Acadia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

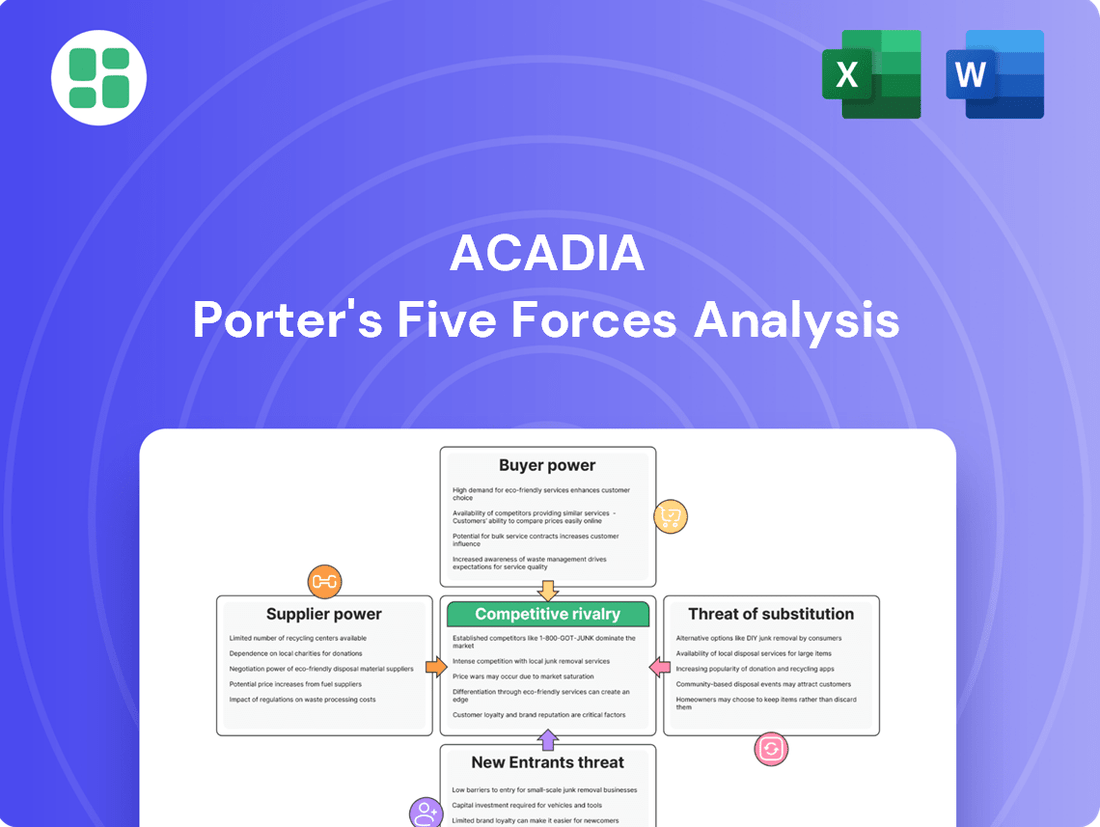

Acadia’s competitive landscape is shaped by the interplay of buyer power, supplier bargaining, and the threat of new entrants. Understanding these forces is crucial for navigating the market effectively. The full analysis delves into the intensity of each force, providing a comprehensive view of Acadia's strategic position.

Ready to move beyond the basics? Get a full strategic breakdown of Acadia’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The bargaining power of specialized contractors in urban real estate markets, like those where Acadia operates, is generally moderate to high. This is due to a limited pool of licensed professionals, particularly those with niche skills, who can then set higher prices.

In 2024, the construction industry continued to grapple with significant cost escalations. For instance, the Producer Price Index for construction inputs saw an increase of 7.2% year-over-year in March 2024, according to the Bureau of Labor Statistics. This inflationary pressure, coupled with persistent labor shortages, further amplifies the leverage of skilled contractors, allowing them to dictate terms more effectively.

Landowners of prime retail locations are critical suppliers for Acadia, and their bargaining power is considerable. This is largely due to the limited availability of desirable urban and suburban sites that align with Acadia's focus on high-quality properties. For instance, in major metropolitan areas, the scarcity of well-situated land suitable for premium retail development can significantly increase acquisition costs.

