Acadia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Acadia's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to navigate market complexities and capitalize on emerging opportunities. Download the full version now for actionable intelligence and a decisive competitive advantage.

Political factors

Changes in urban planning and zoning regulations directly impact Acadia Realty Trust's ability to redevelop or expand its mixed-use and urban retail properties. For instance, in 2024, cities like New York City continued to refine zoning for increased housing density, which could present opportunities for mixed-use developments but also introduce new regulatory hurdles for retail components.

Policies encouraging or restricting density, specific retail uses, or historical preservation can significantly affect project feasibility and profitability. In 2025, we're seeing a trend in some municipalities, such as those in the Pacific Northwest, implementing stricter historical preservation guidelines, potentially increasing development costs for properties like Acadia's urban retail centers.

Understanding local government priorities for urban revitalization is crucial for strategic investment. For example, in 2024, many cities across the US, including those where Acadia operates, allocated significant funding towards downtown revitalization projects, often prioritizing mixed-use developments that integrate residential and retail spaces, which aligns with Acadia's portfolio strategy.

Central bank decisions on interest rates are a major political factor impacting Acadia. The US Federal Reserve, for instance, is anticipated to implement rate cuts towards the end of 2024 and into 2025. These adjustments directly affect borrowing costs for real estate investment trusts (REITs) like Acadia.

Even with anticipated modest cuts, a 'higher for longer' interest rate environment means borrowing costs will remain elevated compared to the previous decade. This has a direct impact on Acadia's ability to finance new property acquisitions and redevelopment projects.

The Federal Reserve's cautious stance on monetary policy, driven by ongoing inflation concerns, significantly shapes the financial landscape for commercial real estate. This cautiousness translates into a more challenging environment for financing and investment decisions for companies like Acadia.

Changes in corporate tax rates and specific tax advantages for Real Estate Investment Trusts (REITs) significantly impact Acadia's profitability and its ability to distribute dividends to shareholders. For instance, a reduction in the corporate tax rate could indirectly benefit REITs by increasing the net income available for distribution, while specific tax breaks for REITs, if altered, could directly affect their appeal to investors.

Fiscal policies, such as potential tax-and-spending bills enacted in 2024 or anticipated for 2025, play a crucial role in either enhancing or diminishing the tax advantages associated with owning commercial real estate. This, in turn, influences investor sentiment and the availability of capital for companies like Acadia. For example, a new tax credit for commercial property development could boost investment in the sector.

A keen understanding of the evolving tax landscape is paramount for Acadia to optimize its financial performance and maximize investor returns. Keeping abreast of legislative changes, such as any proposed adjustments to capital gains taxes or depreciation schedules for commercial properties, allows for proactive financial planning and strategic decision-making.

Trade Policies and Tariffs

Geopolitical concerns and evolving trade policies, including the potential for tariffs, can inject considerable uncertainty into the commercial real estate market. This is especially true for the retail sector, which is vulnerable to supply chain disruptions and shifts in consumer spending patterns. For instance, a significant portion of retail goods are imported, making them susceptible to import duties and trade barriers.

While some of the acute uncertainty surrounding global trade may be receding, the retail segment of the commercial real estate market remains exposed to the potential fallout from these policies. Acadia's retail tenants, in particular, could experience heightened operating costs or a dampening of consumer demand should trade tensions re-emerge or intensify. This could translate into reduced sales for tenants, potentially impacting their ability to meet lease obligations.

The impact of trade policies on Acadia's portfolio can be observed through several key channels:

- Supply Chain Costs: Tariffs on imported goods, a common tool in trade disputes, can directly increase the cost of inventory for retailers, potentially squeezing profit margins.

- Consumer Spending: Trade tensions can lead to economic slowdowns or inflation, both of which can reduce discretionary spending by consumers, impacting retail sales volumes.

- Tenant Viability: For retailers heavily reliant on international sourcing, increased trade friction could jeopardize their business models, affecting their long-term stability and lease security.

- Market Sentiment: Broader geopolitical instability associated with trade disputes can negatively affect investor sentiment towards sectors perceived as more vulnerable, such as retail real estate.

Political Stability and Investment Confidence

Political stability is a cornerstone for investor confidence in the real estate sector, including retail and mixed-use developments. In 2024 and looking into 2025, global geopolitical tensions and upcoming elections in several major economies create a backdrop of potential uncertainty, which can temper investment appetite.

Periods of political instability, whether through unexpected policy changes or shifts in government, often prompt investors to adopt a more cautious stance. This can manifest as a delay in new acquisitions or development plans as stakeholders await clearer market signals. For instance, the lead-up to the 2024 US presidential election saw some investors adopt a wait-and-see approach, impacting transaction volumes in certain commercial real estate segments.

Conversely, a predictable and stable political landscape significantly bolsters long-term investment. Countries with consistent policy frameworks and robust rule of law tend to attract more sustained capital into their real estate markets. This stability allows for more accurate forecasting of economic conditions and property performance, making retail and mixed-use properties more attractive for patient capital.

