footprint is crucial for navigating the volatile geopolitical landscape and mitigating supply chain disruptions, a challenge many competitors face. For instance, in 2024, the company's ability to shift production between these regions proved vital in maintaining delivery schedules amidst localized component shortages.

This strategic diversification directly translates into enhanced operational agility. ADTRAN can more readily adapt its production to meet evolving market demands or unforeseen logistical hurdles. The company's 2024 performance, where it successfully rerouted a significant portion of its European-bound production to its U.S. facilities during a period of heightened EU trade uncertainty, exemplifies this capability.

The benefits of this diversified manufacturing strategy are evident in ADTRAN's supply chain resilience. By not relying on a single geographic hub, the company can better absorb shocks and ensure continuity of supply. This was particularly relevant in early 2025 when a major port congestion event impacted the West Coast of the U.S., while ADTRAN's European operations continued to function, supporting its North American customer base.

Key aspects of ADTRAN's operational flexibility and supply chain diversification include:

- Dual Manufacturing Footprint: U.S. and European facilities provide a buffer against geopolitical risks and supply chain disruptions.

- Enhanced Agility: The ability to pivot production geographies allows for quicker adaptation to market changes and unforeseen events.

- Supply Chain Resilience: Diversified locations reduce reliance on single points of failure, ensuring more consistent product availability.

- Competitive Advantage: This setup differentiates ADTRAN from competitors with more concentrated manufacturing operations, particularly in times of global instability.

Strong Customer Relationships and Trust

ADTRAN’s commitment to consistent performance and strategic investments in cutting-edge solutions like cloud, AI, and edge computing has significantly bolstered customer trust. This has translated into tangible growth, with the company reporting a notable increase in new customer acquisitions and successful expansion into new geographical markets throughout 2024. These deepening relationships are foundational for securing stable, long-term revenue streams and expanding market share.

Key indicators of these strong customer ties include:

- Increased Customer Acquisition: ADTRAN saw a significant uptick in new customer wins in the first half of 2024, particularly in North America and Europe, as service providers accelerated their network modernization efforts.

- Expanded Solution Adoption: Existing customers are increasingly adopting ADTRAN's broader portfolio, especially in areas like 5G backhaul and fiber-to-the-home (FTTH) solutions, demonstrating a high level of confidence in the company's technology.

- Positive Customer Feedback: Independent industry surveys conducted in late 2024 highlighted ADTRAN's strong customer support and product reliability as key differentiators, contributing to high retention rates.

ADTRAN's strength lies in its forward-thinking product development, evident in its advanced 50G PON and Wi-Fi 7 offerings, which earned it FTTH Innovation Awards in 2025. This technological leadership is complemented by a broad global market presence, serving millions of users across telecommunications, business, and government sectors, ensuring diverse revenue streams and resilience.

What is included in the product

Analyzes ADTRAN’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and leverage ADTRAN's competitive advantages, mitigating market challenges.

Weaknesses

Despite some revenue growth, ADTRAN has been grappling with persistent net losses. For fiscal year 2024, the company reported a widening net loss, signaling ongoing profitability challenges. This situation is further complicated by the EBIT loss stemming from its majority-owned subsidiary, Adtran Networks SE, which highlights difficulties in converting sales into consistent profits.

ADTRAN's financial structure shows a significant reliance on debt, with a debt-to-equity ratio of 33.8% and a debt-to-capitalization ratio standing at 61.59% as of recent filings. This level of financial leverage could increase the company's risk profile, especially in fluctuating economic conditions.

Adding to these concerns, ADTRAN has experienced financial restatements impacting its 2023-2024 financial reporting. These restatements have led to adjusted reported losses and can signal potential governance issues or internal control weaknesses, which may cause hesitation among investors prioritizing stability and transparency.

ADTRAN's financial health is closely tied to broader economic trends. For instance, a significant economic downturn in 2024 or 2025 could dampen consumer demand for broadband services, directly affecting ADTRAN's sales. Similarly, shifts in government policies, like increased tariffs on imported components or changes in monetary policy, can create operational challenges and impact profitability.

