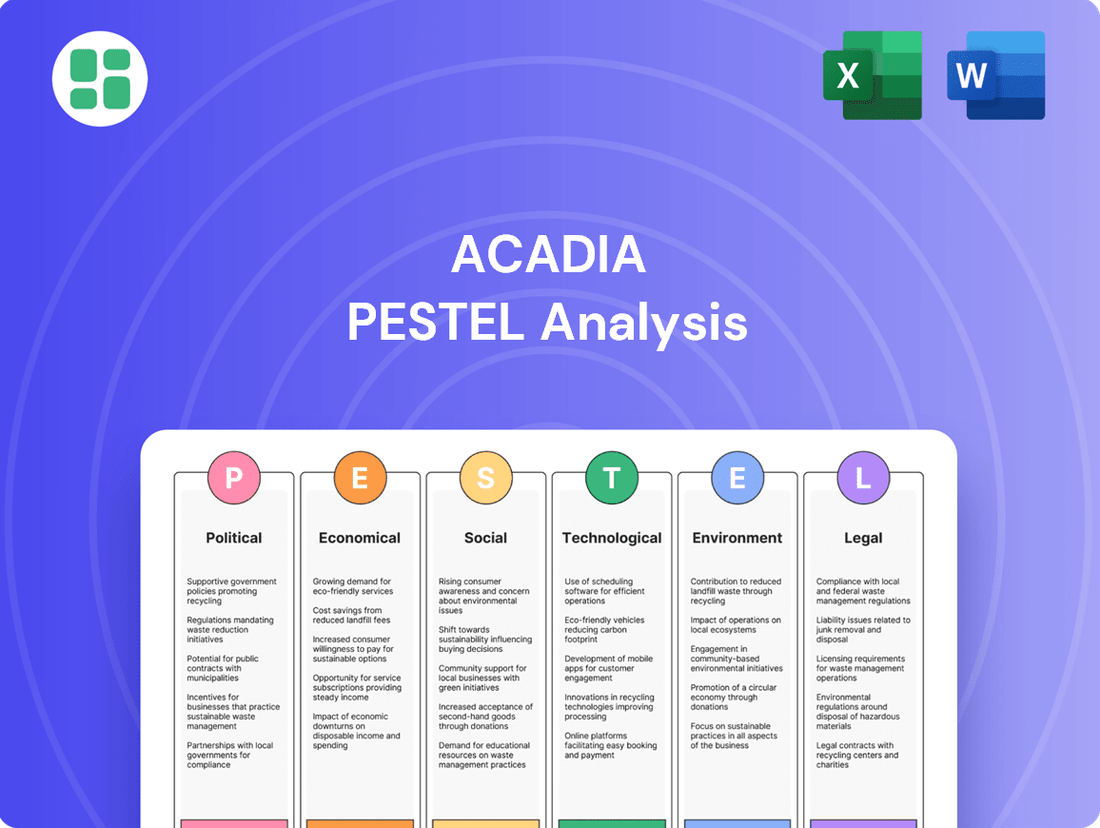

Acadia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

Uncover the critical external factors shaping Acadia's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the company. Gain a strategic advantage by downloading the full, expertly researched report and equip yourself with actionable intelligence for informed decision-making.

Political factors

Government healthcare policies, especially those concerning behavioral health, significantly shape Acadia Healthcare's operational landscape. Recent federal initiatives, like the push for enhanced mental health parity, mandate insurers to offer comparable coverage for mental and physical health issues. This regulatory shift is anticipated to broaden the accessibility and demand for Acadia's specialized services.

Despite potential growth, uncertainties surrounding telehealth regulations and the stability of Medicaid funding introduce a degree of caution within the sector. For instance, the Centers for Medicare & Medicaid Services (CMS) continues to refine reimbursement rates for behavioral health services, with proposed changes in 2024 reflecting ongoing adjustments to value-based care models.

The finalized 2024 enforcement of the Mental Health Parity and Addiction Equity Act (MHPAEA) significantly impacts healthcare providers. This legislation requires health plans to demonstrate equitable access to mental health and substance use disorder benefits compared to medical and surgical benefits.

This stricter enforcement is anticipated to drive higher reimbursement rates and broader coverage for behavioral health services. For organizations like Acadia, this presents an opportunity for increased revenue as more patients gain access to necessary care, potentially boosting the utilization of their services.

