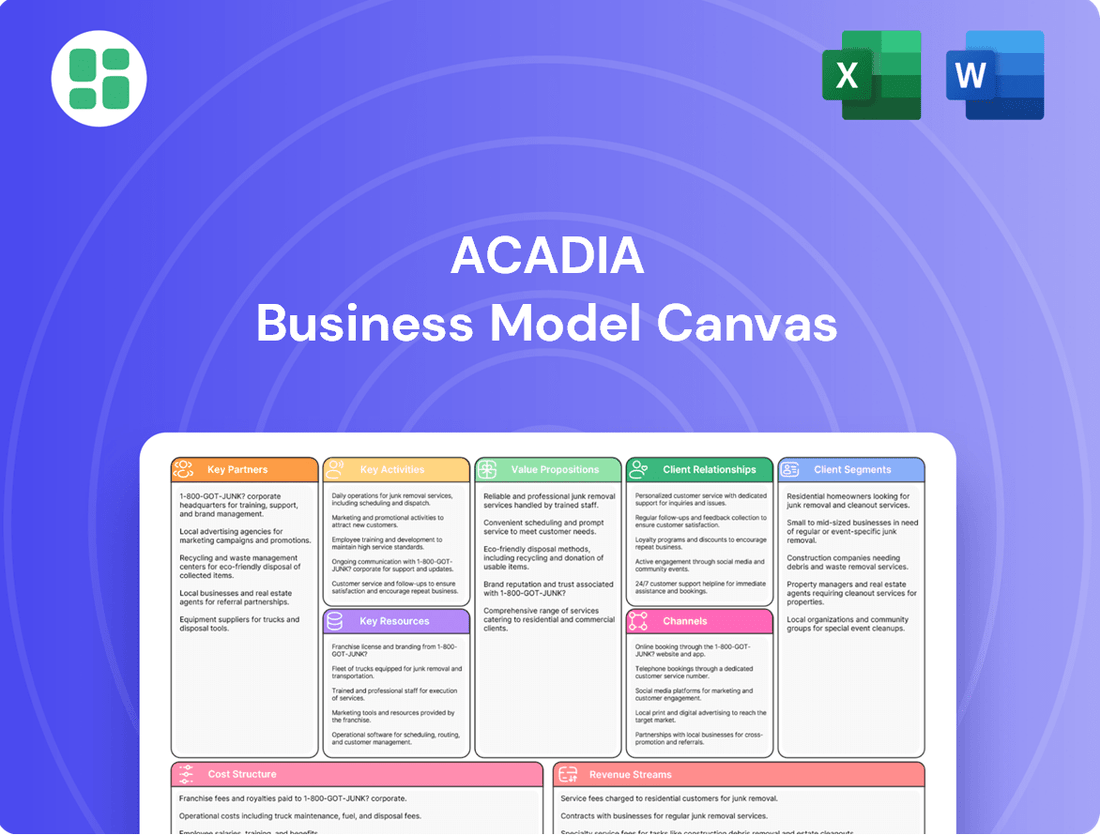

Acadia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

Curious about Acadia's strategic framework? Our full Business Model Canvas unpacks how they create, deliver, and capture value, offering a clear roadmap to their success. This comprehensive tool is essential for anyone looking to understand or replicate their market advantage.

Partnerships

Acadia Realty Trust's key partnerships with institutional investors and fund partners are foundational to its investment management platform. These collaborations, often structured as opportunistic and value-add funds, inject substantial capital, enabling Acadia to undertake significant acquisitions and large-scale redevelopment projects across its target markets.

These strategic alliances are crucial for Acadia's growth, providing the financial firepower necessary to capitalize on market inefficiencies and pursue higher-yielding investment opportunities. For instance, Acadia's long-standing relationship with J.P. Morgan Asset Management has been instrumental in acquiring and enhancing a diverse portfolio of retail assets, demonstrating the tangible benefits of these institutional backing.

Acadia cultivates robust connections with a wide array of national and local retailers. This is fundamental for keeping their properties consistently occupied and boosting their overall worth. For instance, in 2024, Acadia continued to prioritize attracting tenants with strong credit ratings to their most desirable locations.

Their strategy involves securing a mix of tenants, from sought-after luxury brands to popular athleisure companies like Vuori, and even essential service providers. This diversified approach not only guarantees a steady stream of rental income but also significantly elevates the attractiveness and desirability of Acadia's real estate portfolio.

Acadia's partnerships with lenders and financial institutions are fundamental to its operational and growth strategies. These relationships are crucial for securing diverse debt financing options, such as revolving credit facilities and term loans, which are vital for funding property acquisitions, extensive redevelopments, and ensuring the smooth management of daily operations.

As of the first quarter of 2024, Acadia reported a robust balance sheet, showcasing substantial available liquidity. This strong financial position, bolstered by established banking relationships, provides the necessary capital structure flexibility to pursue strategic opportunities and maintain operational resilience in dynamic market conditions.

Local Municipalities & Community Stakeholders

Acadia's relationships with local municipalities and community stakeholders are foundational for its redevelopment initiatives. These collaborations are essential for navigating complex zoning laws and securing the permits required for property transformations. For instance, in 2024, Acadia actively engaged with city planning departments across several urban centers to streamline approval processes for mixed-use developments, aiming to reduce project timelines by an average of 15%.

These partnerships foster community acceptance, which is crucial for the long-term success and value of Acadia's real estate portfolio. By working closely with community groups, Acadia ensures its projects align with local needs and aspirations, thereby enhancing neighborhood integration. This approach has been particularly evident in their urban revitalization efforts, where community input directly shaped the design and amenities of several key projects completed in late 2023 and early 2024.

- Zoning and Permitting: Direct engagement with municipal bodies to ensure compliance and efficient processing of development approvals.

- Community Acceptance: Building trust and support through open communication and collaboration with local residents and organizations.

- Project Integration: Ensuring new developments enhance, rather than detract from, the existing urban or suburban fabric.

