Adani Green Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Green Energy Bundle

Adani Green Energy operates in a dynamic sector where the bargaining power of buyers, particularly large utilities, significantly influences pricing and contract terms. The threat of new entrants, while potentially high due to the growing demand for renewables, is somewhat mitigated by substantial capital requirements and regulatory hurdles.

The complete report reveals the real forces shaping Adani Green Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key component suppliers presents a moderate to high bargaining power for Adani Green Energy's suppliers. Critical inputs such as solar photovoltaic (PV) cells, modules, and wind turbine blades are often sourced from a limited number of manufacturers.

While India is actively expanding its domestic manufacturing capabilities, there's still a notable dependence on imports for specialized components and raw materials like polysilicon and wafers, with China being a significant supplier. This reliance grants foreign suppliers a degree of leverage in pricing and availability.

Government initiatives, including the Production Linked Incentive (PLI) scheme and the Approved List of Models and Manufacturers (ALMM), are designed to foster domestic production and lessen import dependency. For instance, the PLI scheme for solar PV modules aims to attract significant investment, with targets to achieve 10 GW of integrated solar PV manufacturing capacity by 2025-26.

The Indian government's push to boost domestic manufacturing capacity for solar modules and components is significantly impacting the bargaining power of suppliers for companies like Adani Green Energy Limited (AGEL). India's solar module manufacturing capacity nearly doubled from 38 GW in March 2024 to an impressive 74 GW by March 2025. Similarly, PV cell manufacturing capacity tripled over the same period, rising from 9 GW to 25 GW.

This rapid expansion, fueled by supportive government policies, aims to create a more robust domestic supply chain and lessen reliance on imports. As more local suppliers enter the market and scale their operations, the increased competition and availability of components are likely to strengthen the position of renewable energy developers like AGEL. This shift could lead to more favorable pricing and terms from a wider array of domestic manufacturers.

Adani Green Energy's reliance on imported critical minerals like lithium, cobalt, and nickel, essential for renewable energy tech, highlights a significant vulnerability. India's 100% import dependence for these materials means global suppliers, especially those in China, hold considerable sway. This upstream dependency directly translates into increased bargaining power for these suppliers, impacting Adani Green's cost structure and operational stability.

Switching Costs and Supplier Specificity

Switching suppliers for Adani Green Energy's (AGEL) large-scale renewable projects can be a costly endeavor. These costs often stem from the need for design modifications, obtaining new certifications, and ensuring seamless integration with existing operational infrastructure. For instance, a shift in solar panel technology might necessitate redesigning mounting structures and inverters, impacting project timelines and budgets.

The reliance on specialized, advanced technologies further influences this dynamic. AGEL's adoption of cutting-edge solutions like bifacial solar modules and high-capacity wind turbines means they may be more tied to suppliers offering these specific components. This technological specificity can empower certain specialized suppliers, granting them increased bargaining leverage, particularly in the short to medium term, as AGEL navigates procurement for its expansive portfolio.

- High Switching Costs: Transitioning suppliers in renewable energy projects can incur substantial expenses due to design adjustments, re-certification processes, and integration challenges with existing systems.

- Supplier Specificity: AGEL's use of advanced technologies like bifacial solar modules and large wind turbines may create dependencies on suppliers with specialized offerings.

- Supplier Leverage: This technological specificity can enhance the bargaining power of these specialized suppliers, especially when AGEL requires specific components for its ongoing and future projects.

Impact of Government Policies on Supply Chain

Government policies significantly influence the bargaining power of suppliers for Adani Green Energy Limited (AGEL). For instance, the mandate for locally manufactured solar cells in clean energy projects starting June 2026, and the Approved List of Models and Manufacturers (ALMM) for wind turbine components, are designed to bolster India's domestic supply chain and decrease import dependency.

These policy shifts, while beneficial for long-term domestic manufacturing growth, can introduce short-to-medium term market adjustments. AGEL might experience fluctuations in supplier availability and pricing as the industry adapts to these new requirements. For example, a sudden increase in demand for domestically produced components could initially strain existing suppliers, potentially increasing their bargaining leverage.

- Mandated Local Content: Policies requiring locally sourced components, like solar cells from June 2026, can empower domestic suppliers.

- ALMM for Wind: The ALMM for wind turbine parts aims to standardize and potentially increase reliance on approved Indian manufacturers.

- Interim Market Adjustments: Transition periods may lead to temporary shortages or price hikes from domestic suppliers as production scales up.