Acadia's strategy of targeting high-barrier-to-entry markets, where competition for land is intense, further amplifies seller leverage. This dynamic is especially pronounced for street retail in vibrant, high-traffic corridors. In 2024, commercial real estate prices in top-tier urban centers continued to reflect this scarcity, with prime retail land values often exceeding projections, thereby strengthening the bargaining position of landowners.

Financial institutions are crucial suppliers for REITs like Acadia, offering debt and equity. Their influence hinges on interest rate volatility and broader capital market health. In 2024, REITs generally found capital readily available, but rising interest rates and stricter lending in 2025 could escalate financing costs, affecting real estate development and acquisition plans.

Technology and Service Providers

Technology and service providers, such as those offering property management software and data analytics, wield increasing bargaining power as REITs integrate proptech for efficiency. This reliance on specialized platforms can grant these suppliers leverage, particularly as the adoption of such technologies accelerates. For instance, the global PropTech market was valued at approximately $25.9 billion in 2023 and is projected to grow significantly, indicating a rising dependence on these tech providers.

REITs are increasingly looking to technology to streamline operations, enhance tenant experiences, and gain a competitive edge. This growing dependence means that providers of advanced solutions, like AI-driven leasing platforms or sophisticated building management systems, can command better terms. Strategic partnerships, however, can be a key strategy for REITs to mitigate these costs and simultaneously boost operational efficiency by integrating these technologies effectively.

- PropTech Market Growth: The global PropTech market reached an estimated $25.9 billion in 2023, highlighting the increasing reliance on technology providers.

- Supplier Leverage: REITs' growing dependence on specialized proptech for efficiency and competitive advantage gives technology suppliers significant bargaining power.

- Mitigation Strategies: Strategic partnerships and careful vendor selection can help REITs manage costs and enhance operational efficiency despite supplier leverage.

Labor Market Dynamics

The availability and cost of skilled labor, encompassing construction workers, property managers, and specialized real estate professionals, directly influence supplier power within the Acadia Porter's Five Forces Analysis. Labor shortages, a persistent issue in the construction sector, particularly for skilled trades, have been driving up labor expenses for both new development and redevelopment initiatives. For instance, data from the Bureau of Labor Statistics in early 2024 indicated a significant shortage in construction occupations, contributing to wage increases of approximately 4-6% year-over-year for many skilled trades.

Securing and retaining a qualified workforce is paramount for maintaining project timelines and adhering to budgets. The increasing demand for specialized real estate services, such as advanced property management software implementation and sustainable building expertise, further amplifies the bargaining power of suppliers in these niche areas. In 2023, the average hourly wage for construction laborers saw an increase, reflecting the tight labor market conditions.

- Skilled Labor Availability: Shortages in construction trades directly increase labor costs.

- Wage Pressures: Rising wages for skilled workers impact development budgets.

- Specialized Professionals: Demand for expertise in property management and sustainability strengthens supplier power.

- Project Timelines: Workforce availability is critical for on-time project completion.

The bargaining power of suppliers for Acadia is a key consideration in its operational strategy. This power is influenced by factors such as the availability of inputs, the uniqueness of supplier offerings, and the overall cost of switching suppliers. For Acadia, critical suppliers include landowners, construction contractors, and financial institutions.

Landowners of prime retail locations hold significant leverage due to the scarcity of desirable urban and suburban sites. In 2024, commercial real estate prices in top-tier urban centers continued to reflect this scarcity, strengthening landowners' negotiating positions. Similarly, specialized contractors, particularly those with niche skills, can command higher prices due to limited availability, a trend exacerbated by ongoing cost escalations in the construction industry, with producer prices for construction inputs rising 7.2% year-over-year in March 2024.

