Acomo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

Acomo's market position is strong, leveraging its established brand and extensive distribution network. However, understanding the full scope of its competitive landscape and potential regulatory challenges is crucial for future growth.

Want the full story behind Acomo’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Acomo's strength lies in its highly diversified global product portfolio, encompassing a wide range of agricultural commodities and food ingredients. This includes key items like tea, coffee, spices, edible nuts, and cocoa, which are essential components for many food and beverage manufacturers.

This extensive product offering significantly reduces Acomo's dependence on any single commodity. For instance, during 2024, while coffee prices saw volatility due to weather events in Brazil, Acomo's robust presence in tea and spices helped to stabilize overall revenue streams, demonstrating the benefit of its broad diversification strategy.

The company's comprehensive product range allows it to cater to a vast array of customer needs across different segments of the food and beverage industry. This broad market reach enhances Acomo's resilience, enabling it to weather sector-specific downturns and capitalize on growth opportunities in multiple areas simultaneously.

Acomo has showcased impressive financial momentum. In the first half of 2025, sales climbed 14% to €758 million, while adjusted EBITDA saw a significant jump of 85% to €67.9 million when compared to the same period in 2024. This robust performance highlights the company's ability to capitalize on market opportunities and manage its operations effectively.

Further underscoring this strength, Acomo reported a 16% sales increase in the first quarter of 2025. This growth was largely propelled by the strong performance of its Organic Ingredients and Spices & Nuts segments, demonstrating solid demand for its core product offerings and strategic focus areas.

Acomo's strength lies in its deeply entrenched global supply chain and logistics expertise, connecting agricultural producers with consumers across continents. This robust network, spanning multiple continents, ensures efficient sourcing and distribution, a critical advantage in navigating the complexities of international commodity markets. For instance, in 2023, Acomo managed a significant volume of global trade, demonstrating their capacity to maintain reliability even during periods of geopolitical or environmental uncertainty.

Proven Ability to Navigate Market Volatility

Acomo demonstrates a robust capacity for managing market turbulence, a critical strength in the agricultural commodity sector. The company's performance in the latter half of 2024, a period marked by persistent high inflation and significant supply chain disruptions, underscores this ability. This resilience ensures stability and reliability for both its suppliers and customers, a valuable proposition in uncertain economic climates.

This proven track record translates into a significant competitive advantage. For instance, Acomo's ability to maintain consistent operations and pricing during the volatile 2024 period, where many competitors struggled, solidified its market position. This stability is not just about weathering storms; it's about building trust and ensuring continuity of business, which is paramount for long-term relationships in the industry.

- Proven Resilience: Successfully navigated high inflation and supply chain issues in H2 2024.

- Supplier & Customer Stability: Offers reliability in dynamic market conditions.

- Competitive Edge: Demonstrates a significant advantage in the volatile agricultural commodity sector.

- Market Trust: Builds confidence through consistent operations and dependable service.

Strategic Focus on Sustainable and Plant-Based Foods

Acomo's strategic focus on sustainable and plant-based food ingredients is a significant strength, directly addressing the escalating global consumer demand for healthier and environmentally conscious food choices. This alignment with market trends is crucial for long-term growth.

The company's mission, "building routes to healthier foods," clearly articulates its dedication to this expanding sector. This mission acts as a guiding principle, ensuring that Acomo's operations and development efforts are consistently directed towards meeting the needs of this evolving market.

This deliberate focus on sustainability and plant-based products positions Acomo advantageously to capitalize on future market opportunities. As consumer preferences continue to shift towards these categories, Acomo is well-prepared to capture market share and drive revenue growth.

- Alignment with Market Trends: Acomo is a diversified, plant-based food ingredients group, aligning with the increasing global demand for healthier and sustainable food options.

- Clear Mission Statement: The company's mission, 'building routes to healthier foods,' underscores its commitment to this growing market segment.

- Future Growth Potential: This strategic focus on sustainability and plant-based products positions Acomo well to capture future market opportunities driven by evolving consumer preferences.

