Adani Green Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Green Energy Bundle

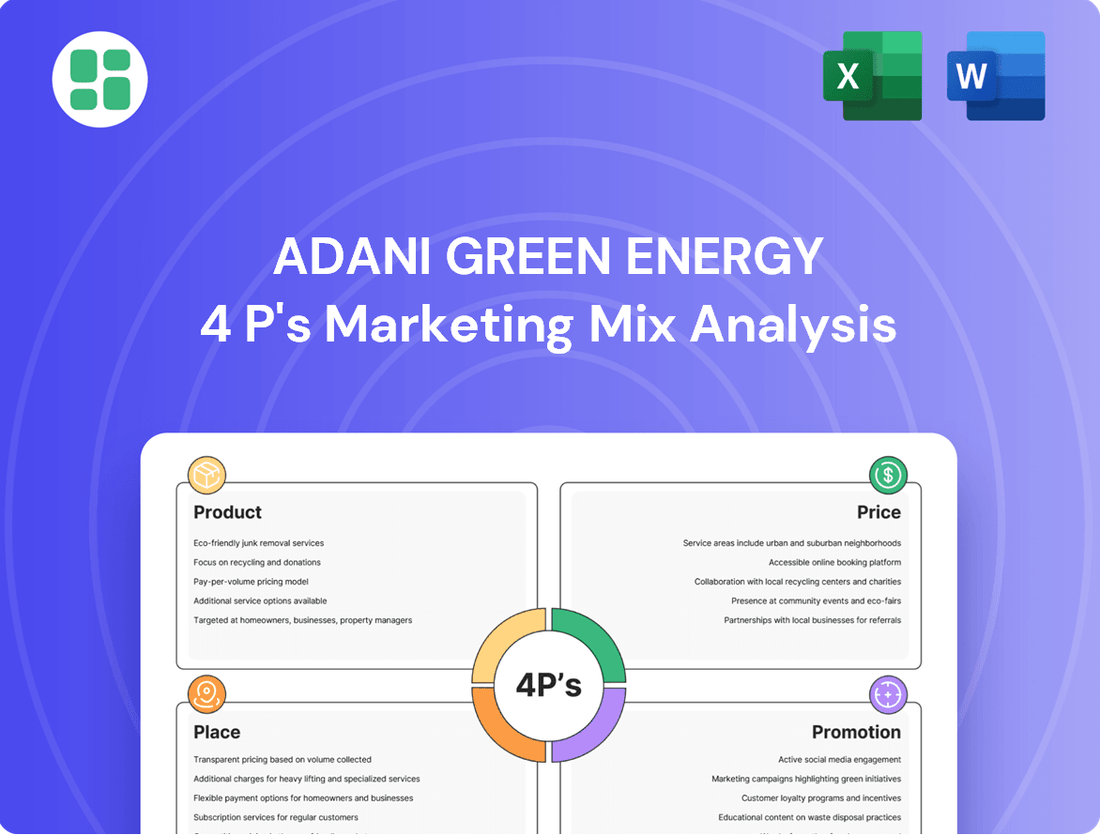

Adani Green Energy strategically leverages its diverse renewable energy portfolio, competitive pricing models, expansive project deployment, and impactful sustainability messaging to drive market leadership. This 4Ps analysis offers a granular look at how these elements coalesce for success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Adani Green Energy's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Adani Green Energy's core offering is the development, construction, and operation of large-scale, grid-connected solar, wind, and hybrid power projects. This encompasses the complete project lifecycle, ensuring reliable renewable energy supply.

The company's product strategy centers on building massive renewable energy facilities. A prime example is the Khavda Renewable Energy Park in Gujarat, which is being developed to be the world's largest single-location renewable energy plant, with a target capacity of 30 GW.

This focus on utility-scale generation allows Adani Green Energy to contribute significantly to India's clean energy transition, providing substantial power output to the national grid. As of March 2024, the company's operational capacity reached 10,976 MW, with a further 2,319 MW under construction.

