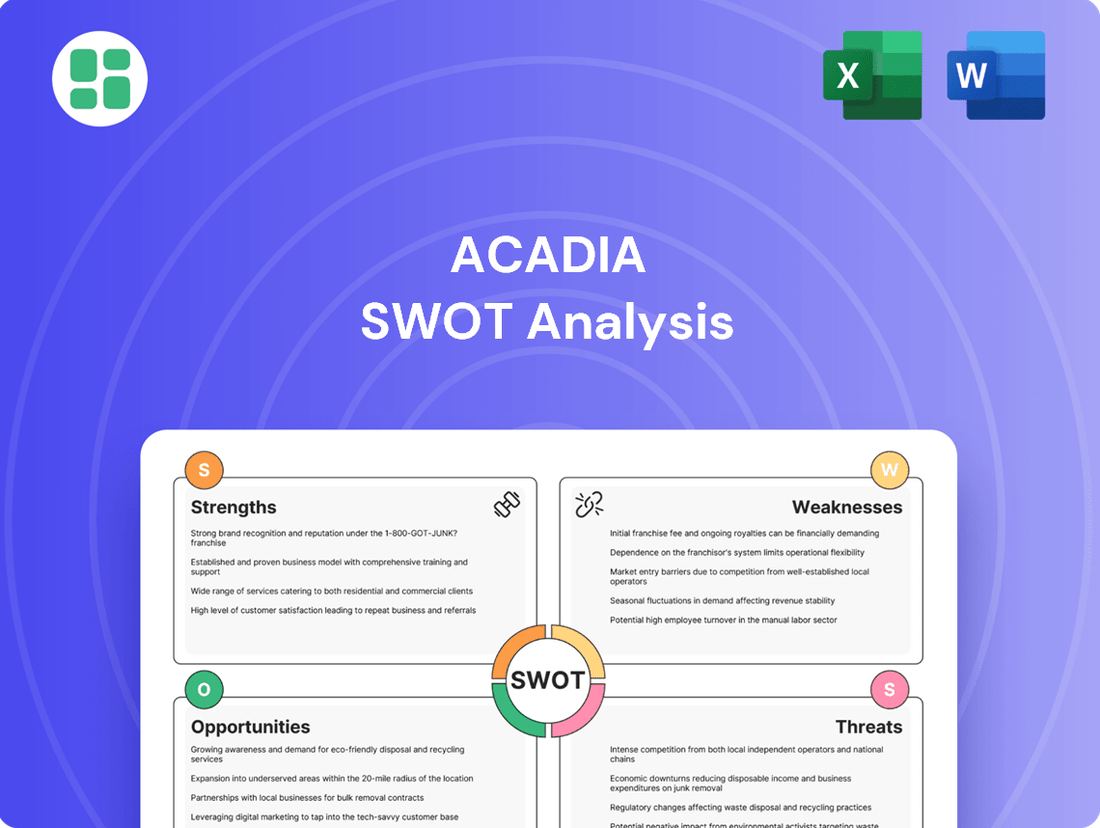

Acadia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

Acadia's strengths lie in its robust clinical pipeline and experienced management team, but it faces significant threats from regulatory hurdles and intense competition. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Acadia's market position, including detailed financial context and actionable growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Acadia Healthcare boasts an impressive geographic footprint, with operations spanning the United States and Puerto Rico. This extensive network includes a wide array of facilities, from inpatient hospitals to residential and outpatient centers, enabling them to reach a broad patient demographic.

Their presence in numerous states and diverse care settings facilitates strong market penetration and ensures patients have accessible entry points to receive necessary treatment. This wide reach is a significant advantage in serving a varied patient base and offering a comprehensive continuum of care.

Acadia Healthcare's strength lies in its focused approach to high-demand behavioral health services, encompassing mental health, substance use disorders, and eating disorders. This specialization directly addresses critical public health needs, areas experiencing a significant and growing demand for care.