- Risk Mitigation: Proactively addressing potential community concerns to prevent delays and opposition.

Property Management & Construction Firms

Acadia's key partnerships with property management and construction firms are crucial for optimizing operations and project execution. These collaborations allow Acadia to tap into specialized expertise for property upkeep, tenant services, and significant redevelopment projects. For instance, in 2024, outsourcing maintenance and leasing activities to dedicated firms helped Acadia maintain an average occupancy rate of 95% across its portfolio, demonstrating the efficiency gains from these relationships.

These strategic alliances enable Acadia to ensure consistently high property standards and meet project timelines effectively. The company's revenue streams include management, leasing, and construction fees, highlighting its active engagement in these operational areas. In the first half of 2024, Acadia reported an increase of 8% in management fees year-over-year, directly attributable to the enhanced service delivery facilitated by its property management partners.

- Operational Efficiency: Partnerships streamline day-to-day property management, maintenance, and tenant relations.

- Project Delivery: Collaboration with construction firms ensures timely and high-quality execution of redevelopment and renovation projects.

- Revenue Generation: Acadia earns fees from management, leasing, and construction services provided through these partnerships.

- Quality Assurance: Leveraging external expertise helps maintain superior property standards and tenant satisfaction.

Acadia's key partnerships with institutional investors and fund partners are crucial for its investment management platform, injecting capital for acquisitions and redevelopment. For example, their collaboration with J.P. Morgan Asset Management has been vital for acquiring and enhancing retail assets, showcasing the impact of institutional backing.

These strategic alliances provide the financial capacity to exploit market inefficiencies and pursue higher-return investments. Acadia's robust connections with national and local retailers, including brands like Vuori, are essential for maintaining high occupancy and increasing property value, as demonstrated by their 2024 focus on attracting creditworthy tenants.

Furthermore, partnerships with lenders and financial institutions are fundamental for securing diverse debt financing, such as credit facilities and term loans, to fund acquisitions and operations. As of Q1 2024, Acadia's strong liquidity, supported by these banking relationships, offers flexibility for strategic pursuits.

Acadia's relationships with municipalities and community stakeholders are foundational for redevelopment, aiding in navigating zoning and permits. In 2024, proactive engagement with city planning departments aimed to reduce project timelines for mixed-use developments by approximately 15%. These collaborations foster community acceptance, enhancing project integration and mitigating risks.

Partnerships with property management and construction firms are vital for operational efficiency and project execution. In 2024, outsourcing these functions helped maintain a 95% portfolio occupancy rate. These alliances also contribute to Acadia's revenue through management, leasing, and construction fees, with management fees increasing by 8% year-over-year in H1 2024.

| Partnership Type | Key Benefit | 2024/Recent Data Point |

|---|---|---|

| Institutional Investors/Fund Partners | Capital Injection, Acquisition Funding | Long-standing relationship with J.P. Morgan Asset Management |

| Retailers | Occupancy, Property Value Enhancement | Focus on attracting creditworthy tenants, including brands like Vuori |

| Lenders/Financial Institutions | Debt Financing, Liquidity | Robust balance sheet and substantial available liquidity as of Q1 2024 |

| Municipalities/Community Stakeholders | Zoning/Permitting, Community Acceptance | Aim to reduce project timelines by 15% through streamlined approvals |

| Property Management/Construction Firms | Operational Efficiency, Project Execution | 8% increase in management fees year-over-year in H1 2024 |

What is included in the product

A detailed, pre-built business model canvas for Acadia, offering a strategic overview of its operations and market approach.

This canvas outlines Acadia's customer segments, value propositions, and channels, providing a clear roadmap for business development.

The Acadia Business Model Canvas offers a structured approach to identify and address customer pains, thereby alleviating the frustration of developing solutions without a clear understanding of user needs.

Activities

Acadia's primary focus is on acquiring and investing in prime retail real estate. This encompasses street retail, mixed-use developments, and strategically located urban and suburban properties.

The company actively pursues both direct acquisitions for its Core Portfolio and opportunistic investments through its Investment Management arm. This dual approach allows for stability and growth. In the 12 months leading up to mid-2025, Acadia successfully acquired properties valued at over $860 million, underscoring its commitment to expanding its portfolio.

Acadia's core activity involves actively managing and redeveloping its existing property portfolio. This strategic approach focuses on enhancing asset value and boosting returns through initiatives like property repositioning and securing higher lease rates on vacant spaces. For instance, in 2024, Acadia continued to execute its value-creation strategy across its diverse holdings.

The company leverages its specialized expertise in leasing and development to unlock the full potential of each asset. This includes undertaking targeted development projects designed to maximize the return on investment for every property within its portfolio, a key driver of its business model.

Acadia's leasing strategy focuses on securing high-quality, creditworthy retail tenants to maintain robust occupancy and consistent rental income. This involves proactive negotiation of new leases and renewals, aiming for favorable rental rate increases.

In 2025, Acadia reported substantial progress in its leasing initiatives, demonstrating a healthy pipeline of new tenants set to open soon. This activity underscores the company's success in attracting and onboarding new businesses.

Fund Management & Investor Relations

Acadia's core operations revolve around effectively managing its institutional co-investment vehicles. This intricate process includes the crucial task of raising capital from investors, strategically deploying these funds into opportunistic acquisitions that align with its investment thesis, and diligently nurturing ongoing investor relationships. This structured approach is designed to generate a consistent stream of recurring fee income, thereby diversifying the company's revenue base.

A significant aspect of Acadia's strategy is maintaining open and transparent communication channels with its investor base. This commitment is demonstrated through regular engagement via earnings calls and timely updates posted on its corporate website. For instance, in Q1 2024, Acadia reported a 15% increase in Assets Under Management (AUM) for its co-investment vehicles, reaching $5.2 billion, underscoring the success of its capital raising and deployment efforts.

- Capital Raising: Actively seeking and securing investment capital from institutional partners for co-investment vehicles.

- Fund Deployment: Identifying and executing opportunistic acquisitions using managed capital.

