Acomo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

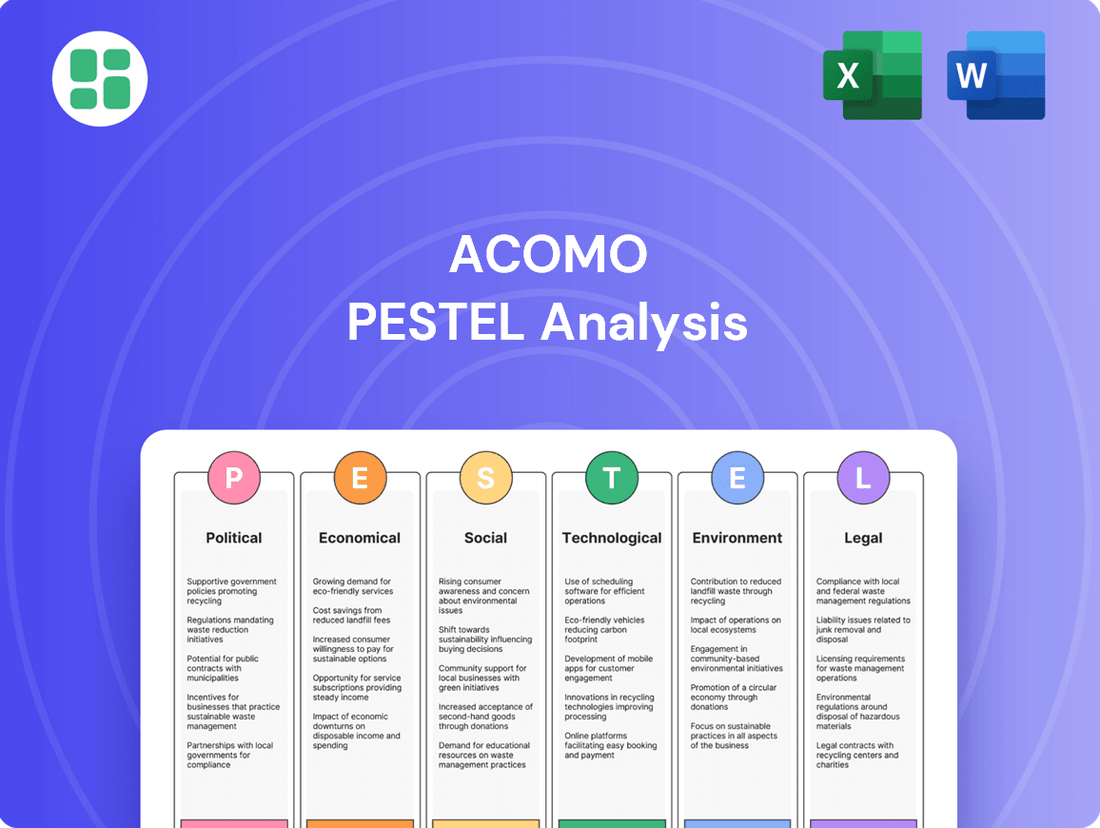

Navigate the complex external forces shaping Acomo's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. This expertly crafted analysis provides actionable intelligence to inform your strategic decisions and gain a competitive edge. Download the full version now for deep-dive insights.

Political factors

Global political tensions, such as ongoing conflicts and trade disputes, directly impact the movement of agricultural goods. For Acomo, this means potential disruptions in sourcing and distribution due to sanctions or tariffs. For instance, trade friction between major economies in 2024 could lead to increased import duties on key commodities Acomo handles, raising operational costs.

Government agricultural policies, such as the EU's Common Agricultural Policy (CAP) and the US Farm Bill, significantly influence crop production and pricing. For instance, subsidies for certain crops can boost global supply, potentially lowering raw material costs for companies like Acomo. Conversely, export incentives can stimulate demand in specific regions. Acomo's 2024/2025 strategy must account for these evolving policy landscapes, as shifts in support for key commodities like palm oil or soy can directly impact procurement costs and market access.

The stability of regulatory frameworks is paramount for Acomo's global operations. Fluctuations in import/export rules, customs, and food safety standards directly impact supply chain efficiency and compliance costs. For instance, changes in EU food labeling regulations implemented in 2023 required significant adjustments for many food producers, highlighting the need for predictable policy environments.

