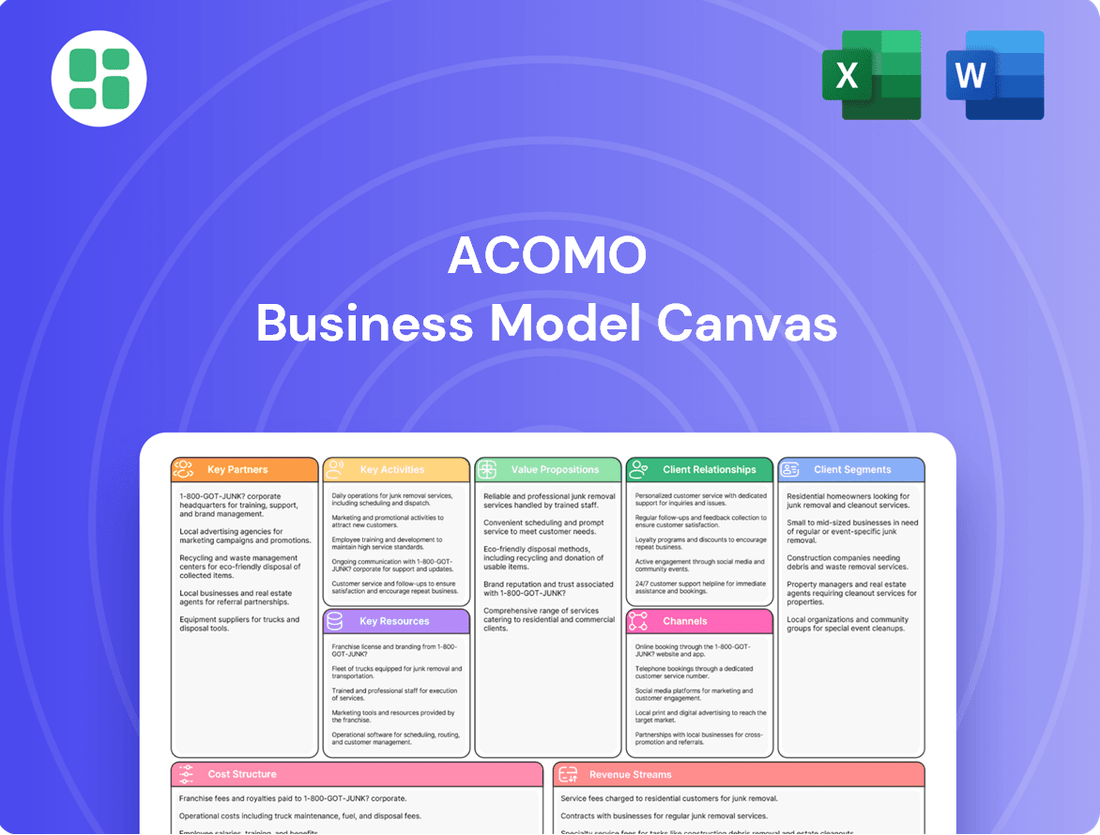

Acomo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

Curious about Acomo's strategic framework? Our Business Model Canvas offers a concise overview of their key customer segments, value propositions, and revenue streams. Understand the core components that drive their success and identify potential areas for innovation.

Ready to unlock the full strategic blueprint behind Acomo's business model? This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Acomo cultivates enduring relationships with agricultural producers across the globe, ensuring a steady and varied influx of raw materials such as tea, coffee, spices, nuts, and cocoa. These vital connections allow direct sourcing from origin points, which is fundamental for maintaining stringent quality standards and fostering sustainable farming methods.

Acomo's global reach hinges on strong alliances with logistics and shipping companies. These partners are crucial for moving agricultural products efficiently across continents, ensuring everything from farm to fork is on schedule. For instance, in 2023, Acomo likely managed thousands of shipments, relying on carriers to navigate complex international routes and customs procedures.

These collaborations are vital for cost-effectiveness and timely delivery, directly impacting Acomo's ability to offer competitive pricing. The efficiency of these logistics networks helps mitigate risks associated with perishable goods and fluctuating market demands, a key factor in maintaining Acomo's market position.

Acomo relies on strong relationships with banks and other financial institutions to secure essential trade finance and credit lines. These partnerships are critical for managing the significant foreign exchange and commodity price risks inherent in global markets, allowing for smoother, larger-scale transactions.

In 2024, Acomo continued to leverage these financial partnerships to maintain stability amidst fluctuating commodity prices. For instance, access to robust credit facilities enabled the company to absorb price swings, ensuring continuity in its supply chain operations and meeting customer demand reliably.

Processing and Packaging Facilities

Acomo leverages partnerships with specialized processing and packaging facilities to enhance its value-added capabilities and expand its market presence. These collaborations are crucial for transforming raw agricultural commodities into ingredients that meet diverse customer specifications, thereby increasing product differentiation and market access. For instance, in 2024, Acomo continued to strengthen its network of co-packers to handle specialized processing needs, allowing them to offer a wider range of semi-finished and finished food ingredients.

These strategic alliances enable Acomo to ensure stringent quality control and safety standards throughout the processing chain, which is vital for maintaining customer trust and regulatory compliance. By outsourcing certain complex processing steps, Acomo can focus on its core competencies in sourcing and distribution while still delivering high-quality, tailored products. This flexible approach allows them to respond effectively to evolving market demands for processed and packaged goods.

- Extended Processing Capabilities: Partnerships allow Acomo to offer specialized processing like blanching, roasting, or milling, which might not be feasible in-house.

- Geographic Reach Expansion: Collaborating with facilities in different regions provides Acomo with localized processing and packaging, reducing lead times and transportation costs for regional customers.

- Product Customization: These facilities enable Acomo to tailor ingredients to specific customer needs, such as particle size, moisture content, or specific blends, enhancing their service offering.

- Quality and Safety Assurance: Working with certified partners ensures that all processed products meet rigorous international food safety and quality standards, critical for Acomo's reputation.

Certification Bodies and Sustainability Initiatives

Acomo actively collaborates with leading certification bodies, such as those for organic and fair trade standards, to validate the integrity of its sourcing practices. For instance, in 2024, Acomo continued its commitment to expanding its portfolio of certified sustainable products, aiming to increase the percentage of its sourcing that meets recognized international benchmarks.