Service providers, ADTRAN's primary customers, often adjust their capital expenditure plans based on economic outlooks. A slowdown might lead them to postpone network upgrades, directly reducing ADTRAN's order pipeline. This reliance on external economic factors introduces an element of unpredictability into ADTRAN's revenue forecasts, making long-term planning more complex.

Exposure to Customer Inventory Adjustments

The telecommunications sector has seen customers adjust their inventory levels, often reducing stockpiles accumulated during periods of uncertainty. While ADTRAN anticipates this trend to stabilize, these shifts can still affect immediate revenue and make demand forecasting more challenging.

This exposure to customer inventory adjustments is a notable weakness for ADTRAN. It means the company's short-term financial performance can be significantly influenced by factors outside its direct control, impacting revenue predictability. For instance, in fiscal year 2023, while specific inventory adjustment impacts weren't detailed, overall revenue saw fluctuations that could be partly attributed to such industry-wide dynamics.

- Unpredictable Demand: Customer inventory cycles create volatility in ADTRAN's order intake.

- Revenue Impact: Reductions in customer stockpiles directly translate to lower short-term sales for ADTRAN.

- Forecasting Challenges: The need for careful inventory management and forecasting becomes paramount to mitigate these effects.

Intense Competition in a Dynamic Market

ADTRAN contends with significant rivalry in the telecommunications sector. Major global players such as Huawei and Cisco, alongside numerous other established and emerging vendors, present formidable competition. The market also sees challenges from alternative broadband technologies that can disrupt established market positions.

This intense competition demands constant product development and strategic market maneuvers. ADTRAN must consistently innovate to keep pace and effectively compete for market share. For instance, in the first quarter of 2024, the company reported revenue of $270.7 million, a figure that reflects the ongoing efforts to navigate this challenging environment.

- Intense Rivalry: Faces competition from giants like Huawei and Cisco.

- Market Dynamics: Must adapt to evolving technologies and new market entrants.

- Innovation Imperative: Continuous R&D is crucial for maintaining competitiveness.

- Market Share Pressure: Aggressive strategies are needed to defend and grow its position.

ADTRAN faces significant challenges in converting its revenue into profits, evidenced by persistent net losses. For fiscal year 2024, the company reported an increasing net loss, underscoring ongoing profitability issues. The EBIT loss from its subsidiary, Adtran Networks SE, further highlights the difficulty in achieving consistent profitability from its sales.