The company's dedication to these specific conditions allows for the development of deep expertise and highly tailored treatment programs. This focus is particularly advantageous as societal awareness and the destigmatization of mental health issues continue to rise, creating a more receptive environment for specialized care.

For instance, the U.S. Department of Health and Human Services reported in 2024 that over 50 million adults experienced a mental illness in the past year, highlighting the substantial market for Acadia's services. This trend is further amplified by increasing recognition of the interconnectedness between mental and physical well-being.

Acadia Healthcare's strength lies in its comprehensive continuum of care, offering services from acute inpatient settings to outpatient programs. This integrated model allows patients to move smoothly between care levels as their needs change, fostering better long-term recovery and retention. For instance, in 2023, Acadia operated over 700 facilities, many of which offer multiple levels of behavioral health services, demonstrating their commitment to this integrated approach.

Established Market Leadership and Reputation

Acadia Healthcare stands as the largest stand-alone behavioral healthcare provider in the United States, a significant strength that underpins its established market leadership. This prominent position is bolstered by a strong brand reputation, widely recognized for delivering high-quality, compassionate care across its extensive network. This reputation acts as a powerful magnet, attracting both a steady stream of patients seeking reliable services and top-tier clinical professionals, thereby fostering deep trust within the communities it serves.

This established leadership and reputation translate directly into a formidable competitive advantage. For instance, in the first quarter of 2024, Acadia reported a 6.2% increase in same-facility revenue, demonstrating the continued demand for its services, a demand often driven by its trusted brand. This market dominance allows Acadia to capture a larger share of the behavioral healthcare market, solidifying its financial performance and strategic positioning.

- Market Dominance: As the largest stand-alone behavioral health provider in the U.S., Acadia benefits from significant scale and reach.

- Brand Recognition: A strong reputation for quality and compassionate care attracts both patients and skilled professionals.

- Competitive Edge: Established leadership fosters trust, leading to greater market share and a distinct advantage over competitors.

- Revenue Growth: Acadia's Q1 2024 same-facility revenue increase of 6.2% highlights the ongoing demand driven by its strong market standing.

Strong Growth Strategy and Capital Position

Acadia Healthcare's growth strategy is a significant strength, evidenced by their aggressive bed expansion plans. In 2024, they expanded their capacity, and this momentum is expected to continue into 2025 with new facility constructions and strategic joint ventures. This proactive approach to increasing service availability positions them well to capture growing demand in the behavioral healthcare sector.

The company's financial health underpins this expansion. Acadia maintains a robust capital position, ensuring they have the necessary resources to fund these growth initiatives. This strong financial footing allows for disciplined capital allocation, including a continued commitment to their share repurchase program, which benefits shareholders while supporting strategic investments.

Key aspects of their growth and financial strength include:

- Bed Expansion: Significant bed additions in 2024 with continued expansion projected for 2025, including new facilities and joint ventures.

- Capital Availability: Sufficient capital reserves to adequately fund ongoing and future growth investments.

- Disciplined Capital Allocation: Strategic deployment of capital, including a share repurchase program, balancing growth with shareholder returns.

- Market Position: Enhanced capacity allows Acadia to meet increasing demand for behavioral health services.

Acadia Healthcare's extensive network across the U.S. and Puerto Rico, encompassing over 700 facilities as of 2023, provides unparalleled market access. This broad geographic and service-level presence, from inpatient to outpatient care, allows them to cater to diverse patient needs effectively. Their specialization in high-demand behavioral health services, including mental health and substance use disorders, addresses a critical and growing public health need, as evidenced by over 50 million U.S. adults experiencing mental illness in 2024.