Long-term Power Purchase Agreements (PPAs) form a cornerstone of Adani Green Energy Limited's (AGEL) product strategy, ensuring predictable revenue and market access for its renewable energy output. These agreements are predominantly with government entities, offering a stable financial foundation.

AGEL's commitment to PPAs is substantial, with agreements like the 1,250 MW energy storage capacity deal with Uttar Pradesh Power Corporation Limited and a significant 5 GW solar agreement with Maharashtra State Electricity Distribution Co. These contracts underscore the company's role in supplying clean energy to critical state power grids.

Adani Green Energy Limited (AGEL) goes beyond simply selling electricity by offering integrated renewable energy solutions. This includes developing hybrid projects that skillfully combine solar and wind power, plus incorporating energy storage systems like pumped hydro. These integrated offerings are crucial for bolstering grid stability and ensuring a more dependable supply of clean energy.

This strategic focus on integration is reflected in AGEL's ambitious target to have at least 5 gigawatts (GW) of energy storage capacity within its portfolio by the year 2030. This commitment underscores their dedication to providing dispatchable and reliable renewable power, a key differentiator in the market.

Advanced Technology Deployment

Adani Green Energy's product, Advanced Technology Deployment, significantly boosts quality by integrating cutting-edge solar and wind technologies. This includes bifacial solar panels and n-type PV modules, which capture more sunlight, alongside horizontal single-axis trackers (HSAT) that optimize panel orientation. These advancements directly contribute to higher energy generation efficiency.

The company also employs larger wind turbines, such as India's largest 5.2 MW turbines, to capture more wind energy. This technological edge is crucial for reducing the Levelized Cost of Electricity (LCOE). For instance, by early 2024, Adani Green had achieved a significant reduction in LCOE across its portfolio due to such technological integrations.

- Bifacial Solar Panels: Increase energy yield by capturing reflected light from the rear side.

- N-type Solar PV Modules: Offer higher efficiency and better performance in low-light conditions compared to traditional p-type modules.

- Horizontal Single-Axis Trackers (HSAT): Allow solar panels to follow the sun's path, boosting energy production by up to 25%.

- Larger Wind Turbines: Such as the 5.2 MW turbines, are designed for higher capacity factors and greater energy capture.

Sustainable and ESG-Compliant Energy

Adani Green Energy Limited's (AGEL) product offering is deeply rooted in sustainability and Environmental, Social, and Governance (ESG) compliance. This commitment is evident in their operational certifications, including being 100% water positive and zero waste to landfill across their entire operational capacity, alongside a ban on single-use plastics. These attributes directly address the growing demand for environmentally responsible energy solutions.

The clean energy produced by AGEL plays a crucial role in reducing carbon emissions, aligning with global and national decarbonization targets. For instance, by the end of fiscal year 2024, AGEL had a total operational renewable capacity of 10,934 MW, significantly contributing to India's clean energy transition and avoiding millions of tonnes of CO2 emissions annually. This focus on sustainability makes AGEL's energy a compelling choice for customers and investors prioritizing environmental stewardship and India's ambitious climate goals.

AGEL's product portfolio, primarily solar and wind power, directly supports India's commitment to achieving 500 GW of non-fossil fuel energy capacity by 2030. Their operational expansion continues to be a key driver in this national objective, with ongoing projects and a robust development pipeline. This strategic alignment ensures their energy product is not only sustainable but also integral to the nation's long-term energy security and environmental strategy.

- 10,934 MW Total operational renewable capacity as of FY24.

- Zero Waste to Landfill Certification across operational capacity.

- 100% Water Positive operational standard.

- Significant CO2 Emission Avoidance annually due to clean energy generation.

Adani Green Energy's product is the delivery of large-scale renewable energy, primarily solar and wind power, backed by long-term Power Purchase Agreements (PPAs). This includes integrated solutions like hybrid projects and energy storage, aiming to provide dispatchable and reliable clean energy. The company leverages advanced technologies such as bifacial solar panels and larger wind turbines to enhance efficiency and reduce costs.

