Acomo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

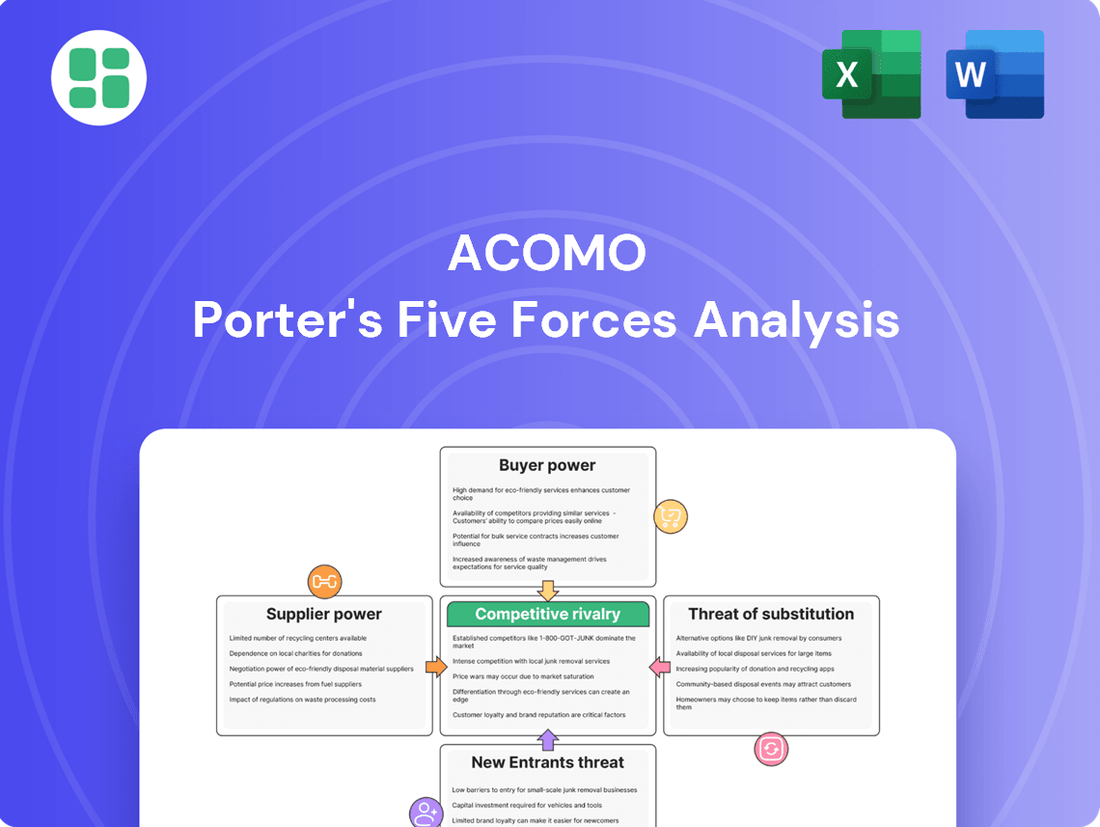

Porter's Five Forces Analysis reveals the intense competitive landscape Acomo operates within, highlighting the significant power of buyers and the constant threat of new entrants. Understanding these dynamics is crucial for navigating Acomo's market.

The complete report reveals the real forces shaping Acomo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Acomo's sourcing of diverse agricultural commodities means supplier concentration isn't uniform. For niche products, like specific high-grade cocoa or specialty teas, where fewer producers exist, suppliers can wield more influence. This is particularly true if these suppliers have invested heavily in unique cultivation or processing methods, making their offerings difficult to replicate.

In contrast, for more standardized agricultural products, such as basic grains or widely grown fruits, Acomo likely deals with a larger, more fragmented supplier base. This fragmentation dilutes the individual bargaining power of any single supplier, as Acomo can readily switch to alternatives. For instance, in 2024, the global coffee market, while diverse, saw significant regional production shifts impacting supplier leverage for certain bean types.