Acomo's financial performance in the first half of 2025 demonstrates considerable strength, with sales increasing by 14% to €758 million and adjusted EBITDA rising by 85% to €67.9 million compared to the first half of 2024. This upward trajectory continued into the first quarter of 2025, with a 16% sales increase driven by strong performance in its Organic Ingredients and Spices & Nuts segments.

| Financial Metric | H1 2024 | H1 2025 | % Change |

|---|---|---|---|

| Sales | €665 million | €758 million | +14% |

| Adjusted EBITDA | €36.7 million | €67.9 million | +85% |

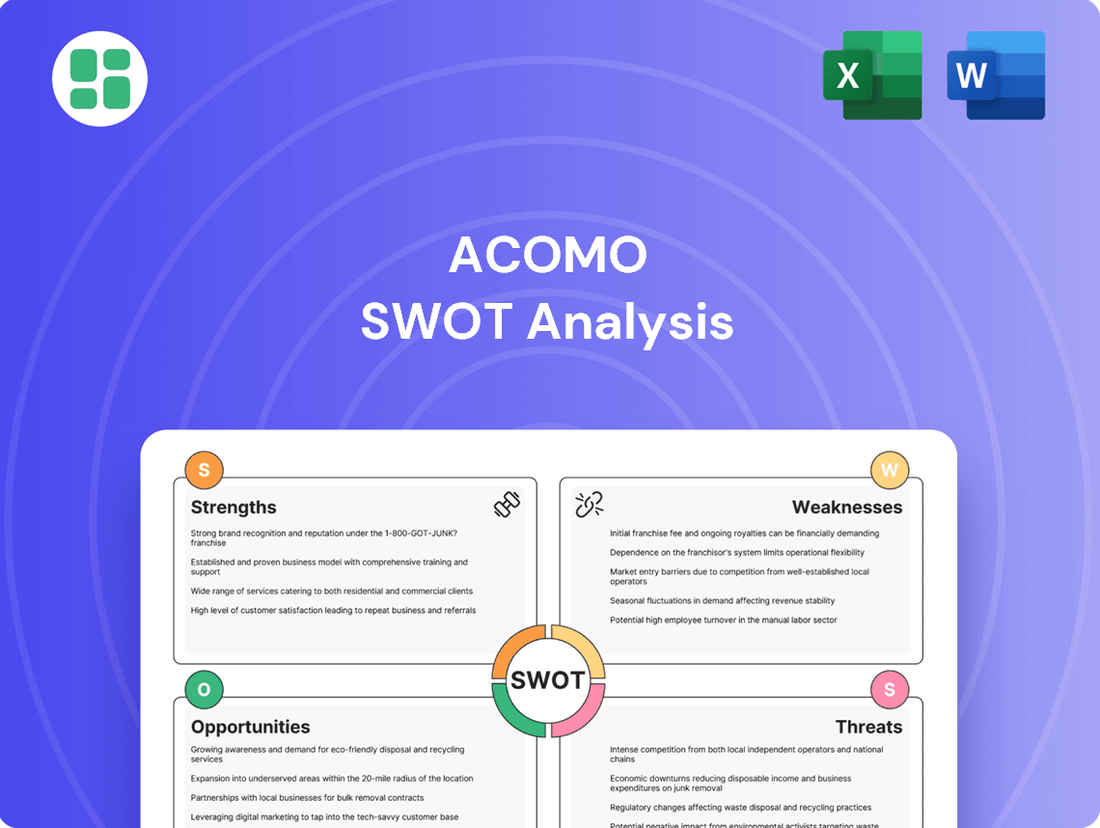

What is included in the product

Analyzes Acomo’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities.

Weaknesses

Acomo's core business, which involves agricultural commodities like cocoa, spices, and edible seeds, means it's directly impacted by swings in global market prices. This exposure creates a degree of unpredictability in its earnings and overall financial performance.

While Acomo managed to navigate some of this volatility, with segments like cocoa showing resilience and contributing positively to H1 2025 results, other areas faced headwinds. For instance, the Edible Seeds division felt the pinch from margin pressure and the uncertainty surrounding US tariffs, highlighting the uneven impact of commodity price fluctuations across its portfolio.

Acomo's reliance on a vast global network exposes it to significant risks from fluctuating trade policies and geopolitical instability. For instance, ongoing trade disputes, such as those involving major economies in 2024, can introduce uncertainty regarding import tariffs, directly impacting Acomo's cost structures and market access.

The company's international footprint means that macroeconomic shifts and trade wars, which are largely outside of its direct influence, can create a volatile trading environment. These external pressures can disrupt established supply chains, potentially leading to increased operational costs and reduced profitability for Acomo.

Acomo navigates a highly competitive environment across its food ingredients and agricultural commodity segments. While Q1 2025 sales demonstrated robust growth, exceeding broader industry averages in certain categories, the company's earnings per share (EPS) growth has not kept pace with the sector's average. This disparity suggests that aggressive competition is a significant factor, potentially impacting profitability and market positioning.