Sustainability is a core product attribute, with AGEL committed to being 100% water positive and zero waste to landfill across its operations. This focus on ESG compliance resonates with the growing demand for environmentally responsible energy. AGEL's product directly supports India's ambitious renewable energy targets, contributing significantly to carbon emission reduction.

| Product Aspect | Description | Key Data/Examples |

|---|---|---|

| Core Offering | Large-scale solar, wind, and hybrid power project development, construction, and operation. | Operational capacity of 10,976 MW as of March 2024; Khavda Renewable Energy Park targeting 30 GW. |

| Integrated Solutions | Hybrid projects combining solar and wind, plus energy storage systems. | Target of 5 GW energy storage capacity by 2030; 1,250 MW energy storage deal with UP Power Corporation Limited. |

| Technology Deployment | Utilizing advanced solar and wind technologies for increased efficiency. | Bifacial solar panels, n-type PV modules, HSAT, and 5.2 MW wind turbines. |

| Sustainability & ESG | Environmentally responsible operations and contribution to decarbonization. | 100% water positive, zero waste to landfill, significant CO2 emission avoidance annually. |

What is included in the product

This analysis delves into Adani Green Energy's marketing mix, examining its diverse renewable energy product portfolio, competitive pricing strategies, strategic global placement of projects, and promotional efforts focused on sustainability and innovation.

Adani Green Energy's 4Ps analysis provides a clear roadmap to address market challenges, offering a structured approach to overcome customer acquisition hurdles and enhance brand perception.

This framework streamlines complex marketing strategies, acting as a readily applicable solution for overcoming competitive pressures and driving sustainable growth.

Place

Adani Green Energy's product, electricity, is distributed via direct connections to India's national and state electricity grids. This strategy focuses on utility-scale projects, which are substantial power generation facilities designed to integrate seamlessly with the primary transmission infrastructure.

By leveraging these grid connections, Adani Green Energy ensures its electricity reaches a wide geographical area, effectively meeting the significant energy needs of diverse regions across India. This approach is crucial for large-scale energy supply, as evidenced by their operational capacity, which reached 10.9 gigawatts (GW) as of March 31, 2024, with a substantial portion of this capacity being operational and grid-connected.

Adani Green Energy Limited (AGEL) primarily distributes its power through direct sales to central and state government entities, along with government-backed corporations. This Business-to-Government (B2G) approach forms the bedrock of its distribution strategy, ensuring a consistent and reliable revenue stream.

These crucial sales are secured via long-term Power Purchase Agreements (PPAs), which lock in prices and demand for AGEL's renewable energy output. For instance, as of March 31, 2024, AGEL had a total operational capacity of 10,934 MW, with a significant portion underpinned by such PPAs with government bodies.

This direct B2G model simplifies the sales cycle considerably compared to the complexities of retail energy distribution, offering predictability and reducing market volatility risks for AGEL.

Adani Green Energy Limited (AGEL) strategically situates its power projects in areas abundant with renewable resources, such as Gujarat, Rajasthan, and Andhra Pradesh. This placement is crucial for optimizing the capture of solar and wind energy, directly impacting generation efficiency and cost-effectiveness.

A prime example of this strategic placement is the Khavda Renewable Energy Park in Gujarat. This massive project, covering an impressive 538 square kilometers, utilizes extensive barren land to facilitate large-scale renewable energy generation, showcasing AGEL's commitment to leveraging prime locations for maximum output.

Expanding Commercial and Industrial (C&I) Segment Reach

Adani Green Energy Limited (AGEL) is actively broadening its market presence by extending its reach into the Commercial and Industrial (C&I) segment. This strategic shift involves moving beyond its traditional focus on government contracts to engage directly with businesses seeking reliable and sustainable energy solutions.