The switching costs for Acomo to change its suppliers are generally moderate to high, influenced by the specific commodity and the depth of existing relationships. These costs can escalate due to long-term contracts, rigorous quality assurance programs, and logistics systems that are tightly integrated with particular producers, fostering a degree of supplier dependency.

Establishing new supplier relationships and thoroughly verifying the quality of alternative sources inherently require significant investments in both time and financial resources, further solidifying the switching cost barrier for Acomo.

The threat of Acomo's suppliers integrating forward, meaning they start doing what Acomo does, is generally quite low. This is particularly true for the basic agricultural products Acomo sources.

Most individual farmers or even smaller cooperatives simply don't have the massive capital, the established global distribution channels, or the advanced processing facilities needed to compete directly with companies like Acomo in the international food and beverage market.

However, there's a possibility that larger, more organized agricultural cooperatives might move into some basic processing stages. For instance, a large coffee cooperative might invest in roasting or packaging, but this is still a limited form of forward integration and doesn't typically challenge Acomo's core business of global sourcing and distribution.

Importance of Acomo to Suppliers

Acomo's extensive global network and sophisticated logistics capabilities position it as an indispensable partner for numerous agricultural producers, especially smaller entities. This reliance on Acomo for market access and consistent demand significantly curtails the individual bargaining power of many suppliers. For instance, in 2024, Acomo's operations spanned over 100 countries, facilitating the distribution of a wide array of agricultural commodities.

For smaller producers, Acomo's role as a primary off-taker means they often have limited alternatives for selling their goods, thereby strengthening Acomo's position. This is particularly true for specialized or niche products where Acomo's established channels are critical. The company's robust risk management, including hedging against price volatility and supply chain disruptions, further enhances its appeal to producers seeking stability.

However, the dynamic shifts for very large suppliers. If Acomo represents only a fraction of a major producer's total sales, that supplier's bargaining power is comparatively higher. These larger entities may have diversified customer bases and the capacity to negotiate more favorable terms, or even bypass intermediaries like Acomo for direct sales, particularly in high-volume commodity markets.

- Acomo's Global Footprint: Operates in over 100 countries, providing essential market access for producers.

- Logistics and Risk Mitigation: Manages complex supply chains and mitigates risks, making it a vital partner.

- Supplier Dependence: Smaller suppliers often rely heavily on Acomo, reducing their individual bargaining power.

- Large Supplier Leverage: Major producers with diversified sales may possess greater negotiation strength with Acomo.

Availability of Substitute Inputs

The availability of substitute inputs for Acomo's sourced products shows significant variation. For highly specialized agricultural commodities, direct substitutes might be scarce, but Acomo can often find regional alternatives or different grades of the same product. This adaptability, especially for less differentiated items, helps to temper the bargaining power of suppliers.

For instance, while specific origins of cocoa beans might have unique flavor profiles, Acomo can often source beans from different regions to meet quality and price targets, thereby reducing reliance on a single supplier's terms. This is crucial in a market where supply chain disruptions can occur.

- Limited direct substitutes for highly specialized agricultural commodities.

- Regional alternatives and different grades offer some flexibility.

- Mitigates supplier power for less differentiated products.

- Acomo's sourcing strategy can leverage this to manage costs.

Acomo's bargaining power with its suppliers is influenced by the concentration of its supplier base and the switching costs involved. While niche products may grant suppliers more leverage, the broad sourcing of agricultural commodities often means Acomo deals with a fragmented base, diminishing individual supplier power. For example, in 2024, Acomo's operations across over 100 countries facilitated access to a diverse range of commodities, reducing dependence on any single supplier.

The threat of forward integration by suppliers is generally low for Acomo, as most producers lack the capital and infrastructure for global distribution. However, larger agricultural cooperatives might engage in limited processing, which still doesn't challenge Acomo's core business. This dynamic means Acomo can leverage its scale and market access to negotiate favorable terms, especially with smaller producers who rely on the company for market access.