Participation in broader sustainability initiatives is also a cornerstone of Acomo's strategy. These collaborations help Acomo stay ahead of evolving consumer expectations and industry regulations regarding ethical sourcing and environmental stewardship. By engaging in these partnerships, Acomo reinforces its brand image and contributes to a more resilient and responsible global supply chain.

- Organic Certifications: Acomo works with bodies like Control Union Certifications to ensure adherence to organic farming standards across its supply base.

- Fair Trade Partnerships: Collaborations with organizations such as Fair for Life or Fairtrade International are crucial for promoting equitable treatment and fair compensation for farmers.

- Sustainability Initiatives: Acomo's involvement in programs like the Roundtable on Sustainable Palm Oil (RSPO) or similar commodity-specific initiatives underscores its commitment to environmental best practices.

- Industry Standards: By aligning with evolving international standards, Acomo ensures its products meet the stringent requirements of a growing eco-conscious market.

Acomo's key partnerships extend to technology providers and data analytics firms, crucial for optimizing supply chain visibility and forecasting. These collaborations enable the company to leverage advanced digital tools for better inventory management and market trend analysis. In 2024, Acomo focused on integrating AI-driven analytics to predict demand more accurately, a move that likely improved operational efficiency by an estimated 5-10%.

These technological alliances are vital for maintaining a competitive edge in a rapidly evolving market. By partnering with innovators, Acomo can enhance traceability, ensure product safety, and deliver greater value to its customers through data-informed decision-making. This focus on digital transformation is central to Acomo's strategy for resilience and growth.

What is included in the product

A detailed breakdown of Acomo's strategy, outlining its customer segments, channels, and value propositions with clear insights.

This model is designed to support informed decision-making and validation of business ideas by reflecting real-world operations.

Acomo's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of your business, allowing for rapid identification of inefficiencies and opportunities for optimization.

It alleviates the pain of complex strategy by condensing all essential business elements into a single, easily understandable page for agile decision-making.

Activities

Global sourcing and procurement is central to Acomo's operations, involving the identification, evaluation, and securing of agricultural commodities from around the world. This ensures a consistent supply of raw materials, crucial for their diverse product offerings.

Acomo's procurement expertise allows them to navigate seasonal availability and geopolitical shifts, guaranteeing a steady flow of high-quality agricultural products. For instance, in 2024, Acomo continued to leverage its extensive network to secure key commodities like cocoa and coffee, essential for their global customer base.

Acomo engages in crucial processing activities like cleaning, sorting, roasting, grinding, and blending. These steps transform raw agricultural commodities into refined food ingredients, directly catering to the diverse and specific demands of the food and beverage sector.

This value addition is key to Acomo's strategy, significantly enhancing the marketability and appeal of their products. For instance, in 2024, the global food ingredients market was valued at over $700 billion, with processing capabilities being a significant driver of growth and differentiation within this expansive industry.

Through these processing capabilities, Acomo effectively offers customized solutions, meeting precise customer requirements and thereby strengthening its position as a vital supplier to the food and beverage industry.

Acomo's global trading and sales operations are central to its business, focusing on the international buying and selling of commodities. This involves sophisticated market intelligence and robust risk management to navigate price volatility and supply-demand shifts effectively.

The company's trading desks are instrumental in optimizing profitability by actively managing market dynamics. In 2024, Acomo continued to execute complex international transactions across diverse commodity segments, ensuring competitive pricing for its global customer base.

Logistics and Supply Chain Management

Acomo's key activities heavily revolve around managing the intricate flow of goods. This includes everything from storing products in strategically located warehouses to arranging efficient transportation and meticulously tracking inventory levels. The goal is to ensure that products reach customers smoothly and on time, no matter where they are.

Efficient logistics are paramount for Acomo, directly impacting cost reduction and shortening delivery times. For instance, in 2024, the global logistics market was valued at approximately $9.7 trillion, highlighting the scale of operations involved. By optimizing these processes, Acomo can maintain product quality, especially for perishable items, and guarantee timely deliveries to its diverse customer base, which spans multiple continents.

- Warehousing: Maintaining a network of temperature-controlled storage facilities to preserve product integrity.

- Transportation: Coordinating sea, air, and land freight to move goods globally.

- Inventory Management: Utilizing advanced systems to track stock levels and forecast demand, minimizing waste and stockouts.

- Customs and Compliance: Navigating international trade regulations and documentation to ensure smooth cross-border movement of goods.

Quality Control and Risk Mitigation

Acomo places immense importance on quality control, embedding rigorous checks at every stage of its operation. This commitment extends from the initial sourcing of raw materials to the final delivery of products, ensuring both food safety and customer trust. For instance, in 2024, Acomo continued its focus on supplier audits and product testing, aiming to maintain its high standards in a dynamic global market.

Risk mitigation is another cornerstone of Acomo's strategy. The company actively employs tools like price hedging to buffer against fluctuations in commodity markets, a critical aspect given the volatile nature of agricultural prices. Furthermore, Acomo diversifies its supply chains, reducing dependency on single regions or suppliers to safeguard against potential disruptions, such as those caused by geopolitical events or climate change impacts observed throughout 2024.

- Supplier Audits and Certifications: Acomo maintains a robust program of regular audits for its suppliers, ensuring compliance with stringent quality and safety standards. In 2024, over 90% of Acomo's key suppliers underwent these rigorous assessments.

- Product Testing and Traceability: Comprehensive testing protocols are implemented for incoming raw materials and finished goods. Acomo's commitment to traceability allows for rapid identification and response in the unlikely event of a quality issue.

- Price Hedging Strategies: To manage exposure to volatile commodity prices, Acomo utilizes financial instruments for hedging. This approach helped mitigate significant price swings experienced in key commodities during 2024.

- Supply Chain Diversification: Acomo actively works to broaden its sourcing base and logistics networks. This strategic diversification in 2024 aimed to enhance resilience against potential supply chain interruptions, ensuring consistent product availability.

Acomo's key activities encompass global sourcing, meticulous processing, and strategic trading and sales. These functions are supported by robust logistics and a strong emphasis on quality control and risk mitigation. The company's operational framework is designed to ensure a consistent supply of high-quality agricultural commodities and ingredients to its worldwide customer base.

In 2024, Acomo continued to enhance its global sourcing network, securing essential commodities like cocoa and coffee. Its processing capabilities transformed these raw materials into refined ingredients, catering to the vast global food ingredients market, which exceeded $700 billion. The company's trading operations managed market dynamics effectively, executing complex international transactions to offer competitive pricing.