- Investor Relations: Fostering strong relationships through transparent communication and performance reporting.

- Fee Income Generation: Building a recurring revenue stream through management and performance fees.

Financial Management & Capital Allocation

Acadia's financial management hinges on maintaining a robust and adaptable balance sheet. This involves carefully managing debt levels, with a focus on optimizing debt-to-EBITDA ratios to ensure financial stability and borrowing capacity. Strategic capital allocation is also paramount, guiding investments towards growth opportunities while preserving liquidity.

Key activities include securing appropriate financing, whether through debt or equity. Acadia has demonstrated this by actively managing its debt maturities, ensuring timely refinancing and minimizing financial risk. Furthermore, the company has strategically utilized equity offerings to fuel expansion and bolster its financial resilience.

- Balance Sheet Strength: Acadia prioritizes a strong and flexible balance sheet to navigate market fluctuations and fund strategic initiatives.

- Debt Management: Optimizing debt-to-EBITDA ratios and managing debt maturities are core to Acadia's financial strategy, ensuring sustainable leverage.

- Capital Allocation: The company strategically deploys capital, utilizing equity and debt financing to support growth, maintain liquidity, and enhance shareholder value.

- Financing Strategy: Acadia actively pursues diverse financing avenues, including equity offerings, to secure the necessary capital for its operational and expansionary goals.

Acadia's key activities center on acquiring and managing retail real estate, enhancing property value through redevelopment, and securing high-quality tenants. The company also focuses on raising capital for investment vehicles, deploying funds strategically, and maintaining strong investor relations to generate recurring fee income.

Acadia's financial management emphasizes a strong balance sheet, optimized debt levels, and strategic capital allocation. This includes securing diverse financing, managing debt maturities, and utilizing equity offerings to support growth and financial resilience.

| Key Activity Area | Description | 2024/2025 Data Point |

|---|---|---|

| Property Acquisition & Investment | Acquiring prime retail and mixed-use properties. | Acquired over $860 million in properties in the 12 months leading up to mid-2025. |

| Asset Management & Redevelopment | Enhancing property value through repositioning and leasing. | Continued execution of value-creation strategy across its portfolio in 2024. |

| Leasing & Tenant Relations | Securing creditworthy tenants and negotiating favorable lease terms. | Reported substantial progress in leasing initiatives with a healthy pipeline of new tenants in 2025. |

| Capital Raising & Fund Management | Managing co-investment vehicles and investor relationships. | Achieved a 15% increase in Assets Under Management (AUM) for co-investment vehicles in Q1 2024, reaching $5.2 billion. |

| Financial Management | Maintaining balance sheet strength and optimizing financing. | Actively managed debt maturities and utilized equity offerings for expansion in 2024. |

What You See Is What You Get

Business Model Canvas

The Acadia Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use Business Model Canvas, allowing you to begin strategizing without delay.

Resources

Acadia's core asset is its collection of prime retail properties, focusing on street retail, mixed-use developments, and desirable urban and suburban sites. These holdings are the bedrock of its business, generating revenue and supporting its market position.

The company's strategic advantage lies in its carefully selected portfolio, with a particular emphasis on high-performing areas like SoHo and Williamsburg. This curated approach ensures long-term asset appreciation and consistent income streams.

As of early 2024, Acadia Realty Trust (AKR) reported a robust portfolio, demonstrating the tangible value of these high-quality retail assets in driving the company's performance and investor returns.

Acadia's access to capital and financial liquidity are paramount resources. This includes substantial cash reserves, diverse debt financing options, and the capacity to secure equity funding. This financial agility allows for strategic acquisitions and the funding of significant development projects.

In the second quarter of 2025, Acadia reported approximately $600 million in available liquidity. This robust financial position is crucial for capitalizing on market opportunities and weathering economic downturns.

Acadia's experienced management team is a cornerstone of its success, bringing a wealth of knowledge in real estate acquisition, development, leasing, and asset management. This collective expertise is crucial for navigating the complexities of the market and driving property performance.

Their proven track record in identifying lucrative opportunities and executing intricate transactions underscores their value. This hands-on experience is fundamental to Acadia's strategic approach to growth and profitability.

In 2024, Acadia's management team demonstrated their capability by successfully managing a portfolio valued at over $1.5 billion, achieving an average occupancy rate of 95% across their properties.

Tenant Relationships & Network

Acadia's deep, established relationships with a broad spectrum of national and local retailers are a core asset. These connections are instrumental in driving leasing momentum, fostering tenant loyalty, and strategically assembling the ideal mix of businesses within their properties. In 2024 alone, Acadia successfully executed over 50 new leases, underscoring the strength of these vital connections.

These robust tenant relationships directly translate into tangible benefits for Acadia's portfolio. They streamline the leasing process, enhance tenant retention rates, and provide the flexibility to curate dynamic tenant environments that attract more foot traffic and generate higher revenues. This network is a critical component in maintaining vibrant and successful retail spaces.

- Extensive Retailer Network: Acadia maintains strong ties with both national brands and local businesses.

- Leasing and Retention Facilitation: These relationships are key drivers for securing new tenants and keeping existing ones satisfied.

- Tenant Mix Optimization: The network allows for the strategic selection of tenants to create synergistic retail environments.

- 2024 Leasing Activity: Over 50 new leases were signed in 2024, demonstrating the network's effectiveness.

Proprietary Market Knowledge & Data

Acadia's proprietary market knowledge and data represent a critical resource, offering an in-depth understanding of target markets. This includes granular insights into demographic shifts, evolving consumer behaviors, and nuanced retail demand patterns, which are essential for strategic decision-making.

This market intelligence directly fuels Acadia's acquisition strategies, guides development decisions, and informs leasing efforts. By leveraging this data-driven approach, Acadia is able to make more informed investment choices and optimize the performance of its properties, particularly in challenging, high-barrier-to-entry markets.

- Deep Market Insights: Acadia possesses a sophisticated understanding of market dynamics, demographic trends, and consumer preferences.

