Acadia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

Acadia's current market position reveals significant strengths in its product portfolio and a growing customer base, but also highlights potential threats from emerging competitors and evolving industry regulations.

Want the full story behind Acadia's competitive advantages, potential weaknesses, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Acadia Realty Trust's strength lies in its specialized focus on high-quality retail, particularly street retail and mixed-use properties. This niche allows for a deep understanding of market trends and tenant requirements, leading to more strategic acquisitions and management. For instance, their street retail portfolio has consistently demonstrated robust performance, outperforming broader retail benchmarks.

Acadia's robust investment platforms are a significant strength, enabling diverse strategies. The company effectively balances its core fund platform, which focuses on stable income from quality assets, with opportunistic and value-add funds that target higher returns through redevelopment. This dual approach provides a well-rounded investment model.

This strategic structure allows Acadia to capitalize on different market conditions and asset classes. By managing both stable income-generating assets and those requiring repositioning, Acadia demonstrates a sophisticated approach to portfolio management. This adaptability is crucial in dynamic real estate markets.

Recent activity underscores the effectiveness of these platforms. Acadia completed over $600 million in acquisitions in the fourth quarter of 2024 and year-to-date 2025. This substantial investment volume showcases their operational capacity and commitment to actively deploying capital across their diverse fund structures.

Acadia Realty Trust boasts impressive financial health, underscored by a strong balance sheet and ample liquidity. This robust financial footing provides significant flexibility for future growth and weathering market fluctuations.

In the second quarter of 2025, Acadia reported a healthy Net Debt-to-EBITDA ratio, indicating efficient debt management. Crucially, the company faces no major core debt maturities until 2028, offering substantial breathing room and strategic planning capabilities.

Further enhancing its financial strength, Acadia has access to untapped revolving credit facilities and has secured forward equity contracts. These resources position the company well to pursue external growth opportunities and manage any unforeseen financial challenges.

Consistent Internal Growth and Occupancy Gains

Acadia has demonstrated a consistent ability to grow its internal operations, with projected same-property Net Operating Income (NOI) growth of 5-6% for the entirety of 2025. This performance is bolstered by significant gains in its street retail segment, which is outperforming suburban properties due to favorable lease renewals and increased occupancy.

The company's leasing efforts have been highly effective, leading to a projected core occupancy rate of 94-95% by the end of 2025. This upward trend is a direct result of strong tenant demand and successful lease execution across its portfolio.

- Consistent NOI Growth: Acadia expects 5-6% same-property NOI growth in 2025.

- Street Retail Strength: This segment is outperforming due to mark-to-market and occupancy gains.

- Rising Occupancy: Core occupancy is projected to reach 94-95% by year-end 2025.

- Robust Leasing: Strong tenant demand is driving increased occupancy levels.

Experienced Management and Long-Term Value Creation

Acadia Realty Trust is steered by a seasoned management team with a demonstrated history of success in the retail real estate industry. Their strategic approach prioritizes long-term value creation through careful execution and targeted investments in markets characterized by robust growth and significant entry barriers. This strategic positioning allows Acadia to effectively leverage the ongoing demand for premium physical retail spaces.

This experienced leadership has been instrumental in Acadia's performance. For instance, in the first quarter of 2024, Acadia reported a Funds From Operations (FFO) per share of $0.47, exceeding analyst expectations and reflecting the positive impact of their disciplined approach to portfolio management and strategic acquisitions. Their focus on high-barrier markets, such as urban cores and affluent suburban areas, has consistently contributed to strong leasing spreads and tenant sales growth.

- Proven Leadership: Management's extensive experience in retail real estate underpins strategic decision-making.

- Long-Term Focus: The company's strategy emphasizes sustainable value creation through disciplined investments.

- Market Advantage: Investments in high-growth, high-barrier markets position Acadia to capture sustained demand for prime retail locations.

- Shareholder Value: The management's approach is designed to deliver consistent, long-term returns for shareholders.

Acadia's specialized focus on high-quality street retail and mixed-use properties provides a distinct competitive advantage. This niche allows for deep market understanding and strategic tenant relationships, driving superior asset performance. Their street retail portfolio has consistently outperformed broader retail benchmarks, demonstrating the success of this focused strategy.