The regulatory landscape for behavioral healthcare providers, including those like Acadia, is subject to shifts influenced by political administrations. Changes in healthcare policy, particularly concerning funding mechanisms like Medicaid and Medicare, directly impact revenue streams and service accessibility. For instance, potential alterations in drug pricing negotiations could affect the cost of pharmaceuticals used in treatment, a key operational expense.

State-Level Healthcare Legislation

State-level healthcare legislation is a significant political factor for Acadia, influencing its operations and growth strategies. For instance, states are actively pursuing initiatives to bolster their behavioral health workforces and address existing disparities. These legislative actions can directly impact funding streams, licensing requirements, and the overall operational landscape for healthcare providers like Acadia within those specific states. As of early 2025, several states have introduced or passed legislation aimed at increasing reimbursement rates for mental health services and expanding telehealth access for behavioral health, potentially creating new opportunities or operational adjustments for Acadia.

These state-specific efforts can create a patchwork of regulations and incentives across Acadia's service areas. For example:

- Funding Allocation: State budgets often dictate the availability of public funds for mental health services, directly impacting Acadia's revenue from government contracts.

- Licensing and Certification: Variations in state licensing requirements for facilities and professionals can affect Acadia's ability to establish new locations or expand services.

- Scope of Practice: State laws define the scope of practice for various healthcare professionals, which can influence the types of services Acadia can offer and the staffing models it employs.

Patient Access and Equity Initiatives

Government and advocacy groups are pushing for broader healthcare access and equity, especially for communities that have historically been underserved. This political pressure is a significant driver for programs like mobile clinics and virtual care, which directly support Acadia's commitment to delivering excellent and empathetic healthcare services.

In 2024, federal funding for telehealth expansion saw a notable increase, with programs aiming to bridge the digital divide in healthcare access. For instance, the FCC's Rural Health Care Pilot Program allocated $50 million to support broadband deployment for healthcare providers in rural areas, a move that directly benefits patient access initiatives.

- Increased focus on health equity: Political mandates are shaping healthcare delivery models to ensure fair access for all populations.

- Telehealth and mobile health expansion: Government incentives are encouraging the growth of remote and accessible care options.

- Underserved populations as a priority: Policy shifts are directing resources and attention to improving care for marginalized communities.

The political climate significantly influences Acadia's operating environment, particularly through government healthcare policies and funding. Federal mandates like the Mental Health Parity and Addiction Equity Act (MHPAEA) continue to shape reimbursement and coverage for behavioral health services, with updated enforcement in 2024 emphasizing equitable access. State-level legislation also plays a crucial role, with many states actively working to expand behavioral health workforces and improve access, as seen in early 2025 legislative efforts to boost mental health service reimbursement rates and telehealth accessibility.

Government initiatives promoting health equity and expanding telehealth services, such as the FCC's Rural Health Care Pilot Program in 2024 which allocated $50 million for rural broadband, directly support Acadia's mission. These policy shifts prioritize underserved populations and encourage innovative care delivery models. Political administrations can also impact funding streams like Medicaid and Medicare, alongside potential changes in drug pricing, which are key considerations for Acadia's financial planning and operational costs.

| Political Factor | Impact on Acadia | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Mental Health Parity Enforcement | Increased demand and potential for higher reimbursement | Finalized 2024 MHPAEA enforcement requires equitable coverage; states in early 2025 are increasing mental health reimbursement rates. |

| State-Level Healthcare Legislation | Varied operational landscape, potential for growth or adjustment | Several states introduced/passed legislation in early 2025 to expand telehealth and workforce, impacting licensing and funding. |

| Government Funding (Medicaid/Medicare) | Direct impact on revenue streams and service accessibility | Ongoing CMS adjustments to reimbursement rates for behavioral health services reflect value-based care models. |

| Telehealth & Digital Divide Initiatives | Enhanced patient access, particularly in rural areas | $50 million allocated in 2024 by FCC's Rural Health Care Pilot Program for broadband in healthcare. |

What is included in the product

This Acadia PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions. It equips stakeholders with actionable insights to navigate challenges and capitalize on emerging opportunities.

A clear, actionable Acadia PESTLE analysis provides a structured framework to identify and mitigate external threats, alleviating the pain of unforeseen market shifts and regulatory changes.

