ADTRAN Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

Uncover the strategic positioning of ADTRAN's product portfolio with our comprehensive BCG Matrix analysis. See which offerings are driving growth and which require a closer look to optimize resource allocation.

This preview offers a glimpse into ADTRAN's market dynamics. Purchase the full BCG Matrix report to gain actionable insights, detailed quadrant placements, and a clear roadmap for future investment and product development.

Stars

ADTRAN's XGS-PON and 10G fiber access solutions are a key growth engine, fueled by the robust expansion of broadband networks worldwide. These cutting-edge platforms allow service providers to deliver lightning-fast internet, essential for meeting escalating bandwidth needs.

The company's strategic emphasis on these high-speed fiber technologies places it advantageously within a market experiencing substantial growth. For instance, the global fiber-to-the-home (FTTH) market was projected to reach over $120 billion by 2024, underscoring the significant opportunity for ADTRAN's offerings.

ADTRAN is making a significant push into the Wi-Fi 7 market with its SDG 9000 Series. This new line of products is aimed at a broad customer base, including homes, small businesses, and apartment complexes.

These Wi-Fi 7 solutions are engineered to deliver robust and secure internet access, capitalizing on the latest advancements in wireless technology. By introducing these early, ADTRAN is positioning itself to benefit from the anticipated surge in Wi-Fi 7 adoption.

The global Wi-Fi market is projected for substantial growth, with Wi-Fi 7 expected to be a key driver. For instance, analysts anticipate the Wi-Fi market to reach over $100 billion by 2027, with Wi-Fi 7 adoption expected to ramp up significantly from 2024 onwards, creating a lucrative opportunity for early entrants like ADTRAN.

ADTRAN's Mosaic One platform is a cloud-based, AI-driven solution designed for optimizing network and service operations. It offers service providers unified visibility and automated management, leading to simplified operations and improved subscriber experiences. This offering is strategically placed within the rapidly expanding network automation and intelligent operations sector, a market where ADTRAN continues to allocate significant investment to bolster its capabilities.

Open and Disaggregated Networking Platforms

ADTRAN's strategic shift towards open and disaggregated networking platforms directly addresses the industry's growing demand for solutions that move away from single-vendor proprietary systems. This strategy is designed to offer greater flexibility and cost savings for service providers, a key market for ADTRAN.

The company's investment in these open architectures positions them to capitalize on the increasing adoption of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV). These technologies are crucial for building more agile and adaptable network infrastructures, which are essential for meeting future demands.

While this market segment is still developing, ADTRAN's commitment to open standards and its growing portfolio of disaggregated solutions indicate strong potential.

- Market Trend Alignment: ADTRAN's focus on open and disaggregated networking aligns with the global industry shift away from proprietary, closed systems.

- Cost-Effectiveness and Future-Proofing: This approach enables service providers to build more economical and adaptable network infrastructures, capable of evolving with technological advancements.

- Growth Potential: The increasing adoption of flexible, software-driven network solutions suggests a high growth trajectory for companies like ADTRAN that are investing in this space.

- Strategic Pivot: This move represents a significant strategic pivot for ADTRAN, aiming to capture market share in the rapidly evolving telecommunications infrastructure landscape.

50G PON Technology for Next-Gen Broadband

ADTRAN is at the forefront of 50G PON technology development, a significant leap beyond current XGS-PON standards for broadband. This innovation promises substantially higher capacities, crucial for meeting escalating data demands in the coming years. Major global operators are already showing support for this next-generation technology, signaling strong market acceptance and future growth.

ADTRAN's proactive engagement in 50G PON positions it as a potential leader in a segment that, while currently small in market share, represents a high-growth opportunity. The company's commitment to this advanced technology underscores its strategy to drive the evolution of broadband infrastructure.

- 50G PON Development: ADTRAN is actively developing and demonstrating 50G PON, targeting mass-market broadband evolution beyond XGS-PON.

- Operator Backing: Major global operators are supporting 50G PON, indicating significant future growth potential and market adoption.

- Market Position: ADTRAN's pioneering work aims to establish leadership in this high-growth, currently low market share segment.