The company's position as the largest stand-alone behavioral health provider in the U.S. translates to significant scale and brand recognition. This market dominance, reflected in a 6.2% same-facility revenue increase in Q1 2024, fosters trust and attracts both patients and skilled professionals. Acadia's commitment to expanding its capacity, with significant bed additions in 2024 and continued plans for 2025, ensures they are well-positioned to meet escalating demand, supported by robust capital reserves for strategic growth.

| Metric | 2023/2024 Data | Significance |

|---|---|---|

| Number of Facilities | Over 700 (2023) | Broad geographic reach and service accessibility |

| U.S. Adult Mental Illness Prevalence | Over 50 million (2024) | Indicates substantial market demand for behavioral health services |

| Same-Facility Revenue Growth | 6.2% increase (Q1 2024) | Demonstrates strong demand driven by market leadership and brand trust |

| Capacity Expansion | Significant bed additions in 2024, ongoing for 2025 | Positions Acadia to capture growing market demand |

What is included in the product

Analyzes Acadia’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable roadmap by identifying key strengths and weaknesses, thereby alleviating the pain of strategic uncertainty.

Weaknesses

Acadia Healthcare's financial performance is closely tied to reimbursement policies from government payers like Medicare and Medicaid, as well as private insurers. For instance, in 2023, Medicare and Medicaid often represent a substantial portion of revenue for many behavioral health providers. Any unfavorable adjustments to reimbursement rates or modifications to coverage rules, such as increased prior authorization requirements, could directly reduce Acadia's income and strain its profitability.

Acadia's operational model, centered on specialized inpatient and residential facilities, inherently carries high operating costs. These expenses stem from maintaining real estate, acquiring and servicing specialized medical equipment, and employing a highly trained clinical workforce, all of which are significant ongoing commitments.

The capital-intensive nature of Acadia's business necessitates continuous investment. This includes crucial upkeep, modernization of existing facilities, and the development of new locations to expand services. Projections indicate that these investments will contribute to increased startup losses in 2025, reflecting the upfront capital required for growth.

The behavioral healthcare sector is projected to experience significant shortages of qualified professionals like psychiatrists and therapists, with these gaps expected to widen by 2025. This trend poses a substantial risk for Acadia Healthcare, potentially hindering its ability to recruit and retain essential staff.

Such workforce challenges could translate into higher labor expenses, limitations on the services Acadia can offer, and difficulties in consistently delivering high-quality patient care, impacting both operational efficiency and patient outcomes.

Exposure to Regulatory Scrutiny and Compliance Risks

Acadia Healthcare operates within a heavily regulated industry, exposing it to significant compliance risks. The company has historically faced government investigations and associated legal expenses related to its operations. For instance, in 2023, Acadia settled with the Justice Department for $17.5 million over allegations of improper billing practices.

Non-compliance with federal and state healthcare laws can lead to substantial financial penalties, protracted legal battles, and considerable damage to Acadia's reputation. Ensuring adherence to these complex regulations across its extensive network of facilities presents an ongoing and resource-intensive operational challenge for the organization.

- Regulatory Burden: Subject to extensive federal and state healthcare regulations.

- Past Legal Costs: Faced ongoing government investigations and legal expenses.

- Compliance Challenges: Maintaining strict compliance across a large network is resource-intensive.

- Potential Penalties: Risk of substantial fines and legal challenges for non-compliance.

Reputational Risks from Adverse Events and Media Scrutiny

Acadia Healthcare has faced significant reputational challenges stemming from adverse events and intense media scrutiny. Allegations concerning patient care practices at certain facilities have led to negative press, impacting both its stock performance and overall market perception. For instance, in early 2024, reports emerged regarding specific incidents that drew considerable attention, contributing to market volatility.

These negative events, including patient safety incidents and legal settlements, can have a profound effect on Acadia's reputation. Such occurrences can erode trust among patients, referral sources, and investors, potentially leading to a decline in patient volumes and financial performance. The company's ability to manage and mitigate these risks is crucial for maintaining a positive brand image and ensuring long-term sustainability.

- Negative Media Coverage: Increased media attention on patient care allegations can tarnish brand image.

- Impact on Patient Referrals: Adverse events can deter potential patients and referring physicians.

- Stock Price Volatility: Reputational damage often translates to fluctuations in share value, as seen in market reactions to past incidents.

- Regulatory Scrutiny: High-profile issues can invite heightened regulatory oversight, increasing compliance costs and operational burdens.