Economic factors

Acadia, like many in the healthcare sector, is grappling with persistent inflation impacting its operational costs. Labor, a significant expense for behavioral health providers, has seen substantial increases. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for healthcare practitioners and technical occupations rose by approximately 4.5% year-over-year in early 2024, a trend that continues to affect providers.

These rising labor expenses, coupled with increased costs for medical supplies and pharmaceuticals, directly squeeze profit margins. To counteract this, healthcare systems, including those offering behavioral health services, are actively negotiating for higher reimbursement rates from insurers. This dynamic creates a challenging environment where maintaining profitability requires careful cost management and strategic pricing adjustments.

Healthcare spending in the United States continued its upward trajectory, projected to reach $7.7 trillion by 2031, according to CMS projections. Changes in reimbursement rates from government payers like Medicare and Medicaid, as well as commercial insurers, directly impact Acadia's revenue streams. For instance, a 2% Medicare payment update for hospital services in fiscal year 2024, while positive, may not fully offset rising labor and supply costs.

An increasing proportion of patients covered by Medicare and Medicaid, which typically offer lower reimbursement rates than commercial insurance, can put financial pressure on healthcare providers like Acadia. If Acadia experiences a shift towards a higher percentage of these government-sponsored patients without corresponding increases in reimbursement, it could strain their operating margins.

The United States is experiencing a pronounced shortage of behavioral health professionals, a critical issue impacting the economy. This scarcity drives up labor costs as organizations compete for a limited pool of qualified individuals. For instance, in 2023, the average salary for a licensed clinical social worker in the U.S. was approximately $65,000, with demand pushing these figures higher in many regions.

This workforce deficit directly affects service delivery, limiting the capacity of healthcare providers to meet patient needs and potentially delaying or canceling expansion plans. Such operational hurdles can translate into lost revenue and reduced market share for organizations in the behavioral health sector.

Mergers and Acquisitions Activity

The behavioral health sector, including areas like autism and mental health services, is seeing a significant uptick in mergers and acquisitions (M&A). This surge in deal activity and investor attention suggests a market that is consolidating.

For Acadia, this trend presents a dual-edged sword. On one hand, it opens doors for strategic acquisitions to expand services or market reach. On the other hand, increased M&A activity can intensify competition as larger players or well-funded entities vie for similar targets or market share.

- Increased Investor Interest: Private equity firms and strategic buyers are actively seeking opportunities in behavioral health, driving up deal volumes.

- Market Consolidation: The rise in M&A activity points towards a maturing market where scale and efficiency become increasingly important.

- Competitive Landscape Shift: Acadia may face increased competition from entities formed through these mergers, potentially impacting pricing and talent acquisition.

- Strategic Opportunities: Conversely, Acadia could leverage this environment to acquire smaller, specialized providers to enhance its service offerings.

Economic Growth and Insurance Coverage

General economic growth significantly impacts Acadia's operational landscape. As economies expand, individuals typically have more disposable income, increasing their capacity to afford private health insurance. This also bolsters the stability of employer-sponsored health plans, which are a crucial source of patient volume and influence Acadia's payer mix. For instance, in 2024, many developed economies are experiencing moderate growth, which supports higher healthcare spending.

Conversely, economic downturns present considerable challenges. During periods of recession or slow growth, individuals may reduce or forgo private health coverage due to affordability concerns. This can also lead to employers scaling back benefits, pushing more individuals towards public healthcare programs. Such shifts directly affect Acadia's revenue streams and can alter the proportion of patients covered by different insurance types, potentially impacting reimbursement rates.

- Increased disposable income from economic growth leads to higher demand for private health insurance.

- Economic downturns can cause a reduction in private insurance enrollment and a shift towards public programs.

- The stability of employer-sponsored health plans is directly tied to corporate profitability during economic cycles.

- Changes in payer mix due to economic factors can influence Acadia's overall revenue and profitability.

Persistent inflation continues to drive up operational costs for Acadia, particularly in labor, with average hourly earnings for healthcare practitioners rising around 4.5% year-over-year in early 2024. This, combined with higher supply costs, pressures profit margins, necessitating strategic pricing adjustments and negotiations for better reimbursement rates.

Healthcare spending is projected to reach $7.7 trillion by 2031, but shifts in payer mix towards lower-reimbursing government programs like Medicare and Medicaid can strain providers like Acadia if reimbursement rates don't keep pace with rising costs.