ADTRAN's advancements in 50G PON technology position it as a leader in the next wave of broadband infrastructure. This technology offers a substantial increase in capacity over current XGS-PON solutions, addressing the ever-growing demand for faster internet speeds. With significant backing from major global operators, 50G PON represents a high-growth opportunity, even though its market share is currently minimal.

ADTRAN's focus on Wi-Fi 7, particularly with its SDG 9000 Series, targets a broad customer base and leverages the latest wireless advancements. This strategic move anticipates a significant surge in Wi-Fi 7 adoption, with the global Wi-Fi market projected to exceed $100 billion by 2027. Early entry into this market segment is crucial for capturing market share.

The company's commitment to open and disaggregated networking platforms aligns with the industry's move away from proprietary systems, offering greater flexibility and cost savings. This strategy positions ADTRAN to benefit from the increasing adoption of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), crucial for agile network infrastructures.

ADTRAN's Mosaic One platform, an AI-driven cloud solution, optimizes network and service operations for providers by offering unified visibility and automated management. This targets the expanding network automation sector, where ADTRAN continues to invest to enhance its capabilities.

| Product Category | Key Technology | Market Opportunity | ADTRAN's Position |

|---|---|---|---|

| Fiber Access | XGS-PON, 50G PON | Global broadband expansion, increasing bandwidth needs | Leading provider of high-speed fiber solutions, pioneering 50G PON |

| Wireless Networking | Wi-Fi 7 | Growing demand for faster, more robust wireless connectivity | Early entrant with SDG 9000 Series, targeting broad customer adoption |

| Network Management | Mosaic One (AI-driven, cloud-based) | Network automation and intelligent operations | Optimizing operations for service providers, simplifying management |

| Network Architecture | Open & Disaggregated Platforms | Shift from proprietary systems to flexible, cost-effective solutions | Strategic pivot to capitalize on SDN/NFV adoption |

