ADTRAN Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

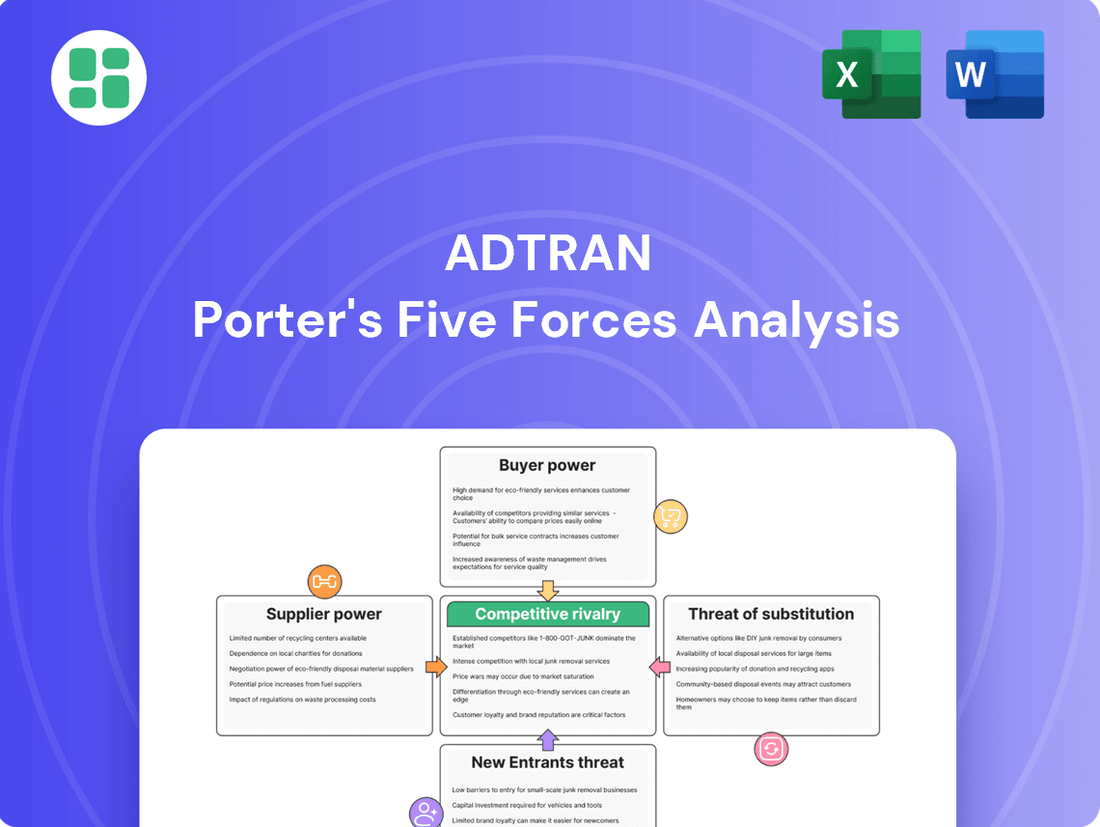

ADTRAN operates within a dynamic telecommunications infrastructure market, where understanding the competitive landscape is crucial. Our Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

The complete report reveals the real forces shaping ADTRAN’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ADTRAN's reliance on a select group of manufacturers for crucial components, such as semiconductors and optical modules, significantly influences its bargaining power. This dependency becomes particularly pronounced when these components are proprietary or involve extended production timelines, granting suppliers considerable leverage.

For instance, the semiconductor industry, a key area for ADTRAN, has experienced supply chain disruptions and price volatility. In 2023, the global semiconductor market saw a slight contraction, but demand for advanced chips remained robust, potentially increasing the cost of these essential inputs for ADTRAN.