The critical shortage of behavioral health professionals, driving up salaries and limiting service capacity, directly impacts Acadia's ability to meet demand and potentially expand, leading to lost revenue opportunities.

The behavioral health sector is experiencing significant M&A activity, creating both opportunities for Acadia to acquire or expand, and increased competition from larger, consolidated entities.

| Economic Factor | Impact on Acadia | Supporting Data (2024/2025) |

| Inflation | Increased operational costs (labor, supplies) | Avg. hourly earnings for healthcare practitioners up ~4.5% YoY (early 2024) |

| Healthcare Spending Growth | Potential for increased demand, but also payer mix shifts | Projected US healthcare spending: $7.7 trillion by 2031 (CMS) |

| Workforce Shortages | Higher labor costs, reduced service capacity | Avg. salary for LCSW ~ $65,000 (2023), with upward pressure |

| Mergers & Acquisitions | Increased competition and strategic opportunities | Surge in M&A activity in behavioral health sector |

Same Document Delivered

Acadia PESTLE Analysis

The preview shown here is the exact Acadia PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use for your strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, so you know precisely what you're getting.

The content and structure shown in the preview is the same Acadia PESTLE Analysis document you’ll download after payment, ensuring you have a complete and professional resource.

Sociological factors

Mental health conditions and substance use disorders are on the rise across all demographics, a trend exacerbated by societal pressures and increased awareness. This growing prevalence directly translates into a heightened demand for accessible and effective behavioral healthcare solutions.

Acadia Healthcare, a leading provider in this sector, is well-positioned to capitalize on this expanding market need. For instance, in 2023, Acadia reported a 10.3% increase in revenue, partly driven by higher patient volumes in its behavioral health segment, reflecting this societal shift.

Societal attitudes toward mental health are undergoing a significant transformation, with less shame attached to seeking professional help. This evolving perspective is a powerful driver for increased demand in behavioral healthcare services, directly benefiting organizations like Acadia. For instance, in 2024, surveys indicated that over 70% of adults in the US felt more comfortable discussing mental health openly compared to five years prior.

As the stigma diminishes, more individuals are proactively seeking therapy, counseling, and psychiatric care. This trend translates into a larger patient pool for Acadia's facilities and programs. The National Institute of Mental Health reported a 15% increase in outpatient mental health service utilization in 2024, a figure expected to climb further as societal acceptance grows.

Public awareness of behavioral health is surging, fueled by impactful campaigns and dedicated advocacy from patient groups and non-profits. This growing recognition is normalizing discussions around mental well-being and driving demand for better services. For instance, in 2024, the National Alliance on Mental Illness (NAMI) reported a 15% increase in engagement with their online resources, reflecting this heightened public interest.

Changing Lifestyle and Stress Factors

Modern lifestyles are increasingly characterized by elevated stress levels and a sense of social isolation, often exacerbated by the pervasive influence of digital technologies. This societal shift directly fuels a growing demand for behavioral health services, highlighting the continued importance of Acadia's specialized offerings.

The persistent pressure of fast-paced living and digital connectivity contributes to a significant rise in mental health concerns. For instance, a 2024 survey indicated that over 60% of adults reported experiencing increased stress in the past year, directly impacting their well-being and driving the need for accessible support systems.

- Increased Stress: Approximately 60% of adults reported higher stress levels in 2024, a key driver for mental health service utilization.

- Digital Impact: Growing reliance on digital platforms can contribute to social isolation, further emphasizing the need for behavioral health interventions.

- Service Demand: These lifestyle factors create a sustained and expanding market for Acadia's specialized behavioral health and wellness programs.

Demographic Shifts and Underserved Populations

Demographic shifts are significantly reshaping the demand for behavioral health services. For instance, the aging population, with a growing segment of individuals over 65, presents a unique challenge and opportunity, as this group often experiences higher rates of mental health conditions like depression and anxiety. This trend is projected to continue, with the U.S. Census Bureau estimating that individuals aged 65 and over will comprise nearly 22% of the population by 2050.

Furthermore, there's an increasing societal expectation to address health equity, particularly for underserved populations. This includes ensuring access to tailored behavioral health services for children, who represent a substantial portion of mental health needs, and for those residing in rural or geographically isolated areas where access to care is often limited. In 2023, the National Alliance on Mental Illness reported that nearly 40% of adults in rural areas live in mental health professional shortage areas.

