Adani Green Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Green Energy Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Adani Green Energy's trajectory. This comprehensive PESTLE analysis provides the essential external context for strategic decision-making. Gain a competitive edge by understanding these dynamics. Download the full report now for actionable intelligence.

Political factors

The Indian government's commitment to expanding renewable energy capacity, aiming for 500 GW by 2030, directly fuels Adani Green Energy's expansion. This strong policy push creates a favorable landscape for substantial investments and project execution, benefiting AGEL significantly.

This clear governmental directive towards de-carbonization offers a predictable and encouraging long-term outlook for renewable energy developers like Adani Green Energy. The focus remains on scaling up green energy infrastructure.

The stability and terms of Power Purchase Agreements (PPAs) are absolutely critical for Adani Green Energy Ltd. (AGEL), acting as the bedrock for its long-term revenue. These agreements, often with government entities and state-backed corporations as the primary buyers of electricity, offer a significant level of payment security, which is vital for project financing and operational continuity.

Any shifts in PPA regulations, including adjustments to tariffs or changes in how these agreements are enforced, can directly influence AGEL's profitability and the overall viability of its renewable energy projects. For instance, a reduction in PPA tariffs could compress margins, while a more streamlined or robust enforcement mechanism could enhance revenue predictability.

Geopolitical stability significantly impacts Adani Green Energy's supply chain, as many renewable energy components are imported. For instance, trade policies and potential tariffs on goods from major manufacturing hubs like China can directly influence the cost of solar panels and wind turbine parts. In 2023, global supply chain disruptions, partly due to geopolitical tensions, led to increased lead times and prices for critical components, affecting project timelines.

International relations play a vital role in ensuring the smooth and cost-effective procurement of essential equipment. Disputes or strained relationships between countries can disrupt trade flows, potentially increasing the cost of imported materials for Adani Green Energy. Maintaining stable diplomatic ties is therefore crucial for securing a consistent and affordable supply of solar modules and wind turbine components.

Subsidies, Incentives, and Tax Benefits

Government support through subsidies, tax holidays, and financial incentives significantly bolsters the economic feasibility of large-scale renewable energy ventures like those undertaken by Adani Green Energy Limited (AGEL). These measures are crucial for reducing the substantial initial capital outlay and improving overall project profitability, thereby attracting investment. For instance, India's Production Linked Incentive (PLI) scheme for solar manufacturing, which AGEL could leverage, aims to boost domestic production.

These incentives directly impact AGEL's project economics by lowering the cost of capital and increasing internal rates of return (IRR). For example, accelerated depreciation benefits and tax holidays have historically been key drivers for renewable energy project financing in India.

- PLI Scheme: India's PLI scheme for high-efficiency solar PV modules, with an outlay of INR 24,000 crore, aims to establish 10 GW of manufacturing capacity, potentially benefiting AGEL's supply chain.

- Tax Holidays: Many renewable energy projects in India benefit from tax exemptions on income for a certain period, enhancing their financial attractiveness.

- Reduced Import Duties: While subject to change, policies aimed at reducing import duties on essential renewable energy components can also lower project costs.

- Green Bonds: Government initiatives promoting green finance and sovereign green bonds can provide AGEL with access to cheaper capital for its expansion.

Political Stability and Support for Infrastructure

Adani Green Energy Limited (AGEL) thrives in environments where political stability is a given and the government actively champions large-scale infrastructure development. This support is crucial for AGEL’s business model, which relies on the successful execution of numerous renewable energy projects.

A predictable political landscape simplifies critical processes like land acquisition and securing necessary regulatory approvals, which are often complex and time-consuming. For instance, India’s National Infrastructure Pipeline (NIP) for 2024-2025 aims to invest ₹111 lakh crore (approximately $1.3 trillion) in infrastructure, with a significant portion allocated to energy, underscoring government commitment.

- Government Policy Alignment: AGEL benefits from government policies promoting renewable energy, such as India's target of 500 GW of non-fossil fuel energy capacity by 2030.

- Regulatory Certainty: Consistent and supportive regulatory frameworks reduce project development risks and attract investment.

- Political Risk Mitigation: Political instability or abrupt policy changes can jeopardize project timelines and financial viability, as seen in past instances of policy reversals affecting the renewable sector globally.

- Ease of Doing Business: A stable political climate generally correlates with improved ease of doing business, facilitating AGEL's expansion and operational efficiency.

The Indian government's aggressive push for renewable energy, targeting 500 GW of non-fossil fuel capacity by 2030, provides a robust framework for Adani Green Energy's growth. This policy direction ensures a sustained demand for green energy and encourages significant capital inflow into the sector, directly benefiting AGEL's project pipeline.

The stability of Power Purchase Agreements (PPAs) is paramount, offering AGEL predictable revenue streams, often secured with government entities. Any adverse changes in PPA terms, such as tariff reductions or altered enforcement mechanisms, could directly impact AGEL's profitability and project financing capabilities.

Government incentives like Production Linked Incentives (PLI) for solar manufacturing and tax holidays are crucial for improving the economic viability of AGEL's large-scale projects. For instance, the INR 24,000 crore PLI scheme for solar PV modules supports domestic manufacturing, potentially streamlining AGEL's supply chain.