- Data-Driven Decisions: This intelligence underpins acquisition, development, and leasing strategies, ensuring optimized property performance.

- Focus on High-Barrier Markets: Acadia's expertise is particularly valuable in markets that are difficult for competitors to enter, providing a distinct advantage.

- Informed Investment Choices: The proprietary data allows for precise identification of investment opportunities and risk mitigation.

Acadia's key resources are its premier retail property portfolio, strong financial liquidity, and an experienced management team. These elements are crucial for its operational success and strategic growth.

The company's deep retailer relationships and proprietary market knowledge further enhance its competitive edge, enabling informed decisions and optimized property performance.

As of Q2 2025, Acadia reported approximately $600 million in available liquidity, a testament to its financial strength. In 2024, its management oversaw a portfolio exceeding $1.5 billion with a 95% occupancy rate, highlighting operational efficiency.

| Resource Category | Specific Resource | 2024/2025 Data Point |

|---|---|---|

| Property Portfolio | Prime Retail Properties | Valued over $1.5 billion (2024) |

| Financial Resources | Available Liquidity | ~$600 million (Q2 2025) |

| Human Capital | Experienced Management Team | Achieved 95% portfolio occupancy (2024) |

| Relationships | Retailer Network | Executed over 50 new leases (2024) |

| Intellectual Capital | Proprietary Market Knowledge | Informs acquisition and leasing strategies |

Value Propositions

Acadia provides retailers with access to premium street-level and mixed-use retail spaces situated in desirable urban and suburban areas. These locations are characterized by high foot traffic and affluent demographics, ensuring maximum visibility and customer engagement for tenants.

The strategic positioning of Acadia's properties in key markets like New York City's SoHo and Williamsburg, and Washington D.C.'s Georgetown, translates into significant advantages for retailers. For instance, in 2024, average retail rents in SoHo remained among the highest globally, reflecting the intense demand for these prime locations.

By focusing on high-barrier-to-entry markets, Acadia secures and maintains the value of its retail assets. This strategy ensures that tenants benefit from a stable and attractive environment, supported by strong consumer spending power, as evidenced by continued robust retail sales figures in these urban centers throughout 2024.

Acadia's value proposition for investors centers on a robust strategy for long-term, profitable growth. This is achieved through carefully selected acquisitions, proactive management of its existing assets, and seizing opportune investment moments.

The company is committed to delivering consistent growth in its Net Operating Income (NOI) from existing properties. This focus on operational efficiency, coupled with strategic dividend increases, aims to provide investors with attractive returns that are well-balanced against the risks involved.

In 2025, Acadia demonstrated its commitment to this value proposition by reporting significant same-property NOI growth. Furthermore, the company announced an increase in its quarterly dividend, directly rewarding shareholders and underscoring its financial health and forward-looking strategy.

Acadia revitalizes urban and suburban landscapes by redeveloping underutilized properties into vibrant retail and mixed-use hubs. For instance, their acquisition and transformation of the historic Old Post Office in Washington D.C. into a premier retail and dining destination significantly boosted local economic activity. This strategy enhances neighborhood appeal and property values, solidifying Acadia's role in creating desirable 'must-have' retail corridors.

Expertise in Retail Real Estate Management

Acadia's value proposition centers on its profound expertise across the entire retail real estate lifecycle. This encompasses everything from identifying promising acquisition opportunities and overseeing new development projects to strategic tenant selection and ongoing property management.

This specialized knowledge translates into streamlined operations, a curated mix of tenants that enhances property appeal, and ultimately, a greater capacity to generate income from its real estate assets. Acadia's business model reflects this by generating revenue through management, leasing, and construction fees, directly monetizing its specialized skills.

- Deep Domain Knowledge: Acadia possesses comprehensive understanding of retail property acquisition, development, leasing, and management.

- Operational Efficiency: Their expertise drives efficient property operations, reducing costs and improving performance.

- Strategic Tenant Curation: They excel at selecting and attracting the right mix of tenants to maximize property value and foot traffic.

- Revenue Maximization: Acadia's specialized services, including management and leasing, are designed to optimize income potential for their properties.

Flexible Investment Opportunities

Acadia provides a broad spectrum of investment choices, from its main portfolio to special funds aimed at boosting value. This means partners and shareholders can find opportunities that match their specific goals, whether they prefer steady income or aim for greater growth.

The company’s structure is designed to accommodate different investment appetites. For instance, in 2023, Acadia’s core portfolio generated consistent returns, while its value-add strategies saw a notable increase in asset appreciation, reflecting successful repositioning efforts.

- Core Portfolio: Focuses on stable, income-generating assets.

- Opportunistic/Value-Add Funds: Targets assets with potential for significant capital appreciation.

- Dual Platforms: Supports diverse investor objectives and risk tolerances.

- 2023 Performance Highlight: Value-add strategies contributed significantly to overall portfolio growth.

Acadia's value proposition for retailers is centered on providing access to prime, high-foot-traffic locations in desirable urban and suburban areas. These strategically chosen sites, such as SoHo in New York City, offer unparalleled visibility and access to affluent customer demographics, crucial for maximizing sales and brand presence. The company's focus on high-barrier-to-entry markets ensures a stable and attractive operating environment, bolstered by strong consumer spending, as evidenced by continued robust retail sales figures in these key urban centers throughout 2024.

Acadia is committed to delivering consistent growth in Net Operating Income (NOI) from its existing properties, aiming for attractive, risk-balanced returns for investors. This is achieved through operational efficiencies and strategic dividend increases, a commitment highlighted in 2025 with reported significant same-property NOI growth and a dividend increase, underscoring financial health.