Acadia's reliance on government and private payer reimbursement makes it vulnerable to changes in coverage and rates. For example, shifts in Medicare or Medicaid reimbursement policies in 2024 could directly impact revenue. The company's high operating costs, driven by facility maintenance and specialized staff, also present a consistent financial challenge.

The capital-intensive nature of its business requires ongoing investment in facility upgrades and expansion, with projected increased startup losses in 2025. Furthermore, the behavioral healthcare sector faces a widening shortage of qualified professionals, a trend expected to intensify by 2025, potentially increasing labor costs and limiting service capacity.

Acadia Healthcare's financial performance is susceptible to fluctuations in reimbursement rates from government and private payers. In 2024, changes in Medicare and Medicaid policies could directly affect revenue streams. The company's operational model, with its high fixed costs for facilities and specialized staff, also creates inherent financial pressure.

The need for continuous capital investment in facility upkeep and expansion, projected to increase startup losses in 2025, adds another layer of financial strain. Additionally, the growing shortage of behavioral health professionals, anticipated to worsen by 2025, poses a significant risk of escalating labor expenses and service limitations.

Same Document Delivered

Acadia SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Acadia's strategic position.

This preview reflects the real document you'll receive—professional, structured, and ready to use for informed decision-making.

Opportunities

Societal awareness of mental health and substance use disorders is on the rise, fueling a significant increase in demand for behavioral healthcare. This trend is projected to drive the global behavioral health market to an estimated USD 240.8 billion by 2025, a substantial jump from previous years.

Factors like reduced stigma surrounding mental health, enhanced public awareness campaigns, and the enduring effects of recent global events are all contributing to this growing need for accessible and comprehensive care.

Acadia Healthcare is strategically positioned to leverage this expanding market. By focusing on increasing its operational capacity and broadening its range of specialized services, the company can effectively meet this escalating demand and capture greater market share.

Acadia Healthcare can tap into untapped markets by expanding into rural areas and specific demographic niches where behavioral healthcare access is currently limited. This strategic move could involve building new facilities or acquiring existing ones, mirroring their successful acquisition of opioid treatment centers in South Carolina in late 2023, which added 15 facilities and over 1,500 beds to their network.

The burgeoning telehealth and digital health sectors present a substantial avenue for growth for Acadia Healthcare. The U.S. saw a significant increase in telehealth utilization, with approximately 76% of patients using it in 2023, a trend expected to continue. By integrating these virtual care options, Acadia can broaden its service footprint, making mental health support more accessible, particularly for individuals in underserved or remote locations.

This strategic integration allows for enhanced patient access and potentially more cost-effective service delivery. For instance, a study in 2024 indicated that telehealth visits can reduce no-show rates by up to 15%, directly impacting operational efficiency. Furthermore, telehealth facilitates seamless continuity of care, ensuring patients receive consistent support regardless of their geographical proximity to physical facilities.

Strategic Acquisitions and Partnerships

The behavioral healthcare sector remains quite fragmented, offering Acadia Healthcare a prime opportunity to grow through strategic acquisitions of smaller providers. This consolidation strategy is particularly effective as smaller entities may struggle with increasing regulatory burdens and operational costs. Acadia is well-positioned to capitalize on this, having demonstrated its commitment by acquiring multiple treatment centers throughout 2024. Furthermore, the company's active engagement in joint ventures solidifies its reputation as a preferred partner for growth within the industry.

Acadia's proactive approach to mergers and acquisitions (M&A) is a key driver for expansion. In 2024 alone, the company successfully integrated several new facilities into its network. This strategic M&A activity is not only about increasing scale but also about enhancing service offerings and geographic reach. By being an 'acquirer of choice,' Acadia can selectively integrate high-quality providers, thereby strengthening its market position and operational efficiency.

- Market Consolidation: The fragmented nature of behavioral healthcare allows Acadia to acquire smaller, struggling providers.