This expansion allows C&I customers to secure clean energy, helping them meet their sustainability goals and reduce their operational carbon footprint. For instance, AGEL's growing portfolio of renewable energy projects, including solar and wind farms, provides a viable alternative to conventional power sources for these businesses.

AGEL's commitment to the C&I sector is underscored by its increasing capacity. By the end of fiscal year 2024, AGEL had operationalized over 10 GW of renewable energy capacity, a significant portion of which can now be leveraged to serve C&I clients directly. This diversification not only strengthens AGEL's revenue streams but also contributes to India's broader renewable energy adoption targets.

- Direct C&I Contracts: AGEL is actively pursuing direct power purchase agreements (PPAs) with industrial and commercial entities.

- Sustainability Goals: This move enables businesses to align with environmental, social, and governance (ESG) mandates and reduce greenhouse gas emissions.

- Capacity Growth: AGEL's operational capacity, exceeding 10 GW by FY24, provides the necessary scale to serve a growing C&I customer base.

- Market Diversification: The strategy reduces reliance on government off-takers and taps into a significant, underserved market segment.

Robust Transmission Infrastructure Planning

Adani Green Energy Limited's (AGEL) strategy hinges on robust transmission infrastructure planning to ensure its renewable energy reaches consumers. This involves meticulous synchronization of grid connectivity and proactive management of potential transmission bottlenecks. AGEL prioritizes securing sites rich in renewable resources, with a clear line of sight on efficient power evacuation pathways.

This strategic site selection is crucial for minimizing delays and maximizing the delivery of generated green energy across the national grid. For instance, AGEL's commitment to integrated planning was evident in its significant capacity additions in the fiscal year ending March 31, 2024. The company reported a total operational capacity of 10.9 GW, with a substantial portion of this growth facilitated by its foresight in transmission planning.

- Grid Integration: AGEL's operational success is directly tied to its ability to integrate its renewable assets seamlessly into the existing transmission network.

- Evacuation Pathways: Securing sites with pre-identified and viable evacuation routes is a cornerstone of their development process.

- Capacity Expansion: By March 2024, AGEL had achieved an operational capacity of 10.9 GW, underscoring the effectiveness of its infrastructure planning in supporting rapid growth.

- Transmission Investment: The company's ongoing investments in transmission infrastructure are vital to support its ambitious renewable energy targets, ensuring power reaches consumers reliably.

Adani Green Energy Limited (AGEL) strategically places its renewable energy projects in resource-rich regions like Gujarat and Rajasthan, optimizing solar and wind energy capture. The Khavda Renewable Energy Park in Gujarat, spanning 538 square kilometers, exemplifies this, utilizing vast barren land for large-scale generation. This focus on prime locations ensures efficient power generation and cost-effectiveness, directly contributing to their operational capacity of 10.9 GW as of March 31, 2024.

| Project Location | Key Benefit | Capacity (as of March 31, 2024) |

| Gujarat (e.g., Khavda) | Abundant solar resources, vast land availability | Significant portion of 10.9 GW operational capacity |

| Rajasthan | High solar irradiation, wind potential | Contributing to overall operational capacity |

| Andhra Pradesh | Favorable solar and wind conditions | Supporting AGEL's renewable energy portfolio |

Full Version Awaits

Adani Green Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Adani Green Energy 4P's Marketing Mix Analysis details Product, Price, Place, and Promotion strategies. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use for your business insights.

Promotion

Adani Green Energy Limited (AGEL) strategically leverages its affiliation with the broader Adani Group, a well-established conglomerate, to cultivate a robust corporate reputation. This association positions AGEL as a prominent and reliable entity within India's rapidly expanding renewable energy landscape.

The company actively highlights its significant achievements to solidify its market leadership. For instance, AGEL's milestone of surpassing 15 gigawatts (GW) of operational renewable energy capacity in early 2024 underscores its dominant position and commitment to growth in the sector.