Financial institutions also represent a crucial supplier group for REITs like Acadia. Their bargaining power is tied to interest rate environments and capital market conditions. While capital was generally available in 2024, potential interest rate hikes and tighter lending in 2025 could increase financing costs, impacting Acadia's development and acquisition plans.

| Supplier Type | Key Factors Influencing Power | Impact on Acadia | 2024 Data/Trend | 2025 Outlook |

|---|---|---|---|---|

| Landowners (Prime Retail) | Scarcity of desirable locations, competition | Higher acquisition costs, limited site availability | Continued high prices in top urban centers | Potential for sustained high costs |

| Specialized Contractors | Limited pool of skilled labor, niche expertise | Increased construction costs, potential project delays | 7.2% YoY increase in construction input PPI (Mar 2024), labor shortages | Persistent wage pressures |

| Financial Institutions | Interest rates, capital market health | Cost of debt and equity financing | Generally available capital, but rising rates observed | Potential for increased financing costs |

What is included in the product

Acadia's Porter's Five Forces analysis reveals the intensity of competition, the power of buyers and suppliers, the threat of new entrants and substitutes, all within its specific industry context.

Instantly identify and address competitive threats with a visually intuitive breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

High occupancy rates in retail properties, especially in desirable areas, typically reduce the leverage tenants have. This means customers have less room to negotiate terms because landlords have many other potential renters.

Acadia Realty Trust’s data highlights this trend, with their Core Portfolio at 95.8% leased by the end of 2024 and 92.2% occupied by mid-2025. Such strong demand suggests that tenants face limited bargaining power due to the scarcity of available prime retail spaces.

Acadia Realty Trust's strategic focus on prime street retail and mixed-use properties in sought-after areas like SoHo and Williamsburg significantly enhances its bargaining power with customers. These desirable locations, characterized by high foot traffic and strong consumer demand, limit tenant alternatives.

The scarcity of comparable prime real estate means tenants seeking these high-growth corridors have less leverage to negotiate unfavorable lease terms or rental rates. This strong tenant demand, a consistent feature in Acadia's key markets, underscores their ability to command favorable conditions.

Acadia Realty Trust (AKR) benefits from a diversified tenant base, which significantly limits the bargaining power of individual customers. This includes a mix of necessity retailers, like grocery stores, and value-oriented discounters, reducing dependence on any single tenant or sector. For instance, in 2023, AKR's portfolio featured a strong representation of essential retail, which tends to be more resilient during economic downturns, thereby diminishing the leverage any one tenant could exert on lease terms.

Switching Costs for Tenants

For retail tenants, the cost of switching locations is substantial. These expenses include initial build-out costs for a new space, marketing efforts to inform customers of the new address, and the potential disruption to established customer traffic. For example, a 2024 report indicated that the average retail store build-out can range from $50 to $250 per square foot, with larger renovations easily exceeding $100,000.

These significant switching costs effectively reduce the bargaining power of tenants. The financial and operational hurdles associated with relocating often make it more advantageous for tenants to accept existing lease terms rather than incur the expense and risk of moving to negotiate slightly better terms elsewhere. This creates a notable stickiness for existing tenants within a property.

- Tenant Relocation Expenses: Build-out costs, marketing, and customer base disruption are key factors.

- Cost-Benefit Analysis: Tenants weigh relocation expenses against potential lease savings.

- Reduced Bargaining Power: High switching costs limit tenants' ability to negotiate favorable lease terms.

- Tenant Stickiness: The effort and cost of moving encourage retention of existing tenants.

Lease Structure and Terms

Acadia Realty Trust's retail leases, especially those for street retail properties, are structured to provide significant control over revenue. These leases often include built-in contractual rent increases and more frequent opportunities to align rents with current market conditions. This lease structure inherently limits the long-term bargaining power of tenants concerning rent escalations.

The company's strategy of negotiating favorable lease terms has directly contributed to its financial performance. For instance, Acadia has achieved consistent same-property Net Operating Income (NOI) growth. In 2023, Acadia reported same-property NOI growth of 3.4%, a testament to the effectiveness of its lease management and tenant negotiation strategies.

- Favorable Lease Terms: Street retail leases often have embedded contractual growth and market rent adjustments.

- Tenant Bargaining Power: Lease structures limit tenants' ability to negotiate against rent increases over time.

- Revenue Control: Acadia maintains greater control over its revenue streams through these lease agreements.

- NOI Growth Driver: Lease terms are a key factor in Acadia's consistent same-property NOI growth, which reached 3.4% in 2023.