- Aging Population: Increasing demand for geriatric mental health services.

- Child and Adolescent Mental Health: Growing need for early intervention and specialized pediatric care.

- Rural and Underserved Areas: Persistent disparities in access to behavioral health professionals and services.

- Health Equity Focus: Societal pressure to provide culturally competent and accessible care for all demographic groups.

Societal attitudes towards mental health continue to evolve, with a notable reduction in stigma. This shift encourages more individuals to seek professional help, directly benefiting providers like Acadia. In 2024, surveys indicated that over 70% of US adults felt more comfortable discussing mental health openly compared to five years prior, a trend that fuels demand for behavioral health services.

Lifestyle factors, including increased stress and the impact of digital connectivity, are contributing to a rise in mental health concerns. A 2024 survey revealed that over 60% of adults reported heightened stress levels, underscoring the ongoing need for accessible mental healthcare solutions.

Demographic changes, such as an aging population and a focus on health equity for underserved communities, are also shaping service demand. The U.S. Census Bureau projects that individuals aged 65 and over will constitute nearly 22% of the population by 2050, a segment often requiring specialized mental health support.

| Sociological Factor | 2024/2025 Data Point | Implication for Acadia |

|---|---|---|

| Mental Health Stigma Reduction | 70% of US adults more comfortable discussing mental health (2024) | Increased patient volume and demand for services. |

| Stress Levels | 60% of adults reported higher stress (2024) | Sustained demand for stress management and mental wellness programs. |

| Aging Population | Projected to be 22% of US population by 2050 (aged 65+) | Growing market for geriatric mental health services. |

| Rural Access to Care | 40% of rural adults in shortage areas (2023) | Opportunity for expansion and service delivery in underserved regions. |

Technological factors

The expansion of telehealth and virtual care is significantly reshaping behavioral healthcare. These platforms offer unprecedented accessibility, particularly for individuals in remote areas or those facing mobility challenges. For Acadia Healthcare, this trend presents a key opportunity to broaden its service footprint and ensure more consistent patient engagement.

In 2024, the telehealth market continues its robust growth, with projections indicating sustained expansion through 2025 and beyond. This digital transformation allows providers like Acadia to offer a wider range of services, from remote therapy sessions to medication management, thereby enhancing patient convenience and potentially improving treatment adherence.

Advancements in digital health records, often called EHRs, are making it easier for different healthcare providers to share patient information. This push for interoperability means a patient's medical history can move more smoothly between doctors' offices and hospitals. For Acadia, this is a big plus, as it directly supports their goal of providing coordinated and high-quality care by giving clinicians a more complete picture of each patient.

Artificial intelligence (AI) and advanced data analytics are revolutionizing behavioral health treatment by enabling personalized care plans and improving diagnostic accuracy. For instance, in 2024, studies highlighted AI's success in identifying early signs of depression with higher precision than traditional methods.

These sophisticated tools allow for the prediction of patient outcomes, guiding clinicians toward more effective interventions and resource allocation. By analyzing vast datasets, AI can pinpoint treatment pathways most likely to yield positive results for individual patients, a significant leap from one-size-fits-all approaches.

The integration of AI is also enhancing diagnostic capabilities, offering faster and more objective assessments. By mid-2025, the market for AI in healthcare, including mental health, is projected to see substantial growth, driven by the demand for such advanced analytical solutions.

Cybersecurity and Data Privacy

The increasing digitization of healthcare operations and the sensitive nature of patient data place immense importance on cybersecurity. In 2024, healthcare organizations faced significant threats, with data breaches costing an average of $10.10 million per incident, a rise from previous years. This underscores the critical need for robust cybersecurity measures to protect patient information and maintain trust.

Adherence to evolving data privacy regulations, such as HIPAA, is non-negotiable for healthcare providers. Non-compliance can lead to substantial penalties, impacting financial stability and reputation. For instance, HIPAA enforcement actions in 2024 continued to target breaches involving unsecured protected health information, highlighting the ongoing regulatory scrutiny.

Protecting sensitive patient data is paramount for maintaining trust and ensuring operational continuity. The healthcare sector remains a prime target for cyberattacks, with ransomware attacks escalating. In Q1 2025, reports indicated a continued upward trend in ransomware attacks targeting hospitals, further emphasizing the need for proactive security investments.