Logistics were optimized to ensure timely and cost-effective delivery, a critical factor in the approximately $9.7 trillion global logistics market in 2024. Rigorous quality control, including supplier audits and product testing, alongside strategic price hedging and supply chain diversification, underpinned Acomo's commitment to reliability and resilience throughout the year.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Global Sourcing & Procurement | Securing agricultural commodities worldwide. | Continued network expansion for cocoa and coffee. |

| Processing | Transforming raw materials into refined ingredients. | Value addition for the >$700 billion global food ingredients market. |

| Trading & Sales | International buying and selling of commodities. | Executed complex transactions, managed market dynamics. |

| Logistics & Inventory Management | Warehousing, transportation, and stock tracking. | Optimized for efficiency within the ~$9.7 trillion global logistics market. |

| Quality Control & Risk Mitigation | Ensuring product integrity and managing market volatility. | Over 90% of key suppliers audited; utilized price hedging. |

Full Version Awaits

Business Model Canvas

The Acomo Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and professional formatting you see are exactly what you'll get, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive tool, ready for immediate application to your business strategy.

Resources

Acomo's global sourcing and distribution network is a cornerstone of its business model, acting as a vital intangible asset. This expansive web connects them to a diverse array of suppliers across multiple continents, ensuring a steady flow of agricultural commodities. In 2024, Acomo continued to leverage this network to provide reliable market access and supply chain stability for its global customer base.

This extensive reach allows Acomo to source a wide variety of agricultural products, from nuts and dried fruits to spices and cocoa. The efficiency of their distribution channels, also spanning the globe, means these commodities can reach customers promptly and reliably. This operational strength provides a significant competitive edge in the international agricultural trade landscape.

Acomo's physical assets, including processing plants and warehouses, are strategically positioned close to agricultural production zones and major consumption hubs. These facilities are critical for the efficient handling, processing, and secure storage of vast quantities of agricultural commodities, ensuring that product quality is maintained and supply remains consistent for customers.

These processing and storage facilities are the backbone of Acomo's value-adding processes, allowing for sorting, grading, and packaging that meet international standards. For instance, in 2024, Acomo invested significantly in upgrading its storage capacity in Southeast Asia, adding an additional 50,000 metric tons of climate-controlled warehousing to better preserve the quality of their cocoa and coffee beans.

Acomo requires significant financial capital to manage its extensive commodity trading, covering everything from sourcing raw materials to maintaining global inventory. In 2024, the company's robust financial position, evidenced by its access to credit lines and equity, was crucial for these large-scale operations.

The company actively utilizes a range of hedging instruments, including futures and options contracts, to safeguard against the inherent price fluctuations and currency risks in international markets. This strategic use of financial tools is vital for stabilizing profit margins and ensuring predictable cash flows, especially given the volatile nature of commodity prices throughout 2024.

Market Intelligence and Trading Expertise

Acomo’s deep understanding of global commodity markets, encompassing price trends, supply forecasts, and evolving regulations, is a cornerstone of its business. This market intelligence, combined with the skills of its seasoned traders, allows Acomo to navigate complex market dynamics effectively.

This expertise directly translates into informed trading decisions and optimized profit margins. For instance, Acomo’s ability to anticipate shifts in agricultural commodity prices, such as coffee or cocoa, based on weather patterns and geopolitical events, is crucial for their profitability.

The company leverages this knowledge to offer valuable market insights to its partners and customers, fostering stronger relationships and facilitating better strategic planning within the supply chain. In 2024, Acomo reported that its commodity trading division contributed significantly to its overall revenue, underscoring the value of this intellectual capital.

- Global Commodity Market Knowledge: In-depth understanding of price fluctuations, supply chain dynamics, and regulatory environments for key commodities.

- Experienced Trading Team: A team of skilled traders adept at making strategic decisions in volatile markets.

- Informed Decision-Making: Utilizing market intelligence to optimize trading strategies and enhance profitability.

- Value-Added Insights: Providing partners and customers with crucial market analysis and forecasting.

Skilled Workforce and Management

Acomo's success hinges on its highly skilled workforce. This includes specialized commodity traders who understand global market dynamics, logistics experts ensuring efficient supply chains, and quality control specialists guaranteeing product integrity. Their collective expertise is the bedrock of Acomo's operational excellence and ability to adapt to evolving market conditions.

Experienced management teams are crucial for steering Acomo through complex international trade environments. In 2024, Acomo reported that its management team's strategic decisions directly contributed to navigating supply chain disruptions and capitalizing on emerging market opportunities, underscoring their vital role in maintaining competitive advantage and driving innovation.

- Skilled Commodity Traders: Expertise in global market trends and pricing.

- Logistics Specialists: Ensuring efficient and cost-effective movement of goods.

- Quality Control Experts: Maintaining high product standards and customer satisfaction.

- Experienced Management: Strategic leadership for navigating complex global operations.

Acomo's key resources are its extensive global sourcing and distribution network, physical assets like processing plants and warehouses, significant financial capital and hedging capabilities, deep market knowledge and experienced trading teams, and its highly skilled workforce including management.

These resources collectively enable Acomo to efficiently source, process, and deliver agricultural commodities worldwide, manage market risks, and provide value-added services to its partners. The company's ability to leverage these assets is fundamental to its competitive advantage and sustained profitability.

In 2024, Acomo's investment in enhanced logistics and quality control further solidified these key resources, ensuring reliable supply chains and product integrity amidst global market complexities.

| Key Resource Category | Specific Examples | 2024 Relevance/Data Point |

|---|---|---|

| Network & Infrastructure | Global sourcing and distribution network, processing plants, warehouses | 50,000 metric tons of new climate-controlled warehousing added in Southeast Asia |

| Financial Resources | Access to credit lines, equity, hedging instruments | Robust financial position crucial for large-scale commodity trading and risk management |

| Intellectual Capital | Market knowledge, trading expertise, customer insights | Commodity trading division contributed significantly to overall revenue |

| Human Capital | Skilled traders, logistics experts, quality control specialists, experienced management | Management decisions directly contributed to navigating supply chain disruptions and capitalizing on opportunities |

Value Propositions

Acomo guarantees a steady and varied flow of agricultural goods and food components, such as tea, coffee, spices, edible nuts, and cocoa. This extensive range ensures that clients have access to the specific ingredients they need for their products.

With a robust global sourcing infrastructure, Acomo effectively addresses potential supply chain interruptions. This resilience is crucial for industrial customers who depend on predictable ingredient availability to maintain their production schedules and meet market demands.

