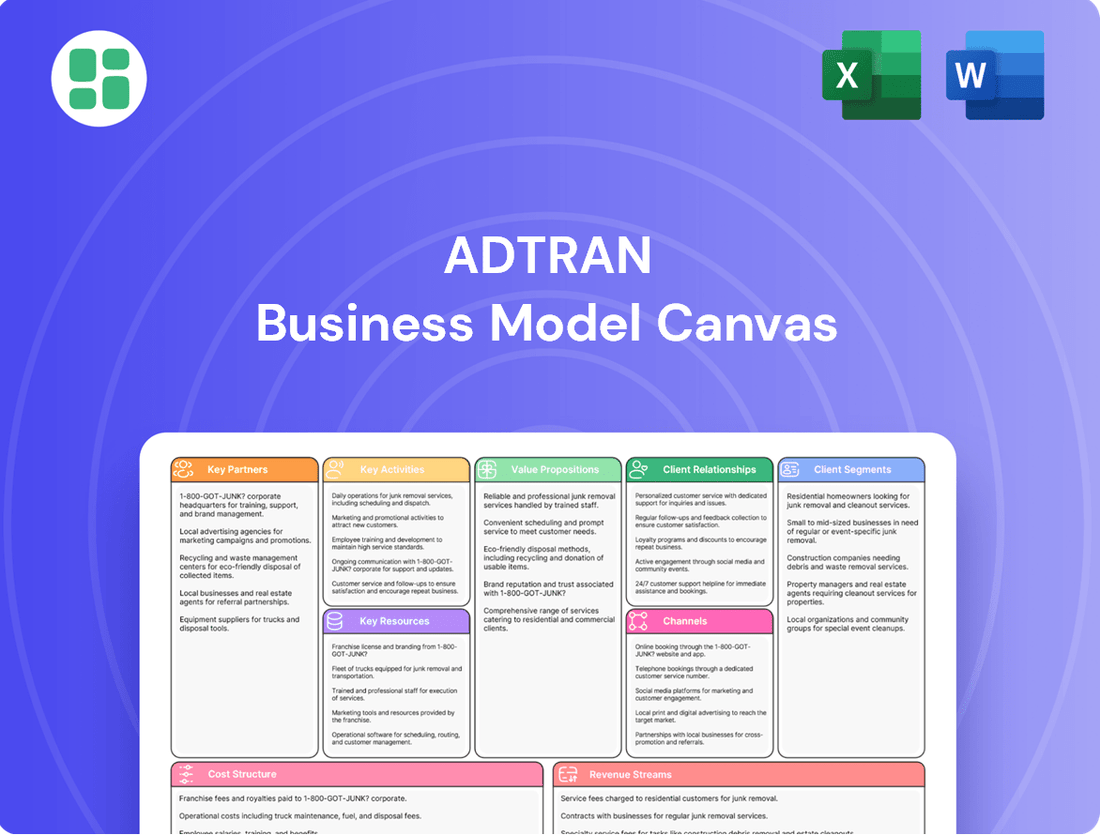

ADTRAN Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

Unlock the full strategic blueprint behind ADTRAN's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

ADTRAN actively cultivates technology alliances to deliver seamless, integrated solutions. These collaborations are crucial for ensuring interoperability across a broad ecosystem of compatible products and services, enhancing the value proposition for customers. For example, ADTRAN partners with 6WIND to provide scalable virtual Broadband Network Gateway (vBNG) and virtual Carrier-Grade Network Address Translation (vCGNAT) solutions, vital for modern network infrastructure.

Further strengthening its offerings, ADTRAN collaborates with Dell to develop AI private cloud solutions specifically tailored for U.S. federal agencies. This strategic partnership leverages Dell's robust hardware and ADTRAN's networking expertise to create secure, high-performance environments for advanced data processing and artificial intelligence applications within government sectors.

ADTRAN actively cultivates strategic alliances with a broad range of telecommunications service providers, from major global players to smaller regional operators. These collaborations are crucial for the co-development and testing of cutting-edge access and aggregation technologies, ensuring ADTRAN’s solutions meet evolving market demands.

The company boasts significant ongoing partnerships with major European operators, facilitating large-scale deployments of its fiber access and optical transport portfolios. For instance, ADTRAN's commitment to innovation in fiber deployment was evident in 2024, with continued investments in next-generation PON technologies aimed at boosting network capacity and efficiency for these partners.

ADTRAN leverages a robust network of channel partners, including value-added resellers (VARs), system integrators, and distributors, to significantly expand its market reach. These partners are crucial for delivering localized sales, installation, and ongoing support services to customers worldwide.

For 2025, ADTRAN has particularly focused on enhancing its APAC partner program. This initiative grants partners access to ADTRAN's comprehensive solution portfolio, which notably includes advanced optical transport technologies and sophisticated software solutions, reflecting a strategic push into key growth regions.

Cloud Service Providers

ADTRAN collaborates with major cloud service providers to deliver integrated managed network services and cloud-native solutions. This partnership allows for the seamless extension of network management tools into cloud environments, enhancing service delivery for enterprises and service providers. ADTRAN's designation as a leading edge computing company in 2024 underscores the strategic importance of these alliances in bringing advanced capabilities closer to the user.

These collaborations are crucial for ADTRAN's strategy to enable distributed computing and offer advanced network functionalities. By leveraging the infrastructure of leading cloud platforms, ADTRAN can provide scalable and robust solutions that meet the evolving demands of digital transformation. This synergy is key to their market positioning in the rapidly growing edge computing sector.

- Cloud Integration: ADTRAN's solutions are designed for deep integration with major cloud platforms, facilitating hybrid and multi-cloud network management.

