Adani Green Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Green Energy Bundle

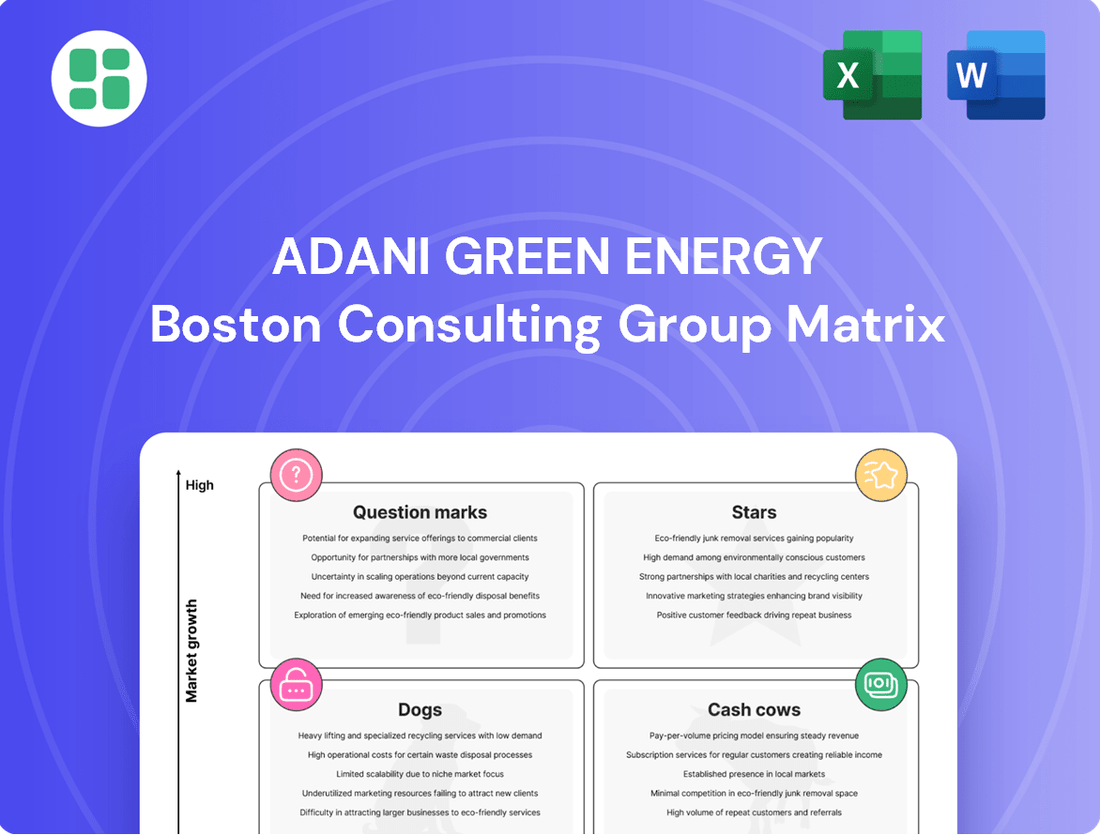

Curious about Adani Green Energy's strategic positioning? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges, offering a foundational understanding of their portfolio's market share and growth rate.

Unlock the full potential of this analysis by purchasing the complete Adani Green Energy BCG Matrix. Gain a comprehensive view of their "Stars," "Cash Cows," "Dogs," and "Question Marks," empowering you with actionable insights for informed investment decisions and strategic planning.

Don't miss out on the detailed quadrant breakdowns and expert recommendations. Secure your copy of the full BCG Matrix today and navigate the renewable energy landscape with confidence and clarity.

Stars

Adani Green Energy Limited (AGEL) has aggressively pursued capacity expansion, adding a remarkable 3.3 GW of greenfield renewable energy capacity in fiscal year 2025. This achievement represents the highest annual addition by any renewable energy company in India, underscoring AGEL's dominant position in a rapidly growing market.

This substantial growth solidifies AGEL's role as a market leader, demonstrating its commitment to executing its strategic plan to significantly expand its operational renewable energy portfolio.

The Khavda Renewable Energy Park, slated for 30 GW capacity, solidifies Adani Green Energy Limited's (AGEL) position as a frontrunner in large-scale green energy. By June 2025, AGEL anticipates having over 5 GW operational at this single site, showcasing the sheer scale of this ambitious venture in a booming industry.