Vulnerability to Supply Chain Disruptions

Acomo's extensive global agricultural supply chain is inherently vulnerable to disruptions. Challenges like fragmented data, complex regulatory landscapes, and logistical hurdles can create significant bottlenecks. For instance, in 2024, persistent port congestion in key shipping regions led to an average of 15% increase in transit times for certain agricultural commodities, impacting delivery schedules and increasing storage costs for businesses like Acomo.

As a global operator, Acomo faces heightened risks from these supply chain vulnerabilities. Such disruptions can translate directly into elevated operational costs, significant delays in product delivery, and a greater potential for food waste, impacting both profitability and sustainability efforts. For example, a severe drought in a major coffee-producing region in early 2025, coupled with existing shipping container shortages, could see the cost of sourcing specific beans rise by as much as 20% for Acomo.

Furthermore, the escalating impact of climate change and the increasing frequency of extreme weather events present a substantial and growing threat to agricultural production and the overall stability of the supply chain. Events such as unseasonal frosts or prolonged heatwaves can decimate crop yields, directly affecting the availability and price of raw materials Acomo relies upon. The World Meteorological Organization reported in late 2024 that the number of climate-related disasters had increased by 35% since 2015, a trend that directly translates to increased volatility for agricultural supply chains.

- Data Fragmentation: Inconsistent data across different stages of the supply chain can hinder efficient tracking and management.

- Logistical Bottlenecks: Port congestion and transportation capacity issues can cause significant delays and increase costs.

- Climate Change Impact: Extreme weather events directly threaten crop yields and supply chain reliability.

Performance Discrepancies Across Segments

Acomo's performance in the first quarter of 2025 highlighted significant discrepancies across its various business segments. While areas like Organic Ingredients and Spices & Nuts demonstrated robust growth, the Tea segment unfortunately saw a decline in sales. This unevenness points to specific challenges impacting certain parts of Acomo's portfolio, possibly due to market conditions or competitive pressures.

These performance variations necessitate a closer look at the underlying causes for each segment. For instance, the struggles in the Tea market in Q1 2025, as reported, indicate a need for tailored strategies to address those particular headwinds. Effectively managing these differences is crucial for maintaining and improving overall group profitability.

- Uneven Segment Growth: Organic Ingredients and Spices & Nuts performed well in Q1 2025, contrasting with a sales decline in the Tea segment.

- Market Pressures: The sales dip in Tea suggests that specific market conditions or competitive dynamics are impacting this segment.

- Strategic Focus Needed: Addressing these performance gaps requires targeted strategies to ensure balanced growth and profitability across Acomo's diverse offerings.

Acomo's dependence on commodity markets exposes it to significant price volatility, directly impacting earnings. For example, while cocoa performed well in H1 2025, edible seeds faced margin pressure and tariff uncertainties, showcasing uneven segment performance. This inherent price risk, coupled with geopolitical factors and trade policy shifts, creates an unpredictable operating environment.

The company's extensive global supply chain, while a strength, is also a vulnerability. Fragmented data, regulatory complexities, and logistical bottlenecks, such as the 15% increase in transit times seen in 2024 for some agricultural goods due to port congestion, can lead to increased costs and delivery delays. Furthermore, climate change and extreme weather events, with climate-related disasters up 35% since 2015 according to the WMO, pose a growing threat to crop yields and supply chain stability.

Acomo also faces challenges with uneven segment performance. While Q1 2025 saw strong growth in Organic Ingredients and Spices & Nuts, the Tea segment experienced a sales decline, indicating specific market pressures or competitive dynamics affecting certain product lines.

Same Document Delivered

Acomo SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The global food ingredients market is experiencing robust expansion, with projections indicating continued strong growth. This surge is largely fueled by a growing consumer preference for ingredients that are clean-label, offer functional health benefits, and are derived from plant-based sources. For instance, the plant-based food market alone was valued at over $40 billion in 2023 and is expected to reach over $100 billion by 2028, showcasing the immense opportunity.

Acomo, with its established position as a diversified group focused on plant-based food ingredients, is strategically positioned to leverage this significant market trend. The company can further capitalize by broadening its product portfolio to include more innovative and in-demand ingredients within these high-growth segments. This strategic alignment directly addresses the evolving dietary habits and heightened health consciousness prevalent among today's consumers.

The food ingredients market is experiencing robust expansion, particularly in the Asia Pacific and North America regions. This growth is fueled by increasing urbanization and a rising consumer preference for processed and ready-to-eat food products. For instance, the global food ingredients market was valued at approximately $250 billion in 2023 and is projected to reach over $400 billion by 2030, showcasing significant upward momentum.