- Edge Computing Enablement: Partnerships with cloud providers are vital for extending computing power and services to the network edge, a key growth area for ADTRAN.

- Managed Services Expansion: These alliances allow ADTRAN to offer comprehensive managed network services that leverage cloud infrastructure for enhanced performance and reliability.

- 2024 Recognition: ADTRAN's standing as a top edge computing company in 2024 reflects the success of its cloud-centric partnerships in delivering innovative solutions.

Industry Associations and Standards Bodies

ADTRAN actively engages with key industry associations and standards bodies to shape the future of networking. This participation is crucial for influencing technological advancements and ensuring widespread adoption of new standards, which directly benefits ADTRAN's product development and market positioning.

By contributing to organizations like the Broadband Forum and the ITU, ADTRAN helps define specifications for next-generation technologies. For instance, their involvement in developing standards for 50G PON is vital for ensuring interoperability and driving the market towards these advanced solutions. This strategic engagement allows ADTRAN to stay ahead of evolving network architectures and maintain a competitive edge.

- Industry Influence: ADTRAN's participation in groups like the Telecommunications Industry Association (TIA) allows them to contribute to the development of critical industry standards, impacting the direction of telecommunications infrastructure.

- Interoperability Assurance: By adhering to and helping shape standards set by organizations such as the IEEE, ADTRAN ensures its solutions seamlessly integrate with other network components, reducing complexity for customers.

- Technology Leadership: Contributions to standards bodies for emerging technologies, such as advancements in fiber access and Wi-Fi 7, position ADTRAN as a leader in innovation and a key player in the rollout of new network capabilities.

ADTRAN's key partnerships extend to technology providers like 6WIND for virtualized network functions and Dell for federal AI cloud solutions, enhancing its product ecosystem. These collaborations ensure interoperability and deliver specialized capabilities, as seen in their joint efforts to advance network infrastructure and secure government computing environments.

The company also fosters deep relationships with telecommunications service providers globally, including major European operators, for co-development and large-scale deployments of fiber access and optical transport solutions. In 2024, ADTRAN continued to invest in next-generation PON technologies, reinforcing its commitment to these strategic operator partnerships and network efficiency.

ADTRAN significantly expands its market reach through a robust network of channel partners, such as value-added resellers and system integrators, providing localized sales and support. For 2025, a key focus is enhancing the APAC partner program, offering access to its advanced optical transport and software solutions to capitalize on growth in that region.

Furthermore, ADTRAN's alliances with major cloud service providers are crucial for integrated managed network services and cloud-native offerings, extending network management into cloud environments. ADTRAN's recognition as a leading edge computing company in 2024 highlights the success of these partnerships in delivering advanced, distributed computing capabilities.

What is included in the product

A detailed breakdown of ADTRAN's strategy, covering key partners, activities, resources, and cost structure to deliver network solutions.

Focuses on ADTRAN's revenue streams and customer relationships, outlining how they create and deliver value in the telecommunications market.

ADTRAN's Business Model Canvas acts as a pain point reliever by providing a clear, structured framework that simplifies the complex process of understanding and communicating their business strategy.

It offers a one-page snapshot, allowing stakeholders to quickly grasp ADTRAN's core components and identify areas for improvement or innovation, thereby alleviating the pain of information overload and strategic ambiguity.

Activities

ADTRAN's commitment to innovation is evident through its continuous investment in Research and Development. This focus drives the creation of advanced networking and communications equipment, encompassing areas like fiber broadband, Wi-Fi technologies, and intelligent network management systems.

The company's dedication to R&D is substantial, with R&D expenses reaching $198.8 million for the trailing twelve months ending March 30, 2025. This significant expenditure underscores ADTRAN's strategy to remain at the forefront of technological advancements in the telecommunications sector.

ADTRAN's core activities revolve around the meticulous design and robust manufacturing of networking hardware and software. This encompasses developing solutions that are not only high-quality and reliable but also scalable to meet evolving market needs. For instance, in 2023, the company continued to invest in its product portfolio, launching new fiber access technologies designed for increased bandwidth and lower latency.

Managing a complex, globally distributed supply chain is paramount to ADTRAN's operational success. This intricate network ensures flexibility in production and the ability to respond swiftly to fluctuating market demands. The company's commitment to this area was evident in its efforts throughout 2023 to strengthen supplier relationships and optimize logistics, contributing to their ability to deliver products efficiently worldwide.

ADTRAN focuses on developing and executing global sales and marketing strategies to connect with telecommunications service providers, businesses, and government entities. This involves crafting targeted campaigns and leveraging diverse channels to showcase their networking solutions.

The company's sales efforts are a significant driver of its financial performance. For instance, in the second quarter of 2025, increased sales commissions were a notable factor contributing to higher non-GAAP operating expenses, signaling robust market engagement and active pursuit of new business opportunities.

Customer Support and Professional Services

ADTRAN's Customer Support and Professional Services are crucial for ensuring client success with their networking solutions. This includes comprehensive pre-sales guidance, offering technical assistance and network planning to architect the right infrastructure. Post-sales, they provide deployment services and ongoing maintenance, ensuring seamless operation and maximizing the value of ADTRAN's technology.

The Services & Support segment is a significant revenue driver, encompassing network design, implementation, and maintenance. They also offer cloud-hosted services, demonstrating a commitment to evolving customer needs. In 2023, ADTRAN's Services & Support revenue reached $135.6 million, a testament to the demand for their expertise.

- Pre-sales support: Technical assistance and network planning for optimal solution design.

- Post-sales support: Deployment services and ongoing maintenance for operational continuity.

- Service offerings: Network design, implementation, maintenance, and cloud-hosted solutions.