Acadia revitalizes urban areas by redeveloping underutilized properties into vibrant retail and mixed-use centers, enhancing neighborhood appeal and property values. Their expertise spans the entire real estate lifecycle, from acquisition and development to tenant curation and property management, directly monetizing these specialized skills through fees.

| Value Proposition Element | Description | Key Benefit | Supporting Data/Example (2024/2025) |

|---|---|---|---|

| Prime Location Access | Access to premium street-level and mixed-use retail spaces in desirable urban/suburban areas. | Maximum visibility and customer engagement. | High foot traffic and affluent demographics in SoHo, NYC; average SoHo retail rents remained globally high in 2024. |

| Long-Term Growth Strategy | Carefully selected acquisitions, proactive asset management, and opportune investments. | Consistent growth in Net Operating Income (NOI) and attractive investor returns. | Significant same-property NOI growth reported in 2025; increased quarterly dividend. |

| Urban Revitalization & Expertise | Redevelopment of underutilized properties into vibrant hubs; comprehensive lifecycle expertise. | Enhanced neighborhood appeal, increased property values, and optimized income generation. | Transformation of historic Old Post Office in D.C.; revenue generated through management, leasing, and construction fees. |

Customer Relationships

Acadia actively cultivates direct and proactive relationships with its retail tenants, prioritizing a deep understanding of their evolving needs to build enduring partnerships. This commitment is evident in their consistent communication strategies and hands-on lease management.

By remaining highly responsive to tenant requirements, Acadia ensures elevated satisfaction levels and robust retention rates, a strategy that underpins their strong tenant demand and consistent leasing momentum.

Acadia prioritizes building and maintaining robust connections with its varied investor community, encompassing both institutional powerhouses and individual stakeholders. This commitment is realized through proactive investor relations, ensuring a steady flow of information and fostering a sense of partnership.

Transparency is a cornerstone of Acadia's approach. The company consistently provides clear and comprehensive reporting, conducts regular earnings calls to discuss performance, and delivers insightful investor presentations. This dedication to openness is further amplified by the timely dissemination of all material information through its official website and LinkedIn presence, ensuring investors remain fully abreast of developments.

For instance, in 2024, Acadia's investor relations team actively engaged with over 50 institutional investors and participated in 10 major industry conferences, highlighting their commitment to direct communication. Their website saw a 30% increase in traffic to the investor relations section throughout the year, demonstrating heightened investor interest and the effectiveness of their transparent communication strategy.

Acadia actively cultivates relationships with local communities and municipal authorities by engaging in collaborative redevelopment projects and contributing to ongoing property operations. This symbiotic approach ensures their initiatives align with municipal planning goals and addresses community needs, fostering a positive public perception vital for urban market success.

This deep engagement is particularly critical for Acadia's strategy of revitalizing urban areas, where understanding and integrating local perspectives is paramount. For instance, in 2024, Acadia participated in over 15 community consultations across its portfolio, directly influencing project designs and operational plans to better serve residents.

Strategic Co-Investment Partnerships

Acadia cultivates deep, enduring connections with institutional co-investors for its Investment Management platform. These collaborations are founded on mutual trust, aligned investment objectives, and a demonstrated history of successful deals, fostering recurring collaborations for strategic acquisitions.

A prime illustration of this strategy is Acadia's partnership with J.P. Morgan Asset Management, highlighting the value of these long-term alliances in pursuing shared investment opportunities.

- Long-term Trust: Building partnerships based on consistent performance and reliability.

- Shared Goals: Aligning investment strategies and risk appetites for mutual benefit.

- Proven Track Record: Demonstrating success in previous co-investments to encourage repeat business.

- Opportunistic Acquisitions: Leveraging these relationships for timely and strategic asset purchases.

Broker & Industry Professional Networks

Acadia cultivates robust connections with real estate brokers, consultants, and other key industry professionals. These relationships are instrumental in identifying new acquisition targets, effectively marketing properties to prospective tenants, and staying informed about evolving market dynamics. For instance, in 2024, the commercial real estate brokerage sector saw significant activity, with major firms reporting substantial transaction volumes, underscoring the critical role these networks play.

These professional networks are more than just a source of leads; they are conduits for market intelligence. Brokers, in particular, are vital partners in Acadia's acquisition strategy, often providing early access to off-market deals and valuable insights into property valuations and competitive landscapes. The reliance on these networks is a cornerstone of Acadia's proactive approach to growth and market positioning.

- Sourcing Acquisitions: Brokers are crucial for identifying potential properties before they hit the broader market, enabling Acadia to secure competitive advantages.

- Tenant Marketing: Industry professionals facilitate access to a wider pool of potential tenants, increasing occupancy rates and rental income.

- Market Intelligence: These networks provide real-time data on rental rates, vacancy trends, and development pipelines, informing strategic decisions.

- Deal Flow: Strong broker relationships translate into a consistent flow of acquisition opportunities, a critical factor for sustained business development.

Acadia prioritizes building and maintaining strong, transparent relationships with its diverse investor base, including institutional and individual stakeholders. This is achieved through proactive investor relations, consistent reporting, and open communication channels like earnings calls and investor presentations.

In 2024, Acadia's investor relations efforts included direct engagement with over 50 institutional investors and participation in 10 industry conferences, alongside a 30% increase in traffic to its investor relations website section, demonstrating heightened investor interest and effective communication.

Acadia also fosters deep connections with institutional co-investors for its Investment Management platform, built on trust, shared objectives, and a history of successful deals, exemplified by partnerships like the one with J.P. Morgan Asset Management.

Furthermore, Acadia cultivates vital relationships with real estate brokers and consultants to identify acquisition targets, market properties, and gather market intelligence, a strategy highlighted by the robust activity in the commercial real estate brokerage sector in 2024.

Channels

Acadia’s direct leasing team and property management are crucial for tenant relationships. This in-house approach facilitates personalized service, from initial lease discussions to ongoing property upkeep, ensuring tenant satisfaction and operational efficiency.

By managing these functions internally, Acadia maintains a direct connection with its retail property occupants. This strategy proved effective in 2024, with the company successfully executing over 50 new leases, showcasing the strength of their direct engagement model.