This project is a prime example of a "cash cow" within AGEL's portfolio, demanding substantial investment but promising significant future returns. Its development reflects a high market share in the rapidly growing renewable energy sector, underscoring AGEL's strategic capital deployment.

Adani Green Energy Limited (AGEL) commands a significant position in India's renewable energy landscape, particularly in utility-scale solar and wind projects. In fiscal year 2025, AGEL accounted for 16% of the country's utility-scale solar capacity additions and 14% of its wind energy additions. This robust market share in a rapidly expanding sector underscores its status as a market leader.

Strategic Partnerships with Global Giants

Adani Green Energy Limited (AGEL) actively pursues strategic joint ventures to fuel its expansion. A prime example is its partnership with TotalEnergies, which has seen the development of 1,150 MW of solar projects. This collaboration is crucial for AGEL's growth trajectory.

Further strengthening its market position, AGEL is also working with Google on new hybrid renewable energy facilities. These alliances are vital for AGEL, as they bring in substantial capital and cutting-edge technological expertise, accelerating the development of projects in rapidly expanding renewable energy sectors.

These strategic collaborations are instrumental in AGEL's ability to scale its operations efficiently and secure a larger share of the burgeoning renewable energy market.

- Joint Venture with TotalEnergies: Development of 1,150 MW solar projects.

- Collaboration with Google: Focus on new hybrid renewable energy facilities.

- Benefits of Partnerships: Access to significant investment and advanced expertise.

- Strategic Importance: Accelerates project development and market share capture.

Ambitious 2030 Capacity Targets

Ambitious 2030 Capacity Targets

Adani Green Energy Limited (AGEL) has set a bold goal of reaching 50 gigawatts (GW) of renewable energy capacity by 2030. This aggressive target underscores AGEL's strategic focus on rapid expansion within India's booming renewable energy sector. The company's ability to secure project sites and manage capital effectively positions it to maintain its leadership in the industry.

This expansion is not just aspirational; it is underpinned by a clear execution strategy. AGEL's ongoing project development is designed to transform current investments into predictable and stable revenue streams in the coming years. For instance, as of early 2024, AGEL had already operationalized over 8.4 GW of renewable capacity, with a further 21.8 GW under construction or committed.

- Target: 50 GW renewable energy capacity by 2030.

- Current Operational Capacity (early 2024): Over 8.4 GW.

- Under Construction/Committed Capacity (early 2024): 21.8 GW.

- Strategic Advantage: Secured sites and robust capital management for sustained high growth.

Adani Green Energy Limited (AGEL) is strategically positioned as a "Star" in the BCG matrix due to its significant market share and high growth prospects in the renewable energy sector. By June 2025, over 5 GW is expected to be operational at the Khavda Renewable Energy Park alone, a testament to its large-scale project execution. AGEL's aggressive expansion, adding 3.3 GW in FY25, the highest in India, further solidifies its leading position in a rapidly expanding market, demanding continued investment for sustained high growth.

| Metric | Value (as of early 2024/FY25 projections) | Significance |

|---|---|---|

| FY25 Greenfield Capacity Addition | 3.3 GW | Highest annual addition by any Indian renewable energy company. |

| Khavda Project Operational Capacity (by June 2025) | > 5 GW | Demonstrates massive scale and future potential. |

| Utility-Scale Solar Market Share (FY25 additions) | 16% | Indicates strong leadership in a key segment. |

| Utility-Scale Wind Market Share (FY25 additions) | 14% | Highlights broad-based strength across renewable technologies. |

What is included in the product

Adani Green Energy's BCG Matrix would analyze its solar, wind, and hybrid projects, identifying Stars for growth, Cash Cows for stability, Question Marks for potential, and Dogs for divestment.

The Adani Green Energy BCG Matrix offers a clear, one-page overview, relieving the pain of understanding complex business unit performance.

Its export-ready design for PowerPoint simplifies sharing, alleviating the burden of manual chart creation.

Cash Cows

Adani Green Energy Limited's (AGEL) extensive long-term Power Purchase Agreements (PPAs) are a cornerstone of its Cash Cow status within the BCG matrix. Approximately 92% of its operational portfolio is secured by these 25-year, fixed-tariff contracts with government entities, ensuring predictable and stable revenue streams.