- Global Political Uncertainty (2024-2025): Heightened geopolitical risks and numerous national elections worldwide can introduce volatility.

- Investor Sentiment Impact: Political instability often leads to a slowdown in real estate transaction activity due to increased investor caution.

- Predictability Drives Investment: Stable political environments foster confidence, encouraging long-term commitments to retail and mixed-use properties.

- Policy Consistency is Key: Predictable government policies regarding property rights, taxation, and development are crucial for attracting and retaining investment.

Government policies on urban development and zoning significantly shape Acadia's operational landscape, influencing its mixed-use and retail property strategies. For example, in 2024, cities like Chicago continued to explore zoning reforms to encourage mixed-use developments, potentially creating new opportunities for Acadia while also necessitating adaptation to evolving regulations.

Fiscal policies, including changes to corporate tax rates and specific incentives for Real Estate Investment Trusts (REITs), directly affect Acadia's profitability and its capacity to distribute shareholder dividends. Anticipated adjustments in capital gains tax structures for 2025 could also influence investor decisions regarding commercial real estate holdings.

Geopolitical stability and the nature of international trade agreements are critical for Acadia's retail segment, as disruptions can impact tenant costs and consumer demand. For instance, ongoing trade discussions in 2024 between major economies could introduce volatility in supply chain costs for retailers occupying Acadia's properties.

Political stability is a key driver of investor confidence in real estate. The period of 2024-2025, marked by numerous global elections, introduces an element of uncertainty that can influence transaction volumes and investment decisions in the commercial property market.

What is included in the product

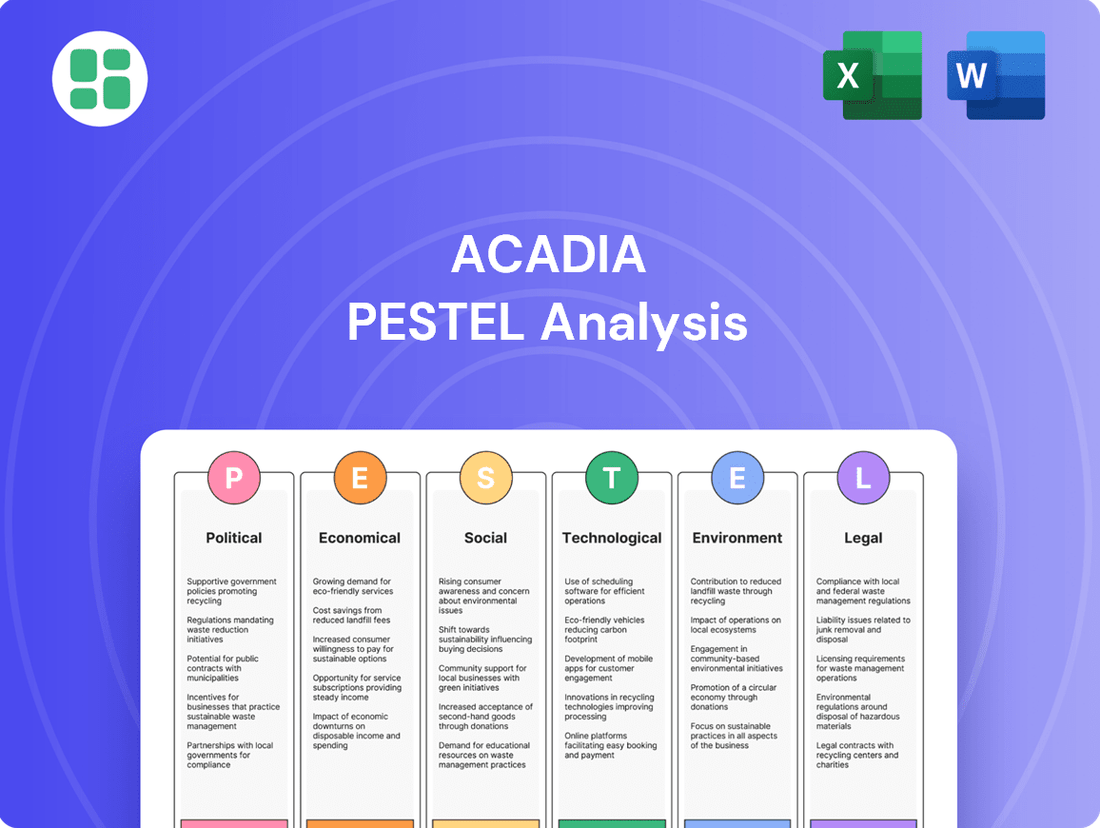

The Acadia PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Acadia across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Acadia PESTLE Analysis provides a clear, summarized version of external factors, relieving the pain point of sifting through extensive data during strategic planning.

Economic factors

Consumer spending is a critical engine for the retail industry, and recent data supports this. Retail trade sales saw a positive uptick from May 2024 to May 2025, demonstrating resilience even with fluctuating consumer sentiment. This sustained spending directly impacts businesses like Acadia, whose success hinges on shoppers visiting their locations.