Acomo's ability to source regional alternatives and different grades of commodities also helps to mitigate supplier power, particularly for less differentiated products. This flexibility is crucial for managing costs and ensuring supply chain stability.

| Factor | Impact on Supplier Bargaining Power | Example/Data (2024) |

|---|---|---|

| Supplier Concentration | Low to Moderate | Acomo sources from a wide network, reducing reliance on single suppliers for most commodities. |

| Switching Costs | Moderate to High | Long-term contracts and integrated logistics can increase costs for Acomo to switch suppliers. |

| Threat of Forward Integration | Low | Most suppliers lack the scale and infrastructure for direct competition with Acomo. |

| Supplier Dependence on Acomo | High for Small Suppliers | Acomo's market access is critical for smaller producers, limiting their negotiation power. |

| Availability of Substitutes | Moderate | Regional alternatives and different grades offer Acomo flexibility, tempering supplier power. |

What is included in the product

Acomo's Porter's Five Forces Analysis reveals the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within Acomo's specific market context.

Pinpoint and quantify competitive threats with a visual, interactive matrix that clearly highlights areas of strategic vulnerability.

Customers Bargaining Power

Acomo operates within the global food and beverage sector, catering to a wide array of clients from major international players to niche producers. The concentration of Acomo's sales among a few key customers significantly amplifies their bargaining power, as these large-volume buyers can leverage their purchasing might to negotiate lower prices.

For instance, if Acomo’s top 10 customers accounted for over 40% of its revenue in 2023, these dominant clients would possess considerable leverage. This concentration means that losing even one major client could have a substantial impact on Acomo's profitability, thereby increasing the customers' ability to dictate terms.

Many of the agricultural commodities Acomo deals with, like bulk coffee or cocoa, are quite standardized. This means customers can easily shop around for the best prices, giving them more leverage. For instance, in 2024, the global coffee market saw significant price fluctuations, making it easier for buyers to switch if Acomo's pricing wasn't competitive.

However, Acomo isn't just a commodity trader. By offering services like processing, custom blending, and specialized logistics, they create unique value. This differentiation makes it harder for customers to find exact substitutes, thereby lessening their bargaining power. Acomo's focus on traceable and sustainable sourcing, a growing trend in 2024, also adds a layer of differentiation that can command premium pricing.

Acomo's customers face moderate switching costs. While the raw materials themselves might be widely available, the value Acomo provides in terms of consistent quality, dependable delivery, and tailored processing significantly influences customer retention.

For instance, in the food ingredients sector, a customer switching from Acomo might encounter the expense and time associated with qualifying a new supplier's product for their specific formulations and ensuring that the new supplier can meet their stringent quality and safety standards. This integration process can take months, impacting production schedules.

In 2024, supply chain disruptions continued to highlight the importance of reliable partners. Companies that had invested in strong relationships with suppliers like Acomo, who offer robust risk management alongside their products, found it more challenging and costly to switch, reinforcing the existing switching barriers.

Threat of Backward Integration by Customers

Large food and beverage corporations, particularly those operating at a significant scale, wield a substantial threat of backward integration. This means they could opt to develop their own direct sourcing channels, effectively cutting out intermediaries like Acomo. For instance, in 2024, major players in the global coffee market, a key sector for traders, continued to explore direct farmer relationships to gain greater control over quality and supply chain costs.

This capability puts pressure on Acomo to clearly articulate its value beyond simple distribution services. Companies like Acomo must demonstrate how they add unique value through expertise, risk management, or market access that these large buyers cannot easily replicate internally. The ongoing consolidation within the food and beverage industry further amplifies this threat, as larger entities gain more resources to pursue such vertical integration strategies.

- Significant Scale Advantage: Large food and beverage companies often have the financial muscle and operational expertise to establish their own sourcing operations.

- Cost Reduction Potential: Bypassing traders can lead to direct cost savings for these large buyers.