Political stability and a supportive regulatory environment are vital for AGEL’s operational efficiency, simplifying land acquisition and approvals. India's National Infrastructure Pipeline for 2024-2025, with a substantial allocation to energy, highlights this governmental commitment to infrastructure development.

| Policy/Factor | Description | Impact on AGEL | 2024/2025 Relevance |

|---|---|---|---|

| Renewable Energy Targets | India's goal of 500 GW non-fossil fuel capacity by 2030. | Drives demand and investment in renewable projects. | Continues to be a primary growth driver for AGEL. |

| Power Purchase Agreements (PPAs) | Long-term contracts for electricity sale, often with government entities. | Ensures revenue stability and project financing. | Key to AGEL's financial model; regulatory stability is crucial. |

| Government Incentives (PLI, Tax Holidays) | Financial support to reduce project costs and improve returns. | Enhances project economics and attracts investment. | PLI scheme for solar manufacturing offers supply chain benefits. |

| Political Stability & Infrastructure Push | Predictable governance and investment in national infrastructure. | Facilitates project execution, land acquisition, and approvals. | India's National Infrastructure Pipeline (2024-25) signals continued support. |

What is included in the product

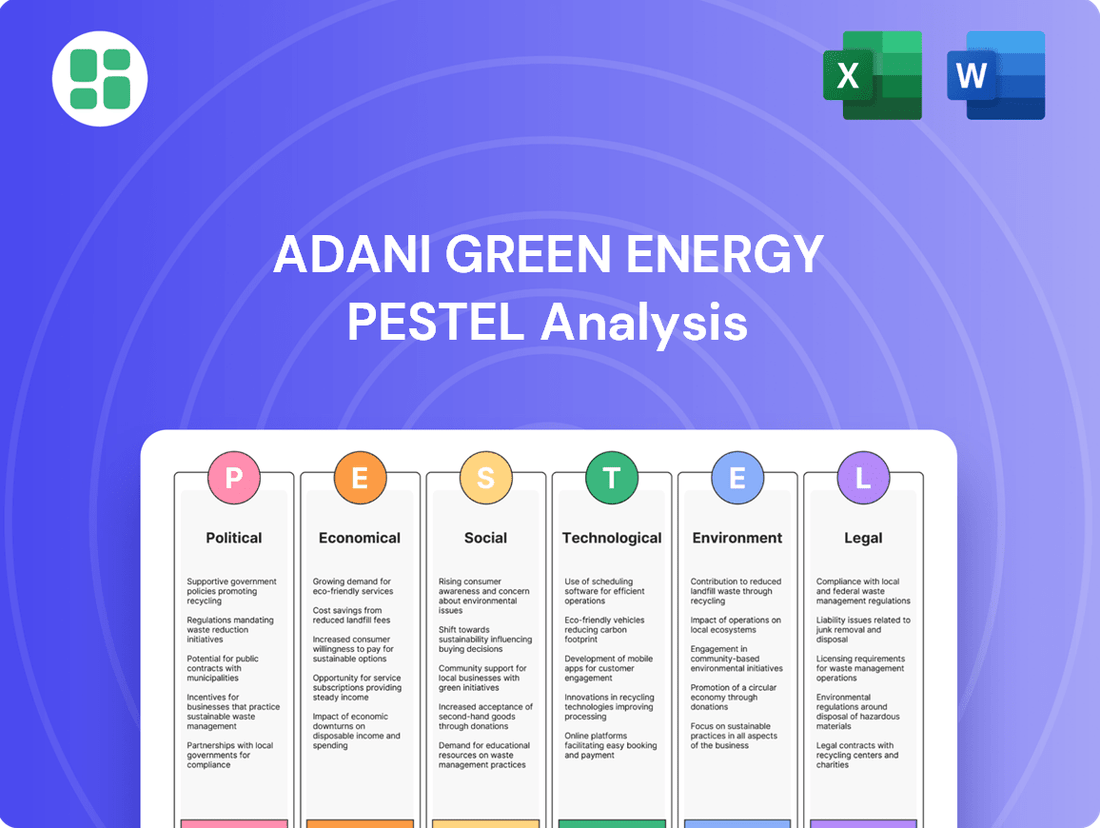

This PESTLE analysis delves into the external macro-environmental factors influencing Adani Green Energy, examining Political stability, Economic growth, Social trends, Technological advancements, Environmental concerns, and Legal frameworks.

A PESTLE analysis for Adani Green Energy offers a strategic roadmap, addressing potential disruptions by highlighting regulatory shifts and technological advancements, thereby proactively mitigating risks and capitalizing on emerging opportunities.

Economic factors

Adani Green Energy Limited (AGEL) operates in a capital-intensive sector, making its expansion heavily reliant on interest rates and the ease of securing financing. Fluctuations in borrowing costs directly impact the financial feasibility and profitability of its renewable energy projects. For instance, a higher interest rate environment would increase the cost of debt, potentially squeezing profit margins and making new developments less attractive.

Favorable interest rates are a significant tailwind for AGEL. Lower borrowing costs translate directly into improved project economics and a better return on investment for shareholders. As of early 2024, global interest rates have seen some moderation from their peaks, which could offer a more conducive environment for AGEL's financing strategies.

Access to a broad spectrum of funding sources is paramount for AGEL's ambitious growth targets. This includes leveraging instruments like green bonds, which cater to environmentally conscious investors, and securing international loans from development finance institutions and commercial banks. AGEL's ability to tap into these diverse financial avenues will be critical in funding its pipeline of solar and wind power projects, which aim to significantly scale up India's renewable energy capacity.