This consistent delivery of ambitious projects and capacity expansions, such as reaching 20.9 GW of total renewable portfolio capacity as of March 31, 2024, reinforces AGEL's brand as a key player driving India's clean energy transition.

Adani Green Energy Limited (AGEL) strategically leverages partnerships to bolster its market position. Announcements of collaborations with global leaders like TotalEnergies and technology firms such as Google underscore this approach. These alliances are crucial for securing vital capital and elevating AGEL's standing in the international clean energy arena.

These joint ventures are instrumental in accelerating India's transition to renewable energy. For instance, AGEL's partnership with TotalEnergies, a major player in the global energy sector, provides not only financial backing but also technological expertise. This synergy is vital for achieving ambitious growth targets and expanding renewable energy capacity across India.

Adani Green Energy Limited (AGEL) prioritizes transparent communication with stakeholders through consistent media engagement. The company regularly issues press releases detailing operational milestones, such as new project completions, and shares quarterly and annual financial results, ensuring investors and the public are informed about its growth trajectory and financial health.

This proactive approach to public relations, including updates on capacity additions and financial performance, aims to build trust and maintain AGEL's visibility within the renewable energy sector. For instance, AGEL's commitment to expanding its renewable capacity, targeting 45 GW by 2030, is consistently communicated to demonstrate progress towards its sustainability goals.

Investor Relations and Analyst Briefings

Adani Green Energy Limited (AGEL) prioritizes investor relations and analyst briefings as a core promotional strategy, ensuring transparency and accessibility of information for financially literate decision-makers. These engagements, including quarterly earnings calls and detailed investor presentations, are vital for communicating the company's financial health and strategic direction. For instance, AGEL's fiscal year 2024-25 performance, including updates on its renewable energy capacity additions and financial results, are disseminated through these channels.

These platforms are meticulously crafted to provide deep dives into AGEL's operational performance, project pipelines, and financial projections, empowering investors and analysts. The company aims to foster trust and provide the necessary data for informed investment decisions by offering comprehensive annual reports and roadshows.

Key elements of AGEL's promotional efforts in this area include:

- Regular Earnings Calls: Providing real-time financial updates and Q&A sessions.

- Investor Presentations: Detailing strategic initiatives, project progress, and future outlook.

- Annual Reports: Offering comprehensive financial statements and operational reviews.

- Analyst Briefings: Facilitating in-depth discussions on market trends and company performance.

ESG Reporting and Sustainability Advocacy

Adani Green Energy Limited (AGEL) actively promotes its robust commitment to environmental, social, and governance (ESG) principles as a cornerstone of its marketing and stakeholder engagement. This focus on sustainability is not just a statement but is backed by tangible achievements and certifications that resonate with environmentally conscious investors and partners.

AGEL's dedication to sustainable operations is evident through its pursuit and attainment of key certifications. These include being water positive, signifying responsible water management, and achieving zero waste to landfill, demonstrating a commitment to circular economy principles. Such credentials are vital for building trust and credibility in the increasingly sustainability-focused energy sector.

The company’s strong ESG performance is further validated by its high ratings from reputable ESG assessment agencies. For instance, in 2023, AGEL was recognized with a leading ESG score, reflecting its proactive approach to managing environmental impact, social responsibility, and corporate governance. This positions AGEL as a leader in the transition towards a greener energy future.

- Water Positive Certification: AGEL actively manages its water footprint to ensure a net positive impact.

- Zero Waste to Landfill: The company implements strategies to minimize waste and divert it from landfills.

- Top ESG Ratings: AGEL consistently receives high marks from ESG rating agencies, underscoring its commitment.

- Green Energy Transition Leadership: By prioritizing sustainability, AGEL positions itself as a forward-thinking leader in the renewable energy sector.

Adani Green Energy Limited (AGEL) actively promotes its brand through strategic affiliations and consistent communication of achievements, leveraging its position within the Adani Group to build a strong reputation. The company highlights its significant operational milestones, such as surpassing 15 GW of operational capacity in early 2024, to underscore its market leadership and commitment to India's clean energy transition.