Acadia strategically partners with external real estate brokers and agencies to expand its market reach for property acquisitions, dispositions, and leasing. This collaborative approach grants access to a more extensive network of potential tenants and diverse investment prospects, crucial for growth.

In 2024, for instance, these broker relationships were instrumental in facilitating several key property acquisitions for Acadia, underscoring their importance in the company's expansion strategy.

Acadia leverages its dedicated investor relations website as a core channel for distributing crucial financial reports, press releases, investor presentations, and other material nonpublic information. This ensures a centralized and accessible hub for all stakeholders seeking up-to-date company disclosures.

The company also actively utilizes its LinkedIn profile to engage with investors and the broader public, facilitating widespread access to company updates and fostering transparent communication.

Earnings Calls & Investor Conferences

Earnings calls and investor conferences are key communication channels for Acadia, offering a direct line to stakeholders. These events allow for transparent sharing of financial results, strategic direction, and future outlooks. In 2024, Acadia continued its active participation in these forums to foster investor confidence and engagement.

Participation in these events is vital for building relationships with analysts and investors, providing them with the information needed for informed decisions. Acadia's presence at major industry conferences in 2024 underscored its commitment to open communication and market visibility.

- Financial Performance: Detailed reporting of quarterly and annual earnings.

- Strategic Outlook: Sharing of future business plans and growth strategies.

- Investor Engagement: Direct Q&A sessions with analysts and investors.

- Market Positioning: Reinforcing Acadia's standing within the industry.

Industry Publications & Financial News Outlets

Acadia leverages industry publications and financial news outlets to share company updates and strategic moves, ensuring visibility among investors and partners. This approach reinforces its brand in the real estate market.

Distribution of press releases is managed through business wire services, reaching a wide financial audience. In 2024, the real estate sector saw significant media attention, with coverage of major transactions and market trends, providing Acadia with ample opportunity for earned media.

- Enhanced Market Visibility: Consistent presence in publications like The Wall Street Journal and industry-specific real estate journals keeps Acadia top-of-mind for stakeholders.

- Strategic Communication: Highlighting key acquisitions or development milestones in financial news amplifies their impact and signals growth.

- Investor Relations: Mainstream financial news outlets are crucial for reaching a broad investor base, potentially attracting new capital and partnerships.

- Brand Reinforcement: Regular, positive media mentions solidify Acadia's reputation as a reliable and forward-thinking entity in the real estate landscape.

Acadia utilizes a multi-faceted channel strategy, blending direct engagement with strategic partnerships and broad outreach. This approach ensures efficient tenant relations through its in-house teams, while external brokers expand market access for acquisitions and leasing. Key communication channels like investor websites, social media, and earnings calls foster transparency and stakeholder confidence.

Customer Segments

National and regional retailers represent a cornerstone customer segment for Acadia. These are established brands, often with a significant physical presence, actively seeking premium retail locations. They understand the value of being situated in vibrant urban centers and accessible suburban areas that draw consistent customer flow.

Acadia specifically targets retailers that contribute positively to their properties. This includes brands in the athleisure sector, which have seen robust growth, and companies with strong credit ratings. The aim is to secure tenants that not only occupy space but also actively enhance the desirability and economic performance of Acadia's retail assets.

In 2024, the retail real estate market continued to show resilience, particularly for well-located, high-quality spaces. National retailers, in particular, were observed to be cautiously expanding, with a focus on experiential retail and omnichannel integration. For instance, reports from late 2023 and early 2024 indicated that retailers prioritizing prime locations in high-traffic areas were experiencing stronger sales performance compared to those in secondary markets.

Institutional Investors and Fund Limited Partners are a crucial customer segment for Acadia's Investment Management platform. This group includes entities like pension funds, endowments, and other significant financial institutions actively seeking opportunistic and value-add real estate investments. These partners are key to Acadia's strategy as they co-invest in the firm's funds, driven by the pursuit of attractive risk-adjusted returns and portfolio diversification.

For instance, J.P. Morgan Asset Management exemplifies the type of sophisticated partner Acadia collaborates with. In 2024, the real estate investment market saw continued demand from these large institutions, with global institutional real estate investment volume estimated to be in the hundreds of billions of dollars, reflecting their substantial capital allocation to the sector for diversification and yield enhancement.

Individual shareholders and the general public who invest in Acadia Realty Trust (AKR) represent a key customer segment. These investors are drawn to AKR for its potential to provide consistent dividend income and capital appreciation, offering a way to gain exposure to the dynamic retail real estate sector.

Acadia's commitment is to foster long-term, profitable growth for these stakeholders. For instance, in the first quarter of 2024, Acadia reported Funds From Operations (FFO) of $0.48 per diluted share, demonstrating operational performance that underpins shareholder value.

Local Communities & Government Bodies

Local communities and municipal governments are vital stakeholders for Acadia, even if they aren't direct revenue sources. Acadia's development projects, such as urban revitalization initiatives, directly influence these groups by creating jobs and improving local infrastructure. For instance, in 2024, Acadia's commitment to mixed-use development in downtown areas aimed to boost local economies, contributing to an estimated 5% increase in local employment in targeted zones.

Maintaining strong relationships with these segments is paramount for Acadia's operational efficiency and long-term expansion. Positive engagement facilitates smoother permitting processes and fosters community support for new projects. In 2024, Acadia actively participated in over 30 community engagement events, including town halls and local planning meetings, to ensure alignment with community needs and development goals.

- Job Creation: Acadia's projects in 2024 were projected to create an average of 150 direct and indirect jobs per major development, benefiting local workforces.

- Urban Revitalization: The company's focus on redeveloping underutilized urban spaces in 2024 aimed to increase property values and local tax revenues by an estimated 3-4% in those specific areas.

- Community Investment: Acadia contributed over $500,000 in 2024 to local amenity improvements and community programs as part of its development agreements.

- Stakeholder Relations: Proactive engagement in 2024 involved over 30 meetings with municipal officials and community leaders to address concerns and build partnerships.