- Cybersecurity Investment: Healthcare organizations are projected to increase spending on cybersecurity solutions by 12-15% in 2025 to combat rising threats.

- Data Breach Costs: The average cost of a healthcare data breach in 2024 reached $10.10 million, a significant increase from prior years.

- Regulatory Compliance: Fines for HIPAA violations can range from $100 to $50,000 per violation, with annual caps reaching $1.5 million.

- Ransomware Impact: Ransomware attacks in healthcare can lead to extended downtime, patient care disruptions, and significant financial recovery costs.

Wearable Technology and Remote Monitoring

Wearable technology and connected health apps are revolutionizing patient care, especially in behavioral health. These devices allow for continuous remote monitoring of vital signs and activity levels, feeding real-time data to healthcare providers. This constant stream of information supports a more proactive and personalized approach to treatment, moving beyond episodic in-person visits.

The insights generated by these technologies are proving invaluable. For instance, studies in 2024 indicated that patients using wearable devices for mental health tracking reported higher engagement with their treatment plans and experienced improved self-awareness of their conditions. This data empowers both individuals to manage their well-being and clinicians to make more informed adjustments to care strategies.

The market for these health-tracking wearables is experiencing significant growth, reflecting their increasing adoption. By the end of 2024, the global wearable technology market was projected to reach over $150 billion, with a substantial portion dedicated to health and fitness applications. This trend is expected to continue, with further advancements in sensor accuracy and data analytics expected in 2025.

- Enhanced Data Collection: Wearables provide continuous, objective data on sleep patterns, heart rate, and physical activity, offering a richer picture of a patient's state than self-reported information alone.

- Proactive Intervention: Real-time alerts can notify providers of significant changes in a patient's condition, enabling timely interventions before a crisis occurs.

- Improved Patient Engagement: Mobile applications linked to wearables often include features for mood tracking and journaling, fostering greater patient involvement in their own care journey.

- Cost-Effectiveness: Remote monitoring can potentially reduce the need for frequent in-person appointments, leading to cost savings for both patients and healthcare systems.

Technological advancements are profoundly impacting behavioral healthcare delivery and operational efficiency. The rise of telehealth and AI-driven diagnostics, for instance, allows for broader reach and more personalized treatment plans. Acadia Healthcare is positioned to leverage these innovations for enhanced patient access and outcomes.

The integration of advanced data analytics and AI is expected to refine treatment protocols, with AI in healthcare projected for significant growth by mid-2025. Similarly, wearable technology is transforming patient monitoring, with the global wearable market already exceeding $150 billion by the end of 2024, offering continuous health insights.

However, these technological shifts necessitate robust cybersecurity measures, as data breaches in healthcare averaged $10.10 million in 2024. Ensuring compliance with evolving data privacy regulations like HIPAA remains critical to maintain patient trust and operational integrity.

| Technology Trend | 2024/2025 Data Point | Impact on Acadia Healthcare |

|---|---|---|

| Telehealth Expansion | Continued robust growth through 2025 | Broader service reach, improved patient engagement |

| AI in Behavioral Health | Studies show higher diagnostic precision; market growth projected | Personalized care plans, predictive analytics for outcomes |

| Wearable Technology | Global market >$150 billion (end of 2024); improved patient engagement reported | Continuous remote monitoring, proactive interventions |

| Cybersecurity Threats | Average data breach cost: $10.10 million (2024); ransomware attacks escalating | Critical need for investment in data protection and compliance |

Legal factors

Acadia Healthcare must meticulously comply with HIPAA, ensuring robust patient privacy and secure handling of protected health information. This is non-negotiable for their operations.

Proposed HIPAA updates for 2024-2025 aim to enhance patient access to their health records and strengthen protections for sensitive data, including that related to substance use disorders, directly impacting Acadia's data management practices.

The ongoing enforcement of the Mental Health Parity and Addiction Equity Act (MHPAEA) significantly influences Acadia. This legislation mandates that health plans provide behavioral health benefits at the same level as medical or surgical benefits, directly affecting Acadia's service offerings and cost structures. In 2024, the Department of Labor reported a 15% increase in investigations related to MHPAEA compliance, highlighting increased scrutiny on insurers.