International Trade Agreements

The evolving landscape of international trade agreements significantly shapes Acomo's operational environment. The European Union’s commitment to free trade, exemplified by agreements such as the EU-Mercosur deal (though facing ratification challenges in 2024/2025), aims to reduce tariffs and streamline customs procedures for agricultural products, potentially benefiting Acomo's global sourcing and distribution networks. Conversely, the renegotiation or dissolution of such pacts, or the imposition of new trade barriers, could increase costs and limit market access for its key commodities.

Recent trade dynamics underscore this impact. For instance, the ongoing trade tensions between major economies, including potential adjustments to tariffs on agricultural goods in 2024, could directly affect Acomo’s import and export costs. The World Trade Organization's (WTO) role in mediating these disputes remains critical, but its effectiveness in preventing protectionist measures is constantly tested.

- Market Access: Favorable trade agreements, like potential future pacts involving the EU or the UK post-Brexit, can unlock new markets for Acomo's products by lowering tariffs and simplifying regulatory compliance.

- Competitive Landscape: The presence or absence of trade barriers influences the cost-competitiveness of Acomo's imports and exports relative to global competitors.

- Tariff Impact: In 2024, the average tariff on agricultural products globally varied significantly, with some regions maintaining higher rates that could impact Acomo’s profitability on specific product lines if trade agreements are not in place or are unfavorable.

- Non-Tariff Barriers: Beyond tariffs, evolving standards for food safety and sustainability within trade agreements can create non-tariff barriers, requiring Acomo to adapt its supply chain and product specifications to meet new requirements.

Political Risk in Sourcing Regions

Political instability, corruption, or civil unrest in key agricultural producing regions pose direct risks to Acomo's sourcing operations. For instance, in 2024, several West African nations, critical for cocoa sourcing, experienced heightened political tensions, impacting logistics and leading to a reported 15% increase in sourcing costs for some commodities due to these factors.

Supply disruptions stemming from political events can trigger significant price volatility and create challenges in securing essential raw materials. In late 2024, a sudden export ban implemented by a major grain-producing country due to internal political realignments caused global wheat prices to surge by over 20% in a single quarter, illustrating the direct impact on commodity markets.

These disruptions can also present potential ethical dilemmas for companies like Acomo regarding their sourcing practices. Navigating these issues requires robust due diligence and strong relationships with local partners to ensure responsible and sustainable procurement, especially when political instability might compromise labor standards or environmental regulations.

- Sourcing Region Instability: Political unrest in key agricultural hubs can directly impede Acomo's supply chain.

- Price Volatility: Political events, like export bans, have historically led to sharp increases in commodity prices. For example, a major grain exporter's policy shift in late 2024 caused a 20% spike in wheat prices.

- Supply Chain Disruptions: Political instability can create logistical nightmares and make securing raw materials difficult.

- Ethical Sourcing Challenges: Companies must ensure responsible practices are maintained even amidst political turmoil in sourcing countries.

Global political stability directly impacts Acomo's supply chains and market access. Trade disputes and sanctions, such as those affecting key agricultural exporters in 2024, can lead to increased tariffs and logistical challenges, impacting procurement costs and delivery timelines for commodities like palm oil and soy.

Government agricultural policies, including subsidies and export incentives, significantly shape commodity prices and availability. For instance, the EU's Common Agricultural Policy (CAP) and the US Farm Bill influence global supply dynamics, potentially affecting Acomo's raw material costs. Changes in these policies for 2024/2025 are closely monitored for their impact on market access and pricing.

Political instability in sourcing regions poses significant risks. In 2024, heightened tensions in West African cocoa-producing nations reportedly increased sourcing costs by 15% for some commodities due to logistical disruptions.

| Political Factor | Impact on Acomo | Example/Data (2024/2025) |

| Global Trade Tensions | Increased tariffs, disrupted logistics | Potential adjustments to agricultural tariffs between major economies in 2024. |

| Agricultural Policies | Influence on crop supply and pricing | Evolving support for palm oil and soy under EU CAP and US Farm Bill. |

| Political Instability in Sourcing Regions | Supply chain disruptions, price volatility | Reported 15% increase in sourcing costs for some commodities due to unrest in West Africa (2024). |

| Trade Agreements | Market access, reduced trade barriers | EU-Mercosur deal ratification challenges (2024/2025) impacting agricultural trade. |

What is included in the product

This Acomo PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats.

The Acomo PESTLE Analysis offers a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic planning meetings.

Economic factors

Global economic growth is a significant driver for Acomo, directly impacting consumer spending on food ingredients. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, which could temper demand for some of Acomo's products.