For ADTRAN, the bargaining power of suppliers is significantly influenced by high switching costs associated with specialized parts. When a company relies on custom-designed or highly specific components for its network equipment, changing suppliers isn't as simple as picking a different vendor off the shelf. This reliance means that suppliers of these critical parts hold considerable leverage, potentially impacting pricing and contract terms due to the significant investment and time required for ADTRAN to find and integrate an alternative source.

In specialized technology sectors vital to ADTRAN's product offerings, such as advanced optical transceivers or specific semiconductor components, a limited number of suppliers often dominate. This concentration means these suppliers have significant leverage, as ADTRAN may have few viable alternatives if they decide to increase prices or alter terms. For instance, the global market for certain high-speed optical components, critical for 5G and fiber deployments, is characterized by a handful of key manufacturers, giving them considerable pricing power.

Impact of global supply chain disruptions

Recent global supply chain disruptions, particularly those experienced in 2022 and 2023, have significantly amplified the bargaining power of suppliers for essential networking hardware. Companies like ADTRAN face increased pressure as the availability of critical components dictates production schedules and market responsiveness. For instance, the semiconductor shortage, which persisted through much of 2023, forced many technology firms to pay premiums or face extended lead times for vital chips, directly impacting their ability to fulfill orders.

ADTRAN's reliance on a consistent supply of specialized networking components means that suppliers who can guarantee stable production and timely delivery gain considerable leverage. This dynamic was evident when certain component manufacturers, facing high demand and limited capacity in 2024, were able to negotiate more favorable terms. The ability to secure these components is crucial for ADTRAN to maintain its production output and meet customer delivery commitments in a competitive market.

- Increased Supplier Leverage: Global events have shifted power towards suppliers capable of consistent production and delivery of networking hardware.

- Impact on ADTRAN's Operations: ADTRAN's production capacity and market delivery timelines are directly tied to its ability to secure essential components.

- Component Scarcity: The ongoing demand for semiconductors and other specialized parts in 2023 and early 2024 has given suppliers greater pricing and negotiation power.

- Strategic Sourcing Importance: ADTRAN's success hinges on its strategic sourcing capabilities to mitigate supply chain risks and ensure component availability.

Proprietary technology held by suppliers

Proprietary technology held by suppliers significantly impacts ADTRAN's bargaining power. When suppliers possess critical, exclusive intellectual property, such as in advanced silicon or optical transceiver technologies, ADTRAN's ability to negotiate favorable terms is diminished. This exclusivity can force ADTRAN to accept higher component costs or less advantageous supply agreements, as alternative suppliers may not offer comparable technology.

For instance, in the telecommunications equipment sector, specialized chipsets or advanced optical components often involve patented designs or manufacturing processes. Suppliers holding these patents can dictate terms, as ADTRAN may have limited recourse without these essential technologies. This reliance on a few key technology holders can translate into increased operational expenses for ADTRAN.

- Limited Supplier Alternatives: Proprietary technology restricts ADTRAN's ability to switch suppliers, increasing supplier leverage.

- Cost Implications: Exclusive technologies can drive up the cost of essential components for ADTRAN.

- Innovation Dependence: ADTRAN's product development may be tied to the technological advancements of these specialized suppliers.

ADTRAN faces considerable supplier bargaining power due to its reliance on a concentrated number of manufacturers for critical components like semiconductors and optical modules. This leverage is amplified by high switching costs associated with specialized or proprietary technologies, as seen in the advanced optical transceiver market where a few key players dominate, influencing pricing. The global semiconductor shortage experienced through 2023 and into early 2024 further empowered suppliers, leading to price volatility and extended lead times for essential chips, directly impacting ADTRAN's production capabilities and delivery schedules.

| Component Type | Supplier Concentration | 2023/2024 Impact | ADTRAN's Vulnerability |

|---|---|---|---|

| Semiconductors | High (Few dominant manufacturers) | Supply chain disruptions, price increases | Production delays, increased costs |

| Optical Modules | Moderate to High (Specialized niche) | Robust demand, potential for price hikes | Higher input costs, limited alternative sourcing |

| Proprietary Chipsets | Very High (Patented technology) | Limited negotiation power, dictated terms | Increased operational expenses, dependence on innovation |

What is included in the product

This analysis dissects the competitive forces impacting ADTRAN, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of each force.