- Reduced Import Reliance: The ultimate goal is to diminish reliance on foreign suppliers, shifting power towards local entities.

The bargaining power of suppliers for Adani Green Energy (AGEL) is influenced by a mix of factors, including import reliance and government policies. While India's domestic manufacturing capacity is growing, AGEL still depends on imported critical minerals, giving global suppliers significant leverage. High switching costs and the specificity of advanced technologies further empower certain suppliers.

Government mandates for locally manufactured components, such as solar cells from June 2026, are designed to bolster domestic suppliers. This shift, however, can lead to interim market adjustments where increased demand for local parts might temporarily enhance supplier bargaining power as production scales up.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Trend (as of mid-2025) |

| Import Reliance (Critical Minerals) | High | India's 100% import dependence for lithium, cobalt, nickel. China is a key supplier. |

| Domestic Manufacturing Growth (Solar PV) | Moderate (decreasing reliance) | India's solar module capacity reached 74 GW by March 2025; PV cell capacity at 25 GW. |

| Switching Costs | High | Costs include design modifications, re-certification, and integration for components like solar panels. |

| Technological Specificity | Moderate to High | Reliance on advanced tech (e.g., bifacial modules) ties AGEL to specialized suppliers. |

| Government Policies (Local Content) | Increasing (for domestic suppliers) | Mandate for local solar cells from June 2026; ALMM for wind turbine components. |

What is included in the product

This analysis dissects the competitive forces impacting Adani Green Energy, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the renewable energy sector.

Adani Green Energy's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and alleviating the pain of complex market assessments.

This analysis allows for customized pressure level adjustments based on new data or evolving market trends, effectively relieving the pain of outdated strategic insights.

Customers Bargaining Power

Adani Green Energy Limited (AGEL) primarily secures its revenue through long-term Power Purchase Agreements (PPAs), typically lasting 25 years, with government entities and government-backed corporations. These agreements, while ensuring revenue predictability, also lock in tariffs, granting customers considerable bargaining power by fixing prices for extended durations.

Adani Green Energy Limited (AGEL) primarily serves large, consolidated customers like the Solar Energy Corporation of India (SECI) and various state electricity distribution companies (DISCOMs). These significant buyers account for a substantial portion of AGEL's overall revenue, granting them considerable bargaining power.

This concentration of buyers allows them to exert significant leverage during Power Purchase Agreement (PPA) negotiations. They can effectively demand more favorable terms or push for price reductions, impacting AGEL's revenue streams.

The financial strain on Indian electricity distribution companies (DISCOMs) significantly impacts their bargaining power. Many DISCOMs are grappling with substantial losses, often stemming from tariffs that don't cover costs and inefficient bill collection processes. This financial fragility can make it harder for them to commit to new power purchase agreements (PPAs) or to consistently meet payment obligations on existing ones.

This situation indirectly strengthens the customers' position. When DISCOMs face financial distress, they may delay payments to renewable energy developers like Adani Green Energy Limited (AGEL) or show hesitancy in signing new contracts. This creates uncertainty for developers, potentially leading to project delays and increasing the indirect bargaining leverage of the DISCOMs as customers.

Government Procurement Process and Targets

The Indian government is a significant buyer of renewable energy, setting ambitious goals like achieving 500 GW of non-fossil fuel capacity by 2030. This substantial demand, however, is channeled through competitive bidding, where the government's primary aim is to secure power at the lowest possible cost. This dynamic inherently strengthens the government's bargaining position, as developers like Adani Green Energy Limited (AGEL) are compelled to offer aggressive tariffs to win contracts.

This focus on cost reduction through competitive tenders directly translates into downward pressure on the tariffs AGEL can command. For instance, in 2023, solar power tariffs discovered through government auctions often fell below INR 2.50 per unit, a testament to the intense competition and the government's procurement strategy.

- Government Targets: India aims for 500 GW non-fossil fuel capacity by 2030, creating a large demand base.

- Competitive Bidding: Procurement occurs via auctions, fostering price competition among developers.

- Tariff Pressure: Government's focus on cost reduction can lead to lower discovered tariffs, impacting developer profitability.

- Buyer Power: The government's role as a major, cost-conscious buyer significantly enhances its bargaining power.