The company's robust investment platforms, balancing core income generation with opportunistic and value-add strategies, offer significant flexibility. This diversified approach allows Acadia to adapt to varying market conditions and capitalize on different investment opportunities. Their ability to manage both stable and repositioning assets showcases sophisticated portfolio management.

Acadia's financial health is a key strength, characterized by a strong balance sheet and ample liquidity. For instance, their Net Debt-to-EBITDA ratio remained healthy in Q2 2025, with no major core debt maturities until 2028, providing substantial strategic flexibility. Access to revolving credit facilities and forward equity contracts further bolsters their capacity for growth and risk management.

The management team's extensive experience in retail real estate is a significant asset, guiding strategic investments in high-barrier, growth-oriented markets. This leadership has been instrumental in achieving strong leasing spreads and tenant sales growth, as evidenced by their Q1 2024 FFO per share of $0.47, which surpassed expectations.

| Key Strength | Description | Supporting Data/Fact |

| Niche Specialization | Focus on high-quality street retail and mixed-use properties. | Street retail portfolio consistently outperforms broader retail benchmarks. |

| Investment Platforms | Balanced core, opportunistic, and value-add strategies. | Over $600 million in acquisitions in Q4 2024 and YTD 2025. |

| Financial Strength | Strong balance sheet, ample liquidity, and manageable debt. | No major core debt maturities until 2028; healthy Net Debt-to-EBITDA in Q2 2025. |

| Experienced Management | Seasoned leadership with a proven track record in retail real estate. | Q1 2024 FFO per share of $0.47 exceeded expectations. |

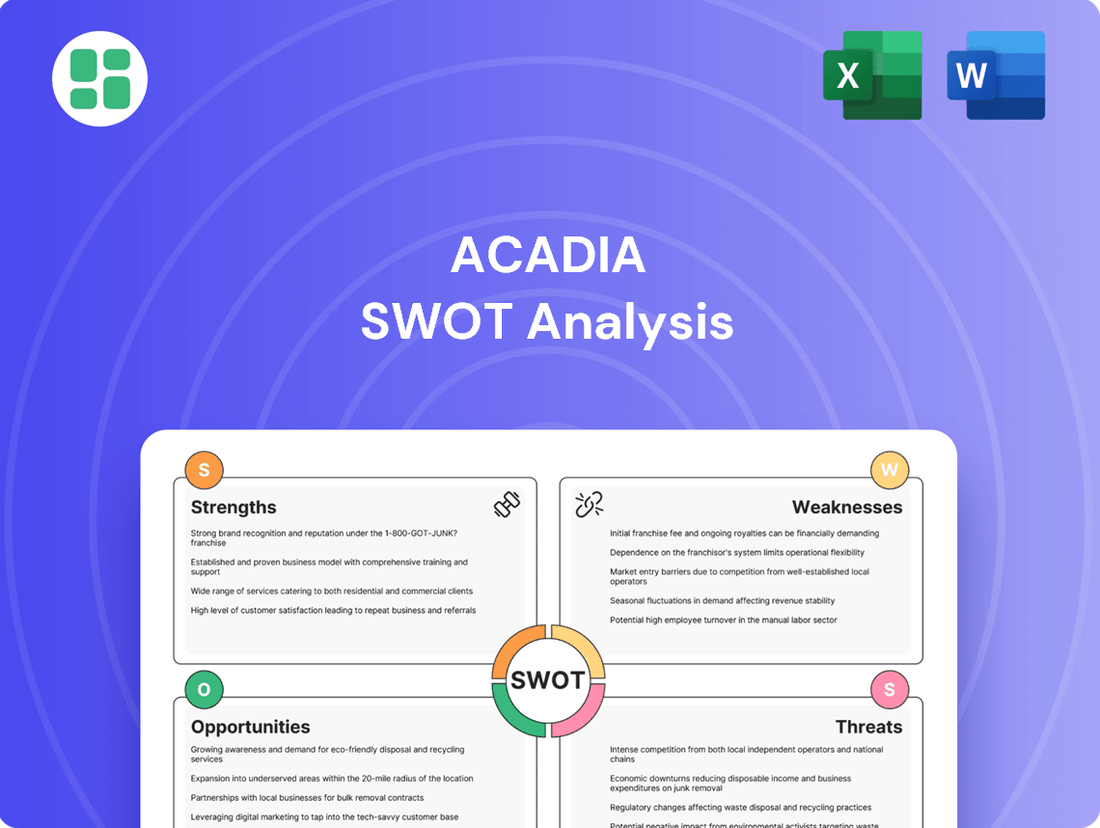

What is included in the product

Delivers a strategic overview of Acadia’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured approach to identifying and addressing strategic challenges, transforming potential roadblocks into actionable insights.