India's electricity demand is projected to surge, with estimates suggesting it could nearly double to over 3,000 billion units by 2030, fueled by robust economic growth and increasing urbanization. This expanding market is a significant tailwind for Adani Green Energy Ltd. (AGEL), as it ensures a consistent need for the clean power AGEL generates.

While AGEL benefits from long-term Power Purchase Agreements (PPAs) that offer predictable revenue streams and price stability, the broader electricity pricing landscape and grid stability are crucial. Fluctuations in overall energy costs and the reliability of the national grid can impact future PPA negotiations and the overall competitiveness of renewable energy sources against conventional power generation.

The sustained demand for electricity directly translates to a reliable off-take for AGEL's power generation capacity. For instance, AGEL's operational capacity stood at 10.9 GW as of December 31, 2023, and the ongoing expansion plans are well-positioned to capitalize on this growing demand, ensuring that the power produced finds buyers.

Inflationary pressures significantly influence the cost of developing and maintaining renewable energy projects for Adani Green Energy. Rising prices for key inputs like polysilicon for solar panels, steel for wind turbines, and construction labor directly increase capital expenditure. For instance, global commodity prices saw substantial volatility in late 2023 and early 2024, impacting the cost of materials essential for solar and wind farm construction.

While Adani Green Energy's Power Purchase Agreements (PPAs) often feature fixed tariffs, unexpected surges in operational and maintenance (O&M) costs due to inflation can squeeze profit margins. Increased expenses for spare parts, transportation, and skilled technicians can erode the profitability of already commissioned projects. Managing these economic headwinds requires robust cost control and potentially hedging strategies against currency fluctuations and material price spikes.

Foreign Exchange Rate Fluctuations

Foreign exchange rate fluctuations present a significant challenge for Adani Green Energy Limited (AGEL), particularly as critical components for solar and wind projects, such as turbines and solar panels, are often imported. A weakening Indian Rupee against currencies like the US Dollar directly translates to higher costs for this imported equipment. For instance, if the Rupee depreciates by 5% against the Dollar, the cost of imported machinery could rise proportionally, impacting project budgets and potentially reducing profit margins. This necessitates robust currency risk management strategies for AGEL to mitigate the financial impact of these volatile movements.

The company's financial performance is therefore sensitive to these currency shifts. For example, a substantial portion of AGEL's capital expenditure for its expansive renewable energy projects relies on imported goods. If the Indian Rupee were to weaken significantly, say by 10% against the USD in a given year, the cost of these essential imports could surge, affecting the overall project economics and return on investment.

- Imported Equipment Costs: A weakening INR increases the rupee cost of imported solar panels and wind turbines, directly impacting project capital expenditure.

- Project Viability: Higher equipment costs due to adverse currency movements can affect the financial viability and profitability of new renewable energy projects.

- Currency Hedging: AGEL actively manages currency risks through hedging instruments to lock in costs for future equipment purchases.

- Impact on Margins: Unmanaged forex fluctuations can erode profit margins on projects with a significant import component.

Economic Growth and Energy Consumption

India's economic expansion is a significant tailwind for Adani Green Energy Limited (AGEL). As the nation's GDP grows, so does its appetite for energy. This sustained demand creates a fertile ground for renewable energy projects, as seen in the projected 6.7% GDP growth for India in FY2024-25, according to the Reserve Bank of India. This robust economic activity necessitates increased power generation across industrial, commercial, and residential sectors, directly benefiting large-scale renewable energy providers like AGEL.

The correlation between economic growth and energy consumption is undeniable. For instance, India's per capita energy consumption has been on an upward trajectory, driven by industrialization and rising living standards. AGEL is well-positioned to capitalize on this trend, with its expanding portfolio of solar and wind power projects designed to meet this escalating demand. The government's focus on infrastructure development further amplifies this, ensuring a consistent need for energy supply.

- Projected Indian GDP Growth: India's GDP is expected to grow by 6.7% in FY2024-25, signaling strong economic activity.

- Energy Demand Correlation: Economic expansion directly translates to higher energy consumption, creating a sustained market for power.

- AGEL's Market Position: AGEL's large-scale renewable projects are poised to meet this growing energy demand.

- Infrastructure Push: Government investments in infrastructure further bolster the need for reliable and increased power supply.

Economic factors significantly shape Adani Green Energy's (AGEL) operational landscape, influencing everything from project financing to input costs. Interest rates directly affect the cost of capital for AGEL's expansion, with lower rates in early 2024 offering a more favorable financing environment. Inflationary pressures, however, increase the cost of essential materials like polysilicon and steel, impacting capital expenditure and potentially squeezing profit margins on existing projects. Furthermore, foreign exchange rate volatility poses a challenge, as a weaker Indian Rupee increases the cost of imported components crucial for solar and wind farm development.