Customers Bargaining Power

ADTRAN's customer base is heavily concentrated among large telecommunications service providers. These major players, such as AT&T and Verizon, are crucial as they procure ADTRAN's equipment in substantial quantities for their expansive network build-outs. This volume purchasing power directly translates into significant leverage for these customers.

The sheer scale of orders placed by these large telecom operators grants them considerable bargaining power. They can effectively negotiate favorable pricing, customized service level agreements, and extended payment terms, directly impacting ADTRAN's profit margins and operational flexibility. For instance, in 2023, major US carriers continued to invest billions in network upgrades, creating opportunities for suppliers but also intensifying negotiation dynamics.

Customers can easily switch between different providers of networking solutions, as many offer similar services like high-speed internet, voice, and video. This abundance of choices significantly lowers the cost and effort for customers to change suppliers, giving them more leverage.

In 2024, the competitive landscape for broadband providers intensified, with many offering speeds of 1 gigabit per second or higher. For instance, reports indicated that over 60% of US households had access to gigabit internet speeds from at least two different providers, directly impacting customer bargaining power.

With numerous companies vying for market share, customers can effectively demand better pricing, improved service features, and more flexible contract terms. This competitive pressure forces ADTRAN and its peers to continuously innovate and offer compelling value propositions to retain their customer base.

The increasing standardization of network components, particularly in less specialized areas, significantly bolsters the bargaining power of customers. This trend allows them to more readily switch between vendors, as interoperability becomes less of a concern. For instance, the widespread adoption of open-source networking software and common interface standards means a customer can more easily replace a switch or router from one manufacturer with a comparable product from another without extensive reconfiguration, thus driving down the cost of switching.

Customer's ability to vertically integrate or insource

Large telecommunications operators, a key customer segment for ADTRAN, possess the significant financial muscle and technical expertise to consider developing their own network solutions or insourcing component manufacturing. This capability directly enhances their bargaining power.

For instance, major players in the telecom industry have historically shown a willingness to bring critical technologies in-house when they perceive cost savings or strategic advantages. This threat of vertical integration means they can push ADTRAN for more favorable pricing and terms, knowing ADTRAN needs their business.

- Potential for Insourcing: Large telecom operators can leverage their substantial R&D budgets and engineering talent to develop proprietary network hardware or software, reducing reliance on external vendors like ADTRAN.

- Cost Reduction Incentive: By bringing certain manufacturing or development processes in-house, operators aim to cut costs, which they can then use as leverage in negotiations with ADTRAN.

- Strategic Control: Vertical integration allows operators greater control over their network's future development and technology roadmap, making them less susceptible to vendor lock-in.

Price sensitivity due to competitive service markets

Telecommunication service providers, ADTRAN's key customers, operate in intensely competitive markets. This competition forces them to prioritize cost-effectiveness in their infrastructure investments to sustain profitability. For instance, in 2023, the average revenue per user (ARPU) for major US carriers remained under pressure, highlighting the need for efficient spending on network equipment.

This intense market pressure directly translates into significant price sensitivity for ADTRAN. Customers actively seek lower prices and a greater value proposition for the network solutions they purchase. This demand for cost savings is a primary driver of customer bargaining power.

- High competition among telecom operators drives down their margins.

- This necessitates seeking cost-effective infrastructure to maintain profitability.

- ADTRAN faces pressure to offer competitive pricing due to this customer behavior.

- Customer demand for lower prices directly impacts ADTRAN's pricing strategies.