Increasing Hybrid and Storage Demand

The demand for reliable, dispatchable renewable energy is surging, driving a significant increase in tenders for hybrid projects combining wind and solar, alongside renewable energy paired with energy storage systems (ESS). This trend highlights how customers are prioritizing round-the-clock power availability and enhanced grid stability.

Developers like Adani Green Energy Limited (AGEL), which are strategically pivoting towards co-located solar and battery energy storage system (BESS) projects, are well-positioned to meet this evolving customer need. AGEL's significant project pipeline, including a substantial portion dedicated to hybrid and storage solutions, underscores this market shift.

For instance, as of early 2024, AGEL had a total operational capacity of over 8.4 GW, with a considerable portion of its under-construction and awarded projects focusing on hybrid and storage capabilities. This strategic focus allows AGEL to offer more integrated and cost-effective power solutions, directly addressing customer desires for consistent and stable renewable energy supply. The complexity of these advanced solutions, however, may also lead customers to expect greater integration and competitive pricing from developers.

- Growing Demand for Hybrid and Storage: Tenders for wind-solar hybrid and renewable energy plus ESS are on the rise, reflecting customer preference for firm and dispatchable renewable power.

- Customer Focus on Reliability: Clients increasingly seek round-the-clock power and improved grid stability, creating an advantage for developers offering integrated solutions.

- AGEL's Strategic Alignment: Adani Green Energy is actively pursuing collocated solar-BESS projects to meet this demand, enhancing its competitive edge in the market.

- Market Expectation for Integrated Packages: The complexity of hybrid and storage solutions may result in customer expectations for more comprehensive and cost-efficient energy packages.

Adani Green Energy's customers, primarily government entities and large DISCOMs, wield significant bargaining power due to the long-term, fixed-tariff nature of Power Purchase Agreements (PPAs). These entities, often facing financial constraints, can leverage their substantial purchasing volume and the government's focus on low-cost energy procurement to negotiate favorable terms. The increasing demand for hybrid and storage solutions also means customers expect integrated, reliable power, potentially increasing their leverage for comprehensive packages.

| Customer Type | Bargaining Power Drivers | Impact on AGEL |

|---|---|---|

| Government Entities (e.g., SECI) | Large procurement volume, competitive bidding, focus on lowest cost | Downward pressure on tariffs, stringent contract terms |

| State DISCOMs | Financial fragility, payment delays, long-term PPA commitments | Potential for delayed payments, negotiation leverage during contract renewals |

| Industrial Buyers (emerging) | Demand for reliable, round-the-clock power, preference for integrated solutions | Opportunity for higher value offerings, but also expectation of competitive pricing for complex packages |