- Revenue contribution: Services & Support segment generated $135.6 million in 2023.

Network Software and Management Solutions Development

ADTRAN's key activities center on creating sophisticated software that manages and orchestrates network operations. This includes developing intelligent network management software and platforms designed to work seamlessly with their hardware products.

A prime example is their Mosaic One platform, which has seen significant adoption. As of early 2024, over 400 customers are utilizing this platform, with a substantial portion leveraging multiple applications within Mosaic One, highlighting its comprehensive utility.

- Development of intelligent network management software

- Creation of orchestration platforms

- Integration of software with hardware offerings

- Enhancement of the Mosaic One platform with new applications

ADTRAN's key activities focus on the design, manufacturing, and ongoing support of advanced networking and communication solutions. This includes significant investment in R&D to develop cutting-edge technologies for fiber broadband and intelligent network management. The company also manages a complex global supply chain to ensure efficient production and delivery.

Furthermore, ADTRAN actively engages in global sales and marketing to reach telecommunications providers, businesses, and government clients. Crucially, they provide comprehensive customer support and professional services, including network planning and deployment, which are vital for client success and represent a significant revenue stream. Their software development, particularly for platforms like Mosaic One, is also a core activity, enhancing network operations.

| Key Activity | Description | 2023/2025 Data Point |

|---|---|---|

| Research & Development | Innovation in networking technologies | $198.8 million R&D expenses (TTM ending March 30, 2025) |

| Design & Manufacturing | Creating high-quality, scalable networking hardware and software | Launched new fiber access technologies in 2023 |

| Supply Chain Management | Optimizing global logistics and supplier relationships | Strengthened supplier relationships and logistics in 2023 |

| Sales & Marketing | Targeted campaigns to service providers, businesses, and government | Increased sales commissions noted in Q2 2025 |

| Customer Support & Services | Pre-sales guidance, deployment, maintenance, and cloud-hosted solutions | $135.6 million in Services & Support revenue (2023) |

| Software Development | Creating intelligent network management and orchestration platforms | Mosaic One platform used by over 400 customers (early 2024) |

What You See Is What You Get

Business Model Canvas

The ADTRAN Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. This isn't a simplified sample; it's a direct representation of the comprehensive business model framework you'll get, ready for your strategic planning. Upon completion of your order, you will gain full access to this exact, professionally structured document, enabling you to immediately begin refining your business strategy.

Resources

ADTRAN's key resources include a robust intellectual property portfolio, featuring over 20 global technology patents. This collection of patents, alongside proprietary software and deep technological expertise in networking and communications equipment, forms a significant competitive moat.

ADTRAN’s core strength lies in its highly skilled engineering and R&D talent, comprising specialists in telecommunications, networking, and software development. This deep expertise is crucial for innovation and staying ahead in a rapidly evolving tech landscape.

The company’s commitment to talent is evident in its ongoing investments, particularly within the financial organization. These investments are designed to bolster the team’s capabilities, ensuring effective execution of strategies and adept management of complex operational and market challenges.

ADTRAN maintains a resilient global supply chain and manufacturing network to ensure timely delivery of its networking equipment. This diverse network allows for sourcing components and manufacturing across various regions, enhancing operational flexibility. In 2024, ADTRAN's strategy focused on navigating evolving trade policies by leveraging its globally distributed operations.

Established Customer Base and Relationships

ADTRAN's established customer base is a cornerstone of its business model, built on deep, long-standing relationships with telecommunications service providers, enterprises, and government entities globally. This diverse clientele includes major players like Tier 1, 2, and 3 Communications Service Providers (CSPs) and cable Multiple System Operators (MSOs), alongside a broad spectrum of distributed enterprises.

- Global Reach: ADTRAN serves customers across domestic and international markets, indicating a wide geographical footprint and market penetration.

- Customer Segmentation: The company caters to various segments within the telecommunications industry, from the largest CSPs to smaller operators, demonstrating adaptability.

- Enterprise Solutions: Beyond telecommunications, ADTRAN also supports distributed enterprises, highlighting its broader applicability in network solutions.

- Relationship Focus: The emphasis on established relationships suggests a strategy centered on customer retention and recurring revenue streams.

Financial Capital

ADTRAN's financial capital is crucial for fueling innovation and growth. This includes securing funds for continuous research and development, covering day-to-day operational costs, and enabling strategic acquisitions or market expansion initiatives. Having robust financial backing ensures ADTRAN can maintain its competitive edge in the telecommunications sector.

The company's liquidity position demonstrates its financial strength. For instance, ADTRAN concluded the second quarter of 2025 with $106.3 million in cash and cash equivalents. This significant amount highlights a healthy improvement in the company's ability to meet its short-term obligations and invest in future opportunities.

- Research & Development: Funding ongoing innovation in network solutions.

- Operational Expenses: Covering the costs of manufacturing, sales, and administration.

- Strategic Investments: Allocating capital for potential acquisitions or partnerships.

- Market Expansion: Supporting entry into new geographical regions or customer segments.

ADTRAN's intellectual property, including over 20 global technology patents, coupled with proprietary software and deep networking expertise, provides a significant competitive advantage. Their skilled R&D team, specializing in telecommunications and software, drives innovation. In 2024, ADTRAN strategically invested in its financial talent to enhance operational execution and market navigation.

ADTRAN's key resources are underpinned by a robust global supply chain and manufacturing network, ensuring product delivery and operational flexibility. The company's financial capital, exemplified by $106.3 million in cash and cash equivalents as of Q2 2025, fuels R&D, operations, and strategic growth initiatives.