ADTRAN's bargaining power with customers is significantly shaped by the concentration of its customer base among large telecommunications providers. These major players, such as AT&T and Verizon, are crucial due to their substantial procurement volumes for network build-outs, granting them considerable leverage. For example, in 2023, these carriers continued significant investments in network upgrades, a trend that persisted into 2024, intensifying negotiation dynamics.

The ability of customers to easily switch between numerous providers offering similar networking solutions lowers switching costs and enhances their bargaining power. In 2024, the competitive broadband market saw over 60% of US households with access to gigabit speeds from multiple providers, a statistic underscoring customer choice and leverage.

The increasing standardization of network components further empowers customers by reducing concerns about interoperability, making it easier to switch vendors. This trend allows customers to demand better pricing and flexible terms, as ADTRAN and its competitors strive to retain business in a price-sensitive environment.

Large telecom operators, possessing significant financial and technical resources, can even consider insourcing or developing proprietary solutions. This potential for vertical integration, driven by a need for cost reduction and strategic control, further strengthens their negotiating position with ADTRAN.

| Factor | Impact on ADTRAN | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High leverage for large telecom providers | Continued significant network upgrade investments by major carriers |

| Ease of Switching | Lowers switching costs, increases customer power | Over 60% of US households have gigabit access from multiple providers |

| Standardization | Facilitates vendor switching, drives price pressure | Widespread adoption of open-source networking and common interface standards |

| Potential for Insourcing | Threat of vertical integration by customers | Telecom operators' focus on cost-effectiveness due to market competition |

Preview Before You Purchase

ADTRAN Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The ADTRAN Porter's Five Forces Analysis you see here details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the telecommunications equipment industry. This comprehensive analysis provides actionable insights into ADTRAN's strategic positioning and potential challenges.

Rivalry Among Competitors

The networking and communications equipment market is a crowded arena, brimming with global giants and nimble regional specialists. ADTRAN navigates this landscape, contending with rivals offering solutions in fiber broadband, Wi-Fi, and sophisticated network management. This intense competition spans across all its product categories, demanding constant innovation and strategic pricing.

The networking solutions industry, including players like ADTRAN, demands substantial initial investments in research and development and sophisticated manufacturing infrastructure. These high fixed costs create a powerful incentive for companies to operate at peak capacity to spread those expenses over a larger output.

This drive for capacity utilization often fuels intense competition. To keep their factories humming and cover their fixed overhead, companies may engage in aggressive pricing, potentially leading to price wars that erode profitability across the sector. For instance, in 2023, the global telecommunications equipment market saw significant pricing pressures as companies worked to maintain market share amidst evolving technological demands.

ADTRAN operates in a sector defined by extremely rapid technological innovation. The networking industry sees product cycles that are often measured in months rather than years, demanding constant investment in research and development to keep pace. This relentless pace means companies must continually refresh their product lines to offer the latest features and performance improvements.

This continuous need for innovation directly fuels competitive rivalry. Companies are in a perpetual race to be the first to market with groundbreaking solutions, as being an early adopter of new technologies can provide a significant market advantage. For instance, the push towards 5G and Wi-Fi 7 technologies necessitates rapid development and deployment of new hardware and software, intensifying the competition among established players and emerging innovators.

Strategic importance of long-term customer relationships

Securing and maintaining long-term contracts with telecommunications service providers is paramount for ADTRAN, given the intricate and extended nature of network deployments. These relationships are the bedrock of stable revenue streams in a sector characterized by high upfront investment and gradual rollout.

Competitors actively vie for these valuable relationships. They often employ strategies such as offering bundled solutions that integrate hardware, software, and services, providing extensive support, and demonstrating robust integration capabilities to lock in customers. This competitive pressure intensifies the importance of customer loyalty and service excellence.

- Customer Retention: ADTRAN's ability to retain existing customers is vital, as acquiring new ones in the telecommunications infrastructure space is a lengthy and costly process.