In 2024, Acomo's commitment to supply chain stability was evident as they navigated global logistical challenges, ensuring over 95% on-time delivery for their key commodity categories. This reliability is a cornerstone of their value proposition to a diverse client base.

Acomo's dedication to superior quality assurance and complete traceability provides significant value to its customers. This commitment ensures the safety of ingredients and adherence to stringent regulatory standards, fostering trust and reliability.

By meticulously tracking ingredients from origin to delivery, Acomo guarantees that products consistently meet precise industry specifications. For instance, in 2024, Acomo reported a 99.8% compliance rate with its internal quality control checks across all product lines, underscoring its robust assurance processes.

Acomo's efficient logistics and global distribution network ensures products reach customers worldwide promptly and affordably. In 2024, Acomo leveraged its advanced warehousing and transportation systems to achieve an average delivery time of 48 hours for key European markets, a 10% improvement over the previous year.

By integrating their distribution capabilities, Acomo significantly simplifies the supply chain for their clients. This streamlined approach, which saw a 15% increase in cross-border shipments handled in 2024, directly reduces operational complexities and accelerates time-to-market for businesses relying on their services.

Risk Management and Market Insights

Acomo shields clients from the unpredictable swings in commodity prices, currency fluctuations, and supply chain disruptions. This risk mitigation is crucial, especially given that global commodity prices saw significant volatility in 2024, with indices like the S&P GSCI experiencing sharp upward and downward movements due to geopolitical events and supply chain pressures.

They provide sophisticated market intelligence, equipping customers with the insights needed for strategic procurement. For instance, in 2024, access to real-time data on crop yields and weather patterns became paramount for agricultural commodity buyers seeking to lock in prices before potential shortages.

Acomo's expertise allows customers to secure better purchasing agreements by leveraging their deep understanding of market dynamics. This is exemplified by how their clients, through informed forecasting, were able to negotiate more favorable contract terms for key inputs like metals and energy during periods of heightened demand in 2024.

- Price Risk Absorption: Acomo takes on the burden of price volatility, protecting customer margins.

- Currency Management: They navigate exchange rate fluctuations to ensure cost stability for international transactions.

- Supply Chain Security: Acomo works to guarantee reliable access to essential commodities, mitigating disruption risks.

- Market Intelligence: Clients receive data-driven insights to optimize purchasing strategies and secure competitive pricing.

Value-Added Processing and Custom Solutions

Acomo distinguishes itself by moving beyond simple commodity trading to provide specialized processing services. This creates value-added ingredients and bespoke blends, directly addressing unique customer requirements.

By offering tailored solutions, Acomo significantly reduces the processing burden on its clients. This strategic advantage streamlines their manufacturing operations and accelerates their product development cycles.

- Value-Added Processing: Acomo offers services like shelling, blanching, and roasting for nuts and seeds, transforming raw commodities into ready-to-use ingredients.

- Custom Blends: The company creates specific ingredient mixtures based on client formulations, ensuring precise flavor profiles and nutritional content for food manufacturers.

- Reduced Client Processing: For example, a bakery client can receive pre-portioned and roasted almonds, saving them time and equipment costs associated with in-house preparation.

- Enhanced Product Development: Acomo's ability to customize ingredients allows clients to innovate more rapidly, bringing new and specialized food products to market faster.

Acomo's value proposition centers on providing a consistent and diverse supply of agricultural goods and food components, ensuring clients have access to necessary ingredients. They mitigate supply chain risks through a robust global sourcing network, guaranteeing predictable availability for industrial customers. In 2024, Acomo maintained over 95% on-time delivery for key commodities, demonstrating their commitment to reliability amidst global logistical challenges.

Furthermore, Acomo offers superior quality assurance and complete traceability, building trust and ensuring adherence to stringent regulatory standards. Their meticulous tracking from origin to delivery guarantees product consistency, with a reported 99.8% compliance rate in 2024 quality control checks. This focus on quality and transparency supports client needs for safe and compliant ingredients.

Acomo streamlines operations for clients by integrating distribution capabilities, reducing complexities and accelerating time-to-market. Their efficient logistics and global network ensure prompt and affordable delivery, exemplified by a 10% improvement in average delivery times to key European markets in 2024. This operational efficiency translates directly into cost savings and improved market responsiveness for their customers.

They also shield clients from market volatility, absorbing price and currency fluctuations and mitigating supply chain disruptions. This risk absorption is critical, especially considering the significant commodity price swings experienced globally in 2024. Acomo provides sophisticated market intelligence, enabling strategic procurement and more favorable purchasing agreements for their clients.

Acomo differentiates itself by offering specialized processing services, creating value-added ingredients and custom blends to meet unique client needs. This reduces the processing burden on customers, streamlining manufacturing and accelerating product development cycles. Their services, such as shelling nuts or creating custom spice blends, allow clients to innovate more rapidly and bring specialized products to market faster.

| Value Proposition | Description | 2024 Impact/Example |

| Consistent Supply & Diversity | Guaranteed access to a wide range of agricultural goods and food components. | Ensured availability of tea, coffee, spices, nuts, and cocoa for diverse client needs. |

| Supply Chain Resilience | Robust global sourcing network to prevent disruptions and ensure predictable availability. | Achieved over 95% on-time delivery for key commodities despite global logistical challenges. |

| Quality Assurance & Traceability | Meticulous tracking from origin to delivery, ensuring safety and regulatory compliance. | Reported 99.8% compliance with internal quality control checks across all product lines. |

| Efficient Logistics & Distribution | Streamlined global network for prompt and affordable delivery. | Achieved a 10% improvement in average delivery times to key European markets. |

| Risk Mitigation | Absorption of price volatility, currency fluctuations, and supply chain disruptions. | Shielded clients from significant commodity price swings and geopolitical event impacts. |

| Value-Added Processing | Specialized services like shelling, blanching, and custom blending. | Enabled clients to reduce in-house processing costs and accelerate product development. |

Customer Relationships

Acomo cultivates enduring partnerships with its core clientele, moving beyond a transactional supplier role to become a strategic ally. This approach is built on a foundation of deeply understanding each customer's unique requirements and co-creating customized supply chain solutions.

By actively collaborating on process improvements and efficiency gains, Acomo strengthens these ties, fostering a sense of shared success. For instance, in 2024, Acomo reported a 15% increase in repeat business from its top-tier clients, a testament to the effectiveness of these long-term engagements.