What is included in the product

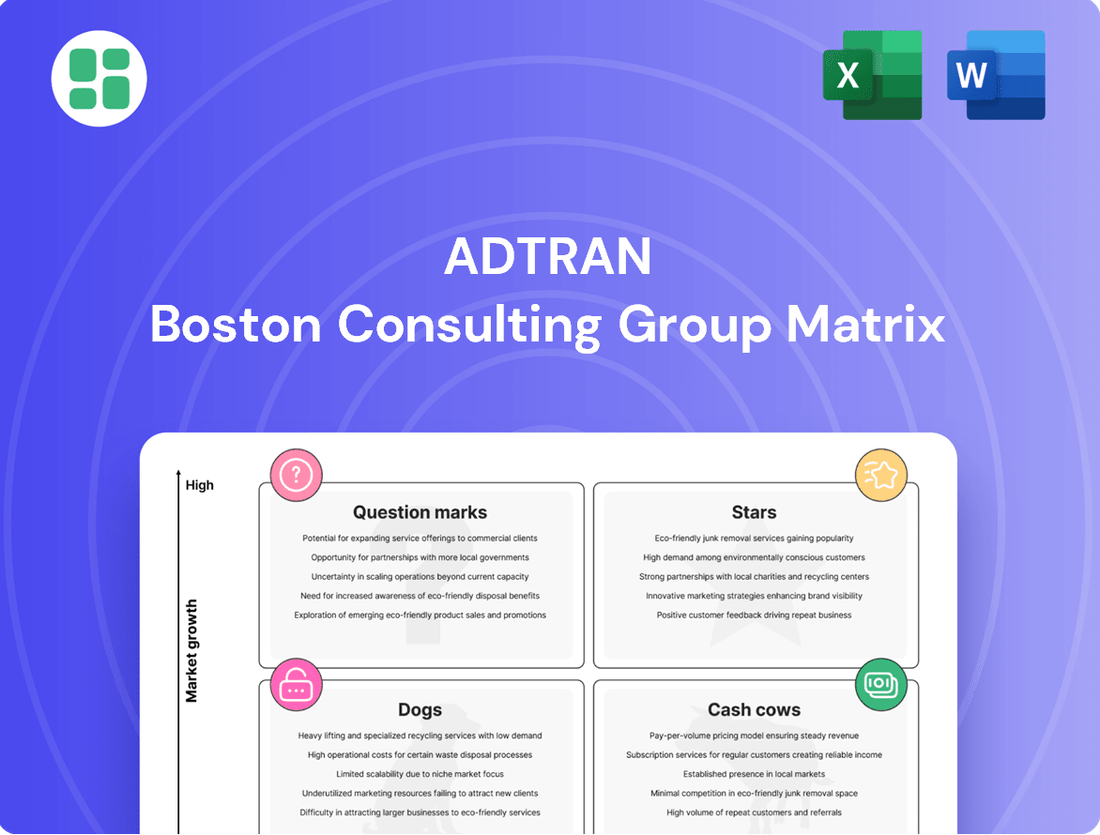

The ADTRAN BCG Matrix analyzes its product portfolio by market share and growth rate.

It guides investment decisions by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG matrix visualizes ADTRAN's portfolio, easing strategic decision-making and resource allocation.

Cash Cows

ADTRAN's established GPON fiber access platforms are indeed classic cash cows. These solutions have been a bedrock of fiber deployment for years, consistently generating revenue. The widespread adoption of GPON for Fiber-to-the-Home (FTTH) and smart city initiatives globally ensures a steady demand. For instance, in 2024, the global GPON equipment market was valued at approximately $10 billion, with ADTRAN holding a significant share due to its long-standing presence and reliability.

ADTRAN's mature Carrier Ethernet and Fixed Wireless Access (FWA) solutions likely represent its cash cows. These offerings, serving established market segments, are expected to maintain a strong market share, providing consistent operational cash flow despite not seeing rapid growth.

In 2023, ADTRAN reported total revenue of $1.4 billion, with its Network Solutions segment, which includes these mature offerings, contributing significantly. While specific segment breakdowns for cash cow performance aren't always detailed, the stability of enterprise and service provider connectivity demands underpins the reliable revenue stream from these products.

ADTRAN's comprehensive professional services, encompassing network implementation, solution integration, and ongoing maintenance, act as a stable cash cow. These services, vital for complex network infrastructures, generate recurring revenue through long-term contracts and leverage ADTRAN's deep expertise and existing customer relationships.

Broad Portfolio of Older FTTx Access Equipment

ADTRAN's extensive portfolio of older FTTx access equipment functions as a classic Cash Cow within the BCG Matrix. While these products are not driving new market growth, they are deeply integrated into existing networks globally, providing a reliable stream of income. This installed base benefits from ongoing demand for upgrades, expansions, and essential maintenance services.

The continued revenue generation from these mature FTTx products stems from their embedded nature in critical infrastructure. ADTRAN effectively capitalizes on this by offering ongoing support, software licenses, and replacement parts, ensuring consistent cash flow without significant reinvestment in R&D for these specific product lines. For example, ADTRAN reported that its Access and Aggregation segment, which includes many of these FTTx solutions, generated $317.7 million in revenue for the first quarter of 2024, demonstrating the ongoing financial contribution of its established technologies.

- Mature Market Dominance: ADTRAN's older FTTx equipment is a staple in numerous telecommunications networks, ensuring a consistent demand for its services and parts.

- Stable Revenue Generation: These products generate predictable cash flow through maintenance contracts, software renewals, and incremental upgrades rather than relying on high-volume new sales.

- Low Investment Requirement: As mature technologies, these Cash Cows require minimal R&D investment, allowing ADTRAN to allocate resources to its growth-oriented Stars and Question Marks.

- Continued Support and Parts: The ongoing need for spare parts, technical support, and licensing for these embedded systems creates a steady, reliable revenue stream for the company.

Legacy DSL/ADSL Network Infrastructure Upgrades

While the broader market for DSL/ADSL is shrinking, ADTRAN can still extract value from its existing customer base needing upgrades or maintenance for their copper-based networks. These are typically low-growth, but stable, revenue sources from a loyal customer segment.

The strategy here is to milk these mature assets for all they're worth with very little additional investment. For example, in 2024, ADTRAN continued to support its installed base, focusing on service assurance and incremental upgrades rather than significant new deployments. This approach aims to maximize profitability from existing infrastructure.