- Contract Value: Long-term contracts with major carriers can represent multi-year revenue commitments, providing significant financial predictability. For instance, in 2024, many telecommunications companies continued to invest heavily in network upgrades, such as fiber-to-the-home (FTTH) deployments, which often involve multi-year infrastructure build-out contracts.

- Competitive Differentiation: Competitors often differentiate by offering integrated solutions and superior customer support, making it challenging for ADTRAN to win new business without a strong value proposition.

- Switching Costs: High switching costs associated with changing network equipment providers further solidify the strategic importance of maintaining strong, long-term customer relationships.

Mergers and acquisitions consolidating market power

The networking sector is experiencing significant consolidation. Mergers and acquisitions are creating larger, more powerful players with expanded product lines and increased financial muscle. This trend intensifies competition for ADTRAN, as these consolidated entities can deploy greater resources and reach more customers.

For instance, in 2023, several key deals reshaped the industry. While specific figures for ADTRAN's direct competitors are complex to isolate due to the dynamic nature of M&A, the overall industry saw billions invested in strategic acquisitions. These moves allow acquired companies to integrate technologies and expand their market share, directly impacting ADTRAN's competitive environment.

- Industry Consolidation: Mergers and acquisitions are a dominant force, creating fewer, larger competitors.

- Enhanced Resources: Consolidated firms benefit from greater financial capacity and broader market access.

- Intensified Rivalry: ADTRAN faces stronger, more diversified competitors due to these market shifts.

- Strategic Imperative: Staying competitive requires ADTRAN to adapt to this evolving landscape of larger players.

Competitive rivalry within the networking equipment sector is fierce, driven by rapid technological advancements and substantial R&D investments. ADTRAN faces intense pressure from both established global players and specialized regional firms, necessitating continuous innovation and competitive pricing strategies to maintain market share. The drive for capacity utilization in manufacturing also fuels aggressive pricing tactics, as seen in 2023's telecommunications equipment market where pricing pressures were significant.

The constant need to innovate, particularly with emerging technologies like Wi-Fi 7, intensifies this rivalry, as companies race to be first to market with cutting-edge solutions. Furthermore, industry consolidation, with billions invested in strategic acquisitions throughout 2023, has created larger, more formidable competitors, demanding greater agility and strategic adaptation from ADTRAN to navigate the evolving competitive landscape.

| Key Competitive Factors | Impact on ADTRAN | Example/Data Point (2023-2024) |

|---|---|---|

| Technological Pace | Requires constant R&D investment and rapid product cycles. | The push for 5G and Wi-Fi 7 mandates swift development. |

| Pricing Pressure | Erodes profitability; driven by capacity utilization. | Global telecom equipment market experienced significant pricing pressures in 2023. |

| Customer Relationships | Long-term contracts with carriers are crucial for stable revenue. | Telecom companies continued heavy investment in FTTH in 2024, involving multi-year contracts. |

| Industry Consolidation | Creates larger, stronger competitors with greater resources. | Billions invested in strategic acquisitions reshaped the industry in 2023. |

SSubstitutes Threaten

While ADTRAN is a leader in fiber broadband, alternative technologies like fixed wireless access (FWA) and low-earth orbit (LEO) satellite internet, such as Starlink, pose a threat. These substitutes can cater to specific customer needs, especially in areas where fiber deployment is challenging or cost-prohibitive. For instance, FWA can offer quicker deployment in certain rural settings, potentially capturing market share from fiber-based solutions.

LEO satellite internet is rapidly expanding its reach, with companies like SpaceX's Starlink aiming to provide high-speed internet globally. By mid-2024, Starlink reported over 3 million subscribers worldwide, demonstrating a significant and growing alternative for broadband access. This can impact ADTRAN's market if these technologies become more cost-competitive or offer superior performance in specific geographies, particularly for residential and enterprise users in underserved regions.