Weaknesses

Acadia Realty Trust's specialization in retail real estate, while a core strength, also presents a significant weakness due to the sector's inherent cyclicality. For instance, the U.S. retail sales saw a modest increase of 3.0% in 2023, but this followed a period of significant volatility, highlighting the sector's sensitivity to economic shifts. This concentration means Acadia's performance is closely tied to consumer spending habits and broader economic health, making it vulnerable to downturns.

A substantial downturn in retail demand, potentially triggered by inflation or reduced disposable income, could disproportionately affect Acadia's portfolio. Even with a focus on high-quality assets, a widespread decline in consumer spending could lead to higher vacancy rates or downward pressure on rental income across their properties. This vulnerability was evident in the early stages of the COVID-19 pandemic, where retail vacancies in many major markets saw a notable uptick.

Acadia's physical retail model faces a significant threat from the persistent growth of e-commerce. The ongoing consumer shift to online shopping directly impacts foot traffic to brick-and-mortar locations, potentially undermining their long-term viability. For instance, U.S. e-commerce sales were projected to reach $1.7 trillion in 2024, a substantial portion of overall retail spending, highlighting the scale of this challenge.

While physical retail has demonstrated resilience and is adapting with hybrid models, the increasing penetration of e-commerce could still lead to store closures and higher vacancy rates, particularly in less differentiated retail segments. This trend could affect Acadia if its physical store strategy doesn't sufficiently integrate or compete with the convenience and breadth of online offerings.

Acadia's retail portfolio is particularly susceptible to fluctuations in consumer spending. As consumer confidence wavers and inflation pressures mount, discretionary spending typically declines, directly impacting retail sales and, consequently, Acadia's rental income. For instance, in early 2024, consumer surveys showed a significant portion of households prioritizing essential goods over non-essential purchases due to increased living costs.

This heightened value-consciousness among consumers poses a direct threat to Acadia's revenue streams. A challenging economic environment, marked by persistent inflation, can lead to reduced foot traffic and lower sales volumes for its tenants, potentially impacting their ability to meet rental obligations or seek lease renewals. This dynamic could constrain Acadia's capacity for rental growth in the coming periods.

Impact of Rising Interest Rates on Financing Costs

While interest rates have shown some easing in late 2024 and early 2025, a prolonged period of elevated borrowing costs remains a significant concern for Acadia. Increased interest expenses directly impact the profitability of new acquisitions and development projects, potentially squeezing margins and reducing overall returns on investment.

Higher interest rates can also lead to a compression of capitalization rates, which in turn can lower property valuations. This valuation pressure directly affects Acadia's net asset value and could make future financing more challenging and expensive, a common vulnerability for real estate investment trusts (REITs) reliant on debt capital.

- Increased Borrowing Costs: A sustained interest rate environment above 5% could add tens of millions in annual interest expense for a REIT of Acadia's scale, impacting distributable cash flow.

- Valuation Compression: A 50-basis point increase in cap rates could reduce property values by several percentage points, impacting the equity generated from asset sales or refinancing.

- Reduced Investment Capacity: Higher financing costs can limit Acadia's ability to pursue new growth opportunities, particularly larger-scale acquisitions or redevelopments requiring substantial debt.

- Sensitivity to Capital Markets: As a capital-intensive business, Acadia's performance is inherently linked to the cost and availability of capital, making it susceptible to shifts in monetary policy.

Competition in Desirable Urban and Suburban Markets

Acadia Realty Trust (AKR) operates in prime urban and suburban markets, which, while offering significant growth potential, also attract substantial competition. This intense rivalry comes from other Real Estate Investment Trusts (REITs), large institutional investors, and private equity firms all vying for similar high-quality, street-level retail and mixed-use assets. For instance, in 2024, the demand for well-located retail spaces in major metropolitan areas saw cap rates compress as buyers competed for limited inventory.