Looking ahead, the National Retail Federation (NRF) projects continued retail sales growth for 2025. This forecast suggests that demand for physical retail environments, such as those operated by Acadia, is expected to remain robust, benefiting from ongoing consumer engagement with brick-and-mortar shopping experiences.

Elevated interest rates, even with the expectation of future cuts, significantly impact the cost of capital for commercial real estate. This translates to tighter debt service coverage ratios and a more cautious approach from lenders, directly affecting Acadia's financing options and project viability.

The benchmark 10-year Treasury rate, hovering around 4.25% as of early 2024, continues to be a key determinant of mortgage rates and capitalization rates across the commercial real estate sector. This sustained higher rate environment pressures property valuations and slows down transaction volumes, creating headwinds for Acadia's acquisition and redevelopment strategies.

While the retail sector has demonstrated a degree of resilience, the persistent higher borrowing costs pose a challenge. For Acadia, this means that the expense of financing new projects or refinancing existing ones is greater, potentially impacting profitability and the pace of expansion.

Persistent inflation continues to be a significant factor for real estate companies like Acadia, directly impacting operational expenses. Costs for essential services such as property maintenance, utilities, and labor have seen notable increases. For instance, the US Producer Price Index (PPI) for services, a key indicator of business costs, rose by 3.5% year-over-year as of April 2024, reflecting these upward pressures.

While inflation has shown signs of deceleration, it remains a critical consideration. The US Bureau of Labor Statistics reported a Consumer Price Index (CPI) of 3.4% in April 2024. This environment directly affects consumer purchasing power and, consequently, the ability of retailers operating within Acadia's properties to absorb higher rental rates, creating a delicate balancing act for pricing strategies.

Acadia must therefore implement robust strategies to manage its operational costs effectively and adjust its rental pricing models. This involves careful negotiation with suppliers, optimizing energy consumption, and potentially exploring automation for certain labor-intensive tasks to mitigate the impact of rising expenses and maintain healthy profit margins in the current economic climate.

Commercial Real Estate Transaction Activity and Valuations

Commercial real estate transaction activity is anticipated to stabilize and potentially grow in 2025, reflecting a narrowing gap between buyer and seller price expectations. This stabilization suggests a potential market bottom, presenting opportunities for financially robust entities like Acadia to enter or expand their portfolios. The retail sector, in particular, is demonstrating notable resilience, offering attractive entry points.

While elevated borrowing costs continue to exert pressure on property valuations, the outlook for 2025 is generally more optimistic. For instance, Moody's Analytics reported that commercial real estate transaction volumes were down significantly in 2023 compared to previous years, but projections for 2025 indicate a recovery. This improved sentiment, coupled with potential price corrections, could unlock value for strategic investors.

- Stabilizing Transaction Volumes: Projections indicate a rebound in CRE deal activity for 2025.

- Price Alignment: Buyers and sellers are moving closer on valuation expectations.

- Retail Sector Resilience: This segment shows strength, offering attractive investment prospects.

- Optimistic Market Sentiment: Despite borrowing costs, overall outlook for 2025 is positive.

Retail REIT Performance and Outlook

Retail REITs are demonstrating notable resilience, with projections indicating continued strong performance through 2025. Some analyses suggest a potential for dividend growth for both industrial and retail REITs in 2024 and 2025, signaling investor confidence.

Despite broader real estate market uncertainties, the retail sector, especially strip retail, is poised to benefit from ongoing development initiatives. Acadia, operating as a retail REIT, is strategically positioned within this sector, which has exhibited consistent and steady performance.

- Sector Resilience: Retail REITs are showing a capacity to withstand economic headwinds.

- Dividend Growth Potential: Projections for 2024-2025 indicate potential dividend increases for retail REITs.

- Strip Retail Advantage: Development activities are expected to boost performance in the strip retail segment.

- Acadia's Positioning: Acadia is well-placed within a historically steady-performing retail REIT market.

The economic landscape for 2024 and 2025 presents a mixed but generally stabilizing picture for retail real estate. While persistent inflation impacts operational costs, consumer spending has shown resilience, with retail sales projected for continued growth through 2025. Elevated interest rates, though expected to ease, continue to influence financing costs and property valuations, requiring strategic financial management.

| Economic Factor | Data Point (2024/2025 Projection) | Impact on Acadia |

|---|---|---|

| Consumer Spending | Retail trade sales positive uptick May 2024-May 2025; NRF projects continued growth for 2025. | Sustained demand for physical retail locations. |

| Interest Rates | 10-year Treasury around 4.25% early 2024; expected future cuts but still elevated. | Increased cost of capital, tighter lending, pressure on valuations. |

| Inflation | CPI at 3.4% April 2024; PPI for services up 3.5% YoY April 2024. | Higher operational expenses (maintenance, utilities, labor); impacts tenant affordability. |

| Transaction Volumes | Projected stabilization and potential growth in 2025; down in 2023 but recovery expected (Moody's Analytics). | Opportunities for portfolio expansion and strategic acquisitions. |

What You See Is What You Get

Acadia PESTLE Analysis

The preview you see here is the exact Acadia PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis.