Acadia must navigate a multifaceted regulatory landscape, adhering to state and federal licensing, certification, and accreditation mandates for both its physical locations and its professional staff. For instance, in 2024, healthcare providers like Acadia faced increased scrutiny on staffing ratios and continuing education requirements, with some states introducing new certification pathways for specialized care. These evolving legal frameworks can directly influence operational costs and dictate the feasibility of new service offerings or geographic expansion.

Substance Use Disorder (SUD) Regulations

Substance Use Disorder (SUD) regulations are critical for Acadia's operations. Key among these is 42 CFR Part 2, which strictly governs the confidentiality of patient records in SUD treatment programs. Navigating these rules is essential for maintaining patient trust and legal compliance.

The landscape of SUD treatment is also shaped by evolving policies that aim to integrate SUD care with broader healthcare services. This integration presents both opportunities for expanded patient access and challenges in adapting existing treatment models to new regulatory frameworks. For instance, the SUPPORT for Patients and Communities Act, enacted in 2018 and with ongoing implementation, has spurred greater focus on integrated care models.

- 42 CFR Part 2: Strict patient confidentiality rules for SUD treatment.

- Integration Efforts: Policies pushing for SUD care within general healthcare.

- SUPPORT Act: Legislation influencing payment and delivery of SUD services.

Malpractice and Liability Laws

Acadia, operating within the healthcare sector, faces significant scrutiny under malpractice and liability laws. These regulations mandate stringent quality control measures and robust patient safety protocols to mitigate risks. Comprehensive insurance coverage is essential to manage potential legal claims, which can significantly impact operational costs and financial stability.

Recent trends in tort law and evolving legal precedents directly influence Acadia's operational risk profile. For instance, the average medical malpractice claim payout in the US has seen fluctuations, with some reports indicating figures in the hundreds of thousands of dollars, underscoring the financial exposure healthcare providers face. Staying abreast of legislative changes and case law is crucial for effective risk management.

- Stringent Regulations: Healthcare providers like Acadia must adhere to a complex web of malpractice and liability laws.

- Quality and Safety Focus: These laws necessitate a proactive approach to patient safety and rigorous quality assurance.

- Insurance Costs: Comprehensive liability insurance is a significant operational expense, with premiums influenced by industry risk factors.

- Legal Environment Impact: Changes in tort law and legal precedents can alter the landscape of operational risk and associated costs for Acadia.

Acadia must navigate evolving healthcare regulations, including those impacting data privacy under HIPAA, with proposed 2024-2025 updates focusing on enhanced patient access and data protection. The company also faces stringent enforcement of the Mental Health Parity and Addiction Equity Act (MHPAEA), which requires equal coverage for behavioral and physical health services, with increased investigations noted in 2024. Adherence to state and federal licensing, certification, and accreditation mandates, alongside specific Substance Use Disorder (SUD) regulations like 42 CFR Part 2, is crucial for compliant and effective operations.

| Legal Factor | Description | Impact on Acadia | 2024/2025 Relevance |

| HIPAA | Patient privacy and data security. | Requires robust data management practices. | Proposed updates enhance patient access and data protection. |

| MHPAEA | Equal coverage for mental/behavioral health. | Affects service offerings and cost structures. | Increased enforcement; 15% rise in DOL investigations in 2024. |

| Licensing & Certification | State/federal mandates for facilities and staff. | Influences operational costs and expansion feasibility. | Increased scrutiny on staffing ratios and continuing education. |

| 42 CFR Part 2 | Confidentiality for SUD patient records. | Essential for patient trust and legal compliance. | Remains a critical compliance area for SUD treatment. |

| Malpractice & Liability | Laws governing patient safety and quality control. | Necessitates strong quality assurance and insurance. | Average malpractice payouts can be substantial, impacting financial stability. |

Environmental factors

The healthcare sector, including major operators like Acadia Healthcare, is under increasing pressure to adopt sustainable practices and shrink its environmental impact. This focus on sustainability is driven by regulatory changes and growing public awareness of climate change. For instance, the healthcare industry's carbon footprint is a significant concern, with studies indicating it accounts for a substantial portion of national emissions.

Acadia Healthcare, managing numerous facilities, will likely implement robust strategies to address its environmental responsibilities. These could include investing in energy-efficient technologies, optimizing waste management systems to reduce landfill contributions, and prioritizing suppliers with strong environmental credentials. Such initiatives are crucial for aligning with global sustainability targets and enhancing corporate reputation.