- Supply Chain Control: Backward integration allows for greater oversight and management of the entire supply chain, from farm to finished product.

- Market Dynamics: Ongoing industry consolidation in food and beverage can empower more companies to pursue backward integration.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Acomo, especially within the food and beverage sector. Many of Acomo's clients operate in highly competitive markets, making them acutely aware of ingredient costs. For instance, in 2024, the global food and beverage industry faced persistent inflationary pressures, leading many manufacturers to scrutinize every component of their cost structure to maintain competitive pricing for their end products.

This sensitivity means that customers often seek the lowest possible prices for commodity ingredients, which can represent a substantial portion of their overall production expenses. When customers have numerous suppliers for similar products, they can more easily switch to a lower-cost alternative, thereby diminishing Acomo's bargaining power. This dynamic is particularly evident for widely available ingredients where differentiation is minimal.

The pressure to secure cost-effective inputs directly impacts Acomo's profit margins and its ability to negotiate favorable terms. For example, if Acomo's competitors offer similar quality ingredients at a lower price point, customers are incentivized to shift their business. This can force Acomo to either absorb lower margins or risk losing market share to more price-competitive rivals.

Key indicators of customer price sensitivity for Acomo include:

- High volume purchases of commodity ingredients: Customers buying large quantities of basic ingredients are more likely to focus on price.

- Intense competition in customer industries: Sectors like packaged foods and beverages often see fierce price wars, pushing manufacturers to demand lower input costs.

- Availability of substitute ingredients: If alternative ingredients can fulfill a similar function, customers have more leverage to demand lower prices.

- Low switching costs for customers: When it is easy and inexpensive for a customer to change suppliers, their price sensitivity increases.

The bargaining power of Acomo's customers is a significant force, especially for standardized commodities where price is the primary differentiator. Large customers, due to their scale, can exert considerable pressure for lower prices, and the threat of backward integration remains a constant concern for intermediaries like Acomo. Customer price sensitivity is heightened by competitive end markets and the availability of substitutes.

| Customer Characteristic | Impact on Acomo's Bargaining Power | Example/Data Point (2024 Context) |

|---|---|---|

| Customer Concentration | High (if few dominant buyers) | If Acomo's top 10 customers represent >40% of revenue, their leverage is amplified. |

| Product Standardization | High (for commodities) | Standard coffee beans or cocoa powder allow easy price comparison, increasing customer leverage. |

| Threat of Backward Integration | High (for large buyers) | Major food manufacturers exploring direct sourcing in 2024 to control costs and quality. |

| Customer Price Sensitivity | High (in competitive markets) | Inflationary pressures in 2024 forced many food manufacturers to scrutinize ingredient costs. |

What You See Is What You Get

Acomo Porter's Five Forces Analysis

This preview displays the complete Acomo Porter's Five Forces Analysis, offering a detailed examination of competitive pressures within the industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently rely on this preview as your final deliverable, ready for immediate application in your strategic planning.

Rivalry Among Competitors

The agricultural commodity and food ingredient trading arena is a crowded space, featuring behemoths like Cargill, Bunge, ADM, and Louis Dreyfus (often called the ABCD companies) alongside a multitude of smaller, specialized regional traders. Acomo navigates this complex environment, facing off against these giants in terms of sheer volume and reach, while also contending with niche players who excel in specific product categories or geographic markets.

This diversity in competitor size and strategic focus means Acomo must be agile. Competition isn't just about matching scale; it's also about outmaneuvering specialized rivals. For instance, in 2024, the global agricultural trade saw continued consolidation, but also the rise of agile, tech-enabled startups focusing on specific sustainable sourcing or traceability solutions.

The agricultural commodity trading sector is largely mature, with growth primarily driven by population expansion, evolving dietary habits, and demand from developing economies. For instance, the global population is projected to reach 9.7 billion by 2050, necessitating increased food production and trade.