Preview the Actual Deliverable

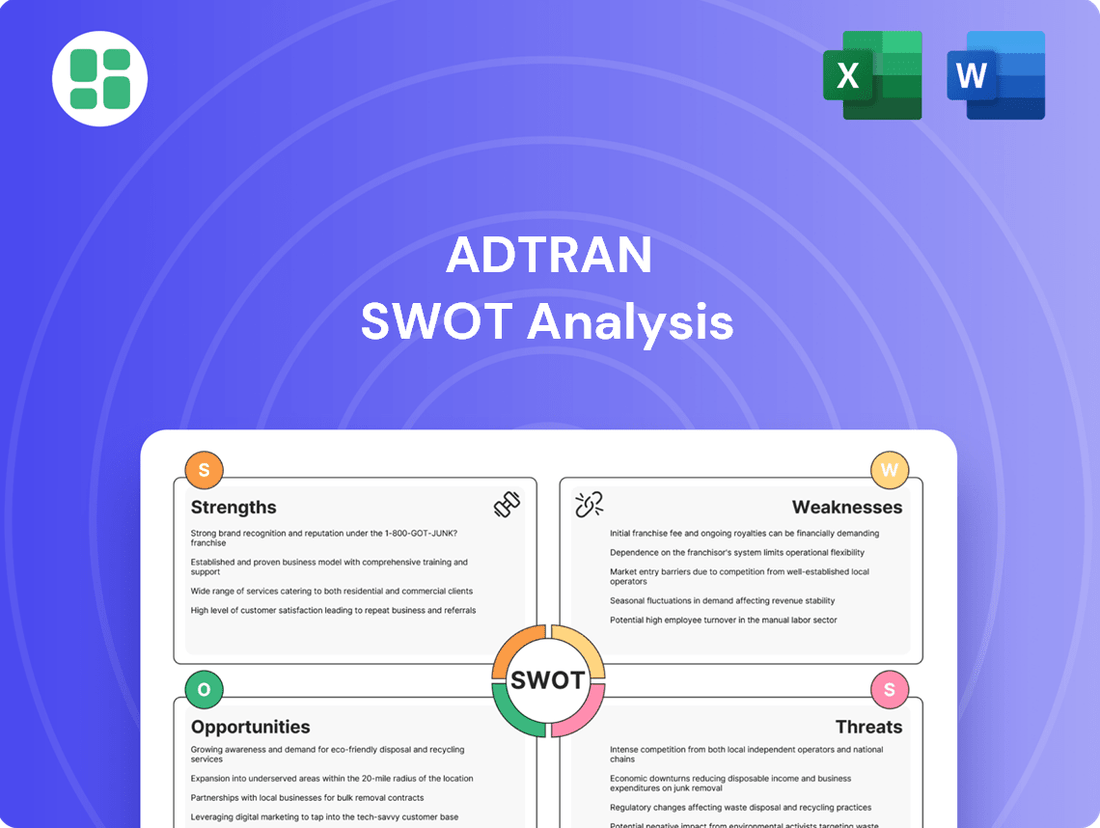

ADTRAN SWOT Analysis

This is the actual ADTRAN SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

Opportunities

The global push for faster internet, driven by remote work, online learning, and streaming, is a major tailwind for ADTRAN. This demand is particularly strong in emerging markets and underserved areas where fiber deployment is accelerating. For instance, the global fixed broadband market was valued at approximately $200 billion in 2023 and is projected to grow significantly through 2028, presenting a substantial opportunity for ADTRAN's network solutions.

ADTRAN is well-positioned to capitalize on the burgeoning demand for telecommunications infrastructure in emerging markets, where connectivity needs are rapidly expanding. This presents a significant avenue for growth as these regions continue to develop their digital capabilities.

Furthermore, substantial government funding and dedicated initiatives, particularly in the United States and Europe, are actively driving the expansion of rural broadband services. These programs are creating new customer segments and unlocking fresh revenue streams for ADTRAN by supporting the build-out of essential digital infrastructure in underserved areas.

The global 5G infrastructure market is projected to reach $162.4 billion by 2027, with ongoing deployments creating a strong demand for ADTRAN's specialized solutions. The company's expertise in fiber access and optical transport directly supports the high-bandwidth, low-latency requirements of 5G fronthaul and the emerging 10G and 50G PON standards.

ADTRAN's portfolio is strategically positioned to capitalize on this network evolution, enabling service providers to build out next-generation access networks. This technological shift offers a substantial opportunity for ADTRAN to expand its market share as a critical partner in building the future of telecommunications.

Leveraging Open, Disaggregated, and Cloud-Managed Solutions

The industry's shift towards open, disaggregated networking and cloud-managed solutions presents a significant opportunity for ADTRAN. This trend allows service providers to move away from costly, proprietary hardware, fostering greater flexibility and operational efficiency. ADTRAN's Mosaic One platform exemplifies this, aligning perfectly with customer demands for more adaptable and cost-effective infrastructure.

This strategic direction not only broadens ADTRAN's market reach but also cultivates deeper customer loyalty by offering solutions that reduce vendor lock-in. The increasing adoption of cloud-native architectures in telecommunications, projected to grow substantially in the coming years, underscores the market's readiness for these types of offerings.

- Industry Growth: The global market for network function virtualization (NFV) and software-defined networking (SDN), key components of disaggregated solutions, was valued at approximately $25 billion in 2023 and is expected to see a compound annual growth rate (CAGR) of over 15% through 2028, indicating strong demand for open systems.

- Cost Savings for Providers: Service providers adopting disaggregated models can realize significant operational expenditure (OPEX) savings, often in the range of 10-20%, by optimizing hardware and software integration.