This high percentage of secured PPAs significantly de-risks AGEL's revenue generation by minimizing market price volatility and guaranteeing a consistent off-take for its power output. The long-term nature of these agreements provides a robust financial foundation, allowing for reliable cash flow generation.

Adani Green Energy Limited (AGEL) firmly sits in the Cash Cows quadrant of the BCG Matrix, evidenced by its impressive operational capacity and high profitability. By June 2025, AGEL is projected to have an operational capacity surpassing 15 GW, a testament to its established and mature asset base that reliably generates substantial cash flow.

The company's financial performance in FY25 underscores this strength, featuring an exceptional EBITDA margin of 91.7%, which is industry-leading. This robust margin, coupled with a significant increase in cash profit, highlights the efficiency and strong cash-generating ability of its existing renewable energy projects.

These mature projects, requiring minimal incremental investment for continued operation and market presence, are the engine driving AGEL's cash flow. The substantial returns they yield allow AGEL to fund its growth initiatives and other business ventures, solidifying its position as a cash cow within the renewable energy sector.

Adani Green Energy Limited's (AGEL) operational portfolio, which functions as its Cash Cows, demonstrated robust performance in FY25. Energy sales surged by 28% year-on-year, reaching 27,969 million units. This significant increase in energy generation directly translated into a 23% rise in revenue from power supply, underscoring the consistent income-generating capability of these established assets.

The company's ability to achieve such growth from its existing, operational assets highlights their maturity and efficiency. This consistent revenue stream from a stable market environment ensures reliable cash conversion, a hallmark of a strong Cash Cow within the BCG matrix framework.

High Plant Availability and Operational Efficiency

Adani Green Energy's operational performance is a key strength, positioning its solar and wind assets as strong cash cows. In FY25, solar plants demonstrated an impressive 99.5% availability, while wind assets achieved 95.9% availability. This high uptime directly translates into consistent and maximized energy generation, underpinning robust cash flow.

This operational efficiency is crucial for maintaining high profit margins within the company's established renewable energy portfolio. The focus on keeping plants running at peak performance ensures that the capital invested in these assets yields optimal returns.

- Solar Asset Availability (FY25): 99.5%

- Wind Asset Availability (FY25): 95.9%

- Impact: Maximized energy generation and consistent cash flow.

- Strategic Benefit: Supports high profit margins from existing infrastructure.

Diversified and De-risked Operational Portfolio

Adani Green Energy's diversified and de-risked operational portfolio, primarily consisting of solar, wind, and hybrid projects across India, acts as a significant cash cow. This strategic mix ensures stable electricity generation even with varying weather conditions, mitigating risks associated with single-source dependency. The company's commitment to long-term Power Purchase Agreements (PPAs) further solidifies its revenue streams from these established, mature assets.

The operational strength of these assets is evident in their consistent performance. For instance, as of March 31, 2024, Adani Green Energy's operational portfolio had a total generation capacity of 8,354 MW, with a substantial portion coming from its solar and wind farms. This robust operational base, supported by long-term contracts, guarantees predictable cash flows, allowing the company to maintain healthy profit margins.

- Diversified Energy Sources: The portfolio includes a balanced mix of solar, wind, and hybrid projects, reducing reliance on any single technology and ensuring consistent power output.

- Geographic Spread: Operations are spread across various Indian states, minimizing the impact of localized weather events or regulatory changes.

- Long-Term PPAs: The majority of the operational capacity is secured under long-term PPAs, providing predictable revenue streams and a stable cash generation engine.

- Mature Market Segment: These established assets operate in a mature market segment, allowing for high operational efficiency and consistent profit margins, reinforcing their cash cow status.

Adani Green Energy Limited's (AGEL) operational portfolio serves as its primary cash cow, characterized by high asset utilization and predictable revenue streams. The company's commitment to long-term Power Purchase Agreements (PPAs), covering approximately 92% of its operational capacity, ensures stable income regardless of market fluctuations.

This strong foundation is further bolstered by exceptional operational efficiency, with solar assets achieving 99.5% availability and wind assets reaching 95.9% in FY25. Such high uptime directly translates into maximized energy generation and, consequently, robust and consistent cash flow, a hallmark of a mature cash cow.