A slower industry growth rate, often characteristic of mature markets, naturally intensifies competitive rivalry. Companies are compelled to vie more fiercely for existing market share rather than capitalizing on rapid market expansion. This dynamic frequently translates into heightened price competition and significant pressure on profit margins.

Acomo navigates competitive rivalry by focusing on value-added services like advanced processing, rigorous quality control, and streamlined logistics management. These offerings aim to distinguish Acomo from competitors, especially in markets where the underlying agricultural commodities are largely undifferentiated. By providing reliable supply chains and customized solutions, Acomo seeks to lessen the impact of direct price competition.

Despite these efforts, a substantial part of Acomo's business is still rooted in commodity trading, where price remains a primary competitive factor. For instance, in the cocoa market, which Acomo is heavily involved in, price fluctuations driven by global supply and demand significantly influence rivalry. In 2024, global cocoa prices saw dramatic increases, with futures contracts for delivery in March 2025 reaching record highs, underscoring the commodity-driven nature of much of the sector.

High Exit Barriers

High exit barriers in agricultural commodity trading, stemming from substantial investments in processing plants, global logistics, and entrenched distribution networks, can trap companies in the industry. For instance, a major trading house might have billions invested in port facilities and storage silos, making it economically unfeasible to divest these assets quickly. This immobility means that even when market conditions turn unfavorable, firms may continue operating, contributing to prolonged overcapacity and intense price competition.

This situation directly impacts competitive rivalry. Companies are less likely to exit, even if facing slim profit margins, because the cost of leaving is simply too high. This dynamic can lead to a scenario where many players remain active, vying for market share in a saturated environment. For example, in 2024, several large grain trading companies reported operating margins in the low single digits, yet continued to invest in new infrastructure rather than consolidate or exit, a testament to these high exit barriers.

- Significant Capital Investments: Businesses in this sector often have substantial fixed assets, such as processing facilities and specialized transportation fleets, making divestment costly.

- Global Network Dependencies: Established relationships with suppliers, buyers, and logistics providers worldwide create inertia, as severing these ties would disrupt operations and require rebuilding from scratch.

- Specialized Assets: Many assets are highly specialized for commodity handling and processing, with limited alternative uses, thus depressing resale values and increasing exit costs.

Fixed Costs and Perishability

The agricultural commodity sector, which Acomo operates within, is characterized by substantial fixed costs. These are tied to the significant investments required for processing plants, extensive storage facilities, and the complex global trading networks essential for operations. For instance, maintaining a global supply chain involves considerable capital expenditure on infrastructure and logistics.

Adding to the competitive pressure is the inherent perishability of many agricultural products. This characteristic demands swift inventory turnover and efficient sales cycles to prevent spoilage and value loss. Companies like Acomo must constantly manage this to avoid significant write-offs, which naturally intensifies the need to maintain sales volumes.

The combination of high fixed costs and product perishability often fuels aggressive pricing behaviors. To ensure capacity utilization and move perishable inventory before it degrades, firms may engage in price wars. This dynamic can lead to reduced profit margins across the industry, amplifying competitive rivalry as players strive to cover their substantial overheads.

- High Fixed Costs: Investments in processing, storage, and global logistics represent significant capital outlays.

- Perishability Pressure: The short shelf-life of many commodities necessitates rapid sales and efficient inventory management.

- Aggressive Pricing: To cover fixed costs and manage perishable inventory, companies may resort to price competition.

- Impact on Rivalry: These factors collectively contribute to an intensified competitive landscape where market share is fiercely contested.

Competitive rivalry within the agricultural commodity and food ingredient sector, where Acomo operates, is intense due to the presence of large, established players like Cargill and Bunge, as well as numerous specialized regional traders. This crowded market forces companies to compete not only on scale but also on agility and niche expertise, a dynamic evident in 2024 with the rise of tech-focused startups offering sustainable sourcing solutions.

The mature nature of the industry, with growth tied to population increases and dietary shifts, further intensifies competition, often leading to price wars and squeezed profit margins. For example, in 2024, global cocoa prices surged to record highs, highlighting how commodity-specific supply and demand dynamics directly fuel rivalry.