The bargaining power of customers is diminished when there are few alternatives and high switching costs. For Acadia Realty Trust, their focus on prime locations with high demand means tenants have limited options, making it harder to negotiate favorable terms. For example, the cost to relocate a retail store can easily exceed $100,000, discouraging tenants from seeking better deals elsewhere.

| Factor | Impact on Tenant Bargaining Power | Acadia's Position (2024/2025 Data) |

|---|---|---|

| Availability of Alternatives | Low availability increases landlord power. | Core Portfolio leased at 95.8% (end of 2024), occupied at 92.2% (mid-2025). |

| Switching Costs | High costs reduce tenant leverage. | Average retail build-out costs range $50-$250/sq ft; relocation can exceed $100,000. |

| Lease Structure | Contractual rent increases limit negotiation. | Leases often include built-in rent escalations and market rent adjustments. |

| Tenant Diversification | Reduces power of individual tenants. | Portfolio includes necessity retailers and value discounters, limiting dependence on any single tenant. |

Same Document Delivered

Acadia Porter's Five Forces Analysis

This preview showcases the complete Acadia Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this in-depth report, ready for immediate use and application to your strategic planning.

Rivalry Among Competitors

The real estate investment trust (REIT) industry, particularly within the retail sector, is a highly competitive arena. Acadia Porter faces numerous rivals, including many publicly traded REITs and a significant number of private real estate companies vying for the same assets and investor attention.

This intense rivalry is underscored by the sheer scale of the market; in 2023, the U.S. boasted roughly 225 publicly traded REITs collectively managing trillions in assets, creating a very crowded competitive landscape for Acadia.

Acadia Realty Trust (AKR) carves out its competitive edge by concentrating on distinct property types and locations. Their strategy centers on high-quality street retail, mixed-use developments, and properties situated in urban and suburban areas. This deliberate focus on specific, often high-barrier-to-entry markets allows Acadia to sidestep direct competition from broader, generalist retail real estate investment trusts (REITs).

By targeting these specialized, desirable assets with robust underlying fundamentals, Acadia cultivates a unique market position. This specialization aligns with a significant trend observed across the global REIT sector, where niche players are increasingly finding success.

The retail real estate sector is experiencing a period of stability, with modest rent increases and a noticeable uptick in foot traffic throughout 2024 and into 2025. This generally positive environment for competition means businesses are vying for consumer attention and market share.

Acadia Realty Trust (AKR) itself demonstrated robust performance, reporting a strong 5.7% same-property Net Operating Income (NOI) growth in the fourth quarter of 2024. Looking ahead, they projected a 5-6% NOI growth for 2025, which is a solid indicator of their operational success and outperformance compared to many industry peers.

While this positive financial outlook for companies like Acadia is encouraging, it also has the potential to sharpen competition for prime retail locations and attractive investment opportunities within the sector.

Acquisition and Development Activity

Competitive rivalry extends to acquisition and development, a key battleground for growth. Acadia Realty Trust, for instance, demonstrated significant activity, closing over $600 million in accretive acquisitions during the fourth quarter of 2024 and the first quarter of 2025. This strategic expansion aims to bolster its presence in crucial markets.

This pursuit of growth isn't unique to Acadia. Other Real Estate Investment Trusts (REITs) and private equity firms are also actively seeking opportunities. This collective interest intensifies competition, often leading to bidding wars for prime properties and promising development sites, impacting acquisition costs and deal flow across the sector.

- Acadia's Q4 2024-Q1 2025 Acquisitions: Over $600 million in accretive deals completed.

- Active Competitors: Other REITs and private equity funds are also pursuing acquisitions.

- Market Impact: Increased competition for desirable properties and development sites.

Access to Capital and Balance Sheet Strength

Competitive rivalry within the REIT sector is significantly shaped by a company's access to capital and the strength of its balance sheet. REITs possessing robust financial foundations and advantageous borrowing costs, such as Acadia Realty Trust (AKR), are inherently better equipped to capitalize on growth prospects and navigate economic downturns. In 2024, Acadia demonstrated this by successfully raising substantial equity and debt, reinforcing its financial flexibility. This financial agility acts as a crucial differentiator, offering a distinct competitive advantage over peers with less substantial financial resources.

This financial strength translates directly into a more potent competitive stance.