AGEL's EBITDA margin of 91.7% in FY25 highlights the profitability of these established assets, which require minimal incremental investment for continued operation. This allows AGEL to leverage these cash cows to fund its expansion into new growth areas.

| Metric | FY25 Data | Significance for Cash Cow Status |

| Operational Capacity (Projected by June 2025) | 15 GW+ | Indicates a large, established asset base generating significant cash. |

| EBITDA Margin (FY25) | 91.7% | Demonstrates high profitability and efficiency of existing operations. |

| Solar Asset Availability (FY25) | 99.5% | Ensures consistent and maximized energy generation from solar assets. |

| Wind Asset Availability (FY25) | 95.9% | Guarantees reliable energy output from wind assets. |

| Energy Sales Growth (YoY) | 28% | Shows strong demand and off-take for power from operational assets. |

Delivered as Shown

Adani Green Energy BCG Matrix

The Adani Green Energy BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase, containing no watermarks or demo content. This comprehensive analysis is ready for immediate strategic application, offering a clear, professional breakdown of Adani Green Energy's business units. You can confidently use this preview as a direct representation of the complete, editable document that will be delivered to you instantly after your transaction.

Dogs

Adani Green Energy's experience with the proposed wind power project in Sri Lanka, which was withdrawn due to financial non-viability and environmental opposition, clearly illustrates a 'Dog' in the BCG matrix. This project, like other 'Dogs', consumed valuable initial resources and management focus but ultimately could not be brought to fruition or was exited because it became unfeasible.

Such ventures tie up capital without delivering the anticipated returns, impacting the company's overall resource allocation and profitability. For instance, Adani Green Energy's withdrawal from the 250 MW wind power project in Mannar, Sri Lanka, in late 2023, highlighted these challenges. The project faced significant hurdles, including financial viability concerns and local environmental objections, leading to its discontinuation.

Adani Green Energy Limited (AGEL) has encountered significant headwinds with certain renewable energy projects facing protracted delays stemming from regulatory approvals and crucial transmission infrastructure limitations. These stalled projects, including those in the pipeline for 2024, represent a considerable risk, potentially becoming cash traps that drain capital without generating any operational revenue.

When projects are stranded due to these persistent bottlenecks, they tie up valuable financial resources that could otherwise be deployed in more productive ventures. This situation necessitates a critical re-evaluation of their viability, with divestiture becoming a strong consideration if the delays are deemed insurmountable and permanent.

Small, non-strategic legacy assets within Adani Green Energy Limited (AGEL) might include older, smaller-capacity solar or wind farms that are no longer central to the company's giga-scale expansion plans. These assets, while contributing to overall generation, may not offer the same economies of scale or strategic market positioning as newer, larger projects. For instance, if AGEL has a portfolio of 50 MW solar farms from its early days, these could be considered legacy if the current focus is on 500 MW or 1 GW projects.

Such assets could potentially drain resources if their operational and maintenance (O&M) costs are disproportionately high compared to their power output and market value. For example, older technology might require more frequent repairs or specialized parts, increasing O&M expenses. If a 50 MW plant has O&M costs equivalent to a much larger, more efficient plant, its profitability would be significantly lower, making it a candidate for divestment or strategic review.

Underperforming Operational Sites

Underperforming Operational Sites in Adani Green Energy's portfolio, when analyzed through a BCG matrix lens, would fall into the 'Dogs' category. These are typically operational sites that consistently struggle with lower-than-expected Capacity Utilization Factors (CUF) or incur higher operational expenditures due to persistent local challenges. For instance, certain solar projects in regions with less consistent sunlight or wind farms facing unexpected maintenance issues could fit this description.

These sites, while operational, may only manage to break even or generate very marginal profits. This situation ties up valuable capital and management attention that could be strategically redeployed to higher-growth or more profitable segments of the company's renewable energy assets. Identifying and addressing these underperformers is crucial for optimizing the overall portfolio's financial health and strategic direction.

- Underperforming Solar Asset Example: A hypothetical solar farm in a region experiencing prolonged periods of cloud cover, leading to a CUF of 18% compared to a portfolio average of 23% in 2024.

- High Opex Challenge: A wind power site facing recurring gearbox failures in 2024, resulting in operational expenditures 15% above the average for similar assets.

- Capital Tie-up: Such underperforming assets may represent a significant portion of capital invested, diverting funds from expansion in high-potential areas.