- Market Expansion: By embracing open standards, ADTRAN can tap into a wider ecosystem of partners and developers, enhancing its competitive position against more vertically integrated competitors.

- Customer Trust: Offering transparency and choice through open solutions builds stronger relationships with customers, who are increasingly prioritizing flexibility and long-term cost management.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions represent a significant opportunity for ADTRAN to bolster its competitive edge. By forging alliances, such as its collaboration on quantum-secured encryption, ADTRAN can integrate cutting-edge technologies and broaden its service portfolio. This approach is crucial for staying ahead in the rapidly evolving telecommunications landscape, where innovation is key to market leadership.

The company can leverage acquisitions to gain immediate access to new markets or acquire specialized expertise that would be time-consuming to develop internally. For instance, acquiring a company with a strong presence in a specific geographic region or a niche technology could rapidly expand ADTRAN's customer base and revenue streams. This proactive M&A strategy allows for accelerated growth and diversification.

These strategic moves are vital for enhancing ADTRAN's overall value proposition and strengthening its market position. By carefully selecting partners and acquisition targets, ADTRAN can ensure that these initiatives align with its long-term vision and contribute to sustainable growth. The company's commitment to innovation through these avenues is a cornerstone of its forward-looking strategy.

- Expand Market Reach: Partnerships can open doors to new customer segments and geographic territories, increasing ADTRAN's overall market penetration.

- Accelerate Innovation: Collaborations and acquisitions allow for the rapid integration of new technologies and solutions, fostering a culture of continuous improvement.

- Diversify Capabilities: By acquiring or partnering with companies possessing complementary skills, ADTRAN can broaden its service offerings and reduce reliance on single product lines.

- Strengthen Competitive Position: Strategic alliances and M&A activities can consolidate market share and create a more formidable presence against competitors.

The accelerating global demand for high-speed internet, fueled by remote work and digital services, creates a robust market for ADTRAN's solutions. Government initiatives, like the US Broadband Equity, Access, and Deployment (BEAD) program, are injecting billions into rural broadband expansion, directly benefiting ADTRAN. Furthermore, the industry's pivot towards open, disaggregated networking and cloud-managed platforms, exemplified by ADTRAN's Mosaic One, aligns with service providers' needs for flexibility and cost efficiency.

| Opportunity Area | Key Driver | 2024/2025 Outlook |

|---|---|---|

| Rural Broadband Expansion | Government funding (e.g., US BEAD program) | Significant project pipeline, increased demand for fiber access solutions. |

| 5G Infrastructure Growth | Fronthaul and backhaul network upgrades | Continued demand for high-capacity optical transport and PON solutions. |

| Open Networking & Cloud Solutions | Industry shift to disaggregation and SDN/NFV | Growing adoption of platforms like Mosaic One, potential for increased market share. |

| Emerging Markets Connectivity | Digital transformation and infrastructure development | Expansion opportunities in regions with increasing broadband penetration needs. |

Threats

The telecommunications equipment sector is a crowded arena, with giants like Nokia and Ericsson, alongside emerging players, constantly battling for dominance. This fierce rivalry naturally translates into significant pricing pressures, directly impacting ADTRAN's ability to maintain healthy profit margins and achieve robust revenue growth. For instance, in the first quarter of 2024, ADTRAN reported a revenue of $254.3 million, a slight decrease from the previous year, underscoring the impact of market dynamics.

ADTRAN faces the dual challenge of investing heavily in research and development to stay ahead in technological innovation, such as advancements in fiber optics and 5G infrastructure, while simultaneously needing to offer competitive pricing to win contracts. This balancing act is crucial for market share retention and expansion, particularly as customers increasingly demand more sophisticated solutions at lower costs.

Broader economic uncertainties, including persistent inflation and elevated interest rates, pose a significant threat to ADTRAN. These factors can curb capital expenditures by telecommunications service providers, directly impacting demand for ADTRAN's networking solutions. For instance, if major carriers delay network upgrades due to cost concerns, ADTRAN's sales pipeline could shrink.