- Financial Flexibility: Acadia's 2024 capital raises provided enhanced capacity for acquisitions and development projects.

- Cost of Capital Advantage: Strong balance sheets often lead to lower borrowing costs, improving profitability.

- Resilience: Well-capitalized REITs can weather market volatility and operational challenges more effectively.

- Strategic Opportunities: Access to capital allows for proactive pursuit of attractive investment opportunities, outmaneuvering less liquid competitors.

The competitive landscape for Acadia Realty Trust (AKR) is characterized by intense rivalry from both publicly traded REITs and private real estate firms. This competition is particularly fierce in the acquisition and development of prime retail assets. In the fourth quarter of 2024 and first quarter of 2025, Acadia completed over $600 million in accretive acquisitions, highlighting active market participation.

This aggressive pursuit of growth is mirrored by other REITs and private equity funds, often leading to bidding wars for desirable properties. Acadia's strong financial position, evidenced by successful capital raises in 2024, provides a significant advantage, enabling them to pursue opportunities more effectively than competitors with less financial flexibility. This financial strength is crucial in a market where access to capital dictates the ability to secure attractive deals.

| Competitor Type | Key Activities | Impact on Acadia |

|---|---|---|

| Publicly Traded REITs | Acquisition of retail assets, development projects | Increased competition for prime locations, potential for higher acquisition costs |

| Private Real Estate Firms | Similar acquisition and development strategies | Intensified bidding for properties, pressure on deal flow |

| Financial Institutions | Providing capital for competitors | Influences the competitive capacity of other market participants |

SSubstitutes Threaten

E-commerce presents a significant threat to traditional brick-and-mortar retail. Globally, e-commerce sales are projected to reach $7.4 trillion by 2025, up from an estimated $5.7 trillion in 2024. This growth directly siphons demand away from physical stores, potentially diminishing their necessity and profitability.

While e-commerce is a powerful substitute, the retail landscape is evolving. Many retailers are adopting omnichannel approaches, blending online and in-store experiences. Physical stores continue to offer unique value through immediate product availability, tactile engagement, and personalized customer service, which online channels struggle to replicate fully.

The growing popularity of alternative retail formats like pop-up shops and direct-to-consumer (DTC) brand experiences poses a significant threat to traditional retail leases. These flexible models cater to evolving consumer shopping habits, offering unique and often temporary engagement opportunities that can divert foot traffic and sales from established brick-and-mortar stores. For instance, the DTC e-commerce boom, which saw significant growth in 2024, often bypasses traditional retail altogether, presenting a direct substitute for physical store presence.

The rise of direct-to-consumer (DTC) brands presents a significant indirect substitute threat by circumventing traditional retail. These companies often leverage online platforms and digital marketing, minimizing reliance on brick-and-mortar stores. For instance, the DTC e-commerce market in the US was projected to reach over $300 billion in 2024, highlighting its growing influence.

Mixed-Use Property Alternatives

For Acadia's mixed-use properties, substitutes can be found in standalone residential or office buildings that lack integrated retail. These alternatives, while not directly replacing the retail function, compete for investment capital and development focus. For instance, in 2024, the demand for multifamily housing remained robust, with U.S. apartment rents increasing by an average of 3.5% year-over-year by Q3 2024, potentially drawing resources away from mixed-use developments.

The threat of substitutes is amplified by evolving market preferences and economic conditions. Purely residential projects might appeal more to investors seeking stable, long-term rental income, especially if office vacancy rates remain elevated. As of late 2024, U.S. office vacancy rates hovered around 19.7%, a figure that could make investors more cautious about the office components of mixed-use properties.

- Standalone Residential Developments: Offer focused rental income streams, potentially appealing to investors prioritizing stability.

- Purely Office Buildings: While facing current headwinds, they represent alternative real estate investments for those with specific market outlooks.

- Alternative Asset Classes: Capital may also divert to sectors like industrial or data centers, which have shown strong growth in recent years, impacting mixed-use investment flows.

Experiential Consumerism and Blended Spaces

The rise of experiential consumerism, where consumers seek integrated entertainment and dining alongside shopping, presents a nuanced threat to traditional retail. This trend, gaining significant traction in 2024 with a growing emphasis on leisure activities, could divert spending from standalone retail spaces. For instance, the global market for experience economy was projected to reach over $7 trillion by 2024, indicating a substantial shift in consumer preferences.