The content and structure shown in the preview is the same document you’ll download after payment, providing a complete PESTLE breakdown for Acadia.

Sociological factors

Consumer preferences are rapidly evolving, with a strong lean towards experiential retail. This means physical stores are transforming from simple places to buy things into immersive, interactive environments designed to engage shoppers. For instance, a 2024 report indicated that 65% of consumers prefer experiences over products. This shift directly impacts how properties like those managed by Acadia need to be conceptualized, pushing for mixed-use developments that offer diverse attractions beyond traditional retail.

Brands are increasingly viewing their physical stores as powerful marketing tools, prioritizing customer experience to build loyalty and brand affinity. This strategy is crucial for attracting and retaining visitors in a competitive market. By 2025, it's projected that experiential retail will account for over 50% of retail sales growth, highlighting the economic imperative for Acadia to adapt its redevelopment strategies to foster dynamic, visitor-centric spaces.

Ongoing urbanization and demographic shifts, like increasing population densities in cities and their surrounding areas, directly impact the demand for retail and mixed-use properties. Acadia's strategic placement in urban and suburban locales means these trends significantly shape potential foot traffic, tenant interest, and the enduring value of its real estate holdings.

The global real estate market's expansion is fueled, in part, by a growing global population and the escalating need for housing and essential infrastructure. This population growth, projected to reach 8.5 billion by 2030, directly influences retail catchment areas and the overall economic health of Acadia's investment locations.

The increasing prevalence of omnichannel shopping, where customers fluidly move between online and physical stores, necessitates that Acadia's properties effectively bridge these digital and brick-and-mortar experiences. This trend means physical retail locations are no longer standalone entities but integral components of a broader customer journey.

A significant majority of consumers, estimated to be over 80% in many developed markets by 2024, now identify as omnichannel shoppers. They demand a consistent and convenient experience, expecting to interact with brands seamlessly whether they are browsing online, using a mobile app, or visiting a physical store, pushing Acadia to facilitate tenants that can offer this integrated approach.

Retailers are actively re-evaluating the purpose of their physical stores, shifting from purely transactional hubs to experiential centers that complement their online presence. This evolution requires Acadia's portfolio to be adaptable, supporting diverse formats that cater to click-and-collect services, in-store returns, and personalized customer engagement, all while integrating with digital platforms.

Demand for Sustainable and Ethical Retail Options

Consumers are increasingly vocal about their desire for retailers that demonstrate strong environmental and social responsibility. A 2024 survey indicated that 68% of consumers consider sustainability a key factor when making purchasing decisions, with 55% willing to pay a premium for ethically sourced goods. This shift directly impacts Acadia's tenant mix, favoring brands that align with these values and pushing for greener property operations.

This evolving consumer consciousness means Acadia's properties need to attract and retain tenants who are committed to sustainability. For instance, brands that actively promote certifications like B Corp or Fair Trade are likely to resonate more strongly with shoppers. This also places an onus on Acadia to implement and highlight sustainable property management practices, such as energy efficiency upgrades and waste reduction programs.

- Growing Consumer Demand: 68% of consumers prioritize sustainability in purchasing decisions (2024 data).

- Willingness to Pay More: 55% of consumers will pay a premium for ethically sourced products.

- Tenant Attraction: Properties attracting tenants with strong ethical and sustainable brand identities.

- Operational Expectations: Increased pressure on property management to adopt sustainable practices.

Impact of Work-from-Home Trends on Urban Retail

While the office sector grapples with hybrid work, its effect on urban retail is complex. Some city centers are experiencing a resurgence in shopper numbers, indicating a potential stabilization or even growth in foot traffic for certain urban retail environments.

For Acadia's urban properties, it's crucial to analyze how evolving hybrid work models influence commuter behavior and local spending habits. This insight is key to strategically adjusting tenant assortments and enhancing property engagement to align with new patterns.

This ongoing shift in work arrangements contributes to a broader transformation of traditional retail experiences, prompting a need for adaptability and innovation in urban commercial spaces.

- Hybrid Work's Nuanced Retail Impact: While office vacancies remain a concern, urban retail is seeing a mixed recovery, with some downtown areas reporting increased visitor numbers. For instance, reports from major cities in late 2024 indicated a 5-10% rise in weekday foot traffic in certain retail districts compared to the previous year, driven by a blend of remote and in-office workers.

- Commuter Patterns and Spending: Understanding the long-term implications of hybrid work on daily commutes is vital. A 2025 study by the Urban Land Institute highlighted that cities with flexible work policies saw a redistribution of spending, with increased mid-week spending in suburban retail hubs closer to residential areas, while central business districts adapted by focusing on experiential retail and evening/weekend activities.

- Tenant Mix Optimization: Acadia's strategy must consider these evolving patterns. For example, properties in urban cores might benefit from diversifying towards food and beverage, entertainment, and service-based tenants that cater to residents and visitors outside traditional 9-to-5 office hours, rather than solely relying on office worker lunch crowds.