Investments in Niche, Non-Scalable Technologies

Adani Green Energy Limited (AGEL) might consider minor investments in niche, non-scalable renewable technologies as potential 'Question Marks' within a BCG matrix framework. These could include highly specialized solar applications or micro-grid solutions for remote areas that don't align with AGEL's primary utility-scale solar and wind projects. Such ventures often have limited market share and restricted growth potential due to their inherent lack of scalability and minimal synergy with AGEL's core business model.

For instance, AGEL could explore investments in advanced geothermal technologies or small-scale biomass projects in specific regions. While these might not offer the massive growth characteristic of AGEL's utility-scale assets, they could provide diversification and learning opportunities. In 2023, the global geothermal energy market was valued at approximately $3.5 billion, with a compound annual growth rate projected at 4.5% through 2030, indicating a niche but growing sector.

- Niche Technology Investments: Small-scale distributed generation projects or specialized renewable tech.

- BCG Matrix Classification: These would likely fall under 'Question Marks' due to low scalability and market share.

- Strategic Rationale: Potential for diversification and technological learning, despite limited synergy with core business.

- Market Context: Niche markets like geothermal show modest but steady growth, e.g., a $3.5 billion market in 2023.

Underperforming operational sites within Adani Green Energy's portfolio, characterized by low Capacity Utilization Factors (CUF) or high operational expenditures, would be classified as 'Dogs'. These assets, while operational, may barely break even, tying up capital and management focus. For example, a solar farm with a CUF of 18% in 2024, significantly below the portfolio average, would represent a 'Dog'. Similarly, wind sites with recurring maintenance issues, leading to operational costs 15% higher than comparable assets in 2024, also fall into this category. These situations necessitate a strategic review, often leading to divestment to free up resources for more promising ventures.

| Asset Type | Example Scenario | BCG Classification | Financial Impact |

| Solar Farm | Low CUF (18% in 2024) due to regional weather patterns | Dog | Ties up capital, low profitability |

| Wind Farm | High Opex (15% above average in 2024) due to frequent mechanical failures | Dog | Drains resources, detracts from strategic growth |

| Legacy Project | Small-scale, older technology assets with high maintenance costs | Dog | Limited economies of scale, potential cash drain |

Question Marks

Adani Green Energy Limited (AGEL) is actively exploring new energy storage solutions beyond its established pumped hydro capacity. While pumped hydro remains a cornerstone, the company's foray into advanced battery storage, including technologies like lithium-ion and potentially future solid-state batteries, falls into the 'Question Mark' category of the BCG matrix.

These emerging storage technologies offer significant growth potential in the renewable energy sector, driven by increasing demand for grid stability and integration of intermittent solar and wind power. For instance, global investment in battery storage is projected to reach hundreds of billions of dollars by the end of the decade, highlighting the market's expansion. AGEL's current market share in these nascent battery storage segments is relatively low, necessitating considerable investment to scale operations and demonstrate technological and economic viability.

AGEL's strategic investments in these areas are crucial for future market leadership. The company's commitment to innovation in storage solutions, such as its participation in hybrid projects that combine solar, wind, and battery storage, signals a proactive approach. For example, AGEL has secured contracts for hybrid projects that include significant battery storage components, aiming to provide round-the-clock renewable power. These ventures require substantial capital expenditure to develop and optimize, with the expectation of high returns if successful in capturing market share.

Adani Green Energy Limited's (AGEL) foray into green hydrogen production aligns perfectly with the Question Mark category in the BCG matrix. The Adani Group has announced plans to invest a substantial $70 billion in the green hydrogen ecosystem, signaling a strong belief in the sector's future potential. This ambitious venture taps into a high-growth market, but AGEL's current market share is minimal, reflecting its nascent position.

The capital-intensive nature of green hydrogen production, coupled with ongoing research and development, presents significant upfront costs and uncertain immediate returns. This characteristic is a hallmark of Question Marks, which require careful strategic management to potentially evolve into Stars. For instance, AGEL aims to develop 45 gigawatts (GW) of renewable energy capacity by 2030, a crucial step to power its green hydrogen ambitions, underscoring the long-term investment horizon.

Adani Green Energy Limited (AGEL) is strategically expanding its focus into the commercial and industrial (C&I) and merchant renewable energy segments, recognizing these as high-growth areas. While AGEL is a dominant force in utility-scale projects, its presence in the C&I sector is currently smaller, necessitating increased marketing efforts and investment to gain significant market share.