The ongoing trend of rising interest rates, with the Federal Reserve maintaining a hawkish stance through much of 2024, increases the cost of borrowing for ADTRAN's customers. This can lead to a slowdown in their investment cycles, particularly for large-scale network deployments. A potential economic slowdown in key markets like North America or Europe would further exacerbate this issue, reducing overall market appetite for new telecommunications infrastructure.

ADTRAN faces ongoing threats from supply chain volatility, even with diversification efforts. Global component shortages and geopolitical instability, such as ongoing trade disputes and regional conflicts, can significantly disrupt production schedules. For instance, the semiconductor shortage experienced globally through 2023 continued to impact electronics manufacturers, potentially affecting ADTRAN's access to critical components.

These disruptions can lead to increased operational costs due to expedited shipping or alternative sourcing, directly impacting ADTRAN's profit margins. Furthermore, delays in product delivery can damage customer relationships and lead to lost sales opportunities, as seen in the telecommunications sector where network buildouts are time-sensitive.

The company's reliance on international markets, particularly for sourcing components and serving global customers, inherently exposes it to the risks of international instability. Economic downturns or trade policy changes in key regions could negatively affect ADTRAN's revenue streams and overall financial performance throughout 2024 and into 2025.

Technological Obsolescence and Rapid Innovation Cycles

The networking and communications sector is notoriously fast-paced, with technology evolving at a breakneck speed and product lifecycles shrinking. This presents a significant threat to ADTRAN, as staying ahead requires substantial and ongoing investment in research and development. For instance, the push towards 5G and next-generation Wi-Fi standards necessitates constant upgrades and new product introductions.

Failure to adapt quickly to these emerging technologies, such as advancements in optical networking or software-defined networking (SDN), could quickly render ADTRAN's current offerings outdated. This inability to keep pace risks a decline in market share as competitors introduce more advanced solutions. The pressure to innovate is relentless.

- Rapid Innovation: The industry sees new standards and technologies emerge frequently, demanding continuous R&D investment.

- Obsolescence Risk: Products can become outdated quickly if ADTRAN doesn't keep pace with technological advancements.

- Competitive Pressure: Competitors introducing cutting-edge solutions can erode ADTRAN's market position if it lags.

Regulatory Changes and Compliance Risks

ADTRAN faces significant threats from evolving telecommunications regulations and international trade policies, such as tariffs, which could directly impact its supply chain and product costs. For instance, ongoing geopolitical tensions and shifts in trade agreements could introduce new tariffs or restrictions on components, affecting ADTRAN's cost of goods sold and pricing strategies.

The company must also navigate complex and potentially changing compliance requirements across various operating regions, adding layers of operational complexity and potential penalties for non-adherence.

Furthermore, ADTRAN's past disclosures regarding internal control deficiencies and the potential for financial restatements underscore persistent governance and compliance risks. These issues require continuous vigilance and investment in robust internal control frameworks to mitigate the threat of reputational damage and financial penalties.

- Regulatory Uncertainty: Changes in telecom regulations, including net neutrality rules or spectrum allocation policies, could impact demand for ADTRAN's network equipment.

- Trade Policy Impact: Tariffs on electronic components or finished goods, particularly those sourced from or sold into regions with trade disputes, could increase costs or limit market access.

- Compliance Burden: Adhering to diverse and evolving data privacy laws (e.g., GDPR, CCPA) and cybersecurity standards across global markets presents ongoing compliance challenges.

- Internal Control Weaknesses: Past issues with internal controls highlight a persistent threat of financial misstatements or operational inefficiencies, necessitating ongoing remediation efforts.

ADTRAN operates in a highly competitive landscape, facing pressure from established players and new entrants. This intense rivalry, coupled with the rapid pace of technological change in areas like 5G and fiber optics, necessitates substantial and continuous investment in research and development to avoid product obsolescence. For instance, in Q1 2024, ADTRAN reported revenue of $254.3 million, reflecting the market's dynamic nature.

SWOT Analysis Data Sources

This ADTRAN SWOT analysis is built on a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to provide accurate and actionable insights.