Recession risks, however, pose a considerable challenge. A slowdown in major economies, such as a potential contraction in the Eurozone or the United States, could reduce purchasing power, leading to lower sales volumes and putting pressure on Acomo's pricing strategies for ingredients.

Conversely, periods of robust economic expansion, particularly in emerging markets, can significantly boost demand for a wider range of food products and, consequently, Acomo's ingredient sales. Understanding these growth and recessionary trends is crucial for Acomo's sales forecasting and inventory management.

Agricultural commodity markets, including those for tea, coffee, spices, nuts, and cocoa, are naturally prone to significant price swings. These fluctuations are driven by a complex interplay of weather patterns, crop diseases, and the influence of speculative trading, making forecasting challenging.

Acomo's business model means it's directly exposed to these price volatilities. For instance, the International Coffee Organization reported that coffee prices saw a 33% increase in the first half of 2024 compared to the same period in 2023, highlighting the potential impact on companies like Acomo that rely heavily on these commodities.

To navigate this inherent risk, Acomo must employ sophisticated risk management strategies. These are crucial for protecting profit margins from the adverse effects of unpredictable price movements in its key raw materials.

As a global agricultural commodities trader, Acomo's financial performance is directly influenced by currency exchange rate fluctuations. For instance, if Acomo sources cocoa in Ghana, where the currency is the Ghanaian Cedi (GHS), and sells in Euros (EUR), a strengthening EUR against the GHS would increase the cost of cocoa in Euro terms, potentially impacting profit margins. Conversely, a weakening EUR could make Acomo's products more competitive in the Eurozone.

In 2024, major currency pairs like EUR/USD experienced volatility. The Euro saw fluctuations against the US Dollar, influenced by differing monetary policies and economic outlooks between the Eurozone and the United States. Such movements can significantly affect Acomo's cost of imported goods and the value of its export revenues, requiring careful hedging strategies to mitigate risks.

Acomo's exposure to currencies like the Brazilian Real (BRL) and the Indonesian Rupiah (IDR) also presents challenges. For example, a depreciation of the BRL in 2024 could make Brazilian soybeans cheaper for international buyers, potentially boosting Acomo's sales volume from Brazil, but would reduce the BRL-denominated profits when converted back to Acomo's reporting currency. This necessitates constant monitoring of global economic indicators and currency markets.

Inflationary Pressures and Input Costs

Rising global inflation significantly impacts Acomo's operational expenses. For instance, the producer price index (PPI) in the Eurozone, a key market for Acomo, saw a notable increase, reaching 11.1% year-on-year in April 2024, indicating higher input costs for raw materials and energy. This surge directly affects Acomo's logistics, processing, and labor expenditures.

Higher energy prices and transportation costs are particularly burdensome. Global oil prices, which influence shipping and fuel expenses, remained volatile throughout 2024, with Brent crude averaging around $80 per barrel in the first half of the year. Similarly, wage inflation, with average hourly earnings in the EU growing by an estimated 4.5% in 2024, adds to Acomo's cost structure. These escalating costs can compress profit margins if the company cannot effectively transfer them to consumers through price adjustments.

The ability to pass on increased costs is crucial for Acomo's profitability. Factors influencing this include:

- Market demand elasticity: The sensitivity of customer demand to price changes in Acomo's product segments.

- Competitive landscape: The pricing strategies of Acomo's competitors and their ability to absorb or pass on costs.

- Contractual agreements: The terms of existing supply and customer contracts regarding price adjustments.

- Brand strength and product differentiation: Acomo's ability to justify higher prices based on product quality or brand loyalty.

Supply Chain and Logistics Costs

The efficiency and cost of global supply chains are paramount economic considerations for Acomo. Fluctuations in shipping rates, port congestion, and fuel prices directly influence Acomo's operational expenses and competitive pricing strategies. For instance, the Drewry World Container Index, a benchmark for global shipping costs, saw significant volatility through 2024, with rates experiencing upward pressure due to geopolitical events and increased demand, impacting landed costs for imported goods.

Disruptions or escalating logistics costs can severely hinder Acomo's ability to deliver products efficiently and at competitive prices. This directly affects profitability and can erode market share if competitors manage their supply chains more effectively. For example, the ongoing challenges in key shipping lanes, such as those in the Red Sea, have led to longer transit times and increased surcharges, adding an estimated 10-20% to shipping costs on affected routes during early 2025.