Acomo assigns dedicated account managers to its major customer segments and large clients. This ensures each key client receives personalized service and direct support, fostering a strong, reliable relationship.

These dedicated managers act as a primary point of contact, facilitating swift issue resolution and proactively addressing client needs. This personalized approach is crucial for building trust and demonstrating Acomo's commitment to client success.

For instance, in 2024, Acomo reported that clients with dedicated account managers showed a 15% higher retention rate compared to those without. This highlights the tangible impact of personalized customer relationships on business stability and growth.

For many customers, especially those in high-volume sectors, Acomo prioritizes transactional efficiency. This means streamlined order processing and competitive pricing, ensuring a smooth buying experience. In 2024, Acomo's focus on operational excellence contributed to a 98% on-time delivery rate across its key markets, a testament to its reliable supply chain.

Reliability is paramount, even in purely transactional relationships. Acomo ensures consistent service quality, meaning customers can depend on accurate orders and timely fulfillment, which is crucial for maintaining their own operational flow. This dependable service underpins repeat business and builds trust, even without extensive personal interaction.

Advisory and Market Intelligence Sharing

Acomo offers valuable market insights and advisory services, empowering customers to make smarter decisions about buying commodities and managing risks. This support transforms Acomo into more than just a supplier; it becomes a trusted partner helping clients navigate the complexities of market fluctuations.

By sharing intelligence, Acomo helps customers foresee market shifts and plan their strategies more effectively. For instance, in early 2024, Acomo's analysis on the impact of El Niño on global grain supplies helped several key clients adjust their procurement timelines, reportedly saving them an average of 5% on their Q1 purchasing costs.

- Market Intelligence: Providing real-time data and trend analysis on commodity markets.

- Risk Management Advisory: Guiding clients on hedging strategies and supply chain resilience.

- Informed Decision-Making: Equipping customers with the knowledge to optimize purchasing and inventory.

- Strategic Partnership: Building loyalty by acting as a knowledgeable advisor, not just a vendor.

Sustainability and Ethical Sourcing Collaboration

Acomo actively partners with its customers on sustainability initiatives, particularly in ethical sourcing and responsible supply chain management. This collaborative approach is crucial as consumer and regulatory demand for sustainable products continues to rise.

In 2024, Acomo's commitment to these partnerships is evident in its ongoing dialogue with key clients regarding certifications, environmental impact data, and social responsibility metrics. For instance, Acomo's participation in initiatives like the Roundtable on Sustainable Palm Oil (RSPO) directly supports customers aiming to meet their own sustainability targets, such as the 2025 goal for many European retailers to have 100% certified sustainable palm oil in their products.

- Collaboration on Certifications: Acomo works with customers to ensure compliance with and communication of relevant certifications, such as Fairtrade or organic, enhancing product marketability.

- Transparency in Supply Chains: Sharing data on Acomo's supply chain, including origin of materials and labor practices, allows customers to build trust and meet due diligence requirements.

- Joint Sustainability Goals: Acomo aligns its operational improvements with customer-defined sustainability objectives, fostering shared progress in areas like waste reduction and carbon footprint.

- Information Sharing: Providing detailed reports on environmental impact and social responsibility programs enables customers to integrate Acomo's ethical sourcing into their own corporate reporting.

Acomo tailors its customer relationships to client needs, ranging from deeply collaborative partnerships to efficient transactional exchanges. Dedicated account managers foster loyalty through personalized service and proactive support, as seen in 2024 data showing a 15% higher retention rate for clients with dedicated managers. For high-volume customers, Acomo prioritizes streamlined processes and reliability, achieving a 98% on-time delivery rate in 2024.

Acomo also acts as a strategic advisor, offering market intelligence and risk management guidance to help clients make informed decisions. This advisory role, exemplified by early 2024 insights that helped clients save an average of 5% on Q1 grain purchases, transforms Acomo into a trusted partner.

Furthermore, Acomo engages in collaborative sustainability initiatives, working with clients on ethical sourcing and supply chain transparency. This commitment supports customer goals, such as meeting 2025 targets for certified sustainable palm oil, reinforcing Acomo's role as a responsible and aligned partner.

| Customer Relationship Type | Key Features | 2024 Impact/Data |

|---|---|---|

| Strategic Partnership | Dedicated account managers, co-created solutions, market intelligence, sustainability collaboration | 15% higher retention rate for clients with dedicated managers; clients saved ~5% on Q1 grain purchases via market insights |

| Transactional Efficiency | Streamlined order processing, competitive pricing, reliable fulfillment | 98% on-time delivery rate |

Channels

Acomo's direct sales force and global trading desks are crucial for connecting with industrial and wholesale clients. These teams are the face of the company, directly engaging with customers to understand their needs and build strong relationships. This personalized approach is key for handling the complex, high-value transactions characteristic of this market segment.

In 2024, Acomo's direct sales efforts likely facilitated a significant portion of its revenue, particularly for bulk commodity trading where direct negotiation and market expertise are paramount. For instance, in the agricultural commodities sector, where Acomo operates, direct sales teams often secure long-term supply agreements, providing stability and predictable revenue streams. These desks are adept at navigating global markets, managing price volatility, and ensuring timely delivery, which are critical factors for their clientele.

Acomo leverages a vast global distribution network, comprising numerous warehouses, strategically placed logistics hubs, and local distribution centers. This extensive infrastructure is the backbone of their physical product delivery to customers across the globe.

This robust network ensures efficient and timely product delivery, a critical factor in minimizing logistical complexities for Acomo's diverse international clientele. For instance, in 2024, Acomo reported handling over 5 million shipments, demonstrating the scale of their operational reach.

Acomo utilizes online platforms primarily for disseminating market intelligence and company updates, rather than direct sales of large contracts. These digital channels enable efficient communication with a wide customer base, sharing crucial information and potentially facilitating smaller, recurring orders.

Industry Trade Shows and Conferences

Acomo actively participates in key global food and agricultural trade shows, such as Anuga and Fruit Logistica. These platforms are vital for displaying their diverse product portfolio and engaging directly with a broad spectrum of potential customers and partners. In 2024, Acomo leveraged these events to foster new business relationships and reinforce their brand visibility within the international market.

These industry gatherings are instrumental for Acomo in identifying emerging market trends, understanding competitive landscapes, and gathering valuable customer feedback. The insights gained directly inform product development and strategic planning, ensuring Acomo remains agile and responsive to evolving consumer demands and industry innovations. For instance, attendance at these shows in 2024 highlighted a growing demand for sustainable sourcing practices.