Preview the Actual Deliverable

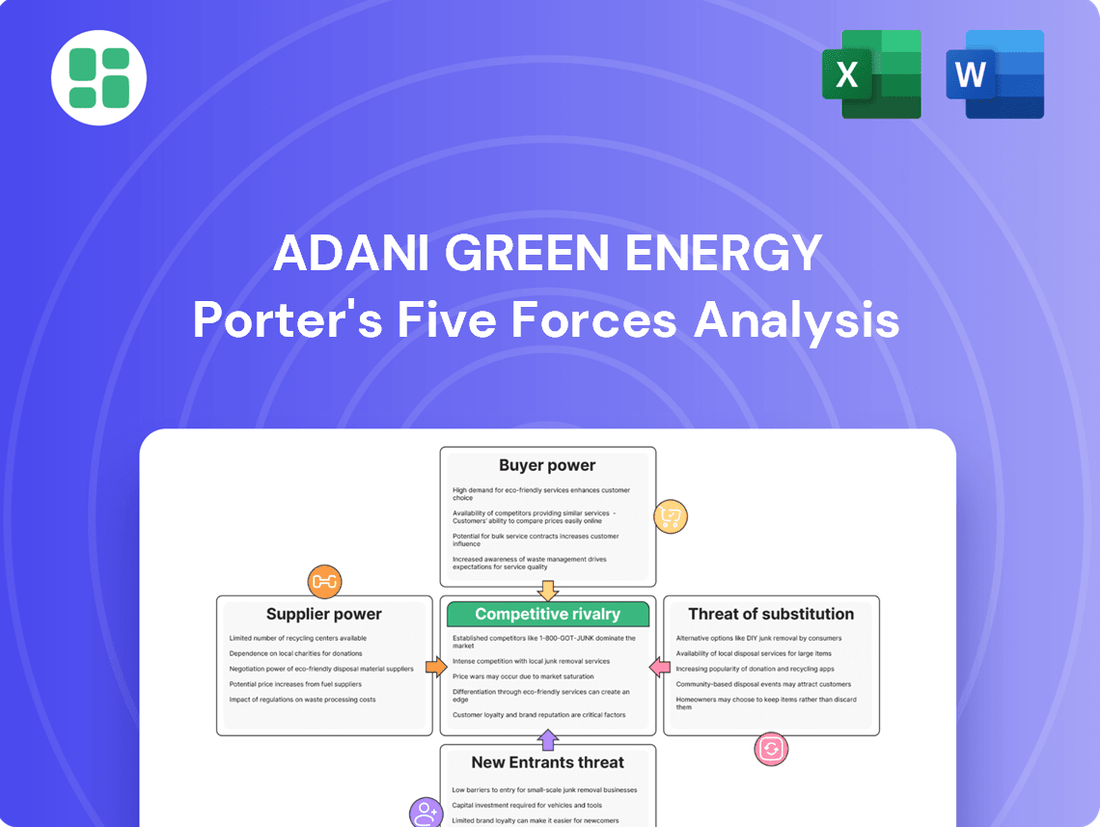

Adani Green Energy Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Adani Green Energy, detailing the competitive landscape including threat of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry within the renewable energy sector. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into the strategic positioning of Adani Green Energy.

Rivalry Among Competitors

The Indian renewable energy sector is booming, with a remarkable 29.52 GW of capacity added in FY 2024-25 alone. This rapid expansion, fueled by a national goal of reaching 500 GW of non-fossil fuel capacity by 2030, is a magnet for new entrants and existing companies alike.

This intense growth environment naturally sharpens competitive rivalry. Companies are aggressively bidding in tenders to secure projects and scale up operations, leading to a crowded marketplace where market share is fiercely contested.

Adani Green Energy Limited (AGEL) faces a robust competitive environment. Major players like Tata Power Renewable Energy, state-owned NTPC, and independent producers such as ReNew Power and JSW Energy are significant rivals. These companies bring substantial financial resources, broad operational experience, and diversified renewable energy portfolios to the market, intensifying competition across all renewable energy sectors.

The renewable energy sector in India is heavily influenced by competitive bidding, driving down tariffs. For instance, solar power tariffs have seen significant reductions, with some bids in 2023-2024 falling below INR 2.50 per unit, putting immense pressure on developers like Adani Green Energy.

This intense price sensitivity forces companies to focus on cost optimization. Adani Green Energy, for example, leverages economies of scale and technological advancements in solar panel efficiency and wind turbine technology to reduce project costs. This constant drive for efficiency directly impacts profit margins and fuels the rivalry among players.

Differentiation through Scale and Technology

Adani Green Energy Limited (AGEL) leverages its massive scale and technological prowess to stand out. The company is known for its swift project execution, deploying advanced technologies like bifacial solar modules and India's largest 5.2 MW wind turbines. Robotic cleaning systems further enhance operational efficiency.

This focus on scale and technology creates a significant competitive advantage for AGEL. However, the renewable energy sector is dynamic, with competitors also investing heavily in technological advancements and expanding their operational scale. This ongoing investment by rivals intensifies the rivalry, driving a continuous need for innovation and efficient project deployment across the industry.

- AGEL's Capacity: As of March 31, 2024, AGEL's operational renewable energy capacity stood at 8,316 MW, showcasing its substantial scale.

- Technological Edge: The company's adoption of bifacial solar modules and 5.2 MW wind turbines represents a commitment to cutting-edge technology.

- Industry Trend: Competitors are also increasing their investments in similar technologies and scale, leading to a highly competitive landscape.

- Rivalry Driver: The pursuit of efficiency and rapid deployment through technology adoption fuels the intense rivalry within the Indian renewable energy market.

Impact of Regulatory and Policy Environment

The Indian government's proactive stance on renewable energy, marked by supportive policies, incentives, and ambitious annual bidding targets, intensifies competition within the sector. This environment, while fostering growth, also introduces regulatory intricacies that can impact project viability and operational efficiency.

However, challenges such as tender undersubscription, protracted power agreement finalizations, and outright tender cancellations, which have been observed in the 2024-25 period, highlight execution hurdles and market absorption issues. These factors can escalate rivalry among developers vying for the limited number of truly viable and bankable projects.