- Flux in Shopping Experiences: The trend undeniably contributes to a dynamic retail landscape. Consumer spending data from Q1 2025 shows a continued rise in online retail, but also a strong preference for curated in-store experiences, suggesting that successful urban retail will need to offer unique value propositions beyond convenience.

Societal values are shifting, with a growing emphasis on health, wellness, and personal fulfillment influencing consumer behavior. This translates to a demand for retail environments that promote well-being, offering spaces for fitness, healthy food options, and services that enhance quality of life. By 2025, the global wellness market is projected to reach $7 trillion, underscoring the commercial opportunity for Acadia to integrate wellness-centric tenants and amenities.

The increasing desire for authentic and personalized experiences is reshaping retail expectations. Consumers are seeking connections with brands that reflect their values and offer unique, memorable interactions. This trend supports the development of mixed-use properties that can house diverse, niche retailers and service providers, fostering a sense of community and belonging.

Demographic shifts, including an aging population in developed countries and a growing middle class in emerging markets, present distinct opportunities and challenges for retail real estate. Acadia must consider how these evolving demographics impact spending power, product preferences, and the demand for specific types of retail and residential spaces.

| Sociological Factor | Description | Impact on Acadia | Relevant Data (2024-2025) |

|---|---|---|---|

| Health & Wellness Trend | Increased consumer focus on well-being and healthy lifestyles. | Demand for fitness, healthy F&B, and services promoting quality of life. | Global wellness market projected to hit $7 trillion by 2025. |

| Experience Economy | Preference for memorable experiences over material possessions. | Need for immersive, interactive retail environments and unique tenant offerings. | 65% of consumers prefer experiences over products (2024). |

| Demographic Shifts | Changes in population age, income, and lifestyle. | Tailoring tenant mix and property design to specific age groups and income levels. | Aging populations in developed nations; growing middle class in emerging markets. |

Technological factors

E-commerce sales are projected to reach $1.7 trillion in the US by the end of 2024, a substantial increase that highlights its continued dominance in consumer spending. This trend necessitates that physical retail spaces, like those managed by Acadia, evolve beyond simple transaction points. Adapting to this digital shift means creating environments that offer unique customer experiences, fostering brand loyalty and encouraging 'showrooming' where customers interact with products in-store before purchasing online.

By 2025, the retail sector is expected to see further integration of online and offline strategies. Acadia's properties must therefore facilitate this blend, supporting omnichannel approaches where physical stores act as extensions of online platforms. This could involve offering click-and-collect services, in-store returns for online purchases, or utilizing physical spaces for experiential marketing and community engagement, thereby providing value that complements the convenience of e-commerce.

The integration of PropTech, encompassing AI, Big Data, and IoT, is revolutionizing commercial real estate by boosting efficiency, security, and tenant satisfaction. For instance, by 2025, smart building technologies are projected to manage energy consumption more effectively, potentially reducing operational costs by up to 20% in well-implemented systems.

Acadia can significantly enhance its portfolio efficiency and accuracy by adopting modern property management software. This move is expected to streamline operations, leading to a projected 15% reduction in administrative overhead and improved overall business performance by the end of 2024.

Key trends for 2025 include the widespread use of dynamic pricing engines, which can optimize rental income by adjusting rates based on real-time market demand, and adaptable management solutions that cater to evolving tenant needs, potentially increasing occupancy rates by 5-10%.

Smart building technologies and the Internet of Things (IoT) are increasingly crucial for optimizing energy usage, enhancing infrastructure, and managing resources in commercial real estate. By 2024, the global smart buildings market was projected to reach over $100 billion, highlighting the significant investment in these areas.

Acadia can leverage IoT sensors for intelligent space management, which can directly translate to reduced energy costs and better adherence to green building certifications. For instance, smart lighting systems alone can cut energy consumption by up to 30% in commercial spaces.

The adoption of these technologies allows Acadia to boost building performance, minimize its environmental footprint, and appeal to a growing tenant base that prioritizes modern, efficient, and sustainable workspaces.

Data Analytics for Strategic Decision-Making

Data analytics and AI are transforming real estate by enabling personalized property recommendations, optimized marketing, and smarter site selection. For Acadia, leveraging these technologies is vital for pinpointing market trends, uncovering investment opportunities, and refining tenant strategies to boost engagement and conversions. For instance, in 2024, real estate tech startups raised over $1 billion in venture capital, highlighting the growing reliance on data-driven innovation.

AI-powered tools can accelerate the identification of emerging market patterns and the discovery of advantageous deals. This predictive capability is essential for maintaining a competitive edge in the dynamic property sector. By analyzing vast datasets, platforms can anticipate shifts in demand and supply, leading to more profitable acquisitions and developments.

- Personalized Recommendations: AI algorithms analyze user behavior and property data to match buyers and renters with suitable listings, improving user experience.

- Optimized Marketing: Data analytics allows for targeted marketing campaigns, increasing reach and conversion rates for specific property types and demographics.

- Informed Site Selection: Predictive analytics helps identify optimal locations for new developments by analyzing demographic, economic, and traffic data.