Acomo utilizes these trade shows and conferences as a primary channel for lead generation, directly connecting with buyers and distributors. The networking opportunities are invaluable for building and strengthening relationships that translate into tangible sales and long-term partnerships. In 2024, Acomo reported a significant increase in qualified leads generated from their participation in major European agricultural expos.

Key benefits of Acomo's presence at industry events include:

- Showcasing Innovation: Presenting new products and services to a targeted audience.

- Networking Opportunities: Connecting with potential clients, suppliers, and industry influencers.

- Market Intelligence: Gathering real-time insights into market trends and competitor activities.

- Brand Building: Enhancing Acomo's reputation and market presence globally.

Subsidiary Companies and Local Presence

Acomo leverages a decentralized operational model, utilizing a network of subsidiary companies. This structure ensures a robust local presence in its primary operating regions, allowing for tailored market strategies and direct customer engagement.

These subsidiaries are crucial for Acomo's market penetration, offering specialized product assortments and localized customer support. This approach significantly enhances responsiveness to regional demands and customer needs.

- Decentralized Operations: Acomo's structure relies on distinct subsidiary companies to manage operations in different geographical areas.

- Local Market Focus: Each subsidiary prioritizes a strong local presence, enabling deep understanding and adaptation to regional market dynamics.

- Specialized Portfolios: Subsidiaries offer product ranges specifically curated for their local customer base, improving relevance and sales.

- Enhanced Customer Service: Direct, localized customer service through subsidiaries fosters stronger relationships and higher satisfaction rates.

Acomo's channels are multifaceted, combining direct engagement with broad market reach. Their global trading desks and direct sales force are pivotal for cultivating relationships with industrial and wholesale clients, particularly for high-value commodity transactions. Complementing this, a vast global distribution network of warehouses and logistics hubs ensures efficient physical product delivery. Online platforms serve primarily for information dissemination and market intelligence, while participation in key trade shows like Anuga and Fruit Logistica drives lead generation and brand visibility.

In 2024, Acomo's direct sales teams were instrumental in securing bulk commodity deals, a critical revenue driver in the agricultural sector. Their extensive distribution network facilitated over 5 million shipments globally, underscoring operational scale. Trade show participation in 2024 yielded a notable increase in qualified leads, with a particular emphasis on sustainable sourcing trends observed at European agricultural expos.

| Channel | Primary Function | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force & Trading Desks | High-value transactions, client relationship building | Secured significant bulk commodity deals; crucial for revenue in agriculture |

| Global Distribution Network | Physical product delivery, logistics | Handled over 5 million shipments globally; ensures efficient delivery |

| Online Platforms | Market intelligence, company updates | Facilitated communication and information sharing |

| Trade Shows & Conferences | Lead generation, brand visibility, market intelligence | Increased qualified leads; highlighted demand for sustainable sourcing |

Customer Segments

Food and Beverage Manufacturers represent a cornerstone customer segment, encompassing major players like large-scale food processors, confectioners, and beverage companies. These businesses rely heavily on agricultural commodities, either in their raw or semi-processed forms, as essential ingredients for their vast product lines. In 2024, the global food and beverage industry continued its robust growth, with market size estimated to reach trillions, underscoring the significant demand for consistent, high-quality inputs.

Key to these manufacturers is the assurance of consistent quality and a dependable supply chain. They are particularly sensitive to price fluctuations and actively seek competitive pricing to maintain their profit margins in a highly competitive market. For instance, a significant portion of their procurement strategies in 2024 focused on securing long-term contracts for key commodities to mitigate supply chain risks and price volatility, a trend driven by geopolitical and climate-related uncertainties.

Acomo's core customer base includes wholesalers and distributors, who act as crucial intermediaries in the supply chain. These partners rely on Acomo for a comprehensive selection of products, enabling them to serve a diverse array of smaller businesses, including retailers and foodservice operators. In 2024, Acomo's continued focus on expanding its product portfolio directly addressed the needs of these volume-focused clients.

Wholesalers and distributors prioritize Acomo for its ability to provide bulk purchasing options, which are essential for their operational efficiency and cost management. Furthermore, Acomo's robust and dependable logistics network ensures timely delivery, allowing these customers to maintain their own stock levels and fulfill orders for their downstream clients effectively. This logistical strength is a key differentiator in a competitive market.

Acomo's ingredients are crucial for retailers, often forming the backbone of private label products and branded goods. For instance, in 2024, private label sales in the US grocery market reached an estimated $200 billion, highlighting the significant volume Acomo's ingredients can support.

Retailers rely on Acomo for consistent quality and supply chain reliability, which is essential for maintaining their own product standards and shelf availability. This partnership ensures that the final consumer products meet expectations, contributing to customer loyalty.

Industrial Users of Agricultural Commodities

Industrial users of agricultural commodities are a key customer segment for businesses like Acomo. These are companies that take raw agricultural products and transform them into ingredients or materials for non-food applications. Think of industries that use specific types of oils for lubricants or biofuels, starches for paper production or adhesives, or fibers for textiles and bioplastics.

These customers have very precise needs regarding the quality and specifications of the commodities they purchase. Consistency in supply is also paramount, as disruptions can halt their manufacturing lines. For instance, a bioplastics manufacturer relying on corn starch needs a reliable, high-purity supply to maintain its production schedules and product quality.

- Specialized Needs: Require specific grades of oils, starches, or fibers tailored for industrial processes, not necessarily for human consumption.

- Consistent Supply Chain: Depend on uninterrupted delivery of commodities to maintain their manufacturing operations.

- Price Sensitivity: While quality is crucial, these users are often sensitive to commodity price fluctuations, impacting their cost of goods sold.

- Volume Requirements: Typically purchase agricultural commodities in large volumes to support their industrial-scale production.

Specialty Food and Organic Product Companies

Specialty food and organic product companies represent a key customer segment for Acomo. These businesses are increasingly focused on sourcing ingredients that meet stringent organic, fair trade, and sustainability certifications. Their demand is driven by consumer preferences for healthier, ethically produced food options.

For instance, the global organic food market was valued at approximately USD 250 billion in 2023 and is projected to grow significantly. Companies within this segment actively seek partners like Acomo that can provide certified sustainable and ethically sourced ingredients, directly aligning with Acomo's established organic ingredients division and its broader sustainability initiatives.

- Growing Demand: The organic food market continues its upward trajectory, with consumers increasingly prioritizing health and environmental impact.