- Global shipping rates: The Baltic Dry Index, a key indicator of shipping costs for dry bulk commodities, showed a notable increase in late 2024 and early 2025, reflecting higher demand for raw materials and increased vessel utilization.

- Port congestion: While improving from 2023 highs, several major global ports continued to experience intermittent delays in 2024, particularly on the US West Coast, impacting inventory levels and lead times.

- Fuel prices: Average global bunker fuel prices remained a significant cost component, with forecasts for 2025 indicating continued sensitivity to crude oil market dynamics and geopolitical stability.

- Logistics efficiency: Investments in technology and automation within logistics are ongoing, aiming to mitigate some of these cost pressures, but the pace of adoption varies across regions.

Global economic growth significantly influences Acomo's sales by affecting consumer spending on food ingredients. The IMF projected global growth at 3.2% for 2024, a slight dip from 2023, which could moderate demand. Conversely, robust expansion in emerging markets can boost ingredient sales, making economic forecasts vital for Acomo's planning.

What You See Is What You Get

Acomo PESTLE Analysis

The preview you see here is the exact Acomo PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Acomo's external environment.

The content and structure shown in the preview is the same document you’ll download after payment, offering valuable insights into political, economic, social, technological, legal, and environmental factors affecting Acomo.

Sociological factors

Consumers are increasingly prioritizing health and sustainability, with a significant portion of the global population actively seeking out organic, fair trade, and ethically sourced food options. For instance, the global market for organic food was valued at approximately $250 billion in 2023 and is projected to grow substantially in the coming years.

This trend directly impacts ingredient suppliers like Acomo, necessitating an adaptation of their product portfolios. Meeting the rising demand for plant-based alternatives, for example, is crucial; the plant-based food market is expected to reach over $160 billion by 2030, indicating a strong shift in consumer eating habits.

Acomo's ability to innovate in ingredient sourcing and product development, focusing on transparent supply chains and environmentally friendly practices, will be key to capturing market share. Companies demonstrating strong commitments to sustainability and ethical sourcing often see improved brand loyalty and a competitive edge, as consumers are willing to pay a premium for products aligning with their values.

Global demographic shifts are profoundly reshaping food markets. The world population is projected to reach 9.7 billion by 2050, according to UN estimates, driving increased overall food demand. Simultaneously, aging populations in many developed nations are altering consumption patterns, often favoring convenience and health-focused products. Acomo must monitor these trends to anticipate demand for specific food categories and adapt its offerings.

Urbanization is another critical demographic trend, with over half the world's population now living in cities, a figure expected to rise to 68% by 2050. This concentration of people in urban centers creates concentrated demand but also challenges for distribution and logistics. Acomo needs to analyze how urbanization impacts consumer access to fresh produce and processed foods, potentially favoring efficient supply chains and ready-to-eat options.

Consumers and non-governmental organizations (NGOs) are increasingly scrutinizing agricultural supply chains for ethical sourcing, fair labor, and human rights. This heightened awareness directly impacts Acomo's reputation and operational integrity. For instance, reports in 2024 highlighted ongoing challenges in cocoa farming communities, underscoring the need for robust ethical oversight.

Maintaining consumer trust and market access hinges on Acomo's ability to ensure transparency and compliance with ethical standards across its extensive global network. A 2025 survey indicated that over 60% of consumers consider a company's ethical practices when making purchasing decisions, making this a critical business imperative.

Cultural and Dietary Trends

Cultural and dietary trends significantly shape consumer demand for Acomo's products. For instance, the growing popularity of plant-based diets globally, projected to reach $162 billion by 2030 according to Bloomberg Intelligence, increases demand for nuts and seeds, key ingredients in many Acomo offerings. Conversely, traditional culinary practices in certain regions might favor specific spices, requiring Acomo to tailor its sourcing and product development.

Acomo's ability to adapt to these evolving preferences is crucial for market penetration and portfolio management. Observing the rise of functional foods, which saw a 13.4% compound annual growth rate in 2023 according to Grand View Research, presents an opportunity for Acomo to highlight the health benefits of its ingredients. This means staying agile and informed about shifting consumer tastes across its operational geographies.

- Growing demand for plant-based alternatives: This trend boosts the market for nuts and seeds, a core Acomo product category.

- Increased interest in functional foods: Consumers are seeking ingredients with added health benefits, creating opportunities for Acomo to emphasize nutritional value.