India's robust economic growth, projected at 6.7% for FY2024-25 by the RBI, is a substantial tailwind for AGEL, driving energy demand across sectors. This increasing demand ensures a consistent market for AGEL's renewable power output, with operational capacity reaching 10.9 GW by December 31, 2023. While long-term PPAs provide revenue stability, the overall electricity pricing and grid reliability remain critical for future contract negotiations and competitiveness.

| Economic Factor | Impact on AGEL | Key Data/Trend (2024-2025) |

|---|---|---|

| Interest Rates | Affects cost of capital for new projects. Lower rates are beneficial. | Global rates moderating from peaks in early 2024. |

| Inflation | Increases costs of raw materials (steel, polysilicon) and O&M. | Volatile commodity prices in late 2023/early 2024 impacting input costs. |

| Foreign Exchange Rates | Weakening INR increases cost of imported equipment. | Sensitivity to USD/INR movements for imported turbines and panels. |

| Economic Growth (India) | Drives energy demand, creating a strong market for renewables. | Projected 6.7% GDP growth for India in FY2024-25. |

| Electricity Demand | Ensures off-take for generated power. | Projected to nearly double to over 3,000 billion units by 2030. |

What You See Is What You Get

Adani Green Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Adani Green Energy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Adani Green Energy.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Adani Green Energy.

Sociological factors

Public perception of renewable energy is increasingly positive, creating a favorable climate for companies like Adani Green Energy. Surveys in 2024 indicated that over 70% of the Indian population supports increased investment in solar and wind power, a trend that directly benefits companies developing these projects by fostering community acceptance and easing regulatory hurdles.

This growing environmental consciousness translates into smoother project execution for Adani Green Energy, as local communities are more likely to welcome renewable energy installations. For instance, in regions where Adani Green has established large solar farms, community engagement programs have reported high levels of participation and positive feedback, minimizing potential land acquisition disputes that can plague such large-scale developments.

Conversely, any resurgence of negative public sentiment, perhaps fueled by misinformation about land use or visual impact, could pose a risk. While currently minimal, a shift in public opinion could introduce delays through local opposition or increased scrutiny from regulatory bodies, impacting Adani Green's development timelines and operational efficiency.

Adani Green Energy Limited (AGEL) projects significantly boost local economies by creating jobs during both the construction and operational phases. For instance, in FY23, AGEL's operational capacity grew by 37%, implying a substantial increase in long-term operational employment across its sites.

By prioritizing community engagement and local hiring, AGEL cultivates positive relationships and secures crucial support for its renewable energy developments. This approach is vital for maintaining its social license to operate.

AGEL's commitment to contributing to local economies and enhancing livelihoods through its projects strengthens its overall social standing and project acceptance, a key factor in its continued expansion.

Consumers are increasingly prioritizing sustainability, and this trend significantly impacts the energy sector. Even for large-scale projects like those undertaken by Adani Green Energy Limited (AGEL), this growing consumer awareness translates into a demand for cleaner power options.

This societal shift directly influences corporate and governmental purchasing decisions. As businesses and governments respond to public sentiment and their own sustainability goals, they are actively seeking to procure more renewable energy. For instance, corporate renewable energy procurement in India saw substantial growth, with companies signing power purchase agreements for gigawatts of clean energy in 2023 and early 2024, directly benefiting AGEL.

Stakeholder Engagement and CSR Initiatives

Adani Green Energy's success hinges on robust stakeholder engagement, particularly with local communities impacted by its renewable energy projects. For instance, in fiscal year 2023-24, the company reported investing ₹250 crore in community development programs, a significant increase from ₹180 crore in the previous year, directly addressing local needs and fostering goodwill.

These Corporate Social Responsibility (CSR) efforts are not just about compliance; they are strategic tools to build trust and preemptively address potential social risks. By actively involving local populations in decision-making and providing tangible benefits, Adani Green Energy aims to ensure smoother project execution and long-term social license to operate. Their commitment to sustainability is further demonstrated by a 15% year-over-year growth in their renewable energy capacity, reaching over 10 GW operational by early 2025, which requires broad societal acceptance.

- Community Development: Focused on education, healthcare, and infrastructure in project-affected areas.

- Environmental Stewardship: Initiatives aimed at preserving local ecosystems and biodiversity.

- Skill Development: Programs to train local youth for employment in the renewable energy sector.

- Dialogue and Transparency: Regular consultations with community leaders, NGOs, and government agencies.

Changing Lifestyles and Urbanization

India's rapid urbanization, with an increasing share of its population moving to cities, is a significant driver for Adani Green Energy Limited (AGEL). This shift naturally escalates energy demands, especially in urban and semi-urban centers where economic activity is concentrated. For instance, by 2023, India's urban population had surpassed 35% and is projected to reach nearly 40% by 2030, creating a substantial and growing market for electricity.

Evolving lifestyles, characterized by greater reliance on technology and modern amenities, further amplify this energy consumption. As more households adopt electric appliances and digital services, the need for a consistent and robust power supply intensifies. This trend directly benefits AGEL by underpinning the demand for its renewable energy solutions, as governments and utilities prioritize sustainable power sources to meet these escalating needs.

- Urban Population Growth: India's urban population is projected to grow significantly, increasing overall energy demand.

- Lifestyle Changes: Modern lifestyles are more energy-intensive, driving the need for reliable power.

- Clean Energy Demand: Growing environmental awareness and policy support for renewables align with AGEL's offerings.

- Infrastructure Needs: Urban expansion requires substantial investment in power infrastructure, creating opportunities for AGEL.

Public acceptance of renewable energy is a cornerstone for Adani Green Energy's operations, with a strong societal preference for cleaner power sources evident in 2024 surveys showing over 70% support for increased solar and wind investment in India. This positive sentiment translates into smoother project approvals and community cooperation, crucial for AGEL's expansion plans.

AGEL's commitment to community development, including substantial investments in local infrastructure and skill enhancement programs, fosters goodwill and strengthens its social license to operate. For example, in FY23-24, the company allocated ₹250 crore to CSR initiatives, directly benefiting project-affected areas and enhancing local livelihoods.