- Focus on Maintenance and Incremental Upgrades: ADTRAN's legacy DSL/ADSL infrastructure represents a mature business segment.

- Captive Customer Base: Existing customers often require ongoing support and minor enhancements for their deployed copper networks.

- Diminishing but Stable Revenue: While growth is minimal, these segments can provide consistent, predictable revenue streams.

- Maximizing Returns on Mature Assets: The goal is to generate cash flow with limited new capital expenditure.

ADTRAN's established GPON fiber access platforms are classic cash cows, consistently generating revenue from widespread adoption in FTTH and smart city initiatives. The global GPON equipment market was valued at approximately $10 billion in 2024, with ADTRAN holding a significant share due to its reliability.

Mature Carrier Ethernet and Fixed Wireless Access (FWA) solutions also represent cash cows, maintaining strong market share and providing consistent cash flow despite slower growth. ADTRAN's Network Solutions segment, including these mature offerings, contributed significantly to its $1.4 billion total revenue in 2023.

ADTRAN's comprehensive professional services, covering network implementation and maintenance, act as stable cash cows. These services generate recurring revenue through long-term contracts, leveraging ADTRAN's expertise and existing customer relationships.

Legacy FTTx access equipment, while not driving new growth, provides a reliable income stream through ongoing support, software licenses, and replacement parts. The Access and Aggregation segment, including these solutions, generated $317.7 million in Q1 2024.

ADTRAN's strategy for these mature assets, including legacy DSL/ADSL infrastructure, focuses on maximizing returns with minimal investment, prioritizing service assurance and incremental upgrades over new deployments.

| Product Category | BCG Matrix Classification | Key Characteristics | 2024 Market Relevance | ADTRAN's Position |

| GPON Fiber Access Platforms | Cash Cow | Established, high demand, reliable revenue | ~$10 billion global market | Significant market share |

| Carrier Ethernet & FWA | Cash Cow | Mature segments, stable cash flow, strong market share | Consistent service provider demand | Established presence |

| FTTx Access Equipment (Legacy) | Cash Cow | Embedded in networks, ongoing support needs | Continued demand for upgrades/maintenance | Strong installed base |

| DSL/ADSL Infrastructure | Cash Cow | Low growth, stable revenue from existing base | Ongoing maintenance and upgrade needs | Loyal customer segment |

Preview = Final Product

ADTRAN BCG Matrix

The ADTRAN BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no missing sections—just the complete, analysis-ready strategic report. You can be confident that the professional layout and comprehensive data presented here are precisely what you'll be working with for your business planning. This ensures a seamless transition from preview to practical application, empowering you with the insights needed for strategic decision-making.

Dogs

End-of-life (EoL) copper-based DSL/ADSL products are positioned as Dogs within the ADTRAN BCG Matrix. These are offerings primarily designed for older DSL and ADSL connections.

The broadband market has decisively moved towards fiber optics, leaving copper-based solutions with shrinking relevance. This shift means very few new copper DSL/ADSL deployments are happening, and existing market share is steadily decreasing.

These legacy products contribute minimal revenue for ADTRAN. However, they still demand a significant amount of support resources when compared to their financial contribution. This makes them prime candidates for either being phased out or divested entirely.

While G.fast initially served as a valuable interim solution for leveraging existing copper infrastructure, older or less optimized G.fast offerings are now encountering diminished demand. This decline is largely driven by the increasing adoption of XGS-PON and other advanced fiber optic technologies that provide superior performance and future-proofing.

These legacy G.fast solutions are situated in a contracting market, presenting ADTRAN with restricted growth opportunities. Continued investment in these areas could potentially divert valuable resources from more promising, high-growth technologies, yielding suboptimal returns.

ADTRAN's legacy hardware, particularly highly specialized or niche offerings, falls into the Dogs category. These products, often from older generations of networking equipment, do not align with the company's current strategic emphasis on next-generation technologies like fiber optics, Wi-Fi 7, and intelligent software solutions. Their contribution to ADTRAN's overall revenue is minimal, likely representing a small fraction of the total, and they operate in segments experiencing stagnation or decline.