However, this phenomenon also acts as a powerful driver for mixed-use developments, a core focus for Acadia Realty Trust. Properties that successfully blend retail with dining, entertainment, and other services are well-positioned to capitalize on this trend. Acadia's strategy of investing in high-quality, well-located retail assets that can accommodate these blended spaces allows them to adapt rather than be directly substituted.

- Experiential Consumerism Growth: The global experience economy is a significant factor, with projections indicating continued robust growth through 2024 and beyond, potentially impacting traditional retail footfall.

- Mixed-Use Property Demand: Well-located, adaptable retail spaces that can integrate entertainment and dining are in higher demand as consumers seek a holistic experience.

- Acadia's Strategic Advantage: Acadia's focus on high-quality, mixed-use properties positions them to benefit from this trend by offering integrated consumer experiences, mitigating outright substitution.

- Adaptation Over Substitution: For well-situated retail assets, the threat is more about adapting to offer broader experiences rather than being entirely replaced by non-retail entertainment venues.

The threat of substitutes for Acadia's retail properties stems from evolving consumer behaviors and alternative ways to fulfill needs. E-commerce continues to grow, projected to reach $7.4 trillion globally by 2025, directly competing with physical stores. Additionally, the rise of direct-to-consumer (DTC) brands, with the US market alone exceeding $300 billion in 2024, bypasses traditional retail channels entirely.

However, the threat is not absolute. Mixed-use developments, a focus for Acadia, can integrate retail with experiential elements like dining and entertainment, aligning with the growing experience economy, valued at over $7 trillion globally in 2024. This integration allows Acadia to adapt and capture consumer spending rather than being directly substituted.

| Substitute Type | Description | 2024 Data/Projection | Impact on Traditional Retail |

|---|---|---|---|

| E-commerce | Online shopping platforms | Global sales projected at $5.7 trillion in 2024 | Siphons demand from physical stores |

| Direct-to-Consumer (DTC) Brands | Brands selling directly to consumers, often online | US market projected over $300 billion in 2024 | Circumvents traditional retail infrastructure |

| Experiential Consumerism | Consumer preference for experiences over goods | Global experience economy projected over $7 trillion in 2024 | Can divert spending from standalone retail if not integrated |

Entrants Threaten

The real estate investment trust (REIT) industry, especially when focusing on acquiring and developing prime retail properties, demands significant capital. This high capital intensity acts as a formidable barrier, deterring potential new entrants. Acadia Realty Trust's consistent ability to raise hundreds of millions in equity and debt financing underscores the sheer scale of financial resources required to compete effectively in this space.

Newcomers often struggle to secure funding on a similar scale, making it difficult to match the investment capacity of established players. Without comparable financial backing, new entrants face an uphill battle in acquiring desirable assets and achieving the economies of scale necessary for profitability and market penetration.

Acadia Realty Trust strategically targets 'high-barrier-to-entry' markets and 'differentiated street retail' in vibrant urban areas. This focus means prime locations are inherently scarce and command premium prices. For instance, in 2024, retail rents in prime Manhattan corridors continued to see robust demand, with some streets experiencing year-over-year increases exceeding 5% for top-tier spaces.

The considerable difficulty and expense involved in securing these highly sought-after, supply-constrained properties present a significant hurdle for potential new competitors. Entrants without established relationships or substantial financial resources will find it exceptionally challenging to compete for these coveted retail sites, thus limiting the threat of new entrants.

Real estate development and property management are heavily regulated, with complex zoning laws, building codes, and environmental standards that are constantly updated. For instance, in 2024, many municipalities continued to tighten building codes for energy efficiency and seismic resilience, adding to development costs and timelines.

Newcomers face significant challenges in understanding and complying with these intricate regulations. The need for specialized legal and technical expertise to navigate permitting processes, which can take months or even years, acts as a substantial barrier.

Companies with established relationships with local authorities and a proven track record in regulatory compliance have a distinct advantage. In 2024, the average time to obtain major building permits in major US cities often exceeded six months, highlighting the time investment required for new entrants.