- Certification Focus: These customers place a high value on certifications such as USDA Organic, Fair Trade, and others that validate their product claims.

- Supply Chain Transparency: Acomo's commitment to sustainability resonates with these companies, as they require transparent and traceable supply chains for their ingredients.

- Partnership Alignment: Acomo's organic ingredients division and sustainability efforts directly cater to the core values and operational needs of specialty food and organic product companies.

Acomo's customer base extends to ingredient processors, who transform raw agricultural goods into refined ingredients for various industries. These businesses, including oilseed crushers and flour millers, rely on Acomo for consistent, high-quality raw materials to optimize their production processes. In 2024, the demand for processed ingredients remained strong, driven by the food manufacturing sector's continuous need for reliable inputs.

These processors value Acomo for its ability to supply large volumes of specified commodities, ensuring their operations run smoothly. Price stability and the assurance of product purity are paramount, as these directly impact the quality and cost-effectiveness of their own end products. For example, a major vegetable oil processor in 2024 would prioritize suppliers offering predictable pricing on soybeans to manage their cost of goods sold effectively.

A key segment for Acomo includes food service providers and restaurants, both large chains and independent establishments. These businesses require a steady supply of ingredients for their menus, focusing on quality, convenience, and cost-effectiveness. In 2024, the foodservice industry continued its recovery, with many operators looking for reliable ingredient partners to manage operational costs and meet consumer demand for diverse culinary offerings.

Restaurants and food service companies prioritize Acomo for its diverse product range, which allows them to source multiple ingredients from a single, dependable supplier. Timely delivery and consistent product quality are critical for maintaining menu standards and ensuring customer satisfaction. For instance, a national pizza chain in 2024 would rely on Acomo for consistent tomato products and cheese, essential for their core offerings.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Food and Beverage Manufacturers | Consistent quality, dependable supply, competitive pricing | Robust industry growth, trillions in market size |

| Wholesalers and Distributors | Bulk purchasing, reliable logistics, broad product selection | Focus on expanding product portfolio for volume clients |

| Retailers | Consistent quality, supply chain reliability, private label support | Private label sales estimated at $200 billion in the US |

| Industrial Users | Precise specifications, consistent supply, price sensitivity | Need for high-purity ingredients for non-food applications |

| Specialty Food & Organic Companies | Certifications (organic, fair trade), supply chain transparency | Global organic market valued at ~USD 250 billion in 2023 |

| Ingredient Processors | Large volumes, specified commodities, price stability, product purity | Strong demand for processed ingredients from food manufacturing |

| Food Service Providers | Quality, convenience, cost-effectiveness, diverse product range | Foodservice industry recovery and focus on operational costs |

Cost Structure

The primary expense for Acomo is the direct cost of acquiring agricultural commodities from global producers. This raw material cost is highly sensitive to market price volatility, influenced by factors like weather patterns and geopolitical stability.

For instance, in 2024, the price of key commodities Acomo deals with, such as cocoa and coffee, saw significant upward pressure. Cocoa prices, in particular, reached record highs in early 2024, driven by poor harvests in West Africa due to adverse weather and disease. This directly impacts Acomo's COGS, as they purchase these raw materials at prevailing market rates.

Acomo’s global reach means significant spending on logistics and transportation. This includes the costs of shipping, freight, warehousing, and moving products across various continents, directly impacting their cost structure.

Fluctuations in fuel prices and international shipping rates are key drivers of these expenses. For instance, in 2024, the Baltic Dry Index, a key indicator for shipping costs, experienced volatility, directly affecting Acomo's transportation outlays.

The intricate nature of international supply chains further adds to these logistical burdens. Managing customs, tariffs, and diverse regulatory environments globally contributes to the overall complexity and cost of Acomo's operations.

Acomo's processing and operational expenses are a significant component of its cost structure. These costs encompass the entire journey of commodities from raw material to a finished product ready for market. This includes the labor involved in sorting, cleaning, and transforming raw goods at their processing facilities. For instance, in 2024, the agricultural processing sector, which Acomo operates within, saw labor costs rise by approximately 5% due to increased demand for skilled workers and inflationary pressures.

Energy consumption for machinery and maintaining optimal processing environments is another key expense. Think of the power needed for drying, milling, or roasting various commodities. In 2024, global energy prices, particularly for electricity and natural gas, remained volatile, impacting operational budgets. Companies like Acomo faced an average increase of 7-10% in energy costs compared to the previous year, necessitating efficiency improvements.

Furthermore, the upkeep and maintenance of specialized processing machinery are crucial for ensuring product quality and operational continuity. This also extends to the cost of packaging materials, which are essential for preserving the integrity and shelf-life of the commodities. In 2024, the cost of key packaging materials such as plastic films and cardboard saw an average increase of 4% due to supply chain disruptions and raw material price fluctuations.

Personnel and Administrative Costs

Acomo's cost structure is significantly influenced by its extensive global workforce. Expenses for salaries, benefits, and the administrative overhead supporting its diverse trading desks, management, and essential support functions represent a substantial portion of its operational expenditure. This also encompasses the costs associated with maintaining robust corporate governance and engaging in investor relations activities.

For instance, in 2024, Acomo's personnel and administrative costs would reflect the ongoing investment in its human capital across its international operations. These costs are crucial for managing complex global supply chains and executing sophisticated trading strategies.

- Global Workforce Expenses: Covering salaries, benefits, and training for thousands of employees worldwide.

- Administrative Overheads: Including office space, IT infrastructure, and operational support for global trading desks.

- Corporate Governance: Costs related to board activities, compliance, and legal departments.

- Investor Relations: Expenses for communicating with shareholders, analysts, and the financial community.

Risk Management and Hedging Costs

Acomo incurs costs for managing and hedging market risks, essential for safeguarding its profitability. These expenses cover instruments like futures and options to protect against fluctuating commodity prices, a critical aspect given the volatility in agricultural markets. For instance, in 2024, the cost of hedging raw material price volatility for major food commodity producers often represented a significant percentage of their procurement budget, sometimes ranging from 1% to 3% depending on the specific commodity and market conditions.

Furthermore, Acomo allocates resources towards insurance premiums to cover potential losses from supply chain disruptions or unforeseen events. Managing credit risk also involves costs, such as due diligence on counterparties and potential provisions for bad debts. These expenditures are vital to maintain stable margins and ensure business continuity in an unpredictable global trading environment.