The increasing demand for sustainable energy, driven by both consumer awareness and corporate ESG goals, directly benefits AGEL. Corporate renewable energy procurement in India saw significant growth in 2023-2024, with businesses actively seeking clean power purchase agreements, aligning with AGEL's expanding portfolio.

India's rapid urbanization, projected to see its urban population exceed 40% by 2030, fuels escalating energy demands, particularly for reliable and sustainable power solutions. This trend underscores the market opportunity for AGEL, as urban centers require robust energy infrastructure to support evolving lifestyles and economic activity.

| Sociological Factor | Description | Impact on AGEL | Supporting Data (2023-2025) |

|---|---|---|---|

| Public Opinion on Renewables | Growing environmental consciousness and preference for clean energy. | Favorable for project acceptance and regulatory ease. | 70%+ public support for solar/wind investment (2024). |

| Community Engagement & CSR | Investment in local development, education, healthcare, and job creation. | Builds social license to operate and mitigates project risks. | ₹250 crore CSR spending in FY23-24; 15% YoY growth in operational capacity (early 2025). |

| Consumer & Corporate Demand for Sustainability | Increasing preference for eco-friendly products and services. | Drives demand for AGEL's renewable energy solutions. | Significant growth in corporate renewable PPA signings (2023-2024). |

| Urbanization & Lifestyle Changes | Rising urban population and energy-intensive modern lifestyles. | Increases overall energy demand, creating market opportunities. | India's urban population projected to reach ~40% by 2030. |

Technological factors

Technological leaps in solar panel efficiency are directly boosting Adani Green Energy's output. For instance, advancements have pushed typical solar panel efficiencies from around 17-19% to over 22% in commercial applications by mid-2025, meaning more electricity from the same footprint.

Similarly, wind turbine technology is seeing significant gains. Larger rotor diameters and improved aerodynamic designs are allowing turbines to capture more wind energy, even at lower wind speeds. This translates to higher capacity factors for Adani Green's wind farms, improving their overall energy generation and profitability.

These efficiency gains are crucial for reducing the Levelized Cost of Energy (LCOE). By generating more power per unit of investment, Adani Green can offer more competitive pricing for its renewable energy, strengthening its market position against traditional energy sources and other renewable developers.

The advancement and affordability of energy storage, especially battery technology, are pivotal for seamlessly integrating variable renewable energy sources like solar and wind into the power grid. As costs continue to fall, Adani Green Energy Limited (AGEL) can leverage these solutions to bolster grid stability and offer consistent, 24/7 power supply.

Decreasing battery storage costs, projected to fall by an estimated 10-15% annually through 2025, will enable AGEL to unlock new revenue opportunities. This will significantly boost the value and reliability of its renewable energy projects, making them more attractive to investors and consumers alike.

Adoption of smart grid technologies and digitalization is a significant technological factor for Adani Green Energy Limited (AGEL). These advancements enhance the efficiency, reliability, and predictability of renewable energy projects by enabling better forecasting, optimized dispatch, and real-time asset monitoring. This directly translates to improved operational performance and reduced downtime across AGEL's extensive project portfolio.

For instance, by 2024, the global smart grid market was projected to reach over $100 billion, indicating a strong trend towards digital integration in energy infrastructure. AGEL's investment in these areas allows for more precise management of its solar and wind assets, crucial for balancing the intermittent nature of renewables and ensuring consistent power delivery.

Research and Development Investments in Renewables

Adani Green Energy Limited (AGEL) operates within a dynamic technological landscape where investments in research and development are paramount for driving innovation and reducing costs in the renewable energy sector. The company directly benefits from the broader industry's R&D efforts, which consistently yield advancements in new materials, more efficient manufacturing processes, and improved operational efficiencies. AGEL's strategic approach to leveraging these innovations, whether through its own internal R&D initiatives or by forging key partnerships, is critical for maintaining its long-term competitive edge in the rapidly evolving renewable energy market.

The global renewable energy sector saw significant R&D investment trends leading up to 2025. For instance, global clean energy R&D spending reached an estimated $30 billion in 2023, a notable increase from previous years, reflecting a strong commitment to technological advancement. AGEL's own commitment to innovation is demonstrated through its project execution and adoption of advanced technologies.

- Technological Advancements: Continued R&D in areas like solar panel efficiency, battery storage, and grid integration technologies directly impacts AGEL's operational costs and output.

- Cost Reduction: Innovations in manufacturing and materials science, such as perovskite solar cells, aim to bring down the levelized cost of energy (LCOE) for solar and wind power.

- Operational Efficiency: AI and machine learning are increasingly used for predictive maintenance and optimizing energy generation from AGEL's renewable assets.

- Industry Collaboration: AGEL's engagement with technology providers and research institutions ensures access to cutting-edge solutions, bolstering its innovation pipeline.

Cost Reduction Trends in Renewable Energy

The global cost of renewable energy technologies continues its downward trajectory, a powerful tailwind for Adani Green Energy. For instance, the International Renewable Energy Agency (IRENA) reported in 2023 that the global weighted average cost of electricity from newly commissioned solar photovoltaic (PV) projects fell by 89% between 2010 and 2022. This trend is largely attributable to manufacturing economies of scale and ongoing technological advancements.