The company's established customer base, comprising major telecommunications providers and diverse enterprises, represents a critical resource. This broad reach and focus on long-term relationships foster customer retention and recurring revenue, supported by a strong financial foundation.

| Resource Category | Key Components | Significance |

|---|---|---|

| Intellectual Property & Technology | 20+ Global Patents, Proprietary Software, Networking Expertise | Competitive moat, innovation driver |

| Human Capital | Skilled R&D Engineers, Telecom Specialists, Financial Talent | Innovation, strategic execution, market adaptation |

| Physical & Supply Chain | Global Manufacturing & Supply Chain Network | Operational flexibility, timely delivery |

| Financial Capital | $106.3M Cash & Equivalents (Q2 2025), Funding for R&D/Operations | Growth fuel, investment capability, liquidity |

| Customer Relationships | Tier 1/2/3 CSPs, MSOs, Distributed Enterprises | Revenue stability, market penetration, recurring income |

Value Propositions

ADTRAN delivers solutions that enable robust, high-speed internet access and reliable connectivity, which are absolutely critical for today's digital world and seamless data transfer. Their core offerings, like fiber access platforms, are designed to bring lightning-fast fiber connections directly to homes and businesses, ensuring users can keep up with increasing bandwidth demands.

ADTRAN provides flexible and scalable network solutions designed to meet the ever-changing demands of technology and growing data volumes. Their offerings allow service providers to efficiently manage and expand their services.

A key aspect of ADTRAN's strategy is their commitment to open and disaggregated networking. This approach, as highlighted in their 2024 investor presentations, enables communications service providers to achieve greater agility and cost-effectiveness in scaling their operations to meet increasing customer needs.

ADTRAN's Intelligent Network Management and Automation value proposition focuses on delivering sophisticated software and tools designed to simplify network operations and boost efficiency. This includes advanced capabilities for managing, automating, and orchestrating complex network infrastructures.

The core of this offering is ADTRAN's Mosaic software suite. Mosaic provides a unified platform for managing ADTRAN's entire fiber networking portfolio, spanning from the core network all the way to the edge. This integration is key to enabling seamless, end-to-end network control and optimization.

By leveraging these intelligent management and automation solutions, service providers can significantly reduce operational expenditures and improve the overall performance and reliability of their networks. For instance, automated provisioning and fault management can drastically cut down on manual intervention, leading to faster service delivery and fewer network disruptions.

Cost Efficiency and Operational Savings

ADTRAN's solutions are designed to drive down costs for its customers by streamlining network infrastructure. This optimization directly translates into reduced operational complexity, making it easier and cheaper to manage networks. Furthermore, ADTRAN's focus on energy-efficient technologies contributes to lower overall energy consumption, a significant operating expense for many businesses and service providers.

Specifically, ADTRAN's edge computing capabilities offer a compelling value proposition for cost savings. By enabling processing and data storage closer to the source, these solutions help enterprises and service providers slash expenses related to hosting services remotely and the backhaul of data. For instance, in 2024, many telecommunications companies are investing in edge deployments to reduce the significant costs associated with transporting vast amounts of data back to centralized data centers.

These cost efficiencies are realized through several key areas:

- Network Optimization: ADTRAN's technology helps customers build more efficient networks, reducing the need for over-provisioning and minimizing hardware requirements.

- Reduced Operational Expenses: Simplified management and automation features lower the labor costs associated with network maintenance and support.

- Lower Energy Consumption: Energy-efficient hardware and software design contribute to a reduced carbon footprint and lower utility bills.

- Edge Computing Savings: Offloading processing to the edge directly cuts down on expensive cloud hosting fees and data transmission costs.

Reliability and Security

ADTRAN prioritizes unwavering reliability and robust security across its entire product range, safeguarding vital network infrastructure and sensitive customer data. This commitment is crucial for maintaining trust and operational continuity for its clients.

In 2024, ADTRAN's focus on these areas is underscored by strategic collaborations. For instance, their partnership with NextNav and Oscilloquartz is designed to deliver secure, GPS-independent timing solutions. This is particularly important for critical infrastructure sectors that require highly precise and resilient timing, even when GPS signals are unavailable or compromised.

- Reliability: ADTRAN's network solutions are engineered for high availability, minimizing downtime for essential services.

- Security: Advanced security features are integrated to protect against cyber threats and ensure data integrity.

- Critical Infrastructure: The company's offerings support sectors like telecommunications, energy, and public safety, where uninterrupted operation is paramount.

- GPS-Independent Timing: Partnerships enhance resilience by providing accurate timing without reliance on GPS, crucial for network synchronization and security.

ADTRAN's value proposition centers on enabling service providers to deliver high-speed internet and efficient network management. Their solutions, like fiber access platforms, meet escalating bandwidth needs. They also champion open networking, boosting customer agility and cost-effectiveness, a strategy actively pursued by many providers in 2024.

Intelligent network management and automation, powered by their Mosaic software suite, simplify operations from core to edge. This translates to reduced operational expenses and enhanced network performance for their clients, with automated provisioning significantly cutting manual intervention.

ADTRAN drives down customer costs through network optimization, reduced operational expenses via automation, and lower energy consumption. Edge computing capabilities further slash expenses by processing data closer to the source, avoiding costly remote hosting and data backhaul, a key trend in 2024 telecommunications investments.