Established Reputation and Relationships

Acadia Realty Trust's success in retail real estate is deeply rooted in its established reputation and extensive network of relationships with national and local tenants, brokers, and community stakeholders. This strong foundation, built over years of operation, offers a significant competitive advantage.

Newcomers face a substantial hurdle in replicating Acadia's credibility and the deep-seated trust it has cultivated. Building these essential connections requires considerable investment in both time and financial resources, making it difficult for new entrants to gain immediate traction.

For instance, in 2024, the retail leasing landscape continued to favor established players with proven leasing track records. Acadia's ability to secure key tenants in its portfolio, often on favorable terms, underscores the value of these long-standing relationships.

- Tenant Relationships: Acadia's established ties with major retailers and emerging brands facilitate quicker lease-ups and renewals.

- Brokerage Networks: Strong connections with real estate brokers provide access to a wider range of opportunities and tenant prospects.

- Community Engagement: Positive relationships with local communities enhance Acadia's attractiveness for development and redevelopment projects.

Specialized Expertise in Retail Real Estate

Acadia's deep specialization in street retail and mixed-use properties presents a significant barrier to entry. This requires extensive market knowledge, sophisticated leasing strategies, and proven redevelopment capabilities that are not easily replicated by generalist real estate firms or new entrants. For instance, in 2024, the retail real estate sector continued to see specialized firms outperforming those with broader portfolios, driven by an understanding of nuanced consumer behaviors and location-specific dynamics.

The learned capability to identify, acquire, manage, and redevelop high-quality retail assets acts as a formidable deterrent. New players would need substantial time and investment to build comparable expertise and track records. This operational platform, honed over years, allows Acadia to navigate complex leasing negotiations and asset repositioning effectively, a critical advantage in a market where tenant mix and experiential retail are paramount.

- Specialized Knowledge: Acadia’s expertise in street retail and mixed-use properties requires intricate market understanding.

- Leasing Acumen: The ability to secure and manage diverse retail tenants is a key differentiator.

- Redevelopment Expertise: Proven success in revitalizing retail assets creates a high entry hurdle.

- Market Trends: Understanding evolving retail consumer habits is crucial for new entrants to match Acadia’s capabilities.

The threat of new entrants in the prime retail property sector, particularly for a company like Acadia Realty Trust, is significantly mitigated by several substantial barriers. High capital requirements, regulatory complexities, established relationships, and specialized expertise collectively make it challenging for new players to enter and compete effectively.

The sheer financial muscle needed to acquire and develop prime retail spaces is a primary deterrent. For instance, in 2024, major urban retail property acquisitions often involved hundreds of millions of dollars, a sum that new entrants may struggle to secure. This capital intensity, coupled with the time and cost associated with navigating complex zoning laws and permitting processes, which can extend for over six months in major cities, further elevates the entry barrier.

Acadia's deep-seated relationships with tenants, brokers, and local communities, cultivated over years, provide a significant advantage. Newcomers would find it exceptionally difficult to replicate this trust and network, which is crucial for securing desirable tenants and development opportunities. For example, in 2024, the retail leasing market continued to favor established firms with proven track records in tenant acquisition and retention.

| Barrier Type | Description | Example Data (2024) |

|---|---|---|

| Capital Intensity | Significant financial resources required for property acquisition and development. | Major urban retail property acquisitions often exceeding $100 million. |

| Regulatory Hurdles | Complex zoning, building codes, and permitting processes. | Average major building permit acquisition time in US cities exceeding 6 months. |

| Established Relationships | Strong ties with tenants, brokers, and community stakeholders. | Proven ability to secure key tenants on favorable terms in a competitive leasing market. |

| Specialized Expertise | Deep knowledge of street retail, leasing strategies, and redevelopment. | Specialized firms outperforming generalists due to nuanced understanding of consumer behavior and location dynamics. |

Porter's Five Forces Analysis Data Sources

Our Acadia Porter's Five Forces analysis is built upon a foundation of robust data, including industry-specific market research reports, company financial statements, and publicly available trade association data.

We leverage insights from competitor annual reports, regulatory filings, and industry expert interviews to provide a comprehensive understanding of the competitive landscape facing Acadia.