- Enhanced Tenant Strategies: Understanding tenant preferences through data allows for tailored leasing and amenity offerings, improving occupancy and retention.

Virtual and Augmented Reality for Property Marketing

Virtual and augmented reality (VR/AR) are revolutionizing how properties are marketed, offering immersive experiences that bridge geographical distances. These technologies allow potential tenants and investors to virtually walk through properties, significantly boosting engagement. For instance, properties featuring virtual tours in 2024 saw an average of 87% more views compared to those without, according to industry reports.

Acadia can leverage VR/AR to provide prospective clients with realistic, 24/7 access to its redeveloped and new properties. This not only enhances the customer experience but also accelerates the leasing or sales cycle by pre-qualifying interest. By 2025, it's projected that over 60% of property searches will incorporate virtual tours, making this a critical adoption for competitive advantage.

- Increased Engagement: VR/AR tours can boost property listing engagement by up to 87% in 2024.

- Remote Accessibility: Enables potential buyers and tenants to experience properties from anywhere, anytime.

- Market Trend: Over 60% of property searches are expected to include virtual tours by 2025.

- Acadia's Opportunity: Utilize VR/AR to showcase developments, improving lead generation and shortening leasing times.

Technological advancements are reshaping how Acadia operates, with e-commerce growth necessitating experiential retail. By 2025, omnichannel strategies integrating online and offline will be standard, with physical spaces serving as brand hubs. PropTech, including AI and IoT, is crucial for efficiency, with smart buildings potentially cutting energy costs by 20% by 2025.

Acadia can boost efficiency by 15% with modern property management software by the end of 2024. Dynamic pricing and adaptable solutions are key for 2025, potentially increasing occupancy by 5-10%. The smart buildings market exceeded $100 billion in 2024, with IoT sensors reducing energy use by up to 30%.

Data analytics and AI are vital for Acadia to identify market trends and opportunities, with real estate tech startups raising over $1 billion in venture capital in 2024. VR/AR tours, which increased property views by 87% in 2024, will be in over 60% of property searches by 2025, enhancing engagement and shortening leasing cycles.

Legal factors

Local zoning and land use regulations are a significant legal factor for Acadia, directly influencing its strategy for street retail and mixed-use properties. These municipal laws dictate what can be built, how densely, and for what purpose, acting as either a constraint or an enabler for development projects. For instance, a city might have specific zoning that prohibits retail on the ground floor of a new building, forcing Acadia to adapt its plans. In 2024, cities across the US continued to grapple with balancing housing needs against commercial development, with some areas seeing stricter regulations on mixed-use projects to preserve neighborhood character.

Evolving building codes, accessibility standards, and safety regulations significantly affect the design, construction, and renovation expenses for Acadia's commercial properties. For instance, the International Building Code (IBC) updates regularly, with the 2024 edition introducing enhanced requirements for fire safety and structural integrity, potentially increasing material and labor costs for new builds or major renovations. Compliance is non-negotiable, directly impacting project timelines and budgets, particularly when modernizing older structures to meet current safety and accessibility mandates.

Governments globally are tightening sustainability rules for commercial properties, with many mandating carbon emission disclosures and higher energy efficiency benchmarks. For instance, the EU's Energy Performance of Buildings Directive continues to push for greener standards. Acadia must diligently track and adhere to these evolving environmental laws to sidestep significant penalties and protect its brand image.

These increasingly stringent environmental mandates are fundamentally reshaping the real estate sector, accelerating the adoption of renewable energy sources and sustainable building practices. By 2024, a significant portion of new commercial constructions in many developed nations are expected to meet net-zero energy targets, a trend Acadia needs to embrace to remain competitive.

Tenant-Landlord Laws and Lease Structures

Tenant-landlord laws significantly influence Acadia's retail operations by defining lease terms, eviction procedures, and tenant rights, which directly impact revenue streams and operational stability. For instance, in 2024, many jurisdictions are reviewing or have recently updated commercial lease regulations, potentially affecting rent escalation clauses or default provisions. Adapting to these evolving legal landscapes is critical for managing Acadia's diverse retail portfolio and ensuring consistent income.

Understanding the intricacies of commercial lease agreements, including renewal options, subletting clauses, and dispute resolution mechanisms, is paramount for Acadia. Changes in legislation, such as new tenant protection laws or modifications to landlord responsibilities for property maintenance in 2025, could necessitate adjustments to standard lease structures. This proactive legal awareness helps mitigate risks and maintain strong tenant relationships.

- Lease Agreement Terms: Laws dictate minimum lease durations, rent control possibilities, and permissible security deposit amounts, impacting Acadia's revenue predictability.

- Eviction Processes: Stringent eviction laws can prolong vacancies and increase costs for Acadia if a tenant defaults or violates lease terms.

- Tenant Rights: Regulations concerning habitability, quiet enjoyment, and non-discrimination affect Acadia's obligations and tenant satisfaction.

- Legislative Changes: Anticipating and responding to new laws, such as those potentially impacting energy efficiency standards for commercial properties in 2025, is vital for compliance and operational efficiency.