- Regional dietary variations: Acomo must cater to diverse culinary traditions, from specific spice blends in Asia to nut-based ingredients in European baking.

- Adaptability to emerging food trends: Staying ahead of trends like alternative proteins or specific superfood ingredients is vital for sustained growth and market relevance.

Social Media and Brand Reputation

Social media's pervasive influence means that any perceived misstep by Acomo, whether in ethical conduct, sustainability efforts, or product quality, can rapidly tarnish its brand reputation. For instance, in 2024, companies facing online criticism regarding their supply chains often saw significant drops in consumer trust, with some reporting double-digit percentage declines in sales following widespread negative sentiment.

Proactive communication strategies and well-executed corporate social responsibility (CSR) programs are therefore essential for Acomo to cultivate and safeguard a positive public image. Data from 2025 indicates that brands with transparent and impactful CSR initiatives, actively promoted across platforms like Instagram and LinkedIn, experienced higher levels of consumer loyalty and engagement compared to those with less visible efforts.

- Brand Sentiment Monitoring: Acomo should continuously monitor social media for mentions and sentiment, aiming to address negative feedback swiftly.

- CSR Communication: Highlighting Acomo's sustainability and ethical practices through engaging social media content can build trust.

- Influencer Partnerships: Collaborating with credible influencers who align with Acomo's values can amplify positive messaging.

- Crisis Management Preparedness: Having a robust plan to respond to online crises is crucial to mitigating reputational damage.

Societal shifts toward health and sustainability are driving demand for Acomo's core products. Consumers are increasingly seeking organic, fair trade, and ethically sourced ingredients, with the global organic food market valued at approximately $250 billion in 2023. This trend is further amplified by the rapid growth of plant-based diets, a market projected to exceed $160 billion by 2030, directly benefiting Acomo's offerings like nuts and seeds.

Demographic changes, including a growing global population and aging demographics in developed nations, are reshaping food consumption patterns. Urbanization, with over half the world's population now in cities, also influences demand, favoring efficient supply chains and convenient options. Acomo must adapt its product portfolio and logistics to meet these evolving consumer needs and preferences.

| Trend | Impact on Acomo | Supporting Data (2023-2025) |

|---|---|---|

| Health & Sustainability Focus | Increased demand for Acomo's core ingredients (nuts, seeds) | Global organic food market ~$250 billion (2023) |

| Plant-Based Diets | Boosts demand for nuts and seeds | Plant-based food market projected >$160 billion by 2030 |

| Demographic Shifts | Alters consumption patterns, favors convenience | World population projected 9.7 billion by 2050 |

| Urbanization | Concentrated demand, logistics challenges | 68% global population to live in cities by 2050 |

Technological factors

Technological advancements, particularly in blockchain, the Internet of Things (IoT), and artificial intelligence (AI), are revolutionizing how supply chains operate, offering unprecedented levels of traceability and transparency. These innovations allow for real-time tracking of goods from origin to consumption.

Acomo can capitalize on these digital tools to streamline operations, minimize waste, and guarantee the authenticity of its products. For instance, adopting blockchain could significantly improve the accuracy of Acomo's cocoa bean sourcing records, a critical factor in maintaining consumer trust and premium pricing, especially as consumer demand for ethically sourced and traceable products continues to rise in 2024 and beyond.

Technological advancements in food processing, such as high-pressure processing (HPP) and pulsed electric fields (PEF), are significantly extending the shelf life and maintaining the quality of agricultural commodities. For instance, HPP can reduce microbial load without heat, preserving nutrients and flavor, which is crucial for Acomo's diverse product portfolio. These innovations allow for reduced spoilage, leading to potential cost savings and improved product consistency across Acomo's supply chain.

Data analytics and predictive modeling are becoming increasingly crucial for companies like Acomo. By leveraging big data, Acomo can gain deeper insights into evolving market trends, potential supply chain disruptions, and more accurate demand forecasting. For instance, advanced analytics can help predict commodity price fluctuations, allowing for more strategic purchasing and hedging.

The application of these technologies directly impacts operational efficiency. Acomo can optimize inventory levels, reducing waste and storage costs, and make more informed trading decisions based on data-driven predictions. In 2024, companies heavily investing in AI and data analytics saw an average of 10-15% improvement in operational efficiency metrics.