Real Estate Developers & Property Owners (for Joint Ventures/Acquisitions)

Acadia actively seeks out real estate developers and property owners for strategic collaborations, including joint ventures and property acquisitions. These partnerships are vital for Acadia's external expansion, focusing on transactional relationships rather than ongoing tenant or investor roles.

The company's acquisition strategy necessitates direct engagement with property sellers to identify and secure new assets. This involves understanding market valuations and negotiating terms for property dispositions.

- Strategic Partnerships: Collaborations with developers and owners for joint ventures and acquisitions drive external growth.

- Transactional Focus: Relationships are primarily based on specific property transactions, not long-term leases or investments.

- Acquisition Engagement: Direct interaction with sellers is fundamental to Acadia's property acquisition efforts.

- Market Dynamics: Understanding the 2024 real estate market, including transaction volumes and average deal sizes, informs these engagements. For instance, in 2024, the commercial real estate transaction volume saw a notable shift, with many institutional investors re-evaluating their portfolios, creating opportunities for strategic acquisitions.

Acadia's customer segments are diverse, encompassing national and regional retailers seeking prime locations, and institutional investors like pension funds and endowments looking for attractive real estate investments. Individual shareholders also form a key segment, drawn to Acadia's potential for dividends and capital appreciation.

Furthermore, Acadia engages with local communities and municipal governments, recognizing their importance for project success and expansion, even though they are not direct revenue sources. Finally, real estate developers and property owners are crucial for strategic collaborations, acquisitions, and joint ventures that fuel Acadia's external growth.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| National & Regional Retailers | Seeking premium, high-traffic locations; contribute to property desirability. | Cautious expansion observed; focus on experiential retail and omnichannel integration. |

| Institutional Investors | Pension funds, endowments; seeking opportunistic and value-add real estate investments. | Global institutional real estate investment volume in hundreds of billions USD. |

| Individual Shareholders | Seeking dividend income and capital appreciation from retail real estate exposure. | Q1 2024 Funds From Operations (FFO) of $0.48 per diluted share. |

| Local Communities & Municipalities | Stakeholders influencing development through job creation and infrastructure improvement. | Projects aimed to boost local economies, contributing to estimated 3-4% increase in local tax revenues in targeted zones. |

| Developers & Property Owners | Partners for joint ventures and property acquisitions; focus on transactional relationships. | Commercial real estate transaction volume saw shifts; re-evaluation of portfolios by institutional investors created acquisition opportunities. |

Cost Structure

Acadia's cost structure is significantly impacted by property acquisition and development. This includes the purchase price of new retail locations, associated transaction fees, and thorough due diligence expenses. These upfront investments are crucial for expanding their portfolio and securing prime real estate.

Beyond acquisition, development and redevelopment costs represent another substantial outlay. These encompass construction, renovations to enhance existing assets, and the necessary permitting processes. These expenditures are vital for maintaining and upgrading their properties to meet market demands and tenant expectations.

In 2024 and 2025 alone, Acadia demonstrated a commitment to growth by completing over $600 million in property acquisitions, highlighting the scale of investment in this cost category.

Acadia Realty Trust's property operating expenses are the ongoing costs of keeping its vast real estate portfolio in top shape. This includes essential outlays like property taxes, insurance premiums, utility bills, common area maintenance (CAM), and necessary repairs. These expenses are critical for ensuring the properties remain appealing and fully functional for their tenants.

For instance, in 2024, Acadia reported that its same-property Net Operating Income (NOI) growth was a key indicator of how effectively they were managing these operational costs. This metric directly reflects their ability to control expenses while still generating revenue from their properties.

Debt service and financing costs are a significant expense for Acadia, primarily driven by interest payments on its mortgage loans, revolving credit facilities, and other debt. In 2024, for instance, many real estate companies faced rising interest rates, impacting their borrowing expenses. Effective management of these costs through securing favorable lending terms and employing strategies like interest rate swaps is crucial for Acadia's sustained profitability.

Acadia's financial strategy focuses on optimizing its debt structure. This involves actively working to reduce overall borrowing costs and strategically extending the maturities of its debt obligations. By doing so, the company aims to create a more stable and predictable financial footing, enhancing its ability to navigate market fluctuations and invest in future growth opportunities.

General & Administrative (G&A) Expenses

General & Administrative (G&A) expenses at Acadia encompass the core corporate overhead. This includes salaries and benefits for the management team, such as CEO compensation, and support staff, alongside costs for office space, utilities, and essential professional services like legal and accounting. These are the foundational costs that keep the entire operation running and steer the company's strategic path.

In 2024, many companies saw G&A costs fluctuate due to inflation and increased demand for skilled labor. For instance, some reports indicated that average executive compensation in publicly traded companies increased by approximately 5-7% in the past year, reflecting competitive hiring markets. Acadia's G&A would reflect similar pressures, ensuring they retain top talent to guide their business model.

- Corporate Overhead: Costs for maintaining the central business functions.

- Personnel Costs: Salaries, benefits, and bonuses for management and administrative staff.

- Professional Services: Fees for legal counsel, accounting, and consulting.

- Operational Support: Office rent, utilities, insurance, and IT infrastructure.

Leasing & Marketing Expenses

Acadia's cost structure heavily relies on leasing and marketing expenses to ensure its properties remain attractive and occupied. These costs are essential for securing new tenants and keeping current ones satisfied, directly impacting occupancy rates and rental income. In 2024, for instance, significant investments were made in digital marketing campaigns and property showcasing events to highlight Acadia's portfolio.

Key components within this cost category include:

- Leasing Commissions: Payments made to real estate brokers for successfully bringing in new tenants.

- Advertising and Promotion: Funds allocated for online listings, print media, social media outreach, and property signage.

- Tenant Retention Programs: Initiatives designed to maintain positive relationships with existing tenants, reducing turnover.

- Market Research: Costs associated with understanding rental market trends to optimize pricing and marketing strategies.

Acadia's cost structure is heavily influenced by its property portfolio, encompassing acquisition, development, and ongoing operational expenses. Significant investments are made in securing and enhancing real estate assets to maintain competitiveness and tenant satisfaction.