These declining costs directly translate into reduced capital expenditures for Adani Green Energy's new projects. Lower equipment prices, coupled with more efficient installation methods, make solar and wind power increasingly competitive against fossil fuels. This cost parity not only enhances profitability but also broadens the addressable market for renewable energy solutions.

- Declining Solar PV Costs: IRENA data shows an 89% drop in global solar PV electricity costs from 2010 to 2022.

- Wind Energy Competitiveness: Offshore wind power costs have also seen significant reductions, with IRENA noting a 69% fall between 2010 and 2022.

- Improved Installation Efficiency: Innovations in logistics and installation techniques further contribute to lower project development expenses.

Technological advancements are fundamentally reshaping Adani Green Energy's operational landscape, driving both efficiency and cost-effectiveness. Continued innovation in solar panel efficiency, with commercial applications reaching over 22% by mid-2025, means more power generation from existing land footprints. Similarly, improvements in wind turbine design are boosting capacity factors, even in less windy conditions.

The decreasing cost of energy storage, particularly batteries, is a critical enabler for integrating renewables. Projections of 10-15% annual cost reductions through 2025 will allow AGEL to offer more reliable, round-the-clock power. Furthermore, the adoption of smart grid technologies and digitalization is enhancing grid stability and operational oversight, with the global smart grid market already exceeding $100 billion by 2024.

Adani Green Energy Limited (AGEL) is strategically positioned to benefit from ongoing R&D investments in the renewable sector, which saw global clean energy R&D spending reach an estimated $30 billion in 2023. These advancements, coupled with the significant cost reductions in solar PV (an 89% drop from 2010-2022) and offshore wind (a 69% drop from 2010-2022) as reported by IRENA, directly lower AGEL's capital expenditures and enhance the competitiveness of its projects.

| Technology Area | Advancement/Trend | Impact on AGEL | Data Point/Projection |

|---|---|---|---|

| Solar Panel Efficiency | Increased power output per unit area | Higher energy generation from same footprint | Over 22% efficiency in commercial applications by mid-2025 |

| Wind Turbine Technology | Larger rotors, improved aerodynamics | Increased capacity factors, better performance in lower winds | Not specified, but generally improves energy capture |

| Energy Storage (Batteries) | Decreasing costs, improved performance | Enhanced grid integration, 24/7 power supply potential | Projected 10-15% annual cost reduction through 2025 |

| Smart Grid & Digitalization | Enhanced forecasting, real-time monitoring | Improved operational efficiency, reduced downtime | Global smart grid market >$100 billion by 2024 |

| R&D Investment | Focus on new materials, manufacturing | Lower Levelized Cost of Energy (LCOE) | Global clean energy R&D spending ~$30 billion in 2023 |

| Cost of Renewables | Manufacturing scale, technological innovation | Reduced capital expenditure, increased competitiveness | Solar PV costs down 89% (2010-2022); Offshore wind down 69% (2010-2022) |

Legal factors

Adani Green Energy's operations are heavily influenced by India's environmental laws, particularly the Environmental Impact Assessment (EIA) notification. These regulations mandate thorough assessments for new projects to gauge potential ecological impacts, requiring multiple clearances from various government bodies before construction can begin. For instance, in 2023-24, the company secured several key environmental approvals for its upcoming solar and wind projects, crucial for maintaining its development pipeline.

Failure to adhere to these environmental legal requirements can lead to significant project disruptions. Non-compliance can result in hefty fines, stop-work orders, and severe reputational damage, impacting investor confidence and future funding. The lengthy and often complex clearance process, as seen with some large-scale renewable projects in the past, directly affects project execution timelines and overall cost-effectiveness.

Adani Green Energy's expansion relies heavily on acquiring significant land parcels for its utility-scale solar and wind farms. This process is governed by intricate land acquisition laws and regulations, which vary across India's states. Navigating these legal frameworks, ensuring fair compensation for landowners and adhering to resettlement policies, is paramount to avoid community backlash and protracted legal battles. For instance, the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, sets stringent guidelines that developers must follow.

Changes in these land laws can significantly influence project timelines and overall development costs. For example, a proposed amendment to increase compensation rates or alter land use zoning could introduce unforeseen expenses and delays for projects in the pipeline. Adani Green Energy must remain agile, closely monitoring legislative developments and maintaining robust stakeholder engagement to mitigate these legal risks and ensure smooth project execution.

Adani Green Energy Limited's (AGEL) financial stability hinges significantly on the enforceability and precise terms of its long-term Power Purchase Agreements (PPAs). These contracts are the bedrock of its revenue generation, providing predictable income streams. For instance, AGEL has secured PPAs for a substantial portion of its operational capacity, offering a degree of revenue visibility. Any adverse legal interpretations or legislative changes impacting contract law or the terms of these PPAs could directly affect AGEL's profitability and future investment plans.

Compliance with National and International Energy Laws

Adani Green Energy Limited (AGEL) navigates a complex legal landscape, requiring strict adherence to both Indian national energy laws and international regulations where its operations or financing intersect. This includes compliance with the Electricity Act, 2003, and its subsequent amendments, which govern power generation, transmission, and distribution in India, as well as various renewable energy policies and targets set by the government. For instance, India's National Green Hydrogen Mission, launched in January 2023 with an outlay of INR 19,744 crore, sets a legal framework and incentives that AGEL can leverage for future green energy projects, impacting its compliance and strategic planning.