Underperforming Optical Transport Solutions

ADTRAN's optical transport solutions, particularly older generations of equipment, may be facing challenges. These solutions, while once competitive, could be losing ground to newer, more advanced technologies offered by rivals. This situation often arises in segments where technological evolution is rapid.

These underperforming solutions might be characterized by a declining market share within a mature, yet highly competitive, sub-segment of the optical transport market. Companies like ADTRAN must carefully assess whether continued investment in these specific product lines is strategically sound, considering the potential for obsolescence and the need to allocate resources to more promising areas.

- Market Share Erosion: Older optical transport solutions might see their market share shrink as competitors introduce more cost-effective or feature-rich alternatives.

- Technological Obsolescence: Products that haven't kept pace with advancements in speed, efficiency, or network management capabilities can quickly become less desirable.

- Increased Competition: The optical networking market is dynamic, with numerous players vying for dominance, putting pressure on less innovative offerings.

- Strategic Re-evaluation: Companies must decide whether to invest in upgrading these older solutions, phase them out, or focus R&D on next-generation products.

First-Generation PON Equipment

First-generation PON equipment from ADTRAN, representing the company's initial forays into passive optical network technology, can be categorized within the Dogs quadrant of the BCG Matrix. These early products, while historically significant, now face considerable challenges due to technological obsolescence.

The market for these older systems is characterized by a very low growth rate. As customers increasingly adopt newer, more advanced PON technologies like GPON, XGS-PON, and the emerging 50G PON, the demand for first-generation equipment naturally diminishes. This migration trend directly contributes to a declining market share for these legacy products, making them less attractive from an investment and strategic perspective.

- Low Growth Rate: The market for first-generation PON equipment is experiencing minimal expansion, with projections indicating a continued downward trend.

- Declining Market Share: Customer adoption of newer PON standards, such as XGS-PON and 50G PON, is directly eroding the market share of ADTRAN's early PON offerings.

- Limited Upgrade Paths: These legacy systems often offer minimal or no viable upgrade paths to current or future PON technologies, restricting their long-term utility.

- Minimal Sales Opportunities: With the shift towards advanced solutions, the potential for new sales of first-generation PON equipment is significantly limited.

ADTRAN's legacy copper-based DSL/ADSL and older G.fast offerings are firmly positioned as Dogs in the BCG Matrix. These products serve a shrinking market as the industry rapidly transitions to fiber optics, leading to declining relevance and minimal revenue generation.

These legacy solutions, including first-generation PON equipment, demand disproportionate support resources relative to their financial contribution, making them candidates for divestment or phase-out. The strategic focus is shifting towards next-generation technologies like fiber optics and Wi-Fi 7.

ADTRAN's older optical transport solutions also fall into the Dog category due to technological obsolescence and increased competition, facing market share erosion and limited upgrade paths.

In 2024, the demand for copper-based broadband solutions continued its sharp decline, with fiber deployments accelerating globally. For instance, FTTH penetration in North America was projected to surpass 60% by the end of 2024, further marginalizing DSL technologies.

| Product Category | BCG Quadrant | Market Trend | ADTRAN Strategy |

|---|---|---|---|

| Legacy DSL/ADSL | Dogs | Declining | Phase-out/Divest |

| Older G.fast | Dogs | Declining | Reduce investment/Phase-out |

| First-Gen PON | Dogs | Declining | Focus on newer PON tech |

| Legacy Optical Transport | Dogs | Mature/Declining | Strategic re-evaluation |

Question Marks

ADTRAN is a key player in the emerging 50G PON space, actively demonstrating and advocating for its adoption as the future standard in broadband connectivity. This technology promises significantly higher speeds and capacity compared to current PON standards.

Although the market for 50G PON is projected for substantial growth, ADTRAN's current market share is relatively small. This reflects the early stage of widespread deployment, with many operators still in the planning or initial trial phases.

Significant investment is crucial for ADTRAN to capitalize on the potential of 50G PON. Securing early customer commitments and establishing a strong foothold in the initial deployments will be key to transforming this into a market-leading product.