Acomo is well-positioned to capitalize on these trends through strategic acquisitions. A prime example is the Delinuts Nordics bolt-on acquisition completed in 2024, which effectively expanded Acomo's geographical reach and product portfolio. Such strategic moves are crucial for enhancing market share and diversifying revenue streams in this dynamic sector.

The growing demand for sustainable food production, exemplified by the rise of regenerative agriculture and eco-friendly products, presents a significant opportunity. Acomo's commitment to sustainability, including its 2024 completion of its first full GHG Scope 3 calculation, directly addresses increasing regulatory and consumer calls for transparency and reduced environmental footprints.

This proactive approach to sustainability can serve as a key differentiator for Acomo's product offerings. By clearly demonstrating its commitment to environmental responsibility and supply chain traceability, the company can enhance its brand reputation and appeal to a growing segment of environmentally conscious consumers and business partners.

Technological Advancements in Supply Chain and Operations

Technological advancements are revolutionizing agricultural supply chains. Digital solutions, automation, and AI are addressing issues like data fragmentation and improving logistics and traceability. Acomo can leverage these innovations to boost operational efficiency and make smarter, predictive decisions, ultimately enhancing its supply chain's resilience.

By investing in and adopting these cutting-edge technologies, Acomo stands to gain significant advantages. This strategic move can lead to substantial cost reductions and a marked improvement in service delivery across its operations. For instance, AI-powered demand forecasting, which saw a 15% improvement in accuracy for leading food distributors in 2024, can help Acomo optimize inventory levels and minimize waste.

- Enhanced Efficiency: Automation in warehousing and logistics can reduce handling times by up to 20%.

- Improved Traceability: Blockchain solutions offer end-to-end visibility, reducing recall times and costs.

- Data-Driven Decisions: AI analytics can predict market trends and potential disruptions with greater accuracy.

- Cost Optimization: Streamlined operations and reduced waste contribute directly to lower operational expenses.

Innovation in Product Development and Value-Added Services

The food ingredients sector is buzzing with innovation, particularly around new flavors, ingredients offering health benefits, and even customized nutrition plans. This trend presents a significant opportunity for Acomo to expand its offerings.

Acomo can capitalize on this by developing unique food ingredients that boast improved qualities. Think about ingredients that naturally extend shelf life, boost nutritional value, enhance texture, or simply taste better. For instance, the global functional food ingredients market was valued at approximately USD 113.5 billion in 2023 and is projected to grow substantially, indicating strong consumer demand for these enhanced products.

Furthermore, moving beyond just trading raw ingredients to offering more comprehensive services can unlock higher profit margins and build stronger ties with customers. This could include:

- Developing bespoke ingredient blends for specific client needs.

- Providing technical support and formulation expertise.

- Offering insights into emerging consumer trends and ingredient applications.

- Expanding into areas like sustainable sourcing certifications and traceability solutions.

Acomo can capitalize on the growing demand for plant-based and functional ingredients, with the plant-based food market projected to exceed $100 billion by 2028. Expanding its portfolio into these high-growth areas aligns with evolving consumer preferences for healthier and more sustainable options.

Strategic acquisitions and bolt-on deals, like the 2024 Delinuts Nordics acquisition, offer avenues for Acomo to increase market share and diversify its revenue streams. These moves are critical for navigating the dynamic food ingredients sector, particularly in expanding regions like Asia Pacific and North America.

Acomo's commitment to sustainability, evidenced by its 2024 GHG Scope 3 calculation, positions it favorably with environmentally conscious consumers and partners. This focus on transparency and reduced environmental impact can serve as a significant competitive advantage.

Leveraging technological advancements in agricultural supply chains, such as AI for demand forecasting, can enhance Acomo's operational efficiency and resilience. For instance, AI improvements in forecasting accuracy reached 15% for leading food distributors in 2024, demonstrating the potential for cost optimization and waste reduction.

Threats

Ongoing geopolitical instability, including conflicts and trade disputes, presents a significant threat to Acomo's global operations. For instance, the persistent trade tensions between the US and China, which saw tariffs impacting agricultural goods, created uncertainty in the market. Similarly, trade friction involving Mexico could affect supply chains for key commodities that Acomo relies on.

These geopolitical shifts directly translate into increased costs for exporting essential crops and the potential for retaliatory tariffs, squeezing Acomo's profit margins. The unpredictability of trade policies demands continuous adaptation and robust risk management strategies to mitigate disruptions in market access and supply chains.