High exit barriers, including substantial investments in processing plants and global logistics networks, mean companies often remain in the market even with low profitability, contributing to prolonged overcapacity and fierce competition. This is illustrated by major grain traders in 2024 reporting low single-digit operating margins yet continuing infrastructure investments rather than exiting.

The combination of high fixed costs, product perishability requiring rapid inventory turnover, and the resulting pressure for aggressive pricing strategies collectively amplifies competitive rivalry. Companies must constantly strive to maintain sales volumes and cover overheads, making market share a critical battleground.

| Competitor Type | Key Characteristics | Impact on Rivalry | 2024 Market Trend Example |

| Global Giants (e.g., ABCD) | Massive scale, extensive global networks, broad product portfolios | High volume competition, price sensitivity, significant market influence | Continued consolidation efforts, focus on supply chain efficiency |

| Specialized Regional Traders | Niche product focus, deep local market knowledge, agility | Targeted competition in specific segments, innovation in service offerings | Growth in sustainable sourcing and traceability solutions |

| Agile Startups | Technology-driven, focus on specific segments (e.g., sustainability, traceability) | Disruptive potential, pressure on incumbents to innovate | Increased adoption of digital platforms for trading and logistics |

SSubstitutes Threaten

The threat of substitutes for Acomo's offerings is significant due to the wide array of alternative ingredients food manufacturers can utilize. For instance, the global sweetener market, excluding sugar, was valued at approximately $32.5 billion in 2023 and is projected to grow, presenting direct substitutes for certain Acomo products. Similarly, the plant-based protein sector, which saw substantial investment and innovation in 2023, offers alternatives to traditional protein sources Acomo might supply.

Emerging food technologies are increasingly offering alternatives to traditional agricultural products, presenting a growing threat of substitutes for companies like Acomo. Innovations such as lab-grown meats, synthetic ingredients, and precision fermentation could significantly alter consumer preferences and demand for naturally sourced commodities. For instance, the cultivated meat market, though still nascent, saw significant investment in 2024, with projections indicating substantial growth in the coming years, potentially impacting demand for conventional livestock products.

While these technologies are currently niche, their rapid development could disrupt established supply chains. Consider the potential impact on categories like cocoa, where alternative chocolate made from fermentation or plant-based sources is gaining traction. In 2024, consumer surveys indicated a rising interest in plant-based and novel protein sources, suggesting a long-term shift that could reduce reliance on traditional protein commodities.

Large food and beverage manufacturers increasingly possess the capability to bypass intermediaries like Acomo and source commodities directly from producers. This direct sourcing reduces their reliance on traders and can lead to cost savings. For instance, in 2024, many major food conglomerates continued to expand their in-house procurement operations, investing in dedicated teams and logistics networks to manage global supply chains more efficiently.

Alternative Supply Chain Models

The emergence of alternative supply chain models, particularly those leveraging blockchain and digital platforms, poses a significant threat of substitution for traditional intermediaries like Acomo. These technologies can enable more direct relationships between growers and end-users, potentially disintermediating Acomo’s core trading function. For instance, platforms facilitating direct farm-to-table sales are gaining traction, bypassing traditional wholesale channels.

These evolving models aim to enhance transparency and efficiency, offering a compelling alternative to the established structures. While still in their nascent stages, the long-term implications for companies like Acomo are substantial, as they could fundamentally alter the value chain. The increasing investment in and adoption of these digital solutions underscore their potential to disrupt established market dynamics.

Consider the following points regarding this threat:

- Blockchain and Digital Platforms: Technologies like blockchain offer enhanced traceability and security, enabling direct connections between producers and consumers, thereby reducing reliance on traditional trading houses.

- Disintermediation Potential: These new models can bypass Acomo's intermediary role by streamlining transactions and improving information flow, potentially leading to lower costs and greater efficiency for both buyers and sellers.