ADTRAN's Mosaic One platform boasts advanced AI/ML-driven network automation and predictive analytics features, signaling high growth potential within the telecommunications infrastructure market. These sophisticated capabilities, while innovative, are relatively new, necessitating substantial customer education and a longer adoption cycle. Consequently, ADTRAN's current market share for these specific, cutting-edge functionalities remains modest.

ADTRAN is likely positioning its specialized IoT connectivity solutions as potential Stars in the BCG matrix. These offerings leverage ADTRAN's core networking strengths to address specific, high-growth segments within the burgeoning Internet of Things market. While current market share in these niches might be modest, the rapid expansion of IoT, projected to reach $1.3 trillion by 2026 according to Statista, presents significant upside potential.

Early-Stage Open Radio Access Network (OpenRAN) Initiatives

ADTRAN's early-stage Open Radio Access Network (OpenRAN) initiatives position them within a rapidly expanding segment of the telecommunications infrastructure market. This focus on open and disaggregated network components is crucial for future network flexibility and cost-efficiency.

If ADTRAN is investing in or developing OpenRAN solutions, they would likely be categorized as a Question Mark in the BCG Matrix. This segment is characterized by high potential growth but also significant uncertainty regarding market adoption and competitive landscape.

- High Growth Potential: The OpenRAN market is projected to grow significantly, with some forecasts indicating it could reach tens of billions of dollars by the late 2020s, driven by operator demand for vendor diversity and innovation.

- Significant R&D Investment: Developing OpenRAN solutions requires substantial research and development expenditure to create interoperable hardware and software components, impacting near-term profitability.

- Strategic Importance: Early investment in OpenRAN is a strategic move to capture future market share in a transformative technology that could reshape the telecom vendor ecosystem.

New Regional Market Expansions with Limited Initial Presence

When ADTRAN enters new regions or targets customer segments with a minimal existing footprint, these ventures can be categorized as Question Marks in the BCG Matrix. These markets often represent untapped growth opportunities, but they require substantial investment in sales infrastructure, marketing campaigns, and product localization to establish a solid market position.

For example, ADTRAN's expansion into emerging markets in Southeast Asia in 2024, where its presence was previously limited, exemplifies this strategy. The company allocated significant capital towards building local partnerships and tailoring its network solutions to meet regional demands. This strategic push aims to convert these nascent markets into future Stars by capturing market share.

Key considerations for these Question Mark markets include:

- Market Potential Assessment: Thorough analysis of the growth trajectory and competitive landscape within the new region or segment.

- Investment Strategy: Determining the necessary capital allocation for sales, marketing, R&D, and operational setup.

- Localization Efforts: Adapting products, services, and support to meet local regulations, languages, and customer preferences.

- Risk Mitigation: Identifying and planning for potential challenges such as regulatory hurdles, economic instability, or intense local competition.

ADTRAN's ventures into emerging technologies like OpenRAN and its expansion into new geographical markets with limited prior presence are prime examples of Question Marks in the BCG matrix. These areas offer substantial growth potential, but also carry inherent risks and require significant investment to establish a strong market position and convert them into future revenue drivers.

The OpenRAN market, for instance, is expected to see robust growth, with projections suggesting it could reach tens of billions of dollars by the late 2020s. ADTRAN's strategic investments in this space, though demanding considerable R&D, are aimed at capturing a significant share of this evolving landscape. Similarly, their 2024 push into regions like Southeast Asia, where their footprint was minimal, highlights the strategy of investing in new markets with high growth potential but requiring localized efforts and infrastructure development.

These Question Mark initiatives necessitate careful market potential assessment, strategic investment planning, and dedicated localization efforts to navigate regulatory, economic, and competitive challenges effectively.

| BCG Category | ADTRAN Example | Market Growth | Market Share | Strategic Focus |

| Question Mark | OpenRAN Solutions | High | Low | R&D Investment, Market Penetration |

| Question Mark | Southeast Asia Expansion (2024) | High (Projected) | Low | Sales Infrastructure, Localization |

BCG Matrix Data Sources

Our ADTRAN BCG Matrix leverages comprehensive data from ADTRAN's financial reports, industry growth forecasts, and competitive market analysis to provide strategic insights.