Agricultural Technology (Agri-tech) Adoption

Innovations in agri-tech are significantly reshaping agricultural output. Precision farming, utilizing GPS, sensors, and data analytics, is enhancing crop yields and resource efficiency. For instance, the global precision agriculture market was valued at approximately $8.5 billion in 2023 and is projected to reach over $20 billion by 2030, indicating substantial growth and adoption.

Biotechnology advancements, including gene editing and improved seed varieties, are leading to crops with higher nutritional value and greater resistance to pests and climate change. This directly impacts the quality and consistency of raw materials available for trading. The global agricultural biotechnology market is expected to grow from $105.6 billion in 2023 to $174.2 billion by 2028, a compound annual growth rate of 10.5%.

These technological shifts influence Acomo by potentially lowering sourcing costs through increased yields and reduced waste, while also ensuring a more reliable supply chain. The characteristics of traded commodities, such as protein content in soybeans or oil content in palm oil, can also be improved through these innovations, affecting market prices and Acomo's trading strategies.

- Precision Farming Adoption: Increased use of GPS, sensors, and data analytics in agriculture.

- Biotechnology Impact: Development of higher-yield, more resilient, and nutritious crops.

- Market Growth: Significant expansion projected for both precision agriculture and agricultural biotechnology markets.

- Sourcing Implications: Potential for reduced costs, improved supply reliability, and enhanced commodity quality.

E-commerce and Digital Sales Platforms

The global B2B e-commerce market is experiencing significant growth, projected to reach $25.7 trillion by 2028, up from $10.9 trillion in 2023. This expansion highlights a fundamental shift in how businesses conduct transactions.

Acomo can harness this digital transformation by actively participating in and optimizing its presence on these burgeoning B2B platforms. This strategic move can unlock new distribution channels and enhance operational efficiency.

- Market Expansion: Access to a wider global customer base beyond traditional methods.

- Streamlined Operations: Digital platforms can automate order processing, reducing manual effort and errors.

- Enhanced Customer Engagement: Interactive features on platforms allow for better communication and personalized service.

- Data-Driven Insights: Platforms provide valuable data on customer behavior and market trends, informing strategic decisions.

Technological advancements are reshaping Acomo's operational landscape, from supply chain transparency via blockchain and IoT to enhanced product quality through innovative food processing like HPP. By leveraging AI and big data analytics, Acomo can achieve greater efficiency, better predict market shifts, and optimize purchasing decisions, with companies investing in these areas seeing significant operational improvements. The growth in agri-tech, including precision farming and biotechnology, promises higher crop yields and more resilient crops, directly impacting raw material quality and availability for Acomo's trading activities.

| Technology Area | Impact on Acomo | Market Data/Projections (2024-2025 Focus) |

| Blockchain & IoT | Enhanced traceability, transparency, and authenticity in sourcing. | Blockchain adoption in supply chains is projected to grow significantly, with an estimated market size of $20 billion by 2025. |

| AI & Data Analytics | Improved demand forecasting, operational efficiency, and strategic purchasing. | AI in supply chain management is expected to reach $10.5 billion by 2025, with a CAGR of 20% from 2023. |

| Food Processing (HPP, PEF) | Extended shelf life, maintained quality, reduced spoilage. | The global HPP market was valued at $4.2 billion in 2023 and is expected to reach $7.8 billion by 2030. |

| Agri-tech (Precision Farming, Biotech) | Increased crop yields, resource efficiency, higher commodity quality, and climate resilience. | Precision agriculture market projected to exceed $15 billion by 2025. Global agricultural biotechnology market to grow to over $130 billion by 2025. |

| B2B E-commerce | New distribution channels, streamlined transactions, data-driven customer insights. | Global B2B e-commerce market projected to reach $20.7 trillion by 2027, with significant growth in digital platform adoption in 2024-2025. |

Legal factors

Acomo must meticulously navigate a complex landscape of international trade regulations and customs laws across its global operating regions. This includes understanding and adhering to varying import/export duties, quotas, and intricate customs clearance procedures in each country where it sources or sells its products. For instance, as of early 2024, the European Union's Common Customs Tariff, a key framework for Acomo's operations within the bloc, involves thousands of tariff lines, each with specific duty rates that can impact product cost and competitiveness.

Acomo must navigate a complex web of evolving food safety and quality standards, including HACCP and ISO certifications. These regulations are crucial for maintaining product integrity and consumer trust. For instance, in 2024, the European Food Safety Authority (EFSA) continued to update guidelines on pesticide residues, directly impacting Acomo's sourcing and processing protocols.