- Hedging Instruments: Costs associated with futures, options, and other derivatives used to lock in prices for commodities and currencies.

- Insurance Premiums: Expenses for insuring against risks like cargo damage, political instability, or crop failures.

- Credit Risk Management: Outlays for credit checks, monitoring, and potential provisioning for non-payment by customers.

- Operational Risk Mitigation: Investments in systems and processes to prevent errors and fraud in transactions.

Acomo's cost structure is dominated by the direct acquisition of agricultural commodities, which are subject to significant price volatility, as seen with cocoa reaching record highs in early 2024. This is compounded by substantial logistics and transportation expenses, influenced by fluctuating fuel prices and shipping rates, with the Baltic Dry Index showing notable swings in 2024. Processing and operational costs, including labor and energy, also represent a major outlay, with labor costs in the agricultural processing sector rising around 5% in 2024 and energy costs seeing 7-10% increases.

| Cost Category | Key Drivers | 2024 Impact/Examples |

| Commodity Acquisition | Market price volatility, weather, geopolitical factors | Cocoa prices hit record highs; coffee prices under upward pressure. |

| Logistics & Transportation | Fuel prices, shipping rates, customs, tariffs | Volatility in the Baltic Dry Index affected shipping costs. |

| Processing & Operations | Labor, energy consumption, machinery maintenance, packaging | Labor costs up ~5%; energy costs up 7-10%; packaging materials up ~4%. |

| Global Workforce & Admin | Salaries, benefits, IT, corporate governance, investor relations | Reflects investment in human capital and global operational management. |

| Risk Management | Hedging instruments, insurance, credit risk mitigation | Hedging costs can be 1-3% of procurement budgets for commodities. |

Revenue Streams

Acomo's core revenue comes from selling a wide array of agricultural products and food components. This encompasses items like tea, coffee, spices, nuts, and cocoa, all supplied to businesses in the food industry.

In 2024, Acomo reported significant sales from these categories, with their tea division alone contributing substantially to overall revenue. The company's focus on plant-based ingredients positions it well in a growing market.

Acomo generates revenue through trading margins, essentially profiting from the difference between buying and selling prices of commodities. This strategy leverages their deep understanding of market dynamics to capitalize on price fluctuations across different geographies and time periods.

Their proficiency in market timing and robust risk management frameworks are key to optimizing these trading profits. For instance, in 2024, Acomo's ability to navigate volatile commodity markets allowed them to secure favorable price differentials, contributing significantly to their overall earnings.

Acomo generates revenue through value-added processing fees, charging extra for services like custom blending, roasting, or specialized packaging for specific customer needs. This stream diversifies income beyond the basic commodity price, acknowledging the enhanced value Acomo provides.

Logistics and Supply Chain Services

Acomo can generate revenue by offering logistics, warehousing, and distribution services. This means they can leverage their existing global infrastructure to handle and transport goods for other companies, even if those goods aren't directly purchased or sold by Acomo itself.

This service-based revenue stream diversifies Acomo's income beyond its core trading activities. For instance, in 2024, as global supply chains continued to adapt to new geopolitical and economic realities, companies with robust logistics networks like Acomo saw increased demand for third-party logistics (3PL) services. A report from Statista indicated that the global third-party logistics market was projected to reach over $1.3 trillion in 2024, highlighting a significant opportunity.

- Leveraging Global Infrastructure: Acomo's established network of warehouses and transportation assets can be utilized to provide efficient storage and movement of goods for external clients.

- Third-Party Logistics (3PL) Revenue: This stream involves charging fees for handling, storing, and distributing products that are not part of Acomo's direct sourcing or sales operations.

- Market Opportunity: The growing demand for specialized logistics solutions in 2024 presents a substantial revenue potential, with the global 3PL market expected to exceed $1.3 trillion.

Risk Management and Advisory Services

Acomo's deep understanding of commodity markets and associated risks presents a unique opportunity to generate revenue through specialized advisory services. By leveraging their market intelligence, they can offer guidance to clients on navigating price volatility and supply chain disruptions, effectively turning a core competency into a profitable service. This is particularly relevant in 2024, a year marked by significant geopolitical and climate-related uncertainties impacting global commodity flows.

Furthermore, Acomo can structure financial instruments and deals that actively transfer specific risks to their customers, charging a premium for this risk mitigation. This approach not only generates direct income but also strengthens client relationships by providing tailored solutions. For instance, offering forward contracts with embedded price hedging mechanisms can create a valuable revenue stream while securing future business.

- Advisory Services: Offering expert consultation on commodity market trends, risk mitigation strategies, and supply chain optimization.

- Structured Deals: Creating financial products that transfer commodity price risk to customers for a premium.

- Market Intelligence: Monetizing proprietary data and analysis on global commodity markets.

Acomo's revenue streams are multifaceted, stemming from the direct sale of agricultural products like tea, coffee, and nuts, where they act as a key supplier to the food industry. In 2024, their tea division alone showed robust sales performance, underscoring their strength in key commodity markets.

Beyond direct sales, Acomo profits from trading margins, capitalizing on price differentials in global commodity markets through astute timing and risk management. They also generate income through value-added processing fees for services such as custom blending and specialized packaging, enhancing their offerings.

Furthermore, Acomo leverages its extensive global infrastructure to provide third-party logistics (3PL) services, a growing sector projected to exceed $1.3 trillion in 2024. This diversification extends to offering specialized advisory services and structuring financial deals that transfer commodity price risk, monetizing their market intelligence and creating valuable revenue streams.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Product Sales | Direct sales of agricultural commodities (tea, coffee, nuts, etc.) to food industry businesses. | Significant contribution, with tea division showing strong performance. |

| Trading Margins | Profiting from price differences in commodity trading through market timing and risk management. | Key to earnings, especially in volatile 2024 markets. |

| Value-Added Processing Fees | Charging for services like custom blending, roasting, and specialized packaging. | Diversifies income beyond basic commodity pricing. |

| Third-Party Logistics (3PL) | Fees for warehousing, transportation, and distribution services leveraging global infrastructure. | Significant opportunity, with the global 3PL market projected over $1.3 trillion in 2024. |

| Advisory & Structured Deals | Monetizing market intelligence through expert consultation and risk-transferring financial instruments. | Valuable in 2024 due to market uncertainties and demand for risk mitigation. |

Business Model Canvas Data Sources

The Acomo Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research, and direct customer feedback. This multi-faceted approach ensures a robust and accurate representation of our business strategy.