Data Privacy and Security Laws

Data privacy and security laws are increasingly important for Acadia, especially as property management and tenant interactions heavily rely on technology. Regulations like the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) set strict guidelines for how tenant and customer data can be collected, processed, and stored. For instance, as of early 2024, CCPA enforcement has seen a notable increase in penalties for non-compliance, with businesses facing fines that can reach thousands of dollars per violation. Acadia must ensure its digital platforms and data handling practices adhere to these evolving legal landscapes to avoid significant financial and reputational damage.

Acadia's operations, which involve collecting and utilizing tenant data for personalized services and operational improvements, must align with these stringent legal frameworks. This includes obtaining proper consent for data usage and providing clear avenues for individuals to manage their personal information. Failure to comply can lead to substantial fines; for example, under GDPR, penalties can amount to 4% of global annual revenue or €20 million, whichever is higher.

To maintain trust and protect sensitive information, Acadia needs to implement robust cybersecurity measures and comprehensive data governance policies. This proactive approach is crucial in mitigating risks associated with data breaches. Reports from 2024 indicate that the average cost of a data breach globally has exceeded $4.45 million, highlighting the financial imperative for strong security protocols.

- Compliance with GDPR and CCPA: Ensuring all data collection and usage practices meet the requirements of major privacy regulations.

- Tenant Data Management: Establishing clear policies for consent, access, and deletion of tenant personal information.

- Cybersecurity Investment: Allocating resources to advanced security technologies and regular vulnerability assessments to protect against breaches.

- Data Governance Framework: Implementing internal controls and training to ensure consistent adherence to data privacy and security standards across the organization.

Acadia must navigate a complex web of legal and regulatory frameworks impacting its real estate development and management. These include zoning laws, building codes, environmental regulations, and tenant-landlord statutes that dictate operational parameters and compliance requirements.

In 2024, legislative bodies continued to refine environmental mandates, with many jurisdictions implementing stricter energy efficiency standards for commercial buildings, potentially impacting construction costs and operational budgets for Acadia. Furthermore, evolving data privacy laws, such as GDPR and CCPA, impose significant obligations on how Acadia handles tenant and customer information, with non-compliance carrying substantial financial penalties.

The legal landscape surrounding commercial leases also remains dynamic, with ongoing reviews of rent control, eviction procedures, and tenant rights in various markets. Acadia's ability to adapt to these changes, including potential new regulations affecting lease terms or landlord responsibilities in 2025, is crucial for maintaining stable revenue streams and mitigating operational risks.

| Legal Factor | Impact on Acadia | 2024/2025 Relevance |

| Zoning & Land Use | Dictates property development feasibility and mixed-use strategies. | Continued urban planning debates balancing housing and commercial needs. |

| Building Codes & Safety | Affects construction costs, timelines, and modernization expenses. | Updates to codes like IBC 2024 increase focus on fire safety and structural integrity. |

| Environmental Regulations | Drives adoption of sustainable practices and energy efficiency. | Increased mandates for carbon disclosures and net-zero targets for new constructions. |

| Tenant-Landlord Laws | Influences lease terms, revenue predictability, and tenant relations. | Potential revisions to rent escalation, default provisions, and tenant protection laws. |

| Data Privacy & Security | Governs handling of tenant data, impacting operational costs and reputation. | Heightened enforcement of GDPR/CCPA with increased penalties for breaches. |

Environmental factors

Climate change is increasingly impacting real estate. We're seeing more frequent and intense extreme weather events, which directly threaten the physical integrity of properties. For Acadia, this means potential damage from floods, storms, and wildfires. This necessitates significant investment in making their properties more resilient to these growing threats.

Beyond just physical damage, the real estate sector faces transitional climate risks. This centers on how properties perform in terms of energy efficiency and their overall carbon footprint. Regulations and market expectations are pushing for lower energy consumption and reduced CO2 emissions, requiring upgrades and new approaches to property management.

Integrating climate risk assessments into investment decisions is no longer optional, it's becoming financially essential. For example, the European Union's Taxonomy Regulation, which came into effect in 2022, is already guiding investment towards more sustainable activities. By 2025, stricter disclosure requirements for climate-related financial risks are expected across many markets, making proactive climate risk management crucial for Acadia's long-term financial health and investor confidence.

The market is increasingly prioritizing sustainability, with investors and tenants actively seeking out green buildings. Properties with ESG certifications, such as LEED or BREEAM, are seeing higher rental premiums and enhanced asset values. For instance, a 2024 report indicated that LEED-certified buildings can achieve rental premiums of up to 3% and higher occupancy rates compared to non-certified peers.

Acadia can leverage this trend by pursuing green building certifications for its portfolio. Investing in energy-efficient designs and retrofitting existing structures with sustainable features will not only boost portfolio value but also attract environmentally conscious tenants. This strategic move can lead to reduced operating costs, such as lower energy bills, and potentially lower vacancy rates, as demonstrated by a 2025 study showing a 5% decrease in operational expenses for buildings with advanced energy management systems.