This heightened competition directly impacts acquisition costs, potentially driving up property prices and consequently putting pressure on Acadia's expected investment returns. The need to secure attractive deals in such a dynamic environment requires constant market monitoring and a proactive approach to identifying and closing on opportunities that add value to the portfolio. Acadia's strategy in 2024 and projected into 2025 continues to focus on differentiated, high-barrier-to-entry locations where its expertise can provide a competitive edge.

- Intense Competition: Acadia faces formidable competition from REITs, institutional investors, and private equity firms in desirable urban and suburban markets.

- Acquisition Cost Inflation: The strong demand for prime street retail and mixed-use properties in 2024 has led to increased acquisition costs.

- Return Compression Risk: Higher purchase prices due to competition can compress potential investment returns for Acadia.

- Strategic Execution: Navigating this competitive landscape necessitates continuous vigilance and the ability to execute accretive deals effectively.

Acadia's reliance on physical retail exposes it to the ongoing secular shift towards e-commerce. While brick-and-mortar retail is evolving, the persistent growth of online sales, projected to exceed $2 trillion in the U.S. by 2025, directly challenges foot traffic and tenant demand for physical spaces. This trend could lead to increased vacancies and downward pressure on rental income if Acadia's portfolio isn't sufficiently adapted to omnichannel retail strategies.

Preview Before You Purchase

Acadia SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The shifting retail environment offers Acadia a prime chance to revitalize its current properties. By transforming traditional retail spaces into vibrant mixed-use or experiential hubs, Acadia can cater to evolving consumer demands. This approach is particularly relevant as consumers increasingly seek engaging experiences, a trend that saw retail experiential spending grow by an estimated 15% in 2024.

Acadia can capitalize on the growing desire for experiential retail by designing its properties to be destinations, not just shopping centers. This means focusing on unique in-store events, personalized services, and engaging environments that encourage longer stays and higher spending. For instance, a 2024 report indicated that 70% of consumers are more likely to visit a store that offers unique experiences.

The integration of online and offline shopping, or omnichannel retail, presents a significant opportunity. Acadia's physical spaces can act as crucial hubs for click-and-collect services, returns processing, and in-store consultations, seamlessly connecting digital and physical customer journeys. Major retailers are increasingly viewing their physical stores as integral to their overall sales strategy, with investments in physical store enhancements projected to grow by 5-10% in 2025.

Acadia's robust financial position and sophisticated investment management capabilities position it to capitalize on strategic acquisitions in underserved or emerging markets. This allows for the pursuit of deals that promise long-term rent growth, enhancing overall portfolio value.

By targeting under-valued retail spaces in affluent or rapidly developing urban and suburban areas, Acadia can unlock significant portfolio appreciation. This strategic approach has been evident in recent acquisitions that have bolstered its presence in prime New York City retail locations, a testament to their successful execution of this opportunity.

Benefiting from Potential Interest Rate Declines

Acadia could see significant advantages if interest rates trend downwards, a scenario anticipated by many economists for late 2025 and into 2026. Lower borrowing costs would directly reduce Acadia's expenses on debt, improving profitability. Furthermore, declining rates often correlate with rising property values, as the present value of future rental income increases, boosting Acadia's asset base.

This potential shift in monetary policy presents several key opportunities for Acadia:

- Reduced Financing Costs: Lower interest rates would decrease the cost of capital for new property acquisitions and development projects, making expansion more financially viable.

- Enhanced Property Valuations: As interest rates fall, the yield on real estate investments becomes more attractive relative to other fixed-income assets, potentially driving up property valuations for Acadia's portfolio.

- Improved Debt Service Coverage: With lower interest expenses, Acadia's ability to cover its debt obligations would strengthen, improving its financial flexibility and creditworthiness.

- Historical Performance Tailwinds: REITs have historically demonstrated strong performance during periods of declining interest rates, suggesting a favorable market environment for Acadia's business model. For instance, during periods of rate cuts, the total returns for REITs have often outpaced broader equity markets.

Urbanization and Demographic Shifts Driving Demand

Continued urbanization, particularly in major metropolitan areas, is a significant tailwind for Acadia. As populations concentrate in urban centers and high-density suburban zones, the demand for convenient street-level retail and adaptable mixed-use properties naturally increases. Acadia's strategic positioning in these growth corridors allows it to capitalize on these demographic shifts, which favor the development of walkable, integrated communities where retail plays a vital role. This trend underscores the inherent value of their well-situated real estate assets.