Climate change poses a significant threat to Acomo, with extreme weather events such as droughts, floods, and heat waves directly impacting agricultural output and supply chains. These disruptions can lead to lower crop yields and increased spoilage, affecting the availability and cost of raw materials. For instance, the 2023 European heatwaves and droughts impacted grain harvests, a key commodity for many food producers, suggesting a potential rise in Acomo's sourcing costs.

The volatility introduced by these environmental challenges necessitates robust adaptation strategies and raises concerns about the long-term reliability of Acomo's sourcing network. Increased spoilage risks and fluctuating commodity prices, as seen with cocoa prices in early 2024 due to weather concerns in West Africa, directly impact Acomo's cost of goods sold and profit margins, highlighting the need for proactive risk management.

Beyond geopolitical tensions, Acomo's agricultural supply chains are vulnerable to logistics and transportation bottlenecks, with global shipping costs experiencing significant fluctuations. For instance, the Drewry World Container Index saw a notable increase in early 2024 compared to the previous year, impacting import and export expenses. These disruptions, coupled with rising fuel prices and persistent labor shortages in key agricultural regions, directly inflate operational costs and can cause considerable delays in product delivery.

Furthermore, the increasing reliance on digital supply chain management systems exposes Acomo to growing cybersecurity threats. A successful cyberattack could cripple operations, leading to significant financial losses and reputational damage. The estimated global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the critical need for robust security measures to safeguard Acomo's supply chain infrastructure.

Intense Competition and Pricing Pressures

The agricultural commodities and food ingredients sectors are characterized by a crowded marketplace, with numerous companies actively competing for market share. This high level of competition often translates into significant pricing pressures, particularly for products that lack distinct differentiation, which can negatively impact Acomo's profitability.

For instance, in the global edible oils market, a key segment for Acomo, price volatility is a constant challenge. Reports from 2024 indicated that while demand remained robust, an oversupply in certain oilseeds, like soybeans, led to a softening of prices, putting pressure on margins for producers and traders. This environment necessitates Acomo's focus on operational efficiency and building strong, lasting relationships with its customers to navigate these economic headwinds.

- Market Saturation: Many established players and new entrants vie for consumer and business demand in food ingredients and agricultural commodities.

- Price Sensitivity: Undifferentiated products are highly susceptible to price wars, directly impacting profit margins for companies like Acomo.

- Innovation Imperative: Continuous investment in product development and process improvement is crucial to maintain a competitive edge and avoid commoditization.

- Customer Loyalty: Strong relationships and reliable supply chains are vital for retaining business in a market where switching costs can be low.

Evolving Regulatory Landscape and Compliance Requirements

Governments and industry bodies are tightening regulations concerning product traceability, food safety, and sustainability. For instance, the EU's ambitious agri-food sustainability policies are setting new benchmarks. Acomo must navigate these evolving requirements, which necessitate meticulous record-keeping and transparent reporting.

Meeting these increasingly stringent compliance standards demands accurate data management and potentially substantial investments in new technological systems and operational processes. Failure to adapt can lead to significant financial penalties, damage to brand reputation, and limitations on market access.

- Increased Regulatory Scrutiny: The global regulatory environment for food and agriculture is becoming more complex, impacting supply chains and operational mandates.

- Sustainability Mandates: Policies like those from the EU are pushing for greater transparency and accountability in environmental and social impacts throughout the value chain.

- Compliance Costs: Adapting to new rules often requires capital expenditure on technology for traceability and reporting, alongside ongoing operational adjustments.

- Market Access Risks: Non-compliance can directly threaten a company's ability to operate in key markets, potentially leading to lost revenue and market share.

Acomo faces intense competition in the agricultural commodities and food ingredients sectors, with numerous players vying for market share. This crowded landscape often leads to significant pricing pressures, especially for undifferentiated products, directly impacting Acomo's profitability. For example, the global edible oils market, a key area for Acomo, experienced price softening in early 2024 due to oversupply in certain oilseeds like soybeans, despite robust demand, squeezing margins for all participants.

The company is also susceptible to cybersecurity threats, as its increasing reliance on digital supply chain management systems exposes it to potential attacks. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the critical need for robust security measures to protect Acomo's operations and data.

Furthermore, evolving government regulations concerning product traceability, food safety, and sustainability present a compliance challenge. For instance, the EU's stringent agri-food sustainability policies require meticulous record-keeping and transparent reporting, with non-compliance risking financial penalties and market access limitations.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including Acomo's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic overview.