The increasing adoption of cloud computing and software-defined networking (SDN) presents a significant threat of substitution for ADTRAN's traditional hardware-centric solutions. As businesses increasingly embrace cloud-native architectures, they may opt for virtualized network functions and software-based management, reducing their reliance on physical network equipment. This shift could devalue ADTRAN's core hardware offerings, as seen in the broader telecom equipment market where software-defined solutions are gaining traction, with cloud infrastructure spending projected to reach over $1 trillion globally by 2024.

The growing preference for open-source software and 'white-box' hardware presents a significant threat of substitution for ADTRAN. Large data centers and service providers are increasingly exploring these alternatives for network functions, valuing the enhanced flexibility and potential cost savings over proprietary systems.

Internal development of networking capabilities by large enterprises

Very large enterprises, particularly hyperscale cloud providers, are increasingly exploring the development of their own networking hardware and software. This internal development acts as a direct substitute for procuring solutions from companies like ADTRAN. For instance, major cloud players are investing heavily in custom silicon and open-source networking software to optimize their massive data centers. This trend bypasses traditional vendor relationships, potentially reducing the addressable market for ADTRAN's offerings.

This insourcing strategy allows these giants to tailor networking components precisely to their unique operational demands and scale. By controlling the entire stack, they can achieve greater efficiency and cost savings. In 2024, significant capital expenditure by leading hyperscalers on proprietary networking infrastructure underscores this shift. This directly competes with ADTRAN's product portfolio by offering an alternative that requires no external purchase.

- Internal development of networking capabilities by large enterprises poses a significant threat of substitution.

- Hyperscale cloud providers are investing in custom silicon and open-source networking software, bypassing traditional vendors.

- This insourcing allows for tailored solutions, potentially leading to greater efficiency and cost savings for these enterprises.

- The trend in 2024 shows substantial capital expenditure by major cloud players on proprietary networking infrastructure, directly impacting the market for external suppliers like ADTRAN.

Evolution of wireless technologies reducing reliance on wired infrastructure

Advancements in wireless technologies, like 5G and enhanced Wi-Fi standards, are increasingly offering viable alternatives to traditional wired connections. This shift could lessen the demand for extensive fiber-to-the-home (FTTH) deployments in certain residential and business segments. For instance, the widespread availability of high-speed fixed wireless access (FWA) powered by 5G is already providing a competitive option for broadband internet, potentially impacting ADTRAN's reliance on wired infrastructure sales.

The increasing capability of wireless solutions presents a significant threat of substitutes. As these technologies mature, they can fulfill a growing range of connectivity needs that were once exclusively met by wired networks. This evolution means that customers might opt for wireless broadband over traditional fiber or copper installations, directly impacting the market for ADTRAN's network equipment.

The threat is amplified by the ongoing investment in wireless infrastructure. Major telecommunication companies are heavily investing in 5G rollout, aiming to capture market share with faster speeds and greater flexibility. For example, in 2024, global spending on 5G infrastructure was projected to reach hundreds of billions of dollars, underscoring the competitive landscape ADTRAN operates within.

- Growing 5G FWA adoption: Fixed Wireless Access (FWA) services, leveraging 5G, are gaining traction as a competitive broadband solution.

- Wi-Fi advancements: Newer Wi-Fi standards offer increased speed and range, potentially reducing the need for wired Ethernet in some indoor environments.

- Reduced last-mile dependency: Wireless solutions can bypass the costly and time-consuming deployment of physical cables to end-users.

- Customer preference for flexibility: Some consumers and businesses may prioritize the ease of setup and mobility offered by wireless connectivity.

Alternative technologies like fixed wireless access (FWA) and low-earth orbit (LEO) satellite internet, such as Starlink, present a significant threat to ADTRAN's fiber broadband solutions. FWA can offer quicker deployment in certain rural areas, potentially capturing market share. LEO satellite internet is rapidly expanding, with Starlink reporting over 3 million subscribers worldwide by mid-2024, demonstrating a growing alternative for broadband access.