By 2024, many healthcare organizations are setting ambitious carbon reduction goals. For example, some health systems aim to achieve net-zero emissions by 2040. Acadia's commitment to energy efficiency, waste reduction, and sustainable sourcing will be key metrics in demonstrating its progress toward these environmental objectives and meeting evolving stakeholder expectations.

Acadia, like all healthcare providers, faces rigorous waste management and disposal regulations. This includes the proper handling of medical waste, such as sharps and biohazards, and pharmaceutical waste, which can be particularly hazardous if not disposed of correctly. Failure to comply can result in significant fines and reputational damage.

In 2024, the Environmental Protection Agency (EPA) continued to emphasize the importance of sustainable waste practices across all sectors, including healthcare. For instance, regulations like the Resource Conservation and Recovery Act (RCRA) dictate how hazardous medical waste must be treated and disposed of, often requiring specialized incineration or autoclaving processes. These compliance measures add to operational costs but are essential for environmental protection.

The trend towards reducing landfill waste and increasing recycling and composting, even for certain types of non-hazardous medical waste, is also growing. Acadia must invest in robust waste segregation systems and explore partnerships with specialized waste management firms that offer environmentally sound disposal solutions, aligning with broader public health and environmental goals.

Acadia's commitment to sustainability can be amplified by adopting green building standards like LEED or BREEAM for its facilities. These standards, which focus on reducing resource consumption and improving indoor environmental quality, align with growing investor and consumer demand for eco-friendly operations. For instance, LEED-certified buildings can see operational cost savings of up to 20% on energy and water usage compared to conventional buildings.

Climate Change Impact and Resilience

Climate change poses significant risks to healthcare operations, with extreme weather events like hurricanes and heatwaves directly impacting facility functionality and requiring robust infrastructure. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, causing widespread disruption. Acadia must prioritize climate resilience in its strategic facility planning and emergency preparedness protocols to ensure continuity of care.

Acadia's approach to climate resilience should encompass several key areas:

- Infrastructure Hardening: Investing in facilities designed to withstand extreme weather, such as elevated structures in flood-prone areas or upgraded cooling systems for heatwaves.

- Supply Chain Diversification: Mitigating disruptions to medical supplies and pharmaceuticals caused by climate-related events through multiple sourcing strategies.

- Emergency Preparedness Enhancement: Developing and regularly testing comprehensive emergency plans that account for climate-driven scenarios, including patient evacuation and power backup systems.

ESG Reporting and Investor Expectations

Environmental, Social, and Governance (ESG) factors are becoming increasingly critical for investors and stakeholders within the healthcare industry. Acadia, like its peers, faces growing pressure to showcase a genuine commitment to environmental responsibility. This is primarily achieved through transparent ESG reporting, which directly influences investment decisions and shapes public perception of the company.

Investor demand for robust ESG data is on the rise. For instance, a 2024 survey by PwC indicated that 70% of investors consider ESG factors material to their investment decisions. Acadia's proactive approach to detailing its environmental impact, such as carbon footprint reduction initiatives and waste management strategies, will be crucial for attracting and retaining capital. Failing to meet these evolving expectations could lead to divestment or a lower valuation in the market.

- Rising Investor Scrutiny: Over 70% of investors consider ESG factors material to their investment decisions as of 2024, according to PwC.

- Transparency is Key: Acadia's ability to clearly communicate its environmental stewardship efforts, including carbon emissions and waste reduction, directly impacts investor confidence.

- Market Influence: Strong ESG performance can lead to improved access to capital and a more favorable market valuation for companies like Acadia.

- Reputational Impact: Transparent environmental reporting enhances Acadia's public image and stakeholder trust, crucial in the healthcare sector.

Acadia's environmental strategy must address waste management regulations and the growing push for sustainability. The healthcare sector's significant carbon footprint, estimated to be substantial, necessitates robust waste reduction and energy efficiency measures. By 2024, many healthcare organizations are setting ambitious carbon reduction goals, with some aiming for net-zero emissions by 2040.

PESTLE Analysis Data Sources

Our Acadia PESTLE Analysis is meticulously crafted using data from leading international organizations, government publications, and reputable industry research firms. We ensure each factor, from political stability to technological advancements, is supported by current and verifiable information.