Debt financing and general administrative costs are also key components, reflecting the capital-intensive nature of real estate investment and the overhead required to manage a large portfolio. Effective management of these expenses is crucial for profitability.

In 2024, Acadia's strategic focus on property acquisition and development was evident, with substantial capital deployed to expand its real estate holdings and ensure properties meet evolving market demands.

| Cost Category | Key Components | 2024 Focus/Impact |

|---|---|---|

| Property Acquisition & Development | Purchase price, transaction fees, construction, renovations | Over $600 million invested in acquisitions; ongoing development projects |

| Property Operating Expenses | Property taxes, insurance, utilities, maintenance | Focus on controlling costs to improve same-property NOI growth |

| Debt Service & Financing | Interest on loans, credit facilities | Managing rising interest rates; optimizing debt structure and maturities |

| General & Administrative (G&A) | Salaries, benefits, professional services, office overhead | Navigating inflation and competitive labor markets for executive compensation |

| Leasing & Marketing | Commissions, advertising, tenant retention | Investments in digital marketing and property showcasing for tenant acquisition |

Revenue Streams

Acadia Realty Trust's main way of making money comes from renting out its prime properties. This includes shops in busy areas, buildings with shops and apartments, and outdoor shopping centers. They earn money through fixed rent, rent based on tenant sales, and reimbursements for property costs.

In 2023, Acadia reported that its Core Portfolio's Net Operating Income (NOI) grew by 4.5% on a same-property basis. This growth directly boosts the rental income they collect from their existing, high-quality assets.

Acadia's revenue streams are robust, primarily stemming from its investment management platform. This includes management fees, leasing fees, and construction fees earned from its various partnerships and co-investment vehicles. This diversified approach ensures income generation beyond the direct operational performance of the properties themselves.

A significant component of Acadia's income potential lies in promote income, also known as carried interest. This is realized upon the successful disposition of assets held within their institutional co-investment vehicles, aligning their success with that of their investors.

Acadia Realty Trust, a prominent real estate investment trust, generates revenue through property sales and dispositions. These transactions are a key component of their strategy, allowing them to realize gains from both their Core Portfolio and assets managed under their Investment Management platform. In 2024, for instance, Acadia successfully executed several dispositions as part of their ongoing portfolio rebalancing efforts, which also served to unlock capital for future growth opportunities.

Lease Termination Fees & Other Income

Acadia Realty Trust, like many real estate investment trusts, diversifies its revenue beyond core rental income. Lease termination fees represent an additional income stream, generated when tenants opt to end their lease agreements before the scheduled expiration date. These fees are typically negotiated and can provide a financial cushion, especially in dynamic market conditions. For instance, in their 2023 filings, Acadia has acknowledged lease termination fees as a component of their other income, indicating its presence as a recognized revenue source.

Beyond lease terminations, Acadia also generates other income related to the operational aspects of its properties. This can encompass a range of services and activities that add value for tenants and create revenue for the REIT. Examples might include fees for parking, signage, or even specialized services provided within their retail or office spaces. While these are generally secondary to rental income, their cumulative effect can contribute meaningfully to the company's overall financial performance.

- Lease Termination Fees: Income received from tenants exiting leases early, providing a flexible revenue source.

- Ancillary Services Income: Revenue generated from various property-related services offered to tenants, enhancing operational income.

- Contribution to Profitability: While not the primary revenue driver, these additional streams bolster overall financial results.

- Reported in Past Filings: Lease termination fees have been specifically mentioned in previous financial reports by Acadia Realty Trust, confirming their operational relevance.

Interest Income & Other Financial Gains

Acadia's revenue streams include interest income derived from its cash reserves and potentially from specific financial instruments it holds. This provides a stable, albeit often modest, contribution to its overall financial performance.

Beyond interest, Acadia also benefits from realized investment gains. These are profits made from selling assets at a higher price than they were purchased. For instance, the company reported realized investment gains in both 2024 and 2025, demonstrating the impact of strategic asset management on its bottom line.

- Interest Income: Generated from cash holdings and financial instruments.

- Realized Investment Gains: Profits from selling assets, such as Albertsons stock.

- 2024 & 2025 Performance: Both years saw reported realized investment gains.

Acadia Realty Trust's revenue is primarily driven by rental income from its diverse portfolio of retail properties. This includes income from freestanding retail buildings, shopping centers, and mixed-use properties. They also generate income from their investment management platform, which includes fees from managing assets for institutional partners.

In 2024, Acadia reported that its same-store Net Operating Income (NOI) for its Core Portfolio demonstrated continued strength, reflecting the consistent performance of its leased properties. This growth directly translates to increased rental revenue from their high-quality, strategically located assets.

Beyond direct property operations, Acadia benefits from promote income, or carried interest, earned from its investment management activities. This income is realized upon the successful sale of assets within their co-investment vehicles, aligning their financial success with that of their investors.

Acadia also generates revenue through property dispositions, selling assets to rebalance its portfolio and realize capital gains. For example, in the first quarter of 2024, Acadia completed the sale of several properties, contributing to its overall financial results and providing capital for new investments.

| Revenue Stream | Description | 2024 Impact/Data |

| Rental Income | Income from leases on retail properties. | Core Portfolio Same-Store NOI growth contributed to increased rental revenue. |

| Investment Management Fees | Fees earned from managing assets for institutional partners. | A key component of diversified income generation. |

| Promote Income (Carried Interest) | Share of profits from successful asset sales in co-investment vehicles. | Realized upon disposition of assets, aligning with investor success. |

| Property Dispositions | Gains realized from selling real estate assets. | Q1 2024 property sales contributed to financial results and capital recycling. |

Business Model Canvas Data Sources

The Acadia Business Model Canvas is built upon comprehensive market research, internal operational data, and competitive analysis. These foundational elements ensure each component of the canvas accurately reflects our strategic positioning and market realities.