The increasing adoption of cloud computing and software-defined networking (SDN) threatens ADTRAN's hardware-centric solutions. Businesses are opting for virtualized network functions and software-based management, reducing reliance on physical network equipment. This shift could devalue ADTRAN's core hardware offerings, as cloud infrastructure spending was projected to exceed $1 trillion globally in 2024.

| Substitute Technology | Key Advantage | Market Penetration/Growth Indicator | Potential Impact on ADTRAN |

| Fixed Wireless Access (FWA) | Quicker deployment, cost-effective in certain areas | Growing adoption, especially in rural markets | Captures market share from fiber deployments |

| LEO Satellite Internet (e.g., Starlink) | Global reach, high-speed potential in underserved areas | Over 3 million subscribers worldwide (mid-2024) | Offers alternative broadband access, potentially impacting fiber demand |

| Cloud-Native/SDN Solutions | Flexibility, software-based management | Increasing enterprise adoption, significant cloud infrastructure spending | Reduces reliance on physical network equipment |

Entrants Threaten

Establishing a significant presence in the networking and communications equipment sector, where ADTRAN operates, necessitates a substantial upfront investment. This includes considerable capital for cutting-edge research and development to stay competitive, building and maintaining advanced manufacturing facilities, and often acquiring critical intellectual property. For instance, the semiconductor industry, a key supplier to networking equipment, saw R&D spending reach over $100 billion globally in 2023, illustrating the scale of investment required even for component suppliers.

These high capital expenditure requirements act as a formidable barrier to entry for many aspiring companies. The sheer financial commitment needed to even begin operations, let alone achieve scale and technological parity, deters a significant number of potential new entrants. This financial hurdle means that only well-capitalized organizations with a long-term strategic vision can realistically consider entering this market.

Developing and deploying sophisticated networking solutions, like those ADTRAN offers, demands a high level of technical acumen. This includes expertise in optics, intricate software development, understanding various network protocols, and managing intelligent network operations. New entrants face a steep learning curve and significant investment in acquiring this knowledge.

The challenge extends to attracting and retaining the specialized talent needed to innovate and operate in this sector. Companies like ADTRAN rely on engineers and technicians with years of experience in telecommunications and network infrastructure. For newcomers, the cost and difficulty of building a team with this specialized skill set represent a substantial barrier to entry.

ADTRAN, like many established players in the telecommunications infrastructure market, benefits from deep-seated relationships with incumbent telecom providers. These aren't just transactional partnerships; they are built on years of reliable service, successful product integrations, and a proven track record of supporting critical network operations. For instance, major carriers often have multi-year contracts and extensive technical integration with existing ADTRAN solutions, making switching vendors a complex and costly undertaking.

New entrants attempting to penetrate this market face a significant hurdle in displacing these entrenched vendor relationships. Gaining the trust and securing the business of large telecommunications companies requires not only superior technology but also the ability to demonstrate long-term commitment and robust support, something ADTRAN has cultivated over its history. This established credibility is a powerful barrier, as carriers are hesitant to risk network stability for unproven alternatives.

Regulatory hurdles and compliance standards

The telecommunications sector, including companies like ADTRAN, faces substantial barriers to entry due to stringent regulatory hurdles and evolving compliance standards. These requirements, which differ significantly across geographic regions, demand considerable investment in legal expertise and adherence processes. For instance, in 2024, the Federal Communications Commission (FCC) continued to implement and enforce regulations concerning network security and data privacy, adding layers of complexity for any new player.

Navigating these intricate and often changing rules presents a significant challenge for new entrants. Companies must dedicate resources to understanding and implementing regulations related to:

- Spectrum allocation and licensing: Obtaining necessary licenses for operating in specific frequency bands can be a lengthy and costly process.

- Interoperability standards: Ensuring new equipment and services can seamlessly integrate with existing infrastructure is crucial and often dictated by industry-wide standards.