The ongoing migration to cities is not just a trend but a fundamental reshaping of where people live and shop. For instance, by the end of 2024, it's projected that over 60% of the global population will reside in urban areas, a figure expected to climb further. This concentration directly benefits real estate portfolios like Acadia's, which are focused on providing essential retail and mixed-use spaces in these high-demand locations. The emphasis on integrated living environments, where daily needs are met within a short walk, further solidifies the importance of their strategically located properties.

- Urban Population Growth: Global urban population expected to exceed 60% by the end of 2024, driving demand for accessible retail.

- Mixed-Use Development Appeal: Consumers increasingly seek integrated communities offering residential, retail, and lifestyle amenities in close proximity.

- Walkability Factor: Properties in walkable urban and suburban areas are experiencing heightened demand and value appreciation.

- Acadia's Strategic Focus: Company's portfolio aligns with demographic trends favoring dense, amenity-rich environments.

Acadia is well-positioned to benefit from the growing demand for experiential retail, with a 2024 report indicating 70% of consumers prefer stores offering unique experiences. By transforming properties into mixed-use or experiential hubs, Acadia can cater to evolving consumer needs, a trend supported by a 15% estimated growth in experiential spending in 2024. Furthermore, the integration of online and offline shopping, or omnichannel retail, allows Acadia's physical spaces to serve as vital hubs for services like click-and-collect, with investments in physical store enhancements projected to rise by 5-10% in 2025.

Strategic acquisitions in underserved or emerging markets, coupled with targeting under-valued retail spaces in affluent areas, offer significant opportunities for portfolio appreciation. Acadia's robust financial position supports this, as seen in its successful acquisitions in prime New York City retail locations. The potential for declining interest rates in late 2025 and 2026 could also reduce financing costs and enhance property valuations, a scenario historically favorable for REITs.

Continued urbanization presents a strong tailwind, with over 60% of the global population projected to live in urban areas by the end of 2024. This demographic shift drives demand for Acadia's street-level retail and mixed-use properties in high-demand urban and suburban corridors, favoring walkable, amenity-rich environments.

| Opportunity Area | Key Trend | Impact on Acadia | Supporting Data (2024/2025) |

|---|---|---|---|

| Experiential Retail | Consumer demand for unique experiences | Revitalization of properties into destinations | 70% of consumers prefer stores with unique experiences; 15% growth in experiential spending (est. 2024) |

| Omnichannel Integration | Seamless online-offline shopping | Physical spaces as hubs for digital services | 5-10% projected growth in physical store enhancements (2025) |

| Strategic Acquisitions | Underserved/emerging markets, under-valued spaces | Portfolio appreciation, rent growth | Successful NYC retail acquisitions |

| Interest Rate Environment | Potential decline in late 2025/2026 | Reduced financing costs, enhanced valuations | REITs historically outperform in declining rate environments |

| Urbanization | Population concentration in cities | Increased demand for urban retail/mixed-use | Over 60% global urban population by end of 2024 |

Threats

A significant economic downturn or sustained high inflation poses a direct threat to Acadia. Such conditions can curb consumer spending, directly affecting retail sales and the ability of tenants to meet rental obligations. This could translate into lower rental income for Acadia's properties.

The outlook through 2025 suggests potential headwinds. A cooling labor market, coupled with persistent inflation, might dampen consumer demand. This scenario increases the risk of tenant bankruptcies and a subsequent rise in property vacancy rates, impacting Acadia's financial performance.

The retail landscape remains intensely competitive, with e-commerce growth continuing to exert pressure on brick-and-mortar stores. This trend could lead to an increase in store closures, potentially affecting occupancy levels and rental income for properties like those Acadia manages. Projections indicate that store closures in 2025 are set to double compared to 2024, highlighting the ongoing challenges.

Unexpected increases in interest rates pose a significant threat to Acadia. For instance, if the Federal Reserve were to raise the federal funds rate by another 75 basis points in late 2024, as some analysts predict, Acadia's cost of borrowing for new acquisitions or refinancing existing debt could rise substantially, impacting profitability.