Partnerships with global entities like TotalEnergies and technology firms are a key promotional tool, securing capital and enhancing AGEL's international standing. These collaborations, like the one with TotalEnergies, are vital for accelerating renewable energy deployment in India.

AGEL prioritizes transparent communication via regular media engagement, issuing press releases on project completions and financial results to inform stakeholders. This proactive approach, including updates on its target of 45 GW by 2030, aims to build trust and maintain visibility.

Investor relations and analyst briefings are central to AGEL's promotional strategy, offering detailed insights into its performance and strategic direction. These engagements provide the data necessary for informed investment decisions, with fiscal year 2024-25 performance updates being a key focus.

AGEL strongly promotes its commitment to ESG principles, evidenced by certifications like being water positive and achieving zero waste to landfill. These credentials, coupled with high ESG ratings in 2023, position AGEL as a leader in sustainable energy.

| Promotional Element | Key Activities | Impact/Data Point |

|---|---|---|

| Brand Affiliation & Reputation | Leveraging Adani Group's conglomerate status | Positions AGEL as a prominent and reliable entity. |

| Highlighting Achievements | Announcing operational milestones | Surpassed 15 GW operational capacity (early 2024); 20.9 GW total portfolio (March 31, 2024). |

| Strategic Partnerships | Collaborations with global leaders (e.g., TotalEnergies) | Secures capital and technological expertise, accelerating India's green transition. |

| Transparent Communication | Press releases, financial result dissemination | Builds trust and maintains visibility; targets 45 GW by 2030. |

| Investor & Analyst Engagement | Earnings calls, investor presentations | Provides deep dives into performance and projections for informed decisions. |

| ESG Commitment | Water positive, zero waste to landfill, high ESG ratings | Demonstrates leadership in sustainability; recognized with leading ESG score (2023). |

Price

Adani Green Energy Limited (AGEL) anchors its pricing strategy in long-term, fixed-tariff Power Purchase Agreements (PPAs), primarily with government-backed entities. This approach ensures a stable and predictable revenue flow, insulating the company from short-term market volatility.

A significant majority, approximately 92% of AGEL's operational capacity, is secured under these 25-year fixed-tariff PPAs. This long-term commitment provides a robust foundation for financial planning and investor confidence by guaranteeing consistent pricing for its renewable energy generation.

Adani Green Energy Limited (AGEL) frequently secures new project pricing through competitive government tenders. These processes, initiated by state and central electricity distribution companies, determine tariffs for renewable energy supply. AGEL's participation in these bids allows it to win contracts at market-driven rates, reflecting the competitive landscape.

A prime example of this pricing strategy is AGEL's 6,600 MW power supply agreement with the Maharashtra State Electricity Distribution Company Limited. This significant contract was awarded through a competitive bidding process, underscoring AGEL's ability to offer competitive tariffs and secure large-scale projects within India's renewable energy framework.

Adani Green Energy Limited (AGEL) leverages significant cost advantages through its massive scale and technological advancements. The development of the world's largest renewable energy park at Khavda, Gujarat, exemplifies this, allowing AGEL to capture substantial economies of scale in its operations.

This scale, combined with the adoption of cutting-edge technologies such as bifacial solar panels and higher-capacity wind turbines, directly contributes to a lower Levelized Cost of Electricity (LCOE). For instance, AGEL's commitment to efficiency aims to drive down costs, making its renewable energy offerings highly competitive in the market.

Government Regulations and Policy Frameworks

Government regulations and energy policies are pivotal in determining Adani Green Energy's (AGEL) pricing strategies. India's commitment to renewable energy, evidenced by targets like achieving 500 GW of non-fossil fuel energy capacity by 2030, directly impacts AGEL's revenue streams through mandated tariffs and power purchase agreements (PPAs).