Unwavering reliability and robust security are cornerstones of ADTRAN's offering, protecting infrastructure and data. Strategic 2024 collaborations, such as with NextNav for GPS-independent timing, bolster resilience for critical infrastructure sectors.

| Value Proposition | Key Features | Customer Benefit | 2024 Relevance |

|---|---|---|---|

| High-Speed Connectivity | Fiber Access Platforms | Enables faster internet for homes and businesses | Meeting increasing bandwidth demands |

| Network Agility & Cost-Effectiveness | Open, Disaggregated Networking | Greater flexibility and reduced scaling costs for service providers | Strategic focus for providers in 2024 |

| Simplified Network Operations | Mosaic Software Suite, Automation | Reduced OPEX, improved performance and reliability | Automated provisioning reduces manual intervention |

| Cost Savings | Network Optimization, Edge Computing | Lower infrastructure, energy, and data transmission costs | Edge deployments reduce backhaul expenses |

| Reliability & Security | High Availability, Advanced Security | Safeguards infrastructure and data, ensures operational continuity | GPS-independent timing enhances critical infrastructure resilience |

Customer Relationships

ADTRAN fosters deep client connections through dedicated account managers and specialized sales teams. This personalized approach is crucial for their key telecommunications, enterprise, and government customers, ensuring a nuanced understanding of unique requirements.

ADTRAN provides extensive technical support and professional services, encompassing network design, implementation, and ongoing maintenance. This ensures customers receive assistance throughout the entire product lifecycle, from initial planning to post-deployment operations.

The Services & Support segment is a crucial part of ADTRAN's offering, delivering specialized engineering assistance and professional services. This includes vital support for network deployment and continuous upkeep, reinforcing customer success.

In 2023, ADTRAN's Services & Support segment generated $132.6 million in revenue, highlighting the significant value customers place on these offerings. This segment is integral to fostering strong, lasting customer relationships.

ADTRAN fosters deep customer relationships, especially with service providers, through collaborative development and feedback loops. This partnership approach is crucial for refining their network solutions. For instance, their work with APAC partners in 2024 highlights a commitment to a 'partner-first ecosystem,' aiming for mutual growth.

Online Portals and Knowledge Bases

ADTRAN enhances customer relationships by offering robust self-service options. Their online portals and comprehensive knowledge bases provide instant access to essential documentation, frequently asked questions, and community forums, enabling users to resolve issues quickly.

The company's commitment to partner success is evident in its updated programs. For instance, the 2025 APAC partner program features a completely revamped ADTRAN Partner Portal. This portal is designed with integrated tools to streamline training and facilitate co-branding efforts.

- Self-Service Accessibility: Online portals and knowledge bases offer 24/7 access to support materials.

- Community Engagement: Forums foster peer-to-peer support and knowledge sharing among users.

- Partner Empowerment: The 2025 APAC Partner Portal provides integrated training and co-branding tools.

Training and Certification Programs

ADTRAN provides comprehensive training and certification programs designed to equip customer staff and partners with the knowledge needed for effective deployment and management of their technologies. This focus ensures a deeper understanding and optimal utilization of ADTRAN's solutions.

The 2025 APAC partner program specifically highlights a streamlined training and certification path. This path is carefully aligned with ADTRAN's entire end-to-end portfolio, making it easier for partners to gain expertise across the company's offerings.

- Enhanced Technical Proficiency: Programs ensure staff can expertly install, configure, and maintain ADTRAN equipment.

- Partner Enablement: Certifications validate partner capabilities, fostering trust and improving service delivery.

- Portfolio Alignment: Training covers the full spectrum of ADTRAN's solutions, from access to core networking.

- Market Readiness: The 2025 APAC initiative aims to accelerate partner readiness and market penetration for new technologies.

ADTRAN's customer relationships are built on a foundation of dedicated support and collaborative engagement. Their Services & Support segment, which generated $132.6 million in revenue in 2023, underscores the value placed on these offerings. This includes personalized account management and extensive technical assistance throughout the product lifecycle.

Furthermore, ADTRAN empowers its customers and partners through robust self-service options, including online portals and knowledge bases, alongside comprehensive training and certification programs. The 2025 APAC partner program exemplifies this, featuring an updated portal with integrated tools for training and co-branding, aiming to accelerate market readiness.

| Customer Relationship Aspect | Description | Key Initiatives/Data |

|---|---|---|

| Dedicated Support | Personalized account management and specialized sales teams | Crucial for telecom, enterprise, and government clients |

| Technical & Professional Services | Network design, implementation, and ongoing maintenance | Services & Support revenue: $132.6 million in 2023 |

| Self-Service & Community | Online portals, knowledge bases, and user forums | 24/7 access to documentation and peer support |

| Partner Enablement | Training, certification, and co-branding tools | 2025 APAC Partner Portal revamp for streamlined partner success |

Channels

ADTRAN leverages a direct sales force to cultivate relationships with major telecommunications providers, large enterprises, and government entities. This specialized team excels at complex solution selling, ensuring deep engagement with these strategic accounts.

In 2024, ADTRAN's direct sales approach was crucial in securing significant deals. For instance, their work with a Tier 1 North American operator for a fiber-to-the-home deployment, valued at over $50 million, highlights the effectiveness of this channel in managing large-scale projects and complex technical requirements.

ADTRAN heavily relies on its extensive network of Value-Added Resellers (VARs) and System Integrators to expand its market reach, particularly to smaller service providers and regional enterprises. These partners are crucial for delivering ADTRAN's solutions to a diverse customer base.

The company's commitment to its channel partners is evident in its enhanced partner program, which aims to foster growth and provide robust support across different geographical regions. This program is designed to equip partners with the necessary tools and resources to succeed.

For instance, ADTRAN reported that in 2023, its channel partners contributed significantly to its revenue, with a notable increase in deal registrations from VARs in the EMEA region, indicating successful market penetration.

ADTRAN leverages a network of authorized distributors to efficiently get its networking solutions into the hands of its partners and end-users worldwide. This strategic approach is crucial for managing the complexities of global logistics and ensuring broad market penetration.