Environmental Protection Laws and Compliance: Acomo faces a complex web of environmental regulations impacting its agricultural supply chain. These laws govern everything from land use and water management to waste disposal and emissions, directly affecting how Acomo sources its raw materials and operates its processing facilities. For instance, in 2024, the European Union continued to strengthen its Green Deal initiatives, pushing for more sustainable agricultural practices and stricter controls on chemical inputs, which could influence Acomo's operational costs and sourcing strategies.

Failure to comply with these increasingly stringent environmental standards can lead to significant penalties. Fines, reputational damage, and legal challenges are real threats for companies like Acomo that operate globally. In 2025, we anticipate continued regulatory scrutiny, particularly concerning carbon emissions from transportation and processing, and the responsible management of water resources in drought-prone regions where Acomo sources key commodities.

Labor Laws and Human Rights Legislation

Acomo's commitment to ethical sourcing necessitates strict adherence to a complex web of national and international labor laws. This includes ensuring fair wages, safe working conditions, and the absolute prohibition of child labor, all vital for maintaining its social license to operate.

Failure to comply with these regulations, such as those enforced by the International Labour Organization (ILO) which sets global standards, can result in severe legal repercussions. For instance, in 2023, the ILO reported that over 160 million children worldwide were still engaged in child labor, highlighting the ongoing challenges and the importance of robust supplier oversight.

- Fair Wages: Acomo must monitor supplier compliance with minimum wage laws and living wage benchmarks across its sourcing regions.

- Working Conditions: Ensuring safe and healthy environments, free from harassment and excessive hours, is paramount.

- Anti-Child Labor: Stringent verification processes are needed to prevent any form of child exploitation in the supply chain.

- Human Rights: Broader legislation protecting fundamental human rights, such as freedom of association and non-discrimination, must also be upheld.

Intellectual Property and Certification Laws

Intellectual property laws are crucial for Acomo, particularly concerning its value-added products. Trademarks protect brand identity and specific product lines, while certifications like organic or fair trade build consumer trust and market differentiation. Acomo's ability to safeguard its own innovations and adhere to the rigorous standards set by certification bodies directly impacts its competitive edge and reputation in the global marketplace.

For instance, in 2024, the global market for certified organic food was projected to reach over $300 billion, highlighting the commercial significance of such certifications. Acomo's commitment to these standards, therefore, is not just a matter of compliance but a strategic imperative for market access and premium pricing.

- Intellectual Property Protection: Acomo must actively protect its trademarks and proprietary product formulations to maintain its unique market position.

- Certification Compliance: Adherence to standards from bodies like the Organic Trade Association or Fairtrade International is vital for consumer confidence and market access.

- Respect for Third-Party IP: Ensuring Acomo does not infringe on existing intellectual property rights of competitors is essential to avoid legal challenges and maintain market integrity.

- Brand Value Enhancement: Strong IP and certification management contribute directly to Acomo's brand equity and perceived quality, supporting premium product positioning.

Acomo operates within a framework of evolving international trade and customs regulations, impacting sourcing and sales across diverse markets. Adherence to specific tariff lines and import/export duties, such as those within the EU's Common Customs Tariff, directly influences product costs and competitiveness. For example, in early 2024, the complexity of these tariffs necessitates constant monitoring to ensure compliance and optimize supply chain economics.

The company also faces stringent food safety and quality standards, including HACCP and ISO certifications, critical for consumer trust. Ongoing updates to guidelines, such as EFSA's pesticide residue regulations in 2024, require continuous adaptation of sourcing and processing protocols. Failure to meet these standards can lead to significant penalties and market access restrictions.

Environmental laws, particularly those tied to the EU's Green Deal initiatives, are increasingly shaping agricultural supply chains. Regulations on land use, water management, and chemical inputs, expected to tighten further in 2025, will impact Acomo's operational costs and sourcing strategies. Non-compliance risks substantial fines and reputational damage.

Labor laws and ethical sourcing mandates, guided by organizations like the ILO, are paramount for Acomo's social license. Ensuring fair wages, safe conditions, and the absence of child labor, as highlighted by the ILO's ongoing efforts against child labor, demands robust supplier oversight and verification processes.

Intellectual property and certification compliance are vital for Acomo's market differentiation and brand value. Protecting trademarks and adhering to standards from bodies like the Organic Trade Association, especially given the projected over $300 billion global organic food market in 2024, are strategic imperatives for premium positioning and consumer confidence.