This C&I segment offers substantial growth potential, but it also comes with demanding customer requirements and a more fragmented market structure compared to utility-scale projects. AGEL's expansion here aligns with its broader strategy to diversify its renewable energy portfolio and tap into new revenue streams, aiming to capture a larger slice of this lucrative market.

New International Market Entries

New international market entries for Adani Green Energy Limited (AGEL) would be classified as question marks in the BCG matrix. These are markets where AGEL has minimal presence but sees significant future growth potential in renewable energy. For instance, exploring opportunities in emerging markets in Africa or Southeast Asia, where renewable energy adoption is accelerating, fits this category.

These ventures require careful strategic planning and substantial capital investment to build brand recognition, establish infrastructure, and navigate local regulatory landscapes. The high growth potential is balanced by the uncertainty of market acceptance and the intense competition from established players.

- High Growth Potential: Markets with strong government support for renewables and increasing energy demand.

- Low Market Share: AGEL's current limited footprint in these new territories.

- Significant Investment Required: Capital needed for market development, project execution, and operational setup.

- Risk of Failure: Uncertainty in market penetration and competitive response.

Pilot Projects for Advanced Technologies and AI Integration

Adani Green Energy Limited (AGEL) is exploring pilot projects for advanced technologies, including next-generation solar modules and AI-driven operational enhancements. These initiatives are crucial for maintaining a competitive edge in the rapidly evolving renewable energy sector.

AGEL's investments in pilot projects for cutting-edge technologies like advanced solar modules, such as bifacial n-type panels, and robotic installation are a strategic move. Furthermore, the deep integration of Artificial Intelligence (AI) and Machine Learning (ML) for performance optimization is a key focus. These technologies, while holding the promise of substantial future returns and enhanced efficiency, currently represent a low market share or limited widespread application within AGEL's existing portfolio. This necessitates significant investment in research and development (R&D) alongside capital for deployment.

- Focus on Bifacial N-Type Solar Modules: These modules capture sunlight from both sides, potentially increasing energy yield by up to 20% compared to traditional monofacial panels.

- Robotic Installation: Automating the installation process can reduce labor costs and improve project timelines, especially for large-scale solar farms.

- AI/ML for Performance Optimization: Predictive maintenance, energy forecasting, and grid integration are areas where AI/ML can significantly boost operational efficiency and output.

- Strategic R&D Investment: AGEL's commitment to R&D in these nascent technologies positions them for future market leadership, despite the current high capital expenditure and unproven widespread scalability.

Adani Green Energy's ventures into advanced battery storage, green hydrogen, C&I and merchant energy, new international markets, and cutting-edge solar technologies all represent significant question marks on the BCG matrix. These initiatives are characterized by high growth potential and substantial required investment, but currently hold a low market share for AGEL.

The company is navigating these areas with considerable capital expenditure and a focus on R&D, aiming to establish a strong future market position. For instance, AGEL's green hydrogen ambitions are backed by a $70 billion investment plan, highlighting the scale of commitment required for these nascent sectors.

The success of these question mark initiatives hinges on AGEL's ability to scale operations, prove technological and economic viability, and effectively penetrate new markets, potentially transforming them into future stars.

| AGEL Question Mark Initiatives | Growth Potential | Current Market Share | Investment Requirement | Strategic Rationale |

|---|---|---|---|---|

| Advanced Battery Storage | High (Grid stability, renewables integration) | Low | Significant (R&D, scaling) | Enhance renewable energy integration |

| Green Hydrogen Production | Very High (Decarbonization, energy transition) | Minimal | Substantial ($70 billion planned investment) | Future energy carrier, decarbonization |

| C&I and Merchant Energy | High (Diversification, new revenue streams) | Moderate/Low (compared to utility-scale) | Moderate (Marketing, project development) | Portfolio diversification, new customer segments |

| New International Markets | High (Emerging renewable demand) | Negligible | High (Market entry, infrastructure) | Geographic expansion, market capture |

| Advanced Solar Tech (e.g., Bifacial N-Type) | High (Efficiency gains, cost reduction) | Low (Pilot/early stage) | Moderate (R&D, initial deployment) | Technological leadership, operational efficiency |

BCG Matrix Data Sources

Our Adani Green Energy BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on renewable energy trends, and official government policies.