- Policy Support: Government initiatives like the National Green Hydrogen Mission and Production Linked Incentives (PLI) for solar PV manufacturing aim to boost domestic capacity and attract investment, fueling competition.

- Bidding Dynamics: Annual renewable energy bidding targets, such as the 50 GW target for 2023-24, create a predictable pipeline but also concentrate competition during tender periods.

- Execution Risks: Delays in PPAs and project commissioning, as seen in instances of tender cancellations in FY25, can lead to project pipeline volatility and increased competition for secured, operational projects.

- Market Absorption: The pace at which discoms can absorb new renewable capacity influences tender success rates, with undersubscription in some tenders indicating a mismatch between supply and demand absorption capabilities, thereby intensifying rivalry for projects with guaranteed offtake.

The Indian renewable energy market is characterized by intense competition, driven by rapid capacity additions and aggressive bidding. Companies like Tata Power Renewable Energy, NTPC, ReNew Power, and JSW Energy are major rivals, all leveraging substantial financial resources and operational expertise.

This rivalry is further fueled by declining tariffs, with some solar bids in 2023-2024 falling below INR 2.50 per unit, forcing a strong focus on cost optimization and technological efficiency. Adani Green Energy's significant operational capacity of 8,316 MW as of March 31, 2024, and its adoption of advanced technologies like bifacial solar modules and 5.2 MW wind turbines, highlight this competitive dynamic.

| Competitor | Operational Capacity (MW) (Approx. FY24) | Key Focus Areas |

|---|---|---|

| Adani Green Energy | 8,316 | Scale, Technology, Rapid Deployment |

| Tata Power Renewable Energy | 7,600+ | Diversification, Grid Integration |

| NTPC | ~5,000 (Renewables) | Utility Scale, Green Hydrogen |

| ReNew Power | 8,000+ | Wind, Solar Hybrid, Storage |

| JSW Energy | 2,000+ (Renewables) | Integrated Energy Solutions |

SSubstitutes Threaten

Despite the rapid expansion of renewable energy sources, India's energy landscape in mid-2025 still heavily relies on thermal power. As of June 2025, thermal power, predominantly coal-fired plants, accounted for over 50% of the nation's total installed power generation capacity. This sustained dominance highlights the persistent threat of substitutes for companies like Adani Green Energy.

This continued reliance on thermal power is largely due to its ability to provide consistent, dispatchable energy, fulfilling base-load power demands. While renewables like solar and wind are growing, their intermittent nature means they cannot always guarantee a steady supply without significant advancements and widespread deployment of energy storage solutions. This fundamental difference in reliability creates a strong substitute threat, as thermal power offers a more predictable and readily available energy source for many consumers and grid operators.

Advancements in Battery Energy Storage Systems (BESS) and pumped hydro storage are increasingly vital for managing the intermittency of renewable sources like solar and wind. These technologies, while not direct replacements for generation, significantly boost the reliability of renewables. For instance, by mid-2024, global BESS installations were projected to reach over 150 GW, a substantial increase from previous years, demonstrating rapid technological progress and cost reduction.

As BESS and pumped hydro storage mature and become more affordable, they not only complement renewables but also begin to offer a viable alternative to traditional fossil-fuel-based peaking power plants. This shift is driven by falling battery costs, with lithium-ion battery pack prices seeing a significant decline over the past decade, making grid-scale storage more economically attractive. This trend directly challenges the need for dispatchable fossil fuel capacity.

The rise of distributed generation, particularly rooftop solar, presents a significant threat of substitutes for utility-scale renewable energy projects like those developed by Adani Green Energy. These decentralized solutions allow consumers, especially commercial and industrial clients and residential users, to produce their own electricity, thereby decreasing their dependence on larger, grid-connected power sources. This trend is further amplified by government initiatives. For instance, the PM Surya Ghar: Muft Bijli Yojana, rolled out in 2024, has demonstrably accelerated rooftop solar adoption across India. This scheme has already seen over 1 million households register for rooftop solar installations, underscoring a tangible shift towards self-generation that directly competes with the demand for power from utility-scale projects.

Other Conventional Energy Sources

While Adani Green Energy focuses on renewables, other conventional energy sources like natural gas and hydropower remain significant in India's energy mix. In 2023, India's natural gas consumption reached approximately 70 billion cubic meters, and hydropower accounted for about 14% of the country's electricity generation. These sources can present a competitive threat by offering established infrastructure and perceived reliability, especially for meeting peak demand, potentially slowing the transition to renewables.