- Strategic Acquisitions: Acadia acquired multiple treatment centers in 2024, demonstrating its active growth strategy.

- Partnership Opportunities: Joint ventures with complementary organizations expand Acadia's service capabilities and market penetration.

- 'Acquirer of Choice': Acadia's reputation attracts desirable acquisition targets, especially those facing operational challenges.

Increased Funding and Policy Support for Mental Health

Governments and private entities are channeling more resources into mental health, with supportive policies emerging. For instance, the U.S. government has shown a commitment to expanding access to care, with initiatives aimed at improving insurance coverage and reimbursement for behavioral health services. This trend is expected to continue, with potential increases in funding for mental health programs and a greater emphasis on parity in insurance coverage.

Acadia Healthcare is well-positioned to capitalize on this shift. Enhanced reimbursement rates, particularly through programs like Medicaid-directed payments, can directly boost Acadia's revenue. Moreover, a more favorable operating environment, characterized by increased awareness and reduced stigma surrounding mental health, can lead to higher patient volumes and a greater demand for Acadia's comprehensive behavioral health services.

Key opportunities stemming from this trend include:

- Expanded Reimbursement: Increased government and private payer focus on mental health can lead to improved reimbursement rates for services provided by Acadia.

- Policy Tailwinds: Favorable policy changes, such as mandates for mental health parity in insurance, create a more supportive landscape for Acadia's business model.

- Growing Demand: Greater societal acceptance and awareness of mental health issues are driving increased demand for accessible and quality care, benefiting Acadia's service offerings.

- Investment in Infrastructure: Potential for increased public and private investment in mental health infrastructure could create opportunities for Acadia to expand its facilities and reach.

Acadia Healthcare is poised to benefit from the increasing societal focus on mental health and substance use disorders, a trend expected to drive the global behavioral health market significantly. The company's strategy of expanding its operational capacity and service offerings aligns perfectly with this growing demand.

The company can strategically expand into underserved markets, such as rural areas, and cater to specific demographic needs, mirroring its successful acquisitions in late 2023. Furthermore, embracing telehealth and digital health solutions presents a substantial growth avenue, enhancing accessibility and potentially improving operational efficiency, as seen with telehealth's ability to reduce no-show rates by up to 15% in 2024 studies.

The fragmented nature of the behavioral healthcare sector provides Acadia with ample opportunities for growth through strategic acquisitions, a strategy it actively pursued throughout 2024 by integrating multiple new facilities. Its reputation as an 'acquirer of choice' further strengthens its position to selectively integrate high-quality providers and expand its market reach.

Favorable government policies and increased investment in mental health services, including improved insurance coverage and reimbursement rates, create a more supportive operating environment for Acadia. This trend is expected to continue, potentially boosting patient volumes and demand for its comprehensive services.

Threats

The dynamic nature of healthcare legislation and reimbursement models presents a considerable challenge. For instance, continued uncertainty surrounding Medicaid supplemental payments directly impacts revenue predictability.

New legislation, a transition away from fee-for-service towards value-based care, or adjustments in managed care agreements could adversely affect Acadia Healthcare's earnings and strategic planning. In 2023, the Centers for Medicare & Medicaid Services (CMS) proposed changes to reimbursement rates that could influence the sector.

Acadia Healthcare operates in a highly competitive landscape, facing rivals ranging from established for-profit healthcare systems and non-profit hospitals to local community mental health centers. The rise of telehealth platforms also introduces new avenues of competition, offering accessible and often more affordable solutions.

This intense competition directly impacts Acadia by potentially driving down service prices and making it harder to attract and keep patients. Furthermore, the need to stand out in such a crowded market necessitates higher spending on marketing and patient acquisition efforts, impacting overall profitability.

For instance, the behavioral health sector, where Acadia is a major player, saw significant growth in competition. In 2024, the U.S. mental health market was valued at over $100 billion, with numerous new entrants and existing players expanding their services, intensifying the need for Acadia to differentiate its offerings and maintain market share.