In 2024, ADTRAN’s channel partners, supported by these distributors, played a vital role in delivering advanced broadband technologies. For instance, ADTRAN’s commitment to expanding fiber access was evident in numerous deployments, with distributors facilitating the supply chain for these critical infrastructure projects.

Online Presence and Digital Marketing

ADTRAN actively cultivates a robust online presence, leveraging its corporate website, social media platforms, and targeted digital marketing initiatives to inform its audience, provide educational content, and cultivate valuable leads. This digital strategy is crucial for engaging potential customers and partners.

The company places significant emphasis on its investor relations website and the consistent dissemination of news releases through digital channels. These are vital for transparent communication with shareholders and the broader financial community, ensuring timely access to critical company updates and performance data. For instance, in the first quarter of 2024, ADTRAN reported revenue of $276.4 million, demonstrating the tangible outcomes of its market engagement strategies.

- Corporate Website: Serves as a central hub for product information, company news, and customer support.

- Social Media Engagement: Utilizes platforms like LinkedIn and Twitter to share industry insights and company updates, fostering community interaction.

- Digital Marketing Campaigns: Employs targeted advertising and content marketing to reach specific market segments and generate qualified leads.

- Investor Relations Portal: Provides comprehensive financial reports, SEC filings, and webcast information for investors.

Industry Events and Trade Shows

ADTRAN actively participates in major industry events and trade shows. These platforms are crucial for demonstrating their latest innovations, engaging with prospective customers, and enhancing brand recognition within the telecommunications sector. For instance, the company is scheduled to exhibit at key conferences in August and September 2025, providing opportunities to connect with industry leaders and showcase their advancements in network solutions.

These events serve as vital touchpoints for ADTRAN to:

- Showcase New Products: Presenting cutting-edge hardware and software solutions to a targeted audience of potential buyers and partners.

- Network with Clients: Facilitating direct interaction with current and prospective customers to understand their evolving needs and build stronger relationships.

- Build Brand Visibility: Increasing market presence and reinforcing ADTRAN's position as a leader in broadband and network access technologies.

For 2024, ADTRAN’s presence at events like the Fiber Connect conference highlighted their commitment to fiber-to-the-home technologies, a segment that saw significant investment and growth throughout the year, with many service providers accelerating their fiber deployment plans.

ADTRAN’s channels are multifaceted, combining direct sales for major accounts with a robust partner network of VARs and distributors to reach a broader market. Digital engagement and industry events further amplify their reach and brand presence.

The direct sales team is key for large deals, as seen in a 2024 fiber-to-the-home deployment exceeding $50 million. Meanwhile, VARs and system integrators are vital for reaching smaller providers, with channel partners contributing significantly to revenue in 2023.

Distributors ensure efficient global logistics for ADTRAN's networking solutions, supporting widespread deployments of advanced broadband technologies. The company also actively uses its website, social media, and investor relations portal for communication and lead generation, reporting $276.4 million in revenue for Q1 2024.

Participation in industry events in 2024, such as Fiber Connect, underscores ADTRAN's focus on fiber technologies and provides platforms for showcasing innovations and networking.

| Channel | Key Customers/Reach | 2024/Recent Data/Impact |

|---|---|---|

| Direct Sales | Major Telcos, Large Enterprises, Government | Secured $50M+ fiber-to-the-home deal with a Tier 1 North American operator in 2024. |

| Value-Added Resellers (VARs) & System Integrators | Smaller Service Providers, Regional Enterprises | Increased deal registrations from EMEA VARs in 2023; crucial for diverse customer base reach. |

| Distributors | Partners and End-Users Globally | Facilitated supply chain for critical infrastructure projects in 2024, expanding fiber access. |

| Digital Channels (Website, Social Media, Investor Relations) | Broad Audience, Investors, Potential Customers/Partners | Q1 2024 revenue of $276.4M; used for lead generation and transparent financial communication. |

| Industry Events & Trade Shows | Industry Leaders, Potential Buyers, Partners | Showcased fiber technologies at Fiber Connect in 2024; scheduled for August/September 2025 events. |

Customer Segments

Tier 1 and Tier 2 telecommunications service providers form a core customer segment for ADTRAN. These are the major national and regional players that need dependable, scalable, and high-performance networking solutions to deliver essential services like broadband, voice, and video to their subscribers.

These large-scale operators rely on ADTRAN's technology to build and maintain their critical infrastructure. For instance, in the first quarter of 2025, significant customers like CenturyLink, Inc. and Deutsche Telekom, AG each represented more than 10% of ADTRAN's total revenue, highlighting their substantial business relationship and reliance on ADTRAN's offerings.

Regional and rural ISPs are a key customer segment for ADTRAN, comprising smaller, often independent companies focused on specific geographic areas, particularly those underserved by larger providers. These businesses require solutions that are both cost-effective and dependable to offer broadband services to their communities.

ADTRAN's success in this segment is evident, with the company adding 12 new Fiber-to-the-Prem customers in the second quarter of 2024. A significant portion of these new clients were U.S. regional service providers, highlighting ADTRAN's ability to meet the unique needs of these geographically focused operators.

Large enterprises and corporations represent a core customer segment for ADTRAN, seeking robust networking solutions to manage complex internal operations, data centers, and campus connectivity. These businesses, often distributed across multiple locations, rely on ADTRAN for reliable and high-performance infrastructure.

ADTRAN specifically targets distributed enterprises, including Fortune 500 companies, that require sophisticated business continuity applications. For instance, in 2023, ADTRAN reported that its network solutions supported critical infrastructure for numerous large organizations, enabling seamless data flow and resilient operations, which is crucial for companies with extensive global footprints.