Concerns about resource scarcity, especially for water and energy, are directly impacting operational expenses and how commercial properties are designed. For instance, the International Energy Agency reported in 2024 that global energy demand is projected to grow, putting upward pressure on prices.

Implementing smart building technologies and integrating Internet of Things (IoT) devices offers a tangible solution to curb energy consumption and optimize resource management. These systems can monitor usage in real-time, allowing for adjustments that lead to significant savings.

Acadia's proactive approach to managing resource utilization is crucial for offsetting escalating utility bills and demonstrating commitment to overarching sustainability objectives. This strategic focus not only benefits the bottom line but also enhances brand reputation in an increasingly environmentally conscious market.

Waste Management and Circular Economy Principles

Increasingly stringent environmental regulations and growing societal demand for sustainability are reshaping waste management in real estate. This trend is accelerating the adoption of circular economy principles, which focus on reducing waste, enhancing recycling, and prioritizing sustainable materials in construction and property upkeep. For instance, the European Union's Circular Economy Action Plan, updated in 2020, aims to make sustainable products the norm, impacting building materials and operational waste. Acadia can align with these shifts by implementing comprehensive waste reduction strategies across its portfolio, potentially leading to cost savings and improved brand reputation.

Acadia's commitment to circular economy principles could manifest in several key areas:

- Waste Reduction Programs: Implementing rigorous programs to minimize waste generation during construction, renovation, and ongoing property management.

- Enhanced Recycling and Diversion: Increasing the diversion of waste from landfills through advanced recycling initiatives and material reuse.

- Sustainable Material Sourcing: Prioritizing the use of recycled, recyclable, and sustainably sourced materials in all development and maintenance activities.

- Circular Business Models: Exploring opportunities for product-as-a-service or take-back schemes for building components to close material loops.

Corporate Social Responsibility (CSR) and ESG Reporting

The real estate sector faces mounting pressure for sustainable development, making Environmental, Social, and Governance (ESG) matters increasingly crucial. Mandatory carbon reporting is on the horizon, necessitating data centralization for effective ESG strategies. Acadia's dedication to Corporate Social Responsibility (CSR) and clear ESG reporting can significantly boost its standing, attract ethically-minded investors, and secure enduring value.

For instance, by 2025, it's projected that over 60% of institutional investors will integrate ESG factors into their investment decisions, a substantial rise from previous years. This trend underscores the financial imperative for companies like Acadia to demonstrate robust ESG performance.

- Growing Investor Demand: Over 60% of institutional investors are expected to integrate ESG factors by 2025.

- Regulatory Shifts: Mandatory carbon reporting is becoming a reality, requiring better data management.

- Reputational Benefits: Strong CSR and ESG reporting enhance brand image and stakeholder trust.

- Long-Term Value: Commitment to sustainability attracts capital and mitigates future risks.

Acadia must navigate evolving environmental regulations and increasing societal expectations for sustainability. This includes adapting to stricter building codes, emissions standards, and waste management policies. For example, many jurisdictions are implementing or strengthening regulations around embodied carbon in new construction, a trend expected to intensify by 2025.

The push for greener operations impacts everything from energy sourcing to water usage. Companies like Acadia are increasingly pressured to adopt renewable energy and implement water conservation measures. A 2024 report by the Global Real Estate Sustainability Benchmark (GRESB) highlighted that properties with strong environmental performance are attracting more capital, with a growing number of investors using GRESB scores in their decision-making.

Acadia's response to these environmental factors will directly influence its operational costs, marketability, and long-term value. Proactive adaptation, such as investing in energy-efficient retrofits and sustainable material sourcing, can mitigate risks and unlock new opportunities. For instance, a 2025 study indicated that buildings with advanced sustainability features experienced a 15% lower cost of capital compared to their less sustainable counterparts.

| Environmental Factor | Impact on Acadia | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change & Extreme Weather | Physical asset damage, increased insurance costs, need for resilient design. | Increased frequency and intensity of events. Global insurance premiums for real estate rose by an average of 8% in 2024 due to climate-related risks. |

| Energy Efficiency & Carbon Footprint | Higher operational costs, regulatory compliance, tenant demand for green buildings. | Growing investor preference for low-carbon assets. By 2025, over 70% of institutional investors plan to increase their allocation to sustainable real estate. |

| Resource Scarcity (Water, Energy) | Increased utility costs, operational disruptions, need for conservation technologies. | Projected 5% annual increase in global energy prices through 2025, according to the International Energy Agency. |

| Waste Management & Circular Economy | Compliance with waste regulations, opportunity for cost savings through reduction and recycling. | EU aims for 70% recycling rate for construction and demolition waste by 2030, with significant interim targets in place by 2025. |

| Environmental Regulations & Reporting | Need for compliance, investment in data management for ESG reporting. | Mandatory climate-related financial disclosures expected to be widespread by 2025, impacting over 80% of publicly traded companies. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Acadia draws from a robust blend of official government publications, reputable market research firms, and leading academic journals. This ensures a comprehensive understanding of political stability, economic forecasts, technological advancements, and societal shifts impacting Acadia.