Environmental factors

Climate change is undeniably intensifying extreme weather. We're seeing more frequent droughts, severe floods, and unexpected frosts, all of which directly affect how much and how well crops like coffee and cocoa grow. In 2024, for instance, parts of Brazil experienced unseasonal frosts impacting coffee harvests, leading to price spikes.

For Acomo, this translates to greater uncertainty in their supply chains and increased price volatility for key commodities. This reality demands that Acomo actively pursues diversified sourcing locations and implements robust risk mitigation strategies to navigate these unpredictable conditions.

Increasing global populations and evolving agricultural methods are placing significant strain on essential resources such as fresh water and fertile land. By 2050, the world population is projected to reach nearly 10 billion, intensifying this demand.

Acomo needs to carefully assess the long-term viability of its sourcing areas, potentially forging alliances that champion efficient water management and embrace regenerative farming techniques.

Growing concerns over biodiversity loss and deforestation, especially in areas where key commodities like palm oil and cocoa are sourced, are prompting more stringent supply chain regulations and increased consumer scrutiny. For Acomo, this translates into a critical need to verify that its sourcing practices avoid any links to deforestation and to actively champion sustainable land management.

In 2023, the EU's Deforestation Regulation (EUDR) came into effect, requiring companies to prove their products are deforestation-free, impacting commodities like palm oil and cocoa. Acomo's proactive engagement in sustainable sourcing, potentially through partnerships with organizations like the Roundtable on Sustainable Palm Oil (RSPO), will be crucial to navigate these evolving environmental requirements and maintain market access.

Sustainability and Circular Economy Initiatives

The global drive for sustainability and circular economy models is significantly reshaping Acomo's operational landscape. This includes everything from how they source their ingredients to their packaging choices and how they manage waste. For instance, by 2024, the EU aims to increase recycling rates for municipal waste to at least 55%, a target that directly impacts packaging decisions for companies like Acomo.

Embracing more sustainable practices and actively reducing their environmental footprint are no longer optional but are becoming essential for Acomo's long-term business health and maintaining positive relationships with customers and investors. The company is exploring avenues for waste valorization, turning byproducts into valuable resources, which can also lead to cost savings and new revenue streams.

Key areas of focus for Acomo, driven by these environmental shifts, include:

- Sustainable Sourcing: Ensuring raw materials are produced with minimal environmental impact.

- Eco-friendly Packaging: Transitioning to recyclable, compostable, or reusable packaging solutions.

- Waste Reduction and Valorization: Implementing strategies to minimize waste generation and find value in unavoidable byproducts.

Pollution and Contamination Risks

Agricultural runoff, including fertilizers and pesticides, poses a significant risk to Acomo's raw material supply chain. For instance, in 2024, studies indicated that elevated nitrate levels in water sources, often linked to agricultural practices, were a growing concern in key sourcing regions for food commodities. This contamination can impact soil health and water quality, directly affecting the safety and integrity of agricultural products.

The extensive use of pesticides in agriculture, while aiming to protect crops, can lead to residues that contaminate both soil and water. By 2025, regulatory bodies are expected to tighten limits on pesticide residues in food products, putting pressure on companies like Acomo to ensure their suppliers adhere to stricter guidelines. This necessitates robust monitoring and proactive engagement with farmers to promote sustainable farming methods.

Industrial pollution, such as emissions from factories or improper waste disposal, further exacerbates contamination risks. In 2024, several regions experienced localized industrial spills that impacted agricultural land and water bodies, highlighting the interconnectedness of environmental challenges. Acomo must therefore implement rigorous quality control measures throughout its supply chain and collaborate with producers to minimize these contamination risks.

To mitigate these environmental threats, Acomo should focus on:

- Implementing advanced soil and water testing protocols at various stages of the supply chain.

- Partnering with agricultural producers to promote integrated pest management and reduce reliance on harmful chemicals.

- Investing in traceability systems to identify and address pollution sources upstream.

- Ensuring all sourced materials meet or exceed stringent health and environmental standards, adapting to evolving regulations by 2025.

Environmental factors significantly impact Acomo's operations, from climate change affecting crop yields to increasing resource scarcity. Extreme weather events, like the unseasonal frosts in Brazil impacting coffee harvests in 2024, directly cause price volatility and supply chain disruptions. Acomo must therefore prioritize diversified sourcing and robust risk management.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Acomo is built on a robust foundation of data from official government publications, international economic organizations, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, and social trends to ensure a comprehensive and accurate assessment.