The continued reliance on and potential expansion of natural gas as a cleaner fossil fuel alternative, alongside hydropower's role in grid stability, poses a substitute threat. For instance, India's target to increase the share of natural gas in its energy mix to 15% by 2030 indicates ongoing investment in this sector. Hydropower projects, though facing environmental constraints, are also being considered for capacity expansion, directly competing for capital and market share that could otherwise go to renewables.

- Natural Gas Consumption: India's natural gas consumption was around 70 billion cubic meters in 2023.

- Hydropower's Share: Hydropower contributed approximately 14% to India's electricity generation in 2023.

- Government Targets: India aims for natural gas to constitute 15% of its energy mix by 2030.

Technological Advancements in Energy Efficiency

Technological advancements in energy efficiency present a significant threat of substitutes for renewable energy providers like Adani Green Energy. Improvements in areas like building insulation, smart grid technology, and more efficient appliances can directly reduce the demand for electricity. For instance, in 2024, the International Energy Agency reported that energy efficiency measures saved the equivalent of the European Union's total final energy consumption, demonstrating a tangible impact on demand.

This trend means that meeting energy needs through conservation rather than new generation capacity becomes increasingly viable. As these technologies become more widespread and cost-effective, they can directly displace the need for additional power, including that from renewable sources. This effectively acts as a substitute by fulfilling energy requirements through reduced consumption.

- Reduced Demand: Enhanced energy efficiency lowers overall electricity consumption, lessening the need for new power sources.

- Conservation as a Substitute: Meeting energy needs through conservation directly competes with the supply of new energy generation, including renewables.

- Technological Impact: Advances in insulation, smart grids, and efficient appliances make reduced consumption a more practical alternative.

- Market Implications: This trend can impact the growth projections for new energy capacity, as demand may not escalate as anticipated.

While distributed generation, particularly rooftop solar, directly competes with utility-scale projects, the broader threat of substitutes for Adani Green Energy also includes advancements in energy storage and efficiency. As battery storage becomes more affordable, it enhances the reliability of renewables, but also offers a substitute for traditional dispatchable power. Furthermore, energy efficiency measures reduce overall demand, directly impacting the need for new generation capacity.

| Substitute Category | Description | Impact on Adani Green Energy | Key Data/Trends (Mid-2024/2025 Projections) |

| Thermal Power | Dominant base-load power source in India, offering consistent supply. | Continues to meet a significant portion of demand, potentially slowing renewable adoption. | Accounted for over 50% of India's installed capacity as of June 2025. |

| Distributed Generation (Rooftop Solar) | Decentralized energy production reducing reliance on grid-scale sources. | Directly competes for customers, especially commercial and industrial, impacting demand for utility-scale projects. | PM Surya Ghar: Muft Bijli Yojana saw over 1 million household registrations by early 2025. |

| Energy Storage (BESS) | Enhances renewable reliability and can substitute for fossil fuel peaking plants. | Increases the viability of renewables but also offers an alternative to traditional dispatchable power. | Global BESS installations projected to exceed 150 GW by mid-2024; lithium-ion battery prices have fallen significantly. |

| Energy Efficiency | Reduces overall electricity demand through technological improvements. | Lowers the need for new generation capacity, including renewables, by decreasing consumption. | IEA reported efficiency measures saved EU's total final energy consumption in 2024. |

Entrants Threaten

The development of utility-scale solar and wind power projects, like those undertaken by Adani Green Energy, demands massive upfront capital for land, equipment, and infrastructure. This high capital intensity naturally deters smaller players, favoring established entities with robust financial backing and access to varied funding streams.

Navigating India's intricate regulatory landscape presents a significant barrier for new entrants in the renewable energy sector. Obtaining essential permits, securing land acquisition approvals, and gaining grid connectivity clearances are complex and time-consuming processes. For instance, in 2023, the average time for obtaining a new power project's environmental clearance in India could extend beyond a year, depending on the project's scale and location.

While the Indian government actively promotes renewable energy, policy shifts and delays in approval processes can discourage less established companies. The necessity of securing long-term Power Purchase Agreements (PPAs) with creditworthy off-takers, often state-owned discoms, adds another layer of complexity. As of early 2024, some discoms have faced financial challenges, impacting their ability to enter into new PPAs, which can deter new, smaller players who lack the negotiating power or financial resilience of established entities like Adani Green Energy.