Failure to comply with these legal mandates can result in significant penalties, operational disruptions, and reputational damage. AGEL's commitment to regulatory compliance is therefore crucial for maintaining its license to operate and its access to capital markets. The company's ongoing projects, such as its solar parks and wind farms, must meet specific environmental clearances and grid integration standards mandated by Indian regulatory bodies like the Central Electricity Regulatory Commission (CERC).

Staying abreast of evolving energy legislation is paramount. Changes in renewable energy tariffs, carbon pricing mechanisms, or environmental protection laws can directly impact AGEL's project economics and future investment decisions. For example, the Ministry of New and Renewable Energy (MNRE) frequently updates policies related to renewable purchase obligations (RPOs) and tariff structures, which AGEL must integrate into its operational and financial planning.

- Grid Connectivity and Transmission Laws: AGEL must comply with Indian Grid Code regulations for seamless integration of its renewable power into the national grid, ensuring stability and reliability.

- Renewable Energy Mandates: Adherence to national and state-level Renewable Purchase Obligations (RPOs) is critical, with penalties for non-compliance, driving demand for AGEL's green power.

- Environmental Laws: Compliance with environmental impact assessment (EIA) regulations and other environmental protection acts is mandatory for all project sites, ensuring sustainable operations.

- International Financing Regulations: For projects financed through international markets, AGEL must also adhere to the legal and compliance frameworks of those jurisdictions, including those related to foreign investment and financial reporting.

Intellectual Property Rights (IPR)

Intellectual Property Rights (IPR) are crucial for Adani Green Energy Ltd. (AGEL) as they safeguard innovations in renewable energy technologies, like advanced solar panel designs or efficient wind turbine components. AGEL's reliance on technology providers means that robust IPR legal frameworks directly influence licensing deals and the integration of new technologies, impacting its competitive edge in the rapidly evolving green energy market.

The global renewable energy sector, valued at over $1.5 trillion in 2024, sees significant investment in R&D, making IPR protection a key differentiator. AGEL's ability to secure and leverage intellectual property, whether through its own innovations or licensing agreements with technology partners, directly affects its operational efficiency and market positioning. For instance, patents on advanced energy storage solutions could offer AGEL a substantial advantage in grid stability services.

- IPR Protection: Safeguarding patented designs for solar modules and wind turbine components is vital for AGEL's technological advantage.

- Technology Provider Reliance: AGEL's dependence on external technology necessitates strong legal frameworks governing licensing and technology transfer.

- Market Impact: IPR laws influence the adoption of cutting-edge technologies, directly impacting AGEL's operational costs and efficiency.

- Global Context: The multi-trillion dollar renewable energy market emphasizes the strategic importance of intellectual property in securing market share.

Adani Green Energy's operations are subject to India's comprehensive environmental legislation, including the Environmental Impact Assessment (EIA) notification. These laws require rigorous assessments for new projects, ensuring ecological impacts are evaluated and multiple government clearances are obtained before construction can commence. For example, in fiscal year 2023-24, AGEL secured crucial environmental approvals for its expanding solar and wind energy portfolios, vital for its ongoing development pipeline.

Adherence to land acquisition laws, such as the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, is critical for AGEL's land acquisition processes. These regulations ensure fair compensation and proper resettlement for landowners, mitigating the risk of community disputes and legal challenges. Navigating these varied state-specific land laws is essential for the timely and cost-effective execution of its large-scale renewable energy projects.

The enforceability of Power Purchase Agreements (PPAs) is a cornerstone of AGEL's revenue stability, providing predictable income streams. Any shifts in contract law or legislative changes impacting these agreements could directly influence AGEL's financial performance and future investment strategies. AGEL's robust PPA portfolio, covering a significant portion of its operational capacity, offers considerable revenue visibility.

AGEL's compliance with national energy laws, such as the Electricity Act, 2003, and government renewable energy policies, is paramount for its operations. The National Green Hydrogen Mission, launched in January 2023 with an INR 19,744 crore outlay, establishes a legal framework and incentives that AGEL can leverage, influencing its strategic planning and compliance requirements for future green energy ventures.

Environmental factors

Adani Green Energy Limited (AGEL) plays a direct role in mitigating climate change by producing clean, renewable energy, aligning with India's ambitious carbon emission reduction goals. India has committed to reducing its emissions intensity by 45% by 2030 and achieving net-zero emissions by 2070, targets that AGEL's operations directly support.

The escalating global imperative for climate action is fueling robust policy support and significant investment into the renewable energy sector. This trend positions AGEL favorably, as it is a key enabler of the transition towards a low-carbon economy, benefiting from favorable regulatory frameworks and increasing investor appetite for sustainable projects.

Adani Green Energy Limited (AGEL) faces environmental challenges due to its large-scale renewable energy projects requiring substantial land. For instance, the Khavda solar park in Gujarat, one of the world's largest, necessitates careful planning to balance energy generation with ecological preservation.

AGEL must comply with stringent biodiversity conservation laws and minimize the ecological impact of its operations. This includes conducting thorough Environmental Impact Assessments (EIAs) and implementing mitigation measures to protect local flora and fauna, ensuring adherence to national and international environmental standards.

Effective land-use planning and the implementation of biodiversity offsetting and habitat restoration strategies are vital for AGEL to secure project approvals and maintain its social license to operate. These proactive measures demonstrate commitment to sustainable development and environmental stewardship.