- Long-Term Structural Threat: The ongoing development and increasing adoption of these alternative supply chain structures represent a persistent and evolving threat to Acomo's established business model.

Price-Performance Trade-off of Substitutes

The threat of substitutes for Acomo hinges on the price-performance trade-off offered by alternatives. If other ingredient suppliers or direct sourcing models can deliver comparable quality and functionality at a lower price point, customers may be tempted to switch. For instance, in the cocoa market, while Acomo offers premium, traceable beans, smaller cooperatives might provide less traceable but cheaper alternatives, impacting Acomo's market share if the price gap widens significantly.

Acomo needs to continually highlight its value proposition beyond just the raw product. This includes emphasizing quality assurance, supply chain reliability, and robust risk management services, which are often bundled into their offerings. For example, Acomo's commitment to sustainability and ethical sourcing, while potentially adding to costs, provides a crucial differentiator that many large food manufacturers prioritize to meet consumer demand for responsible products.

- Price Sensitivity: In 2024, fluctuating commodity prices globally, including for agricultural products Acomo deals with, can make cost-conscious buyers more receptive to substitutes.

- Quality Benchmarks: If substitute ingredients meet industry quality standards (e.g., specific flavor profiles, processing capabilities) at a lower cost, the switching barrier diminishes.

- Innovation in Alternatives: The development of novel ingredients or processing techniques that mimic Acomo's offerings more affordably presents a growing threat.

- Customer Loyalty: Strong relationships and perceived value-added services from Acomo can mitigate the threat, even when substitutes appear cheaper on a per-unit basis.

The threat of substitutes for Acomo is amplified by the growing availability of alternative ingredients and evolving food technologies. For instance, the global market for plant-based proteins, a direct substitute for traditional protein sources Acomo might supply, experienced significant growth and investment throughout 2023 and into 2024. Innovations in areas like cultivated meat, while still developing, represent a long-term substitution risk that could impact demand for conventional agricultural commodities. Furthermore, the increasing capability of large food manufacturers to source directly from producers, bypassing intermediaries like Acomo, and the rise of digital platforms that facilitate these direct connections, present a structural threat by offering more efficient and potentially cost-effective supply chain alternatives.

| Category | 2023 Market Value (USD Billion) | Projected Growth Factor (2024-2028) | Key Substitute Drivers |

|---|---|---|---|

| Sweeteners (Excluding Sugar) | 32.5 | Moderate | Health consciousness, innovation in natural sweeteners |

| Plant-Based Proteins | N/A (Rapidly Growing) | High | Consumer demand for sustainable and ethical options |

| Cultivated Meat | Nascent | Very High | Technological advancements, potential cost reduction |

Entrants Threaten

High capital requirements present a formidable barrier to entry in Acomo's industry. Establishing the necessary infrastructure, including vast storage facilities, processing plants, and global logistics networks, demands significant upfront investment. For instance, companies need substantial funds for inventory management, which can tie up considerable capital, especially with fluctuating commodity prices.

The need for advanced risk management systems and technology further escalates these capital demands. New entrants must also contend with the costs associated with building relationships and securing supply contracts, which often require financial backing and proven operational capacity. In 2024, the average cost to build a new, moderately sized grain elevator with integrated storage and handling facilities could easily exceed $20 million, illustrating the scale of investment required.

Acomo's deeply entrenched supply chain networks are a significant barrier for new entrants. The company has cultivated long-standing relationships with producers and customers spanning numerous countries, a testament to decades of trust-building and operational refinement. These global networks are crucial for ensuring a consistent supply of agricultural commodities and navigating intricate international trade regulations, making them exceptionally difficult for newcomers to replicate swiftly.

The global agricultural commodity trade is burdened by a dense web of international regulations, including stringent food safety standards, import/export tariffs, and sanitary and phytosanitary (SPS) measures. New entrants must invest heavily in understanding and adhering to these complex rules, a significant barrier to entry.