Government and Public Sector Organizations

Government and public sector organizations, including federal, state, and local entities, along with educational institutions, represent a key customer segment for ADTRAN. These organizations require robust, secure, and high-capacity network infrastructure to support critical operations and deliver essential public services. ADTRAN's solutions are deployed globally to meet these demanding needs.

The demand for advanced networking within the public sector is driven by several factors. For instance, the US federal government's ongoing initiatives, such as the Broadband Equity, Access, and Deployment (BEAD) program, allocated $42.45 billion in 2024 to expand broadband access, much of which will necessitate new or upgraded network infrastructure. Similarly, state and local governments are investing heavily in smart city technologies and public safety networks, further increasing the need for ADTRAN's capabilities.

- Federal Agencies: Requiring secure, scalable networks for defense, intelligence, and civilian operations.

- State and Local Governments: Deploying broadband for economic development, smart city initiatives, and public safety communications.

- Educational Institutions: Needing high-performance networks to support remote learning, research, and digital infrastructure for students and staff.

- Public Sector Infrastructure Projects: ADTRAN's technology is vital for projects aimed at bridging the digital divide and enhancing citizen connectivity.

Utility Companies

Utility companies are increasingly investing in robust private communication networks. This is driven by the need for reliable connectivity for smart grid initiatives, ensuring efficient energy distribution and management. In 2024, a significant portion of utility capital expenditure is allocated to these network upgrades.

These networks are crucial for operational technology (OT) systems, enabling real-time data exchange for monitoring and control. Furthermore, utilities are exploring opportunities to offer broadband services, particularly in rural or underserved regions, creating new revenue streams.

- Smart Grid Deployment: Utilities are building out private networks to support advanced metering infrastructure (AMI) and grid automation, with global investment in smart grids projected to reach hundreds of billions by 2025.

- OT Connectivity: Enhancing the reliability and security of operational technology through dedicated private networks is a key driver for utility infrastructure projects.

- Broadband Expansion: Utilities are leveraging their infrastructure to bridge the digital divide, with some municipal utilities reporting significant uptake in their broadband offerings in 2024.

ADTRAN serves a diverse set of customers, from major telecommunications giants to smaller regional providers. Their solutions are critical for building and maintaining the backbone of modern communication networks, enabling everything from high-speed internet to essential public services. The company's ability to cater to both large-scale infrastructure needs and more localized broadband expansion projects underscores its broad market reach.

The company's customer base includes large enterprises and government entities, all requiring robust and secure networking. For instance, in 2023, ADTRAN's solutions supported critical infrastructure for numerous Fortune 500 companies, facilitating seamless data flow. The public sector, with initiatives like the 2024 BEAD program allocating $42.45 billion for broadband expansion, represents a significant growth area.

Utility companies also form a key segment, investing heavily in private networks for smart grid initiatives and operational technology. This trend is expected to continue, with global smart grid investment projected to reach hundreds of billions by 2025. These utilities are increasingly looking to leverage their infrastructure to offer broadband services, further expanding ADTRAN's market opportunities.

Cost Structure

ADTRAN's commitment to innovation is reflected in its significant investment in research and development. These expenses are crucial for staying ahead in the fast-paced networking technology sector. In the second quarter of 2025, ADTRAN reported research and development expenses amounting to $51.9 million.

ADTRAN's Cost of Goods Sold (COGS) encompasses all expenses directly tied to creating their networking hardware. This includes the cost of raw materials like semiconductors and circuit boards, the labor involved in assembly, and manufacturing overhead such as factory utilities and depreciation.

For instance, in the second quarter of 2025, ADTRAN's gross margin experienced fluctuations. These shifts were notably influenced by the specific mix of products sold and the associated transportation costs, both of which directly impact the overall COGS calculation.

Sales, General, and Administrative (SG&A) expenses are crucial for ADTRAN's business model, encompassing the costs of reaching customers, managing operations, and supporting the overall company. These include expenditures on sales teams, marketing campaigns, customer support, and the essential functions of running the business like human resources and finance.

For ADTRAN, these costs remained steady in the second quarter of 2025 compared to the same period in the previous year. This stability suggests effective cost management within these key operational areas, allowing the company to maintain its sales and administrative infrastructure without significant increases.

Supply Chain and Logistics Costs

ADTRAN's supply chain and logistics costs encompass significant expenditures in managing its global operations. These costs include the procurement of components, maintaining inventory levels, operating warehouses, and the intricate process of shipping products to customers across the globe. The company's extensive international network necessitates robust management to ensure efficiency and cost-effectiveness.

For instance, in 2023, ADTRAN reported total cost of sales of $370.7 million. While specific breakdowns for supply chain and logistics within this figure aren't detailed publicly, it represents the overall investment in bringing their products to market. The complexity of a globally diverse supply chain inherently leads to substantial logistical outlays.

- Procurement: Costs associated with sourcing raw materials and components from various global suppliers.

- Inventory Management: Expenses related to holding and managing stock across different locations to meet demand.

- Warehousing: Costs for storing products in distribution centers worldwide.

- Shipping: Expenditures for transporting finished goods to customers globally, including freight and customs.

Customer Support and Professional Services Costs

ADTRAN incurs significant costs in its Customer Support and Professional Services segment. These expenses cover essential functions like technical assistance, specialized consulting, customer training programs, and continuous maintenance of their networking solutions.

These operational expenditures are crucial for maintaining customer satisfaction and ensuring the effective deployment and utilization of ADTRAN's products. In 2023, ADTRAN reported its Services & Support segment as a key contributor to its overall financial performance, demonstrating the importance of these customer-facing cost centers.

- Technical Support: Costs associated with help desks, troubleshooting, and issue resolution.

- Professional Services: Expenses for implementation, integration, and customization projects.

- Training and Education: Investments in customer enablement and skill development.