Higher interest rates directly translate to increased capitalization rates in real estate. This means that for a given net operating income, the property's valuation would decrease, potentially diminishing Acadia's asset base and making future sales less lucrative.

Economic uncertainty, coupled with potential legislative changes affecting financial markets in 2025, could lead to a more conservative approach from lenders and investors, further tightening credit availability and increasing the cost of capital for Acadia.

Intensified Competition from Other Real Estate Investors

The commercial real estate landscape remains a battleground, with numerous investors actively seeking prime retail and mixed-use properties. This heightened competition, especially in sought-after urban centers, can inflate acquisition costs for Acadia, thereby compressing potential investment yields. For instance, during 2024, transaction volumes in prime retail markets saw significant activity, with institutional investors and private equity firms actively deploying capital, pushing cap rates lower in many instances.

While sectors like industrial and multifamily housing are experiencing robust demand, the retail segment faces its unique set of competitive challenges. Acadia must navigate this environment where other real estate players are also targeting similar high-quality assets, potentially leading to bidding wars and a more challenging acquisition pipeline. Data from early 2025 indicates continued investor interest in well-located retail, with a focus on experiential and necessity-based tenants, further intensifying the competitive dynamic.

- Increased Bidding Wars: Intense competition drives up prices for desirable assets, impacting Acadia's acquisition strategy.

- Pressure on Yields: Higher acquisition costs directly translate to lower potential returns on investment for Acadia.

- Focus on Prime Locations: Competition is particularly fierce in prime urban and suburban retail markets, Acadia's core focus.

- Sector-Specific Pressures: While industrial and multifamily are strong, retail faces unique competitive headwinds that Acadia must address.

Changing Consumer Preferences and Retail Formats

Shifting consumer desires, such as a greater emphasis on value, unique experiences, or environmentally friendly options, could compel Acadia to invest heavily in property enhancements or adjust its tenant mix to stay relevant. For instance, a 2024 report indicated that 65% of consumers are more likely to purchase from brands demonstrating sustainability efforts.

Retailers and property owners like Acadia face the ongoing challenge of adapting to these evolving preferences, including the growing demand for personalized customer journeys and integrated online-to-offline shopping. This adaptation often involves significant capital outlay and continuous strategic recalibration. The retail sector saw a notable increase in experiential spending, with consumers allocating an average of 20% more to experiences over goods in early 2025 compared to the previous year.

- Evolving Consumer Demands: Consumers increasingly prioritize value, personalized experiences, and sustainability, impacting leasing strategies.

- Investment Needs: Property upgrades and tenant mix adjustments are necessary to meet these changing preferences, potentially requiring substantial capital.

- Omnichannel Integration: The demand for seamless online and offline retail experiences necessitates technological investments and operational changes.

- Competitive Landscape: Failure to adapt to these trends could lead to decreased foot traffic and rental income for Acadia's properties.

Acadia faces significant threats from a volatile economic climate, with potential for a downturn or persistent inflation to reduce consumer spending and tenant rent payments. The retail sector's ongoing struggle against e-commerce growth means store closures could double in 2025 compared to 2024, impacting occupancy. Rising interest rates, potentially another 75 basis points by late 2024, increase borrowing costs and decrease property valuations by raising capitalization rates.

| Threat Category | Specific Risk | Potential Impact on Acadia | Relevant Data/Projection |

|---|---|---|---|

| Economic Volatility | Recession/High Inflation | Reduced consumer spending, lower rental income, tenant defaults | Cooling labor market projected for 2025; inflation concerns persist. |

| Retail Competition | E-commerce Growth & Store Closures | Decreased foot traffic, lower occupancy rates, reduced rental income | Store closures in retail projected to double in 2025 vs. 2024. |

| Interest Rate Sensitivity | Rising Interest Rates | Increased borrowing costs, lower property valuations, reduced profitability | Potential for additional 75 bps Fed rate hike in late 2024; higher cap rates compress valuations. |

| Consumer Behavior Shifts | Changing Preferences (Value, Experience, Sustainability) | Need for costly property upgrades, tenant mix adjustments, potential loss of market share | 65% of consumers favor brands showing sustainability efforts (2024); 20% increase in experiential spending (early 2025). |

SWOT Analysis Data Sources

This Acadia SWOT analysis is built upon a robust foundation of data, including publicly available financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of Acadia's operational landscape and competitive environment.