Economies of Scale and Scope

Existing players in the agribusiness sector, such as Acomo, leverage substantial economies of scale across their operations. This includes benefits in sourcing raw materials, processing, global logistics, and sophisticated risk management, all driven by their considerable transaction volumes. For instance, Acomo's significant purchasing power allows for more favorable pricing on inputs compared to smaller, emerging competitors.

New entrants face a considerable hurdle in matching these cost efficiencies. Without achieving comparable initial volumes, it's challenging to compete on price against established entities that benefit from lower per-unit costs. This cost disadvantage can significantly deter new companies from entering the market.

Furthermore, Acomo's broad product portfolio allows for economies of scope, where the cost of producing one product can be reduced by producing another. This diversification spreads overhead costs and enhances overall operational efficiency, presenting another barrier for new, specialized entrants.

Key factors contributing to the threat of new entrants related to economies of scale and scope include:

- Sourcing Power: Large players secure better terms for agricultural commodities.

- Operational Efficiencies: High-volume processing and logistics reduce per-unit costs.

- Risk Mitigation: Diversified portfolios and hedging strategies lower overall business risk.

- Capital Requirements: The substantial investment needed to achieve competitive scale acts as a significant barrier.

Risk Management Expertise and Reputation

The agricultural commodity market is a turbulent arena, buffeted by weather patterns, geopolitical shifts, and currency volatility. Newcomers often struggle to navigate these inherent risks. Established companies like Acomo have cultivated decades of expertise in crucial areas such as commodity hedging, sophisticated price risk management strategies, and building resilient supply chains. This deep-seated knowledge is not easily replicated, presenting a significant barrier to entry for those without a proven track record.

For instance, in 2023, global food commodity prices experienced significant fluctuations. The FAO Food Price Index averaged 126.9 points in 2023, a 10.4% decrease from 2022, but still remained elevated compared to pre-pandemic levels. This volatility underscores the need for robust risk management capabilities that new entrants may lack.

- Weather Impacts: Extreme weather events in 2024, such as droughts in South America and floods in parts of Asia, directly impacted yields and supply availability for key commodities like soybeans and rice, highlighting the critical need for sophisticated supply chain management and risk mitigation.

- Geopolitical Instability: Ongoing conflicts and trade disputes in various regions continued to disrupt traditional trade routes and create price uncertainty for commodities like grains and edible oils throughout 2024, requiring established players to have diversified sourcing and logistics networks.

- Currency Fluctuations: Major currency movements in 2024, particularly against the US dollar, affected the cost of imported agricultural inputs and the competitiveness of exported goods, necessitating advanced financial hedging and currency risk management expertise.

- Reputational Capital: A strong reputation for reliability and quality is paramount in the commodity sector. New entrants must build trust with suppliers and customers, a process that takes considerable time and consistent performance, which Acomo has cultivated over its history.

The threat of new entrants in Acomo's sector is significantly mitigated by the immense capital required for operations, extensive regulatory compliance, and the established economies of scale. New players face substantial hurdles in matching the sourcing power, operational efficiencies, and risk mitigation capabilities of incumbents like Acomo.

The need for vast infrastructure, including global logistics and storage, coupled with the costs of navigating complex international trade regulations, creates a formidable barrier. For example, building a new grain elevator in 2024 could cost upwards of $20 million, a sum many potential entrants cannot readily access.

Acomo's deeply entrenched supply chain and strong reputation, built over decades, are difficult for newcomers to replicate. The inherent volatility of commodity markets, as seen with the FAO Food Price Index fluctuating in 2023, demands sophisticated risk management expertise that new entrants often lack.

The substantial investment needed to achieve competitive scale, combined with the cost efficiencies derived from high-volume processing and diversified portfolios, acts as a significant deterrent to new market participants.

Porter's Five Forces Analysis Data Sources

Our analysis leverages a comprehensive suite of data sources, including company annual reports, industry association publications, and market research reports from leading firms like Gartner and Forrester.