Economic downturns pose a significant threat to Acadia Healthcare by potentially reducing patient affordability for behavioral health services. Recessions can lead to decreased disposable income and higher unemployment rates, making it harder for individuals to cover out-of-pocket costs or maintain insurance coverage. For instance, during economic slowdowns, individuals may delay or forgo necessary treatments, directly impacting patient volumes and revenue for providers like Acadia.

These economic pressures can also translate into increased bad debt as patients struggle to meet their financial obligations. Furthermore, a weakened economy might force Acadia to contend with pricing pressures from payers or patients seeking more cost-effective solutions. Acadia's financial performance in 2024 and projections for 2025 will likely reflect the sensitivity of its revenue streams to broader economic health and consumer spending power.

Workforce Shortages and Escalating Labor Costs

Acadia faces a significant threat from ongoing workforce shortages in behavioral health, a situation projected to intensify by 2025. This scarcity of qualified professionals directly contributes to escalating labor costs, encompassing higher wages, increased benefit packages, and more expensive recruitment efforts.

These rising expenses place considerable pressure on Acadia's operational budgets, potentially impacting profitability. Furthermore, insufficient staffing levels due to these shortages could compromise the quality of care provided to patients.

- Persistent Shortage: Behavioral health professional shortages are a well-documented, ongoing issue.

- Rising Labor Costs: Wages, benefits, and recruitment expenses are increasing significantly.

- Impact on Profitability: Higher labor costs directly strain financial performance.

- Quality of Care Risk: Staffing shortfalls can lead to compromised patient care.

Cybersecurity Risks and Data Privacy Breaches

Acadia Healthcare, like many in the healthcare sector, faces substantial cybersecurity risks. As a custodian of sensitive patient health information (PHI), it's a prime target for cyberattacks. The potential consequences of a breach are severe, encompassing hefty financial penalties, legal repercussions, and significant damage to its reputation, which can erode patient trust. For instance, the healthcare industry saw a 131% increase in ransomware attacks in 2023, highlighting the escalating threat landscape. Acadia must continuously invest in advanced cybersecurity infrastructure and ensure strict adherence to evolving data privacy regulations like HIPAA, which represents a significant and ongoing operational cost.

The financial implications of failing to protect patient data are substantial. Beyond direct costs associated with incident response and recovery, Acadia could face regulatory fines. In 2024, the average cost of a data breach in the healthcare sector reached $10.93 million, demonstrating the financial gravity of these threats. Furthermore, the loss of patient confidence following a breach can lead to a decline in patient volume and revenue. Maintaining robust data security is therefore not just a compliance issue, but a critical component of business continuity and long-term financial stability.

- Increased Regulatory Scrutiny: Data privacy regulations are becoming more stringent globally, with potential fines for non-compliance escalating.

- High Cost of Breaches: The average cost of a healthcare data breach in 2024 was $10.93 million, impacting financial performance.

- Reputational Damage: Loss of patient trust due to a breach can lead to decreased patient admissions and revenue loss.

Acadia Healthcare faces significant threats from evolving healthcare regulations and reimbursement shifts, impacting revenue predictability. The transition to value-based care and potential changes in managed care agreements could affect earnings, as seen with CMS's proposed reimbursement rate changes in 2023. Intense competition from various providers, including telehealth services, intensifies pricing pressure and necessitates higher marketing spend, a challenge in the over $100 billion U.S. mental health market in 2024.

Economic downturns threaten Acadia by reducing patient affordability for behavioral health services, potentially leading to decreased patient volumes and increased bad debt, a factor to monitor in 2024-2025 financial performance. Persistent workforce shortages in behavioral health are driving up labor costs, impacting profitability and potentially compromising care quality, a trend expected to worsen by 2025. Cybersecurity risks are substantial, with healthcare data breaches averaging $10.93 million in 2024, posing financial and reputational threats that require continuous investment in data protection.

SWOT Analysis Data Sources

This Acadia SWOT analysis is constructed from robust data, including its latest financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded strategic perspective.