The regulatory framework, including mechanisms like competitive bidding for solar and wind power projects, ensures that AGEL's pricing is competitive yet sustainable. For instance, tariffs discovered through auctions for solar projects have seen significant declines, with some bids as low as ₹2.34 per unit in recent years, reflecting policy support and increased efficiency.

- Tariff Determination: AGEL's pricing is largely dictated by tariffs set through government-backed auctions and PPAs, which provide long-term revenue visibility.

- Policy Incentives: Government incentives such as Viability Gap Funding (VGF) and Production Linked Incentives (PLI) for renewable energy manufacturing can indirectly influence AGEL's cost structure and, consequently, its pricing.

- Renewable Energy Targets: National and state-level renewable energy targets create demand for AGEL's power, influencing the pricing power within the PPA negotiations.

- Regulatory Stability: A stable and predictable policy environment, including consistent tariff structures and timely payments by discoms, is crucial for AGEL's financial health and pricing stability.

Merchant Sales and Market Dynamics

While Power Purchase Agreements (PPAs) remain the bedrock of Adani Green Energy Ltd.'s (AGEL) revenue, the company is strategically expanding its footprint in merchant sales and the commercial and industrial (C&I) sectors. This diversification is crucial for capturing opportunities beyond long-term, fixed-tariff contracts.

Merchant sales expose AGEL to the volatility and potential upside of real-time market pricing. This segment's performance is directly influenced by supply and demand dynamics within the power grid and prevailing wholesale electricity rates, offering a variable revenue stream that complements its PPA-backed assets.

For the fiscal year ending March 31, 2024, AGEL's focus on these growth areas is evident in its expanding project pipeline and operational strategies. The company aims to leverage its scale and operational efficiency to compete effectively in these more dynamic market segments.

- Increased Merchant Capacity: AGEL is actively developing projects with a significant portion allocated for merchant sales, aiming to capitalize on favorable market conditions.

- C&I Segment Growth: The company is targeting the C&I sector, offering tailored power solutions that cater to the specific energy needs of industrial and commercial consumers.

- Market Price Sensitivity: Revenue from merchant sales will be more sensitive to fluctuations in wholesale electricity prices, which can be influenced by factors like fuel costs and grid demand.

- Revenue Diversification: This strategic shift aims to reduce reliance on long-term PPAs and create a more balanced revenue profile for AGEL.

Adani Green Energy's pricing strategy is anchored in long-term, fixed-tariff Power Purchase Agreements (PPAs), predominantly with government entities, ensuring revenue stability. The company secures new project pricing through competitive government tenders, reflecting market-driven rates. AGEL's massive scale, exemplified by its Khavda renewable energy park, and adoption of advanced technologies like bifacial solar panels drive down the Levelized Cost of Electricity (LCOE), enhancing its competitive pricing.

| Pricing Strategy Component | Description | Impact on AGEL |

| Long-term Fixed-Tariff PPAs | Secured with government entities for 25 years. | Provides stable revenue, insulating from market volatility. Approximately 92% of operational capacity is under PPAs. |

| Competitive Bidding | Tariffs determined through government tenders. | Ensures market-driven rates; AGEL won a 6,600 MW PPA with Maharashtra State Electricity Distribution Company Limited via this process. |

| Economies of Scale & Technology | World's largest renewable energy park at Khavda, bifacial solar panels, advanced wind turbines. | Lowers LCOE, making AGEL's pricing highly competitive. |

| Merchant Sales & C&I Segment | Expansion into dynamic market segments. | Offers potential upside from real-time market pricing and caters to specific industrial/commercial needs, diversifying revenue. |

4P's Marketing Mix Analysis Data Sources

Our Adani Green Energy 4P's analysis is grounded in comprehensive data from official company filings, investor relations materials, and industry-specific reports. We leverage information on their renewable energy project portfolio, pricing strategies for power purchase agreements, distribution channels through grid connections, and promotional activities highlighting sustainability achievements.