- Data privacy and security mandates: Compliance with regulations like GDPR or similar regional data protection laws requires robust security measures and transparent data handling practices.

- Universal service obligations: Many regions require telecom providers to offer services in underserved areas, a commitment that can be financially burdensome for startups.

Economies of scale enjoyed by existing large players

Existing large players in the telecommunications equipment market, such as ADTRAN, benefit significantly from entrenched economies of scale. These advantages span across manufacturing, where higher production volumes lead to lower per-unit costs, and procurement, allowing for bulk purchasing of components at discounted rates. For instance, in 2023, major telecommunications infrastructure providers often secured components at prices considerably lower than what a new entrant could negotiate.

These cost efficiencies are further amplified by established global distribution networks. Incumbent companies have already invested heavily in logistics, warehousing, and supply chain management, enabling them to deliver products efficiently and cost-effectively worldwide. A new entrant would face substantial capital expenditure to replicate this infrastructure, making it challenging to compete on price and achieve initial profitability against established players.

The threat of new entrants is therefore mitigated by this cost disadvantage. New companies entering the market typically lack the volume to achieve comparable cost efficiencies. This often forces them to operate with thinner margins or higher prices, hindering their ability to gain market share quickly in a price-sensitive industry.

- Economies of Scale in Manufacturing: Large-scale production facilities reduce per-unit manufacturing costs for incumbents.

- Procurement Power: Bulk purchasing of components allows established firms to negotiate lower prices.

- Global Distribution Networks: Existing logistics infrastructure provides cost advantages in reaching customers.

- Cost Barrier for New Entrants: New players struggle to match these cost efficiencies, impacting price competitiveness.

The threat of new entrants in the networking and communications equipment sector, where ADTRAN operates, is generally low. This is primarily due to the substantial capital requirements for research and development, advanced manufacturing facilities, and intellectual property acquisition, with global R&D spending in related semiconductor industries exceeding $100 billion in 2023. Furthermore, the need for highly specialized technical expertise and the difficulty in attracting and retaining skilled talent create significant hurdles.

Entrenched customer relationships with major telecom providers, built on years of reliable service and integration, present another formidable barrier. New entrants must overcome the complexity and cost associated with displacing these established partnerships. Stringent regulatory requirements and evolving compliance standards, such as those managed by the FCC in 2024, also demand considerable investment in legal and adherence processes, further deterring new competition.

Economies of scale enjoyed by incumbents like ADTRAN, stemming from large-scale manufacturing, procurement power, and established global distribution networks, create a significant cost disadvantage for newcomers. These factors combine to make it challenging for new companies to compete on price and achieve market penetration, effectively limiting the threat of new entrants.

| Barrier Type | Description | Impact on New Entrants | Example Data Point (2023/2024) |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, IP. | Deters less capitalized firms. | Semiconductor R&D spending > $100 billion globally. |

| Technical Expertise | Need for specialized knowledge in optics, software, protocols. | Steep learning curve and talent acquisition costs. | N/A (Qualitative barrier) |

| Customer Relationships | Long-term partnerships with telecom providers. | Difficult to displace incumbents due to trust and integration. | Major carriers often have multi-year contracts with existing vendors. |

| Regulatory Compliance | Navigating complex and varying regional rules. | Requires significant legal and implementation investment. | FCC regulations on network security and data privacy continue to evolve. |

| Economies of Scale | Cost advantages from high production volumes and distribution. | New entrants face higher per-unit costs and price competition challenges. | Incumbents secured components at significantly lower prices than new entrants could negotiate. |

Porter's Five Forces Analysis Data Sources

Our ADTRAN Porter's Five Forces analysis is built upon a foundation of robust data, drawing from ADTRAN's annual reports, investor presentations, and industry-specific market research from firms like IDC and Gartner. We also incorporate data from financial news outlets and competitor filings to ensure a comprehensive view of the competitive landscape.