While solar energy is inherently clean, the operational phase of solar farms, particularly panel cleaning, necessitates water. This is especially true in arid regions where dust accumulation significantly impacts energy output. Adani Green Energy Limited (AGEL) must therefore prioritize efficient water management strategies.

Innovative solutions like robotic dry cleaning or advanced water-efficient washing methods are crucial for AGEL to mitigate its environmental footprint. For instance, some solar farms are exploring the use of recycled water or even dew collection systems. By adopting these practices, AGEL can ensure compliance with increasingly stringent water resource regulations, which are becoming a significant factor in environmental assessments for large-scale projects.

Waste Management and End-of-Life Disposal

The growing scale of renewable energy installations, particularly solar and wind, presents a significant long-term environmental challenge concerning the disposal and recycling of decommissioned components. For Adani Green Energy Limited (AGEL), this means proactively planning for the end-of-life management of solar panels and wind turbine blades. This includes assessing the full life-cycle environmental impact of their assets and developing strategies that embrace circular economy principles to minimize waste and maximize resource recovery.

Emerging regulations worldwide are increasingly focusing on extended producer responsibility for renewable energy equipment. By 2025, the global installed capacity of solar PV is projected to exceed 1.5 terawatts, meaning a substantial volume of panels will eventually require disposal. AGEL's commitment to responsible waste management will be crucial for maintaining its social license to operate and for aligning with evolving environmental standards.

- Circular Economy Focus: AGEL must invest in or partner with entities developing advanced recycling technologies for solar panels, which contain valuable materials like silicon, silver, and copper, and for wind turbine blades, often made from composite materials that are difficult to recycle.

- Life-Cycle Assessment: Conducting thorough life-cycle assessments for all projects will allow AGEL to quantify the environmental footprint associated with manufacturing, operation, and end-of-life disposal, informing more sustainable procurement and design choices.

- Regulatory Preparedness: Staying ahead of anticipated regulations regarding e-waste and composite material disposal will be vital. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive already sets collection and recycling targets that may influence global practices.

- Strategic Partnerships: Collaborating with research institutions and specialized waste management companies can accelerate the development and implementation of effective end-of-life solutions, ensuring AGEL's operations are environmentally sound throughout their entire lifespan.

Resource Efficiency and Sustainable Practices

Adani Green Energy Limited (AGEL) places significant emphasis on resource efficiency and sustainable practices across its entire project lifecycle. This commitment extends from the initial construction phases through to the ongoing operational management of its renewable energy assets. For instance, AGEL actively seeks to optimize energy consumption within its own facilities and minimize material waste generated during construction. This focus on environmentally sound practices is crucial for its long-term viability and reputation.

The company's dedication to these principles directly bolsters its Environmental, Social, and Governance (ESG) profile. By demonstrating strong environmental stewardship, AGEL aims to cultivate greater stakeholder trust and confidence. This is particularly important as the global investment landscape increasingly prioritizes companies with robust sustainability credentials. AGEL's sustainability reports often highlight initiatives such as water conservation and waste reduction in its solar and wind farm developments.

Key aspects of AGEL's resource efficiency and sustainable practices include:

- Optimized Energy Consumption: Implementing energy-efficient technologies within its administrative offices and operational sites.

- Waste Minimization: Employing strategies to reduce, reuse, and recycle materials used in project construction and maintenance.

- Environmentally Sound Construction: Adopting best practices to minimize the environmental footprint during the building of renewable energy infrastructure.

- Water Management: Implementing water-saving measures, especially in water-scarce regions where projects are located.

Adani Green Energy Limited (AGEL) is significantly impacted by environmental factors, particularly the increasing global focus on climate change and sustainability. India's commitment to reducing emissions intensity by 45% by 2030 and achieving net-zero by 2070 directly benefits AGEL's renewable energy operations.

The company faces challenges related to land use for its large-scale projects, such as the Khavda solar park, requiring careful ecological management. AGEL must also address water usage for panel cleaning, especially in arid regions, and plan for the end-of-life disposal and recycling of solar panels and wind turbine blades, a growing concern with the expansion of renewable capacity.

AGEL's proactive approach to resource efficiency and sustainable practices, including waste minimization and water management, strengthens its ESG profile and stakeholder trust. The company's commitment to circular economy principles for component recycling is crucial for long-term environmental compliance and reputation.

| Environmental Factor | Impact on AGEL | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Emissions Targets | Drives demand for renewable energy, aligning with AGEL's core business. | India's target: 45% emissions intensity reduction by 2030; Net-zero by 2070. Global renewable capacity growth continues robustly. |

| Land Use & Biodiversity | Requires careful planning to balance energy generation with ecological impact. | Large projects like Khavda solar park necessitate stringent EIAs and biodiversity mitigation measures. |

| Water Scarcity | Operational water needs (panel cleaning) require efficient management, especially in arid zones. | Increasingly stringent water resource regulations are impacting project assessments. |

| Waste Management & Circular Economy | End-of-life disposal and recycling of components (panels, blades) present a growing challenge. | Global solar PV capacity projected to exceed 1.5 TW by 2025, highlighting future waste volumes. EU's WEEE directive influences global practices. |

PESTLE Analysis Data Sources

Our Adani Green Energy PESTLE Analysis is built on a robust foundation of data from official government reports, international energy agencies, and reputable financial news outlets. We meticulously gather information on policy changes, market trends, and technological advancements to ensure comprehensive insights.