- Ongoing Maintenance: Costs for software updates, hardware maintenance, and service level agreements.

ADTRAN's cost structure is multifaceted, encompassing significant investments in innovation, product delivery, and customer engagement. Key cost drivers include research and development, the cost of goods sold for hardware, and sales, general, and administrative expenses necessary for market reach and operations. Additionally, substantial outlays are directed towards supply chain management and customer support services.

These costs are vital for ADTRAN's ability to deliver advanced networking solutions and maintain customer satisfaction. For instance, R&D expenses were $51.9 million in Q2 2025, while total cost of sales in 2023 was $370.7 million, highlighting the significant capital deployed in product development and delivery.

| Cost Category | 2023 Actual (USD Million) | Q2 2025 (USD Million) | Key Components |

|---|---|---|---|

| Research & Development | Not specified | 51.9 | Innovation, new product development |

| Cost of Goods Sold (COGS) | 370.7 | Not specified | Raw materials, manufacturing, logistics |

| Sales, General & Administrative (SG&A) | Not specified | Steady | Sales teams, marketing, operations support |

| Supply Chain & Logistics | Included in COGS | Significant | Procurement, inventory, warehousing, shipping |

| Customer Support & Services | Key contributor | Not specified | Technical support, professional services, training |

Revenue Streams

ADTRAN's primary revenue stream comes from selling networking hardware. This includes essential equipment like fiber access platforms, optical network terminals, Wi-Fi access points, and routing gear that businesses and service providers need to build and maintain their networks.

In the second quarter of 2025, ADTRAN's Network Solutions segment, which is largely driven by these hardware sales, brought in $219.5 million. This figure represented a significant 83% of their total revenue, clearly showing how crucial hardware sales are to the company's financial performance.

ADTRAN generates significant revenue from software licenses and subscriptions. This includes fees for their network operating software, management platforms, and ongoing subscriptions for advanced features and intelligent network services. A prime example is their Mosaic software platform, which has been adopted by more than 400 customers, highlighting its importance as a recurring revenue source.

ADTRAN generates revenue through professional services, offering specialized expertise to clients. These services encompass critical areas like network planning, design, deployment, integration, and ongoing optimization of customer networks.

The company's commitment to these services is reflected in its financial performance. For instance, the Services & Support segment, which directly includes network design and implementation, brought in $45.6 million in the second quarter of 2025.

Maintenance and Support Contracts

Maintenance and Support Contracts are a cornerstone of ADTRAN's recurring revenue strategy, providing consistent income through service agreements. These contracts ensure customers receive ongoing technical assistance, crucial software updates, and necessary hardware repairs for their ADTRAN network solutions. This segment is a vital component of ADTRAN's broader Services & Support offering.

These service contracts generate predictable revenue streams, bolstering ADTRAN's financial stability. For instance, in the first quarter of 2024, ADTRAN reported that its Services segment, which includes these contracts, contributed significantly to the company's overall performance, demonstrating the value of this recurring income model.

- Recurring Revenue: Provides a stable and predictable income source for ADTRAN.

- Customer Retention: Enhances customer loyalty by ensuring ongoing operational efficiency and support.

- Service Offerings: Includes technical support, software updates, and hardware maintenance.

- Financial Stability: Contributes to the company's overall financial health through consistent income generation.

Managed Services

ADTRAN's managed services offer a significant revenue stream by taking on the operational burden of customer network infrastructure. This allows clients to focus on their core business while ADTRAN ensures network performance and reliability.

The company's strategic push into edge computing and cloud-integrated solutions directly fuels this segment. As networks become more complex, the demand for expert management of these distributed environments grows. For instance, ADTRAN's solutions are designed to simplify the deployment and ongoing management of 5G and fiber networks, which are inherently complex.

- Recurring Revenue: Managed services typically generate predictable, recurring revenue, enhancing financial stability.

- Customer Stickiness: By integrating deeply into network operations, ADTRAN fosters strong customer relationships and reduces churn.

- Value-Added Services: This segment allows ADTRAN to offer higher-margin services beyond hardware sales, such as proactive monitoring, security management, and performance optimization.

- Market Growth: The global managed network services market is projected to grow substantially, with ADTRAN well-positioned to capture a share of this expanding opportunity.

ADTRAN's revenue streams are multifaceted, encompassing hardware sales, software licenses and subscriptions, professional services, and managed services. These diverse income sources contribute to the company's financial resilience and growth, catering to a broad range of customer needs in the telecommunications and networking sectors.

| Revenue Stream | Description | Q2 2025 Contribution (Millions USD) | Key Drivers |

|---|---|---|---|

| Hardware Sales | Sale of networking equipment like fiber access platforms and Wi-Fi access points. | $219.5 (83% of total revenue) | Demand for network infrastructure upgrades and expansion. |

| Software Licenses & Subscriptions | Fees for network operating software, management platforms, and advanced features. | N/A (Integrated within segments) | Adoption of platforms like Mosaic (over 400 customers). |

| Professional Services | Network planning, design, deployment, and optimization. | $45.6 (part of Services & Support segment) | Complexity of network deployments and need for specialized expertise. |

| Maintenance & Support Contracts | Ongoing technical assistance, software updates, and hardware repairs. | N/A (Integrated within segments) | Ensuring network uptime and customer satisfaction. |

| Managed Services | Operational management of customer network infrastructure. | N/A (Integrated within segments) | Growing demand for outsourced network management and edge computing solutions. |

Business Model Canvas Data Sources

The ADTRAN Business Model Canvas is informed by a blend of internal financial reports, customer feedback, and competitive landscape analysis. These sources provide a comprehensive view of our operational strengths and market positioning.