Establishing large-scale renewable energy projects, like those undertaken by Adani Green Energy, requires significant access to grid infrastructure for power evacuation and vast tracts of land, often in remote locations. New entrants face considerable challenges in securing these essential resources, as existing infrastructure is often at capacity or requires substantial upgrades. For instance, in India, the development of transmission lines for renewable energy projects has been a bottleneck, with reports in 2023 highlighting delays in connecting new solar and wind farms to the national grid.

The difficulty in acquiring suitable land parcels, coupled with the high cost of developing new grid connections, acts as a substantial barrier to entry. New companies must navigate complex land acquisition processes and invest heavily in infrastructure development, which can deter smaller or less capitalized players. This situation makes it difficult for new entrants to rapidly scale their operations and compete effectively with established players who have already secured land and grid access.

Long-term PPA Requirements

The renewable energy sector, particularly for large-scale projects like those undertaken by Adani Green Energy, heavily relies on long-term Power Purchase Agreements (PPAs). These PPAs are crucial for securing financing and ensuring revenue stability. In 2024, the trend continues with governments and large utilities seeking multi-year commitments, often through competitive bidding processes.

New entrants face significant hurdles in securing these long-term PPAs. The competitive bidding process typically favors companies with a demonstrated history of successful project execution and strong financial backing. For instance, Adani Green Energy has consistently won bids for large solar and wind projects, such as its 600 MW solar project in Rajasthan awarded in 2023, highlighting the importance of scale and experience.

- High Barriers to Entry: The necessity of securing long-term PPAs, often through competitive auctions, creates a substantial barrier for new companies.

- Established Track Record Advantage: Proven operational history and financial stability are key differentiators in PPA bidding, favoring incumbents like Adani Green Energy.

- Financing Dependence: Project financing for renewable energy assets is intrinsically linked to the availability of secured PPAs, making it difficult for new players without these agreements.

- Market Concentration: The PPA landscape can lead to market concentration, as only a few players can consistently meet the stringent requirements of these long-term contracts.

Technological Expertise and Scale of Operations

The sheer scale and technological complexity of renewable energy projects, exemplified by Adani Green Energy Limited's (AGEL) ambitious 30 GW Khavda project, present a significant hurdle for new entrants. Developing, executing, and operating such massive undertakings requires highly specialized technical expertise that is not easily acquired.

New players must quickly build or gain access to this deep technical knowledge and achieve a comparable operational scale to compete effectively. Without this, they struggle to match the cost efficiencies and operational capabilities that established companies like AGEL have cultivated, creating a substantial barrier to entry.

- Specialized Expertise: AGEL's Khavda project necessitates advanced skills in areas like grid integration, advanced solar technology, and large-scale project management.

- Economies of Scale: New entrants need to achieve significant scale to drive down per-unit costs, a feat challenging to accomplish rapidly against incumbents.

- Technological Advancement: The industry's rapid technological evolution demands continuous investment and adaptation, a burden for newcomers.

The threat of new entrants in India's renewable energy sector, particularly for large-scale projects like those developed by Adani Green Energy, remains relatively low due to substantial barriers. These include immense capital requirements, the need for specialized technical expertise, and the complexities of securing land and grid connections. Furthermore, the competitive landscape for long-term Power Purchase Agreements (PPAs) favors established players with proven track records and strong financial backing, effectively limiting the entry of smaller or less experienced companies.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Utility-scale projects require billions in upfront investment for land, equipment, and infrastructure. | Deters smaller players; favors financially robust incumbents. |

| Regulatory Hurdles | Complex permitting, land acquisition approvals, and grid connectivity processes can take over a year. | Time-consuming and costly for new entrants unfamiliar with the system. |

| PPA Securitization | Long-term PPAs are crucial for financing, but competitive bidding favors established players with strong financial backing and execution history. | New entrants struggle to secure revenue streams needed for project viability. |

| Infrastructure Access | Securing grid evacuation capacity and suitable land parcels is challenging, with transmission development often a bottleneck. | New entrants face delays and high costs for essential project components. |

| Technical Expertise | Developing and operating large-scale projects requires specialized skills in areas like grid integration and advanced technology. | New entrants must rapidly acquire or access this expertise to compete on cost and efficiency. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Adani Green Energy is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and filings with regulatory bodies like the SEC. We also incorporate insights from reputable industry research firms and financial news outlets to capture market dynamics and competitive pressures.